I have received several E-mails over the last few weeks that suggest that the economics…

When you haven’t got a Plan B

The UK is still in the grip of a serious slowdown and the British government has begun its fiscal austerity program which will savage net public spending and cause wide spread job losses. But the Chancellor is still boasting that Plan A – scorch the economy – will be maintained and he has sought legitimacy for his position in the release by the UK Office for Budget Responsibility (OBR) of its Economic and Fiscal Outlook November 2010 yesterday (November 29, 2010). When one examines the OBR document in detail one could be excused for thinking it was a “colouring-in” exercise with a difference – you know, draw nice colourful bar charts to tell the story that you want based on assumptions that will not survive empirical scrutiny in coming months and years. The problem for Britain is that there does not appear to be a Plan B. It is all or nothing and while the “lab rat” nature of the policy experiment is intellectually interesting for researchers such as myself I don’t want to glean enjoyment from what will be the increased suffering of millions. Plan A will fail because the assumptions and projections are unrealistic. When you haven’t got a Plan B then that failure will be very costly.

As an aside I just love the way they try to kid us with their WWW URL – http://budgetresponsibility.independent.gov.uk – that they are somehow “independent” and therefore to be believed.

The UK Chancellor saw the Report as a vindication of his plan to scorch the British economy with his harsh fiscal austerity program. I couldn’t believe that anyone would have taken his outburst yesterday seriously.

The UK Guardian article (November 29, 2010) – George Osborne sees the road to recovery despite report said that “George Osborne vowed yesterday to press ahead with spending cuts and tax rises” even though the OBR Report contained highly dubious forecasts of growth and even then said that the British economy is “delicately balanced”.

Among other things, Osborne told the House of Commons yesterday after the OBR Report was released that:

When we came into office Britain was in the financial danger zone. Our economy was unstable, our public finances out of control, our country on the international watch-list to avoid. We took decisive action. Now the independent OBR have confirmed that the British recovery is on track, our public finances are on the mend, our debt is under control, employment is growing and our economy is rebalancing.

The full Hansard for yesterday was not available yet (inefficient British public service – sack them!)

The point is – which I will expand on – is that the “decisive action” hasn’t even started impacting. If the British recovery “is on track” it is because the fiscal deficits from the previous government have supported aggregate demand and “financed” private domestic saving while stimulating some (very modest) growth.

Any employment growth is largely a consequence of that (more about which later).

The UK Guardian article (November 29, 2010) – George Osborne sees the road to recovery despite report – provided some additional quotes from the Chancellor.

This is an uncertain world but the British recovery is on track. Employment is growing, one million more jobs are being created, the deficit is set to fall, the plan is working. So we will stick to the course. That is the only way to help confidence to flourish and growth to return.

Once again Osborne is lacking in temporal logic. Yes, the British economy has shown some signs of recovery which is to be expected given the size of the fiscal input to the spending stream (planned or not).

But that in no way provides any basis for the fiscal austerity “course” that the Conservatives are now imposing. That will cruel the modest growth that has emerged.

Osborne also told the Commons that “UK would avoid the fate of Ireland” which is obvious because it is a sovereign nation and can limit any financial damage with appropriate fiscal responses. But given the lack of understanding that the Chancellor demonstrates in relation to the appropriate fiscal options there is every danger that in the coming year, the UK will follow Ireland down the negative growth route which will cause the fiscal outcomes to move in the opposite direction to the plan as the automatic stabilisers work to attenuate the collapse of spending.

But to compare the UK (sovereign nation) to Ireland (an inmate of the EMU prison) is not valid and shows that the Chancellor wishes to engage in misleading dialogue with the British public.

What is going to drive this growth?

The OBR outlook is really just a rewrite of the Treasury’s budget forecasts and so it is no wonder the Chancellor will be saying – “see, everything will be okay”.

My guess is that it will not be okay. The OBR report says it should be read cautiously because there are risks of an “overestimate of potential GDP” and “risks around revenues and spending for given state of the economy”. Which in English says – if the overly-optimistic assumptions they have built into their projections are not realised then the scenario falls apart.

