I have received several E-mails over the last few weeks that suggest that the economics…

Yuan appreciation – just another sideshow

The attacks on the use of fiscal policy to stabilise the domestic economies of nations that are still languishing in the aftermath of the financial crisis has moved to a new dimension – a escalation in the attack on China and its stupid policy of managing its currency’s exchange rate. The debate is interesting because it is in fact a reprise of discussions that raged in previous historical periods. Each time there is a prolonged recession, governments start suggesting that the problem lies in the conduct of other governments. There is a call for increasing protection (“trade wars”) or demands for some currency or another to appreciate (“currency wars”). The prolonged recession is always the result of the governments failing to use their fiscal capacity to maintain strong aggregate demand in the face of a collapse in private spending. Typically, this failure reflects the fact that the governments succumb to political from the conservatives and either don’t expand fiscal policy enough or prematurely reign in the fiscal expansion. These episodes have repeatedly occurred in history. And at times, when some “offending” governments have been bullied into a currency appreciation (for example) the desired effects are not realised and a host of unintended and undesirable outcomes emerge. This debate is another example of the way mainstream economics steers the policy debate down dead-ends and constrains governments from actually implementing effective interventions that generate jobs and get their economies back on the path of stable growth. So the yuan appreciation debate – just another sideshow. I wonder why we bother.

Heading off a “currency-war” and the threat of increasing trade protection appears to be the main topic at the Washington meeting convened by the IMF, the World Bank and the Group of 20.

The US Treasury Secretary told an audience at the Brookings Institution this week (October 6, 2010) as a political posturing exercise leading up to the Washington meeting that the:

…. greatest risk to the world economy today is that the largest economies underachieve on growth … [and] … as America saves more, countries overly reliant on exports to us for their own growth will need to change their policies, or else global growth will slow and all of us will be worse off. Countries that chronically run large surpluses need to undertake policies that will boost their domestic demand … [and] … it is very important to see more progress by the major emerging economies to more flexible, more market-oriented exchange rate systems. This is particularly important for those countries whose currencies are significantly undervalued. This is a problem because when large economies with undervalued exchange rates act to keep the currency from appreciating, that encourages other countries to do the same.

So China – appreciate your currency!

The IMF has also joined the “Bash China” chorus. Its chief economist at a Press Briefing on the IMFs World Economic Outlook (October 6, 2010) said in this

Many emerging countries, here most notably China, had relied excessively on net exports before the crisis and must now turn more to domestic demand. These readjustments are essential to maintaining a strong and balanced recovery … What is needed for external rebalancing is a fairly general appreciation of emerging market country currencies relative to advanced country currencies. .

The Chinese have retorted that:

If the yuan isn’t stable, it will bring disaster to China and the world … If we increase the yuan by 20 percent-40 percent as some people are calling for, many of our factories will shut down and society will be in turmoil. If China’s economy goes down, it’s not good for the world economy.

So clearly the Chinese think that an appreciation would damage their trade prospects.

In the UK Guardian (October 6, 2010) – known “progressive” economist Dean Baker waded in on the issue in his article – Economics 101 for deficit hawks. I actually hope the deficit hawks don’t read this article because I would not hold it out as a very accurate lesson for them.

Dean has grasped that the sectoral balances are indeed a powerful framework for organising one’s understanding of the way the economy works. He says:

There are few areas of economics more boring than accounting identities. This is really unfortunate, since it is virtually impossible to have a clear understanding of economic policy without a solid knowledge of the underlying identities.

Most of the people in Washington policy debates were apparently overcome by boredom before they could get this knowledge. As a result, we see some really silly policy debates.

The debate over the value of the dollar against the Chinese yuan is the latest episode in this silliness. The Washington tribal elite has been on the warpath against budget deficits in recent months. They have worked themselves into such a frenzy that nothing will stand in their way: neither concerns about unemployment, nor concerns about the well being of our elderly, nor even concerns about basic economic logic.

I completely agree that the debate about the Chinese currency is out of control. Most commentators have not thought through the implications of their demands, understood the underlying relationships that are involved and considered history. Most of the commentary is at the level of the first-year text book which is bound to lead to erroneous conclusions.

Baker then says by way of 101 instruction that:

The central problem stems from the simple accounting identity that national savings is equal to the broadly measured trade surplus. A country with a large trade surplus will also have large national savings. Conversely, a country with a large trade deficit will have negative national savings. These relationships are accounting identities – there is no way around them.

Well this is not what I would want a deficit terrorist to learn. Please read my blog – Twin deficits – another mainstream myth – for a derivation of the sectoral balances and more background material.

The sectoral balances are:

(T – G) = budget balance, where T is tax revenue and G is government spending.

(S – I) = private domestic balance, where S is total private saving and I is total private investment.

(X – M) = external (trade) balance, where X is total exports and M is total imports.

If (T – G) > 0 then there is a drain on aggregate demand via the public sector. If (S – I) > 0, then the private domestic sector is saving overall and this creates a drain on aggregate demand. If (X – M) > 0, then net exports are positive and this would add to aggregate demand via the foreign sector.

Further, by implication, external deficits drain aggregate demand from the economy and budget deficits add aggregate demand.

These balances are linked via a strict accounting relationship which is derived from the National Accounting framework such that:

(S – I) + (T – G) – (X – M) = 0

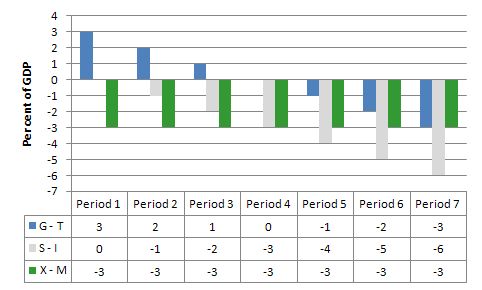

The following graph and associated data table shows you the relationships between the government balance and the private domestic balance when there is a constant external deficit.

You can then manipulate these balances in many ways to tell stories about what is going on in a country.

One way of writing the balances to show the relationship between the government and the non-government sectors:

(G – T) = (S – I) – (X – M)

That is a government deficit (G – T > 0) has to be associated with a non-government surplus, which can be distributed between the private domestic balance and the trade balance.

If there is a trade deficit (X – M < 0) then (S - I) has to be negative (that is, the private domestic sector is spending more than it is earning) if the government budget is in surplus (G - T < 0). That is clear from the graph (see Periods 5 to 7). Another way to "view" the sectoral balances is to express the external position against the domestic position: (X - M) = (S - I) - (G - T) which is the way that Baker wants the readers to be thinking. So if there is an external surplus (X - M > 0), then the right hand side also has to be in surplus. So if the budget was balanced (G – T = 0) then the private domestic sector would carry that surplus (S – I > 0).

The problem with Baker’s depiction of this is that he constructs a budget surplus as “national saving”. In this regard (and I am skipping ahead in his argument) he says:

This brings us back to the budget deficit part of the story. If the United States has a large trade deficit, then it means that net national savings are negative. That is definitional. For net national savings to be negative, then we must have either negative private savings or negative public savings (that is, a budget deficit).

Modern Monetary Theory (MMT) does not construct the relationships in this way. It makes no sense to call a budget surplus a contribution to “national saving”. The conceptualisation of the budget balance runs deep in mainstream macroeconomics and is ultimately at the heart of the loanable funds doctrine and the erroneous theories of financial crowding out. It is also a central implication of the false household-government budget analogy that is at the core of the mainstream approach.

No progressive should use this terminology or depiction.

