I have received several E-mails over the last few weeks that suggest that the economics…

Why fiscal deficits drive private profit

I have been working on the macroeconomics textbook today that Randy Wray and I are hoping to publish sometime next year. We have a publisher and now just have to complete the text which is progressing well. Also today I have been wondering why UK business firms are not horrified at the latest damaging policy announcement by the new conservative British government. My thoughts generalise to any government at present in terms of the obvious need to expand fiscal policy. I brought those two things together today – the practical need for continued fiscal support for private sector activity and the development of our textbook – by considering the macroeconomic origins of profits. It is an interesting story that very few people really understand because they think micro all the time when it comes to the understanding the profits of business firms whereas you have to start thinking from a macroeconomics perspective to really understand this. It also helps you understand the relationship between the government and non-government sector more fully – a relationship which is at the heart of Modern Monetary Theory (MMT). So read on and see if you have thought about this before.

In this context, this article in the UK Guardian (October 20, 2010) – America can carry this deficit – is worth considering. It provides good insight into why the US (and any sovereign government) should be seeking to expand their discretionary fiscal deficits rather than cut them back.

The article says:

The federal fiscal policy debate is being overwhelmed by a growing sense that America must slash its deficit now, before it is too late. Actually, the United States is in no danger of a treasury debt crisis and can carry far more debt than people believe without dire consequences.

Unfortunately, many who argue for rapid deficit reduction base their case on a slew of misunderstandings and fallacious generalisations about the consequences of high public debt

I continually try to reinforce the notion that there is no basis in economic theory or in the way the monetary system operates for advocating deficit reduction at this point in time. I try to highlight where the misunderstandings come from and expose the usual “theoretical authorities” that are used to justify this damaging policy advocacy as erroneous if not out-rightly fraudulent.

There is no doubt in my mind that the case for fiscal austerity is based on the ideological hatred of government intervention rather than any sound economic case that the cutbacks will improve the aggregates we are usually concerned with – output and income growth, reduced unemployment, low inflation etc. It is clear to me that the fiscal austerity approach – for example, epitomised now in the announcement in the UK yesterday – will damage employment growth and undermine economic growth.

Further, the UK Guardian article notes that:

In both the US and the UK (the two high-debt-capacity countries with the longest history of public debt), there is no visible relationship between the public debt ratio and inflation. For example, the peak US public debt ratio of 109% in 1946 was followed by a decade of low inflation.

Similarly, both American and British histories fail to show that high public debt is a drag on growth; in fact, peaks in the public debt ratio have been precursors to unusually strong economic growth.

Most of the deficit terrorists never reflect on history or, if they do, they use it in a distorted manner to weave their lies.

The Guardian authors note that if you examine history and analyse cases where nations did get into trouble with their debt holdings you will see that “(t)hey had some combination of the following conditions that limited their debt-carrying capacity”:

… first, a lack of government control of the money supply of the currency in which most of its debt is denominated; second, debt owed in or convertible into gold; third, the lack of a long history of political stability and an effective means of tax collection; fourth, the lack of a large, liquid market for government debt; and fifth, debt owed personally by a king or other supreme ruler. Not one of these conditions applies to the United States.

So the Reinhart-Rogoff myths are usually wheeled out by the terrorists without them noting that the monetary systems that operated when the debt defaults occurred were not commensurate with those in place now, or that the debt was in a foreign currency, or some other constraint on the sovereignty of the nation was in place.

As I have said often – there has never been a sovereign default in the modern era among nations that issue their own currency, issue debt exclusively in that currency and float that currency on foreign exchange markets. Japan did default during the Second World War but that was politically-motivated and had nothing to do with their financial capacity.

The deficit terrorists, however, always avoid such empirical scrutiny and historical accuracy. Even so-called historians like Niall Ferguson misrepresent the historical record in the ways I have noted above and written about previously.

Please read my blogs – The deficit terrorists have found a new hero. Not! – Ladies and gentleman, civilisation is ending – Person the lifeboats! – for more discussion on this point.

The Guardian authors also note that:

Sadly, discussions about the implications of rising public debt are riddled with many other myths and misplaced fears as well: that there will be insufficient “savings” to absorb the continued massive issuance of public debt securities; that the central bank will always be able to generate inflation to lower the real debt service burden; that the public debt ratio can only be lowered by onerous future tax hikes; and so on … For now, slashing the deficit would be hurtful to the economy and self-defeating. Such well-meaning but wrong-headed action would cause renewed recession and plunging tax revenues. Until the private economy completes the multiyear balance sheet adjustments underlying the current depression, federal debt will continue to swell.

The argument here is that rising public debt ratios per se do not promote economic growth and business profits etc. Rather, it is the fiscal deficits which are matched $-for-$ with debt-issuance that drive the positive dynamics via their impact on aggregate demand. If the government gave up its “gold standard” practice of issuing debt but still maintained a expansionary fiscal stance these positive impacts would still evolve and there would just be more bank reserves in the system.

As an aside, I am writing a paper on this point at present – that these reserves would also provide increased stability for the private banking system. I will publish a blog on that point once I have finished the academic paper which I will present at the American Social Science meetings in Denver in early January 2011.

Anyway, back to my textbook writing today which will help you to understand what most people fail to understand – the macroeconomic origin of profits.

In a recent blog – The fiscal stimulus worked but was captured by profits – I outlined the key findings of Morgan Stanley market briefing which demonstrated that:

Business was the biggest beneficiary of policy stimulus: it didn’t have to pay for the recovery. Consequently, the profit recovery was strong even though the growth recovery was weak.

