Today (April 18, 2024), the Australian Bureau of Statistics released the latest - Labour Force,…

Full employment apparently equals 12.2 per cent labour wastage

There is an election campaign upon us in Australia now and one of the themes the government is developing by way of garnering credit for its policies is that Australia is operating at near full employment thanks to their economic policy framework. Nothing could be further from the truth – both that we are close to full employment and that their policy framework is moving us towards full employment. But this claim, which is repeated often these days and was a catchcry of the former conservative government as well, is a testament as to how successful the neo-liberal orthodoxy has perverted the meaning of signficant concepts (like full employment) and convinced the community that you can be near full employment and therefore there is no real problem to address when you have at least 12.2 per cent of your willing labour resources being wasted. It continually amazes me.

In the May Budget speech the Treasurer said:

Our economy is expected to rebound powerfully, with forecast real GDP growth of 3¼ per cent in 2010-11 and 4 per cent in 2011-12.

Best of all, the unemployment rate is expected to fall further from 5.3 per cent today to 4¾ per cent by mid-2012, around the level consistent with full employment.

Background

There have been two striking developments in economics over the last thirty five odd years. On the one hand, a major theoretical revolution occurred in macroeconomics (from Keynesianism to Monetarism to neo-liberalism); while on the other hand; unemployment rates have persisted at the highest levels known in the Post World War II period.

These developments bear on how the concept of full employment is developed within macroeconomics. Initially, economists defined full employment in terms of a focus on jobs.

The emphasis of macroeconomic policy in the period immediately following the Second World War was to promote full employment. Inflation control was not a major issue even though it was one of the stated policy targets of most governments.

The memories of the Great Depression were still influential for policy design. During the World War II governments learned that full employment could be maintained with appropriate use of budget deficits. It was the onset of the War and the related public expenditure that ended the Great Depression.

Neoclassical remedies tried during the 1930s failed to reduce unemployment. Following World War II, the problem that had to be addressed by governments was how to translate the full employed war economy with extensive civil controls and loss of liberty into a fully employed peacetime model.

The first major statement addressing this problem came in the form of William Beveridge’s (1944) book Full Employment in a Free Society (Allen and Unwin, London).

This statement was consistent with the new Keynesian orthodoxy of the time, which saw unemployment as a systemic failure and moved the focus to analysing the state of aggregate demand in relation to the real capacity of the economy to produce and away from the ascriptive characteristics of the unemployed themselves and the prevailing wage levels.

Beveridge wrote:

The ultimate responsibility for seeing that outlay as a whole, taking public and private outlay together, is sufficient to set up a demand for all the labour seeking employment, must be taken by the State …

The emphasis was on jobs. Beveridge defined full employment as an excess of vacancies at living wages over unemployed persons.

Similarly, in 1993, William Vickrey said:

I define genuine full employment as a situation where there are at least as many job openings as there are persons seeking employment, probably calling for a rate of unemployment, as currently measured, of between 1 and 2 percent.

The post World War II period was marked by governments maintaining levels of demand using a range of fiscal and monetary measures to ensure that full employment was achieved.

Unemployment rates were usually below 2 per cent throughout this period. Importantly, the economies that avoided the plunge into high unemployment in the 1970s maintained a capacity within the economy to functions as an employer of the last resort to absorb the fluctuations in aggregate demand that negatively impact on private production from time to time.

By the 1950s, the focus on jobs subtley shifted and economists began to focus on unemployment. Initially this involved a debate about what constituted the irreducible minimum rate of unemployment. But soon the debate became tangled up in models of unemployment and inflation – the Phillips curve era had begun.

The popularised Phillips curve proposed a relationship between unemployment and inflation and the debate shifted to the existence and nature of a trade-off between nominal and real economic outcomes.

The Keynesian orthodoxy considered real output (income) and employment as being demand-determined in the short-run, with price inflation being explained by a negatively sloped Phillip’s curve (in both the short-run and the long-run). Policy-makers believed they could manipulate demand and exploit this trade-off to achieve a socially optimal level of unemployment and inflation.

Significantly, the concept of full employment gave way to the rate of unemployment that was politically acceptable in the light of some accompanying inflation rate. Full employment was no longer debated in terms of a number of jobs.

Even this notion of full employment was largely abandoned with development of the expectations-augmented Phillips curve that emerged in the late 1960s with the work of Friedman and Phelps.

