Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – August 21, 2010 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

There has been a lot of talk in the Australian federal election campaign about structural budget deficits. These estimates are typically based on overly pessimistic estimates potential GDP and thus should be disregarded.

The answer is True.

The correct statement is the implicit estimates of potential GDP that are produced by central banks, treasuries and other bodies are too pessimistic.

The reason is that they typically use the NAIRU to compute the “full capacity” or potential level of output which is then used as a benchmark to compare actual output against. The reason? To determine whether there is a positive output gap (actual output below potential output) or a negative output gap (actual output above potential output).

These measurements are then used to decompose the actual budget outcome at any point in time into structural and cyclical budget balances. The budget components are adjusted to what they would be at the potential or full capacity level of output.

So if the economy is operating below capacity then tax revenue would be below its potential level and welfare spending would be above. In other words, the budget balance would be smaller at potential output relative to its current value if the economy was operating below full capacity. The adjustments would work in reverse should the economy be operating above full capacity.

If the budget is in deficit when computed at the “full employment” or potential output level, then we call this a structural deficit and it means that the overall impact of discretionary fiscal policy is expansionary irrespective of what the actual budget outcome is presently. If it is in surplus, then we have a structural surplus and it means that the overall impact of discretionary fiscal policy is contractionary irrespective of what the actual budget outcome is presently.

So you could have a downturn which drives the budget into a deficit but the underlying structural position could be contractionary (that is, a surplus). And vice versa.

The difference between the actual budget outcome and the structural component is then considered to be the cyclical budget outcome and it arises because the economy is deviating from its potential.

As you can see, the estimation of the benchmark is thus a crucial component in the decomposition of the budget outcome and the interpretation we place on the fiscal policy stance.

If the benchmark (potential output) is estimated to be below what it truly is, then a sluggish economy will be closer to potential than if you used the true full employment level of output. Under these circumstances, one would conclude that the fiscal stance was more expansionary than it truly was.

This is very important because the political pressures may then lead to discretionary cut backs to “reign in the structural deficit” even though it is highly possible that at that point in time, the structural component is actually in surplus and therefore constraining growth.

The mainstream methodology involved in estimating potential output almost always uses some notion of a NAIRU which itself is unobserved. The NAIRU estimates produced by various agencies (OECD, IMF etc) always inflate the true full employment unemployment rate and completely ignore underemployment, which has risen sharply over the last 20 years.

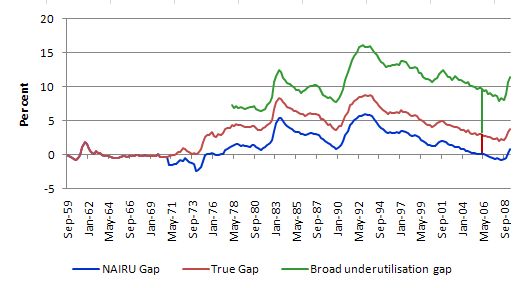

The following graph is for Australia but it broadly representative of the types of constructs we are dealing with. It plots three different measures of labour market tightness:

- The gap between the actual unemployment rate and the Australian Treasury estimate of the NAIRU (blue line), which is interpreted as estimating full employment when the gap is zero (cutting the horizontal axis).

- The gap between the actual unemployment rate and a 2 per cent full employment rate (red line), again would indicate full employment if the line cut the horizontal axis.

- The gap between the broad labour underutilisation rate published by the ABS (available HERE), which takes into account underemployment and our 2 per cent full employment rate (green line).

Some might ask why would we assume that 2 per cent unemployment rate is a true full employment level? We know that unemployment will always be non-zero because of frictions – people leaving jobs and reconnecting with other employers. This component is somewhere around 2 per cent. The other components of unemployment which economists define are seasonal, structural and demand-deficient. Seasonal unemployment is tied up with frictional and likely to be small.

