I have received several E-mails over the last few weeks that suggest that the economics…

Its simple – more public spending is required

Its very balmy weather over here in the Netherlands at present – like early October and people were out in T-shirts are 21:00 last night. I went to Brussels in the afternoon and didn’t even take an overcoat! But in contrast, the economic climate is decidedly chilly. Each week new evidence emerges which demonstrates categorically that the fiscal austerity proponents have not clue about how real economies and monetary systems function. The world is not behaving as they predicted. The models and analysis they provided to governments as support for withdrawing fiscal support are bereft of any credibility. It is also common for economic commentators and policy makers to argue that problems are manifest and complex and there are no silver bullets. Well what Modern Monetary Theory (MMT) tells you is that when there is a recession (and/or tepid growth) such as the world is enduring now and the non-government sector is drowning in debt and unwilling to expand spending the only solution is to expand public spending. That proposition is not manifest or complex. Its simple – more public spending is required.

In the last few days, more economic information has come to light which demonstrates the lunacy of the current international approach to economic policy which is biased towards fiscal retrenchment. The only issue of debate seems to be how quickly the retrenchment should be and the scope of it.

I did some work in South Africa in 2008-09 evaluating the South African government’s public works program for the ILO. Government officials all told me when I was there that the problem of poverty and unemployment was “manifest and complex” and there were no easy or speedy solutions. When I looked into the issue and started to understand the nature of the country and its problem I realised that the “manifest and complex” posturing was just a wall to justify inaction and the implementation of a sequence of IMF-inspired policies which led to no coherent improvements. Even the public works program which directly created a million jobs in the first five years was constrained by the neo-liberal ideology.

I saw the matter differently. With around 60 per cent of the population in poverty, 60 per cent without adequate housing and 60 per cent without adequate or any employment – and it was the same people in each cohort – the solution appeared simple. Expand the public works program to employ people to build houses! My evaluation for the government showed categorically that the willing participants in the public works program vastly outnumbered the jobs that the government created. I recommended an unconditional job offer under the program up to the demand (that is, a Job Guarantee).

It was also clear that those who did get work within the program experienced significant reductions in poverty and enjoyed some financial security.

So there are simple solutions to unemployment: create jobs!

If the private sector currently won’t produce enough jobs then the responsibility has to fall to the public sector. In doing so, the extra income that is generated will unlock the unwillingness of the private sector to create jobs. If a private firm senses a rise in demand for its goods and services it will typically respond (if only to protect its market share) by increasing output. Initially that may not have a proportional effect on employment because the firm may have been hoarding some labour in the crisis.

Eventually (soon enough) the hoarded hours are exhausted and the firm increases employment to meet the growing demand.

It is a fairly simple proposition that has been tried and tested many times in our history. But in general, the conservatives ignore the obvious history and piece together a range of spurious and often unrelated or inapplicable historical events and mount cases that we are in danger of hyperinflation and harsh interest rate hikes.

If they bothered to get their heads out of who knows where and looked out of the window they would see that inflation is stable or falling (and in some cases there is deflation) and interest rates and bond yields are low if not falling and not going to rise any time soon.

They successfully mount smokescreens – the “manifest and complex” – with the added drama of exhortations of impending catastrophe to gain impact in the public debate – to steer us away from the obvious and the simple.

Paul Krugman’s column in yesterday’s New York Times (October 3, 2010) – Fear and Favor – examined how the rich elites contrive to condition the public debate and helps us to understand the “manifest and complex” ruse a little.

The theme of his article is that:

Modern American conservatism is, in large part, a movement shaped by billionaires and their bank accounts, and assured paychecks for the ideologically loyal are an important part of the system. Scientists willing to deny the existence of man-made climate change, economists willing to declare that tax cuts for the rich are essential to growth, strategic thinkers willing to provide rationales for wars of choice, lawyers willing to provide defenses of torture, all can count on support from a network of organizations that may seem independent on the surface but are largely financed by a handful of ultrawealthy families.

In Australia, the role of the conservative think tanks funded by corporations and wealthy families has been instrumental over the last three decades in reinforcing the neo-liberal dominance and lobbying governments. This is a world-wide phenomenon.