This model spearheaded the resurgence of pre-Keynesian macroeconomic thinking in the form of Monetarism. The embedded Natural Rate Hypothesis (NRH) outlined a natural rate of unemployment (NRU), where the inflation-unemployment tradeoff was allegedly a trade-off between unemployment and unexpected inflation.

As workers gained more information the trade-off vanishes. At this point there is only one unemployment rate consistent with stable inflation – the NRU. This led Milton Friedman to famously state in 1968 that:

There is no long-run, stable trade-off between inflation and unemployment.

These developments represented a major theoretical break from the previous versions of the Phillips curve.

The pre-Monetarist Phillips curve models were based on a disequilibrium notion of the relationship between inflation and unemployment in that they modelled the adjustment of prices and wages to some labour market imbalance between supply and demand. The causality was strictly from the labour market disequilibrium to the price adjustment function. There was no presumption that full employment is inevitable or a tendency of a capitalist monetary economy.

The Friedman-Phelps story and the later developments under the rubric of rational expectations and the New Classical school are, instead, based on a market clearing relation and the causality is reversed. Unemployment is considered to be voluntary and the outcome of optimising choices by individuals between work (bad) and leisure (good).

In the natural rate world of Friedman and Phelps, the Central Bank can promote variations in the unemployment rate by introducing unforeseen changes in inflation, a temporary capacity allowed due to expectational inertia on behalf of the workers.

There is no theory in the natural rate hypothesis that changes in the unemployment rate cause changes in inflation. Full employment is assumed to prevail (with unemployment at the natural rate) unless there are errors in interpreting price signals. The tendency is always to restore full employment by market mechanisms.

There is no discretionary role for aggregate demand management.

These arguments were simply rehashes of discredited pre-Keynesian theory but benefitted from the empirical instability in the Phillips curve in most OECD economies in the 1970s.

Any Keynesian remedies proposed to reduce unemployment were met with derision from the bulk of the profession who had embraced the NRH and its policy implications.

The NRH was now the characterisation of full employment and it was asserted that the economy would always tend back to a given NRU, no matter what had happened to the economy over the course of time. Time and the path the economy traced through time were thus irrelevant. Only microeconomic changes would cause the NRU to change.

Accordingly, the policy debate became increasingly concentrated on deregulation, privatisation, and reductions in the provisions of the Welfare State.

Unemployment continued to persist at high levels. The fact that quits were strongly pro-cyclical (contrary to the misperceptions explanation of unemployment) made the NRH untenable. However, the idea of a cyclically-invariant unemployment rate, which was consistent with inflation stability persisted in the form of

the Non-Accelerating Inflation Rate of Unemployment (NAIRU) which was introduced into the literature in 1975.

The approach of Modigliani and Papademos – the first paper on the NAIRU – was in the Phillips mould in the sense that movements in the unemployment rate from some steady-state rate (defined in terms of the rate at which inflation was stable) would promote opposite movements in inflation.

In relation to the NAIRU, they said that:

… as long as unemployment is above it, inflation can be expected to decline.

Various theoretical structures support this conclusion. It can arise in a simple excess demand model where wage pressure builds as the labour market tightens and the firms pass the rising costs on in the form of higher inflation. Marxist-inspired models where inflation arises due to incompatible claims on existing real income also can be used.

Whatever theoretical construct is used to underpin the model the conclusion is simple: there is a defined unemployment rate, which is cyclically-invariant, where price inflation is stable. My early PhD work published in 1987 showed that the assumption of cyclical invariance was crucial to the policy conclusions of the NAIRU proponents but deeply flawed both theoretically and empirically.

The notion of a constant NAIRU that conditions the potential for inflation in the economy has dominated public policy makers since the first oil shocks of the 1970s. Monetarist “fight-inflation-first” strategies now known as inflation targetting have exacted a harsh toll in the form of persistently high unemployment. Full employment as initially conceived was abandoned.

Please read my blog – The dreaded NAIRU is still about! – for further critique of this conceptualisation of full employment.

Unemployment – the tip of the iceberg

A vast body of literature from the 1950s onwards describes the manner in which the labour market adjusts to the business cycle. In my recent book with Joan Muysken – Full Employment abandoned we discuss these adjustment processes.

The literature also ties in with some versions of segmented labour market theory. Together they provide the basis of a theory of cyclical upgrading, whereby disadvantaged groups in the economy achieve upward mobility as a result of higher economic activity.