The concept of structural unemployment is vexed. I actually don’t think it exists because ultimately comes down to demand-deficient. The concept is biased towards a view that only private market employment are real jobs and so if the market doesn’t want a particular skill group or does not choose to provide work in a particular geographic area then the mis-match unemployment is structural.

The problem is that often there are unemployed workers in areas where employers claim there are skills shortages. The firms will not employ these workers and offer them training opportunities within the paid work environment because they exercise discrimination. So what is actually considered structural is just a reflection of employer prejudice and an unwillingness to extend training opportunities to some cohorts of workers.

Also, the government can always generate enough demand to provide jobs to all in every area should it choose. So ultimately, any unemployment that looks like it is “structural” is in fact due to a lack of demand.

So there is no reason why any economy cannot get their unemployment rate down to 2 per cent.

Given that, the NAIRU estimates not only inflate the true full employment unemployment rate but also completely ignore the underemployment, which has risen sharply over the last 20 years.

In the June quarter 2006 the Australian NAIRU gap was zero whereas the actual unemployment rate was still 2.78 per cent above the full employment unemployment rate. The thick red vertical line depicts this distance.

However, if we considered the labour market slack in terms of the broad labour underutilisation rate published by the ABS then the gap would be considerably larger – a staggering 9.4 per cent. Thus you have to sum the red and green vertical lines shown at June 2008 for illustrative purposes.

This means that the Australian Treasury are providing advice to the Federal government claiming that in June 2008 the Australian economy was at full employment when it is highly likely that there was upwards of 9 per cent of willing labour resources being wasted. That is how bad the NAIRU period has been for policy advice.

But in relation to this question, in June 2008, the Australian Treasury would have classified all of the federal budget balance in that quarter as being structural given that the cycle was considered to be at the peak (what they term full employment).

However, if we define the true full employment level was at 2 per cent unemployment and zero underemployment, then you can see that, in fact, the Australian economy would have been operating well below the full employment level and so there would have been a significant cyclical component being reflected in the budget balance.

Given the federal budget in June 2008 was in surplus the Treasury would have classified this as mildly contractionary whereas in fact the Commonwealth government was running a highly contractionary fiscal position which was preventing the economy from generating a greater number of jobs.

The following blogs may be of further interest to you:

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

Question 2:

For nations enjoying strong terms of trade (and external surplus), it is sensible for the government to run budget surpluses and accumulate them in a sovereign fund to create more space for non-inflationary spending in the future.

The answer is False.

The public finances of a country such as Australia – which issues its own currency and floats it on foreign exchange markets are not reliant at all on the dynamics of our industrial structure. To think otherwise reveals a basis misunderstanding which is sourced in the notion that such a government has to raise revenue before it can spend.

So it is often considered that a mining boom which drives strong growth in national income and generates considerable growth in tax revenue is a boost for the government and provides them with “savings” that can be stored away and used for the future when economic growth was not strong. Nothing could be further from the truth.

The fundamental principles that arise in a fiat monetary system are as follows:

- The central bank sets the short-term interest rate based on its policy aspirations.

- Government spending capacity is independent of taxation revenue. The non-government sector cannot pay taxes until the government has spent.

- Government spending capacity is independent of borrowing which the latter best thought of as coming after spending.

- Government spending provides the net financial assets (bank reserves) which ultimately represent the funds used by the non-government agents to purchase the debt.

- Budget deficits put downward pressure on interest rates contrary to the myths that appear in macroeconomic textbooks about “crowding out”.

- The “penalty for not borrowing” is that the interest rate will fall to the bottom of the “corridor” prevailing in the country which may be zero if the central bank does not offer a return on reserves.

- Government debt-issuance is a “monetary policy” operation rather than being intrinsic to fiscal policy, although in a modern monetary paradigm the distinctions between monetary and fiscal policy as traditionally defined are moot.

These principles apply to all sovereign, currency-issuing governments irrespective of industry structure. Industry structure is important for some things (crucially so) but not in delineating “public finance regimes”.

