I have received several E-mails over the last few weeks that suggest that the economics…

The year is nearly done … but spending still equals income

It is a beautifully warm and sunny end to the 2010 which in general has been a pretty awful year. Yesterday, US Department of Labor released the latest Jobless Claims data. That was good news and suggested that not only has the fiscal expansion in the US been supporting growth but that the economy may be turning the corner – albeit very slowly. Earlier in the week the extremists – the unrelenting deficit terrorists who don’t understand what has been going on were at it again. Like an old gramophone record stuck in a worn out groove they chanted their mantras about record debt levels and how best to cut the deficit. They appear to be stuck in a pre-1971 monetary system as well and haven’t yet caught up with the fact that times have changed. We have CDs, DVDs, MP3s and a fiat monetary system. Anyway, I guess we know have an inkling as to their problem now – see this blog – We always knew it – their brains are thinner!. They do not seem capable of understanding that if you want deficits to fall then you need growth. Growth occurs because spending equals income – public or private the cash till operators don’t discriminate. When there is insufficient private spending to support robust growth, then you have to supplement it with public spending. End of story.

The US Department of Labor released the latest Jobless Claims data on December 30, 2010, which showed that:

In the week ending Dec. 25, the advance figure for seasonally adjusted initial claims was 388,000, a decrease of 34,000 from the previous week’s revised figure of 422,000. The 4-week moving average was 414,000, a decrease of 12,500 from the previous week’s revised average of 426,500.

This is the lowest level of new claims since June 2008 which was before the September 2008 collapse of Lehmans and the chaos that followed.

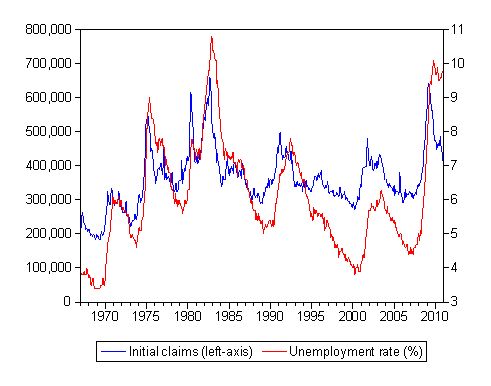

The following graph shows the US Department of Labor initial claims and the US Bureau of Labor Statistics unemployment rate (taken from their population survey). I converted the weekly initial claims data into a monthly seasonally adjusted series to correspond with the monthly data available in seasonally adjusted form from the BLS. The data is from January 1967 to December 2010 (although the December labour force survey data is not yet available).

The graph shows that the unemployment rate tends to lag the initial claims series (see the turning points) which means that the unemployment rate tends to continue rising for a few months after the turnaround in the initial claims data.

This suggests that if this momentum is maintained, the US labour market should start to deliver a lower unemployment rate in the first quarter of 2011. The problem of-course is whether the growth drivers will be cut short by premature fiscal contraction.

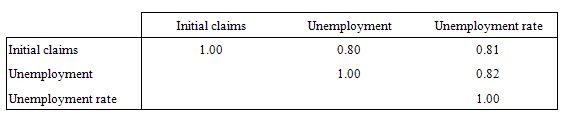

The following table shows the correlation coefficients between the initial claims data, total unemployment and the official BLS unemployment rate. The Table shows that the initial claims series is highly correlated with the broader labour force measures of joblessness.

While the commentators have been arguing that caution is needed because the “claims can be volatile around holidays, and this week’s blizzard might further skew filing activity” ((Source), the US Department of Labor made no special mentions, which suggests that these concerns are probably on the conservative side.

So on first blush, I conclude that the US economy is starting to emerge from its very long slump but the rate at which the unemployment pool declines will be slow at the current pace of recovery.

A simple regression model relating the net change in employment to the change in initial claims shows that the latter is a highly significant (in statistical terms) predictor of the former. I forecasted the model out and the current claims behaviour could be associated with employment gains of between 145,000 and 180,000 jobs per month (for the forecast period).