Arthur Okun’s 1973 work – Upward Mobility in a High-Pressure Economy – (published Brookings Papers on Economic Activity, 1, pp. 207-252) noted that when there is a cyclical downturn commentators focus on the movements in unemployment but ignore the other costly manifestations of the cycle. He said that unemployment was only the tip of the iceberg.

He coined an expression – on a high tide all boats rise – meaning that all the forms of cyclical wastage are reduced and the weak and the small also benefit when the cycle turns up.

He summarised the submerged parts of the cyclical iceberg as follows:

- The most cyclically sensitive industries had large employment gaps, were dominated by prime-age males, offered high-paying jobs, offered other remuneration characteristics (fringes) which encouraged long-term attachments between employers and employees, and displayed above-average output per person hour.

- In demographic terms, when the employment gap is closed in aggregate, prime-age males exit low-paying industries and take jobs in other higher paying sectors and their jobs are taken mainly by young people.

- In the advantaged industries, adult males gain large numbers of jobs but less than would occur if the demographic composition of industry employment remained unchanged following the gap closure. As a consequence, other demographic groups enter these ‘good’ jobs.

- The demographic composition of industry employment is cyclically sensitive. The shift effects are in total estimated (in 1970) to be of the same magnitude as the scale effects (the proportional increases in employment across demographic groups assuming constant shares). This indicates that a large number of labour market changes (the shifts) are generally of the ladder climbing type within demographic groups from low-pay to higher-pay industries.

So when the economy is maintained at full employment, workers in low paying sectors (or occupations) also receive income boosts because employers seeking to meet their strong labour demand offer employment and training opportunities to the most disadvantaged in the population. If the economy falters, these groups are the most severely hit in terms of lost income opportunities.

Upgrading also focuses on the mapping of different demographic groups into good and bad jobs. The groups who experience the greatest relative employment gains when economic activity is high are those who are stuck in the secondary labour market, typically, teenagers and women.

While these groups are proportionately favoured by the employment growth, the industries with the largest relative employment growth are typically high-wage and high-productivity and employ mostly prime-age males.

Expansion is therefore equated with ladder climbing whereby males in low-pay jobs (as a result of downgrading in the recession) climb into better jobs and make space for disadvantaged workers to resume employment in their usual sectors. In addition, favourable share effects in predominantly male industries provide better jobs for teenagers and women.

So fiscal austerity approaches that deliberately maintain low pressure in the economy and stop the tide from rising impose substantial costs that go well beyond those that we can easily see in terms of official unemployment.

This observation bears on our conceptualisation of full employment. This topic was covered in the latest OECD Employment Outlook 2010.

OECD shifts a little but still doesn’t get its

In its Annual OECD Employment Outlook 2010 the OECD has shifted its position slightly by recognising that broader forms of labour wastage are significant but still claim that OECD economies can generate some 80 million jobs while still pursuing fiscal austerity measures.

Their conception of fiscal policy is perverted. See my blog – The OECDs perverted view of fiscal policy – for further discussion.

The OECD said that:

OECD countries need to create 17 million jobs to get employment levels back to where they were before the crisis … Unemployment may have peaked in the OECD area, having reached 8.6% in May 2010.

But when you consider underemployment the OECD recognises the problem is much larger than the one indicated by the official unemployment rate:

Today’s “jobs gap” varies widely between countries: in the United States nearly 10 million jobs need to be created. In Ireland, 318 000 jobs are needed to return to pre-crisis levels, that is one job for every 5 existing jobs today. Spain has lost 2.5 million jobs since the end of 2007. Altogether, there are 47 million unemployed in the OECD area today. But taking into account people who have given up looking for work or are working part-time but want to work full-time, the actual number of unemployed and under-employed in OECD countries could be about 80 million …

The OECD are still pushing its flawed Jobs Study approach to labour market activation. They say:

A strong case can be made to ensure that labour market policies remain adequately funded … But it becomes essential to focus on cost-effective programmes and to target the most disadvantaged groups at risk of losing contact with the labour market.

Most countries have maintained or expanded programmes to help the unemployed find work during the crisis. They should also invest more in training, especially for people with low or obsolete skills. Tax breaks and other types of hiring subsidies for firms that recruit people who have been out of work for more than a year would help jumpstart job creation …

You get get a begrudging that “public work schemes for the most vulnerable families” in poor countries might be required. Please read my blogs – The OECD is at it again! and Now the OECD is saying there is a jobs crisis – for more discussion on the flawed policy framework pushed by the OECD.