I was also interested in Krugman’s conclusion that:

Perhaps the most important thing to realize is that when billionaires put their might behind “grass roots” right-wing action, it’s not just about ideology: it’s also about business. What the Koch brothers have bought with their huge political outlays is, above all, freedom to pollute. What Mr. Murdoch is acquiring with his expanded political role is the kind of influence that lets his media empire make its own rules.

Thus in Britain, a reporter at one of Mr. Murdoch’s papers, News of the World, was caught hacking into the voice mail of prominent citizens, including members of the royal family. But Scotland Yard showed little interest in getting to the bottom of the story. Now the editor who ran the paper when the hacking was taking place is chief of communications for the Conservative government – and that government is talking about slashing the budget of the BBC, which competes with the News Corporation.

I often hear progressives say that the conservatives are misguided but at least they are ideologically consistent and that we should have some respect for this “purity”. I disagree. The blurring of ideology and pure self-interest is always too difficult to disentangle when the right-wing are concerned. There are countless examples of the so-called “ideological” positions being just fronts for manipulating policy makers to gain commercial advantage.

The right-wing continually use the arcane theories of mainstream economists as authority to justify their views. The incursion into the policy debate is thus rendered “scientific” and free from self-interest. The reality is that the theory being used is rarely correctly represented – that is, all the qualifications with respect to assumptions etc are rarely explained to the public.

The theories are rarely applicable or relevant to the real world but still underpin actual policy changes. It is a major scam.

For example, fiscal austerity is being justified by empirically-failed notions of Ricardian Equivalence which alleges that the withdrawal of government spending will be more than replaced by consumer and investment spending. The latter is current flat because according to the theory, private agents are so fearful of the budget deficits that they are saving up to ensure they can meet the future tax hikes that they think will be required to pay back the deficits.

The theoretical models used to derive these results are from La-la land which then means we are not surprised that their main predictions have regularly failed when real world events have given the theory a chance to shine. Please read my blog – Pushing the fantasy barrow – for more discussion on this point.

Any theoretical edifice ultimately stands or falls on its capacity to explain what we observe. Modern Monetary Theory (MMT) is capable of embracing the empirical world. I challenge anyone to produce some stark empirical anomaly within the statements that can be adduced from MMT (that is, from its key proponents rather than those who are learning it).

However, I can produce any number of very stark empirical anomalies with respect to the key propositions of mainstream macroeconomics. The fact is that empirical evidence is never supportive of the deficit-terrorist claims. It isn’t even a matter of interpretation. For example, we didn’t have to wait for three years into this downturn to see that interest rates would not sky-rocket as budget deficits rose. We just have to look back to Japan in the 1990s and beyond to know that.

Which brings me to the latest evidence around the globe.

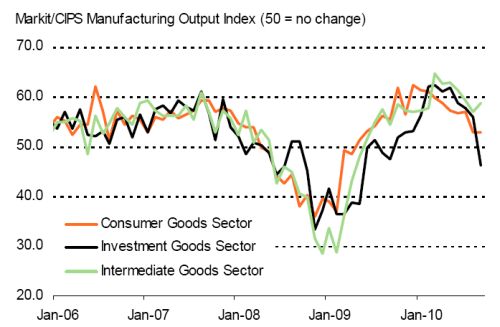

First, manufacturing is slowing in the UK. The recently released (October 1, 2010) – Markit/CIPS UK Manufacturing Purchasing Managers’ Indices (PMIs) – “which is calculated from data on new orders, output, employment, supplier performance and stocks of purchases”:

… fell to a ten-month low of 53.4 in September, down from a revised figure of 53.7 in August.

The Report says that “(g)rowth of production eased again, as rate of increase in new orders remained subdued” and that “(n)ew export orders fell slightly, as global demand weakened”.

The following graph is taken from the Report and shows that “slower growth mainly reflected a marked decline in investment goods production”. So the forward-looking expectations are deteriorating.

