I have received several E-mails over the last few weeks that suggest that the economics…

A total lack of leadership

Tonight (Tuesday Boston time as I write) my very kind and gracious host took me to an early evening Ringo Starr and his All Starrs concert down on the waterfront. I never knew so many Beatles fans from the 1960s had survived the boredom. They were out in force tonight as he sang Yellow Submarine and other pop relics. The highlight of the evening was Edgar Winter (who is one of his all starrs) featuring on Frankenstein which he made a hit in 1972. But where do all these Beatles fans go during the day! Scary. And by the way, Rick Derringer who was in the original Edgar Winter Band was also in Ringo’s band tonight playing some nice guitar (if you like Gibson-motivated pop – I don’t). My host decided to call it an early night and I left with him – while Warren and his partner bopped on. A neat exit you might say! But Ringo at least provided some leadership – poppy and pretty soppy at that. But much better than our leaders of government are providing if the recent G20 declaration is anything to go by. They have just ceded leadership to the IMF – that unelected rabble. Stay tuned for things to get worse.

Another G20 talkfest has ended in Toronto and the final communique suggests that the IMF is now back in charge. If you read the IMF Briefing and the World Bank Briefing to the G20 Summit you will get a sense of deja vu. The line now being pushed is, as always, structural reform of product and labour markets – which you read as deregulation and erosion of worker entitlements.

The IMF is selling the line that:

Credible consolidation plans-designed to be “growth friendly”-would mitigate the dampening effect on domestic demand. Monetary policy accommodation could be maintained for a more extended period to help support activity, since inflation would remain contained as fiscal balances are strengthened.

Their hope is that export surplus nations will rebalance their growth strategies via exchange rate adjustments to stimulate export sectors of the stagnant nations with low interest rates encouraging investment. They also claim that changing tax mixes (from payroll to consumption) will help growth while increasing revenue.

First, monetary policy is an ineffective expansionary tool. Rates are low and have been for some time. Japan failed to grow fast with zero interest rates for years. It was only when fiscal policy reached an adequate level that it started to show signs of life again.

Second, relying on exchange rate adjustments to lead to a major revitalisation of world growth via trade is to seriously underestimate the extent of the demand crisis facing the global economy. The IMF has been pushing export-led growth on to poor nations for decades with little overall shift in the poverty rates at the lowest levels.

All the IMF simulations are based on their GIMF model which is highly flawed. Basically, these models can give whatever result satisfies your ideological disposition. All that needs to be done is ensure the elasticities (the numerical relationships) on key variables – linking policy changes to output and monetary aggregates – are calibrated accordingly. So the GIMF model will always give large real gains when you deregulate the labour market even though there is no credible research literature that would support that conclusion.

In technical terms, the substitution effects are typically much larger than income effects – which means in English, taking a specific example, that the benefits of cutting wages have huge cost effects but the income losses are downplayed. So the supply expands while there are no real demand effects and the world is judged a better place. The empirical research literature by and large does not support the faith in these sorts of models. Please read my blog – GIGO … – for more discussion on this point.

The papers clearly influenced the final decisions taken by the G20 leaders, which culminated in the G20 Declaration. The G20 Declaration says that:

… Building on our achievements in addressing the global economic crisis, we have agreed on the next steps we should take to ensure a full return to growth with quality jobs, to reform and strengthen financial systems, and to create strong, sustainable and balanced global growth …

But serious challenges remain. While growth is returning, the recovery is uneven and fragile, unemployment in many countries remains at unacceptable levels, and the social impact of the crisis is still widely felt. Strengthening the recovery is key. To sustain recovery, we need to follow through on delivering existing stimulus plans, while working to create the conditions for robust private demand. At the same time, recent events highlight the importance of sustainable public finances and the need for our countries to put in place credible, properly phased and growth-friendly plans to deliver fiscal sustainability, differentiated for and tailored to national circumstances. Those countries with serious fiscal challenges need to accelerate the pace of consolidation. This should be combined with efforts to rebalance global demand to help ensure global growth continues on a sustainable path.

This quote is virtually word-for-word from the IMF briefing which says a lot for the independence of our world leaders. They buy, without question the notion that “(s)ound fiscal finances are essential to sustain recovery, provide flexibility to respond to new shocks, ensure the capacity to meet the challenges of aging populations, and avoid leaving future generations with a legacy of deficits and debt.”

But what constitutes “sound fiscal finances” is not spelt out. It is all fudged around what the bond markets will tolerate. But what the bond traders think is a reasonable outcome for their narrow vested interests is unlikely to be remotely what is in the best interests of the overall populace. So what the bond markets will tolerate should not be a gauge by which we judge sound fiscal finance. After all, for most governments the involvement of the bond markets in the decisions to net public spend is voluntary anyway.

