The IMF and the World Bank are in Washington this week for their 6 monthly…

Where are the gold bugs, Austrians and deficit terrorists?

On July 20, the Reserve Bank of Australia (RBA) published the Minutes of its last board meeting (July 6, 2010). This caused headlines for the day – the journalists must have been bored that day – because it raised the possibility that the RBA would increase interest rates in August – right in the middle of an election campaign (the federal election is late August). The bank economists as usual predicted rising rates and significant spikes in the inflation rate. Well today the the Australian Bureau of Statistics released the Consumer Price Index, Australia data for the June quarter and it showed that inflation is moderate and falling. The market economists were “surprised”. I wonder if their organisations have any money dependent on the judgement of their economists? I wouldn’t bet a cent on the basis of their opinions. They continually make false predictions on the outcomes of all the major data releases – always claiming that the economy is overheating and that fiscal support has to be withdrawn. Nothing could be farther from the truth.

In the Pre-Election Economic and Fiscal Outlook (PEFO) released last week by the Australian Government we read:

Inflationary risks are on the upside, with the labour market reaching full capacity over the next year and the strong incomes boost from the terms of trade expected to see demand increasingly stretch the economy’s supply capacity.

Really, with 12.2 per cent of willing workers unemployed or underemployed, a further few percent of hidden unemployed, and a range of other indicators showing that economics activity is not moving ahead very quickly at all? Please read my blog – Full employment apparently equals 12.2 per cent labour wastage – for more discussion on this point.

The latest economic data comes from Veda Advantage which provides a quarterly Consumer Credit Demand Index. They released their latest index for the April to June quarter on July this morning and it:

… shows consumer credit demand has not yet returned to pre-Global Financial Crisis levels. Credit card and personal loan applications for the April to June quarter remained flat (-0.2%) year-on-year. The Veda Advantage index also revealed the largest quarterly drop in mortgage credit demand in the 6 years CDI has been measured, down 20% year-on-year.

That is not suggestive that a major credit-driven consumption boom is replacing the withdrawal of the fiscal stimulus.

Veda Advantage commented on the results:

Australian consumers appear to be continuing the saving habits adopted during the 2009 downturn. Evidence suggests many people continue to focus on paying down debts rather than extending their credit … Overall credit growth remained flat this quarter … Our debt study also found half of Australians with credit cards were looking to reduce that debt in this quarter, however our debt study shows people in the market for credit are predominantly individuals and families on higher incomes, earning above $70 000 so there is still good quality demand for new credit in the market place for the next 6 months.

So the private domestic sector has been restructuring its balance sheets with the support of the fiscal stimulus, which has saved the economy from recession but has not been sufficient to stop labour underutilisation from rising more than it should.

Joseph Stiglitz was interviewed last night on the ABC national current affairs show 7.30 Report. You can see the full transcript to see what he said or watch an extended version of the segment.

Stiglitz is one of those deficit doves who are in part part of the problem. I will comment more on the interview in a later blog but this section was very interesting:

KERRY O’BRIEN: I’m not sure how much you know about Australia’s stimulus packages in response to the crisis, but to the extent that you do, how did the quality of Australia’s stimulus compare with that in the US and elsewhere, in terms of its effectiveness?

JOSEPH STIGLITZ: I did actually study quite a bit the Australian package, and my impression was that it was the best – one of the best-designed of all the advanced industrial countries. When the crisis struck, you have to understand no-one was sure how deep, how long it would be. There was that moment of panic. Rightfully so, because the whole financial system was on the verge of collapse. In that context, what you need to act is decisively. If you don’t act decisively, you could get the collapse. It’s a one-sided risk.

KERRY O’BRIEN: There’s been a lot of criticism of waste in the way some of Australia’s stimulus money was spent. Is it inevitable if you’re going to spend a great deal of government money quickly that there will be some waste and can you ever justify wasting taxpayers’ money?

