Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – April 9, 2011 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

When there is an external deficit, the private sector can reduce its overall indebtedness as long as the government supports saving by running a deficit.

The answer is False.

This question relies on your understanding of the sectoral balances that are derived from the national accounts and must hold by defintion. The statement of sectoral balances doesn’t tell us anything about how the economy might get into the situation depicted. Whatever behavioural forces were at play, the sectoral balances all have to sum to zero. Once you understand that, then deduction leads to the correct answer.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

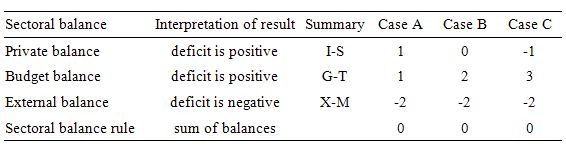

To help us answer the specific question posed, we can identify three states all involving public and external deficits:

- Case A: Budget Deficit (G – T) < Current Account balance (X - M) deficit.

- Case B: Budget Deficit (G – T) = Current Account balance (X – M) deficit.

- Case C: Budget Deficit (G – T) > Current Account balance (X – M) deficit.

For the private sector reduce it overall indebtedness (that is a net result) it must spend less than it earns – that is, run a surplus. So we understand the question to be examining the conditions under which the private domestic sector can run a surplus when the external sector is in deficit.

The following Table shows three cases expressing the sectoral balances as percentages of GDP in each case there is an external deficit. So the constant external deficit then allows you to understand the relationship between the other two balances – government and private domestic.

In Cases A and B, the private balance is in deficit or balanced which means that no net debt repayments could occur even though the government sector is in deficit.

In Case C, we see that the deficit has risen to 3 per cent of GDP and larger than the external deficit as a percent of GDP (2 per cent). At that point, the private sector balance goes into surplus which facilitates reductions in debt levels overall.

So the coexistence of a budget deficit (adding to aggregate demand) and an external deficit (draining aggregate demand) does not necessarily lead to the private domestic sector being in surplus.

It is only when the budget deficit is large enough (3 per cent of GDP) and able to offset the demand-draining external deficit (2 per cent of GDP) that the private domestic sector can save overall (Case C).

The economics lying behind the accounting statements (which are true by definition) is that the budget deficits underpin spending and allow income growth to be sufficient to generate savings greater than investment in the private domestic sector.

But they can only do that as long as they can offset the demand-draining impacts of the external deficits and thus provide sufficient income growth for the private domestic sector to save.

The following blogs may be of further interest to you:

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Saturday Quiz – May 22, 2010 – answers and discussion

Question 2:

Taxation is an essential part of a fiat monetary system and allows the national government to spend.

The answer is Maybe verging on true in the real world.

You might consider this a trick in the sense that taxation is not required by a currency-issuing government to “fund” its spending. That is true. But that observation just raises the question as to what the purpose of taxation is in a fiat monetary system. Then you have to think a bit more deeply than the obvious … and a bit more deeply again.

In a fiat monetary system the currency has no intrinsic worth. Further the government has no intrinsic financial constraint. Once we realise that government spending is not revenue-constrained then we have to analyse the functions of taxation in a different light. The starting point of this new understanding is that taxation functions to promote offers from private individuals to government of goods and services in return for the necessary funds to extinguish the tax liabilities.

In this way, it is clear that the imposition of taxes creates unemployment (people seeking paid work) in the non-government sector and allows a transfer of real goods and services from the non-government to the government sector, which in turn, facilitates the government’s economic and social program.

The crucial point is that the funds necessary to pay the tax liabilities are provided to the non-government sector by government spending. Accordingly, government spending provides the paid work which eliminates the unemployment created by the taxes.

It is the introduction of State Money (government taxing and spending) into a non-monetary economics that raises the spectre of involuntary unemployment. Involuntary unemployment is idle labour offered for sale with no buyers at current prices (wages).

Unemployment occurs when the private sector, in aggregate, desires to earn the monetary unit of account, but doesn’t desire to spend all it earns, other things equal. As a result, involuntary inventory accumulation among sellers of goods and services translates into decreased output and employment. In this situation, nominal (or real) wage cuts per se do not clear the labour market, unless those cuts somehow eliminate the private sector desire to net save, and thereby increase spending.

The purpose of State Money is for the government to move real resources from private to public domain. It does so by first levying a tax, which creates a notional demand for its currency of issue. To obtain funds needed to pay taxes and net save, non-government agents offer real goods and services for sale in exchange for the needed units of the currency. This includes, of-course, the offer of labour by the unemployed. The obvious conclusion is that unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save.

So the point is that for a fiat currency to be used in an economy, people in the non-government sector have to have a motive to get hold of it. The imposition of a tax obligation that can only be extinguished in the fiat unit of account provides that motive.