A sovereign government is never revenue constrained because it is the monopoly issuer of the currency and so the bond markets are really superfluous to its fiscal operations. What the bond markets think should never be considered. They are after all the recipients of corporate welfare on a large scale and should stand in line as the handouts are being considered. They are mendicants. It is far more important that government get people back into jobs as quickly as possible and when they have achieved high employment levels then they might want to conclude the fiscal position is “sound”.

My summary checklist for determining whether fiscal policy is sustainable is:

- Saying a government can always credit bank accounts and add to bank reserves whenever it sees fit doesn’t mean it should be spending without regard to what the spending is aimed at achieving.

- Governments must aim to advance public purpose.

- Fiscal sustainability is not defined with reference to some level of the public debt/GDP ratio or deficit/GDP ratio.

- Fiscal sustainability is directly related to the extent to which labour resources are utilised in the economy – that is, full employment.

- A sovereign (currency-issuing) government is always financially solvent.

- You cannot deduce anything about government budgets by invoking the fallacious analogy between a household and government.

- Fiscal sustainability will not include any notion of foreign “financing” limits or foreign worries about a sovereign government’s solvency.

So when the G20 says:

The path of adjustment must be carefully calibrated to sustain the recovery in private demand. There is a risk that synchronized fiscal adjustment across several major economies could adversely impact the recovery. There is also a risk that the failure to implement consolidation where necessary would undermine confidence and hamper growth. Reflecting this balance, advanced economies have committed to fiscal plans that will at least halve deficits by 2013 and stabilize or reduce government debt-to-GDP ratios by 2016. Recognizing the circumstances of Japan, we welcome the Japanese government’s fiscal consolidation plan announced recently with their growth strategy. Those with serious fiscal challenges need to accelerate the pace of consolidation.

You know that this is being driven by ratio fever and doesn’t reflect the principles that a sovereign government should pursue. The Japanese government’s decision to cut back now will prove to be as bad as its previous tom foolery in 1997.

The G20 statement is full of erroneous claims that budget surpluses “boost national savings” when in fact they reduce national saving by squeezing the spending (and income generating capacity) of the private sector – unless there are very strong net export offsets.

UK Guardian economics correspondent Larry Elliot (June 28, 2010) in his article – G20 accord: you go your way, I’ll go mine says that:

The Toronto summit shows that now the threat of a second Great Depression has passed, it will take another crisis for the G20 to redress global economic imbalances

Born out of necessity in the dark days of late 2008, the cracks are beginning to show in the G20. Developed and developing nations were united when confronted with the collapse of world trade and the shrivelling of industrial output but are finding it harder to keep the show on the road now that the immediate crisis is over.

The communique from the weekend’s meeting is easily summed up: do your own thing. The Americans cannot persuade the Europeans to hold off from fiscal tightening until the recovery is assured; the Germans and the British think the risks of a sovereign debt crisis are far more serious than the possibility of a double-dip recession.

I agree with that assessment. The IMF line has been re-asserted or as Elliot says “normality has returned”. But this normality set in place the conditions that led to the crisis.

Elliot also notes that governments think the harsh outcomes that will accompany the austerity push is a “price worth paying to keep the financial markets happy” but that:

As for the markets, it is certainly true that sovereign debt is their concern this month. But next month they may be getting in a lather about the slow growth caused by the austerity programmes they themselves have necessitated.

The risk is that satisfying the capricious whims of the financial markets leads to policy error and the doomsday scenario. It goes something like this: even before the sovereign debt crisis erupted this spring, there were some tentative signs that the recovery that began in the spring of 2009 was losing momentum. The US has just revised down its growth for the first quarter and has yet to see the pick-up in the labour market that it enjoyed in previous recoveries. Europe’s expansion over the winter was barely perceptible. China has been pounding along but Beijing has been seeking to tighten credit conditions after 2009’s monetary laxity.

So without any credible explanation as to how growth, which depends on aggregate demand growth, will emerge when you cut aggregate demand the most likely scenario is a move back towards or into recession as a result of the G20 stance.

Paul Krugman goes one step further. In his column on Monday (June 27, 2010) entitled – The Third Depression – he says:

We are now, I fear, in the early stages of a third depression. It will probably look more like the Long Depression than the much more severe Great Depression. But the cost – to the world economy and, above all, to the millions of lives blighted by the absence of jobs – will nonetheless be immense.

And this third depression will be primarily a failure of policy. Around the world – most recently at last weekend’s deeply discouraging G-20 meeting – governments are obsessing about inflation when the real threat is deflation, preaching the need for belt-tightening when the real problem is inadequate spending.

The point Krugman is referring to is that history (1930s, 1990s etc) has taught us that major economic downturns are persistent. The on-going deflationary impact on demand that persistently high unemployment imposes is usually underestimated by the conservatives who only see rising budget ratios and freak out. History tells us that recovery comes in starts and is often interspersed with backstepping usually because governments lose their political nerve under the constant bullying of the Flat Earthers (aka deficit terrorists).

