I have received several E-mails over the last few weeks that suggest that the economics…

Stay tuned for a massive rise in the UK unemployment rate

I am working on our textbook today and writing a chapter about one of my favourite topics – the Phillips curve – which describes a relationship between some measure of inflation (wage, price) and some measure of excess supply of labour (usually the unemployment rate). I wrote my PhD about the Phillips curve developing models which demonstrated the inadequacy of the mainstream macroeconomics take on the subject. Today I read a strange tale in the UK Guardian – ONS inflation slip-up leaves millions out of pocket – which has some relevance to the chapter I am working on at present. The point is that if you believe the mainstream neo-liberal economic theories that are forced onto students in our universities around the world then you might expect a massive drop in the UK unemployment rate right now. Why? Read on.

In going back through my notes and documents on the topic, I was reminded of few paragraphs in Lester Thurow’s marvellous little book (1983) – Dangerous Currents – (now out of print) (pages 184-85):

If Newton and his contemporaries had behaved as the economics profession is now behaving and had access to the modern computer, it is likely that the law of gravity would never have been discovered. In Newton’s day, deviant celestial observations were made that did not fit into the existing epicycle theory of heavenly motion, but each such observation could be and was explained with an addition of another epicycle to the system. Given enough epicycles, all patterns were theoretically explainable. Eventually, however, the computational difficulties forced Newton to rethink the existing theory to obtain a simpler set of results based on gravity. But with the modern computer Newton would never have been forced to look for anything new. The computer would have made short work of the necessary geometric computations, making a new theoretical approach seemingly unnecessary.

Like “deviant” celestial motion at the time of Newton, deviant observations in the labor market keep being reported. But each was and still can be made consistent with the orthodox theory. Usually some market imperfection is hypothesized, and as we shall see, each is posited ad hoc and after the fact. At some point it becomes necessary to examine the weight of the evidence to see the extent to which the labor market is or is not working in accordance with the theories of the equilibrium price-auction model. And if it is not, to develop new micro-economic approaches.

Keep that quote in mind.

Please read my blog – Money neutrality – another ideological contrivance by the conservatives and Islands in the sun … – for background discussion to today’s blog.

The Phillips curve is in the area of macroeconomics that focuses on inflation and unemployment. It has been a major arena for fighting out the battle relating to the usefulness of aggregate demand management (fiscal and monetary policy) in reducing unemployment to some irreducible minimum.

The Phillips curve in its various guises promotes a relationship between these macroeconomic aggregates (inflation and unemployment) and raises the question of the existence and nature of a trade-off between nominal and real economic outcomes. Prices are nominal aggregates whereas unemployment is a real variable.

The Phillips in the “curve” is A.W. Phillips who in his now famous 1958 Economica publication established a relationship between nominal (that is, money) wages growth and the unemployment rate. By 1960 (Samuelson and Solow) this relationship was discussed in terms of a trade-off between price inflation and the unemployment rate.

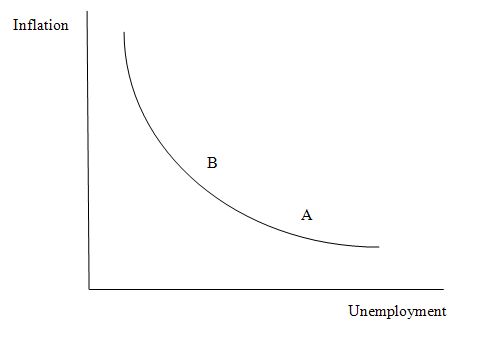

The original curve was drawn something like this:

So there was an inverse relationship found by Phillips. This relationship was understood way before Phillips published his paper and it is an interesting discussion as to why it was his version that became the most well-known. But that is beyond this blog (I covered this in my PhD and also in our 2008 book – Full Employment abandoned.

The reasoning was pretty simplistic. If the government currently inherits point A (with some inflation and some unemployment) but desires for political reasons to reduce the unemployment rate they can do so by increasing aggregate demand (that is, increasing their net spending or reducing interest rates).

As the economy improves – the labour market tightens and workers are able to bid up money wages (the actual wages they take home in dollar bill terms or direct debits).

Firms were considered to have fixed markups over costs, so the stronger demand in the labour market pushes up prices in the goods market. The inflation rate increases as the economy moves from A to B on the “curve”. There is a lot more to it than that – why is the curve shaped in a convex way? What is the exact adjustment path between A and B? etc. But these are all complications that we can ignore here.