However, the government could impose any obligation, which could only be met by people in the non-government sector by acquiring the fiat currency and returning it to the government. This is the reason

Imposing a fine for people every time they walked down the street would be one alternative to taxation to accomplish a “demand” for the particular fiat currency. Once people have to get hold of that currency they will willingly exchange goods and services in return for public spending.

The following blogs may be of further interest to you:

- A modern monetary theory lullaby

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

- Fiscal sustainability 101 – Part 1

- Fiscal sustainability 101 – Part 2

- Fiscal sustainability 101 – Part 3

Question 3:

When a sovereign government issues debt it has no impact on the overall holdings of assets held by the non-government sector.

The answer is True.

The fundamental principles that arise in a fiat monetary system are as follows.

- The central bank sets the short-term interest rate based on its policy aspirations.

- Government spending is independent of borrowing and the latter best thought of as coming after spending.

- Government spending provides the net financial assets (bank reserves) which ultimately represent the funds used by the non-government agents to purchase the debt.

- Budget deficits that are not accompanied by corresponding monetary operations (debt-issuance) put downward pressure on interest rates contrary to the myths that appear in macroeconomic textbooks about ‘crowding out’.

- The “penalty for not borrowing” is that the interest rate will fall to the bottom of the “corridor” prevailing in the country which may be zero if the central bank does not offer a return on reserves.

- Government debt-issuance is a “monetary policy” operation rather than being intrinsic to fiscal policy, although in a modern monetary paradigm the distinctions between monetary and fiscal policy as traditionally defined are moot.

National governments have cash operating accounts with their central bank. The specific arrangements vary by country but the principle remains the same. When the government spends it debits these accounts and credits various bank accounts within the commercial banking system. Deposits thus show up in a number of commercial banks as a reflection of the spending. It may issue a cheque and post it to someone in the private sector whereupon that person will deposit the cheque at their bank. It is the same effect as if it had have all been done electronically.

All federal spending happens like this. You will note that:

- Governments do not spend by “printing money”. They spend by creating deposits in the private banking system. Clearly, some currency is in circulation which is “printed” but that is a separate process from the daily spending and taxing flows.

- There has been no mention of where they get the credits and debits come from! The short answer is that the spending comes from no-where but we will have to wait for another blog soon to fully understand that. Suffice to say that the Federal government, as the monopoly issuer of its own currency is not revenue-constrained. This means it does not have to “finance” its spending unlike a household, which uses the fiat currency.

- Any coincident issuing of government debt (bonds) has nothing to do with “financing” the government spending.

All the commercial banks maintain reserve accounts with the central bank within their system. These accounts permit reserves to be managed and allows the clearing system to operate smoothly. The rules that operate on these accounts in different countries vary (that is, some nations have minimum reserves others do not etc). For financial stability, these reserve accounts always have to have positive balances at the end of each day, although during the day a particular bank might be in surplus or deficit, depending on the pattern of the cash inflows and outflows. There is no reason to assume that these flows will exactly offset themselves for any particular bank at any particular time.

The central bank conducts “operations” to manage the liquidity in the banking system such that short-term interest rates match the official target – which defines the current monetary policy stance. The central bank may: (a) Intervene into the interbank (overnight) money market to manage the daily supply of and demand for reserve funds; (b) buy certain financial assets at discounted rates from commercial banks; and (c) impose penal lending rates on banks who require urgent funds, In practice, most of the liquidity management is achieved through (a). That being said, central bank operations function to offset operating factors in the system by altering the composition of reserves, cash, and securities, and do not alter net financial assets of the non-government sectors.

Fiscal policy impacts on bank reserves – government spending (G) adds to reserves and taxes (T) drains them. So on any particular day, if G > T (a budget deficit) then reserves are rising overall. Any particular bank might be short of reserves but overall the sum of the bank reserves are in excess. It is in the commercial banks interests to try to eliminate any unneeded reserves each night given they usually earn a non-competitive return. Surplus banks will try to loan their excess reserves on the Interbank market. Some deficit banks will clearly be interested in these loans to shore up their position and avoid going to the discount window that the central bank offeres and which is more expensive.

The upshot, however, is that the competition between the surplus banks to shed their excess reserves drives the short-term interest rate down. These transactions net to zero (a equal liability and asset are created each time) and so non-government banking system cannot by itself (conducting horizontal transactions between commercial banks – that is, borrowing and lending on the interbank market) eliminate a system-wide excess of reserves that the budget deficit created.

What is needed is a vertical transaction – that is, an interaction between the government and non-government sector. So bond sales can drain reserves by offering the banks an attractive interest-bearing security (government debt) which it can purchase to eliminate its excess reserves.

