I have received several E-mails over the last few weeks that suggest that the economics…

Even the most simple facts contradict the neo-liberal arguments

The denials continue. In the Wall Street Journal yesterday (August 30, 2010) we see the latest desperate attempt by Harvard (and Stanford) professor Robert Barro to redefine away the recession. The article – The Folly of Subsidizing Unemployment claims that if the US government had not have extended unemployment benefits to 99 weeks “the jobless rate could be as low as 6.8%, instead of 9.5% …” Barro has consistently claimed that the government fiscal intervention has largely caused the recession to persist. As we will argue his track record at predicting and/or explaining economic outcomes is very poor. Simple facts always contradict his fantasy world of Ricardian Equivalence and Natural Rates. I am also adding Stanford to my list of universities which sensible students should boycott if they want to learn some economics given Barro’s presence there. The list is getting longer.

In attacking the decision by the US government to extend the unemployment benefits given that the recession has now endured way beyond the previous expectations, Barro notes that the:

The economic “recovery” has been disappointing, to put it mildly, and it has become increasingly clear that the blame lies with the policies of the Obama administration, not with those of its predecessor.

This will be the only point I agree with him on but for different reasons. Every sovereign government has the capacity to stimulate its national economy using fiscal policy. Whatever might have been said about the Bush government (and for me it is all negative) the fact remains that the Obama administration could have easily addressed the crisis more effectively.

The recovery is now waning and it is because they did not use an appropriately scaled (size) and targetted (towards jobs) fiscal intervention. They were spooked by politicians who are totally entrapped by the neo-liberal myths and a virulent media driven by the likes of New Limited.

The fiscal stimulus should have been much larger.

That is not Barro’s view. He says:

In general, the current administration has been too focused on expanding government, redistributing more from rich to poor, and stimulating aggregate demand. I have previously criticized the stimulus package as cost-ineffective. In particular, whatever tax reductions were in the package did not involve the cuts in marginal income tax rates that encourage investment, work effort and productivity growth.

The reality is that the US government has not expanded government enough, has not redistributed enough real income to those who spend the most and has thus not stimulated aggregate demand sufficiently to increase employment growth.

Fiddling with marginal tax rates is a less expansionary way to design a fiscal intervention (given that some of the tax break is immediately saved and is lost to the expenditure system). Further, there is no robust empirical evidence to support the mainstream claim that labour supply is very responsive to tax rate changes anyway.

This remains one of the many religious beliefs that characterise the mainstream paradigm. These beliefs are convenient to buttress the anti-government, pro-market conclusions the so-called theories deliver but are scant on empirical validation.

In an earlier blogs covering Barro – Pushing the fantasy barrow – I outlined the reason why Barro objects to the use of fiscal policy.

He has an obsession with the erroneous “crowding out” hypothesis and has kept the equally flawed notion of Ricardian equivalence alive in the literature. He continually claims that the government spending has no impact once consumers react and reduce consumption in anticipation of the tax increases. He says the same thing every recession!

So according to Barro, government spending has no real effect on output and employment irrespective of whether it is “tax-financed” or “debt-financed” in his models.

Ignoring the fact that the description of a government raising taxes to pay back a deficit is nonsensical when applied to a fiat currency issuing government, the Ricardian Equivalence models rest of several key assumptions. Should any of these assumptions fail to hold (at any point in time), then the predictions of the models are meaningless.

It just happens that virtually none of the assumptions hold at any point in time. Please read my blogs – Deficits should be cut in a recession and We are sorry – for more detailed discussion on the folly of Ricardian equivalence.

The complete irrelevance of Ricardian equivalence tendencies to the real world hasn’t stopped Barro though from continually promoting it as a viable theory of how the system operates. He should have stopped in the early 1980s when his last attempt at recession-forecasting was so comprehensively demolished by the data.

