I have received several E-mails over the last few weeks that suggest that the economics…

Fiscal responsibility index – reductio ad absurdum ad infinitum

I am Australian but not a proud one. That doesn’t mean anything other than I don’t consider nationalism to be a particularly appealing trait. I would perhaps defend our borders from attack and I prefer Australia winning at sport than the English (but not the West Indies!). But when I read a newspaper headline (March 24, 2011) – Australia tops index ranking for maintaining strong fiscal balance – I feel ashamed that I live in such a nation. Given the methodology that went into construct this index, Australia would be better off being down the bottom of the rankings – by choice rather than inaction. Just when you thought the public debate about fiscal policy couldn’t deteriorate any further … it plunges to new depths. This index is published in a new “study” (I would not actually give it the gravitas of a study) – is actually an exercise in reductio ad absurdum ad infinitum aka total BS.

At the outset, can I just say that it appears Stanford University is now awarding masters degrees which are of a standard that I would fail if I was an examiner.

I refer to a recent publication – The Sovereign Fiscal Responsibility Index (SFRI) – which was produced by 4 masters students from the project completed by a team of four students from the International Policy Studies (IPS) and Masters in Public Policy (MPP) programs at Stanford University.

It took them 6 months to complete – conclusion: they wasted 6 months of their precious lives.

It was supported by the right-wing fanatical organisation – Comeback America Initiative – which says it is about “Keeping America Great”. From what I read of their work they will only succeed in making America a laughing stock as it races to the bottom towards mediocrity – driven by a religious zealotry that invokes fear and mis-information among the populace.

The head man at the CAI is none other than David Walker – former U.S. Comptroller General and CEO of the U.S. Government Accountability Office (GAO) and current head deficit terrorist in the US who is given regular oxygen by the likes of Fox News etc.

It seems that the CAI funded the Stanford project under the direction of Walker although an academic named Joe Nation supervised it. They say that the “client for this project” was CAI, which in normal parlance means that the Stanford Institute for Economic Policy Research provided commissioned research paid for by CAI that supported these graduate students.

But given how poor the quality of the research is this amounts to a disgraceful act of prostitution by Stanford. I advise all prospective students to avoid studying in the Public Policy Program at that institution if you have any self respect and seek to be educated rather than indoctrinated with propaganda.

Further, the Report is full of disarming statements such as “non-partisan” – yeh right – as long as you only consider the erroneous neo-liberal paradigm – and says it obtained its data from the “International Monetary Fund (IMF) and other authoritative, trusted, and neutral international organizations”.

When I think of the IMF I do not come up with descriptors such as “authoritative, trusted, and neutral”. They are the antithesis to the public conduct of the IMF and its long record of poor forecasting, poor outcomes and politically-biased interventions. To think of the IMF and its partner institutions as being neutral and trusted is a joke.

It reeks of desperation – as if these “authorities” will give the Report some gravitas and readers will fail to notice there is no substance at all in the actual document. They might have done the study “under the guidance of the Honorable David M. Walker” but if that impresses you then a sad person you must be – ill-informed about the way the system operates and prepared to lie about the actual state of the economy and the opportunities available to government to fix it.

What exactly is honourable about David M. Walker? His public statements which mislead listeners about the way the US monetary system works and the possibilities it provides the US federal government are dishonourable.

The “Report” turns out to be a front for Walker who is now an out of control missile so obsessed with fear about public deficits and public debt that he seems to have lost a grip on reality.

The Report says that it aims:

The goal of this project is to provide a simple but comprehensive analytic tool and framework for citizens, research institutions, and advocacy groups alike to use in understanding sovereign fiscal responsibility and sustainability. It is specifically intended to illustrate where the United States is, where it is headed, and how it compares with other nations in the area of fiscal responsibility and sustainability.

Yes, I love simple analytical tools and frameworks. Rules of thumb are excellent guides to complex situations and happenings. I use them all the time to gauge my impression of how things are going and where they might go next.

But these tools have to be grounded in a coherent framework not a bed of lies. The house is only as good as the foundation.

This Report fails from the outset because it is built on an erroneous framework – the mainstream macroeconomics government budget constraint and the analogy that the government is like a big household – and hence its budget is financially constrained. Please read my blog – I am now advocating biblioclasm … – for more discussion on this point.