In that blog I did not go into any detail how fiscal deficits underpin private sector profits at the macro level. That is what I am writing about today.

One of my favourite economists – Michal Kalecki was one of the early pioneers in developing an understanding of the origins of profits from a macroeconomics perspective. Another original contribution – somewhat earlier – which was derived in a different manner but has the same implications came from the US businessman-cum-economist Jerome Levy.

Levy wrote his famous contribution in 1914 but it was published as Economics Is an Exact Science (New Economics Library, New York) in 1943.

I have written about Kalecki previously in this blog – Michal Kalecki – The Political Aspects of Full Employment.

Kalecki’s Theory of Profits

The key articles/books that outline Kalecki’s approach to profits are:

- Essai d’une theorie du mouvement cyclique des affaires, Revue d’economie politique, 1935.

- A Macrodynamic Theory of Business Cycles, Econometrica, 1935.

- Essays in the Theory of Economic Fluctuations, 1939.

- A Theory of Profits, Economic Journal , 1942.

- Studies in Economic Dynamics, 1943.

There were two versions of the theory – a simplified version which outlined the fundamental profits equation and the more realistic expanded version which outlined the generalised profits equation.

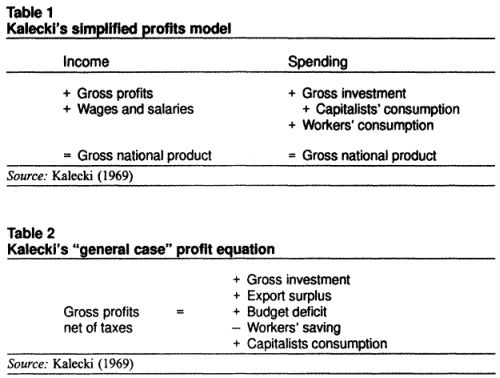

The following Tables are taken from the article by S. Jay Levy (Jerome Levy’s son) ‘Profits: The Views of Jerome Levy and Michal Kalecki’, which was published in the Journal of Post Keynesian Economics (Vol. 24, No. 1 (Autumn, 2001), pp. 17-30). If you have access to a subscription to JSTOR you can read the article on-line HERE

The tables were originally published in Kalecki’s 1952 book – Theory of Economic Dynamics – which was republished in 1965 by Allen and Unwin, London.

The tables show the simplified and generalised versions of the profits equations which I will explain.

To understand Kalecki’s derivation remember that he was a Polish economist trained under a Marxist system and so had an advanced understanding of how the production of surplus value pre-dated but determined profit realisation. The mainstream idea that profits were generated in the “exchange” process (where goods and services are bought and sold) and reflected the marginal contribution of capital was dismissed.

The mainstream economic theory of income distribution and the origin of profits was categorically destroyed in the 1960s (with earlier contributions from Marx and later Sraffa, 1926) in the Cambridge Capital debates. I keep threatening to write a blog about the Cambridge Controversies and will one day. It is a very technical debate but established once and for all that marginal productivity theory (the neo-classical approach) is false. How do the maintream economists cope with that? Answer: they just chose to ignore the findings and continued to lie to their students. But that is for another day.

What Marx didn’t show in his approach to profits was how the total volume of profits in a monetary economy was determined in any given period. That was the question that Kalecki sought to answer.

He was strongly motivated to understand the dual evils of unemployment and poverty and was keen to show that they were intrinsic (chronic) features of the dynamics of capitalism.

S. Levy notes that Jerome Levy was also motivated to understand why the private enterprise system would tolerate unemployment given that it represented massive foregone income and hence opportunities for sales and profits. He thus had a similar quest to find out about how profits were generated:

Levy often explained how he had approached the problem of unemployment. He indicated that he employed people because he expected to make a profit … spending $1,000 for rent, merchandise, and wages with the expectation of getting $1,100 back. He puts the $1,000 into circulation but wasn’t sure where the other $100 came from. He set out to find the answer.

Both Levy and Kalecki sought an understanding of the derivation of total profits by taking a macroeconomics tack. You might like to read the excellent article – Where Profits Come From published by the Jerome Levy Forecasting Center. One of the authors – David Levy – is a grandson of Jerome Levy (Jay Levy, Jerome’s son is David’s father).

In Where Profits Come From we learn that most people fall into a fallacy of composition when exploring the question of profits:

Answering the question “Where do profits come from?” requires a macroeconomic perspective. Profits are produced by specificmacroeconomic flows of funds. Unfortunately, the macro perspective necessary to investigate these flows can be elusive because of a logical trap: the tendency to assume wrongly that circumstances that apply to the familiar case of the single firm also apply to the entire business sector.

To illustrate the problem of applying a microeconomic perspective to a macro situation, consider the following. As every entrepreneur knows, employee costs are a major influence on a firm’s profits. Cutting payroll expenses means a more robust bottom line.Accordingly, it is commonly believed that when firms throughout the economy hold down wages, they improve aggregate profits. However, for the whole business sector, cutting employee compensation reduces revenue as well as expenses.Less worker pay means less personal income and, therefore, less personal spending on the goods and services sold by businesses. Therefore, cutting payrolls will not directly increase corporate profits; however, it may indirectly affect profits through its consequences for such transactions as business investment, personal saving, and other issues … One firm’s profits are in large part the result of its ability to compete with other firms and to secure profits at their expense. Firms’ quest for profits is not unlike a children’s treasure hunt. The children with the sharpest eyes, the cleverest minds, the fastest legs, and, sometimes, the best luck find the most prizes. Yet these attributes have no affect on the total number of prizes available. In seeking the sources of aggregate profits, our interest is in what determines the total volume of profits available for business, and not in factors that affect only how those profits will be divided among firms.

