I have received several E-mails over the last few weeks that suggest that the economics…

The fiscal stimulus worked but was captured by profits

I read an interesting briefing yesterday (October 13, 2010) from the latest Morgan Stanley “Daily Downunder” report Money for Nothing. I cannot link to it because it is a subscription service. The briefing is notable because while it is thoroughly mainstream in its tack, it does present for the first time an awareness that the underlying national income distribution in favour of an ever increasing profit share is problematic and will not sustain a stable recovery. The report also clearly demonstrates that fiscal policy promoted real income growth over the last few years – the only source of private income growth – but this growth has been captured by profits without commensurate growth in employment. The argument resonates with earlier blogs that I have written and confirms two things: (a) the deficit terrorists who want to push for increasing fiscal austerity are dangerous and if successful will push the world economy back into recession; and (b) apart from sustaining the fiscal support for aggregate demand and private saving there needs to be a comprehensive redistribution of income towards the wage share. As a first step a major policy intervention focused on job creation will help achieve that desired redistribution. But more structural policy interventions are required to reverse the neo-liberal attack on the wage share. Once we realise that we have to reject the whole logic of neo-liberalism. That is the challenge – and the necessity – in the period ahead – if broadly shared prosperity is to return.

The Morgan Stanley briefing is focuses on trends in the US and they conclude that:

Business was the biggest beneficiary of policy stimulus: it didn’t have to pay for the recovery. Consequently, the profit recovery was strong even though the growth recovery was weak. If corporates don’t start ‘paying’ – hiring and, to a lesser extent, investing – then expect a double-dip. If they do start to pay, the recovery will continue, but it won’t be as profitable as the first phase of the expansion. The Great Swap that ended the Great Recession involved a big transfer of income from the public sector to the private sector. The ultimate beneficiary was corporates …

I found this interesting because it is rare that a mainstream research unit will ever make that sort of admission. It also resonates with arguments that I made for several years – that while the origins of the economic crisis are many (and interrelated) the underlying income distribution dynamics that the neo-liberal era promoted were unsustainable and remain so.

Please read my blog from early last year – The origins of the economic crisis– for more discussion on this point.

In the long period of growth leading up to the crash, there was a systematic, government-aided redistribution of national income from the wage share to the profit share which in itself allowed for several destructive and ultimately catastrophic dynamics to emerge.

Here is some background to the Morgan Stanley analysis from an Australian perspective. The trends outlined have been replicated in most advanced nations over the same period (with nuances of-course).

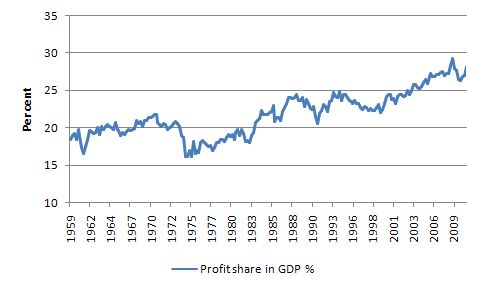

The following graph shows the evolution of the profit share in Australia since 1959 (per cent of GDP). The data is available from the Australian Bureau of Statistics.

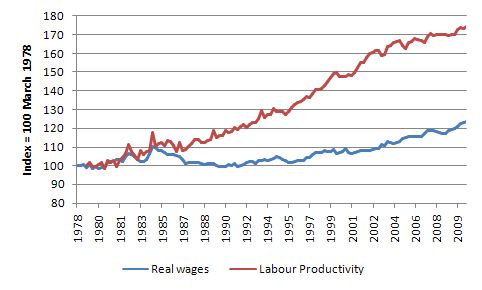

The next graph shows the evolution of real wages (indexed to 100 in December 1978) and GDP per hour worked (in the market sector) – that is, labour productivity for Australia. I could produce similar looking graphs for most advanced countries over this era which show the common trend towards an increasing gap between real wages growth and labour productivity growth. In Australia, real wages fell under the Hawke Labor government Accord era which was the beginning of the government-sponsored fraud against the workers.

Recall, that the Labor government argued that the boost to the wage share in the mid-1970s had “caused” the sharp rise in unemployment in the second-half of the 1970s – which meant they had bought the mainstream lie – the so-called “real wage overhang” argument. They argued that by redistributing national income back to profits within the Accord incomes policy framework the private sector would increase investment and solve the malaise. It was based on flawed logic.

The private sector did not respond in real terms but pocketed the largesse being redistributed to them by the government policy. Further, the centralised nature of the incomes policy only reinforced the bargaining position of firms by effectively undermining the traditional trade union movement skills – those practised by shop stewards at the coalface. The rot had set in.

Under the conservative Howard years (1996-2007) there was some modest growth in real wages overall but nothing like that which would have justified by the growth in labour productivity. In addition, the harsh industrial relations legislation that the conservatives introduced further weakened the trade unions and reinforced the trend towards an ever-increasing profit share at the expense of the workers.

In March 1996, the real wage index was 103.4 while the labour productivity index was 132.7 (Index = 100 at December 1978). By the onset of the crisis (February 2008), the real wage index had climbed to 119.3 (that is, around 16 per cent growth in just over 12 years) but the labour productivity index was 170. So the long growth period after the 1991 recession had been associated with the ever-increasing gap between labour productivity growth and real wages growth.

In the most recent period (June 2010), the real wage index was at 125.3 while the labour productivity index was at 174.3 .

I have constructed the indexes to start at 1978 but that was about when the trend emerged. Prior to this gap emerging in the late 1970s real wages growth kept track with the growth in labour productivity which ensured there would be no “realisation” crisis – that is, to ensure that the consumption demand could keep pace with actual output and the goods produced were sold.

As the gap started to increase the capitalist system encountered a problem. What happened to the gap between labour productivity and real wages? The gap represents profits and shows that during the neo-liberal years there was a dramatic redistribution of national income towards capital. The Australian government (aided and abetted by the state governments) helped this process in a number of ways: privatisation; outsourcing; pernicious welfare-to-work and industrial relations legislation; the National Competition Policy to name just a few of the ways.

Governments around the world introduced similar variants which were designed to ensure an increasing share of real income landed in the hands of capital.

The question then arose: If the output per unit of labour input (labour productivity) is rising so strongly yet the capacity to purchase (the real wage) is lagging badly behind – how does economic growth which relies on growth in spending sustain itself? This is especially significant in the context of the increasing fiscal drag coming from the public surpluses which started to squeeze purchasing power in the private sector over the same period (more or less depending which country we are talking about).

This munificence (income redistribution towards profits) manifested as the ridiculous executive pay deals that we have read about constantly over the last decade or so. It also provided the financial sector with its gambling stakes that exploded into an array of increasingly risky products. The “financialisation” of the global economy would not have been possible if real wages had have grown in line with productivity.

