Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – July 24, 2010 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

If the external sector is in deficit overall and GDP growth rate is faster than the real interest rate, then:

(a) Both the private domestic sector and the government sector overall can pay down their respective debt liabilities.

(b) Either the private domestic sector or the government sector overall can pay down their debt liabilities.

(c) Neither the private domestic sector or the government sector overall can pay down their debt liabilities.

The answer is (b) Either the private domestic sector or the government sector overall can pay down their debt liabilities..

Once again it is a test of one’s basic understanding of the sectoral balances that can be derived from the National Accounts. Some people write to me in an incredulous way about the balances.

The answer is Option (b) because if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the accounting rules.

It also follows that it doesn’t matter how fast GDP is growing, if a sector is in deficit then it cannot be paying down its nominal debt.

To understand this we need to begin with the national accounts which underpin the basic income-expenditure model that is at the heart of introductory macroeconomics.

We can view this model in two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

So from the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

So if we equate these two perspectives of GDP, we get:

C + S + T = C + I + G + (X – M)

This can be simplified by cancelling out the C from both sides and re-arranging (shifting things around but still satisfying the rules of algebra) into what

we call the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

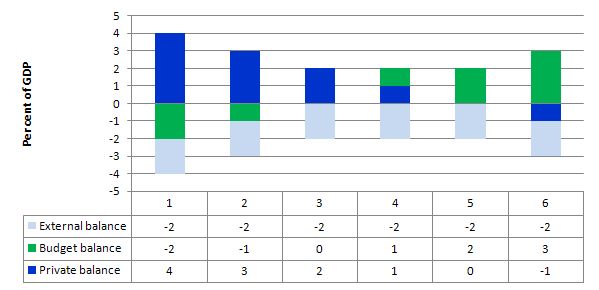

Consider the following graph and associated table of data which shows six states. All states have a constant external deficit equal to 2 per cent of GDP (light-blue columns).

State 1 show a government running a surplus equal to 2 per cent of GDP (green columns). As a consequence, the private domestic balance is in deficit of 4 per cent of GDP (royal-blue columns). This cannot be a sustainable growth strategy because eventually the private sector will collapse under the weight of its indebtedness and start to save. At that point the fiscal drag from the budget surpluses will reinforce the spending decline and the economy would go into recession.

State 2 shows that when the budget surplus moderates to 1 per cent of GDP the private domestic deficit is reduced.

State 3 is a budget balance and then the private domestic deficit is exactly equal to the external deficit. So the private sector spending more than they earn exactly funds the desire of the external sector to accumulate financial assets in the currency of issue in this country.

States 4 to 6 shows what happens when the budget goes into deficit – the private domestic sector (given the external deficit) can then start reducing its deficit and by State 5 it is in balance. Then by State 6 the private domestic sector is able to net save overall (that is, spend less than its income).

Note also that the government balance equals exactly $-for-$ (as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances). This is also a basic rule derived from the national accounts.

Most countries currently run external deficits. The crisis was marked by households reducing consumption spending growth to try to manage their debt exposure and private investment retreating. The consequence was a major spending gap which pushed budgets into deficits via the automatic stabilisers.

The only way to get income growth going in this context and to allow the private sector surpluses to build was to increase the deficits beyond the impact of the automatic stabilisers. The reality is that this policy change hasn’t delivered large enough budget deficits (even with external deficits narrowing). The result has been large negative income adjustments which brought the sectoral balances into equality at significantly lower levels of economic activity.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 2:

The debt of a government which issues its own currency and floats it in international markets is not really a liability because the government can just continuously roll it over without ever having to pay it back. This is different to a household, the user of the currency, which not only has to service its debt but also has to repay them at the due date.

The answer is False.

First, households do have to service their debts and repay them at some due date or risk default. The other crucial point is that households also have to forego some current consumption, use up savings or run down assets to service their debts and ultimately repay them.

Second, a sovereign government also has to service their debts and repay them at some due date or risk default. No different there. But, unlike a household it does not have to forego any current spending capacity (or privatise public assets) to accomplish these financial transactions.

But the public debt is a legal obligation on government and so is totally a liability.

Now can it just roll-it over continuously? Well the question was subtle because the government can always keep issuing new debt when the old issues mature and maintain a stable (or whatever). But as the previous debt-issued matures it is paid out as per the terms of the issue. So that nuance was designed to elicit specific thinking.

