Yesterday (April 24, 2024), the Australian Bureau of Statistics (ABS) released the latest - Consumer…

There is no inflationary outbreak evident – the economy is slowing

The Australian Bureau of Statistics released the Consumer Price Index, Australia data for the December 2010 quarter today and it showed that inflation continues to fall. The ABC News reported that – CPI figure comes in below expectations. Who’s expectations you might ask? Yes, the bank economists and other main-streamers who have a one track obsession that whenever there is some sign of growth there must be inflation. Wrong again. It was clear that inflation is moderating notwithstanding the spikes that will come in the next months as a result of the flood disasters. But when will the inflation-obsessives give up on the idea that the budget deficits cause inflation. The reality is that the Australian economy is slowing down and there is still a significant amount of spare capacity available for real output expansion should aggregate demand rise. Some sectors are growing strongly (mining) but that unlikely to create significant cost pressures elsewhere in the economy given the amount of labour slack. Last month I gave the bank economists a tip. Consult the ideological chart and then predict the opposite. They would have predicted the data movements more accurately if they had have taken my advice. There is no inflationary outbreak evident – the economy is slowing.

When the CPI data for the last quarter came out I posed the question in this blog – Not only smokeless, but looking rusty and unusable – “when does the word down mean down? Answer for all of us mortal folks: when something is consistently pointing downwards. Answer for the bank economists: never when it is applied to movements in the Consumer Price Index – down means up”.

This was in frustration to the continued claims by the mainstream commentators that Australia has an inflation problem. This is one aspect of the current debate about federal flood reconstruction efforts which apparently expose us to dangerous inflation trends because of the extra spending that will be required. A senior bank economist was on the radio last evening advocating significant spending cuts elsewhere to provide “room” for the flood relief. Others are calling for a new tax – the flood levy – to “fund” the spending so that we keep control on the inflation genie.

All this discussion is somehow predicated an analytical falsehood – that the federal government needs to “fund” additional spending – it does not – categorically – it just pretends it does because it is captured by neo-liberal ideology which prevents it from responsibly managing the economy so as to create full employment.

It is also predicated on a denial of the facts – inflation has been falling on all measures for some months now. Today’s data reaffirms the trend. Down means down.

Today’s data is now being represented as giving the “Reserve Bank some time on interest rates”. This is another one of those obsessions – that the trigger-happy RBA is always just about to put rates up. There is absolutely nothing in the plethora of recent data releases to justify the view that there is an immediate threat of inflation that the Pavlovian RBA has to jump on.

The Sydney Morning Herald (January 25, 2011) carried the headline – Inflation rate drops to decade low – which I thought was more apposite given today’s release.

The point is the “experts” had “tipped a CPI rise of 0.7 per cent for the quarter and 3 per cent for the annual pace” whereas the reality is that the index rose “a modest 0.4 per cent” in the December quarter and the “underlying inflation rate sank to its lowest in 10 years”. The annual inflation rate is 2.7 per cent well within the RBA target bands – and falling.

There were still some bank commentators running the “its only a matter of time” flag which I suppose keeps them from despairing. So we were told that later in the year we will see wage and price rises.

I think it is very likely that food prices will rise sharply in the coming months as a result of the floods. But I do not consider that to be inflation because it is an extraordinary event that will work its way through the system as soon as the crops come back. The RBA is clearly smart enough (phew! that took some typing) to differentiate between core and actual inflation – more about which later.

The point I continually emphasis in media interviews is that we still have at least 12.5 per cent of our willing labour resources idle (either unemployed or underemployed). That is a lot of slack to be absorbed.

Yes, the mining sector is going well on the back of very strong world primary commodity prices as the Chinese redefine who is going to have access to energy and other resources in the future (see this blog for more on that – Be careful what we wish for …).

But the east coast economies – the large population centres – are not growing strongly. All the evidence indicates that now as the fiscal stimulus dissipates. And now the floods have significantly curtailed economic activity in those states. So the better policy option now is to ensure that the idle labour actually gets to participate in the investment boom (from mining) and the flood reconstruction efforts where a host of low-skilled labour resources will be required.