These vandals have always tried to derail government fiscal support and they never learn from their mistakes. The arguments that are being rehearsed daily in the media – the call for austerity etc – were all there in Japan in the 1990s and across the globe in the 1930s. In each historical period, governments bowed to the pressure and the economies slid backwards into recession.

Students of economics never learn about these policy errors and so remain blithe to the fundamental shortcomings of the mainstream policy advice.

Krugman says:

But future historians will tell us that this wasn’t the end of the third depression, just as the business upturn that began in 1933 wasn’t the end of the Great Depression. After all, unemployment – especially long-term unemployment – remains at levels that would have been considered catastrophic not long ago, and shows no sign of coming down rapidly. And both the United States and Europe are well on their way toward Japan-style deflationary traps.

In the face of this grim picture, you might have expected policy makers to realize that they haven’t yet done enough to promote recovery. But no: over the last few months there has been a stunning resurgence of hard-money and balanced-budget orthodoxy.

He calls the balanced-budget orthodoxy “the revival of the old-time religion”. While the conservatives have argued that austerity is needed to allow bond markets to continue financing governments, even in the EMU the ECB is doing a pretty good job of that at present.

Further, in yesterday’s blog I noted:

But what is very interesting and unlike the hysteria surrounding the “sovereign debt” crisis part of the story, there hasn’t been much press coverage about what the ECB is now up to. Despite saying there would be no bailouts the ECB is now buying huge amounts of GIPSI debt to ensure the funding crisis in the EMU is contained. While I am happy they are doing that – inasmuch as anything that is done within the context of that flawed system is compromised – there are sinister overtones. The ECB is now an incredibly powerful institution without peer in the EMU. They stand between the system collapsing or muddling through. And they can force austerity onto citizens throughout the member nations but never face the judgement of the voters.

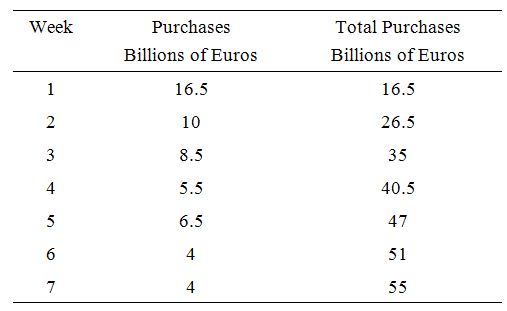

Just to follow up on that today I got some figures of ECB purchases of government bonds for the last 7 weeks. So far they have purchased 55 billion euro which seems to be sufficient to keep borrowing rates down and allow the EMU governments to refinance themselves without having to default. The following Table shows the last 7 weeks of purchases:

I was chatting with Warren Mosler in Boston about this today and we both agreed that there is a sinister element to this. The purchases really amount to a massive fiscal intervention but with the barbs attached that the national governments have to toe the ECB line. This concentration of power within the EMU within an unelected body which can hand out favours at will in return for total compliance is a very dangerous precedent. If anything looks like totalitarianism in the current developments this is it.

On the bond markets, Krugman says:

… it’s true that bond investors have turned on governments with intractable deficits. But there is no evidence that short-run fiscal austerity in the face of a depressed economy reassures investors. On the contrary: Greece has agreed to harsh austerity, only to find its risk spreads growing ever wider; Ireland has imposed savage cuts in public spending, only to be treated by the markets as a worse risk than Spain, which has been far more reluctant to take the hard-liners’ medicine. It’s almost as if the financial markets understand what policy makers seemingly don’t: that while long-term fiscal responsibility is important, slashing spending in the midst of a depression, which deepens that depression and paves the way for deflation, is actually self-defeating.

Whether Krugman is right about another depression remains to be seen. There has been news in the last day or so that does suggest that the public deficits across the EU are propping up demand just enough to stop a depression scenario. Growth in Europe though extremely weak is positive and there is some evidence that the falling euro is helping exporters. I will provide some separate analysis of this at a later date when more data is available.

But the other side of this “optimism” is the growing threat to the banking system. That is a story that has yet to unfold and will affect all the European banks – not just the GIPSIs. But whichever way you look at it the case that has made for austerity by the IMF and several national governments is unconvincing in the extreme and the very likely impact will be for aggregate demand to slow and perhaps head south. This will do nothing to improve the real aspects of the economy that governments should be focused on.

It will also send the financial ratios, that the maintream economists and their media lackeys are obsessed with, further into the hysteria zone.

Thinking about the G20 and the growing threat of deflation, you quickly realise that this is another one of those aspirational inconsistencies that bedevil the mainstream attack on fiscal deficits.

The Flat Earthers (a.k.a deficit terrorists) want to reduce public debt levels. Some also want to reduce private debt levels at the same time. The latter having in general exceeded the sustainable limits in the last credit binge. However, in demanding that we have a general rundown of debt they usually fall into the accounting trap – that they are seeking this dual goal in the context of a country that runs an external deficit and isn’t likely to go into an external surplus anytime soon, certainly not of the magnitude required to provide counter to the domestic surplus ambitions.