As noted, the realisation dilemma of capitalism was in the past moderated by the fact that the firms had to keep real wages growing in line with productivity to ensure that the consumptions goods produced were sold. But in the recent period, capital has found a new way to accomplish this which allowed them to suppress real wages growth and pocket increasing shares of the national income produced as profits.

The trick was found in the rise of “financial engineering” which pushed ever increasing debt onto the household sector. The capitalists found that they could sustain purchasing power and receive a bonus along the way in the form of interest payments. This seemed to be a much better strategy than paying higher real wages. The household sector, already squeezed for liquidity by the obsession in building national government surpluses were enticed by the lower interest rates and the vehement marketing strategies of the financial engineers.

The financial planning industry fell prey to the urgency of capital to push as much debt as possible to as many people as possible to ensure the “profit gap” grew while the output produced was continually being sold. And greed got the better of the industry as they sought to broaden the debt base. Riskier loans were created and eventually the relationship between capacity to pay and the size of the loan was stretched beyond any reasonable limit. This is the origins of the sub-prime crisis.

The fact that governments were able to run surpluses in this period is no indicator of their financial acumen. Rather, it was because the economic growth was being driven by ever-increasing private indebtedness. It was a folly to think we could sustain that growth strategy. As we know it imploded with severe consequences for the very cohort that has been squeezed by the income redistribution – the workers.

Anyway, that is the background to the Morgan Stanley briefing. They are focused on what has been happening in the recovery.

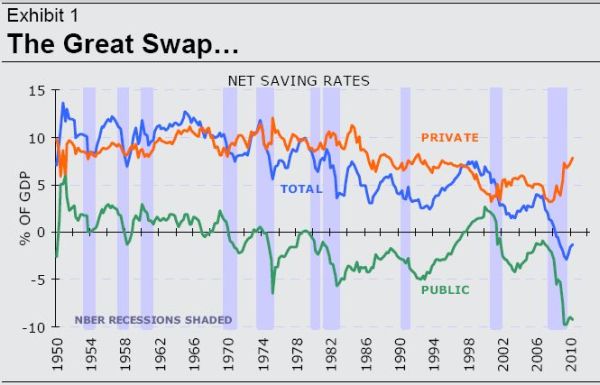

The Morgan Stanley briefing provides the following graph (their Exhibit 1) which “shows how saving was swapped in the US. Private sector saving (households and business) has increased as public sector saving fell. (The net effect, by the way, was to reduce total saving. America had never saved so little at end-2009”.

You will note the mainstream bias in the depiction of the national accounts underpinning Exhibit 1. The “public saving” is really the budget outcome (so a surplus is positive and deficit negative – in relation to the zero line on the vertical axis).

It bears repeating – Modern Monetary Theory (MMT) does not construct budget outcomes in this way. It makes no sense to call a budget surplus a contribution to “national saving”.

To see why it is an erroneous description of the monetary implications of a sovereign government running a budget surplus think about what saving means to a household. When individuals (households) save they postpone current consumption because they want to have higher future consumption. Saving is a time machine for non-government entities to allow them to transfer consumption across time. The obvious motivation is that they face a budget constraint – as users of the currency – and have to forgo consumption now if they want to save.

For the monopoly issuer of the currency – the sovereign government – there is no such financial constraint on spending. It does not have to forgoe spending now to spend in the future. It can always spend what it desires at any point in time irrespective of what it did last period or any previous periods.

Further, when the government runs a budget surplus the purchasing power it extracts from the non-government sector doesn’t go anywhere – it is not stored in any account to use for later purposes. Just as a budget deficit (excess of spending over tax revenue) creates net financial assets (in the currency of issue) a budget surplus destroys net financial assets.

There is no store of purchasing power when the government runs a surplus nor does it make any sense for a government to think in those terms. It can always spend what it likes.

So it is nonsensical to characterise a budget surplus as being “saving”. It is more correctly described as the destruction of non-government purchasing power and non-government net financial assets (wealth).

Once you think of budget surpluses as “national saving” in an analogous way to private saving you are sliding into the slippery and false world of the theory of loanable funds, which is a aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking. This myth underpins the erroneous theories of financial crowding out and is a central implication of the false household-government budget analogy that is at the core of the mainstream approach.The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

So the “total” saving line (blue) in the graph is a false construction.

But if we can go beyond that, the Morgan Stanley Exhibit can be interpreted in the MMT way – a government surplus (deficit) has to be equal to the non-government deficit (surplus) – $-for-$, Yen-for-Yen, Euro-for-Euro. It is not my opinion or prediction – it is an accounting fact. If you want the government to run a surplus (and can engineer that) then you have to be also wanting the non-government sector to be running a deficit (in a flow sense).

That also means that in a stock sense, you have to be supporting ever-increasing non-government sector indebtedness which is distributed between the external and private domestic sectors depending on the balance on the external account. As noted above, pushing the private domestic sector into ever-increasing levels of indebtedness it is not a sustainable growth strategy.

The Morgan Stanley briefing says:

The external deficit fell because private investment spending fell to a post-war low share of GDP. A financing problem had been swapped for an under-investment problem.) Much of the decline in public saving (the larger deficit) fed into household income. Part of this was passive, part discretionary policy.

What do they mean by that?

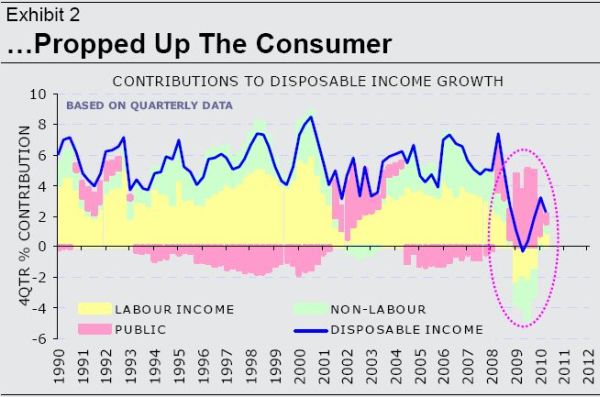

They show in their Exhibit 2 (reproduced below) “the contributions to disposable household income from labour income, non-labour income, and the public sector”. The trends for Australia that I outlined above are evident in this US graph in the period leading up to the crisis. But if you examine the “recovery” period you can see that “The public sector was the household sector’s only source of income last year.”

So this is a mainstream outfit testifying (empirically) that the fiscal stimulus was the only source of growth in private disposable income in 2009. That is a powerful statement of the effectiveness of fiscal policy in itself.