However, the vertical transaction just offers portfolio choice for the non-government sector rather than changing the holding of financial assets.

So debt-issuance does not increase the assets that are held by the non-government sector $-for-$” nor does it reduce the capacity of the private sector to borrow from banks because they use their deposits to buy the bonds (crowding out).

The latter crowding out myth is based on the erroneous belief that the banks need deposits and reserves before they can lend. Mainstream macroeconomics wrongly asserts that banks only lend if they have prior reserves. The illusion is that a bank is an institution that accepts deposits to build up reserves and then on-lends them at a margin to make money. The conceptualisation suggests that if it doesn’t have adequate reserves then it cannot lend. So the presupposition is that by adding to bank reserves, quantitative easing will help lending.

But this is an incorrect depiction of how banks operate. Bank lending is not “reserve constrained”. Banks lend to any credit worthy customer they can find and then worry about their reserve positions afterwards. If they are short of reserves (their reserve accounts have to be in positive balance each day and in some countries central banks require certain ratios to be maintained) then they borrow from each other in the interbank market or, ultimately, they will borrow from the central bank through the so-called discount window. They are reluctant to use the latter facility because it carries a penalty (higher interest cost).

The point is that building bank reserves will not increase the bank’s capacity to lend. Loans create deposits which generate reserves.

The following blogs may be of further interest to you:

- Quantitative easing 101

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Money multiplier and other myths

- Will we really pay higher interest rates?

- A modern monetary theory lullaby

Question 4:

10-year bond yields in Japan and the US have risen slightly in the last week suggesting that bond markets are demanding increased risk coverage for these assets.

The answer is False.

While it might be possible that bond markets are demanding an increased risk coverage on 10-year bonds one cannot conclude that from merely examining the movements in bond yields. That is because yields fluctuate for several reasons.

The only thing that one can reliably conclude (which isn’t saying much at all) is that yields are rising because bond prices are falling in response to lower demand.

In macroeconomics, we summarise the plethora of public debt instruments with the concept of a bond. The standard bond has a face value – say $A1000 and a coupon rate – say 5 per cent and a maturity – say 10 years. This means that the bond holder will will get $50 dollar per annum (interest) for 10 years and when the maturity is reached they would get $1000 back.

Bonds are issued by government into the primary market, which is simply the institutional machinery via which the government sells debt to “raise funds”. In a modern monetary system with flexible exchange rates it is clear the government does not have to finance its spending so the the institutional machinery is voluntary and reflects the prevailing neo-liberal ideology – which emphasises a fear of fiscal excesses rather than any intrinsic need.

Once bonds are issued they are traded in the secondary market between interested parties. Clearly secondary market trading has no impact at all on the volume of financial assets in the system – it just shuffles the wealth between wealth-holders. In the context of public debt issuance – the transactions in the primary market are vertical (net financial assets are created or destroyed) and the secondary market transactions are all horizontal (no new financial assets are created). Please read my blog – Deficit spending 101 – Part 3 – for more discussion on this point.

Further, most primary market issuance is now done via auction. Accordingly, the government would determine the maturity of the bond (how long the bond would exist for), the coupon rate (the interest return on the bond) and the volume (how many bonds) being specified.

The issue would then be put out for tender and the market then would determine the final price of the bonds issued. Imagine a $1000 bond had a coupon of 5 per cent, meaning that you would get $50 dollar per annum until the bond matured at which time you would get $1000 back.

Imagine that the market wanted a yield of 6 per cent to accommodate risk expectations (inflation or something else). So for them the bond is unattractive and they would avoid it under the tap system. But under the tender or auction system they would put in a purchase bid lower than the $1000 to ensure they get the 6 per cent return they sought.

The mathematical formulae to compute the desired (lower) price is quite tricky and you can look it up in a finance book.

The general rule for fixed-income bonds is that when the prices rise, the yield falls and vice versa. Thus, the price of a bond can change in the market place according to interest rate fluctuations.

When interest rates rise, the price of previously issued bonds fall because they are less attractive in comparison to the newly issued bonds, which are offering a higher coupon rates (reflecting current interest rates).

When interest rates fall, the price of older bonds increase, becoming more attractive as newly issued bonds offer a lower coupon rate than the older higher coupon rated bonds.

Further, rising yields may indicate a rising sense of risk (mostly from future inflation although sovereign credit ratings will influence this).

But they may also indicated a recovering economy where people are more confidence investing in commercial paper (for higher returns) and so they demand less of the “risk free” government paper.

So you see how an event (yield rises) that signifies growing confidence in the real economy is reinterpreted (and trumpeted) by the conservatives to signal something bad (crowding out). In this case, the reason long-term yields would be rising is because investors were diversifying their portfolios and moving back into private financial assets.