At that time, Barro and his sycophants in the profession predicted that consumption would not rise after the US Congress gave out large tax cuts in August 1981. Why? They all said that saving would rise to “pay for the future tax burden” – just as they are saying now (read on!). The actual data shows that personal saving rate fell between 1982-84. The fact remains that there has never been a successful empirical application of the theory that they keep using to spread their lies.

Anyway, back to yesterday’s article which focused on:

… the expansion of unemployment-insurance eligibility to as much as 99 weeks from the standard 26 weeks.

He claims that the “unemployment-insurance program involves a balance between compassion-providing for persons temporarily without work-and efficiency”.

Consistent with the way the mainstream think of the labour market, the efficiency loss occurs because “the program subsidizes unemployment, causing insufficient job-search, job-acceptance and levels of employment”.

This is the standard mainstream line that represents a denial that persistent unemployment is always about a lack of jobs. Whenever employment growth has been strong enough in the US, unemployment and the duration of unemployment has fallen fairly quickly.

There is a lovely quote from Michael Piore (1979: 10) about this:

Presumably, there is an irreducible residual level of unemployment composed of people who don’t want to work, who are moving between jobs, or who are unqualified. If there is in fact some such residual level of unemployment, it is not one we have encountered in the United States. Never in the post war period has the government been unsuccessful when it has made a sustained effort to reduce unemployment. (emphasis in original) [Unemployment and Inflation, Institutionalist and Structuralist Views, M.E. Sharpe, Inc., White Plains]

Barro’s claim is based on the notion that each unemployed person has a ‘reservation wage’ – the minimum wage he or she insists on getting before accepting a job. So unemployment benefits are alleged to increase the reservation wage and causes the unemployed person to remain unemployed longer.

Please read my blog – Extending unemployment benefits – an omen – for more discussion on this debate to disabuse yourselves of the nonsensical line that the provision of benefits causes unemployment.

The textbook models that the mainstream economists use deny the fact that aggregate demand drives employment growth and these dynamics mostly accounts for the dynamics of unemployment.

A bevy of econometric attempts have been made to support the mainstream position. I am very familiar with the literature and the complicated statistical techniques used and the studies are always flawed, mostly in elemental ways and should be disregarded.

A rising unemployment rate can reflect a dynamic economy in its early stages of growth where lots of workers are churning in and out of employment. So the duration of jobless spells are short and endured by many in the workforce. The point here is that the churning is also seen on the demand side with lots of jobs being created and destroyed each month.

But in a major cyclical episode job destruction rates rise and job creation rates fall – very significantly. I did a three-year research project studying these labour market dynamics and the results are very consistent across economies and time.

When a major and protracted recession hits the labour market becomes stagnant and there is little job turnover and very little hiring. In this situation, the rising unemployment is always associated with longer durations as the waves of workers transit through the duration categories defined by the statisticians.

Please read my blogs – Unemployment is about a lack of jobs and What causes mass unemployment? – for more discussion on this point.

But there is a “further inefficiency” arising from the “increases in taxes required to pay for the program”.

Taxpayers do not fund anything. They just lose or gain purchasing power as the national government manipulates the policy parameters to balance aggregate demand with its perception of the real capacity of the economy to respond to growth in nominal spending. The fact the government doesn’t achieve desirable outcomes in this quest (through incompetence or otherwise etc) or pretends it does raise taxes to finance spending is not the point. In the current recession, we have seen a rapid movement into deficit to shore up the economy.

Please read my blog – Taxpayers do not fund anything – for more discussion on this point.

Barro concedes that during a recession “it is more likely that individual unemployment reflects weak economic conditions, rather than individual decisions to choose leisure over work” and some extension of unemployment benefits is “reasonable”. But the current US policy has:

… shifted toward a welfare program that resembles those in many Western European countries.

Which is because the recession has persisted for longer than most commentators imagined (excluding MMT proponents who argued from the start that the fiscal intervention was inadequate).

The stagnant US labour market – severely constrained by deficient aggregate spending – is now resembling the European labour markets which have delivered persistently high unemployment for years as governments constrained fiscal policy to fit into the ridiculously tight Maastricht criteria and the ECB ran excessively tight monetary policy to keep the euro inflated.