Where do the deficit terrorists go with that conclusion? Answer: nowhere – they should just go away. Imagine what would have happened without the public stimulus? It would have been an unmitigated catastrophe. The problem is that the move to fiscal austerity is evidence that the deficit terrorists are winning the public debate and this support will disappear – long before the private economy is capable (willing) of filling the gap. A double-dip recession in countries that implement fiscal austerity is almost inevitable now.

The Morgan Stanley briefing then asks how did the fiscal support “help business”. They conclude that:

It meant that business could take out costs – notably labour – without wearing the consequence of ongoing recession. There was a recovery, but corporates didn’t have to pay for it.

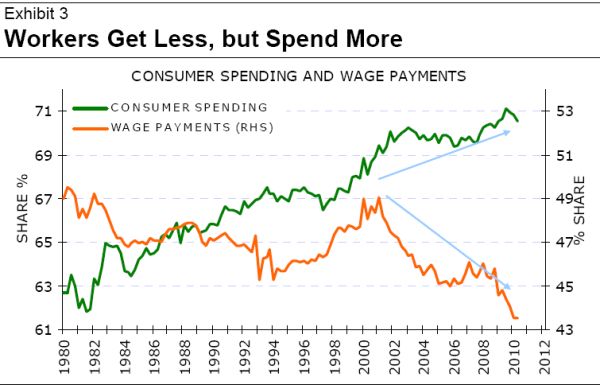

They then produce Exhibit 3 (for the US), which is an alternative way of expressing the second graph I provided above (showing the evolution of the real wage and labour productivity indexes in Australia). Exhibit 3 shows “a long-term view of wages as a share of GDP and consumer spending as a share of GDP”. They suggest the declining wage share has been “presumably due to structural factors (globalization, the opening up of the Asian labour force, labour market deregulation, labour-saving technology etc)”. All these factors have been influential but we cannot understand the role that government policy has played in allowing the “market” sector to undermine working conditions unfettered by regulation and protections.

The Morgan Stanley briefing concludes:

What made this labour cost decline so profitable for corporate America is that consumer demand remained strong even though the wage share was falling. In fact, consumer spending as a share of GDP is now near all-time highs. Put another way, corporate America was able to reduce labour costs, but not face the consequence in terms of weaker consumer spending.

As noted above this spectacular coup was facilitated by the growth of the financial sector aided by the massive deregulation and reduction in responsible oversight by the financial authorities in government. The financial sector was only able to grow in the way it did because of the lack of appropriate oversight by the government. The government under the spell of the neo-liberals ultimately caused the crisis. And … the brief return of active fiscal policy intervention – which was eschewed during the deregulation period – was the only thing that saved the world from a worse meltdown that we have had.

Those lessons are very clear from a correct understanding of the period leading up to the crisis and what has ensued since. The mainstream economics profession are missing in action when it comes to these insights. The only consistent body of macroeconomic thought in this regard – both before and after the crisis – is MMT (sorry! I only deal in facts). The problem is that the mainstream macroeconomics profession, blithely unaware of their ignorance are now back in the business of advising us on what should now happen. Their prognostication and advice will be destructive as it was in the period prior to the crisis.

The Morgan Stanley briefing notes that the “trend decline in the household saving rate, which commenced in the early 1980s” provided a:

… a major tailwind for corporate margins (because consumer spending is the largest demand-side component of GDP, while wages are in aggregate the corporate sector’s largest cost).

Yes, but this sort of growth strategy is ephemeral and an attempt to restore those trends will bring the recovery unstuck fairly quickly.

The Morgan Stanley briefing understands this and also the role that fiscal policy has played in providing a temporary reprieve to the underlying destructive trends:

Over the past 18 months, however, the household sector has seemingly achieved an impossible trinity: the wage share fell, consumer spending remained elevated, while the saving rate increased. What happened? This was possible because of the Great Swap from the government. Direct cash payments from the government now exceed direct taxes paid by consumers. Households now get the government for ‘free’.

Note their reference to households getting “government for free” which is in contradistinction to the Ricardian nonsense that usually comes from the conservatives and claims that the households “know” they will have to pay for the deficits sooner or later via higher taxes and so they try to save more now to provide the means to meet the higher future imposts.

The reality is as the Morgan Stanley briefing depicts it. No deficit is ever “paid back” with higher future taxes. The injection of liquidity by the deficit in this period does not have to be funded now or in the future – it is a net creation of financial assets from the government sector (a flow) which provides a boost for aggregate demand and hence income growth and provides the capacity for the household sector to enjoy increased capacity to save. If tax rates rise in the future it will only be because governments want the private sector to have less purchasing power (perhaps to control inflation pressures). They would have nothing to do with paying back any past deficits

The other point that is that the fiscal stimulus has allowed the corporate sector to enjoy a surge in profits without any substantial pressure on costs.

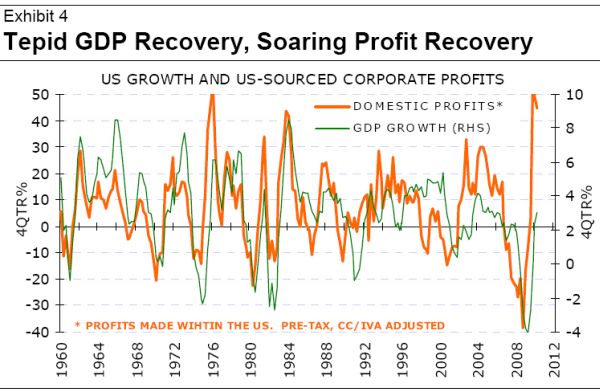

They provide Exhibit 4 (reproduced next) to show this point.

The Morgan Stanley briefing concludes:

This was a boon for business. Corporates enjoy operational leverage – rising sales being spread over fixed costs – so the amplitude of the profit cycle is always larger than the GDP cycle. Exhibit 4 shows GDP growth and top-down profits … this profit recovery has been more than just operational leverage. The profit recovery was largely a ‘cost out’ story. Top-line revenue rose, but the spectacular rise in margins was due to cost control. Hours worked kept falling until December 2009 quarter. There was an exceptionally strong profit recovery despite the exceptionally weak GDP recovery because business enjoyed a recovery that it didn’t have to pay for.

Further “(a)ll of America’s income growth last year accrued to corporates” which has “never happened before”.

That observation should be understood in the context of real “gross domestic income excluding profits in the June 2010 quarter remains below year ago levels”. This allows you to understand – to some extent – why unemployment in the US remains persistently anchored to the 10 per cent level with little employment growth evident.

The fiscal policy intervention has clearly increased real income but it has all been expropriated by the private sector in the form of a recovery in profits.