The yield reflects the last auction bid in the bond issue. So if diversification is occurring reflecting confidence and the demand for public debt weakens and yields rise this has nothing at all to do with a declining pool of funds being soaked up by the binging government!

The following blogs may be of further interest to you:

- Saturday Quiz – April 17, 2010 – answers and discussion

- Time to outlaw the credit rating agencies

- Studying macroeconomics – an exercise in deception

- Time for a reality check on debt – Part 1

- Will we really pay higher interest rates?

Premium Question 5:

Many countries are facing higher public debt to GDP ratios as a consequence of the crisis and some are approaching 100 per cent. Assume the current public debt to GDP ratio is 100 per cent and that central banks keep nominal interest rates and inflation constant and zero. The proponents of fiscal austerity say that by running primary surpluses they can reduce the public debt to GDP ratio even if they create a short-term recession and invoke the automatic stabilisers (which push the budget towards deficit). However, they also claim that it is likely that their strategy will promote growth. The austerity strategy cannot reduce the debt ratio (under our assumptions) if a recession results.

The answer is False.

First, some background.

While Modern Monetary Theory (MMT) places no particular importance in the public debt to GDP ratio for a sovereign government, given that insolvency is not an issue, the mainstream debate is dominated by the concept.

The unnecessary practice of fiat currency-issuing governments of issuing public debt $-for-$ to match public net spending (deficits) ensures that the debt levels will rise when there are deficits.

Rising deficits usually mean declining economic activity (especially if there is no evidence of accelerating inflation) which suggests that the debt/GDP ratio may be rising because the denominator is also likely to be falling or rising below trend.

Further, historical experience tells us that when economic growth resumes after a major recession, during which the public debt ratio can rise sharply, the latter always declines again.

It is this endogenous nature of the ratio that suggests it is far more important to focus on the underlying economic problems which the public debt ratio just mirrors.

Mainstream economics starts with the flawed analogy between the household and the sovereign government such that any excess in government spending over taxation receipts has to be “financed” in two ways: (a) by borrowing from the public; and/or (b) by “printing money”.

Neither characterisation is representative of what happens in the real world in terms of the operations that define transactions between the government and non-government sector.

Further, the basic analogy is flawed at its most elemental level. The household must work out the financing before it can spend. The household cannot spend first. The government can spend first and ultimately does not have to worry about financing such expenditure.

The mainstream framework for analysing movements in the public debt ratio is derived from the so-called government budget constraint model (GBC).

For a detailed explanation of this framework see the blogs that are recommended at the end of this answer. I am assuming this knowledge for the rest of the answer.

A primary budget balance is the difference between government spending (excluding interest rate servicing) and taxation revenue.

The standard mainstream framework (derived from the GBC) focuses on the ratio of debt to GDP rather than the level of debt per se. The following equation captures the approach:

In English, this can be read as saying that the change in the debt ratio – ΔB/Y (at time t) which is the term to the left of the equals sign – is the sum of two terms on the right-hand side of the equals sign:

- The difference between the real interest rate (r) and the real GDP growth rate (g) times the initial public debt ratio.

- The ratio of the primary deficit (G-T) to GDP (Y).

The real interest rate is the difference between the nominal interest rate and the inflation rate.

This equation is really derived from an accounting identity and therefore is true by definition, which is not the same thing as saying it has any significance. In Modern Monetary Theory (MMT) playing around with this framework has little significance.

Mainstream economics, however, uses the framework to highlight their claim that running deficits is dangerous. Even progressives who fall into the deficit-dove category use this frameowrk in a perverse way to justify deficits in a downturn balanced by surpluses in the upturn.

The standard formula above can easily demonstrate that a nation running a primary deficit can reduce its public debt ratio over time as long as economic growth is strong enough.

Furthermore, depending on contributions from the external sector, a nation running a deficit will more likely create the conditions for a reduction in the public debt ratio than a nation that introduces an austerity plan aimed at running primary surpluses.

Here is why that is the case.

A growing economy can absorb more debt and keep the debt ratio constant or falling. From the formula above, if the primary budget balance is zero, public debt increases at a rate r but the public debt ratio increases at r – g.

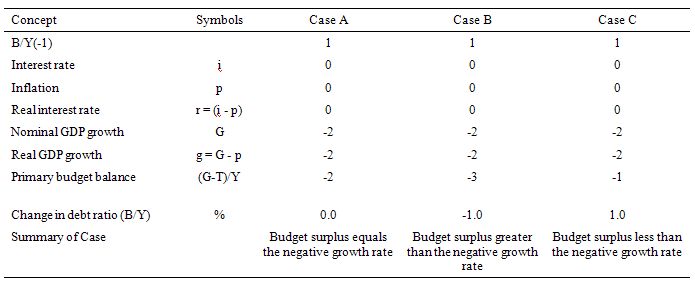

Consider this example which is captured in Year 1 in the Table below.

