It's Wednesday, and as usual I scout around various issues that I have been thinking…

The importance of public sector employment

I was asked by a journalist today to comment on employment trends in the public sector. I was also thinking about the statement made at the G20 meeting which has been reiterated by our Prime Minister – we will do whatever is necessary! Well what is necessary is a massive upscaling of public sector employment. The best place to start would be to offer employment at the minimum wage to anyone who wants a job and cannot find one. However, this week’s news about the revamped job-seeking program, Job Services Australia which appears to be the Australian government’s centrepiece employment strategy tells me that our Government, at least, is lying about being prepared to do what is necessary.

The G-20 concluded overnight and they managed to agree enough to release a 29 point plan to address the global economic crisis. The interesting aspect of the G20 outcome is that it has usurped the G7 as the meaningful place for dialogue. The G7 had never, for example, managed to come up with the glaring need to change the composition of the IMF and to compel it to effectively “deficit spend”. The G20’s agreement to spend more than $1.1 trillion to protect the poorest nations is good as long as the money goes into job creation programs.

The other outcome, which I will write about at a later date, is that it signals major changes are coming for banks and financial institutions generally. When the global economy comes out of the current malaise the financial sector will be significantly smaller than it was at the top of the boom. Banks will be more focused on core business and the derivatives trading will be minuscule and much more oriented to hedging exchange rate exposure for firms in the real goods and services sector. All of that will probably be good. My friend Warren Mosler (who works in the financial markets) has a saying – “The financial sector is a lot more trouble than it’s worth.”

While I won’t go through the G20 statement line by line in this blog, one statement, that has been continually repeated in the lead up to the summit, was echoed in Point 4 of the statement (which I partially quote):

We have today therefore pledged to do whatever is necessary to … restore confidence, growth, and jobs …

Whatever necessary? Based on current form, I don’t believe they will do whatever is necessary. The fastest route back to recovery is for our national government to re-engage itself as a significant employer. Over the last 25 years, under the oppressive neo-liberal mantra that “public is bad and private is good”, our governments, at all levels, have abandoned this responsibility. This abandonment explains why we have had persistently high unemployment for that entire period.

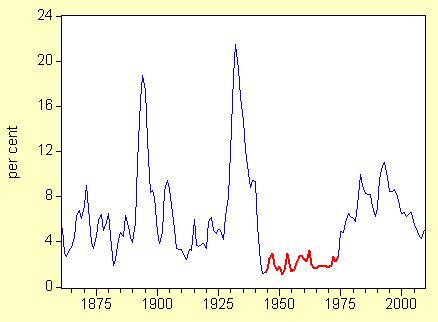

To begin with consider this historical graph which I show to people to remind them of how capitalism operates independent of strong government intervention. It is the Australian unemployment rate from 1861 to 2008. The Great Depression taught us that capitalist economies are prone to lengthy periods of unemployment without government intervention. From 1945 until 1975, governments used fiscal and monetary policy to maintain levels of overall spending sufficient to generate employment growth in line with labour force growth.

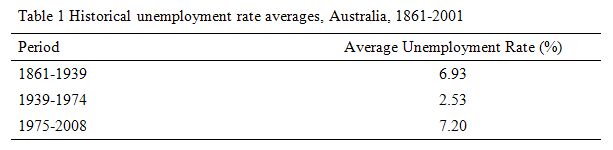

Throughout this Keynesian full employment period unemployment rates rarely rose above 2 per cent. Prior to and after the Keynesian demand management phase the Australian economy rarely achieved unemployment rates below 5 per cent with the averages during those periods being well above that. The following table confirms this categorically.

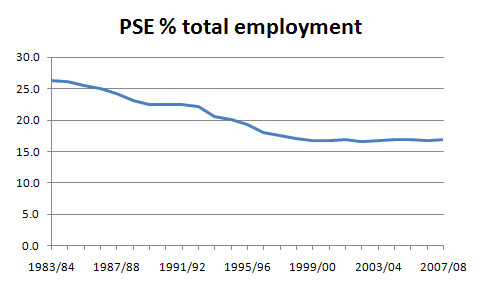

Second, consider the behaviour of Australian public sector employment over the last 25 years portrayed in the following graph (using ABS Labour Force data). Over the time that unemployment (and labour underutilisation generally) has persisted at high levels, the public sector has been reducing its share of total employment. The worst culprit has been the Federal government which has actually shed 185,000 jobs since fiscal year 1983/84.