If you consider that in terms of the current unemployment rate (November 2010 of 9.8 per cent) and factor in labour force growth (particularly the return of the hidden unemployed) then you realise that such a rate of employment growth will not soak up much of the unemployed and long-term unemployment will increase and the accompany poverty.

For an interesting case study of US long-term unemployment and poverty see this Economist Magazine article – Poverty looms for the long-term unemployed – published December 16, 2010. Not a pretty picture at all.

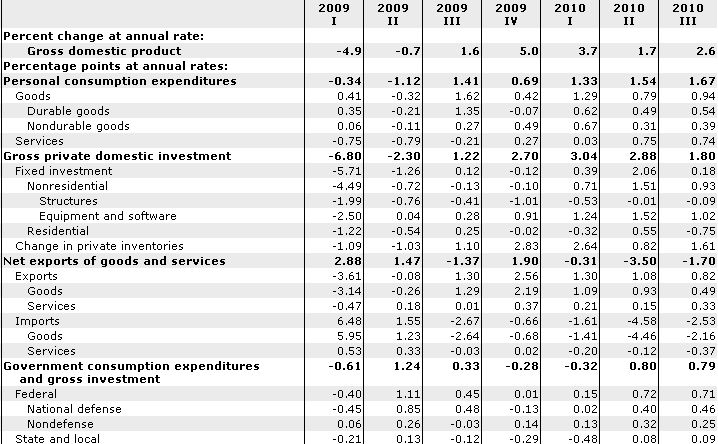

The claims data is consistent with other favourable economic news from the US in recent months. The following Table is taken from the US Bureau of Economic Analysis NIPA data and shows the contributions to quarterly real GDP growth (on an annualised basis) for the different expenditure components.

It shows the growing strength of consumer spending, the falling drain from imports (although net exports is still subtracting from growth) and the continued strong contribution of the US government sector. The late 2009 and early 2010 negative government contributions were the result of the states contracting under the weight of their nonsensical balanced budget rules. The US federal government should have provided ample funds to the states to continue to maintain all services and develop job creation strategies. The recession would have been shorter and less severe had they done this.

The other point to note was the positive contribution from the external sector in early 2009 was not a good sign. It was driven by the fact that imports collapsed more quickly than exports – a sure sign that not only is the world in recession (export demand falling) but the local economy has contracted sharply (import demand falling).

However, there are many problems facing the US economy. First, fiscal austerity in Europe and the UK will have some impacts on the ability of the US economy to continue growing, especially as the Administration is desirous of expanding exports to give it “room” to contract the public contribution to growth.

It is clear that the ECB is running the show in Europe and while it is propping up a number of governments (is France next?) it is also exacting a harsh toll by way of austerity measures. The pro-cyclical fiscal policy being imposed on nation states in the EMU will ensure their recessions are protracted and very damaging. The damage will span generations such has been the magnitude of the demand collapse and the appalling government responses to it.

Second, as has been reported in the last week, China has been tightening monetary policy in an attempt to slow the economy down given the rising property prices in that country.

In this article (December 30, 2010) from The Australian – China’s manufacturing grows at slower pace as government tightens policy – we read that:

CHINA’S manufacturing growth slowed for the first time in five months this month as the government tightened monetary policy … [forecasters predict] … interest rates will rise at least twice in the first half of 2011 after an increase on Christmas Day — the nation’s second since the global financial crisis.

I have been following the debate in China about monetary policy in recent months and the only conclusion I have reached is that too many of their central bank officials have probably been trained in mainstream US-economic’s departments and are now back home poisoning that country with the nonsense they has been pushed down their throats.

Whatever, if the Chinese government does moderate its growth rate, which was maintained at reasonable levels during the crisis by a strong fiscal intervention which redirected demand towards to the domestic economy (as exports slowed), then the rest of the world will feel it. The growth in the EMU – for what it is worth – is being helped by exports to China.