It says nothing of importance about the United States at all and by comparing the US with nations that are part of a different monetary system (for example, the Eurozone nations) the authors reveal the extent of their ignorance.

I should say that the authors are Masters students who might be forgiven for jumping ahead of themselves – strutting before they know anything much. But you cannot forgive the likes of Walker and the supervisor Joe Nation – their involvement reflects a much deeper malaise.

Some edits

Allow me to cut through all this stuff and propose some edits (as if I was the supervisor).

The opening sentences of the Report might usefully have read:

The Governor of the Bank of Japan has publicly admitted that the Bank of Japan can always directly purchase Japanese government debt and thus facilitate public spending without recourse to the bond markets. The Japanese yen floats freely on the foreign exchange markets and the Japanese government does not borrow in foreign currencies. Any sovereign nation shares these characteristics. None have any fiscal solvency risk at all. However, that doesn’t mean they rank highly on our fiscal responsibility index. Many nations have high rates of unemployment and other idle productive capacity (machines, buildings, equipment etc). The governments of these nations are fiscally irresponsible because they have the capacity to bring those idle resources back into production.

The authors might then usefully scrap the rest of the Report – and write it off as youthful exuberance. Then we can all go home and write letters to our politicians telling them to get started on being fiscally responsible – in most cases we would finish our letters by saying – you need to run higher budget deficits at present!

To understand these proposed edits I suggest you do some background reading in Modern Monetary Theory (MMT) by consulting my suite of blogs – Fiscal sustainability 101 – Part 1 – Fiscal sustainability 101 – Part 2 – Fiscal sustainability 101 – Part 3.

Prior to that I would recommend you reading – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

Then you will be armed to combat any resistance to my proposed edits.

Emphasis is everything

If you read the full text of the document you will soon realise this is not something that has been written about Planet Earth. If I was asked to list the major socio-economic concerns in the world at present I would include:

- Poverty

- Unemployment

- Underemployment

- Casualisation and loss of job and income security

- Sluggish real GDP growth reliant on fossil fuel energy

Fiscal responsibility has to be considered in the context of these real outcomes and aspirations. To produce a document that purports to be about how governments might be fiscally responsible then you might expect extensive discussions about the state of idle resources in each nation – which gives the national government fiscal space to bring these resources back into production in addition to a discussion about the type of monetary system the government runs (or accedes to).

In the latter context, we would distinguish between nations such as Australia and the US etc who float the currencies that the national government issues as a monopolist and those who have given up this sovereignty by joining some monetary system where the currency is not issued by national governments and they do not float freely across national borders (such as, Greece etc).

You would clearly outline the perils in trying to compare the EMU nations which are all financially constrained and at the behest of the bond markets (or the mercy of the ECB – the ultimate fiscal authority in the Eurozone) with sovereign nations which are not financially constrained and can spend whenever they choose. For these nations the bond markets have not real importance despite what the politicians themselves might think (and do).

But then if you then try to find any mention of my key socio-economic concerns in the Report – you will find these words never appear. That fact alone is staggering and reveals how impoverished this piece of scuttle is.

I don’t intend to go into the Report line by line. I have read it closely though. I thought I would examine the final results (the rankings) in more detail.

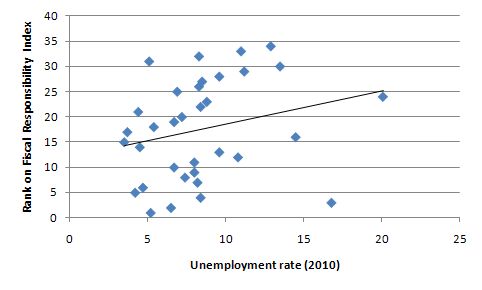

The following graph shows the 2010 national unemployment rates (horizontal axis) and the final Fiscal Responsibility Index scores (vertical axis) from the Report. The data is from the OECD Main Economic Indicators. The black line is a significant regression relationship which indicates that countries with higher unemployment rates tend to perform more poorly on the Index ranking.