To make matters simple, assume a public debt ratio at the start of the period of 100 per cent (so B/Y(-1) = 1).

Assume that the rate of real GDP growth is minus 2 per cent (that is, the nation is in recession) and the automatic stabilisers push the primary budget balance into deficit equal to 1 per cent of GDP. As a consequence, the public debt ratio will rise by 3 per cent.

The government reacts to the recession in the correct manner and increases its discretionary net spending to take the deficit in Year 2 to 2 per cent of GDP (noting a positive number in this instance is a deficit).

The central bank maintains its zero interest rate policy and the inflation rate also remains at zero.

The increasing deficit stimulates economic growth in Year 2 such that real GDP grows by 2 per cent. In this case the public debt ratio falls by 0.1 per cent.

So even with an increasing (or unchanged) deficit, real GDP growth can reduce the public debt ratio, which is what has happened many times in past history following economic slowdowns.

The discussion also demonstrates why tightening monetary policy makes it harder for the government to reduce the public debt ratio – which, of-course, is one of the more subtle mainstream ways to force the government to run surpluses.

Now to the specific proposition outlined in the question. Here are the assumptions adopted:

- Current public debt to GDP ratio is 100 per cent = 1.

- Nominal interest rate (i) and the inflation rate (p) remain constant and zero, which means the real interest rate (r = i – p) = 0.

The following Table shows three cases consistent with running primary surpluses:

- Case A – Budget surplus to GDP ratio equals the negative GDP growth rate.

- Case B – Budget surplus to GDP ratio greater than the negative GDP growth rate.

- Case C – Budget surplus to GDP ratio less than the negative GDP growth rate.

As a result of modelling the assumptions in the formula (above) we can see that the change in the debt ratio (B/Y) is zero in the event of Case A, falls in the event of Case B (by 1 per cent) and rises in the event of Case C (by 1 per cent).

As long as the primary surplus as a per cent of GDP is exactly equal to the negative GDP growth rate, there can be no reduction in the public debt ratio, under the circumstances (which are the most benign possible).

So it is possible under Case B where the primary budget surplus is 3 per cent (noting that the surplus is presented as a negative figure) and the contraction in real GDP is 2 percent for the debt ratio to fall.

Thus if the “facts” can be achieved, the austerity option can reduce the public debt ratio even if they cause a recession. How likely is it that this would occur in the real world when the government was pursuing such a fiscal path? Answer: unlikely.

First, fiscal austerity will probably push the GDP growth rate further into negative territory which, other things equal, pushes the public debt ratio up. Why? The budget balance is endogenous (that is, depends on private activity levels) because of the importance of the automatic stabilisers.

As GDP contracts, tax revenue falls and welfare outlays rise. It is highly likely that the government would not succeed in achieving a budget surplus under these circumstances.

So as GDP growth declines further, the automatic stabilisers will push the balance result towards (and into after a time) deficit, which, given the borrowing rules that governments volunatarily enforce on themselves, also pushed the public debt ratio up.

So austerity packages, quite apart from their highly destructive impacts on real standards of living and social standards, typically fail to reduce public debt ratios and usually increase them.

So even if you were a conservative and erroneously believed that high public debt ratios were the devil’s work, it would be foolish (counter-productive) to impose fiscal austerity on a nation as a way of addressing your paranoia. Better to grit your teeth and advocate higher deficits and higher real GDP growth.

That strategy would also be the only one advocated by MMT.

The following blogs may be of further interest to you:

That is enough for today!

“The austerity strategy cannot reduce the debt ratio (under our assumptions) if a recession results.”

“The answer is False.”

“So austerity packages, quite apart from their highly destructive impacts on real standards of living and social standards, typically fail to reduce public debt ratios and usually increase them.”

Hi, Bill- With all due respect, it sounds to me like the statement you ended the longish question with was… true, not false. As per your discussion and answer. I realize that keeping a lot of multiple negatives in line is a challenge. But the last part of the question should probably take precedence.

Best wishes!

Bill,

I’ll be surprised if you don’t get a lot of push-back on question 2. The explanation comes down to – “taxation might not be essential because the government might instead decide to levy fines on everyday activities.” What *is* taxation except a structured set of “fines” on everyday activity? To me, this looks like a distinction in search of a difference to make.

Bill – on your reference to the “reserve drain” concept (q3), please can you spell out why this doesn’t apply to monetarily unsovereign countries?

Greece and Portugal are settling their budget deficits with national central bank reserves; so why don’t the Greek and Portuguese commercial banks constitute buyers of last resort of their respective CB bonds? Is it really the case that they would prefer to earn less (zero?) in CB reserves than the bond coupon? Are CB reserves somehow lower risk?