Second, there is evidence mounting that world trade is slowing rapidly. The Markit manufacturing exports data “fell for the fifth month running in September to hit a 14-month low and thereby signal a sharp slowing in global trade”

We read that:

… Asia ex-Japan has led the global cycle and points to further slowing in coming months … Taiwan’s exports fall, China’s stagnate … Trade easing likely to add to woes in countries tackling budget deficits … PMI data for the UK, for example, are already showing that export growth has collapsed …

Exports from Greece and Ireland meanwhile also both fell back into contraction in September, acting as a drag on Eurozone exports, which rose at the slowest rate for ten months as a result. Outside of Europe, Japan’s export growth also slumped to near-stagnation in September, according to the PMI survey while, in the US, the ISM survey’s index of new export orders hit a nine-month low.

Get the message! There goes the export boom that was meant to replace the spending lost from the cutbacks in public spending under the fiscal austerity programs.

Third, the former Celtic Tiger now fast becoming an impoverished pussy cat declined further. The NCB Republic of Ireland Manufacturing Purchasing Managers Index ( PMI ) which is “a composite indicator designed to provide an overall view of activity in the manufacturing sector of the Irish Economy and acts as a leading indicator for the whole economy” was released last week (October 1, 2010) for the month of September.

It showed that the PMI:

fell below the no-change mark of 50.0 for the first time in seven months as new business, employment and pre-production inventories all decreased … New export business also declined, for the first time since October 2009 … The decline in new orders was also the principal cause of a marked reduction in outstanding business as firms transferred spare capacity to complete existing work. The latest fall was the fastest since February. Staffing levels decreased for the fourth month running, and at the sharpest pace since November 2009 …

The conservatives have been telling us that the fiscal adjustments will take a little time to work. Well we have been waiting for 18 months in Ireland given that it was the first government to abandon its responsibility for advancing the welfare of its citizens and, instead, embraced the idiocy of fiscal austerity. As predicted by MMT, things are getting worse there. The main production drivers of sustainable growth are collapsing.

The much-touted export sector, which was meant to spearhead recovery is in decline. The latter is no surprise. With many nations cutting back the principle source of growth (net public spending) it was obvious that world export markets would be hit.

The austerians got lost in the classic mainstream logical flaw – the fallacy of composition. They somehow thought that the rest of the world would boom and drag Ireland (or anywhere) out of the funk via exports. But exports are just a response to import demand which is a function of domestic income growth. If all nations are contracting spending then there is insufficient income growth to generate an export boom. It is so obvious and simple. Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

You can also find extremely disturbing evidence of deterioration in manufacturing in Spain, Greece and the Eurozone overall.

None of this evidence is remotely consistent with what the fiscal austerity proponents have been touting.

Fourth, meanwhile manufacturing in the largest economy, the US is now slowing. The September 2010 Manufacturing ISM Report On Business – published by the US Institute for Supply Management said:

While the headline number shows relative strength this month as the PMI reading of 54.4 percent is still quite positive, the overall picture is less encouraging. The growth of new orders continued to slow, as the index is down significantly from its cyclical high of 65.9 percent (January 2010). Production is currently growing at a faster rate than new orders, but it typically lags and would be expected to weaken further in the fourth quarter. Manufacturing has enjoyed a stronger recovery than other sectors of the economy, but it appears that weaker growth is the expectation for the fourth quarter. Both the Inventories and Backlog of Orders Indexes are sending strong negative signals of weakening performance in the sector.”

And then you read this headline from the Associated Press – Extended jobless benefits, public construction boost economy; manufacturing activity grows – which just reports on a number of data releases put out last week by the US Bureau of Economic Analysis.

The BEA – Personal Income and Outlays, August 2010 data (released on October 1, 2010) showed that “consumer spending rose in August and incomes increased by the largest amount in eight months” but that “the income gain was propelled mostly by the government’s short-term extension of unemployment aid, not wage gains”.

Further, the New York Times carried the heading – Construction Spending Rises on Jump in Government Building – and explained that the latest data

(which I cannot find!) shows that “construction spending rose in August as a big jump in government building projects offset further weakness in the private sector”. Private construction spending was at its lowest rate in 12 years.

Then I have been reading that the central banks are debating on what further they can do to arrest this trend towards overall decline into recession.