The point was that there was a perceived “trade-off” between in inflation and unemployment which policy makers could exploit. A whole industry of bright young minds went into modelling this relationship and coming up with “socially optimal inflation-unemployment” mixes.

Note: that the concept of an irreducible unemployment rate does not mean zero unemployment. There will always be people moving between jobs and firms looking for workers to fill newly created vacancies.

The unemployment associated with these movements is referred to as frictional and was considered to be around 2 per cent of the labour force. Hence the old benchmark was that full employment meant a 2 per cent unemployment rate.

I remember when I started to estimate these relationships for my PhD, my then supervisor (at Manchester University, UK) said that I would be trapped in the Phillips Curve industry for the rest of my days (as a joke). I did eventually escape but only just and my next Phillips curve is always just around the corner. In fact, we are working on a new model that incorporates underemployment.

So that seemed to be settled though. It fitted with the Keynesian framework which explained fluctuations in output and employment in terms of aggregate demand (spending) variations and considered unemployment to be the result of deficient demand.

The debate centred on how flat the Phillips curve was – so how much inflation would occur as you drove the economy to full employment. The extreme position was the “reverse-L” models of aggregate supply which considered the Phillips curve to be a right-angle.

This was considered to be consistent with the leading thinking on inflation at the time characterised by the concept of an inflationary gap. This gap was measured by the excess of nominal aggregate spending above the “full capacity” level of output (and spending necessary to support that output level).

Up to full employment (or full capacity), firms react to increased demand by increasing output and employment (and unemployment falls – ignoring participation rate changes which even out once a particular level of activity is reached). They do not seek to increase prices because they would endanger their market share.

Arthur Okun also talked about catalogue pricing where firms with relatively stable costs project a price for the period that their current catalogue is valid. They are dis-inclined to change the prices because customers would see it as a breach of faith (in the announced prices in the catalogue) and with millions of product lines price adjustment becomes expensive (changing labels, etc).

However, once the economy is at full capacity, firms can no longer increase real output and so respond to increasing aggregate spending by increasing prices.

So the economy shifts from being a quantity-adjuster to a price-adjuster in the face of nominal demand variations. In this context, the Phillips curve is very flat if not dead flat up until full employment.

The other key point was that unemployment above the frictional level was considered to be involuntary and thus beyond the control of the individual workers to improve their own circumstances.

Mass unemployment was seen in terms of demand deficiency – that is, a systemic failure to produce enough jobs. An individual worker alone could not relax this constraint to improve their job chances.

Please read my blog – What causes mass unemployment? – for more discussion on this point.

There is every reason to believe that this describes the current situation in most advanced nations. Increasing the demand for labour through government spending is unlikely to add to cost pressures and firms are likely to welcome the extension to their order books and increase real output to meet the demand.

In the Keynesian notion of an inflationary gap – you either had unemployment or inflation but not both together. The flat Phillips curve was challenged by the stagflation of the 1970s – which saw the coincidence of the twin evils.

The Phillips curve became an arena where the ideological struggles in economics about the role of government was fought out.

The next bit is quite complicated and I will just skim. During the Great Depression, the discipline of macroeconomics emerged in its own right and was driven by the work of Keynes (and others). Prior to that microeconomics – the study of individual behaviour – firms, household, individual consumers – dominated and was based on the rational, optimising assumptions that define mainstream theory today.

Accordingly, optimal outcomes were considered to be achieved if these self-seeking individuals interacted in free markets, each pursuing their own maximum welfare. The system of exchanges envisaged in the text books (which do not occur in the real world) coordinated these self-seekers to deliver the best for everyone.

Any discussions at the time of the “macroeconomy” was done in terms of microeconomic principles whereupon the macroeconomy was just an aggregate of the individual relationships. It was total fudge and led to “aggregation inconsistencies”. The fudge to overcome these fatal flaws was in the form of the representative household and firm etc – so one household was assumed to act for all in the same way they considered an individual consumer might act.

The important contribution of Keynes among many was to emphasise the fallacy of composition. These compositional fallacies proved the mainstream microeconomic-to-macroeconomic analysis wrong.

What applies at the individual (micro) level does not apply at the aggregate (macro) level. If you cut the wage of an individual firm’s workers the firm will enjoy lower costs but probably not a major drop in their sales. So they might put more workers on (that is debatable).