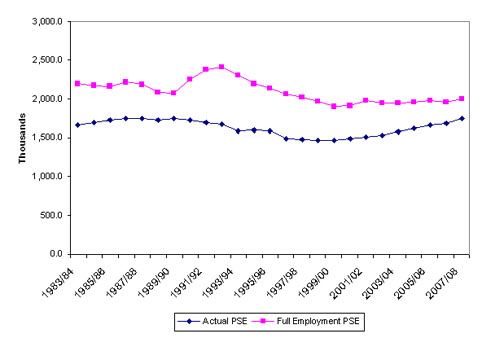

The following chart shows approximately what total public sector employment would have to have been (indigo line) since 1983/84 if the economy was to have been continuously at full employment (defined as 2 per cent unemployment). You can clearly see how the public employment would have had to expand in the 1991/92 downturn to absorb the workers that lost their positions. Compare this with the actual history over this period of total public sector employment. So just at the time when public sector employment should have been growing rapidly (1991/92) due to federal government policy choices it actually fell in absolute terms. That single fact meant that the resulting recession was longer and the recovery slower. It also entrenched long-term unemployment for many and meant that the unemployment rate would only slowly fall over the next decade. It also entrenched the sharp rise in underemployment. Note also that the only reason that public sector employment has risen marginally over this period is the fact that state government employment has risen just enough to offset the absolute declines in federal employment.

In part these federal employment losses were due to privatisation and outsourcing. It was often argued that privatisation merely transferred the workers from the public to the private sector. Keating and Howard both argued this regularly. It was barefaced lie. There were significant job losses in every privatisation example and further an erosion of working conditions. Further, what is not often understood is that we also lost the training capacity that the public sector provided in many areas. Privatisation wiped out significant skill development capacity for which we will be paying the costs in the years to come.

So you can see why I am skeptical of the “do whatever” claims. Juxtapose what is needed during an economic downturn in terms of public employment expansion (to avoid rising unemployment) with the main labour market thrust of the current government – Job Services Australia. The scrapping of the public employment service by the previous federal regime (not that Keating wasn’t planning to do it himself) and it replacement with the privatised Job Network was a poisonous effrontery to common decency. It was all about full employability whereby the unemployed were blamed for their disadvantage despite it clearly being the result of the failure of the economy to generate enough jobs. The abandonment by the federal government of their responsibility to deliver top quality job training and matching services, and, instead, create a profit-based market system was always going to fail. For a start it was never a market and the incentives provided were perverse in the extreme. I have written many academic articles about this. It was a cruel, pernicious and ineffective system. Any decent social democratic government would have scrapped it the day they took office.

But the current federal regime has decided to “improve it”. The new tendering system has caused quite a stir over the last few days as the losers of contracts and the Opposition are screaming blue murder. I have no sympathy for any of them. It was a system that created zero actual jobs at a time when hundred and thousands were needed. It was a system that exhibited corrupt practices with many large service providers being fined for dishonest behaviour. It was a system that collaborated with the government to “breach” (take away benefits) from our most disadvantaged citizens at the time they needed the pittances handed out to them more than ever.

So as the details emerge about the system I will write more. But the fact that the Federal government is persisting with the supply-side approach which blames the victim and epitomises the neo-liberal abandonment of full employment is indicative to me that they are not going to do whatever it takes to defend jobs and minimise unemployment. The only way they will achieve that aim is to take a demand side approach and create work for those who do not have it. This is how governments acted during the golden years following World War II (the red line period depicted on the first graph above).

Digression: Unemployment data in Australia

I have started to analyse the latest Labour Market and Related Payments Monthly Profile data from DEEWR which is now publicly available on a monthly basis. It shows NewStart and Youth Allowance recipients by Centrelink office. The latest data (for February) shows a sharp increase in claims in many areas, particularly the Red Alert suburbs we identified in our Employment Vulnerability Index.

I told a journalist from the Age newspaper in Melbourne this afternoon that the data shows the first real signs of a rapidly deteriorating labour market along the spatial lines we predicted.

Once I have a better picture of the detail I will post a blog about it, with some overlay maps to see how close our risk assessments were to actual outcomes.

Digression: Saturday Quiz

The billy blog Saturday Quiz is being cooked up as I type and it will be available sometime late tomorrow afternoon (if not earlier).