The other point is that the liability on a sovereign government is legally like all liabilities – enforceable in courts the risk associated with taking that liability on is zero which is very different to the risks attached to taking on private debt.

There is zero risk that a holder of a public bond instrument will not be paid principle and interest on time.

The other point to appreciate is that the original holder of the public debt might not be the final holder who is paid out. The market for public debt is the most liquid of all debt markets and trading in public debt instruments of all nations is conducted across all markets each hour of every day.

While I am most familiar with the Australian institutional structure, the following developments are not dissimilar to the way bond issuance (in primary markets) is organised elsewhere. You can access information about this from the Australian Office of Financial Management, which is a Treasury-related public body that manages all public debt issuance in Australia.

It conducts the primary market, which is the institutional machinery via which the government sells debt to the non-government sector. In a modern monetary system with flexible exchange rates it is clear the government does not have to finance its spending so the fact that governments hang on to primary market issuance is largely ideological – fear of fiscal excesses rather than an intrinsic need. In this blog – Will we really pay higher interest rates? – I go into this period more fully and show that it was driven by the ideological calls for “fiscal discipline” and the growing influence of the credit rating agencies. Accordingly, all net spending had to be fully placed in the private market $-for-$. A purely voluntary constraint on the government and a waste of time.

A secondary market is where existing financial assets are traded by interested parties. So the financial assets enter the monetary system via the primary market and are then available for trading in the secondary. The same structure applies to private share issues for example. The company raises funds via the primary issuance process then its shares are traded in secondary markets.

Clearly secondary market trading has no impact at all on the volume of financial assets in the system – it just shuffles the wealth between wealth-holders. In the context of public debt issuance – the transactions in the primary market are vertical (net financial assets are created or destroyed) and the secondary market transactions are all horizontal (no new financial assets are created). Please read my blog – Deficit spending 101 – Part 3 – for more information.

Primary issues are conducted via auction tender systems and the Treasury determines the timing of these events in addition to the type and volumne of debt to be issued.

The issue is then be put out for tender and the market determines the final price of the bonds issued. Imagine a $A1000 bond is offered at a coupon of 5 per cent, meaning that you would get $A50 dollar per annum until the bond matured at which time you would get $A1000 back.

Imagine that the market wanted a yield of 6 per cent to accommodate risk expectations (see below). So for them the bond is unattractive unless the price is lower than $A1000. So tender system they would put in a purchase bid lower than the $A1000 to ensure they get the 6 per cent return they sought.

The general rule for fixed-income bonds is that when the prices rise, the yield falls and vice versa. Thus, the price of a bond can change in the market place according to interest rate fluctuations.

When interest rates rise, the price of previously issued bonds fall because they are less attractive in comparison to the newly issued bonds, which are offering a higher coupon rates (reflecting current interest rates).

When interest rates fall, the price of older bonds increase, becoming more attractive as newly issued bonds offer a lower coupon rate than the older higher coupon rated bonds.

So for new bond issues the AOFM receives the tenders from the bond market traders. These will be ranked in terms of price (and implied yields desired) and a quantity requested in $ millions. The AOFM (which is really just part of treasury) sometimes sells some bonds to the central bank (RBA) for their open market operations (at the weighted average yield of the final tender).

The AOFM will then issue the bonds in highest price bid order until it raises the revenue it seeks. So the first bidder with the highest price (lowest yield) gets what they want (as long as it doesn’t exhaust the whole tender, which is not likely). Then the second bidder (higher yield) and so on.

In this way, if demand for the tender is low, the final yields will be higher and vice versa. There are a lot of myths peddled in the financial press about this. Rising yields may indicate a rising sense of risk (mostly from future inflation although sovereign credit ratings will influence this). But they may also indicated a recovering economy where people are more confidence investing in commercial paper (for higher returns) and so they demand less of the “risk free” government paper.

So while there is no credit risk attached to holding public debt (that is, the holder knows they will receive the principle and interest that is specified on the issued debt instrument), there is still market risk which is related to movements in interest rates.

For government accounting purposes however the trading of the bonds once issued is of no consequence. They still retain the liability to pay the fixed coupon rate and the face value of the bond at the time of issue (not the market price).

The person/institution that sells the bond before maturity may gain or lose relative to their original purchase price but that is totally outside of the concern of the government.