This tract of reasoning really highlights why we have to start at the macroeconomic level and exposes most of the mainstream approaches to understanding the way the monetary system operates as flawed – given that the mainstream typically reasons from specific (micro) to general (macro) as if there is no fallacy of composition.

Kalecki’s simplified model

In Kalecki’s simplified model, he assumed that the economy was comprised of two groups: (a) workers who earned wages and did not save; and (b) capaitalists who produced and earned profits. The economy was closed and there was no government sector.

His basic insight (under these simplified conditions) was that “workers spend what they get” and “capitalists get what they spend” which means that capitalist profits are determined by their propensity to invest and consume which reverses the way people normally consider the causation.

That is, profits are determined by investment not the other way around.

While Kalecki clearly knew that workers also save, he was able to show that by adopting the restrictive “workers do not save” assumption the basic insights were not altered but rendered more easy to understand. This is a case of adopting restrictive assumptions to simplify the analysis that are effective.

Too often in mainstream economics the simplifying assumptions never hold in reality and when they are relaxed the basic analytical results fail (for example, the models that support Ricardian Equivalence).

Kalecki began with the familiar National Accounting identity, which in his simplified model is written as:

GNP = C + I

Where GNP is Gross National Product or total output and national income, C is total private (household) consumption, and I is total private investment spending per period. These aggregates are all flows of expenditure (and hence income).

Note he used GNP rather than Gross Domestic Product (GDP) because he assumed the economy was closed. For an explanation of the difference between GNP and GDP see this site.

Private investment is the sum of spending (output) of new productive capital plus changes in inventories.

Total income is distributed between the two “classes” – workers and capitalists – so that total wages and salaries (V) plus total profits (P) equals GNP. So the distribution of national income is written as:

GNP = V + P

P is gross profits which includes depreciation, retained profits, dividends, drawings from unincorporated firms, rent and interest.

If we set the two different views of the National Accounts equal we get:

V + P = C + I

Or:

P = C + I – V

Note that (C – V) is that component of consumption that is attributed to the capitalists (given workers consumption is equal to V – they “spend what they get”).

So this equation can be read as saying that gross profits (P) is equal to capitalist’s consumption (C-V) plus gross investment. That is, the capitalists “get what they spend”.

Note this is the model outlined in Table 1 above.

The insight provided seems fundamental now but back in the past when Kalecki was working on these ideas few people understood it.

The question Kalecki asked was whether this “definitional equation” – the fundamental profits equation – had any economic meaning. That is, he wanted to explain the causal dynamics that led to the existence of profits overall (at the macroeconomic level) – which linked the two sides of the fundamental equation.

The question of interest is which way the causality flows – from left to right – Do profits determine capitalist consumption and investment? – which is the intuitive way of thinking – or from right to left – Do capitalist consumption and investment determine profits? Kalecki clearly considered the latter causality to be the valid way of understanding profits.

He said (in his 1965 book Theory of Economic Dynamics, pages 45-46):

The answer to this question depends on which of these items is directly subject to the decisions of capitalists. Now, it is clear that capitalists may decide to consume and to invest more in a given period than in the preceding one, but they cannot decide to earn more. It is, therefore, their investment and consumption decisions which determine profits, and not vice versa.

He recognised that there was a time-lag involved between spending and profits. It is the recognition of this time lag that allowed Kalecki to derive his business cycle model – I will write about that another time. Basically, investment depends on expectations of future aggregate demand that are formed in some prior period. These spending decisions then drive economic activity and so profits are a function of investment in some prior period and these flows can be variable.

Digression – Saving and Investment equality

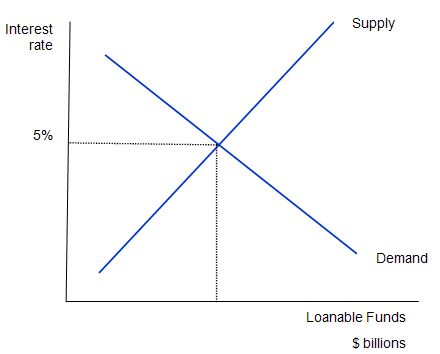

The mainstream macroeconomics approach to saving and investment is based on the flawed Loanable Funds doctrine. Basically, this doctrine was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving.

So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

The following diagram shows the market for loanable funds. The current real interest rate that balances supply (saving) and demand (investment) is 5 per cent (the equilibrium rate). The supply of funds comes from those people who have some extra income they want to save and lend out. The demand for funds comes from households and firms who wish to borrow to invest (houses, factories, equipment etc). The interest rate is the price of the loan and the return on savings and thus the supply and demand curves (lines) take the shape they do.

Mankiw claims in his textbook that this “market works much like other markets in the economy” and thus argues that (p. 551):

The adjustment of the interest rate to the equilibrium occurs for the usual reasons. If the interest rate were lower than the equilibrium level, the quantity of loanable funds supplied would be less than the quantity of loanable funds demanded. The resulting shortage … would encourage lenders to raise the interest rate they charge.

The converse then follows if the interest rate is above the equilibrium.