But the simplicity of their argument is what they rely on. Most people find it hard getting their head around the nuances of national income accounting. I realise that. But in the end it is just adding up and subtracting although I acknowledge what is being added and subtracted might give people some grief.

So it sounds right to reduce debt across the board. That sounds like a safe strategy because “too much” debt is bad and any public debt is to be avoided because – the simple message they continually pump out – taxes will rise to pay back the debt and we all hate taxes.

All of these statements regarding public debt are largely false – taxes do not rise to pay back debt unless the government actually imposes that on the economy. Further, debt is rarely paid back and when it is the fiscal drag that is required to pay it back is extremely damaging to the fortunes of all of us private individuals – it reduces our purchasing power and further, puts a liquidity squeeze on us so we have to start selling down our wealth to pay our taxes. Most people in the community don’t realise this however. The commentators never focus on the deleterious effects of running budget surpluses because they have been conditioned to mouth “surpluses increase national saving” without thinking.

Budget surpluses do not increase national saving. It makes no senses to say that a national government, which is sovereign in its own currency, can save in that currency. What does that mean when the government can spend whenever it likes and doesn’t need a stockpile of saving, as in the case of a household, to expand future consumption? It means nothing. Households, save, that is, forgo current consumption to improve future consumption possibilities. That is because they are financially constrained and have to finance all their spending in one way or another. That constraint does not apply to a sovereign government unless they voluntarily impose it. It makes no sense to impose a constraint that prevents the government from actually fulfilling its charter to expand social welfare.

So there are layers of deceptions that litter the attack by the Flat Earthers (a.k.a deficit terrorists).

But there is another deception or ignorance that rarely gets attention. Economies around the remain close to recession at the moment. By introducing austerity packages which aim to reduce deficits the Flat Earthers (a.k.a deficit terrorists) are ensuring that the likelihood of a double-dip recession is increased. One consequence of this is that their policies are likely to increase the deficits and the public debt/GDP ratio as economic activity declines. They have some sort of religious belief that economic growth is going to come out of the bowels of despair.

Somehow, they think that the private businesses worrying about the lack of orders and timid about the future will suddenly appreciate the fact that the government is cutting incomes even further and in a fit of free market zealotry will suddenly start investing again in productive infrastructure even though they don’t have the warehouse space available to store the unsold production that would result.

The other scenario that the religious zealots pray for is a net exports led recovery – for everyone. Again, this fervence defies accounting. Not every country can run external surpluses. Further, to reconstruct an economy from one thathas been running persistent current account deficits into a net exporting country with positive invisibles takes a long time because it involves fundamental structural change – major changes in industry composition and given the wage levels in Asia – major reductions in real wages in the advanced nations. It is simply not going to happen anytime soon.

But the other consequence was picked up by UK Guardian economics correspondent Larry Elliot (June 28, 2010) in his article – G20 accord: you go your way, I’ll go mine.

Elliot said:

The sluggish recovery has meant that core inflation in the US and eurozone is already below 1%. They are one recession away from deflation, and perhaps not even that. There is so much spare capacity – particularly in European and North American labour markets – that a marked slowdown in activity rather than falling output would do the trick.

Central banks are terrified by the prospect of deflation, not least because none of them – outside of the Bank of Japan – have any experience of coping with it. They would have every right to be worried. Deflation raises the real level of debt; it would hurt consumers, businesses and – crucially – banks.

Deflation – the Japanese problem – arises when aggregate demand deficiency becomes chronic. The only real way out is with a substantial fiscal stimulus of the order that governments are eschewing.

So who is going to be held accountable for all this policy failure when things go backwards again? The IMF cannot be held accountable because they are not elected and have not constituency.

Australia is also heading south

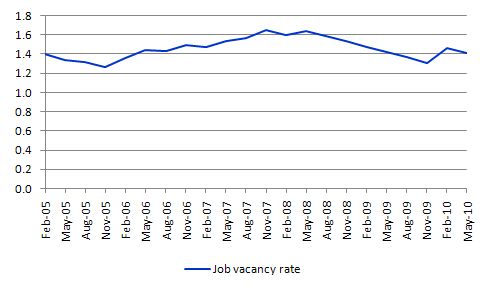

The Australian Bureau of Labour Statistics released its Job Vacancies, Australia for May 2010 today and the results are not looking good. The summary results are:

- Total job vacancies in May 2010 were 164,600, a decrease of 2.8 per cent from February 2010.

- The number of job vacancies in the private sector was 149,600 in May 2010, a decrease of 1.7 per cent from February 2010.

- The number of job vacancies in the public sector was 15,000 in May 2010, a decrease of 12.3 per cent from February 2010.

The following graph shows the vacancy rate (total vacancies as a percent of the labour force) since February 2005 (quarterly seasonally adjusted data). You will clearly excuse the bank economists and others who are claiming we have a red hot economy and the labour market is booming. It is not and this data while retrospective is consistent with a range of indicators that is suggesting the withdrawal of the fiscal stimulus is not being replaced by a renewed surge in private spending.