Australian economic growth is also currently being helped by the demand by China for our resources.

If you go back in history (last 30 years) and examine monetary policy-led dis-inflation exercises the stark reality is that they always open up the output gap (that is, slow the economy). The question is how much. The problem with monetary policy is that the informational feedback is too lagged to be a good guide as to when enough is enough. By the time you realise the rate hikes are impacting negatively on spending it is too late and the problem has been overcooked.

So how China manages this dis-inflation presents a major risk to the US economy.

Third, the deficit terrorists in the US are unrelenting notwithstanding their “thin brains” and are making it virtually impossible in a political sense for the US government to fulfil their fiscal responsibilities which are to ensure aggregate demand is sufficient to maintain high levels of employment growth.

The switch to a Republican-controlled congress at the November elections will be a major setback for the US economy.

Which brings me to this article – The Right Way to Balance the Budget – which appeared in the Wall Street Journal on December 29, 2010.

It is from our pals at the American Enterprise Institute, which houses more thin-brained individuals per square metre than most organisations.

I wonder what the authors of this article think has been going on in the US the last few years. I wonder if they appreciate just how severe this crisis has been and the potential that it presented to become a major catastrophe? I wonder if they have any inkling of the way the monetary system actually operates and the impact of the federal deficits on spending?

The reason I wonder is because there is no sense of reality in the article. It is the outpourings of people obsessed by irrelevance.

The authors note that:

The federal debt is at its highest level since the aftermath of World War II – and it’s projected to rise further. Simply stabilizing debt levels would require an immediate and permanent 23% increase in all federal tax revenues or equivalent cuts in government expenditures, according to Congressional Budget Office forecasts. What’s clear is that to avoid a crisis, the federal government must undergo a significant retrenchment, or fiscal consolidation. The question is whether to do so by raising taxes or reducing government spending.

I note the following:

“There has been an unprecedented rise in the number of persons with very long durations of unemployment during the recent labor market downturn. Nearly 10 percent of unemployed persons had been looking for work for about 2 years or more in the third quarter of 2010” – (Source).

In fact, the US Bureau of Labor Statistics reports that they are:

Because of this increase, BLS and the Census Bureau are updating the CPS instrument to accept reported unemployment durations of up to 5 years. This upper bound was selected to allow reporting of considerably longer durations while limiting the effect of erroneous extreme values (outliers).

The national unemployment rate in the US is at its highest level since 1948 and there are more people unemployed than during the Great Depression – (Source).

The US population is at its highest level since statistics were kept – Source).

The population statistic is unambiguously about scale and doesn’t tell us all that much. Just like the level of federal debt. What does the level of federal debt tell us by way of information about anything that is important? Not much.

It might signal a strong economy being supported by a full-employment budget deficit with very low unemployment and strong productivity growth and real wages growth.

It might signal exactly the opposite.

The other statistics I cited are much more meaningful. They tell us that something dramatically is wrong with the US economy and the damage is in terms of things that matter – people’s jobs, their income-earning capacity, and their ability to risk-manage their lives and those of their families.

In fact, if you read the WSJ article you won’t see any mention on unemployment – the most significant problem facing the US economy given all the pathologies that accompany it. That should tell you why I consider it to be the product of writers who have no real understanding of the situation they are holding themselves out to be experts about.

There is nothing intrinsically interesting about the level of federal public debt. All of it is denominated in US dollars which means that the US government can always honour the interest payments and the redemption.

Given the US government is holding on to its archaic gold standard practice of issuing debt $-for-$ to match its net spending (deficit) which is a voluntary and unnecessary act in the fiat monetary system it now oversees, the only thing that the rising federal debt tells me is that deficits have been rising.

The only interesting question that is generated from that information is – WHY?

Then I focus on the real economy and what is happening and what should be done. I understand that the budget deficit will increase (or surplus decrease) when private spending falters because of the automatic stabilisers. I know that tax revenue falls and welfare payments rise because less people are in work. So without any discretionary intervention from the government I know that the budget deficit will rise and debt levels will rise.