JOSEPH STIGLITZ: If you hadn’t spent the money, there would have been waste. The waste would have been the fact that the economy would have been weak, there would have been a gap between what the economy could have produced and what it actually produced – that’s waste. You would have had high unemployment, you would have had capital assets not fully utilised – that’s waste. So your choice was one form of waste verses another form of waste. And so it’s a judgment of what is the way to minimise the waste. No perfection here. And what your government did was exactly right. So, Australia had the shortest and shallowest of the downturns of the advanced industrial countries. And, ah, your recovery actually preceded the – in some sense, China. So there was a sense in which you can’t just say Australia recovered because of China. Your preventive action, you might say pre-emptive action, prevented the downturn while things got turned around in Asia, and they still have not gotten turned around in Europe and America.

Waste has to be put into perspective eh!

There is no greater form of waste in an economic system than unemployment. The obsession with inflation is a denial that the losses from unemployment dwarf all other economic costs. They are permanent losses, they are huge and they are personally borne.

All the available evidence so far is consistent with the fundamental conclusions that you reach from an understanding of Modern Monetary Theory (MMT). While the Austrians, the gold bugs, the deficit terrorists are repeatedly being shown to have got it wrong as each new data release emerges, the MMT position has been consistent and accurate with respect to the data.

The fiscal deficits helped salvage the real economies from a collapse. There was never any problem of solvency and sovereign governments are facing no shortage of demand for their paper (the tenders remain oversubscribed in the advanced countries). Bond yields remain low and there is no sign that they will escalate in the near future while the economy is so weak.

Eventually bond yields will rise as the the economy improves and investors diversify their portfolios (and so demand less government paper). But by then the automatic stabilisers will be in reverse and deficits will be falling anyway. But this observations provides no succour for the crowding out mob. It just reflects the arcane (convertible currency hangover) habit of governments in issuing debt when they do not need to.

Nothing more than that. The government just spends into the economy and borrows back its own spending. Simple as that. There is no finite savings pool that the government is competing to access with other private investors.

So where is inflation heading

As noted in the introduction, the ABS released the June quarter CPI data today and the outcomes have stunned the market (bank) economists and all the gold bugs and deficit terrorists. Yes, inflation is moderate and falling.

As noted in the introduction, the most recent RBA Board Minutes caused headlines because they raised the possibility that the RBA would increase interest rates in August – right in the middle of an election campaign (the federal election is late August).

Always trying to assert its own sense of self-importance the RBA said:

Members noted that the coming month would see important announcements about the health of the European banking sector, which had the potential to have a significant impact on financial markets and global confidence. There would also be an updated reading on domestic prices. This was expected to show further moderation in the year-ended underlying rate, although underlying inflation was likely to remain in the top half of the target range over the period ahead. Headline inflation was expected to rise, owing to the effects of some tax increases, with the year-ended increase in the CPI rising above 3 per cent. The important question for the Board at its next meeting would be whether the new information materially changed the medium-term outlook for inflation.

The RBA once again led everyone to believe that if today’s CPI figure was above 3 per cent then they would increase rates at its next meeting in a few weeks.

The bank economists, also a group who has a heightened sense of their own self importance and are rarely correct in their predictions, were convinced that this was no inevitable. They interpreted the RBA’s statement in the minutes as a warning that rates will almost certainly rise in August.

The median “market economist” forecast was for inflation to rise by 1.0 per cent in the last quarter. It rose 0.6 per cent.

The ABC News report said:

Of the 21 economists surveyed by Bloomberg the lowest estimate was for a 0.8 per cent rise, while many economists were a long way off the mark, with one forecasting a 1.2 per cent surge.

Some of the most prominent market economists in the public debate claimed there were some “downside surprises” in the data. Like that demand is falling in the Australian economy as the fiscal stimulus is withdrawn. Hardly a surprise if you were constantly bent on talking the economy up all the time which is the wont of these business economists. It gets them on TV more often.

The ABC report called the result “a surprisingly soft inflation number” and now all the market economists are backtracking and saying that there will be no rate hike next week.

And what does it say for the Government’s prediction of a red hot fully employed economy with considerable upside inflation risks? Answer: Treasury and Finance economists are also consistently wrong.

Why? They apply mainstream textbook models and listen to the hysteria in the press.

The ABS Consumer Price Index’s headline figure rose 0.6 per cent in the June quarter compared with the previous quarter – that was well below the median analyst forecast of a 1 per cent rise.