To see why it is an erroneous description of the monetary implications of a sovereign government running a budget surplus think about what saving means to a household.

When individuals (households) save they postpone current consumption because they want to have higher future consumption. Saving is a time machine for non-government entities to allow them to transfer consumption across time. The obvious motivation is that they face a budget constraint – as users of the currency – and have to forgoe consumption now if they want to save.

For the monopoly issuer of the currency – the sovereign government – there is no such financial constraint on spending. It does not have to forgoe spending now to spend in the future. It can always spend what it desires at any point in time irrespective of what it did last period or any previous periods.

Further, when the government runs a budget surplus the purchasing power it extracts from the non-government sector doesn’t go anywhere – it is not stored in any account to use for later purposes. Just as a budget deficit (excess of spending over tax revenue) creates net financial assets (in the currency of issue) a budget surplus destroys net financial assets.

There is no store of purchasing power when the government runs a surplus nor does it make any sense for a government to think in those terms. It can always spend what it likes.

So it is nonsensical to characterise a budget surplus as being “saving”. It is more correctly described as the destruction of non-government purchasing power and non-government net financial assets (wealth).

Once you think of budget surpluses as “national saving” in an analogous way to private saving you are sliding into the slippery and false world of the theory of loanable funds, which is a aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking. The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

In Mankiw’s macroeconomics textbook, which is representative, we are taken back in time, to the theories that were prevalent before being destroyed by the intellectual advances provided in Keynes’ General Theory.

Mankiw assumes that it is reasonable to represent the financial system as the “market for loanable funds” where “all savers go to this market to deposit their savings, and all borrowers go to this market to get their loans. In this market, there is one interest rate, which is both the return to saving and the cost of borrowing.”

So in the theoretical classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times, when consumption fell, saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. Public surpluses are just another source of “saving” in this model.

So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

In this mythical market for loanable funds, the real interest rate adjusts to ensure that the supply (national saving) of loanable funds and demand (investment) for loanable funds is always equal. The supply of funds comes from those people who have some extra income they want to save and lend out and in this conception public surpluses. The demand for funds comes from households and firms who wish to borrow to invest (houses, factories, equipment etc). The interest rate is the price of the loan and the return on savings and thus the supply and demand curves (lines) take the shape they do.

Mankiw says that the “supply of loanable funds comes from national saving including both private saving and public saving.” Think about that for a moment. Clearly private saving is stockpiled in financial assets somewhere in the system – maybe it remains in bank deposits maybe not. But it can be drawn down at some future point for consumption purposes.

Mankiw thinks that budget surpluses are akin to this. As noted above – budget surpluses are not even remotely like private saving. You should clearly understand by now that budget surpluses destroy liquidity in the non-government sector (by destroying net financial assets held by that sector). They squeeze the capacity of the non-government sector to spend and save. If there are no other behavioural changes in the economy to accompany the pursuit of budget surpluses, then as we will explain soon, income adjustments (as aggregate demand falls) wipe out non-government saving.

Please read my blog – Budget deficits do not cause higher interest rates – to see why “progressive” Dean Baker is sitting in the same camp on this issue as the conservative neo-liberal economists like Elmendorf (US CBO director) and Mankiw (Harvard right-winger).

Baker’s main point is that for the US:

At a given level of GDP, the main determinant of the trade deficit is the value of the dollar in international currency markets. This is very basic supply and demand. If the dollar is higher in value relative to other currencies, then our exports will cost more to people living in Germany, Japan, and China.

So to fix the deficit with China he clearly thinks the Chinese have to appreciate its currency.

I wonder what happened between mid-2005 and late 2008, when the Chinese government allowed the Yuan to appreciate by nearly 20 per cent against a trade weighted basket of currencies (their main trading partners). Over this period, the bi-lateral trade balance between China and the US grew from $US205 billion in 2005 to $US268 billion in 2008. I will come back to this at the end.

As we will see later, the “Bash China” movement is a reprise of the “Bash Japan” movement in the 1980s and that led to undesirable consequences.

Baker also says after noting that as a result of the collapse “people are now saving much more” and “investment has fallen due to overbuilding” so that “private-sector savings are no longer negative”:

This leaves us with our large budget deficit. The budget deficit follows from the fact that we have a trade deficit, which is, in turn, the result of the over-valued dollar.

The implied causality would lead you think that the trade deficit is “causing” the budget deficit. The correct way of thinking is that the two must co-exist if the private domestic balance is in surplus. Why?

If we start from a given external deficit (X – M < 0) and the private domestic sector was in deficit (S - I < 0) then the public balance could be in surplus (see Periods 5 to 7 in the graph) and economic growth could continue. But the private domestic sector would be increasingly accumulating debt and this growth strategy would be unsustainable. So there is nothing inevitable about a trade deficit being associated with a budget deficit as is shown in the scenarios modelled in the above graph. It all depends on what the private sector spending and saving decisions are. The way to think about it is that the budget deficit is endogenous (that is, responds to the spending decisions of the private domestic sector). This is because the budget outcome is, in part, a result of the automatic stabilisers which respond to changes in the level of economic activity which is driven by private sector spending and saving decisions (as is the external balance). Thus, if we move from this situation (private deficit) to a situation where the private domestic sector is spending less than they are earning (S - I > 0) and the external sector remains in deficit (X – M < 0) then the combined outcomes drain aggregate demand and promote a decline in real output and national income. Without any discretionary change in fiscal policy the income adjustments will drive the budget balance into deficit (via the automatic stabilisers) - see the transition from Period 3 then 2 then 1 in the above graph. Obviously, if the government expands its discretionary fiscal position (a rising deficit), it can drive the private sector into a net saving position fairly quickly and maintain economic growth. This may also expand the external deficit (via rising import spending) but doesn't necessarily have to. It would all depend on the spending and saving decisions of the private domestic sector. Baker then attacks the conservatives who:

… routinely express horror over the size of the budget deficit … [but] … anyone who hopes to get the trade deficit down must recognize the need to lower the value of the dollar. And, if one wants to get the budget deficit down, then it is necessary to reduce the trade deficit.

But again this doesn’t necessarily follow. A lower value of the dollar may help improve the trade position. This depends on the trade elasticities and relative inflation rates, which in turn, reflects relative productivity growth rates. The responsiveness of the trade balance to nominal exchange rate movements is not unambiguous.

However, the second statement “to get the budget deficit down … it is necessary to reduce the trade deficit” is a false statement. It depends on what you want to achieve. The correct statement is that if you want the private domestic sector to keep saving and running down its precarious debt levels and you want to maintain economic growth in output and income, then the larger is the drain on aggregate demand coming from the external sector, the larger the budget deficit has to be.

You can desire to expand exports faster than imports and thus reduce the external drain on aggregate demand, but then if the private sector is saving or in balance, the budget will still have to be in deficit until net exports become positive and exceed the drain on aggregate demand arising from the private domestic balance.

Clearly, the IMF and other bodies are pushing for export-led growth strategies as part of their pressure to reduce budget deficits. But this

Please read my blogs – Export-led growth strategies will fail and Fiscal austerity – the newest fallacy of composition– for more discussion on this point.

The other way of approaching the problem is to reduce the import propensity (that is, reduce the percentage of each new dollar of national income that goes to imports). The “Buy Australia” or “Buy America” type programs try to achieve this aim. In a world of multi-national capitalism these measures are not effective. Patriotism only goes so far when it comes to people making decisions in shops or on-line as to what they purchase and why.