This is an example of how the design of the fiscal intervention matters. The first thing the US government (and all governments) should have done as the crisis was becoming evident was to offer a minimum wage job in the public sector to anyone who wanted one. That is, implement a Job Guarantee.

By implementing this “automatic stabiliser” in the form of a flexible buffer stock of jobs the government would have ensured that at least a minimum (socially desirable and adequate) income could be available to all workers irrespective of what happened in the private sector. In that sense, the government would have underpinned the capacity for the workers to continue to enjoy a minimum consumption level without increasing debt. This policy would have put a much higher floor in the fall in aggregate demand. The deflationary consequences of the huge rise in unemployment should never be underestimated.

By allowing unemployment to rise so substantially, governments have ensured that workers in general are being excluded from the benefits of the fiscal intervention.

The Morgan Stanley briefing summarise this outcome in this way:

… corporates will not enjoy another year of recovery that they don’t have to pay for. With the public sector’s support for consumers now fading, the consumer will only be able to sustain the recovery if private income growth recovers – and the largest component of that is labour-related. Put another way, if corporate America doesn’t start to hire, profits will suffer in a double-dip. If they do hire – the base case – tepid recovery continues, but margin improvement will be much less substantial that last year. This, in my view, points to current earning forecasts being too high under almost any scenario. In a more-of-the-same growth scenario, too high; in a double-dip scenario, far too high.

So it is clear what is going on now. If the fiscal stimulus declines under the political pressure being applied by the deficit terrorists then the growth support disappears. What will replace it? Answer: more broadly motivated private spending growth.

How will that occur? Answer: there needs to be a strong recovery in employment which means that firms have to start hiring rather than pocketing the profits that have risen courtesy of their increasing proportionate claims on national income.

The problem is that the proponents of fiscal austerity are also the same lobby that has lobbied governments to introduce policy structures that have suppressed real wages growth and which have have undermined full-time employment and, instead, promoted an increasing incidence of precarious low-wage employment. All these trends are interconnected and causal.

So what is needed is a comprehensive change in policy direction. Fiscal policy has to be used to provide continued support for aggregate demand. Industrial relations legislation has to reverse the trend towards an increasing profit sector. Financial regulation and wholesale restructuring and reform of the financial sector has to be introduced to reduce the size of that sector and to force banks to serve public purposes.

I provide some ideas in the following blogs – Operational design arising from modern monetary theory and Asset bubbles and the conduct of banks – on how financial sector reform should proceed.

The problem is that I see no trend towards this emerging. I only see more of the same which pushed the world economy into this mess.

Conclusion

There has to be a much more vocal public opposition to the distributional dynamics of neo-liberalism. To restore stable economic growth there has to be a major redistribution away from profits back to the wage share. That will require a reversal of some of the more pernicious legislative attacks on wages and conditions. Mechanisms which allow workers to proportionally enjoy the fruits of labour productivity growth will have to be restored or reconstructed. In the past, strong unions played this role. What will play this role in the future remains unclear.

I now have a busy day ahead in London – my second last day here. The weather is pretty dank and cold but dry.

Last night I saw a play – War Horse – at the National Theatre in London, which was one of the most creative experiences I have had the pleasure of witnessing. I believe it is heading to the US – in March 2011 it begins at the Vivian Beaumont Theatre at the Lincoln Center, New York. I recommend it highly – a fantastic night and the puppetry is something to see.

That is enough for today!

Bill, the frequent link to “Asset bubbles and the conduct of banks” is clearly a key plank of the case you make that a build up of savings does not lead to asset bubbles. You say in that frequently linked to post that the Japanese experience shows that savings can build up in a zero interest rate environment and no asset bubbles result. Are you saying that the Yen carry trade did not lead to 1T USD of Japanese savings being pumped into asset bubbles in US sub prime, Irish housebuilding etc etc? The financialization that you wring your hands about (quite rightly) seems to me dependent on the build up of savings that you advocate.

A contributory factor to the profits rise could be employer uncertainty. I’ve seen surveys done in the U.S. which show that one of employers’ main concerns is uncertainty about tax and regulation. If employers are less certain about what profit they’ll make in two or three years, they’ll want guaranteed extra profit THIS year before they get out of bed in the morning.

Also Bill says that JG “would have ensured that at least a minimum (socially desirable and adequate) income could be available to all workers. . . . In that sense, the government would have underpinned the . . . consumption level without increasing debt.”

The problem with that argument is that the unemployed already enjoy a “minimum socially desirable” income via unemployment benefits (at least in most European countries). In other words JG has little effect here. Alternatively if JG wages are much above benefit levels, then that increases the attractions of JG relative to normal jobs. And that tends to create JG type work AT THE EXPENSE OF normal employment, particularly low paid normal employment. Calmfors, the Swedish labour market economist, called this the “iron law of active labour market policy”. Roughly speaking, the iron law states that attractive wages on JG type schemes give rise to the above problem.

Ralph,

I wouldn’t say unemployment benefits are ‘minimum socially desirable’, more ‘minimum we can get away with without a riot’.

Nothing wrong with the attraction of JG jobs vs. normal jobs. That’s how you put a floor under job standards. Private jobs have to be a lot more attractive and anything else should go to the wall.

There is no reason why a decent society should put up with people making profits from poor jobs. By allowing people to make a profit of others backs, society expects a return in terms of the quality of that job and its environment.

Interesting article. I’m understanding better the merits of a JG vs Warrens proposal of tax cuts.

Both are deficit stimuli but JG promotes more equitable distribution of wealth. When Warren proposed JG, wasn’t he accused of trying to run a Nazi slave labour scheme? There are no baseless, fact less arguments these dogs won’t stoop to.

Anyone care to place odds on the private sector hiring at the expense of their profits?

The folly of the neo-liberal economic arguments are so obviously exposed during a down turn. When we do finally get through this economic mess and credit starts growing again. I fear their theories look plausible and all will be forgotten. The chance of implementing MMT will fade.

I’m starting to think our best hope is for the deficit terrorists to fail completely. That will be no consolation to millions unemployed.

JG makes more intellectual sense since it is self-balancing – particularly if you extend it to a Universal Benefit that is paid to all as long as they work. Then all jobs that are currently minimum wage become equivalent to ‘volunteer’ jobs and ‘guarantee’ jobs. Attracting people away from JG jobs then becomes a matter of a couple of dollars an hour rather than eight or ten.

However slashing direct taxes has more popular appeal and therefore more political chance of getting implemented. The difficulty is how to reverse the measure when the economy heats up again. Politicians like slashing taxes, but resort to complexity and stealth to put them up again.