To put this in perspective we need to consider how the RBA thinks about the data.

The headline inflation rate increased by a relatively modest 0.6 per cent in the June quarter and this translates into an annualised increase of 3.1 per cent for the year to June.

The RBA’s formal inflation targeting rule aims to keep annual inflation rate (measured by the consumer price index) between 2 and 3 per cent over the medium term. So they have a forward-looking agenda.

But they do not rely on the headline rate. Instead, they use two measures of underlying inflation which attempt to net out the most volatile price movements. Those measures rose only 0.5 per cent in the quarter which gave an underlying rate of inflation of 2.7 per cent for the year to June.

Given the Reserve Bank’s inflation target band is 2-3 per cent there will be no rise next month. But then that was never in doubt. It was just the market economists shouting at us as they do each day that led people to think that a rise was imminent.

To understand this more fully, you might like to read the March 2010 RBA Bulletin which contains an interesting article – Measures of Underlying Inflation. That article explains the different inflation measures the RBA considers and the logic behind them.

The concept of underlying inflation is an attempt to separate the trend (“the persistent component of inflation) from the short-term fluctuations in prices. The main source of short-term “noise” comes from “fluctuations in commodity markets and agricultural conditions, policy changes, or seasonal or infrequent price resetting”.

The RBA uses several different measures of underlying inflation which are generally categorised as “exclusion-based measures” and “trimmed-mean measures”.

So, you can exclude “a particular set of volatile items – namely fruit, vegetables and automotive fuel” to get a better picture of the “persistent inflation pressures in the economy”. The main weaknesses with this method is that there can be “large temporary movements in components of the CPI that are not excluded” and volatile components can still be trending up (as in energy prices) or down.

The alternative trimmed-mean measures are popular among central bankers. The authors say:

The trimmed-mean rate of inflation is defined as the average rate of inflation after “trimming” away a certain percentage of the distribution of price changes at both ends of that distribution. These measures are calculated by ordering the seasonally adjusted price changes for all CPI components in any period from lowest to highest, trimming away those that lie at the two outer edges of the distribution of price changes for that period, and then calculating an average inflation rate from the remaining set of price changes.

So you get some measure of central tendency not by exclusion but by giving lower weighting to volatile elements. Two trimmed measures are used by the RBA: (a) “the 15 per cent trimmed mean (which trims away the 15 per cent of items with both the smallest and largest price changes)”; and (b) “the weighted median (which is the price change at the 50th percentile by weight of the distribution of price changes)”.

While the literature suggests that trimmed-mean estimates have “a higher signal-to-noise ratio than the CPI or some exclusion-based measures” they also “can be affected by the presence of expenditure items with very large weights in the CPI basket”.

The authors say that in the RBA’s forecasting models used “to explain inflation use some measure of underlying inflation (often 15 per cent trimmed-mean inflation) as the dependent variable”.

So what has been happening with these different measures?

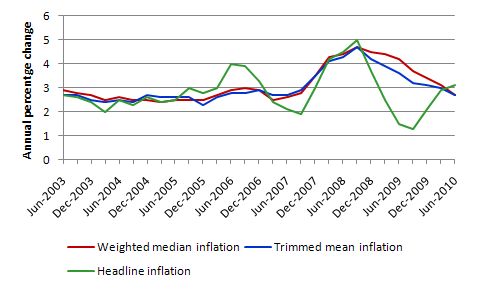

The following graph shows the thre main inflation series published by the ABS – the annual percentage change in the all items CPI (green line); the annual changes in the weighted median (red line) and the trimmed mean (blue line).

Remember the trimmed measures (weighted median and trimmed mean) are designed to depict tendency or trend and attempt to overcome misleading interpretations of trend derived from the actual series.

My interpretation is that underlying inflation trend is downward and falling towards the lower end of the RBA target band. There is no inflationary threat in Australia at present.