Back to the 1980s

We should also not forget that the Americans have been through this rhetoric in the past. During the recession of the early 1980s, it was fear of Japan and the NICs (South Korea, Singapore, Hong Kong and Taiwan). Today it is China and India. In particular, Japan was the bogey country causing imbalances in world trade and preventing the US and other “trade deficit” countries from growing.

In the early 1980s, for example, the former US Vice President, Walter Mondale, who at the time was lobbying to become the 1984 Democratic Presidential nomination told the New York Times (October 13, 1983) that:

We’ve been running up the white flag when we should be running up the American flag … What do we want our kids to do? Sweep up around the Japanese computers?”

I cover some of the history of this period and debate in this blog – What you consume or what you produce? and noted that after rehearsing a vehement protectionist stance, Walter Mondale eventually became the US Ambassador to Japan in the Clinton Administration and was full of praise for them. But during the recession of the early 1980s, he was leading the calls for protection against the Japanese.

But during the recession of the early 1980s, many US factories closed because they could not (allegedly) compete against the new manufacturing strength of Japan and north-east Asia.

In the 1970s and 1980s, Japan was the fasted growing advanced nation and its manufacturing innovations allowed it to become an export powerhouse. All the claims now being made about China’s “overvalued” currency were made against Japan in the 1980s. Japan ran large trade surpluses with the US and the latter started to place extreme political pressure on Japan to allow the Yen to appreciate in value. It was stated often during that period that if only the Yen would appreciate then the US current account deficit would be reduced and its prospects for growth would be solid.

The history of the yen is actually interesting and in the post World War 2 era reflects a lot of US meddling. The abandonment of the Bretton Woods agreement in 1971 by the US (President Tricky Nixon) was in no small part due to the large current account deficits the US were running against Japan. The US believed then – just another historical reprise of the current debate – that the currencies of their main trading partners were undervalued.

Interestingly, immediately after the US devalued in mid 1971, they negotiated (in December 1971) the Smithsonian Agreement which was an attempt to get several nations to revalue their currencies and re-establish the fixed exchange rate regime abandoned earlier that year. The agreement wasn’t sustainable given the changes in the underlying trade fundamentals that had brought the system down in the first place and it was abandoned in March 1973.

At that point, most currencies floated (hallelujah!) although the Japanese government was under intense domestic pressure to prevent the currency from appreciating because local firms etc did not want a return to the large external deficits of the 1960s (yes, they were misguided in thinking that high-priced imports that they were barely able to afford was a good thing). So Japan never really floated freely in this period.

While the Yen did appreciate somewhat during the rest of the 1970s, the two oil shocks really damaged its economy and pushed the Yen down so by the early 1980s, with export surpluses returning, there was a claim that the currency was undervalued.

As the trade surpluses grew, there was clearly strong Yen demand in international currency markets but there were offsetting factors which prevented it from rising in value consistent with the growing surpluses. Some of these offsetting factors were controlled by the US – for example, the higher US policy interest rates. US Federal Reserve boss Paul Volcker was the architect of that policy!

Ironically, at that time the IMF were trying to assert their neo-liberal stamp on world governments and together with its biggest “shareholder” (the US government) they pushed heavily for deregulation of capital flows between countries.

As the restrictions on international capital mobility were relaxed, the large surpluses Japan had been accumulating courtesy of their trade strength manifested in large outflows on the Capital Account of its Balance of Payments as the Japanese pursued asset building opportunities in other currencies. These net outflows thus reduced the excess demand for the Yen in the foreign-exchange markets and that was the main reason the Yen didn’t appreciate despite the growing trade surpluses.

Enter the so-called Plaza Accord in September 1985 where of senior officials from France, Japan, West Germany, the US and the UK met and agreed to depreciate the US dollar against the Yen and the German Mark. The central banks would engage in official intervention in foreign-exchange markets to ensure the currencies moved in the direction outlined in the Accord.

History tells us that the depreciation of the US dollar against the Yen, while it made US manufactured goods cheaper in world markets did not fundamentally alter the trade balance against Japan.

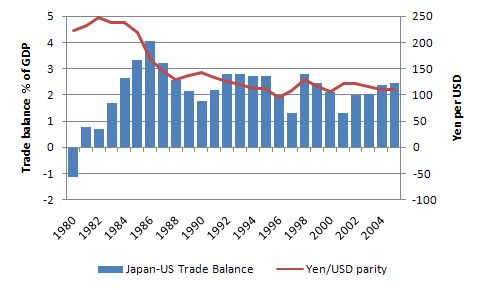

The following graph shows the evolution of the Japanese trade balance (blue bars) with the US from 1980 to 2005 and it Yen/USD parity (red line) over the same period. In 1985, the 239 Yen bought $US1 and by 1988 the Yen had appreciated to 128. By 1985 it was around 80. It is clear that the bi-lateral trade balance didn’t react very much at all.

There are debates about why that result occurred including complaints by the US that Japan imposed import restrictions. The most patent reason was that the rapid appreciation of the Yen created fears of a major recession in Japan and they reacted to the loss of export competitiveness by loosening monetary policy and the lower borrowing rates.

This subsequently was a factor in the huge real estate boom in the late 1980s that led to its property price meltdown and subsequent “lost decade”. During this meltdown Japanese imports collapsed as national income declined sharply. Further, the carry trade since then has kept the value of the Yen lower than otherwise (given the low interest rates) thwarting to some extent the policy of the US to keep it “overvalued”.

China and domestic growth

What might have explained the lack of responsiveness between 2005 and 2008 of the bi-lateral trade balance as the yuan appreciated? After all the outcome noted above was contrary to the mainstream textbook model predictions. There are several reasons why the textbook treatment of this issue failed to provide an adequate prediction.

First, it is not commonly understood but China is not a large manufacturing nation. It is an assembly line for components manufactured elsewhere. So a good proportion of the Chinese export to the US are not made in China and so the yuan-sensitive input proportions of Chinese goods are sometimes quite small. That means an appreciating yuan will only alter the export price by a small margin.

Second, China imports similar goods from the US, Germany and Japan – IT items, sophisticated capital goods (for example, jet engines) and so stimulating US exports to China is not a simple matter of appreciating the yuan against the US dollar. The US dollar parity against the Yen and the Euro is more important.

Third, for many low-cost, labour intensive exports, an appreciating yuan will just redistribute the exports among other Asian nations. Countries like Malaysia, Vietnam and Bangladesh are in direct competition with China to access US markets and a relative price change in the yuan against the US dollar would see China lose some of their market share but would not likely reduce the US trade position overall. Further, this would cause job losses and falling incomes in China and reduce their demand for US exports.

A much more sensible strategy – should you want China to grow their domestic market (and be able to support higher imports) – is to put pressure on Chinese firms, particularly those engaging with US companies – to increase the wages they pay their local workers. China is a poor nation overall with a less than comprehensive social security system. By encouraging high wages and more generous pension systems, the West would not only help China escape poverty but also reduce the “cultural” reliance on high private savings. In turn, the local population would have a greater capacity to purchase US made goods and services.

I will discuss this topic in more detail in another blog – I am running out of time this morning.

However, the idea that the world’s growth prospects rely on a rebalancing of world trade is erroneous and consistent with the claim that expansionary fiscal policy is not desirable.

There are several points we can make about this.

From a MMT perspective currency sovereignty requires flexible exchange rates. So the conduct of the Chinese government in terms of its exchange rate is not desirable under normal conditions. It is not only monetary policy that is tied under any sort of peg arrangement. Fiscal policy is also constrained. A country that operates on a gold standard, or a currency board, or a fixed exchange rate is constrained in its ability to use the monetary system in the public interest, because it must accumulate reserves of the asset(s) to which it has pegged its exchange rate.