“Alternatively if JG wages are much above benefit levels, then that increases the attractions of JG relative to normal jobs. And that tends to create JG type work AT THE EXPENSE OF normal employment, particularly low paid normal employment. Calmfors, the Swedish labour market economist, called this the “iron law of active labour market policy”. Roughly speaking, the iron law states that attractive wages on JG type schemes give rise to the above problem.”

Ralph,

I am surprised. Have you been captured and at this minute being tortured by enemy forces? This sounds a typical bogus mainstream argument. “Iron law” ha ha ha. Maybe Calmfors is now on Bills hit list of discredited economists.

How can jobs be crowded out by stimulus spending on JG? obviously the economy is stimulated and there is more demand for the work of non JG workers. If employers want to keep workers they will have to redesign jobs and increase salaries. Maybe take a cut in profit. This dream keeps me sane. When wages are raised the economy gets more stimulus, how grand is that?

With a JG scheme, there will be lots of lovely lolly floating around for the non-government sector to cream off. Companies with well structured jobs paying decent salaries will still be able to enjoy the cream. Maybe a lot of the crappier jobs are done by JG workers.

When we do finally get through this economic mess and credit starts growing again.

But we aren’t through it yet, and I suspect there are some very big shoes yet to drop. We could even still see a global depression, and I can think of several scenarios that would provoke it, economic and political. If several of these shocks were to converge, the result would be catastrophic. I don’t see a recovery locked in by any means and if there is one it will be slow and extended with a lot of social unrest due to the pain. It’s just not possible to walk away from a long financial cycle as though it didn’t happen.

Bill:

This is a great post and points out that 1) due to the leakage of stimulus to the corporate sector, a larger stimulus than what might “classically” be estimated is needed, 2) stimulus delivered via the private sector, rather than the government is inherently inefficient.

I am shocked, just shocked that the Morgan Stanley report didn’t recommend increasing corporate taxes to capture a portion of “… a recovery that it didn’t have to pay for. ”

There are interesting dynamics in the econ/political debate in the US – the Fed is split, I think everyone knows that a “double dip” will be disastrous, the FX markets are going to start going crazy. There is pressure for a 2nd stimulus, but until the November election, no one is saying a thing regarding another stimulus. And if the state governments start cutting, there is obviously going to be a severe downturn in demand.

The other way the US is committing economic suicide is over China. The only thing keeping households alive is cash flow (through the 1980s-2000 by increase in private debt to offset income losses), so how does increasing import prices help households?

Is it reasonable to assume that US industry will “instantly” step in to hire and produce the goods that China is providing? And since we are asking China to raise their costs (and presumably their prices), clearly the expectation would be that whatever the US could produce for internal consumption would be at a higher price than what is currently provided? This is insanity.

Considering their previous commitment to raising wages, I feel this push on China to raise the RMB has nothing to do with increasing US incomes – may be as short-term as an FX arbitrage play or simply ideology trumping thought.

Food for thought.

After a major policy shock, behavior responds with two types of reaction. One is a negative reaction that attempts to defend against the shock and if policy counters there is a conflict. The second reaction is a positive one, where behavior reinforces the shock and collapses internally towards a resistance bottom (i.e., poverty/survival). For living beings this type of reaction is a distress loop with a chain of unidirectional decline. For humans this is facilitated by a mindset with an ideological framework that positions an erroneous policy that benefits a minority with priviledge (political, religious, cultural, etc.). This mindset reinforces the policy shock such as “austerity measures that are good for you”, forcing human behavior to think that pain and suffering is virtuous and neccessary because the policy is realistic and “of the right logic ” or “rational”.

The ideology of the mindset nullifies a negative reaction to fight the policy by promoting the image of the priviledged “rich and famous” as representatives of an ideal and normal outcome. This is done with analytical reports, news, pictures, videos, movies and internet sites among other media. They imply; “look what you can be! How come you are not one of them? Try harder!” If you fail as with austerity it is nearly certain, then they say with contempt, ” There is something wrong with you!……You are incompetent, lazy and lack skills”! At the end you believe and accept that your misery and dispair is the outcome of your own failures and thus “you are enjoying the consequences and friuts of your labor”!

History is full of prolonged episodes of such decline and “dark ages” of distress.

Bill, it was obvious from the get-go that the major portion of the stim would flow almost directly to corporate coffers, failing to benefit employment much or to lift consumer demand. In fact, this was one of the early and persistent criticisms that the US stim was another gift to business.

This is a reason that some proposed a payroll tax holiday instead in order to put the half the funds directly into the hands of workers. That would have lifted demand and created space for rebuilding balance sheets. However, even here business would pick up the other half, but the argument is that at least some businesses would invest that.

This seems to be a point of contention between your approach, emphasizing spending, and Warren’s approach of chiefly reducing taxes. Care to comment on it?

On top of JG, the UK should establish an ‘Economic Stimulus Payment(ESP)’.

It should be payed:

1) to low paid workers / carers (like those who are already entitled to Working Tax Credit)

2) on a quarterly basis,

3) living in regions and boroughs which have low inflation and high unemployment.

4) whenever un(under)employment (excluding JG) is above the MMT threshold.

5) Payment is entirely discretionary, so it is not a benefit or entitlement.

Unemployment in communities can be measured accurately enough, and inflation can be estimated well enough at a regional level to make the stimulus effective without undue inflationary pressure. These people can just spend this into the economy or pay off their debts.

So if employing people is so lucrative, why is the unemployment rate so high?

Neil, you claim that “Private jobs have to be a lot more attractive and anything else should go to the wall”. You could make a fortune here. Private sector employers (who are in competition with each other for labour) would love to know how to make their jobs more “attractive”. You tell them how to do it (other things, profit in particular being equal) and you’ll be handsomely rewarded.

As regards forcibly upping wages at the expense of profit, we’d need a huge “wages and price control bureaucracy” to do that. OK in war time, but not otherwise, I think.

Andrew, thanks for your concern at the possibility that I’ve been captured by deficit terrorists and am being tortured. I’m actually OK (I think). You ask “obviously the economy is stimulated (by stimulus directed at JG) and there is more demand for the work of non JG workers.”

My answer is that where an economy can take more stimulus without inflation, there is no point in directing the stimulus at JG, because the latter are relatively unproductive jobs. The stimulus is far better directed at standard public and private sector output and jobs.

Rather like Neil, you want to “redesign jobs and increase salaries”. Sounds great. As I said to Neil, there’s a fortune awaiting you here.