Its liability is to pay the specified coupon rate at the time of issue and then the whole face value at the time of maturity.

There are complications to the primary sale process – some bonds sell at discounts which imply the coupon value. Further, there are arrangements between treasuries and central banks about the way in which public debt holdings are managed and accounted for. But these nuances do not alter the initial contention – public debt is a liability of the government in just the same way as private debt is a liability for those holders.

The following blog may be of further interest to you:

Question 3:

If the US budget deficit keeps rising to meet the need for more fiscal stimulus, the US government would have to bear the political costs of a rising public debt ratio.

The answer is False.

Again, this question requires a careful reading and a careful association of concepts to make sure they are commensurate. There are two concepts that are central to the question: (a) a rising budget deficit – which is a flow and not scaled by GDP in this case; and (b) a rising public debt ratio which by construction (as a ratio) is scaled by GDP.

So the two concepts are not commensurate although they are related in some way.

A rising budget deficit does not necessary lead to a rising public debt ratio. You might like to refresh your understanding of these concepts by reading this blog – Saturday Quiz – March 6, 2010 – answers and discussion.

While the mainstream macroeconomics thinks that a sovereign government is revenue-constrained and is subject to the government budget constraint, MMT places no particular importance in the public debt to GDP ratio for a sovereign government, given that insolvency is not an issue.

However, the framework that the mainstream use to illustrate their erroneous belief in the government budget constraint is just an accounting statement that links relevant stocks and flows.

The mainstream framework for analysing the so-called “financing” choices faced by a government (taxation, debt-issuance, money creation) is written as:

which you can read in English as saying that Budget deficit = Government spending + Government interest payments – Tax receipts must equal (be “financed” by) a change in Bonds (B) and/or a change in high powered money (H). The triangle sign (delta) is just shorthand for the change in a variable.

Remember, this is merely an accounting statement. In a stock-flow consistent macroeconomics, this statement will always hold. That is, it has to be true if all the transactions between the government and non-government sector have been corrected added and subtracted.

So in terms of MMT, the previous equation is just an ex post accounting identity that has to be true by definition and has not real economic importance.

For the mainstream economist, the equation represents an ex ante (before the fact) financial constraint that the government is bound by. The difference between these two conceptions is very significant and the second (mainstream) interpretation cannot be correct if governments issue fiat currency (unless they place voluntary constraints on themselves to act as if it is).

That interpretation is inapplicable (and wrong) when applied to a sovereign government that issues its own currency.

But the accounting relationship can be manipulated to provide an expression linking deficits and changes in the public debt ratio.

The following equation expresses the relationships above as proportions of GDP:

So the change in the debt ratio is the sum of two terms on the right-hand side: (a) the difference between the real interest rate (r) and the GDP growth rate (g) times the initial debt ratio; and (b) the ratio of the primary deficit (G-T) to GDP. A primary budget balance is the difference between government spending (excluding interest rate servicing) and taxation revenue.

The real interest rate is the difference between the nominal interest rate and the inflation rate.

A growing economy can absorb more debt and keep the debt ratio constant or falling. From the formula above, if the primary budget balance is zero, public debt increases at a rate r but the public debt ratio increases at r – g.

So a nation running a primary deficit can obviously reduce its public debt ratio over time. Further, you can see that even with a rising primary deficit, if output growth (g) is sufficiently greater than the real interest rate (r) then the debt ratio can fall from its value last period.

Furthermore, depending on contributions from the external sector, a nation running a deficit will more likely create the conditions for a reduction in the public debt ratio than a nation that introduces an austerity plan aimed at running primary surpluses.

The following blog may be of further interest to you:

Question 4:

Fiscal rules such as are embodied in the Stability and Growth Pact of the EMU will continually create conditions of slower growth because they deprive the government of fiscal flexibility to support aggregate demand when necessary.

The answer is False.

One word in the question renders this proposition false. I had originally worded the question (following EMU) “will bias the nations to slower growth” etc which is true and I considered that too easy.

The fiscal policy rules that were agreed in the Maastricht Treaty – budget deficits should not exceed 3 per cent of GDP and public debt should not exceed 60 per cent of GDP – clearly constrain EMU governments during periods when private spending (or net exports) are draining aggregate demand.