That is not his point though. He wants to implicate the extension of the welfare net with the high unemployment.

He attempts to make this point by appealing to the US Bureau of Labor Statistics JOLTS survey database. He says:

The administration has argued that the more generous unemployment-insurance program could not have had much impact on the unemployment rate because the recession is so severe that jobs are unavailable for many people. This perspective is odd on its face because, even at the worst of the downturn, the U.S. labor market featured a tremendous amount of turnover in the form of large numbers of persons hired and separated every month.

For example, the Bureau of Labor Statistics reports that, near the worst of the recession in March 2009, 3.9 million people were hired and 4.7 million were separated from jobs. This net loss of 800,000 jobs in one month indicates a very weak economy-but nevertheless one in which 3.9 million people were hired. A program that reduced incentives for people to search for and accept jobs could surely matter a lot here.

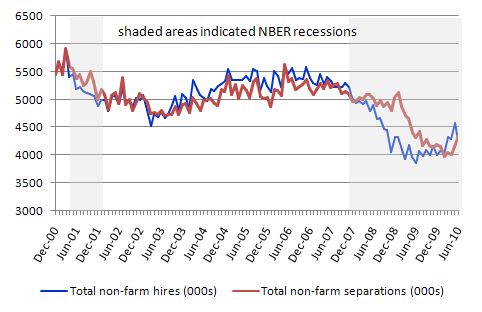

The following graph shows the movements in hires and separations for the US economy as published by the BLS. The shaded areas indicate NBER designated recessions using their business cycle dating methodology.

While labour markets are clearly dynamic in the sense that even in a downturn new jobs are being continually created and destroyed the rates of each dynamic change in a cyclical way. So while there were new jobs being created at the height of the downturn there was a severe shortfall of new jobs emerging as is shown in the graph.

The point that Barro ignores is that in a period of highly constrained aggregate demand and general labour market contraction the unemployment queue expands and the ordering of different demographic cohorts within the queue becomes significant. The workers who are more advantaged are able to transit in and out of jobs during a recession more easily than a low-skilled worker who may face prejudice and discrimination from employers.

Further, with the US labour market now locked into a situation where the tepid employment growth barely absorbs new entrants and the most disadvantaged workers are being trapped in long-term unemployment. In this state, we get what the institutional labour economists (like me) call “bumping down”.

Accordingly, when there is an overall shortage of jobs, higher-skilled (more educated) workers tend to take jobs that were previously occupied by lower skilled workers. The low-skilled are then forced out into the unemployment queue. So there are two inefficiencies: (a) the skills-based underemployment; and (b) the unemployment.

Bumping down is one of the costs (inefficiencies) of recession – the part of the iceberg that lies below the water!

Please read my blogs – Full employment apparently equals 12.2 per cent labour wastage and More fiscal stimulus needed in the US – for more discussion on this point.

The point is that some workers are able to transit into new jobs (which may be below their skills levels) while other workers suffer entrenched unemployment. You may shuffle the queue somewhat through training and depriving the unemployed of income support but when there are not enough jobs you will not reduce the unemployment rate at all. All you will do, if successful, is shuffle who endures the unemployment.

Barro thus uses this data dishonestly. I would also remind you of the fable of 100 dogs and 95 bones (or now 91 bones in the case of the US) which I present (again) for to jog your memories. Barro falls into this trap.

Case study: the parable of 100 dogs and 95 bones

Imagine a small community comprising 100 dogs. Each morning they set off into the field to dig for bones. If there enough bones for all buried in the field then all the dogs would succeed in their search no matter how fast or dexterous they were.

Now imagine that one day the 100 dogs set off for the field as usual but this time they find there are only 95 bones buried.

Some dogs who were always very sharp dig up two bones as usual and others dig up the usual one bone. But, as a matter of accounting, at least 5 dogs will return home bone-less.

Now imagine that the government decides that this is unsustainable and decides that it is the skills and motivation of the bone-less dogs that is the problem. They are not skilled enough.