Meanwhile, Reuters reported on the the speech made by US Federal Reserve Chairman Ben Bernanke on September 30, 2010 to a group of shool teachers. He reportedly said that central bank “has a role to play in returning the economy health” and that:

… even though our economy is stabilized and growing, clearly it is still a very difficult time for many Americans … The unemployment rate is still almost 10 percent, inflation is quite low, and the Federal Reserve has the responsibility … to do our part to help the economy recover and make sure that jobs come back to the United States.

There is still a belief that monetary policy should be the primary counter-stabilisation aggregate policy tool. The attacks on the use of fiscal policy despite all the evidence supporting its effectiveness are consistent with this view. There is still the naive belief that monetary policy will help.

In that vein, I thought this article in the New York Times (October 4, 2010) – Cheap Debt for Corporations Fails to Spur Economy – was apposite even though it is written with an almost incredulous air – like – why isn’t the economy acting like the textbooks say it will instead of rejecting the whole body of theory that is represented in the mainstream macroeconomics textbooks.

The article said:

Companies like Microsoft are raising billions of dollars by issuing bonds at ultra-low interest rates, but few of them are actually spending the money on new factories, equipment or jobs. Instead, they are stockpiling the cash until the economy improves. The development presents something of a chicken-and-egg situation: Corporations keep saving, waiting for the economy to perk up – but the economy is unlikely to perk up if corporations keep saving.

The low interest rates were never going to stimulate strong rebounds in investment spending while the economic prospects remain so gloomy. Business firms will only invest if they think they can realise profits from the extra production. It doesn’t matter how cheap the loans are – if the output cannot be sold it is not worth producing.

The idea that the private sector would sink into an recession impasse where there was no incentive to expand spending despite the massive latent demand potential embodied in the unemployed should they regain employment was the centrepiece of Keynes’ idea of an under full employment equilibrium. It was this idea that provided the rationale for an exogenous (external to the impasse) injection of public spending.

Such spending would kick start the production process and engender confidence among firms that demand growth might be more robust. The extra jobs that the public stimulus supports also provides incomes to the previously unemployed who then spend more and via the multiplier the expansion broadens across the economy.

It is this simple logic that the fiscal austerity camp have somehow missed.

The NYT article notes that the failure of firms to invest:

… underscores the limits of Washington policy makers’ power to stimulate the economy. The Federal Reserve has held official interest rates near zero for almost two years, which allows corporations to sell bonds with only slightly higher returns – even below 1 percent. But most companies are not doing what the easy monetary policy was intended to get them to do: invest and create jobs.

This reporting reflects the inherent biases among the media. The failure of firms to invest underscores the limits of monetary policy not aggregate macroeconomic policy, in general. The fact that the article fails to reflect on fiscal policy as the obvious way to overcome this impasse is evidence of the neo-liberal taint that dominates the financial media – even if it is implicit and involuntary in some cases.

The NYT article does not that the low interest rates have “in fact hurt many Americans, especially retirees whose incomes from savings have fallen substantially”. This brings home the point made by MMT that monetary policy is a very unreliable way to stimulate aggregate demand. There are uncertain distributional consequences which do not play out in straight forward ways. Fiscal policy is direct and can be targetted to enhance spending in fairly predictable ways.

The only major issue is getting the level of the intervention correct. In the recent stimulus episodes, the interventions were far to modest and while effective as far as they went were not sufficient to underwrite a rapid recovery with minimal private employment loss. Blame for that does not go to the policy instrument itself but rather to the deficit terrorists who made it politically difficult for governments in most nations to use their capacities to the benefit of the wider population.

Instead, monetary policy has been used extensively – despite its impotency – and as the NYT notes “(b)ig companies like Johnson & Johnson, PepsiCo and I.B.M. seem to have been among the major beneficiaries” because they have been able to accumulate substantial (cheap) reserves. The NYT says:

That is part of what has become the great question of this long, jobless recovery: When will corporate America start to feel confident enough to put its cash to work, building factories and putting some of the nation’s 14.9 million unemployed to work? Businesses are holding on to their protective cash cushions, worried perhaps that the economy could slip back into recession or at least grow too lethargically to make an investment worthwhile.

They will only start investing and employing strongly again when the prospects for growth are sustainable and robust. With fiscal support being withdrawn those prospects are absent and have been replaced by pessimism. That is why private spending remains flat despite the low interest rates.