In those circumstances, if the private spending withdrawal is sufficiently severe, the automatic stabilisers alone will drive the budget deficit above the required limits. Pressure then is immediately placed on the national governments to introduce discretionary fiscal contractions to get the fiscal balance back within the limits.

Further, after an extended recession, the public debt ratios will almost always go beyond the allowable limits which places further pressure on the government to introduce an extended period of austerity to bring the ratio back within the limits. So the bias is towards slower growth overall.

It is also true that the fiscal rules clearly (and by design) “deprive the government of fiscal flexibility to support aggregate demand when necessary”. But that wasn’t the question. The question was will these rules continually create conditions of slower growth. The answer is no they will not.

Imagine a situation where the nation has very strong net exports adding to aggregate demand which supports steady growth and full employment without any need for the government to approach the Maastricht thresholds. In this case, the fiscal rules are never binding unless something happens to exports.

The following is an example of this sort of nation. It will take a while for you to work through but it provides a good learning environment for understanding the basic expenditure-income model upon with Modern Monetary Theory (MMT) builds its monetary insights. You might want to read this blog – Saturday Quiz – March 20, 2010 – answers and discussion – to refresh your understanding of the sectoral balances.

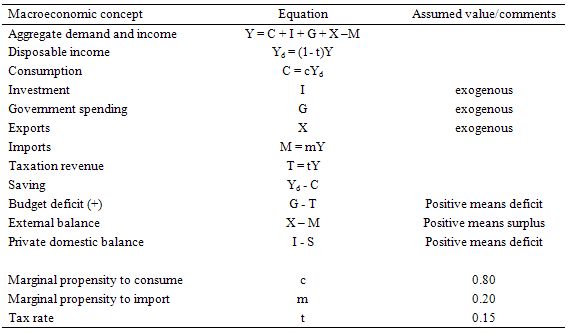

The following table shows the structure of the simple macroeconomic model that is the foundation of the expenditure-income model. This sort of model is still taught in introductory macroeconomics courses before the students get diverted into the more nonsensical mainstream ideas. All the assumptions with respect to behavioural parameters are very standard. You can download the simple spreadsheet if you want to play around with the model yourselves.

The first Table shows the model structure and any behavioural assumptions used. By way of explanation:

- All flows are in real terms with the price level constant (set at whatever you want it to be). So we are assuming that there is capacity within the supply-side of the economy to respond in real terms when nominal demand (which also equals real demand) changes.

- We might assume that the economy is at full employment in period 1 and in a state of excess capacity of varying degrees in each of the subsequent periods.

- Fiscal policy dominates monetary policy and the latter is assumed unchanged throughout. The central bank sets the interest rate and it doesn’t move.

- The tax rate is 0.15 throughout – so for every dollar of national income earned 15 cents is taken out in tax.

- The marginal propensity to consume is 0.8 – so for every dollar of disposable income 80 cents is consumed and 20 cents is saved.

- The marginal propensity to import is 0.2 – so for every dollar of national income (Y) 20 cents is lost from the expenditure stream into imports.

You might want to right-click the images to bring them up into a separate window and the print them (on recycled paper) to make it easier to follow the evolution of this economy over the 10 periods shown.

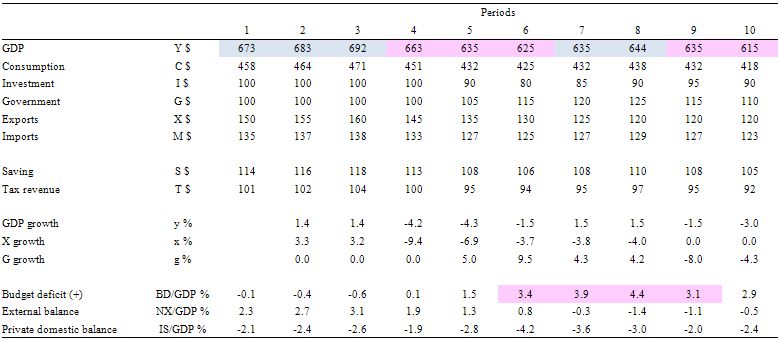

The next table quantifies the ten-period cycle and the graph below it presents the same information graphically for those who prefer pictures to numbers. The description of events is in between the table and the graph for those who do not want to print.