But the significant progress is that underemployment is now being pushed onto the centre stage as a major policy problem in its own right.

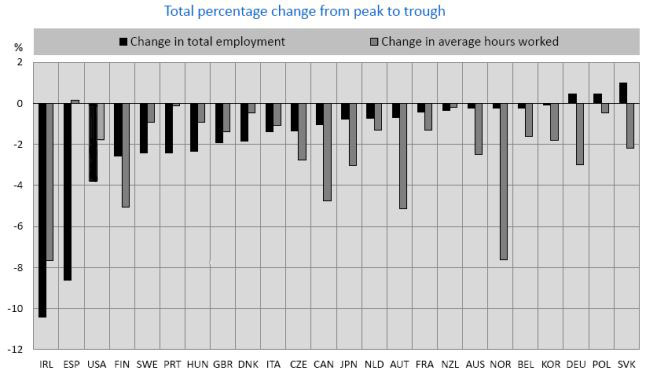

The following graph is taken from the OECD Employment Outlook 2010 which was released on July 7, 2010.

It shows the adjustments in employment (black bars) and working hours (grey bars) expressed as percentage changes that the different OECD countries experienced from the peak of the last cycle to the trough of the downturn. For some nations, the trough is still to come. The nations that were mostly employment-adjusting (Spain, Ireland, USA, Sweden, Portugal, Denmark, Italy, United Kingdom) all saw substantial increases in their official unemployment rates.

The predominantly hours-adjusting countries, Australia, New Zealand, Austria, Canada, Japan, etc all saw less significant rises in their official unemployment rates but rapid increases in the rate of underemployment.

Some countries shed jobs and hours in sigificant proportions (for example, Finland) saw large rises in both the unemployment rate and underemployment.

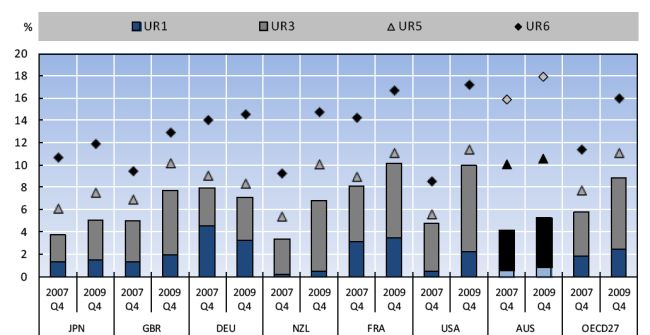

The next graph also comes from the OECD Employment Outlook 2010 and shows how the adjustments in real activity (persons and/or hours) impacted on the unemployment rate and broader measures of labour underutilisation by comparing quarter 4, 2007 and quarter 4, 2009 for various OECD countries (the different colouring for Australia just reflects that this graph came from that particular country-specific Report).

The OECD offers the following definitions:

- UR: Unemployment rate.

- UR1: Long-term unemployed (one year or more) as a percentage of the labour force.

- UR3: Unemployment rate (ILO definition).

- UR5: Unemployed plus persons marginally attached to the labour force, as a percentage of the labour force plus persons marginally attached to the labour force.

- UR6: Unemployed plus persons marginally attached to the labour force plus underemployed workers, as a percentage of the labour force plus persons marginally attached to the labour force.

- Underemployed persons: defined as persons who are either: i) full-time workers working less than a full-week (less than 35 hours in the United States) during the survey reference week for economic reasons; or ii) part-time workers who want but cannot find full-time work.

- Persons marginally attached to the labour force: refers to persons not in the labour force who did not look for work during the past four weeks, but who wish to work, are available to work and -in the case of Australia, Canada, Italy, Japan, New Zealand and the United States-have looked for work sometime in the past 12 months.

- Discouraged workers are the sub-set of marginally attached workers who are not currently searching for a job because they believe none are available.