Humour

Our friend Sean Carmody just alerted me to this story – Moody’s Commercial Paper Rating May Be Cut, S&P Says which says that:

Moody’s Corp., owner of the second- largest credit-rating company, may have its commercial paper ranking cut by its bigger competitor Standard & Poor’s.

S&P today placed Moody’s A-1 short-term debt rating on CreditWatch negative, citing reports that a computer error may have caused Moody’s to give Aaa ratings to debt that didn’t deserve them.

Hilarious. Criminals eating each other up. I recommend a major Moody’s retaliation.

Conclusion

I liked Krugman’s conclusion:

So I don’t think this is really about Greece, or indeed about any realistic appreciation of the tradeoffs between deficits and jobs. It is, instead, the victory of an orthodoxy that has little to do with rational analysis, whose main tenet is that imposing suffering on other people is how you show leadership in tough times.

And who will pay the price for this triumph of orthodoxy? The answer is, tens of millions of unemployed workers, many of whom will go jobless for years, and some of whom will never work again.

It is consistent with the sentiments I expressed last Friday in the blog – Something is seriously wrong. It would be hard to distinguish some of these policy makers and so-called leaders from the characteristics that define extreme sociopaths.

Today (Boston time) I am giving a workshop on fiscal sustainability to a group hand-picked by the host investment fund. My host tells me that the group comprises a financial market participants and venture capitalists. It will probably be a tough audience but I am also told they are not hard-core ideologues and are open to persuasion.

So my goal for tomorrow: Have another 37 people join the Modern Monetary Theory camp and start agitating. There are 37 invitees!

That is enough for today!

What’s the community’s thoughts on using fiscal incentives to get private sector businesses to invest rather than relying on government spending, ie increasing investment allowances and reducing jobs taxes for businesses.

Would it work? If not, why not?

This article on sectoral balances and the references therein makes the point: http://www.interfluidity.com/v2/871.html

Bill,

Thanks, as usual.

Can’t quite agree with Krugman that we’re at the 1933 stage here.

More like ’31 on the bank-financial side, and more like ’37 on the deficit-hysteria side.

In both cases, headed downward, toward banking failure/consolidation and deepening recession, if not the bust of all busts.

No Pecora Commission, yet no lack of meaningless reforms to fix the problems we don’t understand.

Ever upwards.

They have just ceded leadership to the IMF – that unelected rabble. Stay tuned for things to get worse.

Welcome to the New Technocracy. Democracy is just so 18th century, you know.

The New Technocracy is not to be confused with the old technocracy, the high priesthood. The old “wise men” of the New Technocracy do not wear robes.

Looking more and more like the New World Order conspiracy theorists were on to something.

Neil, how are financial incentives not subsidies? Subsidies are “spending” in that they add to the deficit. I generally don’t like subsidies to private business because they are public gifts.

The best way to increase investment is to increase lagging demand and that means accommodating the public’s desire to save/delever, and to stimulate consumer demand from the bottom, where it will be spent into the economy immediately on necessities. Investment is pro-cyclical.

But I am not an economist, so what do I know?

ECB Bond purchase program is finished with 60 billions:

http://www.ecb.europa.eu/press/pr/date/2010/html/pr100630.en.html

Gerhard,

Those are “covered bonds” – on-balance sheet securitized products not government bonds.

Paul Krugman’s post today is appropriately entitled The Conventional Superstition. He concludes:

Flat Earthers? Robin Hood & Opray Winfrey already tried it. You were born too late or you’d point out the mechanics were previously legislated and the act extended – several times. It would be more credible if you tried to be more accurate. You know there’s no free lunch – but stop short of laboring over it. Equations are base lines. They’re the starting line for extended thought. Economics is about the rates-of-change in the flow-of-funds. Get the flow right and the equations (holes & leakages), are less significant.

Be careful not to call your niche modern monetary theory. You (& everyone else), lack an adequate knowledge of money & central banking. But this is just a blog.

I agree the US urgently needs added fiscal stimulus. I won’t commit to there’s some “best” way. Stimulus now, by whatever means is “best”.

@Neil

Im starting to think that the non-financial corporate sector (ex-petroleum) feels like they are on the rack as much as the household sector. Put those two sectors together both as victims in this. I dont know if these sectors would respond to accelerated investemnt tax breaks, they seem to be hoarding cash because they dont know what is going to come at them next.

That could be a savvy politicians coalition here, ie demonize the banks and oil…ala Andrew Jackson in US history only throw the oil interests into the serpent pit with the banks. I think you could raise alot of campaign cash from this coalition also via the internet from the household sector and via corporate donations from the victimized non-financial corporate sector (ex-petroleum).