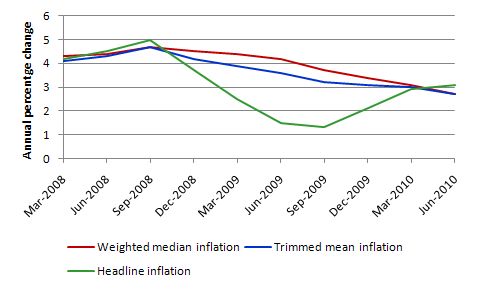

The following graph zooms the sample from March 2008 (the start of the crisis in Australia) to June 2010 to show you more clearly what the inflation trend in Australia looks like – consistently downward. This is despite the significant fiscal stimulus in the earlier part of this sample.

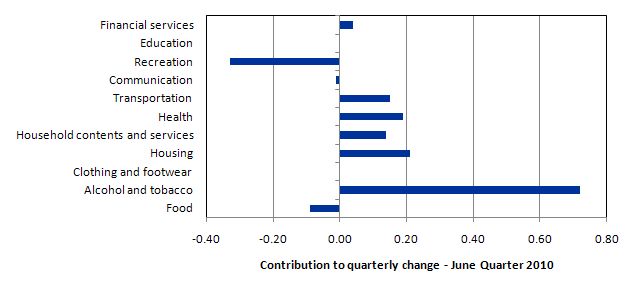

The following bar chart shows the contributions to the quarterly change in the CPI for the June 2010 quarter by component. The most significant price rises were in “tobacco (+15.4%), hospital and medical services (+3.8%), automotive fuel (+2.1%), rents (+1.1%) and house purchase (+0.6%)” all which were driven by policy changes or external influences.

In other words, if you are trying to find evidence of demand pull factors you will be disappointed.

The ABS reports that “The most significant offsetting price falls were in domestic holiday travel and accommodation (-6.0%), fruit (-4.8%), audio, visual and computing equipment (-6.3%), vegetables (-3.0%) and overseas holiday travel and accommodation (-1.9%)”. These are the sort of items that might tell you that demand is too strong.

Further, in recent days the major supermarket retailers Woolworths and Coles (which own many department and other appliance stores) and their major competitor in household goods Harvey Norman have all reported deflationary trends in their operations. That might be observed in details of a Woolies Catalogue as an example. They have indicated that demand is weak in retail land where demand pull pressures always show up first.

Where are the gold bugs at the moment?

At the height of the crisis as governments were implementing fiscal stimulus measures to save the real sectors of their economies from total collapse, the first major criticisms came from the gold bugs – the Austrian school devotees and other paranoid elements who frequent the policy debate.

Remember this guy – Watch out for spam! – who has an E-mail list and was warning us all about the pending sovereign defaults and advising his subscribers to get into gold!

Seems that no government has defaulted yet and public debt tenders are oversubscribed in most countries. Inflation is falling and gold prices are now in reverse.

The following graph shows the spot gold price over the last thirty days.

It is clear that financial markets are moving into riskier options to get higher yields and the trend in gold is down.

Last night on the COMEX, the New York gold futures fell again and reached their lowest level in the last 90 odd days.

The following graph was taken at 15:05 Wednesday EAST from the COMEX December 2010 gold futures. That is a very strong signal that the falls in the spot will continue.

I liked this interpretation in the Sydney Morning Herald today by Michael Pascoe:

There’s no point trying to tell the hard-core gold bugs that. Those with a fanatical devotion to the metal spruik the imminent failure of fiat money/civilisation/Australian cricket as compelling reasons to stock up on gold bars and shotguns. There’s no arguing with such conviction.

A step back from the Waco types, the threat of another financial crisis and the accompanying currency uncertainties have done wonders for gold demand and therefore the price, but it follows that any retreat from such fear would hit gold hard.

The reason is quite simple. The world economy is currently growing on the back of the fiscal stimulus packages that are still working their way through the system. This has helped the private domestic sector to resume saving and reduce their debt exposures. Not enough that is for sure but we are in a better position that we were two years ago.

The future is unclear because the austerity push that is now starting in earnest around the world will start to really bite by the end of the year. Then we are facing the prospect of a double-dip global recession.

So you goldies – stay long if you dare!