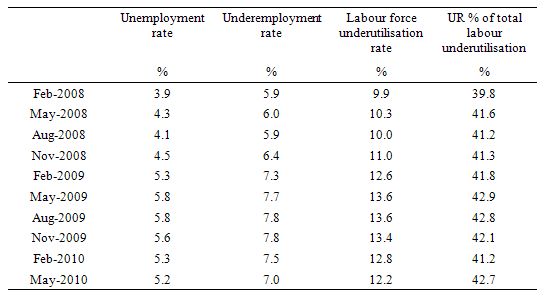

Labour underutilisation in Australia

The following table is derived from the Australian Bureau of Statistics Labour Force data for June 2010 and shows the evolution of the official unemployment rate and the underemployment rate since the low-point of the last cycle (February 2008) to the most recent release (May 2010).

Note: that this only broadens the measure of labour underutilisation to count underemployed workers and ignores marginal workers and the hidden unemployed. The hidden unemployed alone add between 1 to 1.5 per cent to the total labour underutilisation rate.

So you can see that presently as we allegedly approach full employment 12.2 per cent (around 13.5 per cent if you include hidden unemployed) of Australia’s willing labour resources are idle – either unemployment or not working enough hours to satisfy their preferences.

What sort of perverted concept is it that say this is full employment?

In this article, Melbourne Age economics reporter Tim Colebatch says that the:

The OECD’s Employment Outlook reports that in 2009, 21 per cent of Australians in that prime working age group were unemployed or outside the labour force. Of the 27 OECD countries the IMF terms “advanced” – that is, part of the rich world – Australia ranked 20th on that key indicator. Switzerland was top, with only 13 per cent of its prime working age people not in jobs.

Broadly speaking, in the past 10 years, employment rates have risen for older workers, but fallen for men of prime working age. But do you ever hear any minister talk about it? The Treasury? The Reserve Bank? The Productivity Commission? Why is no one in government asking why so many people in the prime of their working life are dropping out of the workforce – and what we should do about it?

But that’s not the only weakness in Australia’s labour market. The OECD says that while Australia’s unemployment rate last year was the eighth lowest among its 30 members (not the lowest, as ministers sometimes claim), “overall slack in the labour market is actually higher than the OECD average”.

So while the government and the sycophants who commentate on the labour market are generally claiming we are close to full employment, the reality is that our labour market is very sick and denying millions of people job opportunities and access to adequate hours of work.

The OECD Employment Outlook 2010 reports that:

Even before the current downturn, Australia had amongst the highest rates of involuntary part-time employment in the OECD … More than 60 per cent of involuntary part-time workers have no post-school qualifications, and one-third of them are aged under 25.

So when you are worried about the capacity of the real economy in the future to cope with the rising dependency ratio and improve its productivity growth in line with an ageing population and increased demand for certain goods and services what is the best policy option now?

Answer: waste as many labour resources as you politically get away with and focus on depriving our youth of adequate education and job opportunities.

Colebatch says:

These are young people falling through the cracks, without the skills to hold down a good job, and many may lack the desire or self-discipline to get them. These are the kids most at risk of joining those who have dropped out of the workforce.

Shouldn’t this be the kind of issue our political leaders talk to us about? Shouldn’t this be an issue they tackle?

Attention election campaign: Not a word mentioned of this yet. Lots of talk about full employment though and self-praise from the government.

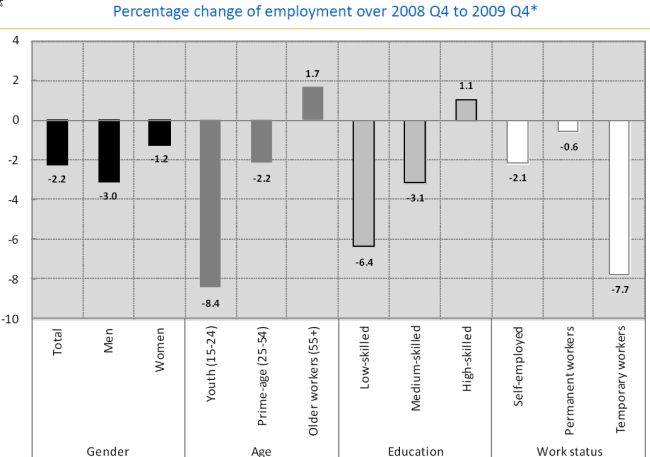

It is not rocket science to learn that the youth, the low-skilled, the casual and temporary workers all lose ground in absolute and relative terms during an economic downturn.

When considering the change of government in 2007 from an arch neo-liberal conservative regime to the so-called Labor Government – which had its foundations as the political arm of the trade union movement, the OECD Employment Outlook 2010 concludes that there has been no significant change in policy towards improving the fortunes of young Australians who are deprived of job opportunities because they lack skills and are rationed out of the overall inadequate level of employment on offer.