But if you then apply this “micro” logic to the entire economy and cut the wages of all workers – sure enough costs go down but so does demand (spending) and hence sales because all workers are now poorer.

There are many fallacies in mainstream micro-based reasoning. It was this recognition of the existence of these fallacies that really defined the terrain for what we now call macroeconomics.

Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

But during the dominant Keynesian period, the economics profession was largely split into two separate narratives. The macroeconomists – who considered that demand drove output and employment; and the microeconomists – who held onto the believe in free markets and government deregulation etc.

That tension was still very patent when I entered the profession in the early 1980s although by then the resurgence of the mainstream micro influence was very much in full sway.

In the 1960s, the micro arm of the profession which was largely anti-government intervention, pro-deregulation, anti-welfare etc began to regain the centre stage. This was the period when the idea of a “government budget constraint” entered the literature. Accordingly, the government was bound by the same principles as the household.

This analogy – totally erroneous from the outset – drove a huge literature which provides the basis for the attacks on government deficits and borrowing.

During the 1950s and 1960s the micro-economists attempted all sorts of ploys to show that the dominant macro models – which put government intervention at centre-stage – were “irrational”, “inefficient” and/or reliant on a deeply flawed understanding of human behaviour.

They mainstream (the micro-economists) wanted to regain the dominant position and integrate macroeconomics back into the “choice-theoretic” paradigm. That is just a fancy term for seeing all behaviour in terms of rational individual action based on free markets and self-interest.

The aim as to explain all economic outcomes in terms of the “micro” model. So when individuals were free to choose they would deliver optimal outcomes to all.

So how to explain unemployment? Well far from being seen as involuntary – unemployment now was considered to be an optimal outcome (initially) where individuals traded leisure for work because they could get more satisfaction from an hour of the former than spending the income derived from an hour of the latter.

Unemployment was thus considered to be a “voluntary” state – freely chosen and optimal.

How does that fit into the Phillips curve? Not easily but here goes.

Milton Friedman and Edmund Phelps in two separate papers attacked the basic concept of the Phillips curve. They claimed that workers were really concerned with real wages not money wages – so what the money you earn can buy rather than the money per se.

This was an old battle and it is clear that workers are concerned with both money wages and the real equivalents. The mainstream (which I now call the neo-liberals) said that a concern with monetary aggregates was “irrational” but that claim is easily dismissed.

For example, most workers have nominal commitments (like a mortgage) where they have to come up with $Z per week or default on their loans. Say a worker earns $1000 per week which buys a basket of goods and services (X).

The worker can take a real wage cut in one of two ways: (a) with an unchanged nominal wage – so prices rise and their $1000 only buys a basket Y, which is less in real terms; or (b) with a reduced nominal wage.

Most workers will prefer option (a) because it means they can still pay their nominal commitments and reduce their real standard of living by cutting back on what they buy elsewhere. Option (b) may immediately threaten their solvency.

The point was that the original Phillips curve was largely thought of in nominal terms although as I discussed in my PhD thesis this was only the stylised textbook version. The literature clearly realised that workers were also concerned with real equivalents.

Whatever, Friedman and Phelps claimed that you had to include not only unemployment in the Phillips relationship but also expected inflation. The reasoning is simple. Workers want to maintain a particular real wage and so at each level of unemployment and the higher they expected inflation to be the higher their money demands would be (to preserve the real wage equivalent).

So there was a family of Phillips curves envisaged each one denoting a particular expected inflation rate.

So what? The mainstream claimed that the economy would come to rest when the expected inflation rate equalled the actual inflation rate. This would be a stable inflation rate because workers were receiving the real wage consistent with optimal outcomes.

This was a very important point in the development of the neo-liberal paradigm. The unemployment rate that was consistent with stable inflation was called the natural rate – later the NAIRU (non-accelerating inflation rate of unemployment).

Please read my blog – The dreaded NAIRU is still about! – for more discussion on this point.

Full employment as genuine policy goal was abandoned with the introduction of the so-called natural rate hypothesis (NRH) and its assertion that there is only one unemployment rate consistent with stable inflation. In the NRH, there is no discretionary role for aggregate demand management and only microeconomic changes can reduce the natural rate of unemployment. Accordingly, the policy debate became increasingly concentrated on deregulation, privatisation, and reductions in the provisions of the Welfare State with tight monetary and fiscal regimes instituted. High unemployment persisted. The fact that quits were strongly pro-cyclical made the natural rate hypothesis untenable.