Ralph,

Isn’t it equally likely that for every business made less competitive by the JG, there will others made -more- competitive? That’s what regulations do–banning child labour was a catastrophe for companies whose business models depended on it, yet it was probably a boon for companies who didn’t, and I think the evidence is clear the overall economy somehow muddled through. Conditions change all the time, for lots of reasons, making some companies less profitable, others more profitable–the overall effect is as likely to be neutral as it is to be positive or negative.

And upping wages at the expense of profit is precisely what happened throughout the first half of the 20th century, no price controls needed. When unions were strong, certain companies were better able to compete than others. Smashing unions simply made other business models more competitive while increasing the share of profits versus wages. Still waiting on it to make us all better off, but I’m sure it’ll kick in before too long.

“Private sector employers (who are in competition with each other for labour) would love to know how to make their jobs more “attractive””

Let’s think now. Let’s say we create a load of public sector vacancies that are near where the individual lives, provide a reasonable 37 hour week, perhaps contribute to a pension, train you do do something useful, provide work that is at least mildly interesting and pays a living wage.

I would think natural selection would do the rest.

Slight typo there that should be ‘non-private sector’ vacancies. I would include any useful work – voluntary positions, ‘big society’ work, and caring for the elderly or the young.

“When we do finally get through this economic mess and credit starts growing again.

But we aren’t through it yet, and I suspect there are some very big shoes yet to drop. We could even still see a global depression, and I can think of several scenarios that would provoke it, economic and political. If several of these shocks were to converge, the result would be catastrophic. I don’t see a recovery locked in by any means and if there is one it will be slow and extended with a lot of social unrest due to the pain. It’s just not possible to walk away from a long financial cycle as though it didn’t happen.”

This should be interesting Tom.

With private sector credit growth having reached a level just before the GFC that has no historical precedent, exactly how much credit growth do we expect to see returning any time soon? The last giant peak just before a catastrophic fall was the crash of 1929 and that was significantly smaller as a % of GDP to that which was recently reached. Further, I believe that in the 1929 episode, much of that excessive debt was held by a few tens of thousands of individuals for the purpose of speculating in the stock market. This time, much of the debt is being broadly held by the public at large – the consumer has consumed too much debt and the consequences have been severe. What it going to entice them to return to pre-GFC levels – and then beyond? Consumer credit in the US is still falling. Here in Australia, it has never recovered from the fall it took during the GFC and is currently travelling sideways, more or less.

I’m a bit sceptical of the prospect of credit growth soon booming once again to the extent that it sets another new record by exceeding 300% of GDP. I think for a long time to come, if we want strong, sustained growth it will have to be driven by broad growth in workers (consumers) incomes rather than by further growth in credit. For this to occurr, we are propably going to need the union movement to regain much of the former strength and membership density it has lost over the neo-liberal period.

Another thing to consider is the marginal tax rate (in the US). A payroll tax of 15% and marginal tax rates for even modest paying jobs at 25%. If the stimulus spending did result in increased incomes, the government would quickly recapture the money in the form of greater tax revenue. So those are your two choices under the current economic environment: the stimulus spending will end up as corporate profits or tax revenue. This is why I favor the payroll tax holiday. This will increase the income of workers, allow the money to stay in the economy longer (due to lower tax collection), and increase aggregate demand to hopefully drive up private sector employment to give workers greater bargaining power. We do need more infrastructure spending and a JG but these will not solve wage distribution and long term economic problems.

As an aside, it occurs to me that, for a government to match its deficit spending with debt issuance could be considered ‘currency manipulation’. Is this realistic?

“I think for a long time to come, if we want strong, sustained growth it will have to be driven by broad growth in workers (consumers) incomes rather than by further growth in credit. For this to occur, we are probably going to need the union movement to regain much of the former strength and membership density it has lost over the neo-liberal period.”

I have worked for a US MNC as a white collar worker for 16 years. One of the conditions of employment was to sign an exemption against joining a Union. It seemed a good idea at the time. As a white collar worker, I believed I was on the better end of the pointed stick. In my naivety I thought I would benefit by keeping Unions in check.

As my career progressed. Despite several promotions, stock awards and pay rises. My working conditions and quality of life were not improving anyone near expectation. Looking at the senior management echelons, I was surprised to see many individuals retiring wealthy in their early 40’s.

When the illusion of common prosperity evaporated. It was clear everyone below Director level was being shafted mercilessly. I yearned to join a white collar Union. Alas, it is against the terms of my employment. Laws in many countries need to change, to outlaw companies discriminating against Union workers.

The irony is, this MNC is regarded as one of the finest companies to work for. Winning HR awards year after year. It’s a pity the employees are not seeing it exactly the same way.

Lefty says:

Friday, October 15, 2010 at 7:12

“I’m a bit sceptical of the prospect of credit growth soon booming once again to the extent that it sets another new record by exceeding 300% of GDP. I think for a long time to come, if we want strong, sustained growth it will have to be driven by broad growth in workers (consumers) incomes rather than by further growth in credit. For this to occurr, we are propably going to need the union movement to regain much of the former strength and membership density it has lost over the neo-liberal period.”

We don’t really want credit growth returning to pre-GFC levels, do we? After all, it was such leverage that got things out of hand in the first place.

I’d argue for better credit pricing. If the US really wants to get itself out of this hole they really ought to temporarily take some independence away from the Fed and raise rates to around 2% because 0% is simply a green light for banks and big business to hoarde cash and ride the yield curve. Hence why company profits are booming yet unemployment is not falling. Fiscal and monetary stimulus is indeed falling into the hands of those who don’t really need it.

The Govt needs to take responsibility away from the Fed who will now embark on all sorts of silly experiments of QE and other hair brain near-sighted schemes because they have no ammo left and are the only power vested to deal with the recovery.

I still believe the best form of stimulus would simpy have been to cut taxes with focus on the middle income bracket plus a handout for lower earners. The waste in various stimulus schemes has been eye-popping and simply shifted wealth from public to big-end private hands.

Oh yeah, and let’s build up the unions again, great point. It has taken decades to crush those corrupt communist hostile wharfies, BLF, tanker drivers etc. A handful holding the country for ransom and displaying more greed then even the best of the NL’s.

Ultra-leftist ideals are dead and have been stamped out of Western political and union organisations for a simple reason; no one wants those loonies running the world.

I assume that the Aussie and US graphs (on profit share, real wages, productivity growth and deficit propped up consumer spending), could be interpreted as a general image of OECD development. In these graphs one couldn’t find much support for lower wages as a remedy for unemployment, one could say rather the opposite. But its probably easier to talk about pseudo issues like labor market frictions.

Ray,

“We don’t really want credit growth returning to pre-GFC levels, do we? After all, it was such leverage that got things out of hand in the first place.”

Exactly. But this was a chief driver of economic growth and will need to be replaced.