The declining inflation is just another indicator that the macroeconomic policy settings are too tight at present.

Trends in inflation

The headline inflation rate increased by a relatively modest 0.4 per cent in the December quarter and this translates into an annualised increase of 2.7 per cent for the year to December down from the June quarter of 3.1 per cent.

The RBA’s formal inflation targeting rule aims to keep annual inflation rate (measured by the consumer price index) between 2 and 3 per cent over the medium term. So they claim to have a forward-looking agenda although exactly what that means is difficult to discern.

But they do not rely on the headline rate. Instead, they use two measures of underlying inflation which attempt to net out the most volatile price movements. To understand this more fully, you might like to read the March 2010 RBA Bulletin which contains an interesting article – Measures of Underlying Inflation. That article explains the different inflation measures the RBA considers and the logic behind them.

The concept of underlying inflation is an attempt to separate the trend (“the persistent component of inflation) from the short-term fluctuations in prices. The main source of short-term “noise” comes from “fluctuations in commodity markets and agricultural conditions, policy changes, or seasonal or infrequent price resetting”.

The RBA uses several different measures of underlying inflation which are generally categorised as “exclusion-based measures” and “trimmed-mean measures”.

So, you can exclude “a particular set of volatile items – namely fruit, vegetables and automotive fuel” to get a better picture of the “persistent inflation pressures in the economy”. The main weaknesses with this method is that there can be “large temporary movements in components of the CPI that are not excluded” and volatile components can still be trending up (as in energy prices) or down.

The alternative trimmed-mean measures are popular among central bankers. The authors say:

The trimmed-mean rate of inflation is defined as the average rate of inflation after “trimming” away a certain percentage of the distribution of price changes at both ends of that distribution. These measures are calculated by ordering the seasonally adjusted price changes for all CPI components in any period from lowest to highest, trimming away those that lie at the two outer edges of the distribution of price changes for that period, and then calculating an average inflation rate from the remaining set of price changes.

So you get some measure of central tendency not by exclusion but by giving lower weighting to volatile elements. Two trimmed measures are used by the RBA: (a) “the 15 per cent trimmed mean (which trims away the 15 per cent of items with both the smallest and largest price changes)”; and (b) “the weighted median (which is the price change at the 50th percentile by weight of the distribution of price changes)”.

While the literature suggests that trimmed-mean estimates have “a higher signal-to-noise ratio than the CPI or some exclusion-based measures” they also “can be affected by the presence of expenditure items with very large weights in the CPI basket”.

The authors say that in the RBA’s forecasting models used “to explain inflation use some measure of underlying inflation (often 15 per cent trimmed-mean inflation) as the dependent variable”.

The special measures that the RBA uses as part of its deliberations each month about interest rate rises – the trimmed mean and the weighted median – also showed moderating price pressures.

So what has been happening with these different measures?

The annual growth in the weighted median fell from 2.4 per cent in the September quarter to 2.3 per cent in the September quarter, while the trimmed mean fell from 2.5 per cent to 2.2 per cent over the same period.

Please read that again and recite – down means down. Then reflect on how close to the lower band of the RBAs targetting range the data is now moving. Before long – at this rate – the RBA will have to announce we are dropping to the levels where they will have to drop interest rates and they will be exhorting the federal government to increase the deficit – to stop disinflation.

Given the Reserve Bank’s inflation target band is 2-3 per cent and all measures of inflation are falling at present (with underlying real unit labour costs also falling) I cannot see how anyone can forecast that there will be an interest rate hike in the foreseeable future.

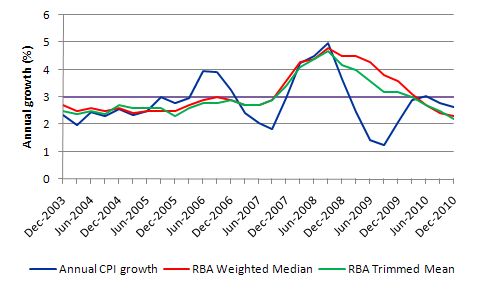

The following graph shows the three main inflation series published by the ABS – the annual percentage change in the all items CPI (blue line); the annual changes in the weighted median (red line) and the trimmed mean (green line).