“When there is an external deficit, the private sector can reduce its overall indebtedness as long as the government supports saving by running a deficit.”

Surely the keyword here is “can” which I would have thought makes the answer TRUE.

Andy, if can means “may be able to”, you’re right. In the UK at least, can means “is able to”, so Bill’s answer stands.

Net financial assets is not equal to bank reserves … (though I guess you didn’t mean it while phrasing it that way).

No, no net financial assets are created. These are created by government expenditures. So primary market transactions do not create net financial assets. One more point – the price changes in secondary markets do change the Net Financial Assets.

SNA 2008 13.59: Long-term securities should always be valued at their current prices on markets, whether they are bonds on which regular payments of interest are paid or deep-discounted or zero-coupon bonds on which little or no interest is paid. The price should always be that including accrued interest (the so-called “dirty” price). Although the nominal liability of the issuer of a long-term security may be fixed in money terms, the market prices at which fixed interest securities are traded may vary considerably in response to variations in general market rates of interest. As the issuer of a longterm security usually has the opportunity to refinance the debt by repurchasing the security on the market, valuation at market prices is generally appropriate for both issuers and holders of long-term securities, especially financial transactors who actively manage their assets or liabilities.

Anders

Bill’s says FALSE is correct.

We can’t both be right. I accept that Bill’s answer is more likely to be correct.

It just seems to me that for the answer to be FALSE the question would have to have been phrased differently i.e.

‘When there is an external deficit, the private sector can ‘ALWAYS’ reduce its overall indebtedness as long as the government supports saving by running a deficit.’

I may be being a bit pedantic. Anyway I think I’ve got the basic idea.

“One more point – the price changes in secondary markets do change the Net Financial Assets.”

That’s arguable – since it is just an accounting policy. The value promised to the currency issuer is just par plus a stream of interest.

Have you evidence that the central bank will repo more than nominal value?

Ramanan: Long-term securities should always be valued at their current prices on markets, whether they are bonds on which regular payments of interest are paid or deep-discounted or zero-coupon bonds on which little or no interest is paid.

How does the repo system work? Market value or par? Seems strange it would be market value since the Fed influences market value by controlling rates. So I would assume par?

What I quoted in my previous comment was from the System of National Accounts 2008.

Central banks have collateral standards and you can go and check these standards at their websites. In the collateral standard, they also specify how they do the valuation and also specify the haircut

Here:

Also it defines margin as:

– from OVERVIEW OF THE FEDERAL RESERVE’S PAYMENT SYSTEM RISK POLICY ON INTRADAY CREDIT

In other words, lets say there is a government bond which pays 7% coupon semiannually and yields are low. In other words, the market value of the bond is sufficiently above 100. Then a financial institution can borrow more than 100 by pledging this bond as collateral even though the face value is 100.

You cannot value a bond at 100 permanently even if its a government bond.

Ramanan

Still trying to get my head round your post on the other thread.. let’s ignore current regulations for a moment and say the Fed buys a $1000 government bond directly from the govt. So Fed balance sheet now has $1000 additional asset, $1000 increase in treasury account liability, and the treasury balance sheet has a $1000 Fed account asset, $1000 bond liability.

Then the market value of the bond falls to $900.

Does the Fed then revalue its bond at $900? If it does, and the treasury doesn’t revalue it’s corresponding liability, then NFA (consolidated govt) decreases without a corresponding NFA flow, which is stock-flow inconsistent. But if the treasury does revalue it’s debt liability, this also doesn’t make sense as it’s nominal liability was fixed at the date of issue. So I can only conclude that the Fed would retain the original bond at $1000 on it’s balance sheet.

But then the Fed would seem to be valuing some of it’s govt debt holdings (e.g repo’d debt) at market value +/- margin/haircut, and some at face value, which is inconsistent. So I can only conclude that I don’t know what I’m talking about 🙂

Andy/Anders

My take on Bill’s q.1 is that the key part of the question is “.. as long as..” This implies that the clause immediately following is sufficient to make the preceding clause true, but in this case it is not – it is necessary, but not sufficient. Hence, the answer to q.1 is false.

Bill, can you confirm that by “reduce overall private sector indebtedness”, you simply mean “increase private sector NFA” without reference to gross private sector debt levels?

“NFA (consolidated govt) decreases without a corresponding NFA flow, which is stock-flow inconsistent. ”

No, to get stock-flow consistency, you need to take into account change in capital values:

Stock at period n = flow from n-1 to n + change in value of stock from n-1 to n.

Imagine, for instance, that you buy a zero coupon bond that matures in 10 years. Each year that you hold the bond, it is gaining in value, even though there are no “flows”. Nevertheless your savings are increasing every period merely by holding the bond.