Specifically, they forecast that the UK economic growth will actually accelerate (1.8 per cent instead of previous forecast of 1.2 per cent in 2010) which is greater than the expectations of the OECD and the IMF. Most forecasters are in my camp I think and believe the overall outlook painted by the OBR is unrealistically optimistic.

OBR says that “Rebalancing away from private consumption towards investment and net trade is a theme of our central forecast”. So they are saying household consumption will be relatively flat and growth will be driven by net exports and business investment.

They base some of their export-led recovery hope on what happened in the past. They say:

We therefore forecast a strong contribution to growth from net trade throughout the forecast horizon. Chart 3.13 shows how this compares with the experience following the 1990s recession and sterling depreciation. In that episode a 15 per cent decline in sterling translated into an average trade contribution of 0.6 percentage points a year from 1993-95. Our forecast is for a 0.7 percentage point contribution across the 5 year forecast horizon against a backdrop of a 25 per cent decline in sterling.

Yes, the historical data is fact. But the world conditions that created that data are very different to now. The previous episodes of fiscal retrenchment in the UK episodes were conducted in times of strong world growth. The outlook for the Eurozone is bleak notwithstanding Germany’s export performance. The US may continue growing albeit slowly.

But when austerity is the flavour of the day single country attacks on spending will backfire. Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

The OBR recognise this vulnerability but dismiss it. On Ireland they claim that the worst is past! That is optimism for you.

Ireland is “the UK’s fifth largest export market and accounts for 6.2 per cent of total exports – larger than the combined share of the ‘BRIC’ economies (Brazil, Russia, India and China)”. The OBR say that poor Irish demand would have “a material impact on UK export growth” but they claim that:

… much of this effect may have already occurred: the very sharp decline in Irish domestic demand, which was a precursor to recent events in financial markets, caused UK exports to Ireland to fall by 14 per cent in 2009, worsening the UK’s trade balance by around £4.3 billion.

The smart prediction for Ireland is that things will remain very bad there for some time to come. The new “bailout” conditions which will force even harsher austerity will not be growth promoting. This weakness for British exports will continue. Note the OBR say “may” have past! I say – there is more to come yet!

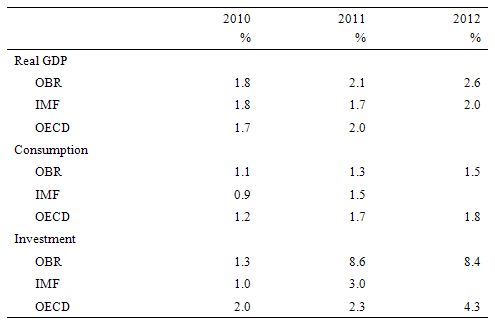

The following Table provides some comparison between the forecasts for 2010-2012 by the OBR and those available from the IMF (WEO as at October 2010) and the OECD (Economic Outlook as at October 2010). The investment forecast discrepancies are stark and if the more moderate forecasts of the OECD and IMF are accurate then the whole OBR outlook melts down very quickly.

I have not included the respective net export outlooks because it is hard to get comparable forecasts but piecing together the evidence suggests that the OBR are very optimistic indeed.

And remember, the IMF and the OECD are much more optimistic than I would dare to be given the degree to which aggregate demand is being hit from the fiscal austerity packages being imposed on weak economies everywhere.

What has been driving growth to date?

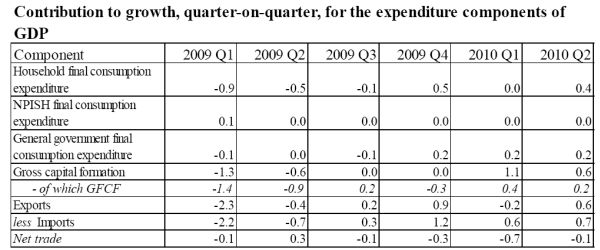

The following Table is taken from the most recent UK National Accounts. The Table shows the contributions to UK growth by aggregate demand (expenditure) component. NPISH are Non-profit institutions serving households and note that Gross fixed capital formation (GFCF) is for the public and private sectors taken together. The private component of the latter collapsed in 2009.