So a range of dog psychologists and dog-trainers are called into to work on the attitudes and skills of the bone-less dogs. The dogs undergo assessment and are assigned case managers. They are told that unless they train they will miss out on their nightly bowl of food that the government provides to them while bone-less. They feel despondent.

Anyway, after running and digging skills are imparted to the bone-less dogs things start to change. Each day as the 100 dogs go in search of 95 bones, we start to observe different dogs coming back bone-less. The bone-less queue seems to become shuffled by the training programs.

However, on any particular day, there are still 100 dogs running into the field and only 95 bones are buried there!

You can find pictorial version of the parable here (for international readers this version was very geared to labour market policy under the previous federal regime in Australia and was written around 2001).

In the US there are about 91 bones for every 100 dogs and in Spain 80 bones for every 100 dogs!

The point is that fallacies of composition are rife in mainstream macroeconomics reasoning and have led to very poor policy decisions in the past.

There are simply not enough jobs

Barro tries to argue that the current recession is different from the 1982 recession and the “dramatic expansion of unemployment-insurance eligibility to 99 weeks is almost surely the culprit”.

He says:

… in the 1982 recession the peak unemployment rate of 10.8% in November-December 1982 corresponded to a mean duration of unemployment of 17.6 weeks and a share of long-term unemployment (those unemployed more than 26 weeks) of 20.4%. Long-term unemployment peaked later, in July 1983, when the unemployment rate had fallen to 9.4%. At that point, the mean duration of unemployment reached 21.2 weeks and the share of long-term unemployment was 24.5%.

These numbers provide a stark contrast with joblessness today. The peak unemployment rate of 10.1% in October 2009 corresponded to a mean duration of unemployment of 27.2 weeks and a share of long-term unemployment of 36%. The duration of unemployment peaked (thus far) at 35.2 weeks in June 2010, when the share of long-term unemployment in the total reached a remarkable 46.2%. These numbers are way above the ceilings of 21 weeks and 25% share applicable to previous post-World War II recessions.

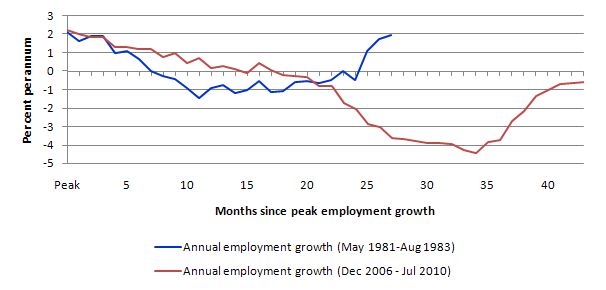

The following graph should set him straight. It shows the annual US employment growth (per cent) which is a strong indicator of the strength of labour demand in the economy starting with the peak employment growth corresponding to the 1982 recession (blue line) and the current downturn (red line). The peak employment growth occurred in May 1981 and December 2006, respectively.

We then trace out the months as the US economy went into recession. The fiscal response in 1982 was significant and arrested the downturn much earlier so that by the 27th month after the peak, employment growth was back at that level.

In the current recession, the situation is very different. Not only is the amplitude of the employment growth decline much worse but also the length of the recession is much longer (currently in 43rd month since the peak) and there is still no sign of a return to the previous peak.

The fact that employment growth has been negative for so long in the recent episode accounts for the larger pool of long-term unemployed. Whatever the government had done about the provision of unemployment benefits this situation would still have occurred. In fact, inasmuch as the extension of the benefits gave some income support to the unemployed, aggregate demand was probably higher than it would have been if the benefits had not have been extended.

In that case, employment growth would have been even worse and the unemployment rate higher than otherwise.

Given this, all the calculations that Barro then performs in his article to show that “the unemployment rate would have been 6.8% rather than 9.5%” are meaningless and should be disregarded.