But the idea of a cyclically-invariant steady-state unemployment rate persisted in the form of the NAIRU concept, first introduced in the mid-1970s. The NAIRU was constructed as meaning that when unemployment is above it then inflation should decelerate and vice-versa. While various theoretical structures have been used to justify the NAIRU as a viable concept, the conclusion from each is simple: there is only one cyclically-invariant unemployment rate associated with stable price inflation.

The NAIRU concept has dominated macroeconomic policy making in most OECD countries since the late 1970s and the “fight-inflation-first” strategies have exacted a harsh toll in the form of persistently high unemployment and broader labour underutilisation. Under the sway of the NAIRU, policy makers around the World abandoned the pursuit of full employment as initially conceived.

Of-course they couldn’t admit that so they started redefining what full employment meant. So if you read this literature you will quickly realise that the neo-liberals define full employment as being the NAIRU which is divorced from any notion that there has to be enough jobs available to meet the desires of the available labour force. So in one small change in taxonomy governments have been able to turn their failure to provide enough jobs into a success – well we are at full employment now because we are at the NAIRU. So it is a pernicious concept indeed.

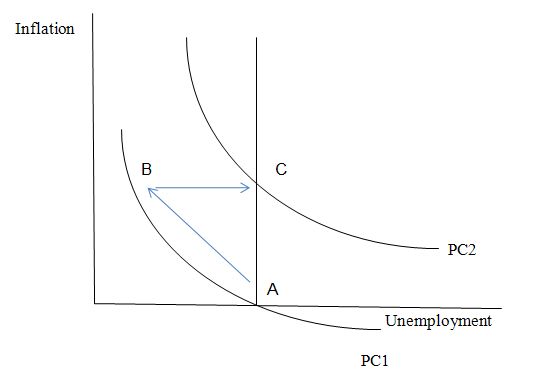

Consider the following diagram which now embodies these developments. There are now two Phillips curves (PC1 and PC2 – noting that I didn’t start counting today at 0!). PC2 reflects a higher rate of expected inflation than PC1. PC1, for simplicity, assumes zero inflation. The unemployment rate in this diagram at A is the natural rate (expected inflation = actual inflation = 0).

Now go back to our earlier story with the government expanding spending to reduce unemployment. The economy moved to B to exploit the trade-off which might be very flat indeed (so there might not be much of an inflation spike if any).

But according to Friedman, as the firms pay higher money wages and inflation starts to rise workers increase their expected inflation rate. And as they build those expectations into their wage demands the labour market starts to contract again. This is a complex story but basically firms start laying off workers again because at the even higher money wages it is considered unprofitable to keep them on.

The economy starts moving back to and eventually hits point C where expected inflation = actual inflation – now higher than at point A. Note – the unemployment rate is back to the natural rate.

The lesson they wanted to impart – the government cannot buck against the natural rate – and if it tries to do so it will cause inflation without any real gains.

This simple idea led to the resurgence of the mainstream micro-macro.

The advent of the inflation in the mid-1970s as a result of the OPEC oil price hikes was used as evidence that Friedman was correct even though the price inflation had nothing to do with excess demand for labour and associated wage demands.

Friedman’s emphasis on expectations in 1968, which changed the direction of policy in the 1970s, was rooted in developments a long time before this.

By extending the role of inflation expectations to the labour market, Friedman was able to solve the problem that Phillips’s 1958 model and subsequent developments presented for neoclassical (micro-based) monetary theory. Phillips’s model clearly refuted long-run neutrality – the notion that there was no trade-off between monetary variables and real outcomes.

The Keynesian consensus was that the government could choose, indefinitely, a combination of real output and inflation defined by the Phillips curve.

While the development of what is called the Expectations-Augmented Phillips Curve was not based on empirical grounds, the cost instability after the first OPEC oil shock in 1974 and the resulting inflation was very fortuitous indeed. It gave the Monetarist developments a credibility that they could not get in terms of the theoretical debate. I won’t go into that debate here.

The Monetarists challenged the notion of a stable Phillips curve to justify their demand management and stabilisation policy stance and that view was given an open slate by the price chaos in that period (after the OPEC shocks). The Monetarist explanation seemed almost self-evident, especially when the Keynesian approach to inflation and unemployment seemed to be inapplicable when both were present.