The ONA report that “For the year 2009, gross fixed capital formation decreased by 15.1 per cent” and returned to modest positive growth in the second quarter 2010 (partly because of private housing boost and in spite of a declining government contribution).

It is clear that the external sector has not been a positive contributor. So the OBR is predicting a very dramatic turnaround in the external sector’s contribution as you can see in the next Table.

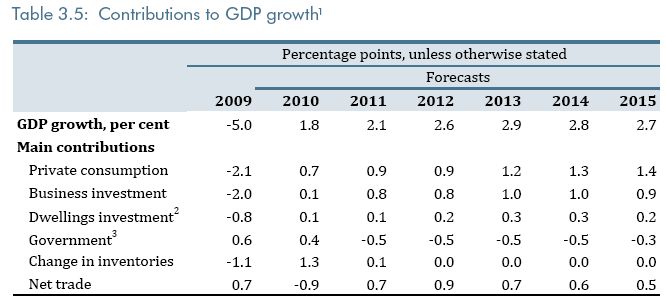

Now compare that to the OBR’s scenario contained in the following Table (taken from their Table 3.5). It is clear they are predicting a major turnaround in the contribution from the external sector and business investment.

It is also likely that the fiscal austerity drive will impact negatively on the household saving ratio. OBR predict that it will remain more or less constant over the coming years although they realise that there is still significant indebtedness in the household (and private sector generally) which will dampen spending.

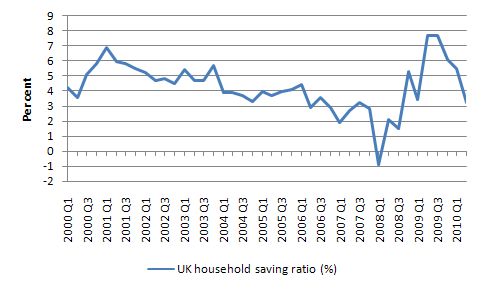

The following graph comes from the UK Office of National Statistics shows the UK household saving ratio leading up to the crisis. Modern Monetary Theory (MMT) proponents watched the decline of household saving ratios in many countries over the last decade closely and predicted that they were the canary in the mine.

The ONS said at the time of release (April 6, 2010) that:

The household saving ratio in the UK in 2008 was 1.7 per cent of total resources, the lowest recorded since 1970. This figure is also substantially lower than the average of 7.6 per cent recorded between 1970 and 2008.

The situation got worse and it took the onset of the crisis to provide the motivation and the rapidly increasing budget deficits to provide the capacity for households to reverse the credit binge. Overall, the private sector cannot run permanent deficits – eventually households and firms have to stabilise their balance sheets and reduce the precariousness of their positions. In the downturn that certainly occurred.

The following graph is taken from the most recent UK National Accounts data and shows the household saving ratio from 2000 (first quarter) to 2010 (second quarter). The capacity of the household sector to save as the crisis unfolded was aided by the fiscal support to aggregate spending.

The point is that if private spending and net exports are not as robust as the OBR is predicting (and it is hard to see their forecasts being accurate) then the harsh cutback in public contribution to nominal demand growth will reduce the capacity of the households to further insulate themselves from their debt exposure. If housing prices continue to fall then further financial strife is likely.

On Page 39, the OBR say:

The relative weakness of our forecast reflects the headwinds to growth from the outlook for credit conditions, efforts to reduce private sector indebtedness and the scale of the fiscal consolidation, which is yet to have its full effect on the economy.

Yes, but the calibration of these headwinds is far too optimistic.

The UK Guardian editorial today (November 30, 2010) captures the situation well:

For all the fiendish complexities, at heart forecasting is the art of the ruler: straight lines reconnect a depressed present with a trend extrapolated from a happier past. Thus business investment – which has sunk like a stone – is now predicted to surge. Perhaps it will. If so, the wider economy may dodge the axe being flung at the state. But perhaps business will falter. If so, Mr Osborne will learn the lesson being absorbed by those early cutters in Dublin whom he once admired. Namely, that writing pain into the start of his story does not guarantee a happy ending.