This leads to significant constraints on both monetary and fiscal policy because they must be geared to ensure a trade surplus that will allow accumulation of the reserve asset. This is because such reserves are required to maintain the exchange rate parity. If a country is running a fixed exchange rate and faces a current account deficit, the domestic economy has to bear the brunt of the required adjustment.

So the government has to depress domestic demand, wages and prices in an effort to reduce imports and increase exports. Accordingly, the nation loses policy independence to pursue a domestic agenda. Floating the exchange rate effectively frees policy to pursue other, domestic, goals like maintenance of full employment.

Please read my blog – Modern monetary theory in an open economy – for more discussion on this point.

The caveat is that these constraints are not binding where a nation experiences a strong trade position such as China at present. In those case, there is fiscal space courtesy of the Balance of Payments capital account (financial flows boosting foreign reserve buffers). The general problem of external surplus countries is also avoided in these cases – that being that export-oriented growth resulting in persistent external surpluses reduces the domestic standard of living – because China has the capacity to offset this impact via fiscal policy.

In the current downturn, it has led the World in its use of domestic policy initiatives to ensure that unemployment impacts were muted and growth continued. China has clearly been ahead of the pack here and demonstrated how an appropriately applied fiscal stimulus can maintain domestic growth even as net exports are falling. Their example contradicts the claims by the deficit terrorists that fiscal policy is ineffective.

Further, MMT places a primacy on fiscal policy and thus considers monetary policy to be the weaker of the two in terms of its capacity to pursue effective counter-cylical stabilisation (that is, boost aggregate demand when private spending falls and vice versa). As I have noted often, there are many uncertainties about the use of monetary policy. It is a blunt instrument (that is, impacts across all regions if at all) and thus cannot be targetted. It’s final impact is also depenendent on distributional nets which are not clear – creditors and fixed income receivers gain, debtors lose – what is the net effect on spending?

For these reasons, fiscal policy is preferred and so the conventional arguments about the flexibility of monetary policy being constrained by a pegged currency are less important to MMT. But as noted above, all aggregage policy (fiscal and monetary) is constrained under a peg in unproductive ways.

MMT also takes a different view on trade to that outlined in mainstream economics textbooks. Imports are benefits to a nation while exports are a cost. The mainstream position is that imports are somehow bad too many of them is worse and exports are virtuous. Exports involve a nation giving up its resources to another nation so the citizens in the latter can enjoy them. That is a cost. Imports are the opposite.

The US trade position (deficit) is actually a boost to their standard of living. If the US government was successful in forcing the yuan to appreciate and, in turn, choke of imports then this would in the short-term further reduce the material standard of living of Americans who are already suffering under with the unemployment and income loss fallout of their collapsed economy. By denying the US citizens access to the cheapest possible imports the US government would be compounding the consequences of their failure to implement fiscal policy of sufficient magnitude and jobs focus as private demand collapsed. The so-called “huge trade deficits” are benefits to the United States and Europe.

But the US government would also be promoting a lower US dollar parity overall which would just entrench these “costs” (lower real terms of trade) over time.

Further, as long as the developing countries haven’t signed up to IMF-bullied currency-pegs or other limitations on their currency sovereignty, they have the domestic capacity to improve standards of living without a reliance on net exports (with exceptions when food is totally imported).

China clearly understands that it has the fiscal capacity to stimulate domestic demand. Most of the growth in recent years has come from public infrastructure spending. Please read my blog – China is not the problem – for more discussion on this point.

I would also note that no-one is forcing the US citizens to buy Chinese-made goods and services. The logic of the “land of the free” is to let people buy what they like.

So in that context, it is unclear why US commentators and politicians would want to push China in this way. China’s exchange rate policy is holding the US dollar up against the renminbi. But the nation with the stronger currency has the upper hand which is contrary to the way the mainstream economists and public commentators think.

A strengthening currency tells you that the real terms of trade are improving. That is, more real goods and services can now coming into shore on boats than have to leave shore. That is a net benefit. You can buy more real goods and services from abroad for less sacrifice in costly exports.

The appropriate policy reaction to the “demand draining impacts” of this outcome is to use fiscal policy to maintain strong aggregate demand and employment. In that way, the nation can maximise its “enjoyment” of its superior currency position – it generates enough income (and saving) in the private domestic sector to purchase goods and services on offer as well as being able to buy on superior terms the goods and services that arrive on boats from abroad.

I will write more about this in the weeks to come.

Conclusion

The simple line being pushed by the IMF, the World Bank, the US government and others about China is really a smokescreen to avoid facing up to the fact they have failed to implement appropriate fiscal policy. They should have expanded their deficits by much greater amounts in the early days of the crisis. They still short be increasing net public spending and creating local jobs. If the Chinese want to make or assemble cheap plastic items then the US workers can do other things.

But to say that the US government no longer has the capacity to increase employment in the US labour market unless China appreciates it currency is plainly false and amounts to the abandonment of the US government’s responsibility to manage the US economy in the interests of its citizens.

The appropriate policy response is not to start trying to modify trade or worry about what China is doing. The US government and other sovereign governments have all the capacity they need at present to stimulate domestic demand and create high levels of employment.

Ultimately China will realise that its citizens want more than bits of paper in foreign currencies and they will allow the exchange rate to float. There is already simmering pressure in China among workers to push for higher wages and a greater access to consumer goods. This pressure will not be able to be resisted by the Chinese government as time passes.

But I don’t want to be misinterpreted. I also think the yuan should float but for different reasons than those given by the pundits in the current assault on China. The point is that I think it is a side-show for the rest of us.

What we need to do on a multi-lateral basis is to curb the financial sector and force it to correspond only with the needs of the real sector. This would require large policy shifts which would outlaw most of the current trading behaviour and would require speculative behaviour to be advancing the stability of the real economy.

Saturday Quiz

The Saturday Quiz with the premium additions will be back tomorrow some time with Answers and Discussion on Sunday.

On Sunday I am catching the Eurostar to London where I will be staying all of next week. I have some meetings and other things to do.

That is enough for today!

I thought the same thing reading Baker’s article.

Still, if you were ranking comprehension / effort at comprehension on a scale of 1 to 10, where MMT is 10 by imposition, then Baker seems around 5 or 6 – a good start, but off the rails part way through – although not in an utterly irremediable way. It doesn’t seem entirely bad.

I haven’t been exposed to Mankiw’s textbook, but it sounds like he’s off the charts at 0 and unsalvageable.

Hi – please can you recommend any useful commentary / analytical frameworks on import propensity?

Scott Fullwiler’s piece at the link below is very helpful to illsutrate how the govt sector and private sector reach an ex post balance at a given level of GDP, based on the two sectors’ relative propensities to run a surplus / deficit; but when you add the foreign sector, it doesn’t feel as compelling.

http://neweconomicperspectives.blogspot.com/2009/07/sector-financial-balances-model-of_26.html

The argument that if a trading partner wants to accumulate our currency in exchange for their labour then good luck to them seems to me somewhat dodgy. The elite people in the exporting country will already be getting everything they personally want from the importing country. They may be sending their children to university in the importing country, using medicines made in the importing country etc etc. Like all people everywhere who already have every luxury, what is left is an appetite for money, hence the elite are very happy to export in return for currency rather than real goods and services. If the importing country had a fiscal rule that it would balance government spending with taxation, then in order to import it would have to come up with something other than currency to exchange for the imports. Likewise the exporting country would have to accept something other than currency. To my mind that would benefit the average joe in both countries. The elite in what was just an exporting country would have to pass on the fruits of the labour to the average joe as say places to study abroad or medicines or whatever can not be hoarded in a bank account. Similarly the average joe in what was the purely importing country would probably much rather be doing work that was wanted by the trading partner rather than doing say a JG job.