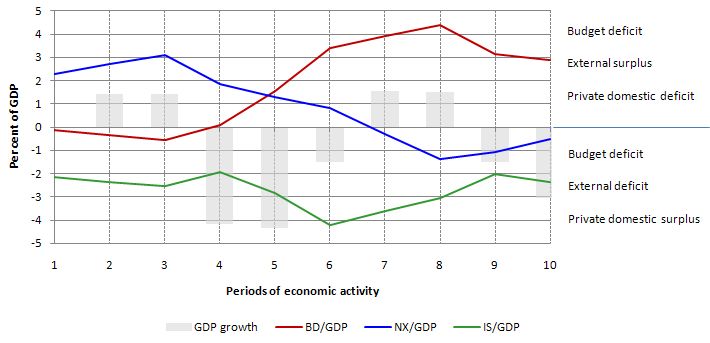

The graph below shows the sectoral balances – budget deficit (red line), external balance (blue line) and private domestic balance (green line) over the 10-period cycle as a percentage of GDP (Y) in addition to the period-by-period GDP growth (y) in percentage terms (grey bars).

Above the zero line means positive GDP growth, a budget deficit (G > T), an external surplus (X > M) and a private domestic deficit (I > S) and vice-versa for below the zero line.

This is an economy that is enjoying steady GDP growth (1.4 per cent) courtesy of a strong and growing export sector (surpluses in each of the first three periods). It is able to maintain strong growth via the export sector which permits a budget surplus (in each of the first three periods) and the private domestic sector is spending less than they are earning.

The budget parameters (and by implication the public debt ratio) is well within the Maastricht rules and not preventing strong (full employment growth) from occurring. You might say this is a downward bias but from in terms of an understanding of functional finance it just means that the government sector is achieving its goals (full employment) and presumably enough services and public infrastructure while being swamped with tax revenue as a result of the strong export sector.

Then in Period 4, there is a global recession and export markets deteriorate up and governments delay any fiscal stimulus. GDP growth plunges and the private domestic balance moves towards deficit. Total tax revenue falls and the budget deficit moves into balance all due to the automatic stabilisers. There has been no discretionary change in fiscal policy.

In Period 5, we see investment expectations turn sour as a reaction to the declining consumption from Period 4 and the lost export markets. Exports continue to decline and the external balance moves towards deficit (with some offset from the declining imports as a result of lost national income). Together GDP growth falls further and we have a technical recession (two consecutive periods of negative GDP growth).

With unemployment now rising (by implication) the government reacts by increasing government spending and the budget moves into deficit but still within the Maastricht rules. Taxation revenue continues to fall. So the increase in the deficit is partly due to the automatic stabilisers and partly because discretionary fiscal policy is now expanding.

Period 6, exports and investment spending decline further and the government now senses a crisis is on their hands and they accelerate government spending. This starts to reduce the negative GDP growth but pushes the deficit beyond the Maastricht limits of 3 per cent of GDP. Note the rising deficits allows for an improvement in the private domestic balance, although that is also due to the falling investment.

In Period 7, even though exports continue to decline (and the external balance moves into deficit), investors feel more confident given the economy is being supported by growth in the deficit which has arrested the recession. We see a return to positive GDP growth in this period and by implication rising employment, falling unemployment and better times. But the deficit is now well beyond the Maastricht rules and rising even further.

In Period 8, exports decline further but the domestic recovery is well under way supported by the stimulus package and improving investment. We now have an external deficit, rising budget deficit (4.4 per cent of GDP) and rising investment and consumption.

At this point the EMU bosses take over and tell the country that it has to implement an austerity package to get their fiscal parameters back inside the Maastricht rules. So in Period 9, even though investment continues to grow (on past expectations of continued growth in GDP) and the export rout is now stabilised, we see negative GDP growth as government spending is savaged to fit the austerity package agree with the EMU bosses. Net exports moves towards surplus because of the plunge in imports.

Finally, in period 10 the EMU bosses are happy in their warm cosy offices in Brussels or Frankfurt or wherever they have their secure, well-paid jobs because the budget deficit is now back inside the Maastricht rules (2.9 per cent of GDP). Pity about the economy – it is back in a technical recession (a double-dip). Investment spending has now declined again courtesy of last period’s stimulus withdrawal, consumption is falling, government support of saving is in decline, and we would see employment growth falling and unemployment rising.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 5:

The fact that large scale quantitative easing conducted by central banks in Japan in 2001 and now, more recently, in the UK and the USA has not caused inflation provides a strong refutation of the mainstream Quantity Theory of Money, which claims that growth in the stock of money will be inflationary.