Surprised by that? You should not be. In general the nations with the highest unemployment rates had the worst cyclical downturn and experienced the largest increases in their budget deficits. Given they all follow the arcane practice of issuing government debt to match $-for-$ the net public spending increase it was obvious public debt levels would rise.

While the Report says these nations have no fiscal space left, the reality is exactly the opposite – they have the highest unemployment rates and therefore the most idle labour. That labour is the “fiscal space” – and the national governments can always afford to purchase that labour and put it to productive use.

The following graph tells the story in another way. It shows the percentage change in real GDP between 2007-2009 (horizontal axis) and the final Fiscal Responsibility Index scores (vertical axis) from the Report. The GDP data is from the IMF World Economic Outlook database. The black line is a significant regression relationship which indicates that countries with lower real GDP growth in that period tended to perform more poorly on the Index ranking.

Surprised by that? You should not be. Please see above.

The point is that the Report is only measuring the differential impacts of the recession albeit in a roundabout manner which is inefficient. Trying to suggest that the public debt ratio or the deficit to GDP ratio have meaning in their own right is the fatal error these authors make.

A rising budget deficit, in the recent historical context, is telling us that the particular nation’s economy has deteriorated in real terms. It tells us nothing at all about solvency risk or capacity to pay. We know logically by understanding the nature of the monetary system that a government like the US can always pay its US dollar bills. So can the British government, the Japanese government and almost all other governments.

We don’t need to go to an elaborate 6-month exercise computing financial ratios to know that. And if we want to find out how bad people’s lives are as a result of cyclical deterioration, it is better to focus on the variables that matter – as outlined above in my list of key socio-economic concerns.

I would have failed this Master’s thesis had I been the examiner. It reflects a very poor understanding of the subject matter, has a very incomplete bibliography (which is tantamount to be poor scholarship) and is largely a sequence of major analytical errors. The Report is basically an exercise in Reductio ad absurdum ad infinitum But Stanford seems to think that is an appropriate standard. Just goes to show!

Something the Report can do

The only interesting thing I was able to use the text for was this word cloud (top 200 words) weighted by frequency. It gives you an idea of what to expect.

You won’t find the word unemployment, underemployment, poverty etc among the frequencies. That is more than an oversight – it is a travesty of scholarship.

Conclusion

It just gets worse each day. We are living through an anti-intellectual period disguised as informed research and commentary. The heathens are at the gates!

Lucky its the weekend and I can retire to … reading economics! (and detective novels, playing in my band, etc).

But just reflect on the statement by the Bank of Japan Governor the other day about the capacity of the central bank to facilitate all national government spending if push comes to shove. I don’t need to say anymore than that!

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow.

That is enough for today!

There are loads of these groups across the globe who purport to be economists with impeccable credentials. All you do is go to them with a suitably large amount of money and they will write a report stating exactly what you want said. This can then be used as ‘expert testimony’ in a persuasion game you are currently playing.

It’s all part of the modern media, PR and lobbying game which seems to employ vast armies of people in advanced economies.

Quite how we’ve manage to develop an economy that is based upon describing the Emperor’s clothes in different ways would probably make a good study in itself.

I had to laugh at these comments in the news article:

“Britain, which has slashed spending to work its way out of fiscal crisis, was ninth.”

– They forget to mention the soon to arrive economic crisis as GDP falls and unemployment rises.

“Countries such as Australia and New Zealand that have implemented strong fiscal rules have seen declining debt levels and reasonable government spending.”

– Declining government debt levels which have forced the private sector to go on a credit binge to ensure economic output “gets sold”

“They reveal the power of good fiscal governance.”

– This “good fiscal governance” is exactly what is responsible for the terrible NZ economy since… well, much before I was born.

I like it that you’re busting the chops of American neoliberal retards but I think you need to read this if you think that “real GDP growth” has anything meaningful to do with the concept of sustainability, except as an antonym.

On David Walker – he would like to bring back debtor’s prisons. Really. See Wiki or google.

Stanford University is now awarding masters degrees which are of a standard that I would fail if I was an examiner.

I don’t think that’s the problem in orthodox economics. The problem is that you would fail if you were an examinee. No mumbling “eppur si muove” as you leave the room, either!

It’s pretty transparent that the neo-liberals are crap at forecasting – just look at the rate at which growth predictions for the UK are falling.