Dear Stone (at 2010/10/09 at 0:16)

Remember we are doing macroeconomics which (mostly) abstracts from the details that concern you (and me!).

best wishes

bill

Bill, I just think that if a voter (my only influence) wants to avoid harming repressed people in other nations and also to ensure that their own personal employment prospects are protected then the only avenue is via macroeconomics and it is to vote for government spending to be balanced by taxation. That conclusion seems to fly in the face of the typical MMT conclusion- am I muddled about that?

Dear stone (at 2010/10/09 at 0:37)

There is nothing logical that follows in your statement. You are muddled.

1. You may not want to net exploit another nation’s resources/labour and think running a trade balance is okay.

2. Then if you want the private domestic sector overall to save (and be able to risk manage their debt positions etc) then the government has to run a deficit. If Net Exports = 0, and the budget is balanced, then the private sector can never save overall and thus never spread consumption over time in a pattern that they may desire.

best wishes

bill

Bill I should have stated that I also want the pool of savings in my country to remain a constant size in the long term (no long term net saving). Does that sort it out?

Bill I realize that your second point-

“2. Then if you want the private domestic sector overall to save (and be able to risk manage their debt positions etc) then the government has to run a deficit. If Net Exports = 0, and the budget is balanced, then the private sector can never save overall and thus never spread consumption over time in a pattern that they may desire.”

-is the absolute crux of my difficulty with accepting the MMT stuff. To my mind for every person who is saving at any given time there will be another person at a different stage of life who will be drawing down savings. So to my mind for individual people or corporations to “spread consumption over time in a pattern that they may desire” there is absolutely no requirement for the aggregate “private domestic sector overall” to net save.

Persistent overall saving by the private sector is what is enabled by persistent deficits and equates to a ponzi structure for empowering the oligarchy as far as I can make out.

Among the bloggers I (non-economist) follow, in order to get some perspective to try to understand present-day economics conundrums, billy blog explanations have been very helpful. In the case of today’s blog, it could have been more helpful if Bill had presented formulaic representations similar to those shown above for MMT in order to demonstrate how his concepts regarding MMT sectoral balances differ from those formulated by Dean Baker or Greg Mankiw of Doug Elmendorf.

stone: if you didn’t want to bequeath anything to your offspring, and if you could predict your date of death perfectly, then yes you should never want to net save over your lifetime. But since those conditions don’t hold for most people, there is at least an aspiration to net save over the lifetime. That is simply an empirical fact, I think; so the govt needs to strike a stance which will accommodate this desire.

Plus there’s the simple fact that each accounting period, private sector agents balancing income and expenditure like to run at least a small surplus as a buffer to ensure they at least break even.

If you look at my Scott Fullwiler link above, you’ll see that there are propensities to run a surplus/deficit in both the private and public sectors: if the public sector insists on balancing its budget during a recession, GDP will clear at an unattractively low level.

MMT Proselyte, in the UK at any rate people do not need to predict their date of death because pensions have to convert to an annuity before you are 70. Also many UK people who own their houses (about 70% of people) buy an equity release scheme to convert the value of their house to an annuity in old age. Many other people sell their houses to pay for nursing home accomodation if they get dementia or whatever. It seems that what you are advocating is not a practical measure but rather that each generation should accumulate ever greater savings simply as a kind of dynastic fantasy game that obviously was never possible prior to expanding currencies being introduced. That would be all very well except that ever greater savings leads to a gross destortion of the economy with the FIRE sector expanding to deal with all the acumulating wealth.

So to my mind for individual people or corporations to “spread consumption over time in a pattern that they may desire” there is absolutely no requirement for the aggregate “private domestic sector overall” to net save.

There are two problems with this. First. unless the pensions are quite handsome, people will want to net save in order to be prudent. In the US, pensions are not only generally inadequate but also insecure, with the possible exception of some government positions (although in today’s environment everything is up for cut backs and there is even agitation about government employee pensions).

Secondly, most Americans place a high priority on passing wealth to offspring. They regard this as basic to the American Dream. Bottom line is that this cannot be changed politically. A corollary to this is that the American Dream also includes becoming wealthy as one’s birthright as a citizen. This is also a core American value. Altering these would require cultural change.

The other issue is capital investment which is also a kind of saving that comes out of either retained earnings or debt. Prudent management looks to their financial ratios and desires to limit leverage, which requires savings for financing expansion.

The idea of keeping savings constant, e.g., as a percentage of GDP, is problematic macro-wise for a lot of reasons, especially if the percetage is zero as you seem to suggest. The largest difficulty perhaps is that the result of trying to control savings leads to an increase in the use of leverage. Do you propose to limit the amount of debt as a percentage of GDP, too? And as you do these things, one thing leads to another, and there are unintended consequences. Moreover, how could this possibly become a political platform that the public would buy?

As I have said elsewhere, the real problem is not savings in the economic sense of income that is not consumed or taxed but rather in economic rent in the sense of revenue derived from non-productive sources. Income needs to be distributed and productive investment needs to provide resources including employment proportional to population growth in a sustainable way. Furthermore, government needs to provide for public purpose. This requires optimal use of economic/financial resources, which means eliminating inefficiencies, and economic rent – land rent, monopoly rent,and financial rent – the primary inefficiencies. Economic rent/financialization results in in the long-term financial cycle of expanding leverage that the world is now having to deal with again.

The answer is not limited saving but rather reducing inefficiency by eliminating conventions and institutions based on economic rent-seeking as well as cheating. There is no problem in growing the pie in a sustainable fashion. The problem is slicing the pie to the advantage of some without justification based on productive contribution. Wealth (stock of cumulative saving) that is gained from productive contribution is the basis of capitalism. Wealth is a chief economic motivator or incentive. Proposing to alter this is tantamount to calling for a social, political and economic revolution in the West (which ins’t a bad idea in my book, but I don’t see happening anytime soon short of systemic breakdown that is not out of the question). No savings is way out of paradigm.

Operating in the current model, the solution is incentivizing productive contribution and disincentivizing non-productive extraction aka parasitism. That is possible, but very difficult with a corporatocracy/kleptocracy in charge.

Sorry cannot resist this: (though I have done this very often and plan to do this less frequently but surely).

MMT semi-quibbles about the statement “governments do not borrow.” Thats fair to some extent, given that governments and their central bank can unilaterally set the yield curve. However, when applied in the context of the external world, complaining about a nation with a negative net asset position not being indebted to the Rest of the World is a one hell of a quibble!

Let us consider the US Household buying a Chinese Car example. Assume that the household purchases a Chinese car by borrowing from a bank. Since loans make deposits, initially the household finds himself with increased deposits at his bank account. He then makes a transfer to the Chinese car company and now is indebted to the banking system. The bank in turn is indebted to the Chinese Car maker. Why is this a liability. Firstly because accountants tell us that it is so. More importantly if someone is going to buy the bank, he/she will surely look at the deposits of this bank. Jump a few steps – the People’s Bank of China acquires the dollars and since it has an account at the Federal Reserve, it becomes the Fed’s liabilities. Now, imagine the US Treasury announcing an auction and the PBoC purchasing Treasuries. Now the US Treasury is indebted to PBoC. Why – because the US government borrowed from the Chinese 😉

(I am sure MMT fans will think how misguided the last statement is)

In the above example, the liability of a US bank was transferred to the US Treasury. If “debt is not debt”, the US of A is less indebted to the Chinese once the US Treasuries are purchased ??? Paradoxical … ain’t it ?