The answer is False.

The question requires you to: (a) understand the Quantity Theory of Money; and (b) understand the impact of quantitative easing in relation to Quantity Theory of Money.

The short reason the answer is false is that quantitative easing has not increased the aggregates that drive the alleged causality in the Quantity Theory of Money – that is, the various estimates of the “money supply”.

The Quantity Theory of Money which in symbols is MV = PQ but means that the money stock times the turnover per period (V) is equal to the price level (P) times real output (Q). The mainstream assume that V is fixed (despite empirically it moving all over the place) and Q is always at full employment as a result of market adjustments.

Yes, in applying this theory they deny the existence of unemployment. The more reasonable mainstream economists (who probably have kids who cannot get a job at present) admit that short-run deviations in the predictions of the Quantity Theory of Money can occur but in the long-run all the frictions causing unemployment will disappear and the theory will apply.

In general, the Monetarists (the most recent group to revive the Quantity Theory of Money) claim that with V and Q fixed, then changes in M cause changes in P – which is the basic Monetarist claim that expanding the money supply is inflationary. They say that excess monetary growth creates a situation where too much money is chasing too few goods and the only adjustment that is possible is nominal (that is, inflation).

One of the contributions of Keynes was to show the Quantity Theory of Money could not be correct. He observed price level changes independent of monetary supply movements (and vice versa) which changed his own perception of the way the monetary system operated.

Further, with high rates of capacity and labour underutilisation at various times (including now) one can hardly seriously maintain the view that Q is fixed. There is always scope for real adjustments (that is, increasing output) to match nominal growth in aggregate demand. So if increased credit became available and borrowers used the deposits that were created by the loans to purchase goods and services, it is likely that firms with excess capacity will re

The mainstream have related the current non-standard monetary policy efforts – the so-called quantitative easing – to the Quantity Theory of Money and predicted hyperinflation will arise.

So it is the modern belief in the Quantity Theory of Money is behind the hysteria about the level of bank reserves at present – it has to be inflationary they say because there is all this money lying around and it will flood the economy.

Textbook like that of Mankiw mislead their students into thinking that there is a direct relationship between the monetary base and the money supply. They claim that the central bank “controls the money supply by buying and selling government bonds in open-market operations” and that the private banks then create multiples of the base via credit-creation.

Students are familiar with the pages of textbook space wasted on explaining the erroneous concept of the money multiplier where a banks are alleged to “loan out some of its reserves and create money”. As I have indicated several times the depiction of the fractional reserve-money multiplier process in textbooks like Mankiw exemplifies the mainstream misunderstanding of banking operations. Please read my blog – Money multiplier and other myths – for more discussion on this point.

The idea that the monetary base (the sum of bank reserves and currency) leads to a change in the money supply via some multiple is not a valid representation of the way the monetary system operates even though it appears in all mainstream macroeconomics textbooks and is relentlessly rammed down the throats of unsuspecting economic students.

The money multiplier myth leads students to think that as the central bank can control the monetary base then it can control the money supply. Further, given that inflation is allegedly the result of the money supply growing too fast then the blame is sheeted home to the “government” (the central bank in this case).

The reality is that the central bank does not have the capacity to control the money supply. We have regularly traversed this point. In the world we live in, bank loans create deposits and are made without reference to the reserve positions of the banks. The bank then ensures its reserve positions are legally compliant as a separate process knowing that it can always get the reserves from the central bank.

The only way that the central bank can influence credit creation in this setting is via the price of the reserves it provides on demand to the commercial banks.

So when we talk about quantitative easing, we must first understand that it requires the short-term interest rate to be at zero or close to it. Otherwise, the central bank would not be able to maintain control of a positive interest rate target because the excess reserves would invoke a competitive process in the interbank market which would effectively drive the interest rate down.

Quantitative easing then involves the central bank buying assets from the private sector – government bonds and high quality corporate debt. So what the central bank is doing is swapping financial assets with the banks – they sell their financial assets and receive back in return extra reserves. So the central bank is buying one type of financial asset (private holdings of bonds, company paper) and exchanging it for another (reserve balances at the central bank). The net financial assets in the private sector are in fact unchanged although the portfolio composition of those assets is altered (maturity substitution) which changes yields and returns.