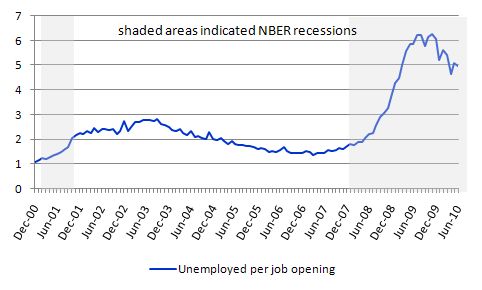

To further consolidate this point, the following graph shows the total number of unemployed per job opening (non-farm and seasonally adjusted).

The BLS describe the data relating to this graph in this way:

When the recession began in December 2007, there were 1.8 unemployed persons per job opening. The ratio rose to a high of 6.2 unemployed persons per open job, more than twice the highest ratio seen since the JOLTS series began … From the high of 6.2 unemployed persons per job opening in November 2009, the ratio fell to 5.0 in June 2010.

My version of it is that the unemployed cannot search for jobs that are not there!

The paradox of the quit rate

In Chapters 2 and 7 of my 2008 book with Joan Muysken – Full Employment abandoned – we consider the type of labour market that Barro considers relevant to the real world. It allowed us to develop the standard Classical view on unemployment which is still pushed down the throats of students today by the likes of Barro and Mankiw and the mainstream macroeconomics profession in general.

The Classical/neo-classical model is represented by the following equations and is graphically depicted the graph below:

Labour demand: Ld = f(w) f’ < 0 Labour supply: Ls = f(w) f’ > 0

Equilibrium: Ld = Ls

where w is the real wage which is the ratio of the nominal wage, W and the price level P. The real wage is considered to be determined in the labour market, that is, exclusively by labour demand and labour supply. Keynes showed that this assumption is clearly false.

The labour demand (Ld) function is the derivative of the production function with respect to labour input (the marginal product). The ad hoc imposition of the so-called law of diminishing returns ensures this derivative is positive but declining as employment is increased. Hence, the labour demand function is downward sloping with respect to real wages. This is a short-run relation based on the fixity of other inputs.

In English, this means that as workers are added to some fixed stock of productive capital, they become less and less productive. Firms are supposed to only pay a real wage (that is, some product equivalent) that is equal to what the worker at the margin produces. Thus as productivity falls they are prepared to offer employment at lower and lower real wages.

The labour supply (Ls) function, which is based on the idea that the worker has a choice between work (a bad) and leisure (a good), with work being tolerated to gain income. The relative price mediating this choice is the real wage which measures the price of leisure relative to income. That is an extra hour of leisure “costs” the real wage that the worker could have earned in that hour.

The imposition of the ad hoc assertion that the substitution effect outweighs the income effect means that a rising real wage will elicit increased labour supply and vice-versa. What this means is that the rising cost of leisure is deemed (that is, asserted) to be a more important motivator than the extra income that the worker earns and so they work more as the real wage rises.

The following graph (Figure 2.1 in Full Employment Abandoned) summarises these results. The important Classical result is that the interaction between the labour demand and supply functions determines the real level of the economy at any point in time. Aggregate supply (using the aggregation fudge of the so-called representative firm) is thus a technological mapping from the equilibrium employment determined by the equilibrium relationship into the production function. Say’s Law (in whatever version) is then invoked to assume away any problems in matching aggregate demand with this supply of goods and services.

The equilibrium employment level, E* in the graph, is constructed as being full employment because it suggests that every firm who wants to employ at the equilibrium real wage, w* can find workers who are willing to work and every worker who is willing to work at that real wage can find an employer willing to employ them.

The Classical economist thus considered the preferences of the workers always would have a bearing on the labour market outcome and through price adjustment (real wage flexibility) any changes in supply preferences would – via mediation through the demand side – result in a changing full employment level.

In other words, adoption of the competitive paradigm demands that departures from full employment are ephemeral at best. Any sustained unemployment (say BC in the graph) must be due to a real wage constraint (a real wage, w1, above the marginal productivity at implied equilibrium full employment) which would be competed away more or less immediately.