In the country-specific documents that accompany the EO, the Australian report – Economic Outlook – Australia – warned that “Australia should intervene quickly to avert a major rise in youth unemployment”.

The OECD say that:

Young people are likely to be hit hard by rising unemployment as the global downturn continues. In Australia, where more young people work than in most OECD countries, the government should encourage more teenagers to stay in school past the age of 16 in order to boost their skills and improve their long-term career prospects for when the economy recovers and labour demand picks up again.

The following graph is taken from the OECD Employment Outlook 2010 and provides different perspectives on who have suffered the most during the recent recession? The bars show the percentage change of employment over 2008 Q4 to 2009 Q4.

The problem is that there are no effective policy frameworks in place to address the issue. The disadvantage stems from a lack of jobs. The policy framework being pushed by the OECD and which is generally supported by governments around the world is a supply-side “full employability” approach. So push and prod the disadvantage, churn them through ineffective training programs divorced from a paid-work context, strip them of income support benefits where possible in the hope that they will be ready for work should a job comes along.

In an environment where the macroeconomy is imposing a harsh employment constraint (lack of jobs) on the labour market, the supply approach, at best, just shuffles the labour underutilisation queue and does very little to induce the sort of upward mobility I discussed earlier in this blog.

How the media perpetuates the NAIRU myth

So with that background and discussion about the OECD Employment Outlook – I close by considering a July 10, 2010 article by Sydney Morning Herald senior economics writer Ross Gittins – Few good reasons why 5% unemployment is considered full employment.

Gittins said:

WHO would have expected it? A year ago we thought we were headed for a severe recession and this week we learn the rate of unemployment is down to 5.1 per cent. Do you realise that’s just a fraction above what economists regard as full employment?

Huh? If 5 per cent of the labour force – 600,000 people – is still looking for work, how on earth can economists say we’re at full employment? Good question. Unfortunately, economists don’t have a good answer.

Gittins says that “to an economist, “full employment” doesn’t mean … [that] … everyone who wants a job has found one”. This statement is only partially correct. It applies only to the neo-liberal NAIRU segment of the profession which happens to dominate.

In my view, full employment means that everyone who has a job has one; everybody who desires a certain level of working hours can get them and there are no workers forced out of the labour force (via declining participation) because there are not enough jobs available to make active search effective.

In broad terms and allowing for country-specific differences this will mean an official unemployment rate of around 2 per cent (that is, the frictional rate), zero underemployment and zero hidden unemployment.

A far cry from where Australia and as the OECD Employment Outlook graphs show the rest of the world is at.

Gittins says that full employment to an economist (the subset I identified above):

… refers to the lowest sustainable rate of unemployment. That is, the lowest rate to which unemployment can fall before shortages of labour lead to excessive wage increases and start pushing up the rate of inflation.

In the jargon, this is the “non-accelerating-inflation rate of unemployment”. So in an economist’s mind the NAIRU is synonymous with full employment.

Please read my blogs – The dreaded NAIRU is still about! – and Modern monetary theory and inflation – Part 1 – for more discussion on why the NAIRU is a useless basis for conducting policy.

But Gittins, who considers himself the “down-to-earth” economics educator of the masses takes a totally uncritical perspective on this issue. In doing so, he perpetuates the full employment myth.

When the unemployment rate got down to 4 per cent in early 2008, most economists would have regarded that as clearly below the NAIRU. The private-sector wage index rose by 4.3 per cent over the following year, clearly on the high side. And the underlying rate of inflation has now been above the target range of 2 to 3 per cent for more than three years. So I guess that does confirm that the NAIRU is nearer 5 per cent than 4.

A guess is not a very good basis for promoting a flawed concept especially when you focus blame on labour costs and ignore other vital components in the inflation outcome.

If you care to consult the ABS data – TABLE 16. CPI: Group, Sub-group and Expenditure Class, Points Contribution, by Capital City – you will see that food prices arising from drought, petrol prices (world problem), other imported price rises, and statutory charges (government tax hikes) dominated the change in the CPI during the period that Gittins implicates labour costs.

The fact is without these non-labour contributions to the price level, inflation would have been modest.