The point is that quantitative easing and/or low interest rates will not stimulate aggregate demand to the degree necessary to overcome the private spending. In that absense of another round of substantial fiscal expansion our economies will just grind on – slowing growing or going back into recession.

Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion on the monetary policy myths that pervade the public debate.

Conclusion

The evidence is all pointing to the fact that with the fiscal stimulus waning (or being hacked to death) many economies are slowing again. Monetary policy is then held out as the main hope to keep the recovery progressing despite all the evidence – and supporting MMT logic – that such policy changes are benign at best.

I come back to the starting proposition that the solution to the current crisis was and remains expanding fiscal policy. It is so obvious. But a litany of lies and smokescreens have been erected to obfuscate that simple truth by the self-interested conservatives who are prepared to cause worse unemployment and rising poverty as a means to leverage their politicians of choice into office so they can garner preferred treatment in subsequent years.

We need a riot in the streets of our towns urgently.

Anyway, now I have to go to work for the day! I am operating in reverse while I am “upside” down in the Northern Hemisphere – blog first then work second. This reorganisation is being liberally aided by jet lag!

That is enough for today!

One of the tenets of MMT is that the currency issuer should fund the currency user’s desire to net-save.

Is there a reason why it doesn’t recommend simply discouraging them from net-saving on a distributional basis? For example removing pension tax relief, increasing duty on purely financial transactions, negative interest rates on savings accounts, etc.

I quite agree with Bill that Ricardian ideas come from “La-la” land. The idea that the average household pays any attention to “national debt per household” and taylors its spending accordingly is pure lunacy. The irrelevance of Ricardian ideas was nicely demonstrated by a survey done in Singapore, where it was shown that the reaction of 80% of households to a government handout was (amazingly) to spend it!

See: http://courses.nus.edu.sg/course/ecswong/workingpapers/pdf/Ricardian_Equivalence.pdf

The average mentally retarded dog could have predicted the above household reaction.

Regarding Ralph’s comment about “mentally retarded dogs”, it never ceases to amaze me when I come across an otherwise sensible person who seems to believe in such Ricardian ideas. Strangely enough I can recall quite clearly the first time I ever heard someone claim that households adjust their spending in the face of a government deficit in anticipation of tax rises at some unspecified future date: I just started laughing as the idea sounded so utterly preposterous.

Unfortunately, riots in the streets don’t necessarily help, because even the potential rioters are so convinced of the mainstream logic that deficit spending is bad that their anger will not be able to formulate a useful and coherent goal. The only thing you can do is educate, and I am very thankful for your blogging as it helps a layperson like myself. I am spending some time to spread the word among friends and colleagues, but it is a difficult endeavour.

I am reminded of a story by the late Douglas Adams, which he used to illustrate the difficulty of talking with creationists, but in my discussions I sometimes have the feeling that it is much the same with some of the mainstream misconceptions. His story goes as follows:

A man didn’t understand how televisions work, and was convinced that there must be lots of little men inside the box, manipulating images at high speed. An engineer explained to him about high frequency modulations of the electromagnetic spectrum, about transmitters and receivers, about amplifiers and cathode ray tubes, about scan lines moving across and down a phosphorescent screen. The man listened to the engineer with careful attention, nodding his head at every step of the argument. At the end he pronounced himself satisfied. He really did now understand how televisions work. “But I expect there are just a few little men in there, aren’t there?”

There have always been kings and queens, and there will always be kings and queens, dominating the little guy… how do you shift a mentality so embedded in everything from the media to education?

Bill, I’m one of those who find it hard to understand all this guff.

To me, it all seems totally counter-logical. The state is in debt? Devalue the currency, you say. Simple. (But then who would lend more money?) Do things look tight? Then spend, spend, spend (and then devalue the currency, I guess).

But what about Iceland, for example? What about the fact that there is a huge lv levels of debt out there? I read a book recently The Enigma of Capital: And the Crises of Capitalism by David Harvey. It scared the sweet baby Jesus out of me. The amount of DEBT there is. It seems we are skating on very thin ice.

One of Krugman’s more insightful editorials – note it was on the opinion page and he left economic out of the discussion.