Meanwhile, the so-called lucky country is not so lucky!

Regular readers will know that I track the daily data releases from the Australian Bureau of Statistics to allow me to form views on how the Australian economy is going. The theme at present is that the mainstream economists, politicians and central bank (RBA) have all been claiming that the economy is close to full employment and booming above or near to trend growth rates.

My reading of the data as it has been unfolding before our eyes in the period since fiscal contraction has started and the RBA has been tightening monetary policy is that the economy is slowing and nowhere near capacity.

Unemployment rose last month as employment growth slowed. Business equipment investment went backwards; demand for credit is flat and construction (which had remained strong throughout courtesy of the capital works program associated with the fiscal stimulus) has also gone backward in recent months.

Of-course, the RBA and everyone else has said – never mind our terms of trade are at record levels and net exports associated with our “one-in-a-century” mining boom will take care of everything.

Well on the eve of our September quarter National Accounts being release (tomorrow) we now know that net exports will be a contractionary force on real GDP growth in the third quarter.

The ABS released their Balance of Payments and International Investment Position data today for the September quarter and these results feed directly into the National Accounting framework.

The main results were:

In seasonally adjusted chain volume terms, there was a turnaround on net goods and services of $1,457m from a surplus of $1,389m in the June quarter 2010 to a deficit of $68m in the September quarter 2010. This is expected to detract 0.4 percentage points from growth in the September quarter 2010 volume measure of GDP.

That is, net exports have contracted and will reduce real GDP growth by 0.4 percentage points in September. Given the negative implications of the reductions in business equipment investment and construction, the Australian economy is clearly slowing.

What policy logic would justify deliberately reducing output and employment growth when the recovery from the downturn was less than robust and when you have at least 12.5 per cent of available labour resources sitting idle (either unemployed or underemployed)? Answer: only a neo-liberal vandal could see any sense in the current government policy of fiscal contraction and rising interest rates.

The RBA claims it is taking action now just in case aggregate demand get out of hand next year. But in fighting a war that hasn’t even begun the casualties are (the poor and disadvantaged) are already getting mowed down by “our won troops’ fire”. There is no defensible logic for forcing unemployment up now!

Meanwhile the government continues to chant their mantra – we will the budget into surplus by … – as if that goal is something to chase independent of what is happening in the economy where things actually matter – job creation, and output and income generation. It is just mindless vandalism.

Tomorrow we will see the extent of the damage in the last quarter.

The ABS also released their Government Finance Statistics today for the September quarter which gives us an indicator of the contribution of government spending (consumption and investment).

The data shows that public spending on consumption and investment rose 0.9 per cent in the September quarter and this will help bolster the real GDP growth figures tomorrow.

But once again it demonstrates that the Australian economy is still highly dependent on the fiscal contribution even though it is being withdrawn at present.

Conclusion

The proof will be in the British pudding. I think it will be an ugly, very flat pudding that is not to anyone’s liking. As we have noted in previous blogs – the UK is entering “lab rat” status and joining their Irish comrades. Ireland is really forecasting Britain’s immediate and medium-term outlook.

Tomorrow: Australian National Accounts come out and I probably might say something about them. Prediction – growth will be slower. Negative? probably not but closer to zero than trend (which is around 3.5 per cent per annum). Diagnosis: Australian government incompetence – to smug for their own good.

That is enough for today!

“That is, net exports have contracted and will reduce real GDP growth by 0.4 percentage points in September. Given the negative implications of the reductions in business equipment investment and construction, the Australian economy is clearly slowing.”

I must admit it is a bit annoyling to hear the RBA Governor warning about potential inflation down the line due to the mining boom and getting a recent pre-emptive hike then seeing this occur.

One would think at this particular point of the wobbly global recovery inflation slightly above the mean is a very minor concern. I do not agree with constant government stimulus which some perpetually advocate however I think the economy is more than capable of a good medium term outcome on cruise control and a neutral budget position.

The main factor holding the British government back from more stimulatory measures is inflation, which is around 3% as opposed to the 2% target. But I’m suspicious as to how much of this 3% is what might be called genuine inflation. I.e. I suspect much of it consists of “one off” factors, like the recent VAT increase and world raw material price increases. Has anyone analysed this? Could Bill analyse it?