Someone may ask (accusing me of failing to distinguish between the Gold Standard and fiat money regimes) – we live don’t live in the Gold Standard era – what is the liability ? Just more pieces of paper – isn’t it .. etc. Short answer: a debtor nation is liable to be target net exports or face pressure on its currency and its acceptability.

I do not think Dean Baker said anything grossly wrong in the first few paragraphs. He gets into the neoclassical logic of giving importance to price elasticities as opposed to income elasticities but thats different – though in the case of the United States and China, it becomes important.

Dean Baker is right. Exports minus imports is saving in the sense that running a current account surplus leads to a situation in which a nation’s income is higher than its expenditures. If a debtor nation is running a current account surplus, it leads to a situation in which it is less indebted to the rest of the world. Dean Baker does not advocate a government surplus. He just says that such an such situation leads to a national saving. There is a great advantage of consolidating the balance sheets of all the sectors of a nation!

Yep – nobody forcing the US citizens to import, But that precisely is the problem!. However Tim Geithner and Ben Bernanke (and Alan Greenspan) know this! Imports cannot be banned because of WTO rules.

However what Greenspan and his followers do not understand is actually understood by some Post Keynesians. Mainstream economists simply do not properly understand how damaging current account deficits is. Endemic trade deficits are a haemorrhage from the circular flow of national income. Why ? Simple. Combine the balance sheets of all sectors of a nation and you have an evergrowing indebtedness to the rest of the world if the situation arises. Now I understand some commenters may point out that growth can do the trick, but what if growth itself constrained by the balance of payments problems ?

In the previous post, it was suggested that in the case of an ever expanding public debt to national income, blowing up of interest payments do not appear problematic. Well if foreigners hold a lot of government debt, then ? Ben Bernanke and (today) Alan Greenspan have spoken about this possibility. However, they are confused and want austerity. They live in a world where agents are optimal and superefficient and hence there is no possibility of discretionary attempts to reach net exports or possibilities of concerted efforts in using fiscal policy and coordinated efforts to do international trade.

As the restrictions on international capital mobility were relaxed, the large surpluses Japan had been accumulating courtesy of their trade strength manifested in large outflows on the Capital Account of its Balance of Payments as the Japanese pursued asset building opportunities in other currencies. These net outflows thus reduced the excess demand for the Yen in the foreign-exchange markets and that was the main reason the Yen didn’t appreciate despite the growing trade surpluses.

I’m having trouble following this. How did Japanese purchase of capital assets abroad keep the Yen from appreciating?

Ken

Ramanan: “Assume that the household purchases a Chinese car by borrowing from a bank. Since loans make deposits, initially the household finds himself with increased deposits at his bank account. He then makes a transfer to the Chinese car company and now is indebted to the banking system. The bank in turn is indebted to the Chinese Car maker.”

Could you explain that last statement, please? The bank certainly does not owe the car maker any money. Do you mean that it owes the car maker gratitude? Or what?

Thanks. 🙂

The most patent reason was that the rapid appreciation of the Yen created fears of a major recession in Japan and they reacted to the loss of export competitiveness by loosening monetary policy and the lower borrowing rates.

This subsequently was a factor in the huge real estate boom in the late 1980s that led to its property price meltdown and subsequent “lost decade”.

Again, I’m having trouble following. I thought it was the MMT position that the natural and appropriate rate of interest was zero and that this would not in and of itself cause asset price bubbles. But here you say that loosening monetary policy was a cause of the Japanese real estate bubble, which seems to contradict that thesis ….

Tom Hickey and MMT Proselyte, it may have always been the American dream that each American would forge a dynasty of ever increasing wealth such as the Rosthchilds or whatever. However – and this is an extremely important however- before sophisticated expanding fiat currency it had to remain just that a dream. I think infact you are being very generous in saying that it is a special to Americans. People fall for that way of thinking right accross the world. However when you think about it it is a proposterous sick in the head dream and we should face up to that. By defination we are talking about wealth that is never spent and never going to be spent- it is just numbers on a bank balance. It is exponentially increasing with no limit because the expansion of the currency is specially designed to accomodate it. I also think it is worth bearing in mind that the fascination with growing wealth for the sake of it is probably an inclination that people (such as me) who have an interest in how money works are much more likely to fall for. My fear is that the way the economy is constructed is governed by that (probably small) subset of people who want to grow money rather than spend it. I think that that twists the whole architecture of the economic system. Captitalism should be about different economic agents with POTENTIAL for exponential growth in deadlocked struggle against the finite limit of our finite world. Just as ecology is about POTENTIAL exponential growth of populations of organisms in deadlocked struggle in the finite biosphere. The terminal sickness capitalism is now in is because people have stupidly thought that they could convert POTENTIAL exponential growth into actual universal exponential growth. Didn’t Einstein say the greatest force of all is compound interest. If constrained that can be a force for stability and efficiency. If unrestrained- then in the human body that is cancer.

Ken – don’t forget, MMT is big on targeted taxation incl on asset values, in such a way as to limit asset bubbles. Japan, needless to say, didn’t have such mechanisms in place.

stone – maybe you won’t be convinced by the desire to accumulate net assets. But the prudence point is key: if you aim to break even, you’ll come unstuck when you get some unforeseen expense.

So MMT admits that a zero interest rate policy could trigger asset bubbles, but relies on an activist fiscal/tax policy to squash them?

Ken

Mr Cameron looks over the fence into Mr Kan’s backyard. He sees rows of lovely fruit trees, ripe peaches, plump raspberries and other delectable fruits. Mr Kan’s large and busy family is cheerily working, riding around the well kept garden on small shiny trains.

Mr Cameron sighs and looks around his scruffy back yard. Several scrawny boys are struggling to dig up a rather odd looking turnip. He would so love to have a yard like Mr Kan. Being well meaning (but rather dim witted) he considers his options.

Mr Kan’s family is hard working. They also love collecting IOU’s to stick on their walls. Mr Cameron’s family has a talent for writing IOU’s. In the kitchen, one obese boy is enthusiastically colouring IOU’s. Another is cutting them into delightful shapes, just how the Kans like it. The table is groaning with lush fruit.

Outside in the yard, two thin boys fight feebly over a rotting carrot. He muses. “If I get my family hungry and fit enough, they will whip me up a garden like Mr Kans in no time at all. We can stop giving IOU’s to Mr Kan. We can paper our walls with Mr Kan’s IOU’s.”

After putting the back yard boys on a stricter diet, he was surprised the garden was not growing as planned. The two fat boys had unilaterally embarked on an intensive programme, re-colouring all the IOU’s. Amazingly….. with no effect whatsoever. Mr Cameron even asked the postman to pop around Mr Kan’s house and tell him to increase his prices. A large tattooed man came out of Mr Kan’s kitchen, and told him politely to bugger off. He also said to stop sending him coupons for crappy turnips.

Luckily a wise old farmer called Bill was strolling by. A deflated looking Mr Cameron asked him what he might do. Well said Bill. To start with, get those scurvy backyard boys motivated on a fruit diet. Slim down the fatties, get them out to buy some good quality tools and seeds. You’ll see, with the right tools and encouragement you too can have a lovely garden. Grow your own fruit boy!

Well ….! As you can imagine, Mr Cameron didn’t like that piece of advice at all. He had been to the Oxford college of abolished knowledge. The two fat boys had filled his heads with all kinds of woeful stories, even threatening to leave home if their fruit was reduced. It just wouldn’t do.