English writer Skidelsky termed this period the end of the Keynesian era.

So the biggest development since Phillips was seen to be the expectations-augmented Phillips curve of Friedman (1968) and Phelps (1967, 1968). This model had major policy implications and spearheaded the resurgence of pre-Keynesian macroeconomic thinking in the form of Monetarism.

The concept of the natural rate of unemployment (NRU) became central to the idea that the trade-off between inflation and unemployment captured in the Phillips curve was in fact a trade-off between unemployment and unexpected inflation. Once expectations are realised as workers gain more information the trade-off vanishes. At this point there is only one unemployment rate consistent with stable inflation – the NRU.

The business cycle was now characterised in terms of swings in expectations and mistakes made by workers about the actual inflation rate. This version replaced the long-standing Keynesian view that the business cycle is driven by demand fluctuations.

You should start to be appreciating why the mainstream think that austerity is good. They really believe that the business cycle is supply-driven rather than driven by demand fluctuations.

Now the mainstream theory then took this idea further with the introduction of the misperceptions theory of the business cycle.

Accompanying Friedman and Phelps attack on the prevailing view that there is a stable trade-off between inflation and unemployment was an attempt to reclaim the terrain that mainstream (neo-classical) monetary theory had lost after the Great Depression.

Friedman’s 1968 paper “The Role of Monetary Policy” argued that monetary policy could only have real effects in the short-run, at an increasingly worse trade-off. The starting point was classical monetary theory, which suggests that monetary policy cannot have real effects but only change the price level.

All that a monetary expansion it does is alter prices and nominal incomes in a proportionate way. To gain a short-run trade-off in this paradigm Friedman had to appeal to the notion of expectational errors and adaptive learning behaviour.

Accordingly, when labour markets tighten and demand pressure pushes money wage rates up, workers supply more labour because they mistake the rise in money wages for a rise in real wages. It was assumed that workers supply more labour when their real wages rise.

These economists assumed that information was asymmetric so firms do not make these relative price mistakes. The firms know the real price level and thus realise that the real wage is actually falling because the rise in money wages is less than the rise in inflation. This is why they are prepared to increase employment (according to marginal productivity theory).

So the business cycle upswing is all about supply-shifts driven by the workers being deceived about the price level increase in relation to their money wage increases.

Eventually, the workers turn up at the shops and realise that the price level has risen further than they thought.

As workers realise their errors they withdraw the extra labour again – because they do not want to supply more labour at lower real wages. As a consequence, the economy’s output and employment levels fall again – to their natural levels.

So the downswing in activity is a supply withdrawal from workers.

So this unemployment rate that is commensurate to these natural output levels and stable inflation – the natural rate of unemployment – was considered to be insensitive in the long run to monetary policy. The only way the workers can be induced to supply higher hours than are implied by the natural rate of unemployment is for the monetary authority to maintain ever-increasing money wage rate inflation.

This drives the price level ahead of money wages and continually trick the workers – for a time.

There were many versions of the way misperceptions worked but the crucial point of the exercise was not related to the research program of Phillips.

It was to restore classical monetary theory to the dominant position by way of reconciliation between its neutrality properties and the empirical finding of a short-run trade-off between inflation and unemployment.

The economy oscillates around a natural rate of unemployment (which is invariant (neutral) to monetary and aggregate fiscal policy), because economic agents make expectational errors. The errors cannot be exploited permanently without ever-accelerating inflation.

So they would explain the current rise in unemployment (which is above most of the conservatives estimates of the NAIRU) as being driven by workers withdrawing from work because they think the real wage is lower than what it is. It is just a matter of time before they will find out and offer their labour again.

Going back to Thurow’s Dangerous Currents, he says of this notion (tongue in cheek):

… why do quits rise in booms and fall in recessions? If recessions are due to informational mistakes, quits should rise in recessions and fall in booms, just the reverse of what happens in the real world.

Given that quits are not countercyclical then the orthodox labour market model that constructs unemployment as being a supply-side phenomenon is plain wrong.

What this means is that the misperceptions-type models which construct unemployment as being driven by workers withdrawing their supply rather than there not being enough jobs is not a description of the way our world operates.

The data violently contradicts that central notion of mainstream macroeconomics. Labour supply shifts do not explain shifts in employment and unemployment.

But the empirical reality did not stop my confreres in the profession. Before long – about 10 years – this story had become even more extreme and morphed into rational expectations. In other words, workers could not be fooled because they knew as much about the economy and factored all policy decisions into their decision making.