Conclusion

Anyway, I would be embarrassed right now if I was a gold bug or an Austrian or a deficit terrorist. The data is continually going against their wild assertions. We are now a few years into the fiscal interventions. The world doesn’t look remotely like they said it would.

I know they will say – it is only a matter of time. Mauldin, for example, is claiming he has a deflationary-then-inflationary perspective. At least that is better than what he was last year when he was predicting hyperinflation and default.

I guess it is better to become a “up-down” type because eventually you will proven correct. But what a pathetic lot they are!

Me? I an a MMT person and I see weak aggregate demand being exacerbated by fiscal withdrawal and I see no inflation in sight that will come from demand pull factors.

That is enough for today!

“Where are the Austrians?”

I looked for them yesterday. They are assembled in a sort of mental panic room. A Peter Boettke quotes Ludwig van Mises

and then asks the gloomy question: “What can we do to follow in Mises’s footsteps but resist this conclusion?” So the guardians of our civilization feel sorry for themselves and are depressed. I tried to cheer them up with some advice (below) which was unfortunately no solace for them.

(“A good start would be to calibrate your theories to reality – meaning present observable economic phenomena. There’s no credit expansion instead a contraction. Deflation is on the menu not inflation. The most important currencies are free-floating on the market. And beside some minor protectionist measures there’s no overall drive to shut down trade.”)

According to these folk, fiscal stimulus did absolutely nothing, and further, was the cause of the GFC (at least according to the first commenter)!

Stiglitz is a positive beacon of light by comparison.

Talking of Austrians, this article mentions the obvious (if you read this blog) in relation to Ireland and their Austerity measures:

“Cutting government spending while the private sector is de-leveraging is a hard way to go. (In our opinion, it is the right way to go…but that’s another issue!)

What happens is that as the feds cut back it reduces income to the private sector, which is itself in cutback mode. This then causes tax revenues to fall – which increases the deficit…

You end up with a vicious cycle of cuts, deficits and more cuts…which doesn’t worry us…”

At least you know their heart’s in the right place! 😐

I have a question regarding the RBA statement: “Headline inflation was expected to rise, owing to the effects of some tax increases…”

If the government simply raises taxes, can that actually be regarded as inflation? It would seem to me that discouraging spending would be deflationary.

You also mention that there was no evidence of “demand pull factors” – is there a situation where inflation can occur without the associated demand (which is what the RBA’s implying)?

“All the long-run results from the simulations are neo-classical which means that aggregate demand (and hence fiscal policy) has no long-run effect on real outcomes (GDP growth, employment, income generation etc).”

I have come to the conclusion that the entirety of mainstream (macro)economic thought since Marx has been (and continues to be) dedicated to finding increasingly clever ways to deny Marx’s observation of the tight linkage between wages and aggregate demand.

Bill,

I’m still pretty new to economics but this statement today

“Eventually bond yields will rise as the the economy improves and investors diversify their portfolios (and so demand less government paper). But by then the automatic stabilisers will be in reverse and deficits will be falling anyway. But this observations provides no succour for the crowding out mob. It just reflects the arcane (convertible currency hangover) habit of governments in issuing debt when they do not need to”

highlights a gap in my understanding: if the central bank controls the short term rate, does this comment refer to longer bonds, or is it saying that the central bank will gradually raise rates as the markets begin to expand naturally, or am I completely clueless?

Thanks.

wtf……the inflation data simply measures costs during the period (whether some idiosyncratic increases should be regarded as inflation per se, or not). It is not a forward looking forecast for spending, or relative preferences. If the bottle of beer i drink went up 50c, the effect on me is paying 50c more each time I have one (bring on Friday!!). I wouldn’t reduce my consumption, so that’s a cost to me. Increasing it $5 a bottle might influence my behaviour, but that’s a different question.

wtf,

In the UK people constantly harp on about how we should raise interest rates because the headline CPI is 3.2%, yet if you exclude all direct sales taxes (the ‘CPIY’ rate), it is just 1.6%. I think that the only price measures worth looking at are ones which exclude taxes, as tax decisions can easily be reversed if necessary, and the CPIY shows the general trend more accurately.

john,

i’m new to economics too. I think Bill is referring to the government issuing debt by putting government bonds up for auction. This is how governments borrow money (from the bond markets). The price is determined in an auction, and rates we see currently are because government debt is in demand at the moment (despite the fact mainstream economists were saying it would not be in demand). Bill is also saying that governments do not need to issue debt in order to spend.