I provide a refutation of the theory of loanable funds in this blog – Budget deficits do not cause higher interest rates – for more discussion on this point.

Its conception of the way the banking operates is deeply flawed. There is no finite pool of saving that is competed for. Loans create deposits so any credit-worthy customer can typically get funds. Reserves to support these loans are added later – that is, loans are never constrained in an aggregate sense by a “lack of reserves”. The funds to buy government bonds come from government spending! There is just an exchange of bank reserves for bonds – no net change in financial assets involved. Saving grows with income.

Please read the following blogs – Money multiplier and other myths – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.

But importantly, deficit spending generates income growth which generates higher saving. It is this way that MMT shows that deficit spending supports or “finances” private saving not the other way around.

This takes us back to Kalecki.

It is clear that in the simplified profits model – capitalist’s gross saving equals gross investment. Kalecki (like Keynes) demonstrated that the equality of saving and investment was totally independent of the level of interest rates which were determined in the money market.

The mainstream approach was to see interest rates as adjusting to equilibrate (real) saving and investment and thus ensure that aggregate demand would always be equal to aggregate supply – thus negating the possibility that the economy could suffer from a shortage of demand. This denial of unemployment was the basis of Say’s Law (later Walras’ Law).

However, Keynes and Kalecki clearly understood that saving and investment were brought into equilibrium (in a closed economy without a government sector) by variations in national income driven by changes in effective (aggregate) demand. That insight provided the fundamental break with classical thinking that dominated economics (and policy) at the onset of the Great Depression and which, when applied, worsened the depression.

So in Kalecki’s model, fluctuations in spending drive fluctuations in output and income which ensure the demand drain (saving) comes into equality with spending injections (investment).

This is also the basic idea that drives the spending multiplier model. Please read my blog – Spending multipliers – for more discussion on this point. Thus increased investment spending stimulates aggregate demand and firms respond by increasing production.

This, in turn, leads to higher wage and salary payments and higher induced consumption which feeds back into the spending stream and promotes further output and income. At each stage of the process, some of the income generated goes to saving and so the successive consumption spending flows become smaller and smaller until they exhaust. At that point, the sum of the saving generated by the income responses will equal the initial investment injection and the economy regains equilibrium.

A person thinking from a micro perspective might think the profits equation is odd – after all, if the capitalist consumes more the volume of funds they have at the end of some period should be less. It is here that the fallacy of composition enters the fray.

Kalecki asked “what would be the sources of financing this investment if capitalists do not simultaneously reduce their consumption and release some spending power for investment activity?” He responded as such (in his 1966 book – Studies in the Theory of the Business Cycle (Blackwell, Oxford), page 46):

It may sound paradoxical, but according to the above, investment is ‘financed by itself’.

While that might be true for an individual business firm, acting in isolation, it cannot be true for the economy as a whole. Why? Answer: the consumption of one capitalist are the source of profits for another capitalist. This leads to the statement I have written before in this blog – investment brings forth its own saving!

Kalecki clearly understood that counter-intuitive notion that investment “automatically furnishes the savings required to finance it” as long as their is idle capacity. That is, as long as increasing aggregate demand does not outstrip the real capacity of the economy to produce.

Kalecki’s generalised model

Kalecki subsequently complicated the model to include a foreign sector, a government sector and a recognition that workers do save. He then sought to examine how significant were the influence of the fiscal deficit, external balance and workers’ savings on total profits.

To answer that question, he used the following familiar equation for total national income (Y):

Y = C + I + G + NX

where G is government spending and NX is net exports (total exports minus total imports). C is the aggregate of capitalists’ consumption (Cp) and workers’ consumption, which is total worker income post tax (Vn) minus workers’ saving (Sw).

So we could write this model as:

Y = Cp + (Vn – Sw) + I + G + NX

to recognise the different sources of total consumption.

Total income claimants on national income (Y) are:

Y = Pn + Vn + T

where P and V are as before (profits and total wages and salaries) but the subscript n denotes these flows are net of taxes paid, and T is total taxes.

Thus (setting the expenditure components of total income equal to the claims on total income) we get:

Cp + (Vn – Sw) + I + G + NX = Pn + Vn + T

We can solve this for Gross Profits after tax (Pn) to get:

Pn = I + (G – T) + NX + Cp + Vn – Sw – Vn

So:

Pn = I + (G – T) + NX + Cp – Sw

which says in English, that gross profits after tax (Pn) equals gross investment (I), plus the fiscal deficit (G – T), plus the export surplus (NX), plus capitalists’ consumption (Cp) minus workers’ saving (Sw).

This is the model shown in Table 2 in the graphic provided above.

So the gross profits after tax will be higher, the higher is gross investment (I), the larger the fiscal deficit (G – T), the higher is capitalists’ consumption (Cp) and the lower is workers’ saving (Sw).

I could elaborate the behavioural factors that Kalecki thought drove Cp and Sw but that would take me more time than I have today. There are also distributional complexities that are very interesting.

For example, when there are positive net exports and/or fiscal deficits, then gross net profits (Pn) will rise higher than the level that would be generated by gross investment and capitalist consumption (as in the simplified model). So an individual domestic capitalist who is able to increase their net exports will be able to glean extra profits “at the expense of their foreign rivals”.

Kalecki said (in his 1965 book noted above, page 51):

It is from this point of view that the fight for foreign markets may be viewed.

I will write a further blog in time about how the foreign sector can be elaborated within this model.