Resp,

i get it now, you’re a communist communism is dead & so will be MMT

Great column, as always, Prof Mitchell. You may notice that the Guardian comment pieces (which I notice you refer to quite often here in your blog posts) allows reader comments below the main article. Abandon hope all ye who enter there; the level of understanding of even the basic sectoral accounting relationships is as lacking as you might expect. That said, I do enter the bear-pit sometimes and use the insights of MMT to make some comments there.

I get in now, flow5. You are an Austrian. 🙂

Fans of Hayek need to wake up and realize that now the road to serfdom begins with financial capitalism and leads through state capture to debt peonage.

Tom:

I was thinking about the UK chancellor’s decision to reduce the investment allowance on plant and equipment and move it to a reduction on the corporation tax rate rather than any extra money as such. That struck me as entirely the opposite approach to what is required (ie increase the profit tax, reduce the payroll tax and increase the allowance for investment in plant).

I’ve never understood why politicians get so moist over the headline rate of corporation tax. It’s only impressive to the hard of accounting. The only thing that matters to a company accountant is how many absolute pounds, shillings and pence are heading towards the exchequer.

Tom, I think is it more like an Austerian or an Assertionian or an A**holian.

“Be careful not to call your niche modern monetary theory. You (& everyone else), lack an adequate knowledge of money & central banking. But this is just a blog.”

And flow5 is just a commenter on a blog with too much time on his hands.

flow5:

“Equations are base lines. They’re the starting line for extended thought. Economics is about the rates-of-change in the flow-of-funds. Get the flow right and the equations (holes & leakages), are less significant.”

I’m not sure what you’re saying here – that equations don’t mean anything, so get the equations for flow right? Or think about flow without equations, just using some kind of intuitive instinct? If you mean the former, Bill talks about the differences between stocks and flows, and writes many equations on the subject. For example:

https://billmitchell.org/blog/?p=4870

If you mean the latter – well, good luck trying to model an economy without any maths.

flow5 said: “Be careful not to call your niche modern monetary theory. You (& everyone else), lack an adequate knowledge of money & central banking. But this is just a blog.”

Please enlighten us. I would like to hear a different viewpoint.

@Ramanan

“Those are “covered bonds” – on-balance sheet securitized products not government bonds.”

In statement 2009_06_04 I read:

“have underlying assets that include exposure to private and/or public entities”

Sorry for asking: What is the difference between the former and the latter?

Gerhard

Gerhard,

You are right I think. The covered bonds are bonds backed by cash flows from bank loans and/or government securities. So they are almost like mortgage backed securities, (if you ignore the cash flows from government bonds in the former). The only main difference is that the covered bonds appear in a bank’s liabilities and are not off-balance sheet. I think the cash flows from government bonds backing covered bonds is just to make them less riskier. The major exposure is the loans/mortgages.

So the ECB covered bond purchases is just like the purchases of MBSs by the Fed in the US.

I don’t know any Austrias. And Milton Friedman was stupid. (1) Friedman’s MV doesn’t eqaul PQ. (2) Friedman’s IORs @ .25% are contractionary. (3) Friedman’s “money multiplier” is not a base for the expansion of new money & credit. (4) money lags aren’t long and variable. (5) the member banks pay for what they already own (which shrinks the supply of loan funds & raises long-term interest rates). REG Q was a conspiracy.

SEE: 1.

(1) The Commercial & Financial Chronicle Thursday, April 6, 1967 “MONETARY POLICY BLUNDER CAUSED HOUSING CRISIS”

(2) The commercial & Financial Chronicle, Thursday, June 6, 1968 “REPEAT OF 1966-TYPE CREDIT CRUNCH UNLIKELY DESPITE TIGHT MONEY”

Dr. Leland James Pritchard, PhD, Economics, Chicago, 1933, MS, Statistics, Syracuse

Forerunner of MMT?::: Subject to the limitation that the Reserve banks may not hold at any one time more than $5 billion of securities purchases direclty from the Treasury. This is regarded by many, including members of Congress and some Secretaires of the Treasury, as beinvbg more in the nature of an “overdraft” privilege. This Treasury borrowing privilege amends Sec. 14 (b) of the Federal Reserve Act. It has been extended from time to time by Congress. The reasons given for this direct borrowing amendemnt are the convenience of the Treasury, economy in the amount of cash the Treasury would othewise consider it prudent to hold, the smoothing out of interest rates in the money markets, and an immediate source of funds for temporary financing in the event of a national emergency.

“well, good luck trying to model an economy without any maths” I give to you the GOSPEL:

(1) Ben S. Bernanke

Chairman and a member of the Board of Governors of the Federal Reserve System. Chairman of the Federal Open Market Committee, the System’s principal monetary policymaking body.

At the same time, because economic forecasting is far from a precise science, we have no choice but to regard all our forecasts as provisional and subject to revision as the facts demand. Thus, policy must be flexible and ready to adjust to changes in economic projections.