A fundamental aspect of this labour market conception, which has analogues in later New Classical Barro versions of the model, is that fluctuations in unemployment reflect supply-side changes arising from imperfect information or reflecting changing preferences between leisure and work.

This is the shady world that Barro inhabits.

In Barro’s dream world, he considers the classical labour market model to be applicable to the real world (see Chapter 9 of his text book). So to repeat – the real wage is assumed to be determined in the labour market at the intersection of the labour demand (Ld) function and the labour supply (Ls) function. The equilibrium employment level is constructed as full employment because it suggests that every firm who wants to employ at that real wage can find workers who are willing to work and every worker who is willing to work at that real wage can find an employer willing to employ them. Frictional unemployment is easily derived from the Classical labour market representation, as is voluntary unemployment.

Holding technology constant (and hence the Ld curve fixed), all changes in employment (and hence unemployment) are driven by labour supply shifts. There have been many articles written by key mainstream economists (such as Milton Friedman) that argue that business cycles are driven by labour supply shifts.

The essence of all these supply shift stories is that quits are constructed as being countercyclical despite all evidence to the contrary. This induces Lester Thurow in his marvellous book from 1983 – Dangerous Currents to ask:

why do quits rise in booms and fall in recessions? If recessions are due to informational mistakes, quits should rise in recessions and fall in booms, just the reverse of what happens in the real world.

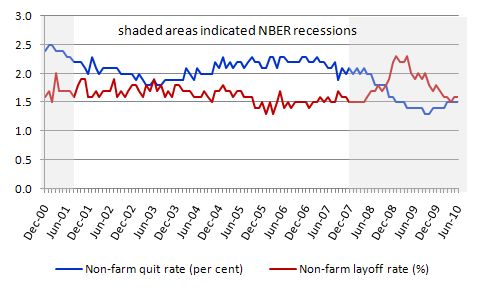

So one of the most simple ways to reject the mainstream macroeconomics conception of the labour market, which constructs unemployment as being a supply side phenomenon and hence quits as being countercyclical is to look at the quit rate.

The US Bureau of Labour Market Statistics publishes the JOLTS which includes estimates of the quit rate. The following graph shows in a compelling way that the quit rate (non-farm quits as a percent of total seasonally-adjusted non-farm employment) behaves in a cyclical fashion as we would expect – that is, it rises when times are good and falls when times are bad. Many studies have demonstrated this phenomenon for several countries where decent data is available.

Further, the layoff and discharges rate also published by the BLS which reflects the demand-side of the labour market is shown (in red) to be firmly counter-cyclical as we would expect. Firms layoff workers when there is deficient aggregate demand and hire again when sales pick-up. Again this is contrary to the orthodox logic.

The clear significance of this behaviour is that the orthodox explanation of unemployment that Barro considers to be reasonable is not supported by empirical reality.

Conclusion

Barro’s macroeconomics textbook is one of the worst that has ever come across my desk. It is full of deceptive statements and outright falsehoods. His track record in predicting and/or explaining economic outcomes according to his extreme theoretical position is very poor. The most simple set of data usually is enough to expose his erroneous reasoning.

His career as a Wall Street Journal Op Ed writer is similarly blighted. He should just stay quiet and leave the reasoning to those who understand how the system operates.

Admin note

There appears to be an issue with the Complete billy blog on one page! archive. I have fixed it temporarily by splitting the MySQL output onto two pages. I will examine this issue further though. Sorry for any inconvenience and thanks for the feedback about this.

That is enough for today!

Bill: I am also adding Stanford to my list of universities which sensible students should boycott if they want to learn some economics given Barro’s presence there. The list is getting longer.

The question is not as much who is on the list as who isn’t. 🙂

The last couple of bad econ op eds I’ve read from links here have each had its silver lining. The commenters, for the most part, have been ripping the writer a new one. It’s good to know that some “regular people” can see through the econobabble of a Stanford/Harvard economics professor.