CPI-CT, which is CPI at a constant tax rate is flat at 1.4%. The underlying index figure is pretty much identical to the December 2009 figure (113.8 vs 113.1). Most of the change over the last three years is due to fluctuating energy costs, with a touch of service sectors. Goods have gone nowhere for a year.

The ‘headline rate’ is almost 50% higher due to the constant rise in VAT over the last two years and the rise in road fuel duty. Which I suppose shows that the taxes are having their intended consequence – sucking money needlessly out of the economy.

‘Focus on Consumer Prices Indices’ at the Office of National Statistics has it all in gory detail.

Ralph, a commentor on this blog told me recently that around half of the British inflation at present is accounted for by VAT hikes. Sorry I can’t be more helpful than that, your question just jogged my memory.

cheers

And I see Niel has come in just ahead of me.

The main factor stopping the Government is a 2% inflation target?

Inflation targets, like NAIRU unemployment targets, are plucked out of the same monkeys ass.

Hey, don’t forget the US. Obummer has just announced a freeze on government worker’s pay and says he wants to work with John Boner on spending. How do you think that is going to work out? Australia and Britain have nothing on us when it comes to incompetent politicians.

“What policy logic would justify deliberately reducing output and employment growth when the recovery from the downturn was less than robust and when you have at least 12.5 per cent of available labour resources sitting idle (either unemployed or underemployed)? Answer: only a neo-liberal vandal could see any sense in the current government policy of fiscal contraction and rising interest rates.”

The current Australian policy is one of fiscal expansion and rising interest rates – the Libs have spotted this inconsistancy, although of course they were wrong about which part of it should be changed.

Calling it vandalism is also misleading – it’s more like trigger happy paranoia! They’re jumping at shadows because they’re scared inflation could take off again like it did in ’08.

Just heard that Vince Cable, head of dept that brought forward the bill for the increase in tuition fees in the UK and promoted it, is thinking of abstaining from voting for it. You could not make it up. Madness!

I can just imagine what Bill is typing right about now in response to Australia’s rather lame Q3 GDP of 0.2%. I do agree that any economist still looking for a near term hike needs to be shot.

Dear Ray (at 2010/12/01 at 11:40)

I haven’t started typing yet – later for that – I actually have a job to do in my spare time!

But as you will read – today’s National Accounts figures signal policy failure in bright neon lights. They ran scared too early and unemployment will rise again.

Ridiculous – and not to far away from the nonsense that the EMU is enduring. Stupid, ideologically-driven politicians and their advisers and supporting officials making poor judgements which inflict damage on people other than them!

best wishes

bill

You have to admit, whatever your political pursuasion, MMT is proving to be the best predictor of economic outcomes.

I’m actually using Bill’s and Warrens Blogs as reference to shape some financial decisions. (No pressure guys, I take responsibility for my own due diligence). In only a few months following the blogs, they have saved me from a couple of serious investment mistakes.

Recently I avoided exchanging into AUD. Thanks for that. More people should take MMT seriously, because it is profitable to do so.

Dear Andrew Wilkins (at 2010/12/01 at 14:12)

My invoice is in the mail! (-:

best wishes

bill

“As an aside I just love the way they try to kid us with their WWW URL – http://budgetresponsibility.independent.gov.uk – that they are somehow “independent” and therefore to be believed.”

I think you do yourself no credit at all by descending to cheap jibes and mud-slinging.

The “gov.uk” is, as I’ve understood it, an internet-enforced convention governing domain names. If this were a privately-funded think-tank – however ideologically-slanted (like this one?) – the domain would be “co.uk” but since it’s funded by government it gets the domain name that goes with that territory.

That says nothing whatever about its freedom (or otherwise) from government influence. If you want to be totally cynical about that, that’s up to you. The first person appointed to head it (Terry Burns) was well-known for his robust independence and I don’t see any reason why an unbiased person would give Robert Chote any less credit for that, given his credentials. Perhaps you have some reason for assuming otherwise (other than blind prejudice I mean)?