Remember the trimmed measures (weighted median and trimmed mean) are designed to depict tendency or trend and attempt to overcome misleading interpretations of trend derived from the actual series. They are all heading downwards.

My interpretation is that underlying inflation trend is downward and falling towards the lower end of the RBA target band. There is no inflationary threat in Australia at present.

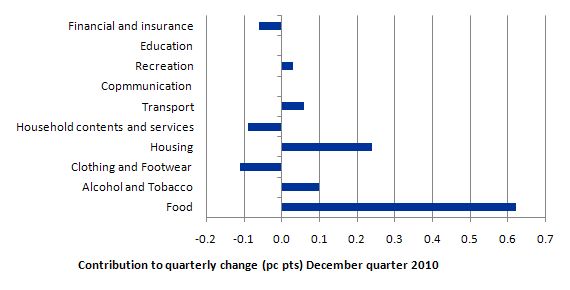

The following bar chart shows the contributions to the quarterly change in the CPI for the December 2010 quarter by component. The most significant price rises were for “fruit (+15.5%), vegetables (+11.4%), domestic holiday travel and accommodation (+3.8%), automotive fuel (+2.1%) and house purchase (+0.7%)”.

So we can see the start of the weather-related impacts on food prices here. That will get worse as the full losses to productive capacity in the farms arising from the floods is revealed.

There is no evidence of demand pull factors among these contributors.

The ABS reports that the “most significant offsetting price falls were for pharmaceuticals (-6.2%), deposit and loan facilities (-1.3%), motor vehicles (-1.0%), audio, visual and computing equipment (-4.8%) and motor vehicle repair and servicing (-1.9%)”. So bank charges are falling in the face of heated debate about their gouging behaviour in recent months and threatened government action to “make them more competitive”. Further, the rising Australian dollar is now starting to feed through to imported prices and that is pushing local prices down.

But the important point is that there is no evidence that growth in nominal aggregate demand is outstripping productive capacity overall.

Regional trends

The other point of interest is the continued claim that price pressures are building up as a consequence of the mining boom (is it really a boom?). This is one of the other favourite talking points for the bank economists every time a media outlet puts a microphone in front of them. The claim is that inflation will seep out of Western Australia where a significant proportion of the mining activity is located. Perth is the capital city of Western Australia so you would expect to see evidence of rising inflation there if the claim had any merit.

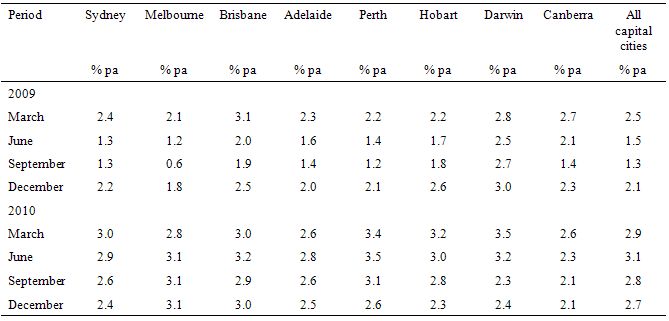

The following Table shows the annual inflation data for the Australian capital cities since March 2009. The data is from the ABS. The impact of the crisis in 2009 is clear as is the early recovery period in the first two quarters of 2010 when price inflation in the capital cities returned to normal levels (with some disparities).

Inflation took a plunge in Perth by year’s end. Brisbane another capital in a mining state overall has moderating inflation over the course of 2010 with the December result partially affected by the weather issues. Inflation will rise there in first quarter 2011 because it has been devastated by the floods. But that has nothing to do with the economy overheating.

Darwin is another mining capital city (Northern Territory) and it is also currently enjoying good commodity prices and strong demand. But its inflation rate is low and stable.

Postscript

Our Neo-liberal-inspired Greens party were showing their stripes once again today with their leader Bob Brown claiming that the flood levy was essential to “pay for” the crisis but they then differentiated themselves from the other parties by saying that the poor should pay but companies should. Very progressive sounding policies but an appalling statement from a wannabe progressive party.