The mistake lies in thinking that such a government is revenue-constrained and that a booming mining sector delivers more revenue and thus gives the government more spending capacity. Nothing could be further from the truth irrespective of the rhetoric that politicians use to relate their fiscal decisions to us and/or the institutional arrangements that they have put in place which make it look as if they are raising money to re-spend it! These things are veils to disguise the true capacity of a sovereign government in a fiat monetary system.

In the midst of the nonsensical intergenerational (ageing population) debate, which is being used by conservatives all around the world as a political tool to justify moving to budget surpluses, the notion arises that governments will not be able to honour their liabilities to pensions, health etc unless drastic action is taken.

Hence the hype and spin moved into overdrive to tell us how the establishment of sovereign funds. The financial markets love the creation of sovereign funds because they know there will be more largesse for them to speculate with at the expense of public spending. Corporate welfare is always attractive to the top end of town while they draft reports and lobby governments to get rid of the Welfare state, by which they mean the pitiful amounts we provide to sustain at minimal levels the most disadvantaged among us.

Anyway, the claim is that the creation of these sovereign funds create the fiscal room to fund the so-called future liabilities. Clearly this is nonsense. A sovereign government’s ability to make timely payment of its own currency is never numerically constrained. So it would always be able to fund the pension liabilities, for example, when they arose without compromising its other spending ambitions.

The creation of sovereign funds basically involve the government becoming a financial asset speculator. So national governments start gambling in the World’s bourses usually at the same time as millions of their citizens do not have enough work.

The logic surrounding sovereign funds is also blurred. If one was to challenge a government which was building a sovereign fund but still had unmet social need (and perhaps persistent labour underutilisation) the conservative reaction would be that there was no fiscal room to do any more than they are doing. Yet when they create the sovereign fund the government spends in the form of purchases of financial assets.

So we have a situation where the elected national government prefers to buy financial assets instead of buying all the labour that is left idle by the private market. They prefer to hold bits of paper than putting all this labour to work to develop communities and restore our natural environment.

An understanding of modern monetary theory will tell you that all the efforts to create sovereign funds are totally unnecessary. Whether the fund gained or lost makes no fundamental difference to the underlying capacity of the national government to fund all of its future liabilities.

A sovereign government’s ability to make timely payment of its own currency is never numerically constrained by revenues from taxing and/or borrowing. Therefore the creation of a sovereign fund in no way enhances the government’s ability to meet future obligations. In fact, the entire concept of government pre-funding an unfunded liability in its currency of issue has no application whatsoever in the context of a flexible exchange rate and the modern monetary system.

The misconception that “public saving” is required to fund future public expenditure is often rehearsed in the financial media.

First, running budget surpluses does not create national savings. There is no meaning that can be applied to a sovereign government “saving its own currency”. It is one of those whacko mainstream macroeconomics ideas that appear to be intuitive but have no application to a fiat currency system.

In rejecting the notion that public surpluses create a cache of money that can be spent later we note that governments spend by crediting bank accounts. There is no revenue constraint. Government cheques don’t bounce! Additionally, taxation consists of debiting an account at an RBA member bank. The funds debited are “accounted for” but don’t actually “go anywhere” and “accumulate”.

The concept of pre-funding future liabilities does apply to fixed exchange rate regimes, as sufficient reserves must be held to facilitate guaranteed conversion features of the currency. It also applies to non-government users of a currency. Their ability to spend is a function of their revenues and reserves of that currency.

So at the heart of all this nonsense is the false analogy neo-liberals draw between private household budgets and the government budget. Households, the users of the currency, must finance their spending prior to the fact. However, government, as the issuer of the currency, must spend first (credit private bank accounts) before it can subsequently tax (debit private accounts). Government spending is the source of the funds the private sector requires to pay its taxes and to net save and is not inherently revenue constrained.

You might have thought the answer was maybe because it would depend on whether the economy was already at full employment and what the desired saving plans of the private domestic sector was. In the absence of the statement about creating more fiscal space in the future, maybe would have been the best answer.