“The waste in various stimulus schemes has been eye-popping and simply shifted wealth from public to big-end private hands.”

Are you talking about Australia or somewhere else? I have been in a position to witness the delivery of some excellent BER projects that will deliver concrete benefits for decades.

You are aware that problems with Australian government stimulus projects have been GROSSLY exaggerated by the MSM aren’t you? This is what is eye-popping here – the truly extrordinary level of misinformation, wild speculation, hysteria and facts reported but deliberately seperated from the context needed to understand them. I have never in my life witnessed anything quite like the incredible beat-ups clearly intended to bring active fiscal policy into disrepute. And the MSM has done this very successfully – a meme has been created in the minds of the public: the government has stuffed up absolutely everything – burned down thousands of homes, fried little old ladies in their beds everywhere, delivered inferior, massively overpiced school buildings, funnelled billions of dollars to organised crime etc etc etc. I am dismayed that such outrageous lies have become broadly accepted as the truth, due largely to those opposed to government programmes having near-total domination of the channels of information that reach the public.

Were mistakes made? Yes. It would be incredible if none were made implementing such huge projects. But the extent of the problems has been wildly blown out of all proportion.

Continue this later – rushing out.

Lefty,

who really knows what is fact and fiction in these regards. The home insulation scheme was hairbrained as witnessed by the thousands of supposedly qualified installers who suddenly popped up for the quick killing and then when the program was terminated the Govt had to pay millions in compensation.

The BER was a blatant field day for builders to overcharge. How much, I don’t know but I’d say a billion or 2 probably went down the toilet all up. I guess that isn’t excessive in the scheme of things at the time. Add in the NSW Labor Govt’s cock up of the Metro west scheme ($400 million and counting) and the level of corruption we have seen in that state and I’d say that Labor governments in Australia probably haven’t had the best record in thrift recently.

The best course of action for the Government would have been to implement tax cuts. Very difficult to waste money when you leave it up to the recipient to decide. As long as the recipients are the needy and those who can actually provide useful stimulus with the funds.

While the tax cuts were in the system the govt could have been planning another large fiscal stimulus into hospitals.

One cannot use the GFC as an excuse for a lack of planning and accountability. The current Govt’s standard response to this is to reshuffle ministers so they don’t have to face the music when the inquiries start (let’s start with Peter Garrett and Penny Wong).

And for the record I am most definitely against the extension of the Bush tax cuts for the top bracket of US taxpayers. It is ludicrous to fathom how putting extra money at the margin into their pockets is going to be spent rather than saved.

Ray,

The insulation programme was not well designed and was (understandably) implemented in haste. However, the reason it was pulled is because it was politically sabotaged by the senseless braying of the media pack who successfully blew a small handfull of incidents and problems out of all proportion. Remember that in the 12 months the programme ran, it delivered around 15 years worth of installations under normal circumstances. So straight away, we realise that the media is not comparing remotely apples with apples when the bleat incessently about the incidents that occurred. 1.1 million jobs were done under the programme – the last 1.1 million jobs before the programme has seen twice as many installer deaths and many times the number of fires. And to put this in further perspective, there only a little over 8 million houses in Australia. So we should all know someone who has been electrocuted, fried alive or lost their house to fire. But this fact can be conveniently ignored because nothing sells news like good, old-fashioned hysteria.

As to the BER, I have little doubt that there was some overcharging and perhaps a few shonks here and there. But as one who has been in a position to witness quite a few BER projects, the level of waste and incompetence portryed in the media is so far from the actual situation that it is bordering on blatant lying. I have not personally seen a bad one, nor do I know anyone who has (and I know many people who have had them delivered at their workplaces). The media have cherry-picked a small handfull of problems with the programme and portrayed them as being representative of the ENTIRE programme. Further, before the BER, the construction sector was spiralling sharply downward, so there is little doubt that many jobs both directly and indirectly connected with the sector were saved. Was saving jobs, livelyhoods and the roofs over families heads a waste of money?

The MSM have chosen the theme – ie, massive disaster, massive waste – and in doing so have created a meme. And that meme is :government is incompetent and fiscal activism is a disasterous waste of money. It is completely untrue but sadly, that no longer matters.

Lefty:

Question: Why should home insulation installers and builders (BER) get to become rich from a multi-billion dollar stimulus. What about nurses (more hospitals), labourers (any public works program) or accountants (say re-writing the entire tax code would keep many busy) for example?

Add perceived government bribery, lobbying and bias as to who benefits from these programs and I believe the media is right to question the due process in selection of stimulus spending.

And as I’ve said many times, what about sensible tax cuts for the same quantum of stimulus to ensure there is no corruption, deaths, fires etc.

Pretty simple alternative I’d have thought.

Ray,

Question: what do you think happened to the money paid to installers and builders after they recieved it? Did it simply evaporate into thin air? Or did it continue to circulate throughout the economy, helping to prop up demand for all manner of goods and services (that equalls jobs, by the way) in what was at the time an extremely uncertain economic climate climate? (hint: it’s the second one.)

The media is right to question anything governments do – indeed, that is it’s major role. But the media has not done this in this case. It has created a whole new version of reality, incongruent with the actual reality, and used it’s near total dominance of the channels of information that reach the public to severely warp and distort our understanding of what has occurred. Their success in this has been nothing short of spectacular – a government goes to the polls presiding over what is probably the strongest economy in the developed world, having completely avoided the serious recession that has enveloped so many other economies, with interest rates about as low as they get under normal circumstances and unemployment only slightly above the NAIRU definition of full employment (unacceptably high by my reasoning but that’s another story) – and they are all but wiped out, clinging onto power by their fingernails. It should have been an easy victory for them, yet they were all but destroyed. Why? The most common comment I hear from people is “Labor stuffed up badly”. So the political asassination has been effective – the meme has been entrenched in the public’s mind. It is most unfortunate that what the public “knows” about the last 18 months of governence is largely hysteria, distortions and misrepresentations.

Are you suggesting that stimulus projects such as the BER did not employ any extra labourers? (hint: the B in BER stands for “building” – how do you propose to build without labourers?) More nurses would be a good idea – but you have a slight problem with the timing. The idea of stimulus is to roll it out QUICKLY, before unemployment becomes entrenched. Last I heard, it still took years of intense training and study to become an enrolled nurse, more for a registered nurse. In other words, the nurses you call for would still be studying after the recession was long over – not much of a boost to employment when it was needed.

Tax cuts? Not saying they’d be completely ineffective but if you spread the initial $900 per taxpayer cash-splash (which was demonstated beyond any reasonable doubt to have ramped up consumer spending) as tax cuts over a year, you get about $17 a week extra in your pocket. Can’t see much of a consumption spending surge coming off the back of that, it would have to be much larger. The rest of it could have been spent in that manner I suppose but I for one am glad that excellent public goods, such as the new school buildings that will be used to educate children within for the next few decades, were delivered instead.