In other words, there was not even a short-run trade-off to exploit. The workers could never be tricked.

You will all have heard the finance report on TV quoting some bank economist or another saying the “market has already factored that in” – which is left over from the Rational Expectations onslaught.

Please read my blog – The myth of rational expectations – for more discussion on why RATEX is very kooky (and plain wrong).

It morphed however into the nonsensical notions of Ricardian Equivalence which is, in part, driving the austerity push now. These households and firms know full well (it is alleged) that taxes will be higher in the future to “pay back the deficits” so they save instead of spending which means that fiscal policy is ineffective because as fast as the government spends the private sector saves. So the story goes.

Please read my blog – Ricardians in UK have a wonderful Xmas – for more discussion on this point.

I was thinking about all this today when I read the report in the UK Guardian (March 21, 2011) – ONS inflation slip-up leaves millions out of pocket.

The story is about how the UK Office of National Statistics has now been found to have miscalculated the UK inflation figures between 1997 and 2009.

Apparently, they have been understating the true inflation rate for 14 years which has left “Wage earners, pensioners and benefit claimants … worse off for the past 14 years …”

The Guardian says that:

… these figures masked the extent to which real incomes have been eroded by rising inflation … “Real wages have been squeezed more than CPI would have suggested … Effectively, wage earners have been fooled”.

First, Friedman predicted that workers could be fooled temporarily but not for long. Our UK wage earners must be pretty stupid indeed.

Second, now that they have found out that they have been getting screwed for so long the mainstream textbook models that are taught to students every day would predict that there will be a major withdrawal of labour.

Certainly unemployment will rise but that will be because of the austerity cutbacks. The students will be taught, however, that it is a supply correction around the natural rate as workers find out what the true inflation rate has been.

Of-course, most nations are currently recording unemployment rates well in excess of the estimated NAIRUs (natural rates) so things are really strange if you believed any of this.

Conclusion

I don’t and our textbook will not subject students to this rubbish.

That is enough for today!

No, they always suspected it. It’s just that there’s nothing they could do about it. And there’s still nothing they can do about it.

I haven’t finished reading yet. I know this isn’t the point

but I don’t believe this is debatable. It is erroneous. They will just give their CEO a big payrise!

RatEx says people’s savings rise with net government spending…so there’s no crowding out?

I hope that the new MMT-textbook will contain chapter explaining how futile it is to save for the future pension payments.

Here’s a picture from finnish pre-saving pension system, pension contributions as a % of gross wages. At first, there is considerable demand drainage until 2015 about, when the system starts to cause inflationary pressures. Is this really so stupid system as it seems?

http://farm6.static.flickr.com/5022/5549367641_60d1792d5d_z.jpg

It is very good to point out the history of how micro and macro have become incorrectly intertwined. I am doing a decent job of getting people to understand MMT, a lot of people still have their objections but I could they are warming up to it.

I think the Newton astronomy analogy is slightly dangerous for economics. For Physics simplicity may be guide that things are on the right track. For biology it inconveniently almost never is. Economics is human behavior and it is hard for me to believe that the interaction of billions of humans trying to get along/outwit each other will result in a system like a dozen planets gliding through a vacuum. To me the critical point is whether predictions are wrong. The lack of quits in recessions shows the theory is drivel irrespective of any mathematical garnish or otherwise.

I keep running into this neoliberal idea that workers will withdraw their labor as their compensation rate falls, and it drives me nuts. Have any of these people ever held a job in the real world? I’ve held jobs from top-end consulting all the way down to ditch digging, and of the many thousands i’ve worked with during this time, I’ve never met anyone who did this. Workers may be less satisfied as their wage goes down, but why would they work less? They would already be making less at the lower wage, and these economists are saying that the worker would then compound that loss by working less too. That’s nonsense! The lower wage would more likely make the want to work MORE in order to try to maintain their lifestyles (not to mention, avoiding the spouse and kids bitching up a storm over their new “austerity).

You know what I think? I think they’re all PAID to advocate this stupidity. I think they are paid because if this case can actually be made and foisted off on the public, then by logical extension, progressive taxation becomes a bad thing, and if you pull a little harder still, ANY taxes on the rich are a bad thing. And the rich ARE the folks who endow chairs in economics at elite universities, aren’t they?

And you do have to dance with the ones who brung you.