The following blogs may be of further interest to you:

- A mining boom will not reduce the need for public deficits

- The Futures Fund scandal

- A modern monetary theory lullaby

Question 3:

A sovereign national government, that is, one that issues its own floating currency faces no solvency risk with respect to the debt it issues.

The answer is Maybe.

The answer would be true if the sentence had added (to the debt it issues) … in its own currency. The national government can always service its debts so long as these are denominated in domestic currency.

The answer would be false if the sentence had have mentioned that the government had borrowed in foreign currencies in addition to its own currency.

But the best answer is maybe.

It also makes no significant difference for solvency whether the debt is held domestically or by foreign holders because it is serviced in the same manner in either case – by crediting bank accounts.

The situation changes when the government issues debt in a foreign-currency. Given it does not issue that currency then it is in the same situation as a private holder of foreign-currency denominated debt.

Private sector debt obligations have to be serviced out of income, asset sales, or by further borrowing. This is why long-term servicing is enhanced by productive investments and by keeping the interest rate below the overall growth rate.

Private sector debts are always subject to default risk – and should they be used to fund unwise investments, or if the interest rate is too high, private bankruptcies are the “market solution”.

Only if the domestic government intervenes to take on the private sector debts does this then become a government problem. Again, however, so long as the debts are in domestic currency (and even if they are not, government can impose this condition before it takes over private debts), government can always service all domestic currency debt.

The solvency risk the private sector faces on all debt is inherited by the national government if it takes on foreign-currency denominated debt. In those circumstances it must have foreign exchange reserves to allow it to make the necessary repayments to the creditors. In times when the economy is strong and foreigners are demanding the exports of the nation, then getting access to foreign reserves is not an issue.

But when the external sector weakens the economy may find it hard accumulating foreign currency reserves and once it exhausts its stock, the risk of national government insolvency becomes real.

The following blogs may be of further interest to you:

- Modern monetary theory in an open economy

- Debt is not debt

- The deficit and debt debate

- Debt and deficits again!

Question 4:

Under current institutional arrangements, the change in the ratio of public debt to GDP will exactly equal the primary deficit plus the interest service payments on the outstanding stock of debt both expressed as ratios to GDP minus the changes in the monetary base arising from official foreign exchange transactions.

The answer is False.

If we left out the last part of the question “minus the changes in the monetary base arising from official foreign exchange transactions” then the answer is true. The offical foreign exchange transactions do change the monetary base but have no accounting impact on the ratio of public debt to GDP

So without that addition, the answer would be true as long as you note the caveat “under current institutional arrangements”. What are the institutional arrangements that are applicable here? I am referring, of-course, to the voluntary choice by governments around the world to issue debt into the private bond markets to match $-for-$ their net spending flows in each period. A sovereign government within a fiat currency system does not have to issue any debt and could run continuous budget deficits (that is, forever) with a zero public debt.

The reason they is covered in the following blogs – On voluntary constraints that undermine public purpose.

So given they are intent on holding onto these gold standard/convertible currency relics the answer is true.

The framework for considering this question is provided by the accounting relationship linking the budget flows (spending, taxation and interest servicing) with relevant stocks (base money and government bonds).

This framework has been interpreted by the mainstream macroeconommists as constituting an a priori financial constraint on government spending (more on this soon) and by proponents of Modern Monetary Theory (MMT) as an ex post accounting relationship that has to be true in a stock-flow consistent macro model but which carries no particular import other than to measure the changes in stocks between periods. These changes are also not particularly significant within MMT given that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency.

To understand the difference in viewpoint we might usefully start with the mainstream view. The way the mainstream macroeconomics textbooks build this narrative is to draw an analogy between the household and the sovereign government and to assert that the microeconomic constraints that are imposed on individual or household choices apply equally without qualification to the government. The framework for analysing these choices has been called the government budget constraint (GBC) in the literature.