So what is the concern? Designing a policy reaction that will prop up aggregate demand while the private sector is sorting itself out. When the cause of the private spending collapse is financially-sourced (too much debt, falling property values, debt defaults) I know things are going to be drawn out and the economy will need very signficant fiscal support to stop it collapsing altogether as the job cuts and resulting lost incomes multiply throughout the spending system.

I expect to see debt levels to rise significantly. I understand the reasons and the implications. The US government will be able to service the debt because it is a sovereign government and is never revenue constrained as the monopoly issuer of the US currency. So the debt increase is of no importance to me.

I also am aware that historically, growth always reduces the public debt ratio as it boosts revenue collections and reduces the budget deficit. Income and output growth only comes with sufficient spending growth. You will not get this while there are 9.8 per cent of your workforce officially unemployed and nearly double that idle in some way or another.

You will not get that by withdrawing the ficsal support while there is idle capacity – which there clearly is in the US. It is likely that the full-employment budget balance is around a 4 per cent of GDP budget deficit. That is, an on-going budget deficit of about 4 per cent of GDP will be required in the steady-state.

I am very sure that is the case. Hence I expect, given current existing institutional practices regarding debt-issuance, that the debt levels should continue to rise in the US. Record level after record level. Who should care about that? Well the unemployed who gain jobs as a result of the more appropriate nominal demand growth should applaud it.

Businesses who enjoy the rising profits and more stable demand conditions should applaud it. And so on!

The last thing that the American people should be concerned about at present (or ever really) is the level of federal debt.

The other thing I understand is that US households are increasing their saving rate after several years of bingeing on credit. The crisis was, in part, a product of this binge. There has to be a rundown in private debt in the US for stable growth to be possible.

I also note that the external sector continues to be in deficit and is unlikely to turn to surplus any time soon.

So taken together, what do those insights tell me? Answer: that if the private domestic sector is to successfully reduce its debt levels (which it has to!) and the external sector remains in deficit, then the government sector has to remain in deficit. Any question of it trying to “balance the budget” will just undermine the future stability of the economy.

The private sector has to reduce its dangerous debt levels! Those debt levels are the issue because that sector faces insolvency which will precipitate another financial crisis. The public debt levels are just associated with the public deficits which are essential to this process of private deleverage because they are supporting economic growth and generating income growth which, in turn, provides the capacity for private saving to grow without damaging demand.

Where do the WSJ authors think the growth that is driving the initial jobless claims came from? What do they think might have happened if the US government had not have provided the (paltry and inadequate) fiscal support that they did? No response in any of their writings in the past to those questions.

We are dealing with blind ideologues here who have very little comprehension of what they are writing about.

The article basically reiterates the work of Harvard economists Alberto Alesina and Silvia Ardagna who claimed that tax hikes were an inferior way to reduce the deficit. They claimed that spending cuts were the only way to proceed.

Please read my blog – The deficit terrorists have found a new hero. Not! – for more critical discussion on their work.

The WSJ authors just accept the erroneous Alesina/Ardagna analysis uncritically. They clearly do not understand its limitations and plain errors of reasoning.

But blind ideologues just seize on anything that has “Harvard” (or equivalent) attached to it which suits their arguments.

The most mind-numbing aspect of the article is that it never really answers the question: what is the necessity for fiscal consolidation? It just assumes everyone agrees that the US government has to achieve this without any further context or explanation.

The authors reveal their clear biases when they conclude that the best way to cut spending is to cut welfare/pension entitlements and government salaries. They ask:

Why is reducing entitlements and government pay so important? One explanation is that lower social transfers spur people to work and save. Reducing the government work force shifts resources to the more productive private sector.

Another reason is credibility. Governments that take on entrenched, politically sensitive spending show citizens and financial markets they are serious about fiscal responsibility.