I keep running into this neoliberal idea that workers will withdraw their labor as their compensation rate falls

Do you? This blog is the only place where I have seen it.

“Do you? This blog is the only place where I have seen it.”

it’s everywhere, both implicitly and explicitly in economic textbooks. there was a big mankiw-generated kerfuffle on the blogs about this recently, i think

Dear MamMoTh (at 2011/03/23 at 4:38)

You should consult any mainstream textbook and the courses that are taught everyday in our universities world-wide. You clearly haven’t studied economics.

best wishes

bill

Right, I see. I think they were referring to the effects of a tax increase on high income people.

I must say in that case they might be right, because they can afford it. Although they might end up firing their nannies and legal latin-american cleaning lady. I don’t see it as a problem if Mankiw stays home to clean his own toilet instead of going out to a fancy restaurant.

The idea that labor would withdraw labor as compensation rate fell was explicit during the rise of the neoliberals in the 70s/80s, coincident with a US environment of a high savings rate, a relatively low private debt load and where real wages rose as productivity increased.

Of course, all of that can be ignored in the interests of micro economic/pseudo psychological “human nature” speculation.

In the 60s/70s, labor actually could withdraw a portion of their product from the market, there were sufficient safety nets plus the employment market was such that one could re-enter with some ease. A worker could actually take some personal risks and try own their own time – which is of course a dangerous thing if done by more than a few.

Today’s neo-liberals are not quite so stupid as to use the outdated labor withdrawal/leisure time/lazy ass worker theory, so now we have the expectations theses where consumers (we no longer have any workers around) withdraw spending in order to pay for higher future taxes. Apparently those consumers used all their tax savings from the previous 30 years of tax cuts paying for private tuition, private transportation, private health care and making up for the fact that productivity increases are apparently now inversely linked to real wage rates.

It really is the same flawed “logic” in a new package – the point is to have any easily marketable excuse to avoid an increase in public spending.

Well, that would be more or less the classical “Say’s law”. Which might, eventually, have some legitimacy as long as the worker doesn’t work for a living. Let’s suppose that 90 % of the population just get’s buy as subsistence farmers. Some of them try to get some extra income by taking a paid job. If they don’t depend on that income for survival, they might withdraw their labour if the renumeration is to low, so that it’s not worth to take the job, and this would put a floor under wages. If, as in modern urban society, people can’t get by without monney income (or using up savings), there isn’t such a floor, and therefore, wages can drop below sustainability of the labour force (people will die off… – may be this is a form of “voluntary” withdrawal from the labour market as well?). And may be, some will squat on some land, and try to grow foodstuff, because the chances for a job that pays enough to survive are close to nonexistant, so they will “withdraw” as well. (Of course, this looks pretty much like the end of civilization, put that’s what neo-liberal ideologues try to achieve anyhow…

No, I haven’t studied economics. It’s too close to astrology.

I choose to study science and now realize how boring it is not being able to have theories without any empirical evidence.

“No, I haven’t studied economics. It’s too close to astrology.

I choose to study science and now realize how boring it is not being able to have theories without any empirical evidence.”

just pick the most palatable version of economics you can find and take it with a grain of salt. economics isn’t going away anytime soon 🙂

More evidence that some MMT ideas are beginning to diffuse more widely into the mainstream media and blogosphere:

http://yglesias.thinkprogress.org/2011/03/households-and-states/

If you haven’t studied economics, how can you tell it’s close to astrology (or anything else you haven’t studied)? Closer to psychology and politics, with some philosophy mixed in, IMH (semi-learned) O.

That’s pretty close to what astrology is, only with astronomy in place of politics.

Actually I chose to withdraw my labour when I found work conditions were unacceptable because I could start a pension, but before I reached 55 I only left unacceptable jobs when I had a better job to go to.

I know a board member who resigned over a principal because failure to resign would have resulted in his loss of reputation and inability to get another position. He called it correctly.

If you are an ant in the organisation you have to put up with poor pay and conditions, get out or organise with other workers to change you conditions (ie unionise!)

MamMoth,

What you were referring to earlier is called the “backward bending labour supply curve”.

The theory rests upon some rather unrealistic assumptions, The main ones being that all agents are homogenous and utility maximising, workers actually choose their hours, and that their are no contractual obligations between either party.

As with most mainstream economics the problem is that what’s true for an individual is not true for all individuals.

Fallacy of Composition 101.