In terms of changing portfolio compositions, quantitative easing increases central bank demand for “long maturity” assets held in the private sector which reduces interest rates at the longer end of the yield curve. These are traditionally thought of as the investment rates. This might increase aggregate demand given the cost of investment funds is likely to drop. But on the other hand, the lower rates reduce the interest-income of savers who will reduce consumption (demand) accordingly.

How these opposing effects balance out is unclear but the evidence suggests there is not very much impact at all.

For the monetary aggregates (outside of base money) to increase, the banks would then have to increase their lending and create deposits. This is at the heart of the mainstream belief is that quantitative easing will stimulate the economy sufficiently to put a brake on the downward spiral of lost production and the increasing unemployment. The recent experience (and that of Japan in 2001) showed that quantitative easing does not succeed in doing this.

Should we be surprised. Definitely not. The mainstream view is based on the erroneous belief that the banks need reserves before they can lend and that quantitative easing provides those reserves. That is a major misrepresentation of the way the banking system actually operates. But the mainstream position asserts (wrongly) that banks only lend if they have prior reserves.

The illusion is that a bank is an institution that accepts deposits to build up reserves and then on-lends them at a margin to make money. The conceptualisation suggests that if it doesn’t have adequate reserves then it cannot lend. So the presupposition is that by adding to bank reserves, quantitative easing will help lending.

But banks do not operate like this. Bank lending is not “reserve constrained”. Banks lend to any credit worthy customer they can find and then worry about their reserve positions afterwards. If they are short of reserves (their reserve accounts have to be in positive balance each day and in some countries central banks require certain ratios to be maintained) then they borrow from each other in the interbank market or, ultimately, they will borrow from the central bank through the so-called discount window. They are reluctant to use the latter facility because it carries a penalty (higher interest cost).

The point is that building bank reserves will not increase the bank’s capacity to lend. Loans create deposits which generate reserves.

The reason that the commercial banks are currently not lending much is because they are not convinced there are credit worthy customers on their doorstep. In the current climate the assessment of what is credit worthy has become very strict compared to the lax days as the top of the boom approached.

Those that claim that quantitative easing will expose the economy to uncontrollable inflation are just harking back to the old and flawed Quantity Theory of Money. This theory has no application in a modern monetary economy and proponents of it have to explain why economies with huge excess capacity to produce (idle capital and high proportions of unused labour) cannot expand production when the orders for goods and services increase. Should quantitative easing actually stimulate spending then the depressed economies will likely respond by increasing output not prices.

So the fact that large scale quantitative easing conducted by central banks in Japan in 2001 and now in the UK and the USA has not caused inflation does not provide a strong refutation of the mainstream Quantity Theory of Money because it has not impacted on the monetary aggregates.

The fact that is hasn’t is not surprising if you understand how the monetary system operates but it has certainly bedazzled the (easily dazzled) mainstream economists.

The following blogs may be of further interest to you:

There are many ways to look at this. For example, for debt/gdp ratio higher than 1, if deficit/gdp remains above the growth rate, it will result in an exploding debt/gdp eventually triggering a crisis in the currency markets, threatening acceptability of the currency.

Exports will not automatically increase before a crisis is triggered because its a supply side factor – the consumer choice in the foreign country depends on the competitiveness of the exporting nation and the demand from the consumer – the propensity to import and the national income. Currency adjustments do not change supply side factors – a nation has to become more competitive first to take advantage of the currency devaluation.

Plans of fiscal austerity are imposed by a nations creditors because the idea is to reduce the current account. The conditions for reduction of the public debt may work if the nation becomes a net exporter and this is what the creditors want. Creditors also want to make a killing by demanding higher interest rates and are also betting on the eventual strengthening of the currency. They also have to be paid a premium for the risk of a further devaluation of the currency.

The debtor nation has to carry out the austerity plans because it must borrow. The creditor is under no such compulsion.

Dear Bill,

I heard a very good description of a recession yesterday: it’s when all the fog and miasma lift off the landscape, and reality is revealed.

Cheers …

jrbarch

This time I performed very poorly. Seems I need a debriefing. On the other hand some questions like N°4 which hinges on one word border on sophistry. Anyhow my question which was also raised in the past by other commenter. Is there any macro textbook to further immerse oneself with the subject? I’ve Randall Wray’s “Understanding Modern Money”. Beside that?