Thanks Billy

Well, at least we know that Barro’s economic ignorance is not genetic and he is also a good father and confines himself to brainwash only the ignorant public and not his children. Josh Barro says exact the opposite in regard to UI (link_http://www.nationalreview.com/agenda/231450/how-much-do-ui-extensions-matter-unemployment-josh-barro) Robert Reich also comments:

Dear Tom – at 2010/09/01 at 2:45

I know that but I am just trying to maintain some suspense – sort of make the others quake in fear that they might be included on my list! (-:

best wishes

bill

Thank you, Billy! I’m a reformed U Chicago MBA – working hard to purge my mind of the lies and distortions thrust upon me during business school. I’m so happy to have found your site! Funny that my Political Compass score is very close to your score.

Dismayed,

By reformed do you mean you have destroyed your MBA from Chicago or asked to have it expunged so as to remove any association between the university, its MBA program, and indeed yourself ?

cheers.

Barro is talking his own book, literally. Seems to be endemic. Bill Black has a great post today over at Yves’ place describing the same thing in the field of law and economics with Easterbrook and Fischel’s mainstream textbook. It’s a jaw dropper.

William Black: Theoclassical Law and Economics Makes the Law an Ass

“By reformed do you mean you have destroyed your MBA from Chicago or asked to have it expunged so as to remove any association between the university, its MBA program, and indeed yourself ?”

Come on, be reasonable. He worked hard for that, and it’s always easier to be taken seriously if you have an education even if you didn’t agree with any of it. Bill talks frequently about his struggles with his lecturers, but as far as I know he didn’t burn his degree at the end of it.

Grigory,

By using the degree one is endorsing the University where the degree was received.

For the record – I don’t have a degree…… anymore.

Dear Bill…apologies if you’ve already answered this, but any thoughts on how we get the MMT message out more to the uninitiated?

The blogs from yourself / UMKC / Mosler / NewDeal2020 are great, and your topical engagement and huge breadth of discussions are particularly useful. And it seems many people have been converted by having the patience to wade through a number of articles until the penny drops. But if one is trying to ‘convert’ a friend by directing them to some written materials, I think in practice most uninitiated people will find this blog quite intimidating – as you need to read several pages just to get the gist (eg there are several ‘101’ pages, most of which are split into 3..). A side-effect of this is that, as I surf MMT blog comments, I constantly see patient commenters composing from scratch the same paragraphs again and again to the traditional “but what if the govt can’t pay the debt?” stuff from first-timers.

I know this sounds like dumbing down, but what I think would help is one single, definitive, web page we can send people to, which carries an overview of the main tenets of MMT (incl a summary to make it mega-clear) with links to specific topics where people will want to drill down (hyperinflation, JG, NAIRU etc). Then we can tell a potential convertee – read the whole of this page; it’s all there.

I had hoped that Wikipedia would be helpful here, but the site is almost entirely un-MMT-ized: the pages for govt debt, budget deficit etc are shockingly deficient as they stand. Even the page for MMT (redirecting to Chartalism) isn’t that clear.

Do you think any MMT-friendly economics faculties have any students who would be willing to put in some time either to ripple MMT through wikipedia, or else to create THE definitive MMT intro page on the basis of the content which already exists (eg on your site)?

Best wishes

Proselyte

Where is there an MMT friendly economics faculty?

Oh, well … it appears that ideology triumphs over economics once more! Ideologically-motivated syllogism: a) Unemployment benefit is a form of government intervention; b) Extending unemployement is definitely a form of government intervention; c) The recession is persisting; d) Therefore, fiscal intervention by the government is making the recession to persist. But government fiscal intervention is not an ‘either or’ type of quality. Instead, it is quantitative: How much more or how much less. A classic example of trying to shove a square peg into a round hole: Flattening something of quantitative nature into that of ‘either or’ is an act of absurdity at its finest!

Dismayed: You may be amused by the mentions of the 1950s UC Bschool here: http://michael-hudson.com/2008/09/the-chicago-schools-long-descent/ Plus ça change…