But can anybody point me towards an MMT-based forecast, for comparison?

The paper contains the statement, “Iceland has already defaulted and its Sustainable Fiscal Path reflects reforms made since default occurred.”

Is that true? Did Iceland default on its government bonds? Or is the author slyly equating the default of Iceland’s privately owned banks with a government default?

Uh-oh. Krugman just decided to talk about MMT, and of course, he got it wrong.

“Krugman Blog: Deficits and the Printing Press (Somewhat Wonkish)”

http://krugman.blogs.nytimes.com/2011/03/25/deficits-and-the-printing-press-somewhat-wonkish/

My attempt to correct him:

“No, you are misrepresenting what Modern Monetary Theory says. MMT says that the deficit is the wrong number to measure, and only in that context do deficits not matter.

“MMT instead would look at the unrealized potential output of an economy (in ours now, this is vast), and add money to that economy sufficient to realize that potential. Once that potential was reached however, of course adding additional money would be inflationary, but if it were absolutely necessary for the government to spend in excess of this, MMT would use taxes to remove the excess money from the economy while at the same time providing the government with additional non-inflationary spending power.”

Krugman is big news – he had that spat with Jamie Galbraith before but this is the first time the phrase MMT has appeared on his site, the #1 rated financial blog.

Too bad he refuses to accurately reflect what MMT says. He falls in my estimation all the more because Mosler says they had dinner and PK does actually get it…

Chalk it off to agnotology. Those in the know make use of a vast number of useful idiots via the medea and corrupt intellectuals to keep spreading the neoliberal horsepucky, while they hijack every government worth hijacking and concentrate the money issuing power and therefore the political power.

From Krugman’s blog:

“The key thing to remember is that current conditions – lots of excess capacity in the economy, and a liquidity trap in which short-term government debt carries a roughly zero interest rate – won’t always prevail. ”

Given that the excess capacity in many developed countries has existed for decades, why is he so confident that it “-won’t always prevail” under the current system – he clearly believes in the arbitrary NAIRU.

He says this.

“Suppose, now, that we were to find ourselves back in that situation with the government still running deficits of more than $1 trillion a year, say around $100 billion a month. And now suppose that for whatever reason, we’re suddenly faced with a strike of bond buyers – nobody is willing to buy U.S. debt except at exorbitant rates.”

He has a vivid imagination. Some might say a bit wonkish.

“a strike of bond buyers”

I’d like to see that.

Such an unlikely event might just cause somebody to ask the question:

Why does a government that issues its own currency feel the necesssity to issue debt anyway ?

Apart from giving the bond dealers a free lunch of course.

Krugman’s post is an obvious strawman; MMT has always emphasised that a government’s that issues its own currency are not financial constrained but they do face real resource constraints, the capacity utilisation rate of the economy matters.

On a related note I’ve been reading krugman’s boom “The return of depression economics and the crisis of 2008”. It seems as though Krugman is aware of operational realities of different monetary systems. This is his comment on Argentina:

Later on he mentions how this inability of Argentina to ‘print money’ undermined its ability to respond to future crises:

I’ve just got around to reading the Krugman article.

Benedict, Krugman sure misrepresented MMT, based on my still-developing grasp of the issues.

Firstly, I don’t know of an iron-clad MMT rule that says deficits never matter: what if you have a booming external trade account ? Bill often talks about the exceptions.

As for the hypothetical example Krugman used, clearly an economy at full capacity. Why would any government in its right mind pursue an expansionary fiscal policy under such circumstances.

Maybe the dreaded bond buyers would have good cause to retreat from their normal self-interested pursuits and hold off a while in that situation.

I think mdm nails it: “Krugman’s post is an obvious strawman”. Sad.

Much better to discredit Krugman than to try and get him on side. He’s a complete sell-out who only cares about his own bank balance.

1. Benedict@large, your comment on PK’s blog doesn’t seem to have been published yet.

2. “Suppose, now, that we were to find ourselves back in that situation with the government still running deficits of more than $1 trillion a year, say around $100 billion a month. And now suppose that for whatever reason, we’re suddenly faced with a strike of bond buyers – nobody is willing to buy U.S. debt except at exorbitant rates.”