Kind Regards

Charlie

Seems to me like one quarter’s worth of gold prices is just statistical noise when looked at against the trend of the past ten years (exponential up) …. although that bubble has to collapse at some point.

Ken

Bonds aren’t used by governments to fund spending. They are used as an instrument to maintain the central banks target interest rate.

To increase liquidity the government / RBA buys bonds. and to reduce liquidity bonds are sold.

Bonds are not a fiscal policy instrument as the textbooks want us all to believe.

Gold is now at my buy point of the rising long term trend support line. GLD touched that line 6 times, which signifies that this trendline is a reliable point of support. The significance of this line is that it is not steep, which also brings a higher probability that GLD will find support here.

CharlesJ,

Thanks but my confusion runs a bit deeper than this. In his blog Deficit spending 101 – Part 3 Bill says,

“While we have seen that the funds that government spends do not come from anywhere and taxes collected do not go anywhere, there are substantial liquidity impacts from net government positions as discussed. If the funds that purchase the bonds come from government spending as the accounting dictates, then any notion that government spending rations finite savings that could be used for private investment is a nonsense. A financial expert in the US, Tom Nugent sums it up like this:

One can also see that the fears of rising interest rates in the face of rising budget deficits make little sense when all of the impact of government deficit spending is taken into account, since the supply of treasury securities offered by the federal government is always equal to the newly created funds. The net effect is always a wash, and the interest rate is always that which the Fed votes on. Note that in Japan, with the highest public debt ever recorded, and repeated downgrades, the Japanese government issues treasury bills at .0001%! If deficits really caused high interest rates, Japan would have shut down long ago!”

In the post above he says,

“Eventually bond yields will rise as the the economy improves and investors diversify their portfolios (and so demand less government paper). But by then the automatic stabilisers will be in reverse and deficits will be falling anyway. But this observations provides no succour for the crowding out mob. It just reflects the arcane (convertible currency hangover) habit of governments in issuing debt when they do not need to”

So my question is, if it is true that the interest rate “the interest rate is always that which the Fed votes on” then it must follow that when “eventually bond yields will rise as the the economy improves and investors diversify their portfolios (and so demand less government paper)” yields have risen because the Fed voted it so. But if that is true then it has nothing to do with “demand” for “less government paper”.

Or I’m confusing terms or something, what do I have wrong here?

John, this is a macro site and your not suposed to ask specific questions on things like interest rates! At least thats the response I get when I ask grade 9 questions! Still I get where you are heading. You want to know what direction long term interest rates are going to go and why. Me too. I have read this site for 5 months and I can tell you for sure the Governments of the world dont set long term interest rates, the bond markets do. The bond investors or lack of them dictates the interest rate. You can confirm the Fed doesnt control long term interest rates by listening to Bernanke’s last testimony. He actually says so about half way through. As business prospects improve money will move from Bonds to viable projects at higher interest rates than Bonds. If bond issues are to succeed then the interest rate will be higher as the competition will be both attractive (low risk) and higher return. Long term rates are low now because investments ( lending money) is seen as very risky so better to buy capital secure bonds. Hyman Minsky described this market in a very understandable way. Steve Keen’s lecture on Minsky’s hypothosis is easy to follow. You can find the lecture at Steve Keen’s debtwatch. Eventually good solid business ventures will become viable (safe to lend to) and this will start the cycle all over again. Good luck with you understanding.

apj, you couldnt be more wrong about the effect price increases (inflation) has on retail customers actions. I worked in pubs for 20 years and every time beer went up even 5 cents a glass public bar drinkers cut back for a while. Eventually they would go back to the old consumpion but it did effect staffing rosters (employment ) very quickly in the short term. Hours were cut everytime. Not everyones budget can ignor increases of 50cents an item and that is why I support MMT. MMT demands that Gov fill the gaps in demand until the private sector is viable (attracting investors away from Bonds) again.