How does Kalecki see fiscal deficits in this model? The way in which the fiscal deficit generates profits is via its effect on national income. The fiscal deficit means that the private sector is receiving more flows from the government than it is returning via taxes. Fiscal deficits provided an increased capacity for capitalists to realise their production because they expand the economy.

Kalecki said that fiscal deficits allow the capitalists to make profits (net exports constant) over and above what their own spending will generate.

In Where Profits Come From, we read:

Government sector saving is a negative source of profits … Government expenditures add to business sector revenue both directly through government purchases of goods and services and indirectly by increasing the income of households, which then buy from business. Flows to the government either increase business expenses or reduce business revenue. If the government sector saves (spends less than it receives), the subtractions from profits will more than offset the additions to profits; a government surplus is a negative source of profits. Conversely, a government deficit is a positive source of profits because more money flows from the government sector to become business revenue than government takes away from business.

While the terminology – “government saving” – is misleading from a MMT perspective – you can easily just substitute the term “fiscal surplus” for “government sector saving” without loss of insight in this context.

The point is that when the government runs a surplus it reduces profits via its squeeze on aggregate income. That is why all the business sector should be screaming at the fiscal austerity plans that are rampant at present.

It doesn’t make any sense, for the business lobby groups to be calling for cuts in the fiscal deficits. The only time that a rising fiscal deficit will not add to profits (in real terms) is if there is full capacity and the rising deficits push nominal aggregate demand beyond the real capacity of the economy to increase output and real income.

We are so far from that point in most economies at present that it doesn’t bear scrutiny.

So the fact that the business groups often lead the charge against fiscal deficits reflects the triumph of ideology over good judgement and the triumph of ignorance over understanding. I just shake my head in wonderment when I see a business person railing against fiscal deficits.

Further Where Profits Come From provides insights in this regard. They argue that our (new) understanding of the determinants of total profits:

… can reveal flaws that invalidate other conclusions. For example, public officials, forecasters, and investment advisors often use the saving investment identity to argue that increases in personal and government saving will increase investment in plant and equipment, thereby improving the economy. Since saving equals investment, they reason, policies that increase personal or government saving must increase investment. By contrast, the profits perspective immediately highlights the omission of business saving from such analyses, and it emphasizes ways in which changes in personal and public saving will influence profits without necessarily affecting total saving or investment. Higher non business saving reduces business saving and therefore profits, rather than increasing investment. Moreover, weaker profits are likely to lead to less investment and, therefore, less total saving.

In other words, theories of crowding out which claim that government spending and private investment compete for a finite pool of saving and this competition has to be resolved by higher interest rates are nonsensical.

Private investment drives private profits and brings forth its own saving via the expansion of national income.

Equally, fiscal deficits drive private profits and, if accompanied by debt issuance, merely borrow back the funds they spend and stimulate growth in saving via the expansion of national income.

These are fundamental insights of a modern monetary economy that seem to be lost on the deficit terrorists and the maintream macroeconomics textbooks. Students who fail to learn these insights really have no understanding about the way the economy functions.

Conclusion

The students who use the textbook that Randy Wray and I are writing at present will learn the fundamentals of the modern monetary system and how the government sector contributes to the fortunes of the private sector through fiscal deficits.

In this paper – The Indispensable Federal Deficit – published June 2010, the author says:

There is a wide range of views on the present role of the federal budget deficit in the economy; some people do not believe it has any positive influence, some think it is helping moderately, and some see it as a critical support that is becoming less necessary as the economy begins to recover. Only a few recognize that it is and will remain a necessary support to keep the economy out of a severe depression. In truth, the economy and profits are entirely dependent on the federal budget deficit, without which not only would expansion be impossible, but the economy itself could not for long function at all … The federal budget deficit has usually been a major profit source in modern history … The support to profits from the federal government will remain a requirement for as long as balance sheets in the private economy are shrinking.

I couldn’t agree more. The reasoning is based on a correct understanding of how total profits are determined in a monetary economy. Pity the business sector didn’t understand that and started to lobby those neo-liberal politicians accordingly.

That is enough for today!

Where Profits Come From: “Since saving equals investment, they reason, policies that increase personal or government saving must increase investment.”

The subsequent discussion shows why that conclusion does not follow. However, there are two identities. One is

S = I

In the other, (S – I) appears as a term, instead of 0.

Obviously, S and I cannot stand for the same things in both identities. Could you please explain the different meanings? Thanks. 🙂

Funnily enough, I had thought of this already. It’s nice to see my simple logic vindicated by a real economist. There was a time when I thought I was the only person in the world who thought something was fishy.

I had a cost cutting CEO in a huge corporation, he cut our salaries and awarded himself a huge bonus at the end of the year when profits increased. I thought, that’s grand he is making a jolly good profit. If we poor saps are spending less, the other companies must also be squeezed for revenue. I have a background in IT, so I did a few recursive loops in my brain. I realised if things continued and we got pay cuts every year, he would soon own the entire world. Of course by then we would be working for a few washers and half a peanut. It was obvious if all other companies followed suit, we would be toast.

Having re-grown my frontal lobe at Billy Blog, I am having all kinds of wonderful revelations. The latest is that the neoliberal paradigm is always a win/lose proposition. Capital wins and labour loses. They have not yet had to face up to their biggest logical problem. In a closed circuit, they will be like piranhas. After they have devoured the meat and bones of all the labour, they will be forced to devour each other. Corporate boardrooms will be like Blofelds lair, shark ponds and all.