The GBC is in fact an accounting statement relating government spending and taxation to stocks of debt and high powered money. However, the accounting character is downplayed and instead it is presented by mainstream economists as an a priori financial constraint that has to be obeyed. So immediately they shift, without explanation, from an ex post sum that has to be true because it is an accounting identity, to an alleged behavioural constraint on government action.

The GBC is always true ex post but never represents an a priori financial constraint for a sovereign government running a flexible-exchange rate non-convertible currency. That is, the parity between its currency and other currencies floats and the the government does not guarantee to convert the unit of account (the currency) into anything else of value (like gold or silver).

This literature emerged in the 1960s during a period when the neo-classical microeconomists were trying to gain control of the macroeconomic policy agenda by undermining the theoretical validity of the, then, dominant Keynesian macroeconomics. There was nothing particularly progressive about the macroeconomics of the day which is known as Keynesian although as I explain in this blog – Those bad Keynesians are to blame – that is a bit of a misnomer.

This is because the essential insights of Keynes were lost in the early 1940s after being kidnapped by what became known as the neo-classical synthesis characterised by the Hicksian IS-LM model. I cannot explain all that here so for non-economists I would say this issue is not particularly important in order to develop a comprehension of the rest of this answer and the issues at stake.

The neo-classical attack was centred on the so-called lack of microfoundations (read: contrived optimisation and rationality assertions that are the hallmark of mainstream microeconomics but which fail to stand scrutiny by, for example, behavioural economists). I also won’t go into this issue because it is very complicated and would occupy about 3 (at least) separate blogs by the time I had explained what it was all about.

For the non-economists, once again I ask for some slack. Take it from me – it was total nonsense and reflected the desire of the mainstream microeconomists to represent the government as a household and to “prove” analytically that its presence within the economy was largely damaging to income and wealth generation. The attack was pioneered, for example, by Milton Friedman in the 1950s – so that should give you an idea of what the ideological agenda was.

Anyway, just as an individual or a household is conceived in orthodox microeconomic theory to maximise utility (real income) subject to their budget constraints, this emerging approach also constructed the government as being constrained by a budget or “financing” constraint. Accordingly, they developed an analytical framework whereby the budget deficits had stock implications – this is the so-called GBC.

So within this model, taxes are conceived as providing the funds to the government to allow it to spend. Further, this approach asserts that any excess in government spending over taxation receipts then has to be “financed” in two ways: (a) by borrowing from the public; and (b) by printing money.

You can see that the approach is a gold standard approach where the quantity of “money” in circulation is proportional (via a fixed exchange price) to the stock of gold that a nation holds at any point in time. So if the government wants to spend more it has to take money off the non-government sector either via taxation of bond-issuance.

However, in a fiat currency system, the mainstream analogy between the household and the government is flawed at the most elemental level. The household must work out the financing before it can spend. The household cannot spend first. The government can spend first and ultimately does not have to worry about financing such expenditure.

From a policy perspective, they believed (via the flawed Quantity Theory of Money) that “printing money” would be inflationary (even though governments do not spend by printing money anyway. So they recommended that deficits be covered by debt-issuance, which they then claimed would increase interest rates by increasing demand for scarce savings and crowd out private investment. All sorts of variations on this nonsense has appeared ranging from the moderate Keynesians (and some Post Keynesians) who claim the “financial crowding out” (via interest rate increases) is moderate to the extreme conservatives who say it is 100 per cent (that is, no output increase accompanies government spending).

So the GBC is the mainstream macroeconomics framework for analysing these “financing” choices and it says that the budget deficit in year t is equal to the change in government debt (?B) over year t plus the change in high powered money (?H) over year t. If we think of this in real terms (rather than monetary terms), the mathematical expression of this is written as:

which you can read in English as saying that Budget deficit (BD) = Government spending (G) – Tax receipts (T) + Government interest payments (rBt-1), all in real terms.