In the US it is illegal for a foreign entity to own a majority of an airline company, but no problem for media companies. All hail Murdoch!!

“The reality is that the theory being used is rarely correctly represented – that is, all the qualifications with respect to assumptions etc are rarely explained to the public.”

Good take-away from Krugman’s “rare form” editorial. (He’s rarely so explicit about naming names … means he’s pissed off.)

But Krugman himself is guilty in the past of failing to qualify his theories, and reveals this in his own blog post from last Thursday, “Models Versus Slogans” (http://krugman.blogs.nytimes.com/2010/09/30/models-versus-slogans/):

“… the case for free trade is profound, but also conditional: it depends … on having sufficient policy levers to achieve more or less full employment simultaneously with free trade.”

Now wait a minute. It depends on what? In all of Krugman’s more public advocacy for free trade (as well as everyone else’s advocacy for it), I’ve never once heard anyone cite this conditionality, … and I certainly would have remembered anyone saying this, because these “sufficient policy levers” are EXACTLY what neoliberalism is fighting to keep from us. In other words, the very same people who are the firmest advocates of free trade are the exact same people who would set it up to NOT achieve its stated “lifts all boats” goals. And Krugman knew this all along, but didn’t tell us until now? Sounds like the man’s got a bit of built-in ideological bias, no?

“Unfortunately, riots in the streets don’t necessarily help, because even the potential rioters are so convinced of the mainstream logic that deficit spending is bad that their anger will not be able to formulate a useful and coherent goal.”

Riots would or will be an overt violent response to a hidden violent attack. Formulating a useful and coherent goal enacting qualitative change depends on the spread of useful and coherent ideas.

Any person concerned with the actual social evolution should think of Internet viral forms for spreading policy proposals based on MMT and their supporting ideas.

Cheap Debt for Corporations Fails to Spur Economy … http://www.nytimes.com/2010/10/04/business/04borrow.html?partner=rss&emc=rss

Let’s see, surprised? Not really

pebird: Yeah … and rather odd, is it not? Restrictions on bank ownership, but not media. If anything, a media giant can be just as headachesome as his banking counterpart and perhaps even more. The US need to go back to a library too look up on the era when the government broke up the Mama Bell. Media need to be decentralized.

RayW, I read that. Good article.

Neil Wilson said: “… negative interest rates on savings accounts, etc.”

That one is a really bad idea. What is negative interest rates saying?

Elizabeth said: “But what about Iceland, for example?”

The debt was denominated in foreign currency. mishkin is the worst.

Elizabeth said: “What about the fact that there is a huge lv levels of debt out there?”

Too much debt is usually a problem even if denominated in a government’s own currency because of the differences between earning and spending it can create to budgets (not just the government’s).

Elizabeth – start browsing in the briefing 101 section. Don’t forget that every debt is an asset to someone, all of which nets to zero. Most of the debt from sovereign nations is held by its own private sector.

Bill,

It could be starting over here. Only last week there was a warning that the banks would be targeted. Now reportedly a hugh bomb went off outside Ulster Bank in Derry.

It’s frightening that Ireland is one of the few places, where real terrorists might conceivably counter attack debt terrorism. Left wing organisations in the North like Sinn Fein have links to the real IRA. The latest blast is in the North, so it is probably not linked to the deficit problems in Eire. It’s not a hard stretch of the imagination to see a resurgence of militancy in the South. I do not condone armed insurgency under any cicumstance.

Ambrose Evans-Pritchard piles on:

IMF admits that the West is stuck in near depression

Careful Tom, you wandered into Deficit Terrorist central.

The dark force is very strong in this one.

http://www.telegraph.co.uk/finance/comment/damianreece/8041979/With-help-from-retail-royalty-Osborne-has-bought-himself-some-time.html

Horror…..

“There was an audible gasp when he told the conference that we are spending £120m a day on paying the interest on the debts accumulated by Labour.”

Sado-masochism…..

“It’s only right that, as a nation, we are prepared to take the pain and the unpleasant medicine to get ourselves back on track. Taking the pain, and being seen to take the pain, is indeed part of that confidence-boosting process.”

and statement of the week….