Equivalently, if you sell a zero coupon bond for $100, then even though you do not need to make annual payments (no flows), still you must keep track of your increasing debt obligation in order to properly determine your net-worth.

Paradigm,

To really achieve a stock-flow consistent framework, you have to make sure that financial assets = financial liabilities. Else you may not get this identity and some inconsistencies may creep in.

So yes, the Fed needs to use market values of securities, not face value. Or some fair value. However national account compilers should use market values.

I know what you mean about the Treasury not revaluing, it may continue to say the liability as unchanged but national accountants will need to make sure assets = liabilities.

“…valuation at market prices is generally appropriate for both issuers and holders of long-term securities,…” as the System of National Accounts says.

My comment in the other thread was on revaluation gains/losses and even this one is.

Ok, RSJ, I see that you must be right, silly me. So the Treasury would account for its bond liabilities at market value, even though it is only committed to paying the nominal values of interest and principal. Changes in capital values certainly seems to complicate things, but I can see that it’s necessary.

So then we have the situation where non-govt NFA can increase merely due to valuation changes, without any vertical transaction… which was Ramanan’s original point, I think.

Isn’t the treasury’s willingness to pay market value at the behest of the central bank a vertical transaction?

Might price changes in the ‘horizontal’ be considered as something like the leveraging of HPM that occurs when banks lend with the undistributable reserve in the holders balance sheet being treated as a liability rather than capital. I suppose this though would make it inconsistent with accounting convention. (Don’t quote me)

“Bill, can you confirm that by “reduce overall private sector indebtedness”, you simply mean “increase private sector NFA” without reference to gross private sector debt levels?”

Holding NFA constant, it’s clear that debt can increase or decrease. Debt increases when banks make loans, and decreases when the loans are paid off.

Now if banks make bad loans, then an increase in NFA is needed to avoid defaults. Maybe that’s what Bill means, but if so he could be a lot more clear.

“You cannot value a bond at 100 permanently even if its a government bond.”

You can. That’s just an accounting policy. There is no reason at all why when constructing an economic model you have to follow the accounting policy of the national accounts systems.

Obviously you have to take those national account policies into account when you are interpreting the data supplied by those institutions. But that is it.

The question is whether mark to market is having a detectable economic effect at the repo level. Is the repo of bonds limiting anything?

There is a bond expiring in 2031 (issued in 2006) with a coupon of 7% and there is a bond expiring in 2031 (issued in 2011) paying a coupon of 3%.

Surely the two bonds have different value but according to you, they are valued at 100.

If you have a different accounting procedure, please propose one. Your present system runs into the above inconsistency.

“Surely the two bonds have different value but according to you, they are valued at 100.”

now Ramanan that is disingenuous at best.

Accounting is a bunch of policies and transactions. The transactions are facts, the policies are opinions which adjust the transactions to present a view.

The view that national accounts presents may not be useful for the purposes of economic modelling – particularly if your theories suggest that markets do not value efficiently.

It would be a perfectly rational policy to value bonds from the currency issuer’s point of view, which could simply be the total of how much is outstanding on the bond in nominal terms. That would accrue the coupons and eliminate them from current expenditure.

It would also be perfectly rational to value them at par, and allow the coupons to be part of current expenditure.

Or anywhere in between – which is theoretically what mark to market will do.

There is no such thing as a fixed set of rules. This is not physics.

“now Ramanan that is disingenuous at best”

No its not. Accountants take time to think about such things and iron out internal contradictions.

“Accounting is a bunch of policies and transactions. The transactions are facts, the policies are opinions which adjust the transactions to present a view.”

Yes true. But National Accountants follow the rule I quoted @ Sunday, April 10, 2011 at 23:11

“There is no such thing as a fixed set of rules.”

True but any set of rules has to be self-consistent.

For example in my previous example, would you value both bonds at 100 ? Of course not. For the private sector one bond has more value than the other. The prices at which they trade will of course be different. If someone were to gift me only one, I would chose the one with the higher coupon (in the example).

Another reason. Let us say that the central bank announces a rate hike and bond prices fall due to this. Or bond prices fall due to investor expectations regarding something which is irrelevant here. If bond prices fall, it is right to say that the net worth of the private sector fell. Which is reasonably right. If I held the bonds, I am less richer now.

However if you value it according to your rule, no such inference can be made.

Paradigm,

“So then we have the situation where non-govt NFA can increase merely due to valuation changes, without any vertical transaction… which was Ramanan’s original point, I think.”

Yes, that is my point. In fact if you see my comment at the other thread, I have gone into complications due to the foreign sector and how the net financial assets of the domestic private sector change in various scenarios.