What is their greatest prize of all? put forward by the loons at Von Mises? A constrained currency ! ….. oh what joy we will have if they ever slip that one past the sheeple! Piranhas on steroids.

We can really see how the new paradigm is mapping out in the UK. The CEO’s voting for cuts are either completely barmy or confident they will be winners in a cost cutting game. To think I worry about antibiotic resistant super bacteria devouring human flesh. We should worry more about the wallet devouring George Osbourne.

BTW I also think he looks like a bloodless refugee from Twilight.

Excellent exposition on Kalecki!

I also like the way Hyman Minskey handled the macro approach (based on Kalecki as well) to profits in his classic “Stabilizing an Unstable Economy”. I agree with Minksy’s conclusion that “stability breeds instability” because of aggressive financial innovation in private financial markets. However, I am not sure that Minsky understood or agreed with MMT, as he does discuss the need for governments to have to repay borrowings.

I would be curious on other opinions on Minsky?

Go to the search box at the top of the page and type in Minsky. There are a quite a few items with Bills views on Mr M.

Just search on page “Minsky” and you will quickly learn more.

I keep hearing a questions from people about the financial problem that the UK had a few decades ago. I vaguely remember something about it, but am not familiar with it. I think George Soros was involved. Anyway, the questioners are claiming that it discredits MMT. One person said that it happened after the UK quit using the gold standard. Would someone familiar with the incident please explain it to me?

By the way, Andrew Wilkins, I agree with what you say and I think it will something to watch the sharks kill each other.

There was an incident when the UK was thinking about joining the Euro. They tried to peg the pound in a range against the German Mark if I remember rightly.

Soros and a gang of others recognized an arbitrage, forcing the pound to revalue. It was a similar problem faced by Thailand during the Asian crisis.

The Gold standard people and some of the positive money people are so worried about inflation eating their retirement savings, they will try to discredit any Keynesian, post Keynesian or progressive ideas. They usually have a poor grasp of economics and are clutching at straws. Unfortunately, they are popular straws. Many people were just looking for banking stability. They blundered into the wrong website and got brainwashed. I think most are in the 45-65 age range.

Not sure if Bill has ever torn some of these Austrian ideas to shreds. They fear MMT because they can’t argue the ideas. They will often resort to taunts of Stalinist or something worse. I often hear the goal of MMT is to secretly inflate away poor savers hard earned wealth.

Bill, In the first part of the above article you defend government borrowing, as you normally do, with little or no reference to the fact that governments can “print and spend” as an alternative to “borrow and spend”.

Doesn’t that make you a Keynsian rather than an MMTer? Lerner tended to favour the “print” option while Keynes tended to favour the “borrow” option. I regard the print option as far better, which I why I support MMT. I’d like to see you rattle the Keynsian cage a bit more.

GLH – if you google for “Black Wednesday”- it is on wikipeadia. It was because they tried to peg the £ to the DM and Soros broke the peg and appropriated >£1B. I thought MMT was against any such avoidance of free floating currencies and MMTers use Black Wednesday as an example of why such pegs are bad.

minor point:

is household net interest income a component of total income?

if so, is it included in V?

Andew: Capital wins and labour loses.

That’s why its called “capitalism.”

Thanks Stone

@ Ralph

“Doesn’t that make you a Keynesian rather than an MMTer? Lerner tended to favour the “print” option while Keynes tended to favour the “borrow” option. I regard the print option as far better, which is I why I support MMT. I’d like to see you rattle the Keynsian cage a bit more.”

It is rather a strong assertion to say that Keynes favoured the ‘borrow option’. It seems to me that you are heading for a semantic tangle. According to Victoria Chick (Macroeconomics after Keynes, 1983, p.318) “Keynes … was very specific about the source for his ‘public works’: new money … and when he spoke of monetary policy, [he] clearly meant a policy of open market operations”. I can only note that this is a rotation by pi from the direction you are travelling in.

Chick disposes of the tangle (p.319-320) by identifying Keynes’s view of fiscal policy as (in the familiar symbols) G – T = delta M, which means the creation of new money when running a deficit. On the other hand, she identifies Keynes’s view of monetary policy as minus delta B = delta M, meaning an open market purchase (not ‘borrowing’) designed to affect the interest rate. She notes that Keynes specified the creation of new money when recommending ‘public works’ (his restricted notion of spending into the economy), and envisaged open market operations as monetary policy.

Are we to throw Victoria Chick’s analysis away and take up Ralph?

I’ve come to the conclusion that most of the CEOs probably do understand that these fixes are not fixes at all. But they care not about the fixes which we do. They really dont care about profits as much as market share. If they have everyone as a customer the price of stuff is meaningless. If every transaction has to go through them, for whatever sector they are in, they have CONTROL. This is the game they are playing with each other, the battle for market share. They are monopolists not capitalists.

Greg: “They are monopolists not capitalists.”

The two are not mutually exclusive. 🙂 In fact, history shows that successful capitalists tend to become monopolists. In some cases, like Microsoft, they become monopolists first.

For hoi polloi, Profits: The Views of Jerome Levy and Michal Kalecki is a freely available working paper version of the S J Levy paper; looks the same.

Brianovitch, thanks for all that detail. I’ll certainly look at Victoria Chick’s writings.

About Borrow vs Spend – I got this by debating William Hummel of What Is Money website and understanding money email list.

I think “Borrowing” always has to be done to keep the currency’s purchasing power high. If not for anything else but psychological herd mentality purposes.