So starve the disadvantaged out of their lazy bunkers and have them grovel in the street for any work they can find and cut public salaries so that the fat cats in Wall Street can have another long lunch and conclude that the real income pie that is being produced is out their for their picking.

The credible empirical research does not find that welfare provisions inhibits supply responses to jobs growth when there are sufficient jobs available. You cannot search for jobs that are not there.

Further, there is no credible evidence that says the private sector is more productive than the public sector. How productive has the financial sector been over the last decade?

How large are the economic costs that have been imposed on the world by an unproductive, dysfunctional private sector in the last decade? Answer huge costs which outstrip any public service wage bill.

The WSJ authors finish with the now familiar deficit-terrorist mantra – “cutting spending is good for growth”. They say that:

… policies that credibly reduce government spending in the long run boost economic growth by more than their simple effects on deficits might imply.

There is no credible evidence to support that claim. Cutting government spending at present in the US will reduce growth and reinforce the other negative factors that I noted above.

Spending equals income – whether it is private or public. When there is less private spending than desired you have to keep income growth going via public spending.

Digression – obsessed by irrelevance

In terms of being obsessed by irrelevance you might rather like to read – Microcosmographia-Academica – which was written in 1908 as a commentary on political machinations in universities (it was specifically written about Cambridge, England, but the relevance to all the institutions I have worked at during my career is very high).

It was promoted with the following advertisement:

If you are young, do not read this book; it is not fit for you;

If you are old, throw it away; you have nothing to learn from it;

If you are unambitious, light the fire with it; you do not need its guidance.

But, if you are neither less than twenty-five years old, nor more than thirty;

And if you are ambitious withal, and your spirit hankers after academic politics;

Read, and may your soul (if you have a soul) find mercy!

It is very humorous.

I particularly liked this line “Cynicism is the besetting and venial fault of declining youth, and disillusionment its last illusion”.

End of Year

So this is the last blog for 2010 – as I said – a pretty awful year.

For all those who read my blog and especially those who take the time to add to the debate via the comments I am very appreciative. I hope my modest input into the debate has helped some of you form new understandings of how things work.

I also hope everyone finds some peace and joy in 2011 – even the deficit-terrorists (an epiphany would be even better)!

Thanks for the fun in 2010!

Saturday Quiz

Okay, you non-cynics, the special New Year’s Day Saturday Quiz will be available sometime tomorrow.

That is enough for today!

Another perspective on the US Unemployment number was the increase in non-seasonally adjusted number up 24 879 to 521 834. Ironically, the seasonally adjusted continuing claims increased by 57k. The BLS data notoriously favours a low side, market and media friendly number only to be revised up in the next released. Also interesting the inventory makes up 1.61% of the GDP number. Looks like a lot of stocking and not alot of consumption; at some point this restocking will end as no one is buying. I don’t think the US is any where near recovery.

Dear Bill,

I don’t know about epiphanies or waiting for angels Bill, but a few or the more significant thoughts dropped into the blogosphere from your pen are worth revisiting as 2010 fades away, forever:

Should be held up on a placard behind every politician that appears on TV.

I think this thought: “It is all unnecessary and the capacity is within the government’s grasp to remedy it. There is just a failure of leadership”. needs reworking just a little:

Cheers ….

jrbarch

“Hence I expect, given current existing institutional practices regarding debt-issuance, that the debt levels should continue to rise in the US. Record level after record level. Who should care about that? Well the unemployed who gain jobs as a result of the more appropriate nominal demand growth should applaud it.Businesses who enjoy the rising profits and more stable demand conditions should applaud it. And so on!”

If unemployed and businesses win, who are the losers? Cause when somebody wins, someone else loses right?

Hmmm … The first question I must ponder in the New Year: shall I cancel my The Economist subscription? Charlemagne is an idiot and my subscription adds to his salary. Estonia as an economic paragon? http://goo.gl/Wg2p7 Happy New Year to All!

Thanks Billy for all your efforts. As a retired proletarian radical you have helped me understand basic macro and monetary theory. 2010 has been the year I discovered your blog and began to truly understand. I have landed not to far from my Libertarian Marxist roots. Thanks again.