Neither the poor nor the rich will “pay for” the damage. The flood levy will make rich and poor alike “pay” in the form of lost purchasing power and perhaps rising unemployment (if the injection does not offset the withdrawal). But that “payment” has nothing to do with providing the federal government with the “funds” to spend on flood relief.

Why don’t The Greens come out and challenge the whole notion that the federal government needs to “raise funds” to spend? Answer: their macroeconomics is essentially neo-liberal inspired.

Why don’t The Greens come out and damn the federal government for pursuing budget surpluses at a time when the external sector is in deficit and the private domestic sector needs to save overall to reduce their damaging debt levels? Answer: they haven’t taken the time to understand the sectoral balances and if they had they would have know that the Government is deliberately pursuing a strategy that will force the private sector into further debt if successful.

Why don’t The Greens criticise the federal government for its irresponsible strategy to pursue budget surpluses when the Australian economy is slowing, inflation is falling and there is 12.5 per cent of available workers sitting idle in one way or another? Answer: because they are neo-liberals but refuse to acknowledge it and show some political leadership on the progressive side.

Please read my blogs – Neo-liberals invade The Greens! and Taxpayers do not fund anything – for more discussion on this.

Conclusion

Get the message! Australia is cooking the growth goose and leaving more than 1.2 millions workers lying idle in one way or another. The NAIRU-ideologues have got it wrong again – as usual.

What is obvious is that there is moderating inflation. It might surge in the future but then again it might not. When it starts showing signs – that is, there are several indicators all pointing to an overheating economy then policy makers should act.

But while inflation is falling and the other indicators are all showing considerable slack remains in the economy it is ridiculous to be advocating policy tightening.

Part of the problem is that the underlying labour market dynamics are not well understood by the neo-liberals and their models thus lead them into making erroneous predictions all the time.

I would be embarrassed right now if I was a deficit terrorist or an inflationist (the two usually go together). The data is continually going against their wild assertions. The world doesn’t look remotely like they said it would.

The Government should immediately introduce a new fiscal stimulus targetted at job creation and the first projects could focus on flood reconstruction. Any idea that they should introduce a flood levy (read: tax) to “pay for” the flood relief is an abuse of macroeconomic policy given that the inflation rate is falling and we have huge reserves of idle labour – and a very damaged suite of public infrastructure (schools, roads, bridges, public buildings etc).

That is enough for today!

The reality is that the annual core measures of inflation have been falling for over 2yrs……uninterrupted……economists in particular don’t seem to be thinking about why that might be, despite the clues littered everywhere…….I never understood today’s ‘forecast’, preferring to be kind and assume they were just the top side of a very wide forecast range…..though I can’t claim to have got it right either…..I had core at +0.5%! People are now going to be surprised when Q4 GDP is not materially better than the ‘surprise” Q3.

I like the State/City breakdowns….say it all, really.

On the Greens, I’m not sure how much their economics is ‘inspired’ ny NL tendencies….I just think they simply don’t do economics – period. But I take your point.

The Greens simply don’t understand anything – no surprise they don’t understand economics or the monetary system.

And how about these gems about the ‘building inflationary pressures’ from everybody’s favourite interest rate hawk/inflationista Adam Carr:

– It seems that we’ve just been lucky in reality, that when utility prices or what have you have surged, we’ve either had soft food or a drop in fuel prices or or some other oddity. But our luck is going to run out.

– The key drivers of CPI. They are going up. I don’t think anyone would argue against that. Now think of what happens when they start rising together, as they did from 2006-08. It’s not pretty.

– But I think my logic and reasoning is sound and I remain sceptical about any suggestion that inflation pressure has moderated.

– All the key drivers of inflation are rising rapidly, but they are volatile – the timing of some of these moves have proven very fortuitous and allowed some quite favourable quarterly outcomes.

What a hack

Thanks for this post, Bill, and especially the deserved criticism of Brown and the Greens. I will show it to my Greens-voting friends, who seem not to understand that the party’s fiscal stance, with its acceptance of arbitrary spending limits, renders most of their other progressive-sending policies meaningless.