Suppose also that dollar bills are made of green cheese.

Krugman is also missing the vital role of the Job Guarantee. If the economy is at full capacity, and large price rises are occuring (for whatever reason), the government can safely choose some fiscal / monetary contraction to create a buffer to protect them from the price rises, without causing unemployment. The buffer being EMployed people at the minimum wage, not UNemployed people.

This is actually the most important part of MMT!

CharlesJ – I hope that you are not correct in saying that the JG is the most important aspect of MMT.

MMT is hard enough to build political support for; if it is packaged up with the JG, it becomes a purely progressive proposal – and so dead-on-arrival.

Without the JG, there is a chance we can get the wealthy to support MMT (I mean heck, it was Cheney who said “deficits don’t matter”), and treat the JG as a distinct and subsequent goal.

I say this whilst being a supporter of the JG…

Anders, I think the wealthy would favour the JG, It’s just the cheapest services you can get.

I believe the biggest problem would be the unions, a point Bill has already made if I remember correctly.

MamMoTh – the JG is for public stuff, so no benefit to the rich.

I like JG; my issue with it is that you need meaningful differentials between unemployment benefit (UB), the JG wage (JGW) and the minimum wage (MW).

Today, you only need a good differential between MW and UB to incentivise the feckless to take a job.

With the JG, you would need:

– JGW > UB

– MW > JGW because otherwise why would you leave your cushty job filing for the local authority to go and flip burgers? .

This is tantamount to a chunky rise in the MW = unappealing from the perspective of the wealthy.

Anders, MamMoTh,

JG should appeal to trade unions, if the government puts in place legislation to prevent it being used as a cheap alternative to regular labour. E.g. govt could say that local authorities could have a maximum of ,say, 10% of the workforce as JG except in special circumstances – this and other measures should keep the public sector trade unions happy. It can also be sold to them on the basis that full employment improves the wage bargaining position of all workers, as JG is less onerous than unemployment, but only if UB is a lower income than the JG wage.

As far as the private sector goes, it should also be regulated somehow to prevent abuse by employers. I personally think that JG should only involve the private sector where the pool of JG workers become quite large, say, during a recession, but should be limited to short temporary assignments of less than 3 months, and no private employer should be able to hire JG workers more than once in the same year.

The minimum wage in the market would not be set officially, but would be determined by the market – it would therefore have to offered at a higher rate than the JG wage in order to attract workers off JG. I don’t see this as being difficult after employers have got used to it.

“I like JG; my issue with it is that you need meaningful differentials between unemployment benefit (UB), the JG wage (JGW) and the minimum wage (MW).”

You don’t have unemployment benefit or a minimum wage with JG. JG guarantees that all who want a job can have one. An equivalent pension is paid to those who can’t work due to age or infirmity.

Don’t forget that ‘Jobs’ under the Job guarantee could be a wide definition of ‘useful work’ – such as caring for relatives or the family. That’s a political choice.

Anybody who doesn’t want to work outside of that needs to have their own independent means (or starve), and private sector jobs that are not more attractive than the JG jobs will cease to exist due to straight competition

The economy shouldn’t be there to service the needs of sweatshops. Private sector businesses will have to compete with JG to attract people away from it – by offering higher salaries, shorter hours, or more interesting work. In other words a chase to the top rather than the bottom.

And the reason the wealthy with vision would like that is that it creates space. JG positions will be effective in preventing poverty, but almost certainly be inefficient economically due to their stop/start nature. Yet they will eliminate abusive competition and create space for businesses with better systems to move in.

Neil,

“Anybody who doesn’t want to work outside of that needs to have their own independent means (or starve), and private sector jobs that are not more attractive than the JG jobs will cease to exist due to straight competition.”

This is the only thing I disagree with. Many people receiving UB/JSA are not actually fit for work, have undiagnosed health problems, illiteracy etc, and are therefore having to pretend to look for work. There should be a catch-all benefit to allow for the many imperfections in the benefit system. Forcing people who have an undiagnosed personality disorder, or severe depression into work of any kind can literally cause their suicide or be a threat to the health and safety of others.