However, this is merely an accounting statement. It has to be true if things have been added and subtracted properly in accounting for the dealings between the government and non-government sectors.

In mainstream economics, money creation is erroneously depicted as the government asking the central bank to buy treasury bonds which the central bank in return then prints money. The government then spends this money. This is called debt monetisation and we have shown in the Deficits 101 series how this conception is incorrect. Anyway, the mainstream claims that if the government is willing to increase the money growth rate it can finance a growing deficit but also inflation because there will be too much money chasing too few goods! But an economy constrained by deficient demand (defined as demand below the full employment level) responds to a nominal impulse by expanding real output not prices.

But because they believe that inflation is inevitable if “printing money” occurs, mainstream economists recommend that governments use debt issuance to “finance” their deficits. But then they scream that this will merely require higher future taxes. Why should taxes have to be increased?

Well the textbooks are full of elaborate models of debt pay-back, debt stabilisation etc which all “prove” (not!) that the legacy of past deficits is higher debt and to stabilise the debt, the government must eliminate the deficit which means it must then run a primary surplus equal to interest payments on the existing debt.

Nothing is included about the swings and roundabouts provided by the automatic stabilisers as the results of the deficits stimulate private activity and welfare spending drops and tax revenue rises automatically in line with the increased economic growth. Most orthodox models are based on the assumption of full employment anyway, which makes them nonsensical depictions of the real world.

More sophisticated mainstream analyses focus on the ratio of debt to GDP rather than the level of debt per se. They come up with the following equation – nothing that they now disregard the obvious opportunity presented to the government via ?H. So in the following model all net public spending is covered by new debt-issuance (even though in a fiat currency system no such financing is required). Accordingly, the change in the public debt ratio is:

So the change in the debt ratio is the sum of two terms on the right-hand side: (a) the difference between the real interest rate (r) and the GDP growth rate (g) times the initial debt ratio; and (b) the ratio of the primary deficit (G-T) to GDP.

A growing economy can absorb more debt and keep the debt ratio constant. For example, if the primary deficit is zero, debt increases at a rate r but the debt ratio increases at r – g.

Thus, if we ignore the possibilities presented by the ?H option (which is what I meant by current institutional arrangements), the proposition is true but largely irrelevant.

You may be interested in reading these blogs which have further information on this topic:

- On voluntary constraints that undermine public purpose

- Deficits 101 series

- Questions and answers 1

- Will we really pay higher taxes?

- Will we really pay higher interest rates?

- The consolidated government – treasury and central bank

Question 5:

It would be impossible for a central bank to directly purchase treasury debt to facilitate the national government’s budget deficit while still targeting a positive short-term policy rate.

The answer is Maybe.

The conditionality relates to whether the central bank decided to offer a support rate. In the Australian case, the RBA does offer a support payment on overnight reserves which is 25 basis points below the current target rate. So if this policy was maintained then the answer would be true. If the policy was revised such that the support rate was set equal to the current target rate then the answer would be false.

So what is the explanation?

The central bank conducts what are called liquidity management operations for two reasons. First, it has to ensure that all private cheques (that are funded) clear and other interbank transactions occur smoothly as part of its role of maintaining financial stability. Second, it must maintain aggregate bank reserves at a level that is consistent with its target policy setting given the relationship between the two.

So operating factors link the level of reserves to the monetary policy setting under certain circumstances. These circumstances require that the return on “excess” reserves held by the banks is below the monetary policy target rate. In addition to setting a lending rate (discount rate), the central bank also sets a support rate which is paid on commercial bank reserves held by the central bank.

Commercial banks maintain accounts with the central bank which permit reserves to be managed and also the clearing system to operate smoothly. In addition to setting a lending rate (discount rate), the central bank also can set a support rate which is paid on commercial bank reserves held by the central bank (which might be zero).

Many countries (such as Australia, Canada and zones such as the European Monetary Union) maintain a default return on surplus reserve accounts (for example, the Reserve Bank of Australia pays a default return equal to 25 basis points less than the overnight rate on surplus Exchange Settlement accounts). Other countries like Japan and the US have typically not offered a return on reserves until the onset of the current crisis.