But then you really have to remember that since MMT is correct you are not really borrowing just giving interest to money saved by non-governmental entities.

Perhaps it is just semantics. What really matters is policy choice and priorities, ie the effects on the real economy.

Some Guy:

Hoi polloi have a question.

The Kalecki simplified profit equation is:

V+P = Cw +Cc+I, where Cw is workers’ consumption and Cc is capitalists’ consumption.

Assuming the workers do not save (V = Cw), we arrive at P = I+Cw, “profits equal investments plus capitalist consumption”, as expected.

Now, in the following cycle assume the capitalists decided to consume 20 wage units(w.u.) and invest 80w.u. out of available 100 w.u. By Kalecki’s equation, by the end of the production cycle, we would have P= 100 w.u.

Let’s assume that :

economy is very simple,composed of a household sector and

a business sector that produces and distributes only consumer goods and services.

Furthermore, suppose there is no inventory building-all goods are consumed in the

period they are produced.

(“Where Profits Come From”)

and that the capitalist sector produced 100w.u. of goods and the capitalist and worker households, who allocated 20 w.u. and 80 w.u. (total wages) respectively, jointly consumed the output.

So, by the end of the business cycle, the capitalists’ net worth is unchanged, 20 w.u. mutually consumed and profited and 80 w.u. obtained from the workers consumption. Profit(P’) iz zero

The article “Where Profits Come From” seems to confirm the zero profit conclusion:

If the household sector spends all of its income during a given period, the business

sector will not secure any profits.

So, question (1) is why P is different from P’ and (2) “Where Profits Come From” in the simple economy ?

ABC, I don’t see any genuine economic reasons why “borrow and spend” should be more beneficial for a currency’s value than “print and spend”. However, you are right to refer to the “herd mentality” if by that you mean that “print and spend” is liable to give the markets and credit rating agencies apoplexy.

I suspect this is exactly what Keynes was wrestling with: the knowledge that print is preferable to borrow, but “we mustn’t say so”. That is, if Brianovitch above is right in saying that K had no objections at all to printing, then K buried the point deep in the convoluted language of his General Theory. The result is that a lot of people – not just me – have got the impression that K preferred borrowing to printing.

Re my criticism of Bill above (23:58) the only thing wrong with it (assuming Brianovitch is right) is the assumption that K favoured borrowing. I.e. replace the word Keynes with the word “borrow” (or something like that) and my criticism still stands.

Tom Asimakopulos (Canadian Journal of Economics,1975) explained Kalecki’s theory of distribution with an excellent model. This is for his credit!

Regarding ABC’s comment

“About Borrow vs Spend” …… “But then you really have to remember that since MMT is correct you are not really borrowing just giving interest to money saved by non-governmental entities.”

The UK has a program of QE. Long term bond debt is being replaced by short term debt. Recently an article in the Guardian claimed that total UK Government borrowing is at a record high. Does this prove the total failure of QE? More savings than ever prefer to earn interest from Government handouts, rather than search for yield in private investment markets.

QE is pushing the hungry children from one Government nipple to another with less milk. More children are coming to mummy. Am I right in thinking the debasement of the pound is only a small part related to QE. It is mostly driven by expectations of lower economic rental yields in the private sector?

Tom: That’s why its called “capitalism.”

I was wondering how socialism has become such an ugly word. Thrown around like an insult these days.

Logically, socialism has the high moral ground and is more benificial to the majority than anti-social capitalism.

Is it a hangover of WWII and the Stalinist Russia menace. There are such strong associations in peoples minds.

Socialism gets associated with Communism which gets associated with Totalitarianism which gets associated with bullets in the back of the neck.

The master manipulators in Murdochs coterie constantly reinforce these associations.

As an afterthought.

I want to make SOCIALISM a power word once again. Stand up and be proud to be sociable.

Can we start referring to capitalists as ANTI-SOCIALISTS. Be ashamed to be selfish.

I think it puts everything in the correct perspective.

Andrew, there are three factors of production: land, capital and labor. Feudalism, capitalism and socialism correspond to them, depending on which factor is dominant. An integrated system would harmonize the three factors and not favor any one of them.

Truly excellent and educational post, more like this please! Thank you for your effort in writing these! I look forward to the eventual foreign sector version and would definitely love to read a Cambridge Capital Controversy post or two.

Tom Hickey, talking about “dominant factors” as if the factors had an existence independent of people’s social frameworks smacks of commodity fetishism; it also falls foul of the Sraffa/CCC demonstration that “capital” is not a homogenous entity. It would be better to speak about which social class, who control various factors/means of production, commands the most socio-economic power (“relations of production”) and can use their power to skew the distribution of surplus in their direction.

Tom,

You have a thoughtful and balanced perspective.

Do you know where tribes in the remote jungle areas fit in? They seem to achieve production effortlessly without land ownership, money or a master/ servant relationship. There is usually a hierarchy of leadership (a chief) and seniority (respect of elders). Their society doesn’t seem to correlate strongly with any of the 3 dimension. Kind of a left wing anti-feudalism if that’s possible.

I like aspects of the tribal societies very much, it seems to work well on a small scale. In many ways, the social and work aspects of their life experience are better than ours. A well run kibbutz or cooperative society might be a modern equivalent. I feel it’s a shame these are not more popular.

Andrew Wilkins:

Have a read of a book called “the tipping point” by Malcolm Gladwell. It talks about why small tribes seem to work so well, as well as a bunch of other awesome stuff.