Even when there are appropriate benefits, prejudice by staff administering these benefits often prevents people receiving the benefits they are entitled to. Doctors are also notoriously bad at diagnosing mental health problems, and that’s even if those people ask for help – many don’t ask for help for a variety of reasons, often they themselves don’t know they have a problem.

“Many people receiving UB/JSA are not actually fit for work, have undiagnosed health problems, illiteracy etc, and are therefore having to pretend to look for work”

Yes, which is why I said that there should be a living pension for those who are excused by reason of age or infirmity.

But if you want resources from the state, then the default requirement should be that you supply your labour to the state.

The state would then have to decide who is excused – which is no different to the Invalidity Benefits that are in place now. And yes the health system and social service system would have to get better at spotting and diagnosing those unfortunate individuals with mental health problems, etc. However I suspect it would be a lot easier once you remove the ‘get the bill down at all costs’ atmosphere, and stop running the system on half manpower.

MamMoTh: “I think the wealthy would favour the JG, It’s just the cheapest services you can get.

“I believe the biggest problem would be the unions”

Unless the unions are doing equivalent work for more than the JG jobs pay, why would unions object?

Charles J., a JG applies to those “willing and able to work,” i.e., jobseekers that can’t find a job. Those who are unable to work would be covered otherwise, in the US by SS Disability, for example. This doesn’t work perfectly though. In the US a significant portion of the homeless population is mentally challenged.

Min: Unless the unions are doing equivalent work for more than the JG jobs pay, why would unions object?

I guess you have unions and then you have unions… The unions I am most familiar with will object to anything that might look like a loss of salary, that is the government hiring the unemployed for less than what they earned in the private sector. I am personally agnostic about the JG, I can see the benefits and the rationale behind it, but I don’t consider it feasible to absorb all but frictional unemployment.

Speaking of unions I am familiar with, just the other I read that one of them was asking that every time a worker of the local government dies, the city should hire a family member (widow/er, eldest son, etc…). Nothing to do with the JG, but a lot to do with my skepticism about unions.

Neil – that’s helpful. I agree that “the economy shouldn’t be there to service the needs of sweatshops”, but any policy whose initial impact is a rise in the MW will I think struggle to get a listen. I like your idea that the JGW can be basically get at today’s MW plus only a small amount, since once the JG system is up and running, I guess you can in fact withdraw benefits from those who decline to take the JG job; but doesn’t this make it workfare – a step the MMTers have conscious ly resisted?

MamMoTh: “The unions I am most familiar with will object to anything that might look like a loss of salary, that is the government hiring the unemployed for less than what they earned in the private sector.”

Well, if they would otherwise earn zero. . . .

FWIW, it seems to me that a jobs guarantee should not replace unemployment insurance, but supplement it.

Clarification: By supplement it, I mean that it would be there if the unemployment benefits run out, not that someone could get unemployment benefits and a guaranteed job at the same time. (Although that would probably work, too, with reduced benefits.)

“but any policy whose initial impact is a rise in the MW will I think struggle to get a listen.”

no, the initial impact will be that those people on crappy minimum wage jobs will leave them and go onto the JG. The sweatshops will then close.

Then businesses will have to compete with the JG for people and wages will go up, as will the wage share. That is the point and it needs to be sold as such.

“but doesn’t this make it workfare ”

We’re all on workfare unless we’re wealthy enough to get somebody else to do the working for us via the capitalist extraction system.

“Workfare” is the derogatory term used by those who want a starving unemployment buffer to keep wages low.

To everybody else working for a living is called a job.

The fundamental principle surely is that if you want resources from society you should be expected to contribute in a manner that your peers in society find acceptable.

Surely getting something for nothing should be discouraged. You can hardly complain about rentiers and usurers while pandering to the genuinely feckless.

Some Guy – about 20 years ago over 50% of the Victorian (Australian state) prison population was incarcerated for failure to pay fines, isn’t that debtors prison. As economic conditions have deteriorated over the past 20 years I imagine that a higher proportion of the prison population is there for poverty

Yes, they have been brought back in all but name in many US states, which flout the US constitution and judicial rulings in a quest to squeeze blood from stones. Walker thinks this a welcome development, and works hard to widen debt peonage by making up lies about the evil of government debt, otherwise known as “money”.