If the support rate is zero then persistent excess liquidity in the cash system (excess reserves) will instigate dynamic forces which would drive the short-term interest rate to zero unless the government sells bonds (or raises taxes). This support rate becomes the interest-rate floor for the economy.

The short-run or operational target interest rate, which represents the current monetary policy stance, is set by the central bank between the discount and support rate. This effectively creates a corridor or a spread within which the short-term interest rates can fluctuate with liquidity variability. It is this spread that the central bank manages in its daily operations.

In most nations, commercial banks by law have to maintain positive reserve balances at the central bank, accumulated over some specified period. At the end of each day commercial banks have to appraise the status of their reserve accounts. Those that are in deficit can borrow the required funds from the central bank at the discount rate.

Alternatively banks with excess reserves are faced with earning the support rate which is below the current market rate of interest on overnight funds if they do nothing. Clearly it is profitable for banks with excess funds to lend to banks with deficits at market rates. Competition between banks with excess reserves for custom puts downward pressure on the short-term interest rate (overnight funds rate) and depending on the state of overall liquidity may drive the interbank rate down below the operational target interest rate. When the system is in surplus overall this competition would drive the rate down to the support rate.

The main instrument of this liquidity management is through open market operations, that is, buying and selling government debt. When the competitive pressures in the overnight funds market drives the interbank rate below the desired target rate, the central bank drains liquidity by selling government debt. This open market intervention therefore will result in a higher value for the overnight rate. Importantly, we characterise the debt-issuance as a monetary policy operation designed to provide interest-rate maintenance. This is in stark contrast to orthodox theory which asserts that debt-issuance is an aspect of fiscal policy and is required to finance deficit spending.

So the fundamental principles that arise in a fiat monetary system are as follows.

- The central bank sets the short-term interest rate based on its policy aspirations.

- Government spending is independent of borrowing which the latter best thought of as coming after spending.

- Government spending provides the net financial assets (bank reserves) which ultimately represent the funds used by the non-government agents to purchase the debt.

- Budget deficits put downward pressure on interest rates contrary to the myths that appear in macroeconomic textbooks about ‘crowding out’.

- The “penalty for not borrowing” is that the interest rate will fall to the bottom of the “corridor” prevailing in the country which may be zero if the central bank does not offer a return on reserves.

- Government debt-issuance is a “monetary policy” operation rather than being intrinsic to fiscal policy, although in a modern monetary paradigm the distinctions between monetary and fiscal policy as traditionally defined are moot.

Accordingly, debt is issued as an interest-maintenance strategy by the central bank. It has no correspondence with any need to fund government spending. Debt might also be issued if the government wants the private sector to have less purchasing power.

Further, the idea that governments would simply get the central bank to “monetise” treasury debt (which is seen orthodox economists as the alternative “financing” method for government spending) is highly misleading. Debt monetisation is usually referred to as a process whereby the central bank buys government bonds directly from the treasury.

In other words, the federal government borrows money from the central bank rather than the public. Debt monetisation is the process usually implied when a government is said to be printing money. Debt monetisation, all else equal, is said to increase the money supply and can lead to severe inflation.

However, as long as the central bank has a mandate to maintain a target short-term interest rate, the size of its purchases and sales of government debt are not discretionary. Once the central bank sets a short-term interest rate target, its portfolio of government securities changes only because of the transactions that are required to support the target interest rate.

The central bank’s lack of control over the quantity of reserves underscores the impossibility of debt monetisation. The central bank is unable to monetise the federal debt by purchasing government securities at will because to do so would cause the short-term target rate to fall to zero or to the support rate. If the central bank purchased securities directly from the treasury and the treasury then spent the money, its expenditures would be excess reserves in the banking system. The central bank would be forced to sell an equal amount of securities to support the target interest rate.