I messed up Question 3 because of the word “political” – I figured regardless of the actual positive effects of a fiscal stimulus, the US government would still need to bear political costs. (Pete Peterson and his buddies aren’t going anyway anytime soon, unfortunately).

I mean that is happening now, isn’t it – all the costs are political, not economic.

Sometimes I read too much between the lines.

Yes, pebird. Got #3 right through test-taking psychology, although I knew Bill’s answer was quite wrong. Here is how a mainstream media TV interview would go if sane policies were adopted in the USA:

Government Economist: The deficit-spending stimulus was a success and reduced our debt. The debt was 2 zillion, now it is 1 zillion, and GDP grew from 3 to 4 jillion.

MSM Interviewer: No, it was a failure.

Economist: What do you mean? 2 is bigger than 1.

Interviewer: No, it isn’t. And I don’t know what planet you liberals are from. 3 is bigger than 4, so the economy shrunk.

Economist: Is Not!

Interviewer:Is So!

Economist: That is a dead parrot.

Interviewer: You are a communist. And a witch. Get him!

Economist is dragged away by burly men. Muffled blows and screaming are soon drowned out by audience applause.

**********

Stephan, well, since I found a very cheap copy, I ordered Godley’s old Macroeconomics textbook. His more recent book with Lavoie and Professor Mitchell’s Full Employment Abandoned book (afaik the only other fully in-paradigm book besides Wray) are pricier. And there is the textbook that Mitchell & Wray are writing, so just use a time machine. Perhaps we can all get free copies if we promise to be bodyguards for the authors when they are interviewed as above.

I hope Q2 is intended for me.

bill said: “First, households do have to service their debts and repay them at some due date or risk default.”

And, “Second, a sovereign government also has to service their debts and repay them at some due date or risk default.”

Is it more accurate to say “First, households do have to service their debts and repay them at A PREDETERMINED due date or risk default and do this by paying down the principle over time.”?

Is it more accurate to say “Second, a sovereign government also has to service their debts and repay them at some UNKNOWN due date or risk default and don’t do this by paying down the principle over time.”?

bill said: “The other crucial point is that households also have to forego some current consumption, use up savings or run down assets to service their debts and ultimately repay them.”

What if they get a raise or work more hours?

What if households have poor assumptions about their future wage per hour rate or ability to work more hours?

bill said: “Now can it just roll-it over continuously? Well the question was subtle because the government can always keep issuing new debt when the old issues mature and maintain a stable (or whatever). But as the previous debt-issued matures it is paid out as per the terms of the issue. So that nuance was designed to elicit specific thinking.”

What if china some day says we are NOT rolling over the debt and want paid back with currency? What if they say we are also revaluing the currency and price inflation goes up? Is the USA going to be able to sell any debt, and even if so, at what interest rate?

What if there are entities in the gov’t bond markets that are acting like political agents instead of economic agents?

bill said: “The other point is that the liability on a sovereign government is legally like all liabilities – enforceable in courts the risk associated with taking that liability on is zero which is very different to the risks attached to taking on private debt.

There is zero risk that a holder of a public bond instrument will not be paid principle and interest on time.”

Someone can correct me if I’m wrong, but I thought Russia partially defaulted on the foreigners in the late 1990’s.

I believe there are times when public bond defaults are acceptable (especially with foreign central banks who have a currency peg) so that the interest rates on them are higher and so that the capital requirement on the short-term gov’t debt is NOT zero.

For Q1, what if the currency printing entity sent every citizen and legal resident 20 $100 bills (currency)? What if real GDP went up and the gov’t raised taxes some? Would that be considered G staying the same and T going up so that gov’t currency goes up but gov’t debt falls with a gov’t surplus?

bill said: “Most countries currently run external deficits.”

Is that a problem, many debtors and few savers (wealth/income inequality)?

“MV = PQ”

Try putting all the different M’s in there, from currency to the broadest M, for say the last 25 years to calculate all the different velocities over time.

I believe that would be quite enlightening.

I said: “Is that a problem, many debtors and few savers (wealth/income inequality)?”

Is that how neofeudalism works, the many debtors can never retire and the few savers could retire but won’t?