2) European Central Bank (ECB) Central Bank for the EURO

The transmission mechanism is characterised by long, variable and uncertain time lags. Thus it is difficult to predict the precise effect of monetary policy actions on the economy and price level…

3) Janet L. Yellen, President and CEO of the Federal Reserve Bank of San

Francisco

You will note that I am casting my statements about the stance of policy and the outlook in very conditional terms. I do this because of the great uncertainty that surrounds these issues. Frankly, all approaches to assessing the stance of policy are inherently imprecise. Just as imprecise is our understanding of how long the lags will be between our policy actions and their impacts on the economy and inflation. This uncertainty argues, then, for policy to be responsive to the data as it emerges, especially as we get within range of the especially as we get within range of the desired policy setting.

(4) Thomas M. Hoenig

President of Federal Reserve Bank of Kansas City

Monetary policy must be forward-looking because policy influences inflation with long lags. Generally speaking a change in the Federal funds rate may take an estimated 12-18 months to affect inflation measures….But the course of monetary policy is not entirely certain. & will depend on how the economy evolves in the coming months.

(5) William Poole*

President, Federal Reserve Bank of St. Louis

However inflation is measured, economists agree that monetary policy has at most a minimal influence on the rate of change in the price level over relatively short time periods-months, quarters or perhaps even a year. Central banks are responsible for medium- and long-term inflation-such inflation, as Milton Friedman wrote, is a monetary phenomenon that depends on past, current and expected future monetary policy. As a practical matter, the medium- to long-term likely is a period of two to five years.

(6) Robert W. Fischer – President Dallas Federal Reserve Bank

November 2, 2006:

“In retrospect [because of faulty data] the real funds rate turned out to be lower than what was deemed appropriate at the time and was held lower longer than it should have been. In this case, poor data led to policy action that amplified speculative activity in housing and other markets. The point is that we need to continue to develop and work with better data.”

(7) Governor Donald L. Kohn

I think a third lesson is humility–we should always keep in mind how little we know about the economy. Monetary policy operates in an environment of pervasive uncertainty–about the nature of the shocks hitting the economy, about the economy’s structure, and about agents’ reactions. The 1970s provide a sobering lesson in the difficulty of estimating the level and rate of change of potential output; these are quantities we can never observe directly but can only infer from the behavior of other variables.

(8) James Grant (Grant’s Interest Rate Observer)

“Both use quantitative methods to build predictive models, but physics deals with matter; economics confronts human beings. And because matter doesn’t talk back or change its mind in the middle of a controlled experiment or buy high with the hope of selling even higher, economists can never match the predictive success of the scientists who wear lab coats.”

———————————————————————————————————————–

First, there is no ambiguity in forecasts: In contradistinction to Bernanke (and using his terminology), forecasts are mathematically “precise” :

(1) “Money” is the measure of liquidity; the yardstick by which the liquidity of all other assets is measured.

(2) Income velocity is a contrived figure (fabricated); it’s the transactions velocity (bank debits – Vt) that’s important (i.e., financial transactions are not random);

(3) Nominal GDP is the product of monetary flows (M*Vt) (or aggregate monetary demand), i.e., our means-of-payment money (M), times its transactions rate of turnover (Vt).

(4) The rates-of-change (roc’s) used by economists are specious (always at an annualized rate; which never coincides with an economic lag). The Fed’s technical staff, et al., has learned their catechisms;

(5) Friedman became famous using only half the equation (the means-of-payment money supply), leaving his believers with the labor of Sisyphus.

(6) Contrary to economic theory, & Nobel laureate, Dr. Milton Friedman, monetary lags are not “long and variable”. The lags for monetary flows (MVt), i.e. the proxies for (1) real-growth, and for (2) inflation indices, are historically, always, fixed in length. However, the FED’s target, nominal gdp?, varies widely.

(7) Roc’s in (MVt) are always measured with the same length of time as the specific economic lag (as its influence approaches its maximum impact (not date range); as demonstrated by the clustering on a scatter plot diagram).

(8)

(9) Consequently, since the lags for (1) monetary flows (MVt)…. by using simple algebra, economic prognostications are infallible (for less than one year).

(10) Asset inflation, or economic bubbles, are incorporated: including housing, commodity,, dot.com, etc. This is the “Holy Grail” & it is inviolate & sacrosanct: See 1931 Committee on Bank Reserves Proposal (by the Board’s Division of Research and Statistics), published Feb, 5, 1938, declassified after 45 years on March 23, 1983.

(11) The BEA uses quarterly accounting periods for real GDP and the deflator. The accounting periods for GDP should correspond to the specific economic lag, not quarterly.

(12) Monetary policy objectives should not be in terms of any particular rate or range of growth of any monetary aggregate. Rather, policy should be formulated in terms of desired roc’s in monetary flows (MVt) relative to roc’s in real GDP.

(13) Combining real-output with inflation to obtain roc’s in nominal GDP, can then be used as a proxy figure for roc’s in all transactions. Roc’s in real GDP have to be used, of course, as a policy standard.