Appendix Update: Monday, April 6, 2009

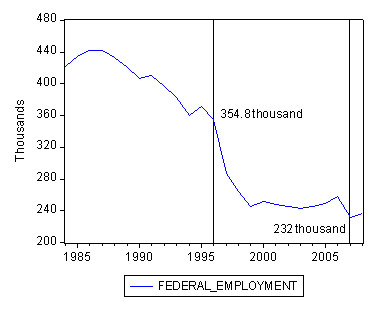

One reader (see comments) asked me whether it was true that under the previous Australian government (from 1996 to 2007) that federal government employment rose by 200,000 persons. The answer is that it didn’t. Have a look at the following graph and read my comment (below) for sources of the data. At the beginning of 1996 the Commonwealth of Australia employed 353.3 thousand people. By May 2007 (the last time this survey was taken and just before that regime was ditched by the electorate), public sector employment and the Commonwealth level was 232 thousand. That regime continued the cuts in federal employment that the Hawke-Keating government had begun.

The private job placement model is ridiculous. Obviously designed to function only during periods of growth, it can’t even keep it’s own staff in a job during a downturn!! My sister-in-law is employed by one of these agencies and I fear for her job. As you know, Gladstone is all red zone.

And has scrapping the CES in favour of private providers actually saved the fed (yes I know that is a silly concept) any money in the long run? They are still entirely funded by the public purse, plus we have to pay for their margin as well, seeing as it is automatically profit-driven.

I have always argued that the moment a government service is transferred to private ownership, the very core purpose of it’s existence changes from “maximise the public good” to “maximise private profit/shareholder returns”. The two concepts are mutually exclusive. The privatized public service cannot achieve both functions at once, the greater good will always be subjugated to the profit motive.

We here in Gladstone have first hand experience with what can happen when a vital government service that people cannot live without is controlled by private interests, I will write about it when an appropriate thread topic comes up.

On the G20, why would poorer nations need loans from the IMF or anybody Bill. Are they not sovereign?

“My sister-in-law is employed by one of these agencies and I fear for her job”.

Perhaps I jinxed it by posting this. Her husband lost his job this afternoon. “No longer viable in this economic climate” apparently. Three small children and a mortgage. And some of his wife’s co-workers have already been given the chop.

Just awfull.

Dear Lefty

Each job loss is a tragedy. But don’t forget that the Job Network agencies and their staff (in general as an institution) cooperated with the government for profit to treat the most disadvantaged citizens in our nation in a most harsh and inhumane way all in the name of the “free market”. So it is live by the sword then die by it. I hope everyone who is displaced finds a job though.

best wishes

bill

Yes I hope so too. Because now she too has been told to expect redundancy shortly. If it wasn’t for the mortgage freeze for those made redundant because of the downturn, they would be screwed.

Bill, do you know anything about the claim that under Howard, the federal public sector actually grew by 200 000?

Dear Lefty

The claim (wherever it comes from) is patently false. The official ABS data for Cat. No. 6248.0.55.001 – Wage and Salary Earners, Public Sector, Australia which was the last released in this series (a new annual survey is now available) shows all. From Table 6a. Wage and Salary Earners, Level of Government, Industry (‘000) you can chart a graph that shows it to be false. I have added a little Appendix to the story to show you the chart. Read the main blog.

best wishes

bill

Thanks for that Bill.

I’m unsure of the origin of the claim, it’s just something that’s been floating around the blogs for a while.

cheers

Any idea what the 3 sharp upward spikes (quickly subsiding) represent Bill? I notice that 2 of them are in the immediate wake of recessions.

Dear Lefty

No, they were in the ABS data. I will investigate and see what I can determine.

best wishes

bill

Hmm. They all look to represent roughly 50 000 jobs each time. I could surmise that the two immediately on the back of recession might indicate an increased need for social security provision and a corresponding increase in staff, perhaps hired on a contractual basis and then given the flick when private sector employment growth significantly resumed.

The third spike ocurrs at the same time as the Howard government is desperately trying to sell workchoices and avoid having the public giving them the order of the boot. Whether or not this is significant at all I couldn’t say.

Or federally funded schemes that were classed as jobs created.

Update on Federal Employment data

I have checked the data that was used to construct the Commonwealth public sector employmen graph the other data. The updated graph is annual data from the ABS (fiscal years) and seems to be slightly different from data I had from the datacubes from the ABS. At least the bumps identified previously are now smoothed out. I don’t know what the problem was. The ABS does revise data from time to time and maybe that explains it. But the message remains the same. Total federal employment fell systematically since the mid-1980s with some blips along the way.

So I am sorry for causing all that speculation about the spikes.

No worries. Thanks Bill.