Bill – I imagine UK CPI is probably the same story, although exacerbated by devaluation and VAT. But what if global commodity prices, driven by EM demand, keep the CPI high? One answer is not to worry, as it is fundamentally temporary, and can’t morph into a wage-price spiral as long as unemployment remains at 8%.

But at some point don’t we conclude that we have stagflation and need to take action? If so, what measures should be taken? You blogged on cost-push inflation recently but I didn’t get a clear sense of how an MMT-friendly govt should act (short of a JG) to get rid of it.

Thanks – Anders

You can’t have stagflation without a confirmatory wage rise. It was the imposition of unemployment that broke the spiral last time. The real standard of living cost was imposed upon labour by the discipline of unemployment.

What I see at the moment is high producer prices leading to very little consumer price inflation leading to next to no wage increases. Everything is being squeezed.

Of more concern is the prospect of debt-deflation. Higher costs but no more income which causes a further collapse in demand and real deflation. The the massive private sector debts risk liquidation and the cascade effects you get from that.

I have a feeling that the “MMT will is very likely to bring about a devaluation in the currency and lead to a short-term cost-push price hike in various inputs. What do we do about that?” is the elephant in MMT’s room.

The neo-classicists just use unemployment until labour accepts the drop in real standard of living. I’m not sure there’s an alternative to that. Everything I think of seems to end up there.

“The neo-classicists just use unemployment until labour accepts the drop in real standard of living. I’m not sure there’s an alternative to that. Everything I think of seems to end up there.”

Right, this is the result of monetary policy that raises interest rates to provoke recession. MMT’ers would use fiscal policy to address inflation by withdrawing nongovernment NFA using targeted taxation. The targeting preference would be taxing away economic rent, which is by implication heavily progressive taxation.

Off topic but …

If I’m remembering correctly, bill said something about a post on inequality (wealth/income I assume).

Here are some posts to think about:

http://globaleconomicanalysis.blogspot.com/2011/01/world-economic-forum-endorses-fraud.html

http://globaleconomicanalysis.blogspot.com/2011/01/steve-keen-responds-to-world-economic.html

http://www.debtdeflation.com/blogs/2011/01/25/mish-mashes-the-wef/

http://www.debtdeflation.com/blogs/2011/01/21/how-i-learnt-to-stop-worrying-and-love-the-bank/

“Prior to 2008, such ignorance was excusable simply because it was so widespread, as the dominant neoclassical school simply ignored dissidents like Minksy. After the crisis, he is receiving long overdue respect for focusing on the importance of credit in a capitalist economy while neoclassical economists effectively ignored it.”

nick rowe is in neoclassical fantasyland with:

http://worthwhile.typepad.com/worthwhile_canadian_initi/2011/01/inequality-and-debt-the-soft-bigotry-of-low-expectations.html

If bill does a post about inequality (income/wealth), I hope he can include debt and price inflation targeting in it too. Thanks!

From above: “Prior to 2008, such ignorance was excusable simply because it was so widespread, as the dominant neoclassical school simply ignored dissidents like Minksy. After the crisis, he is receiving long overdue respect for focusing on the importance of credit in a capitalist economy while neoclassical economists effectively ignored it.”

Importance of credit/debt?

Is there anywhere where all new medium of exchange is not demand deposits created from debt whether gov’t or private?

Just a general observation.

Bill, I would hope by now you are getting calls from Finance ministers all over the world.

MMT is getting it consistently and demonstrably right.

Any signs of the politicians (I’ve given up on the economists) waking up ?

Well done Bill for sticking to your guns throughout this cycle saying that disinflationary forces from overseas and the excess of capacity in the domestic economy (including ample available labour) were sufficient to comfortably contain inflation within the RBA band. The latest figures once again show how economists have gotten NAIRU completely wrong and their subsequent calls for higher rates based on employment levels likewise invalid.

I am very concerned how politicians and the public have virtually no understanding of budget surplus/deficit mechanics other than the ridiculous notion that the former is good and the latter bad. The whole surplus goal is politically motivated in the belief that we are somehow putting pennies back in the jar for a rainy day. In the middle of the GFC both sides of politics were attempting one-upmanship by who could achieve a surplus quicker.