I think this blog is the point that I have been raising for some time, namely that supplying the private sector with additional income can be harmful to the degree that it perpetuates unsustainable relative prices. When the private sector “needs” more deficit spending, then incomes are most likely being disproportionally captured by the wealthy, and increasing the overall level of income supplied to the private sector exacerbates this, as capital income is in the first loss and first gain position.

This will cause even more income, proportionally, to be captured by the wealthy, and you will need to deficit spend even more, etc. By not letting capital income take the hit, the cost of capital remains excessively high.

If you look at the “profit share of GDP graph”, the steady growth there meant that firms could expect to earn a return on capital in excess of GDP growth, which is unsustainable. That expectation became embedded into the cost of capital — if you will, the rate of interest demanded for actual investment became too high. Firms would only undertake capital investments and expand hiring if the return on that investment required them to take a proportionally greater share of national income, or equivalently, if undertaking the investment would push down labor incomes share and prevent real wages from rising with productivity.

That cost of capital rate needs to fall, and the difficulty that the deficit proponents need to face are how to bring that rate down while simultaneously continuing to deficit spend up until full employment is achieved. If your operational rule of thumb is to deficit spend until firms begin hiring again, then you are guaranteeing to meet their cost of capital whatever it happens to be, and therefore the cost of capital will not fall. That is the only way that, over the long term, you can get rising profit shares in perpetuity, and the corresponding permanent immiseration of labor.

On the other hand, in a economy without countercyclical deficit spending, when the private sector boom ends, it is followed by a bust, during which time capital takes the hit and wage shares increase as a share of total income, even if the adjustment mechanism is that total income falls, but capital income falls even faster than wage income. Capital income is in the first loss and first gain position. Eventually those lower capital shares become embedded in a new, lower cost of capital for firms. That adjustment could take a decade, as these are forward looking long term rates. Elsewhere I cited cross country comparisons that exhibit a correlation between the amount of external income supplied to the private sector (from both the foreign and government sectors) and declines in median wage shares.

I understand that not supplying enough income to the private sector in order to justify unwarranted earnings assumptions is a brutal prescription for ensuring that the cost of capital does not remain high — but my question is, what other mechanism are you going to replace it with?

My preferred mechanism, and the only mechanism for which there is a historical precedent, is extremely high top marginal tax rates, as well as high corporate tax rates. But in that case, you will not be deficit spending large amounts. If you insist on *deficit* spending, rather than just increased spending together with increased taxation, then I’m not aware of any other policy that would prevent wage shares from falling in perpetuity. Indeed, they have been falling for 30 years now.

During the post war low employment period, when top tax rates were 90%, the deficit was extremely stable, and there was little countercyclical deficit spending. Simultaneous to that, government debt as a share of GDP was rapidly falling in an era of high growth. According to MMT, this should have driven the economy into a terrible recession, but the private sector did not “need” a lot of external income because the existing income and expenditure patterns between households and firms were such that this provided enough demand. I.e., wages were rising with total income in a stable pattern, and additional income, proportional to GDP, from outside this household/firm nexus was not needed in order to achieve full employment and high growth.

Except for a brief recession right after WW2 from demobilization, U.S. recessions in that period were either created by the CB in an attempt to control inflation, or were the result of a supply shock (e.g. 1974). Insufficient demand was not a problem in that high marginal tax world, and that was a period of relatively constant, and by today’s standards, extremely low budget deficits.

RSJ: When the private sector “needs” more deficit spending, then incomes are most likely being disproportionally captured by the wealthy, and increasing the overall level of income supplied to the private sector exacerbates this, as capital income is in the first loss and first gain position.

This disproportional capture is the result of economic rent and that should be taxed away to disincentivize it. This is especially obvious in periods of historically high financialization. See Michael Hudson’s work documenting this.

Tom, exactly right. But then by taxing it away, you are reducing the deficit. So really, government should have two separate fiscal arms. The spending arm would keep spending until some employment/inflation metric has been achieved — shifting taylor rule targeting to fiscal policy.

The taxing arm would keep increasing or decreasing top tax rates as well capital taxes to keep median wages growing with, but not faster than, GDP.

When both arms achieve their goals, the deficit will be relatively small, and relatively constant, as a share of GDP. It would still vary across the business cycle, but not nearly as much as it does now.

This is a different policy approach than “there is no crisis that cant be solved with large enough deficits”. If the cause of the crisis is rising income inequality, then deficit spending will not solve it. It will ameliorate the pain, but at the cost of increasing inequality even more. You want to simultaneously apply the palliative, which is spending, while addressing the disease.

But to do that, you cannot look at the private sector as a monolithic entity that desires more funds because it borrowed too much. Look at the private sector as a set of competing interests that has reached a state where median wages are too low in comparison to the prices of goods that people buy, and so external demand is necessary to prevent prices from falling (e.g. and to prevent real wages from rising). The only way that can happen is if there is either a large export surplus or if households are borrowing too much, but those are mechanisms. It is not the level of debt per se that causes the demand failure, but the price mismatches cause the demand failure. For the U.S., we would need price deflation of about 30% to recover the median wage losses we experienced since our last period of robust growth. A “one armed” policy to only deficit spend whatever it takes prevents that adjustment from occurring.

RSJ @ 17:01: But to do that, you cannot look at the private sector as a monolithic entity

Right. It is necessary 1) for government to spend into the economy where augmented demand is needed, 2) to tax where there are imbalances, especially accruing from economic rent, which reduces the eventual build up of inflationary pressure, leads to inequality, etc., and 3) to reform institutions and structures that were causally involved in order to level the playing field. Moreover, many of the causes of the crisis have not been effectively addressed and either remain as they were or have even been augmented.

In the present crisis the first and third were accomplished insufficiently and inefficiently, and the second was left undone, and this has sparked social dissatisfaction and political unrest.

Guys.

Do the neo-liberals actually want mass unemployment, homelessness etc?

“Do the neo-liberals actually want mass unemployment, homelessness etc?”

No, but the people they work for (knowingly or unknowingly) do.

The unemployed are there to ensure that the ‘middle classes’ (ie anybody with a job) stay on the rat wheel.

RSJ, your argument chimes exactly with what I’ve been thinking was a flaw in MMT. The only difference was that I thought that what was needed was to move the tax burden over to a tax on gross assets (ie a flat tax on cash, real esate, shares etc as a % of the asset value). That would keep money recirculating and prevent it accumulating in bubbles.