Dear readers. I can leave you all to finish the story and it isn’t a “happy ever after” ending.

MMT Proselyte, I’m very convinced by the desire to accumulate net assets. I’m also very convinced of the inanity of thinking that a viable (except in the immediate term) economy could be based on attempting to accomodate that desire on a net basis. Any viable system has to be one where people strive to do that but are constrained by a finite limit. Any attempt to do otherwise inevitably leads to the financial economy becoming disconnected from the real economy because the real economy is always grounded in the real finite world.

With regard to “don’t forget, MMT is big on targeted taxation incl on asset values, in such a way as to limit asset bubbles. Japan, needless to say, didn’t have such mechanisms in place”- So the idea is that some infinitely wise politically pure pannel of MMTers will oversee and be able to quench all asset bubbles whilst prudently pumping money in so as to appease the desire to accumulate net assets American dream ?

Ramanan, I’ve been totally with you on the need to avoid trade deficits. to my mind even if the people in the exporting nation never spend their USD, the trade deficit is still a great social evil. The fact that government deficit spending enables trade deficits is one of the key reasons for having the “arbitary fiscal rule” of balancing (over the long term) government spending and a wealth tax in my opinion.

Tom Hickey, I just want to reclarify- I think people and corporations should be freely able save at stages of their life when they can with a view to amassing wealth to pay for things at other stages or for expediencies. For individuals, the best way to cover expediencies late in life is to convert wealth into insurance and annuities early on in old age. The state should do everything to facilitate people in saving for and insuring for possible expenses in old age. The role of the state should not be to artificially inflate accumulated dynastic wealth by expanding the currency. That by definition does not result in pensioners spending more. By definition it results in ever more wealth being handed on to the next generation and so on. It is also a ponzi structure. It distorts capitalism and prevents capitalism from being able to serve its social purpose. There is a clamour for sound money. The only thing holding many people back from politically demanding sound money is the fear that all the money will get hoarded by an oligarchy. That is why “sound money” can only work in conjunction with a wealth tax as far as I can see. Any other tax type would get evaded by oligarchs. Inheritance tax is little use because as far as I can see how oligarchs pass on inheritance is by the old man making a loosing trade with the heir making a winning trade in the markets.

Tom Hickey, with regard your assertion that a non-expanding currency in conjunction with redistributative taxation would result in greater use of leverage- I think the opposit would be the case. In a general enviroment of expanding currencies, short term government surpluses can induce private sector indebtedness- but that is a very different scenario from one where all the major currencies are non-expanding (what I’m suggesting is needed). In a non-expanding currency with redistributative taxation, money for investment would have great scarcity value and earning potential. There would be plenty of lucrative earning possibilities for directly employing the money rather than lending it on to provide leverage. It is a glut of cheap money that fuels use of leverage.

Hi Stone,

“a glut of cheap money that fuels use of leverage.” A glut is a stock, you’re back into a stock here, do you want to be like this goofball: 😉

(Aside: I often wonder how mch better off we in US might be if he just kept to the clarinet and an Ayn Rand groupie vice civil service)

Stone, this is revealing, he and his ilk (sociopaths) think all this is just a “psychology” problem that is preventing loan origination, yes to him WE have the psychological problem. They think they have established this huge stock of reserves for we peons to come begging and sign up for, then all will be better…nice. This isnt even how credit works, but even so, it is now over 2 years that this stock of reserves have sat there to no effect and they still dont get it, talk about slooooow to pick up on things, stubborness.

Consider: Stock measures of “money” are useless to all but the unjust, you may not want to associate intellectually with this concept even in your limited way where you are hypothetically considering a policy of a fixed stock of “money” here.

The only thing that is holding things together over here is about a $100B+/mo. flow of NFAs to the non-govt sector created by current US fiscal policy, they (mainstream policymakers) are blind to this flow. Without this I swear it would be chaos over here.

Resp,

Ramanan,

Think of the US as running a current account deficit by delivering NFA to the rest of the world.

For the moment, assume a US government budget balance. That would mean that the US private sector is delivering NFA to the rest of the world, while generating negative NFA for itself.

From a pure MMT perspective, that’s not a good situation for the US private sector. You can frame in terms of either a dearth of private sector NFA, or a leakage in aggregate demand.

So now assume the government attempts to fill the private sector NFA gap by delivering NFA outward – i.e. by running a deficit.

Some of that government NFA delivery may end up net with the private sector, and some of it may add to the external leak by ending up net with the rest of the world.

It appears to me that the MMT criterion for such an operation is that the government continues to deliver NFA in this situation until employment has filled up and the inflation constraint becomes binding. When the inflation constraint becomes binding, the government starts to increase taxes in order to reverse the NFA delivery. The inflation constraint includes allowing for any effect that the exchange rate may have on imported inflation.

Viewed in this way, the external sector is a relatively minor conceptual adjustment to a closed economy MMT NFA mechanism.

Moreover, your concern about the nature of foreign delivered NFA as liabilities or borrowing is subsumed by the operation of the overarching NFA-inflation constraint mechanism. However, I do think the theory becomes more robust by assuming the government’s fiat control over interest rates is put into practice along with the inflation constraint/taxation criterion.

JKH,

Yes I understand such arguments.

Your point about viewing it as a “relatively minor conceptual framework adjustment” is what I am writing against. Many Post Keynesians point out that Keynes should have started from the open economy. And btw, Keynes seems to have understood balance of payments problems well. The recent meet of Finance Ministers and talks of currency wars is a proof of that.

Unfortunately it is not so simple JKH. Somehow current account deficits such as a few percentage of GDP appears minor. Over time, it builds up adding to the stock of net liabilities to the rest of the world and nations end up being hugely indebted to the rest of the world. 40% is bad.

The inflation constraint etc are imported but simply diverts the attention from important unsustainable processes which are building.

The supplying of NFA to the rest of the world is simply a restatement of Ben Bernanke’s the global saving glut.

There is a big danger in consolidating all sectors. One is told of the US as a single person and the rest of the world exporting stuff to her in exchange of worthless pieces of paper. However, this consolidation is dangerous. It totally hides the mechanisms happening.

Not only do nations import by increasing their liabilities to the rest of the world, they also import by selling assets – foreign reserves. In the latter case, is the importing nation “supplying NFA” to the rest of the world ? The payment is in some other currency.

Imports are due to demand from citizens. Imports put a downward pressure on demand. Imports just leave foreigners with IOUs which provide interest payments in perpetuity. If a nations “does not borrow” to pay for imports, why do foreigners earn interest ?

I agree with Alan Greenspan that the US is engaged in a dangerous game. However his reasons are completely crazy. He wants austerity which is a nonsensical solution. However, any doctrine which says expand fiscal policy without worrying about the external world is just overconfidence. Of course nations have biased their fiscal policy in the opposite direction of what is needed but they are just worried. “Net saving desire” of foreigners depends on various factors. It is not an innate desire. It depends amongst other things, the trade performance of the debtor nation. Foreigners may be impressed by the temporary deterioration of trade if there are good reasons for reversals.

Its also true that theoretically there is no upper limit to the external debt/gdp. However that rule is an exception and may not even be true for the United States. Foreigners may allow the external debt to keep building but at some point with probability 1, it will get embarrassing. Also there is no automatic mechanism for any adjustment. None.

Of course, none of what I am saying can be interpreted to be anti-fiscal. Good fiscal policy increases demand and consumers end up buying locally purchased goods. However, there is still a residual left – people also purchase foreign products. Different nations have different propensities to import. Also over time, this residual builds up and the effect of fiscal policy becomes less and less dilute.