Bill’s JG could be targeted perfectly on recovery efforts in Qld. Focus the underemployed on the essential infrastructure necessary to rebuild. No leaf raking here, the jobs would be most interesting and challenging and would bring Qld up to latest world standards. While the GFC called for general stimulus here we have a real world disaster that could help remove labour slack and benefit the whole country if only implemented sensibly and apolitically.

-neale

Neil – appreciate the post, but is it correct to say “You can’t have stagflation without a confirmatory wage rise”? I thought stagflation was just persistent inflation accompanied by unemployment and low growth.

As I say, it may be that without a wage-price spiral, there’s no risk of accelerating inflation, but I have the sense that persistent inflation of 3-4% isn’t something MMT usually tolerates.

I certainly have no appetite to resort to the traditional classical approach of using higher U to drive down CPI. Given that inflation from devaluation and VAT can’t be eliminated in the short term, to get the overall CPI down towards 2% would mean creating deflation elsewhere in the economy – which would be disastrous.

“I thought stagflation was just persistent inflation accompanied by unemployment and low growth.”

Definitions again. Inflation is a already a rate of change. Something has to be constantly changing for it to be persistent and somebody has to be paying those new prices for them to be confirmed.

A single price rise event due to a devaluation or tax hikes will drop out of the annual figure in a year. The reason the UK has had 3% inflation for two years is that there has been two sequential VAT rises. Unless there is another one next January we will lose at least 1% of inflation then just from that.

Neil -ok so I hear you that VAT and FX are non-recurring, but couldn’t one believe that commodity prices might keep going up (in GBP terms) on a recurring basis?

Thanks

Anders said: “As I say, it may be that without a wage-price spiral, there’s no risk of accelerating inflation, but I have the sense that persistent inflation of 3-4% isn’t something MMT usually tolerates.”

What if the excess supply is coming from overseas like china and the middle east dollar pegers?

What if china and the middle east find somewhere else to sell their goods and oil? Fewer goods and oil sold to the USA, prices of them going up, no need to buy financial assets in the USA, dollar down, interest rates up?

Global food prices and inflation targeting

Supply side cost-push developing in food?

Tom – exactly; are you clear on the MMT prescription for this?

Anders, Bill has a post on supply side inflation:

Modern monetary theory and inflation – Part 2

Tom – thanks, and Neil has directed me to the same place, but I found it hard to follow.

I think Bill’s saying the following:

1. when you genuinely have supply-side inflation, you have competing claims on resources between various factions (labour vs capital) which you need to adjudicate between in order to avoid accelerating inflation. [Or does this also apply to demand-side inflation?]

2. Supply-side reforms are necessary in such a situation (which I think means union reforms, liberalising the labour market etc)…

…but the US/UK/Australia have done all this stuff already: what if we develop stagflation resulting from global commodity prices (which are driven by EM demand-side inflation) – what should we do?

I’m pretty sure Bill didn’t cover this..

Cheers

Anders, I posted something on this at Warren’s in a thread addressing supply side inflation:

The solutions [to supply side cost-push inflation] are increasing production or providing substitution through increased investment and technological innovation, or else some kind of rationing through markets or otherwise. The fiscal policy option might be increased spending/tax incentives for increasing production or substitution, or else some kind of market rationing like tradable vouchers.

Since supply side cost-push typically involves petroleum, Warren suggested state to state negotiated contracts.

Tom – thanks, that’s v helpful.

Cheers

I think best solution would be to use incomes policy. Here in Nordic countries, as in Netherlands, we have successfully used Polder Model of collective bargaining to tame inflation. http://en.wikipedia.org/wiki/Polder_Model

Sometimes labor just have to accept cut in living standards.

“Fed Up says:

Wednesday, January 26, 2011 at 13:54

Is there anywhere where all new medium of exchange is not demand deposits created from debt whether gov’t or private?”

Government “debt” is not a debt at all. Government spends by crediting bank accounts.