I imagine that the insertion of “independent” into the URL was an attempt (probably forlorn – judging from your ill-informed reaction) to emphasise that it’s not part of government although government-funded.

“The proof will be in the British pudding.”

Just so. Meantime your comprehensive rubbishing of the forecast (plus questioning of the forecasters’ integrity because they haven’t seen the MMT light) was entirely predictable. You entirely fail to mention (as does The Guardian) that it was the central one of a wide range, with clearly-identified vulnerabilities, and with two “what-ifs” (alternative outcomes if it all goes pear-shaped).

I think you’ve excelled yourself.

My mistake. The man initially appointed to head the OPB was not Terry Burns but Sir Alan Budd (to whom my description applied), Robert Chote, BTW, formerly headed the Institute for Fiscal Studies – not known as a government lapdog.

“Perhaps you have some reason for assuming otherwise (other than blind prejudice I mean)?”

Robert,

Fundamentally all human operations suffer from common human failings. The OBR will report according to middle of the road current thinking – whether that thinking is flawed or not. Why? Because those who pay the piper call the tune however ‘independent’ they might like to pitch the PR and rocking boats doesn’t get you anywhere.

The OBR report is a very large and well crafted document that essentially provides the same story as all forecasts – “we predict this, but we might not be right for various reasons”.

Neil: “The OBR report is a very large and well crafted document that essentially provides the same story as all forecasts – ‘we predict this, but we might not be right for various reasons'”.

Fair comment. I just don’t think people’s integrity should be so lightly questioned.

The setting-up of the OBR (with Alan Budd as its first head) was I believe a genuine attempt on the new government’s part to increase the public’s confidence in the Treasury’s own forecasting (which had fallen into general disrepute under the previous government). The Treasury’s forecasters know that if they succumb to political pressure to stray too far from reality this will now be glaringly obvious, since the OBR is applying its own independent judgment to the same data.

So I don’t really understand what you mean by this:_

“The OBR will report according to middle of the road current thinking – whether that thinking is flawed or not. Why? Because those who pay the piper call the tune however ‘independent’ they might like to pitch the PR and rocking boats doesn’t get you anywhere.”

Neither the OBR nor the Treasury is deciding-upon fiscal policy; they are each forecasting (on the basis of stated assumptions) what is the degree of probability that the government’s policy targets will be met. It’s no part of the OBR’s brief to say: “we wouldn’t start from here”, but that doesn’t preclude them from concluding that the government won’t get to where it says it wants to be, if that’s what they think. Nor would they have anything to lose if they did (in fact they’d probably win more kudos).

Bill takes an extremely jaundiced view of their latest relatively upbeat assessment but then he would, wouldn’t he? By definition any assessment that doesn’t condemn the whole approach and predict its failure has to be crap. It may be so, but to ascribe it to sycophancy (in effect) is paranoid IMO.

I heard the OBR is staffed with Osborne’s buddies – can anyone recall the details?

Robert: IFS is no govt lapdog? Well it’s majorly ideological – as pro small state as Cato/Heritage/Peterson/AEI. So it’s hardly ‘mudslinging’ to point out the support they give for some of the most radical govt reforms in recent UK history.

Best

MMTP

” Nor would they have anything to lose if they did (in fact they’d probably win more kudos).”

They have a lot to lose. These are not Judges who can only be removed by an act in both houses of parliament.

They suffer from the same human frailties as everybody else. They please their paymasters. Everybody does it – conscious or not. It’s the reason scientific reports have bias and it is the reason statistical reports have bias if they do anything other than state the bald numbers.

They are writing the report using the ‘accepted’ economic theories – which are clearly wrong and have no basic in fact. You can explain the movement of the planets using a geocentric model of the solar system – in fact those equations have much better predictive capacity than most economic theories. But that doesn’t make it accurate because the model used is just wrong.

Neil: “…in fact those equations have much better predictive capacity than most economic theories.”

I like the way you were careful to write “most”. After all, it would never do, would it, to even hint that MMT might not have better predictive capacity than that?

Personally, I wouldn’t enter the reservation that you do. But then I’m not an economist.