The fiscal policy reaction function depends in complex ways on external debt and the currency movements. And so does the central bank reaction function. Keeping rates at zero is another overconfident doctrine. The currency movement also depends on the two. Just because the short term rates are exogenous doesn’t mean it is “exogenous exogenous”. (As an aside, zero rates is another overconfident proposal – in theory, taxes may be used to reduce demand but its impossible in practice to fine tune this).

There is a definite gap in demand post 1971. It is somewhat surprising that in the Gold Standard era, the growth was good.

Why is there so much talk of protectionism and currency wars etc ? This is because nations are worried about the external world. Just like everyone wants to be on facebook, nations cannot but be social with the rest of the world. They want a devalued currency because they want to be net exporters and the weaker currency helps them. But isn’t it contradictory that nations want a weaker currency and at the same time be worried about currency devaluations ? No, not at all.

Also its completely untrue that “twin deficits” is a myth. There was a post saying there is no correlation. A complex dynamical system can hardly be studied by simple tools such as correlation. It also puts the causality of external deficits causing budget deficits into trouble. One cant say A is correlated with B and B is not correlated with A.

Nations seem to be moving in the right direction about coordinated efforts. But the confusion with economic concepts prevents any rational solution. Its the only way to prevent further cracks in the foundations of growth.

stone, I think you need to start a political party. 🙂

I agree with Bill. Your macro is muddled, and I am afraid that if your party won and implemented your program, it would be a disaster for the nation. What you are proposing amounts to returning to some sort of fixed rate regime, which is what setting a limit on currency issuance amounts to. That never worked so well in the past, and it is not likely to work well again. Moreover, it did not prevent the wealthy from increasing their wealth either.

Ramanan, I think you are overlooking the fact that the US is a special case with a GDP of ~15T and the runner up with a GDP of less than 2T. The US not only runs the global reserve currency, its physical currency has been the world standard. The international underground economy prefers $100 bills, for example.

Floating rates generally work to correct trade imbalances, but they don’t work “as they should” in the case of the US and the ROW in the minds of some economists. The answer is that the world wants the US dollar, so it is overvalued. The US would like to see the dollar drop about 20% relative to the major currencies to rectify the trade balance. This is what currency folks see as the objective of QE 1 and likely QE 2. This is not lost on the ROW. As a result a trade war is in the making. This is unnecessary and stupid.

The MMT answer, which Warren argues eloquently, is that there is no problem with the US running full employment with large deficits and also accommodating a trade balance that is positive in real terms (imports exceed exports) by absorbing all the imports that the world want to send the US in exchange for holding dollars.

It seems to me that this is the optimal solution globally at this point. It it good for the US in that the US gets what it produces at optimal capacity/full employment, plus imports less exports, which benefits the US in real terms. At the same time it benefits other economies by increasing revenue from exports, which is what the trading partners of the US want. What is not to like about this?

stone @ 18:03, why didn’t this happen under the (fixed rate) gold standard? The Great Depression was a monster debt-deflation.

Tom,

“The MMT answer, which Warren argues eloquently, is that there is no problem with the US running full employment with large deficits and also accommodating a trade balance that is positive in real terms (imports exceed exports) by absorbing all the imports that the world want to send the US in exchange for holding dollars.”

I am afraid its a mere assertion. How big can the US net external debt get ? 50%, 100%, 200% ?

“Floating rates generally work to correct trade imbalances, but they don’t work “as they should” in the case of the US and the ROW in the minds of some economists”

Any proof ? Unfortunately neither fixed or floating does.

The US wants a devalued currency to reduce its trade deficits and perhaps go into a surplus. The fact that the latter may be morally incorrect is of no consequence.

The currency folks do not see it as a tool to devalue the currency. Rather they take positions because “QE is a sin”

“It seems to me that this is the optimal solution globally at this point. It it good for the US in that the US gets what it produces at optimal capacity/full employment, plus imports less exports, which benefits the US in real terms. At the same time it benefits other economies by increasing revenue from exports, which is what the trading partners of the US want. What is not to like about this?”

Maybe in an imaginary world. Do the math. Endemic trade deficits keep increasing indebtedness to the rest of the world. Its the quibble about not being indebted in your own currency is what I am anti-quibbling about.

Arguments such as the US being in the #1 spot ignore the fact that over time, others catch up. Who knows the Euro Zone nations become one nation ?

Unfortunately, arguments such as “all policymakers are silly” is incorrect. The simple solution of expanding fiscally is not an optimal solution. It risks being more indebted to the rest of the world. No nation would do that.

Ramanan,

“Not only do nations import by increasing their liabilities to the rest of the world, they also import by selling assets – foreign reserves. In the latter case, is the importing nation “supplying NFA” to the rest of the world ? The payment is in some other currency.”

The bilateral NFA position between two countries does not depend on currency any more than it depends on bond versus stock financial composition. It’s an accounting identity.

As usual, you raise some reasonable observations about CA deficit risk, but I don’t see where the presence of these risks contradicts the MMT interpretation of CA deficit sustainability. The latter doesn’t suggest CA deficits can grow to infinity any more than government deficits can grow to infinity.

R.,

Maybe another way of putting the question is why wouldn’t taxation as a response to domestic inflation deal with the CA deficit risks that concern you?

JKH,

The MMTers can always come back and say “where did we say that we are say that all current account deficits are sustainable?”. However its there everywhere indirectly. And neither have they discussed the sustainability and one hears “… Imports are benefits” Here is an MMT statement:

“The irony/tragedy for the US is, of course, we should welcome all such moves, open ourselves for virtually unlimited imports from anywhere in the world (with sufficient quality control restrictions- no poison dog food, contaminated wall board, etc.), and enjoy the tax cut that comes along with it so we have sufficient purchasing power to be able to buy all of our own domestic output at full employment plus whatever the rest of the world wants to net export to us.”

The only way to balance a deterioration of the current account is to make discretionary attempts to target a “primary surplus” on the balance of payments. It either reverses the indebtedness to the rest of the world or stabilizes the ratio net external debt/gdp. A miraculous escape is foreign assets earning more than foreign liabilities. However, that is a bet. Soon the net interest payments in one direction will catch up whatever the interest differential is.

Neoclassicals on the other hand, argue for primary surplus on the government finances! That IMF solution works sometimes because there is a tendency to reduce demand and hence imports (People have less income to buy imports). The IMF solution also stresses on export oriented policies but strongly stresses on the former.

Endemic trade deficits just lead to one situation: a growing public debt and a growing external debt – gold standard, fixed or floating. The currency adjustments do not automatically reverse the trend. Rather, discretionary efforts need to be made. But that is against the logic “exports are costs…”

The United States was once the Creditor of the Rest of the World. The number in 1971 +30%. That number is now around -25% to -30%. The net factor income went negative as well around 1994 but for some reason came back to being positive. Once the number goes negative, it just keeps increasing and the external debt keeps rising without a limit. The trouble is that foreigners may allow the process to go on for a long time, just like an equity boom and the devaluation is not smooth. One cannot keep saying imports are benefits etc.

Also I have avoided talking of inflation because even though it is important, it unnecessarily complicates the subject.

Ramanan: Who knows the Euro Zone nations become one nation ?

This is bordering on the ridiculous. The economic asymmetry is obvious, and the cultural and historical asymmetries greatly exceed it. I would say that the likelihood of another European war is greater than a United States of Europe anytime soon.

R.,

Good comment.

The important word in your quote is “want”.