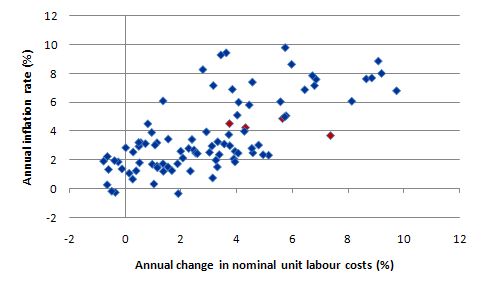

The following graph taken from ABS data shows the annual change in nominal unit labour costs (so wages growth scaled by productivity growth) and the inflation rate from September 1995 to September 2009. The red observations are for the four-quarters of 2008. There is no simple relationship between unit labour costs and the inflation rate – certainly not the one envisaged by Gittins.

For the December quarter ULC rose by 7.4 per cent while inflation dropped and continued to drop as the economy went into the downturn.

Gittins also chooses to promote the myth that the NAIRU has risen since the 1970s:

It is worth noting, however, that since the post-war Golden Age ended with the arrival of stagflation in the mid-1970s, NAIRUs have risen significantly in most developed economies.

No, the NAIRU doesn’t exist! The estimated NAIRUs have risen and fallen largely with the official unemployment rate given the techniques used to estimate them really only produce filtered versions of the official rate.

They have step-jumps but the economists fail to explain why. So in the mid-1970s when unemployment rates started to rise to new unprecedented levels, the NAIRU estimates all jumped to but it was difficult to associate that jump with anything other than a collapse in aggregate demand.

And if you took in the material in the background above you will realise that the NAIRU is conceptually, strictly independent of the cycle. This is the area I devoted a considerable portion of my PhD work to in the late 1980s and early 1990s.

Gittins at least acknowledges that the litany of reasons trotted out to justify pushing NAIRU estimates up “aren’t terribly convincing”.

This is not the first time that Gittins chooses to perpetuate these dangerous myths. Please read my blog – Do not learn economics from a newspaper – for another classic case.

In the blog – Modern monetary theory and inflation – Part 1 – I outline an alternative way of achieving true full employment without jeopardising price stability. The superior approach is based on the introduction of a Job Guarantee

Conclusion

The ABS released their Mental Health of Young People data today and found that “One in four young Australians aged 16-24 years had a mental disorder in 2007”. That is about the proportion of our youth that are being left idle in the labour market (unemployed or underemployed) as a result of the neo-liberal policy environment.

While I am not suggesting the cohorts exactly overlap, the research evidence suggests that there would be considerable overlap. Labour market exclusion leads to social alienation and then other pathologies.

Dealing with labour underutilisation should be one of the policy priorities and to do that governments need to ensure aggregate demand is sufficient to provide enough jobs.

The wastage is so large and long-lasting that it is foolish to demote this as a policy priority unless you support governments deliberately undermining the life potential of a large proportion of their population.

I was away in Sydney at the weekend having fun and went to the Museum of Sydney’s excellent exhibit – Skint! Making do in the Great Depression which “explores the spirit and flavour of life in Sydney in the 1930s: the community spirit and political activism, everyday life and key events and personalities of the period. It brings together evocative images, objects, oral histories and film to help us understand the story of Sydney in the Great Depression”.

The archival footage that was available with contemporary commentary from people depicted (who lived through the Depression as children etc) was more than enough to convince any reasonable person that mass unemployment is not a chosen state by optimising individuals.

If you get a chance and are in Sydney the exhibit is excellent.

That is enough for today!

I heard Julia Gillard on the news the other day boasting about how she was going to force the non-government sector into deficit.

All she needs now is some big shoes and a red nose.

Bill,

Another good blog.

I wonder whether the flaw in the NRU based theories is linked to economists panicking when they see both employment returning, and price rises, during a recovery period. When people start (return to) work, for the first 1-4 weeks they are not very productive, as they are ‘learning the ropes’ and aclimatising. When this happens on aggregate throughout the economy, I imagine it leading to temporary price rises as demand exceeds supply for a while. Economists might fail to see this as temporary. Do you think this is correct?

Kind Regards

Charlie

Bill,

Will you write a post on the Krugman versus Galbraith debate?