The central bank would act only as an intermediary. The central bank would be buying securities from the treasury and selling them to the public. No monetisation would occur.

However, the central bank may agree to pay the short-term interest rate to banks who hold excess overnight reserves. This would eliminate the need by the commercial banks to access the interbank market to get rid of any excess reserves and would allow the central bank to maintain its target interest rate without issuing debt.

The following blogs may be of further interest to you:

- The consolidated government – treasury and central bank

- Saturday Quiz – May 1, 2010 – answers and discussion

- Understanding central bank operations

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

Check out the dialogue between Tom Hickey and Almitra under “There is no credit risk for a sovereign government”.

The prosecution rests.

Bill, most of the governments in my country (Canada) do not have the power to create money. Thus I assume they have to collect taxes in order to spend, unlike our Federal government. Does MMT have anything to say to such governments which, whether they have any actual power or not, are generally held responsible by their voters for their Provinces economic performance?

Of course the Federal government could finance their deficits, but that will probably be a cold day you know where. Can the provinces do anything to counter foolish fiscal and monetary policy by the Federal government? The same would be true for States in the USA and Provinces in Australia I believe.

Bill –

I disagree with your answer to question 2. The presence of the statement about creating more fiscal space in the future doesn’t prevent maybe from being the best answer. Look again at the question’s wording:

…to create more space for non-inflationary spending in the future.

Just because a sovereign government’s not revenue constrained doesn’t mean it’s totally unconstrained. One constraint is the value of its currency – if more is created then the value declines, which can result in inflation. One workaround is for the government to borrow in a foreign currency, but this introduces sovereign debt risks. Having foreign assets means these risks can be avoided.

There also seems to be an error in one of your listed fundamental principles:that arise in a fiat monetary system

Budget deficits put downward pressure on interest rates contrary to the myths that appear in macroeconomic textbooks about “crowding out”.

You’ve previously mentioned that though crowding out does not occur the way it says in the textbooks, it does occur. And the downward pressure budget deficits put on interest rates is usually swamped by the effect you mention in the following point:

The “penalty for not borrowing” is that the interest rate will fall to the bottom of the “corridor” prevailing in the country which may be zero if the central bank does not offer a return on reserves.

And as there are significant economic benefits from doing so, wouldn’t it be best phrased the other way round?

The “penalty for borrowing” is that the interest rate won’t fall to the bottom of the “corridor” prevailing in the country which won’t be zero if the central bank offers a return on reserves.

Q3. Why and how would a govt issue debt in a foriegn currency if it issues its own floating rate currency?

I have trouble with the “maybe” anwers. Policy change could make almost any answer what you want it to be. Economics is not an exact science like physics.

Bill et al,

I have heard economists of TV talking about the economic recovery in terms of “gathering pace”, “self reinforcing” etc. Is there any evidence that, with no extra stimulus, a recovery can/does accelerate? I noticed that the recent global deflation seemed to accelerate, showing signs that it “gathered pace” until the stimulus took hold, and that might lead an amateur like me to think that the recovery will/could also accelerate. At the same time I find it hard to believe that a recovery could accelerate (or even continue) without extra and on-going stimulus, and to accelerate would require an accelerating level of stimulus. Does MMT have anything to say about the pace of recession / recovery in relation to stimulus? Does the recovery ‘run out’ when a one-off stimulus runs out?

Kind Regards

Charlie

With reference to my comment above – where there is a one-off stimulus or no stimulus, would the perceived acceleration / deceleration in growth be due to, both percieved credit worthiness in the private sector, and accelerating / decelerating desire for credit?

Charlie

markg –

Q3. Why and how would a govt issue debt in a foriegn currency if it issues its own floating rate currency?

Because issuing debt reduces the value of a currency. Issuing debt in a foreign currency and converting it to their own increases the value of their own currency.

Of course this is only the short term effect, but it’s still very useful where there’s a short term problem. What happens in the long term depends what the government chooses to do with the money.