“But the time will soon come when those paying the most will expect to see their efforts rewarded with taxation falling and a sense of a country having been changed permanently and changed for the better. ”

I’m almost wishing they will be successful in their policy implementation. It’s too painful to watch.

@Andrew Wilkins

The state of the public debate here in the UK fills me with despair.

Mark Lennox: “There have always been kings and queens, and there will always be kings and queens, dominating the little guy… how do you shift a mentality so embedded in everything from the media to education?”

There have been kings and queens since the Agricultural Revolution. However, for the last millenium, their power has been eroding in favor of people in general. That movement quickened with the revolutions of the past 200 years. What royalty we have left are treading water. But the new aristocrats are fighting back, and corporations, which are not democratic institutions, are gaining power with regard to nation states.

Elizabeth: “To me, it all seems totally counter-logical.”

Indeed, it does. Bill Mitchell is quite prolific, and this site has a wealth of material to read. Things will became clear.

Elizabeth: “The state is in debt? Devalue the currency, you say. Simple.”

Nobody is saying to devalue the currency. OK? The fact that the state is in debt is not in itself a problem. This has been known for a long time. Not long ago I was reading a book on the history of money in America, written in the late 19th century by a mainstream believer in the Gold Standard. He said that the national debt is not in itself a problem.

The phrase, “devalue the currency” has no real meaning in MMT terms. A fiat currency has no intrinsic value to start with. When people use that phrase, they might have different things in mind. In the context of debt, they usually mean inflation. Today our problem is not inflation, but deflation. Inflation would be a boon, but not because of the national debt.

One of the main functions of money is as a medium of exchange. A major problem right now is that there is too little exchange going on. Inflation would encourage people to buy goods and services with their money, thereby increasing exchange, creating jobs, business opportunities, etc. That is the reason to “devalue the currency” now, not the national debt.

Elizabeth: “(But then who would lend more money?) Do things look tight? Then spend, spend, spend (and then devalue the currency, I guess).”

People are not lending money now because the economy is stagnant. But as consumers begin to spend, the economy will pick up and money will get lent to take advantage of the opportunities that emerge. If consumers will not spend, then the gov’t must, to get us out of the quagmire. Once the economy is rolling again, with moderate inflation (“devaluing the currency” ;)), there will be no particular need for further inflation (“devaluation”). (There may be need for inflation to reduce inequality, but I do not understand things well enough to claim that.)

Elizabeth: “But what about Iceland, for example?”

IIUC, private banks in Iceland took deposits from all over Europe (in Euros) promising to pay very high rates of interest. They failed. Iceland does not guarantee deposits in Euros by foreigners, but the European gov’ts tried to get Iceland to do so for those deposits. The gov’t said yes, but the Icelandic people, in a referendum, said no. It is very complicated.

Elizabeth: “What about the fact that there is a huge lv levels of debt out there?”

American households have too much debt. This happened before, in the 1920s, and played a part in bringing about the Great Depression. In the current crisis, the gov’t bailed out the big financial institutions, but has yet to bail out all but a few ordinary Americans. The prospects of that happening any time soon are dim.

Elizabeth: “I read a book recently The Enigma of Capital: And the Crises of Capitalism by David Harvey. It scared the sweet baby Jesus out of me. The amount of DEBT there is. It seems we are skating on very thin ice.”

Remember, in our system, debt is money. I. e., for each dollar of debt created one dollar of money is also created. That is why debt is not necessarily bad, no matter how much there is. However, private bank debt carries interest, so that more money has to be created to pay it, which means ever increasing debt (or defaults and bankruptcies). Private debt has characteristics of a Ponzi scheme, which makes it scary. That’s why I think that American households are carrying too much debt. However, with a fiat currency (modern money), the gov’t is the ultimate source of money. It can always pay its debts, and there is no Ponzi scheme characteristic, where you keep having to find new lenders, or new money to lend. The fact that people lend money to the gov’t does not mean that the gov’t would go broke if the people do not lend to it. Where do the get the money in the first place? The gov’t, which is the ultimate source of money. That is not something to worry about. Not that we do not have real economic worries, but worrying about gov’t finance only gets in the way of addressing our real worries.