I have commented on it here:

http://socialdemocracy21stcentury.blogspot.com/2010/07/galbraith-versus-krugman-on-deficit.html

Regards

Dear Bill,

There is an interesting debate between Krugman and Jamie Galbraith on the government’s ability to deficit spends. Jamie seems to subscribes to the idea of MMT, Paul Krugman admitted that Jamie was right but Krugman seems to suggest that one day when the economy about to recover, the huge monetary expansion (budget deficit) that private prefer to hold during recession as saving would enter the real economy as private increase their spending and this would cause hyper inflation.

Could you respond to this;

Jamie Galbraith’s testimony;

http://www.angrybearblog.com/2010/07/professor-jamie-galbraiths-testimony-to.html

Krugman’s response

http://krugman.blogs.nytimes.com/2010/07/17/i-would-do-anything-for-stimulus-but-i-wont-do-that-wonkish/

Krugman’s on Jamie’s comment regarding Krugman’s earlier response

http://krugman.blogs.nytimes.com/2010/07/17/more-on-deficit-limits/

Cheers

Anas

FYI,

Good write up here of the Jamie v. Paul debate: http://www.correntewire.com/paul_debates_jamie_and_mmt

Thanks for the link Scott. I have been in the power industry for 30 years. William Hummel’s site introduced me to economics about 10 years ago. Like you said, I don’t think he fully gets MMT, but he is close. I credit his easy to understand articles as my first step to MMT. Although you guys have done a great job (Wray’s book, CFEPS.org, and the blogs) I thought MMT would never enter the mainstream. But now I see some traction. Hopefully if someone like Krugman “gets it” and can overcome his “politics trumps economics” attitude, all your (MMT teachers) hard work will finally pay off.

Thoma’s oblique response to last weeks ugliness:

http://economistsview.typepad.com/economistsview/2010/07/is-galbraith-right-that-deficits-are-never-a-problem.html

As best as I can tell, it is just that no one in “authority” trusts the electorate with the knowledge of what deficits are. That and that those who believe they are most in control (Summers today) have their heads so far us their asses they look normal.

Can someone answer Anas Jalils query directly.

I am assuming this might be the case and MMT offers a fiscal policy response which is taxation to remove such inflationary pressures from the private sector. From what I can see ,that side of the debate is not elaborated because notions about future rise in taxes can be misused by deficit doves to cut necessary spending today. I might be completely wrong , someone please clarify.

These days Krugman is more journalist than he is academic. As soon as he started writing for SLATE I’d pretty much written him off as just another **** pretending he understood macroeconomics.

krugman is not someone I would want on my side nor is he someone I would debate. Stop reading what he writes, stop mentioning his name, and he might simply go away.

Anas and pb, see Randy Wray’s response on Krugman’s follow-up post:

http://community.nytimes.com/comments/krugman.blogs.nytimes.com/2010/07/17/more-on-deficit-limits/?permid=68#comment68

I’ve been thru the Galbraith v Krugman exchange. K’s only (and not very forcefully put) objection to G’s ideas is that a monetary base expansion might be inflationary in two or three years time.

Billyblog regulars should know the answers to K’s concerns. First answer: base expansions do not improve banks capital. And since banks are capital constrained not reserve constrained, a base increase does not enable banks to go on a lending spree.

Second, extra money in the hands of Main Street will certainly be stimulatory. But if inflation looms as a result, any government with an I.Q. above zero ought to be able to implement deflationary measures to counteract the inflation.

Unfortunately most governments don’t have I.Q.s much above zero. Thus perhaps the best option is to nuke Washinton D.C., Wall Street and other world financial centers. Or as Warren Mosler puts it at the top of his site, “The financial sector is a lot more trouble than it is worth”.

According to the 2006 Census 17.6% of males between 25 and 64 were not in the workforce or classified as ‘officially’ unemployed (not specified category excluded). the equivalent number for females is 32.5%.

This makes the official unemployment number look like a joke, especially when a lot of those working are part time and want full time work.

Add in the 800,000+ (approx 8% of the potential workforce) working overseas then you can eaily get to 25%+ real unemployment/underemployent quite easily. Near Great Depression levels.

You have an Australia that has been incapabale of generating enough jobs for its rapidly growing population for decades now. Which is to be expected since Govt’s since the 70s have been killing manufacturing and returning Australia to its pre WW2 past of being a mine and a (rapidly declining) farm, with a few hairdressers and insurance salesmen thrown in.

And some idiots want to increase the population to 30+ million? What, so we can have 35%+ real unemployment? Heck lets go for 40% so we can have a real social collapse.