While I am on my soapbox why do we let anyone speculate in housing? Housing is shelter not an investment and ponzi type speculation is penalizing generations of home owner with supersized mortgages. All the crowing about how stabelizing Recorse loans are in Australia is exactly wrong. If housing falls in price all the negativly geared ponzi speculators will rush the exists to protect there family homes that were used to get the loan to buy the speculative investment house. Obvious really.

john, Punchy, I believe we will all agree that secondary market bond yields are the result of secondary market supply and demand. However the ultimate source of supply in the secondary market is the primary market. When government issues bonds it does not pick an arbitrary maturity and then prints bonds at that maturity to the amount it likes but it tries to match projected demand, i.e. issue in the amount and maturity point that is most favoured by the market. Naturally, if the government issues less than demanded by the market then yields will go down. If it issues more, then yields will go up. And here comes the question: does the FED have full control over the issuance strategy of the Treasury? Role – yes, control – not at all. And then what will happen to long-term yields if Treasury does not issue long-term debt at all? Well, private sector will start begging it to issue as Bill has many times discussed this case for Australia which has also happened in the US before (http://www.treasurydirect.gov/indiv/research/articles/res_invest_articles_30yearbondarticle_0106.htm)

I am sure I did not answer your question directly but I wanted to show that there are more things in play than just a FFR. And the problem is more likely not with the lack of control but rather with bond issuance.

punch,

Thanks for the detail! I actually don’t care where interest rates go: I’m a self employed architects so I have no “real” money! I’m really just interested in the implications of the shift from commodity money to fiat money that apparently happened without any revisions to the text books. I’m chewing my way through Minsky’s book on stabilizing instability, Skidelky’s Keynes and Godley’s “Monetary Ecionomics” which is wonderfully full of equations and reawakening math skills dormant since I veered off into trig and engineering 30 years ago. This is what happens to architects when you deprive them of something to work all night on! I was just looking for a conceptual clarification on whether governments that issue currency can rally defend their policy rate in all instances and as best as I can tell they can, at least for short bonds.

Cheers!

For John, July 30 at 7:20.

The Fed sets the overnight interest rate. The overnight rate greatly influences short term rates. As the term increases the influence of the overnight rate decreases and market forces become more important. At 2-3 years the overnight rate is very influential. At 10 years market influence is strong. If the Fed wanted to it could control longer term rates by buying or selling longer term bonds. So-called ”quantitative easing” accomplished this when the Fed bought non-government bonds and caused a decline in interest rates in those markets.

As the economy improves the Fed will put up the overnight rate which will influence other rates as well.

Hope that helps.

Kieth Newman,

Thanks, you rounded out the intuition I had been working toward. It clarifies Bills repeated assertions regarding the dormant tools governments are not using. That helped and is appreciated.

John:

With respect to “dormant tools” not used, I think you’ll find that one of Bill’s main problems with current government policy is that it is far too reliant on monetary policy. He believes demand in the economy should be regulated through variable levels of government spending (and taxation) rather than the blunt and uncertain tool of changing interest rates. So in fact the “dormant tool” is fiscal policy.

The current main objection to that by conservatives who want as little government involvement in the economy as possible is that government debt will become prohibitively high. They invoke the logic of household finance, saying governments can only live within their financial means. This logic is very intuitively appealing and confuses people who would otherwise agree with Bill’s views. This is where “modern monetary theory” (MMT) comes in. MMT agrees that a country must live within its means but that the means are not financial but rather available productive capacity and labour. According to MMT the finances required to achieve full employment can be easily managed with a proper understanding of monetary operations under a regime of a free-floating fiat currency.

I might add that I find the term MMT a bit odd since Bill and company’s views are based not on theory but on the real world functioning of monetary operations. Selective reading of texts on the websites of central banks and a few other sources show this to be the case. These readings are mostly pretty dull unless you an enthusiast, but it is all there. The strange part is that so few economists are interested in exploring these insights.

An interesting piece on De/Inflation under Persistently Large Output Gaps, quoted in Brad De Longs Treasury View critique, here…

http://www.hmrc.gov.uk/inheritancetax/intro/basics.htm