@ Ralph.

“That is, if Brianovitch above is right in saying that K had no objections at all to printing, then K buried the point deep in the convoluted language of his General Theory. The result is that a lot of people – not just me – have got the impression that K preferred borrowing to printing.”

I have never said that Keynes had no objection to ‘printing’. Keynes talked about ‘new money’ in much the same way as MMT refers to ‘crediting accounts’. Neither does Keynes use the term ‘borrowing’ in terms of running a deficit. He uses the term ‘open market purchases’ as exerting downward pressure on interest rates in the context of monetary policy in much the same way as MMT talks about ‘debt issuance’ to maintain the government’s ability to control monetary policy. Terms like ‘printing money’ and ‘borrowing’ should be jettisoned as unhelpful.

The General Theory has its difficulties which stem mainly from deploying as many assumptions as possible from classical theory in order to show that even on their own terms their theory was wrong. Understanding this intention is the important point, and then any notion that Keynes language is ‘convoluted’ can easily fall away. The notion that the General Theory represents Keynes’ final view can be easily dislodged. By the time of the National Debt Enquiry in 1945, Keynes makes it clear that he understands money as endogenous and that the state can set the interest rates. Indeed, he sets out specific policies for postwar interest rates to be set exogenously (Collected Works, XXVII, p.399). It would be more useful to see Keynes as the first Post Keynesian (possibly the second if we take Abba Lerner into account); a precursor to MMT still struggling with a gold standard and fixed exchange rates. So, Ralph, no more ‘printing’ or ‘borrowing’, please.

Tom Hickey, talking about “dominant factors” as if the factors had an existence independent of people’s social frameworks smacks of commodity fetishism; it also falls foul of the Sraffa/CCC demonstration that “capital” is not a homogenous entity. It would be better to speak about which social class, who control various factors/means of production, commands the most socio-economic power (“relations of production”) and can use their power to skew the distribution of surplus in their direction.

Agreed. Sorry for not stating that clearly. Thanks for clearing it up.

In each case, the dominant social class emphasizes the economic rent favorable to that class and also cheats in favor of the dominant factor, even making such economic cheating legal politically. This creates imbalances that become magnified economically and disruptive socially and politically.

Andrew: I like aspects of the tribal societies very much, it seems to work well on a small scale. In many ways, the social and work aspects of their life experience are better than ours. A well run kibbutz or cooperative society might be a modern equivalent. I feel it’s a shame these are not more popular.

This is a basis of anthropological economics. Anthropological economists see economics as one of the social, biological and evolutionary sciences (SBE) that function within an overarching paradigm. They criticize mainstream economists for physics envy, abandoning examination of the relevant data for non-empirical assumptions necessary for their mathematical models, which only model worlds of their fantasies.

Actually, there is a large “underground economy” modeled on ancient tribes. It began in the countercultural revolution of the Sixties, and it continues today among those who have recognized the inadequacy and abject failure of conventional society. One of the older wise men (RIP), who called himself “a student,” often said, “Look at what everyone else is doing and do exactly the opposite, and you’ll be fine. They are 180 degrees off.”

This is an international movement, and it can found globally if one looks for it. However, it is purposefully unorganized and leaderless, and it conceals itself from prying eyes by appearing to be unsuccessful judging on mainstream criteria because it is based on distribution rather than personal accumulation. A fundamental principle is voluntary cooperation by self-sufficient individuals for mutual benefit, with decision making based on consensus. The unit is a circle of trust.

This is actually a natural structure and most people form a close network rather automatically without even realizing it explicitly. Each of these close networks is based on certain structural rules, or norms. Most people simply receive their norms as conventions. People that live experimentally choose their norms carefully based on philosophical, scientific, and historical knowledge, rigorous observation, personal and group experience, and feedback from the environment. There are a lot of very smart people involved, but having a good heart is the real requirement for authentic participation.

A number of these groups are consciously and intentional working on creating models for living holistically. There are nodes through which they gather and network. The net has now made this a global in outreach, but initially it was almost entirely personal and face to face.

Happy to hear an MMT textbook is coming next year! It is much needed for all kind of purposes.

The popularity of the flawed mainstream ideas comes mainly from such formal, scientifically looking economics textbooks which are studied in the universities. Once the students are brainwashed from the very beginning, it is very difficult, for most of them, to change their views later – it’s kind of like their “first love”, unless they didn’t fall in love on the first place.

The MMT textbook will be the real thing and it should find its way to the universities worldwide.

…So the fact that the business groups often lead the charge against budget deficits reflects the triumph of ideology over good judgement and the triumph of ignorance over understanding. I just shake my head in wonderment when I see a business person railing against budget deficits…

It’s probably due to their incapability to distinguish between the budget deficit and the size of government. A decrease in the latter, especially in the form of fire-sales of assets under pressure to decrease the deficit, most certainly is in the interest of the business community.

…In truth, the economy and profits are entirely dependent on the federal budget deficit,…

or exports? surely, the ‘nations’ with the sharpest eyes, the cleverest minds, the fastest legs, and, sometimes, the best luck deserve to find the most prizes ;-). globalization is a great excuse for thinking micro on a grand scale.

I love the subject, but, although the equation is simple, I am having difficulty pinpointing exactly where the data comes from. Can you provide the tables and line #s for each of the variables in Kalecki’s profits equation? Preferably the expanded one, but the simpler one would still be greatly appreciated.