(14) Because of monopoly elements, and other structural defects, which raise costs, and prices, unnecessarily, and inhibit downward price flexibility in our markets, it is probably advisable to follow a monetary policy which will permit the roc in monetary flows to exceed the roc in real GDP by c. 2 – 3 percentage points.

(15) I.e., monetary policy is not a cure-all, there are structural elements in our economy that preclude a zero rate of inflation. In other words, some inflation is inevitable given our present market structure and the commitment of the federal government to hold unemployment rates at tolerable levels.

(16) Some people prefer the “devil theory” of inflation: “It’s all Peak Oil’s fault”, “Peak Debt’s fault”, or the result of the “Stockpiling of Strategic Raw Materials/Industrial Metals” & Soaring Agriculture Produce. These approaches ignore the fact that the evidence of inflation is represented by “actual” prices in the marketplace.

(17) The “administered” prices of the world’s monopolies, and or, the world’s oligarchies: would not be the “asked” prices, were they not “validated” by (MVt), i.e., “validated” by the world’s Central Banks. Dr. Milton Friedman said it best: “inflation is always and everywhere a monetary phenomenon”.

To: anderson@stls.frb.org

Subject: As the economy will shortly change, I wanted to show this to you again – forecast:

Date: Wed, 24 Mar 2010 17:22:50 -0500

Dr. Anderson:

It’s my discovery. Contrary to economic theory, monetary lags are not “long & variable”. The lags for monetary flows (MVt), i.e., the proxies for (1) real-growth, and for (2) inflation indices, are historically, always, fixed in length. However the lag for nominal gdp varies widely (I am using the Board of Governors’ required reserves figures). Of course rates-of-change in bank debits work better.

Assuming no quick countervailing stimulus:

2010

jan….. 0.54…. 0.25 top

feb….. 0.50…. 0.10

mar…. 0.54…. 0.08

apr….. 0.46…. 0.09 top

may…. 0.41…. 0.01 stocks fall

Should see shortly. Stock market makes a double top in Jan & Apr. Then real-output falls from (9) to (1) from Apr to May. Recent history indicates that this will be a marked, short, one month drop, in rate-of-change for real-output (-8). So stocks follow the economy down.

Re: “Looking more and more like the New World Order conspiracy theorists were on to something.”

Just look at Toronto. Robocops all over the place. This really is police-state fascism–with a smile, so long as you do not disrupt things. Back at Bill’s blog, “Something is seriously wrong,” the last post, by Ames, is basically, and unfortunately true. Most debate is really irrelevant–the big financial and corporate powers are definitely in control, and if you don’t like it we’ll break your head. We own the police and we own the military. As that Rockefeller man, Brzezinski, has said in his books:

“This regionalization is in keeping with the Tri-Lateral Plan which calls for a gradual convergence of East and West, ultimately leading toward the goal of one world government. National sovereignty is no longer a viable concept.”

“The nation state as a fundamental unit of man’s organized life has ceased to be the principal creative force: International banks and multinational corporations are acting and planning in terms that are far in advance of the political concepts of the nation-state.”

So there you have it: what is really going on is that government is being put into the hands of “international banks and multinational corporations. In other words, Wall St. and The City are engineering a wholesale transfer of wealth and power taking place. When it has been completed, it will be a very different world. Meanwhile, the more confusion that can be sown, the better. They can do what they do under the surface, and then present themselves as the saviours.

Flow5,

If it has some been some time before anyone has responded to your comments, it has been because we are all pretty ‘gob-smacked’ about how rood and disrespectuful your comments have been.

First, your casual assumption that we are all communists, simply reveals the fact, that you are so impatient, you could not be bothered to read through Bill’s blogs and the responses to them. All you’ve done is show how quickly you jump to conclusions. If you read Bills’ blogs you will see how often he refers to, how undemocratic various global institutions are – how does this square with Bill being communist.

To add insult to injury, you then demonstrate how insecure you are, by submitting comments which are so long, and address so many points, that it is clear to us that you are only interested in demonstrating how clever you are, how many important contacts you have, and how large your ego is. I am saying this point because I am not an economist, I’m just a normal (unemployed) person, and as such I am used to be treated as scum (so if you want to treat me the same – i’m used to it), so I will save all the other contributors’ blushes and tell you myself.

If you wish to present a reasoned argument, do so in a ‘few’ paragraphs, with a link to your own blog – that’s the polite way we do things in the blogoshpere’.

If you are upset that people might be tacking MMT seriously, then maybe make your own theory accessible, by creating your own blog, and making the content free. Always deal with one point at a time, and don’t try to shut everyone up, by making your comments take up nearly as much space as Bill’s original blog.

I can tell you now, if you want to sell your ideas to the public – you failed – you just made yourself look scared and desperate.

I normally close with ‘Kind Regards’ but I just don’t feel like it.

Charlie

UN report calls for world to ditch dollar, migrate to new global currency

Comparing an economy with a gold standard and fixed exchange rates to a modern economy is frm now on always and everywhere a flow5 phenomenon.