Dear Bill;

Happy New Year – wow, what an awful year, indeed. But as far as thanking us followers – it is truly the other way round. The daily commentary provided by this blog has enabled me to cement the understanding I initially began to get from the books and public statements of James Galbraith, Warren Mosler and the folks at New Economic Perspectives. I feel like I am getting a free college education thanks to you. I am truly amazed by the quality, pertinence and sheer volume of the narrative you present here. I start my day with Billy Blog and celebrate each week according to my score on the Saturday quiz. I don’t comment much because I don’t often feel that there is a lot to add to a subject after you have unpacked and presented it. But I believe there are a great many people out here like me – following the links backward and forward for as many hours as we can spare. This blog is a beacon of hope and a gift to all of humanity.

Thanks, Bill. And never doubt that you are making a gigantic difference. Trends that can’t continue won’t. And when – when! – the tide turns, the Billy Blog will be remembered as one of the monumental works of MMT.

Happy New Year Bill!

As you ‘blind us with brilliance’, the rest can only ‘baffle us with bulls$!t’.

ASIDE: I thought you and others might be interested in this article on the BBC website entitled “Thatcher ‘lectured by Macmillan’ over economic policies”:

http://www.bbc.co.uk/news/uk-politics-12092460

Quote:

Kind Regards

Charlie

Thank you for all of your work and effort to educate us, Bill. I’ve ordered your text book and will continue to refine my understanding of MMT. I only wish that I had found you sooner – I could have saved the tuition and mental anguish of earning a U Chicago MBA.

I second Dale. Thank you Bill for all your hardwork, insights, and commentary. I wake up every morning to a new post and truly learn something new everyday.

Thanks for the education, worth more to me than my undergraduate degree and CFA studies combined!

Happy New Year!

thanks bill for teaching us the truth from mmt. Can you write more on why the fed is continuing with qe2 when their stated purpose was to bring long term interest rates down.

Dear Bill,

Happy New Year!

Thank you for your incredible work and keep going!

“This blog is a beacon of hope and a gift to all of humanity.”

Agreed.

Happy New Year Bill 🙂

Thank you for your amazing work!

Can’t thank you enough for the education you’ve given me this year. I hope your year is all that you hope for.

I await with bated breath our jobless recovery, followed by our payless paycheck. Cheers!

Martin from Italy: “If unemployed and businesses win, who are the losers? Cause when somebody wins, someone else loses right?”

Not right. The economy is a many-person, non-zero-sum game. Economic transactions are typically win-win. Rising levels of gov’t debt, when the gov’t has a fiat currency, are a boon to all under conditions of high unemployment. Some people may benefit more than others, but that does not mean that the others lose. 🙂

I second, third, fourth the happy new year wishes. May 2011 bring you the satistaction of seeing your work light the dimness in policy-makers’ heads…and lots of good swell. One measure of the utility of your work is the amount of “trained” individuals (like MBAs and CFAs above) finding your work so useful. Keep up the good work….though I note your Friday sabbaticals haven’t really taken…..

“The authors reveal their clear biases when they conclude that the best way to cut spending is to cut welfare/pension entitlements and government salaries.”………………..exactly what the Republicans are up to now with the debt ceiling claptrap. How dare they assume to deny the less fortunate after voting for, and securing, large tax cuts for the rich? What, exactly, is wrong with the Democratic Party? I sincerely hope that Obama has some grand plan, because right now it looks as though he is steering the US public, by ommission, to a party that has no stake in their futures.

“Reducing the government work force shifts resources to the more productive private sector.” ……Hmm….individual companies have a profit motive, that is for certain, so you’d expect private enterprise to make some more dough in areas that are not public goods…..and even where they are! See: Privatisation. And yet, private industry such as pharmaceuticals neve fail to credit public expenditure on research and development for their own profits. They just take it for themselves in true free rider style.