“The question is whether mark to market is having a detectable economic effect at the repo level. Is the repo of bonds limiting anything?”

Lets say interest rates rise a lot and there are some government bonds whose price falls below $100 .. say $96.

Do you think the central bank will lend a financial institution $100 for pledging one bond ? Of course not, even though you maintain that it should be valued at $100.

“Do you think the central bank will lend a financial institution $100 for pledging one bond ?”

The central bank will have to pay $100 when it is redeemed, and the pull to redemption will ensure that the asset is worth $100.

I’d be more concerned if there was evidence that the central bank was repo’ing more than $100 for a $100 bond – because mark to market suggested they were ‘worth’ $140.

“For the private sector one bond has more value than the other.”

It may have from their viewpoint as constrained currency users, but if I’m only really concerned with transactions between government sector and non-government sector I’d wonder whether that change in perceived value is just noise at the macro level.

Noise which can be eliminated by recalculating the accounts using a different accounting policy – consistently yes, but one that provides a different viewpoint.

Similarly with the external sector. Standard accounting policy requires that you value in the domestic reporting currency. However in reality they may have been transacted in a completely different currency and not ever converted to the reporting currency. Economically that could distort the amount of domestic currency that appears to exist substantially. So you need a different accounting policy to deal with that – to make sure you’re not drawing incorrect conclusions.

I don’t know which policy gives the best view in terms of understanding the underlying macro tendencies. Are most bonds held to redemption from auction? Does the repo change based on the market price? Does it matter if the external balance sheets are valued in the domestic currency?

All interesting questions for which I don’t think there is a black and white answer.

Ramanan

So, correct me if I’m wrong here..

Suppose the CB buys a $1000 treasury via open market ops, holds it while the bond price falls to $900, and resells it back via OMO.

Neither of these vertical transactions affect the NFA of the govt or non-govt sector, since they are just asset swaps/monetary operations.

The end result is that the non-govt sector went from having a treasury valued at $1000, to having a treasury valued at $900 plus $100 deposit.

The CB increased it’s reserve liabilities by $100, while the Treasury reduced it’s liabilities by $100. So, no net change in govt NFA or non-govt NFA. Check.

If we were to continue to value the original treasury at $1000, then NFA (govt) would have decreased by $100, while NFA (non-gov) would have increased by $100. But, since the non-gov sector can’t gain from these transactions, this must be wrong, supporting your revaluation hypothesis.

Is this reasoning right?

Not sure what redemption you are talking of here. The central bank doesn’t pay at the redemption date. It is paid by the Treasury. The pull to par effect is not the way you think. Bond prices generally increase and at coupon payment dates fall. The dirty price of the bond doesn’t fall continuously to par.

Now again:

Lets say I am a bank and wish to borrow from the central bank. If I need to borrow, $100 I can’t pledge the bond whose market value is $96 as collateral. I need to give 100/96 of bonds which is > 1. That is, If I need $1m, I need to provide 10,417 bonds – 10,000 bonds won’t do.

See my quote @ Monday, April 11, 2011 at 6:05 and the reference “OVERVIEW OF THE FEDERAL RESERVE’S PAYMENT SYSTEM RISK POLICY ON INTRADAY CREDIT”. It clearly says market value. You should stop asserting and try to prove that it is not possible to borrow more than $100 on a bond whose market value is more than $100 (such as $120).

Yes there is a pull to par effect, but central banks also have margin requirements and if the market value changes, the counterparty needs to take some action such as posting additional collateral. However that is a different issue. However it still shows that market values are used not the par value.

At any rate, central banks can charge huge amount of haircut on many securities. Some securities are not acceptable. Does that mean those securities have to be valued zero?

A rise in interest rates can cause a drop in bond prices and the total effect of this can be substantial and can hardly be categorized as “noise”.

National accountants follow the guidelines given in the IMF’s Balance of Payments and International Investment Position Manual. Of course, there are interesting things happening – that is a different matter. But its better to have a “Pink Book” than not have one and instead of asserting that “I don’t think there is a black and white answer.”

To me you are sounding like “Oh that is debatable, the best is to say that all bonds should be valued at $100”

Paradigm Shift,

The discussion of OMOs with falling or rising bond prices can get confusing.

If bond prices fall, the net financial assets of the private sector (assume closed economy) falls. This fall doesn’t require any open market operation and is independent of any OMO. It can be due to some market factors or simply due to some central bankers making hawkish statements.

In your example, are these Temporary OMOs or Permanent OMOs ?

‘To me you are sounding like “Oh that is debatable, the best is to say that all bonds should be valued at $100″’

Yes it would likely sound like that from your particular rules bound viewpoint.

To everybody else it says that there is more than one way of looking at things.

So ,when a sovereign government issues debt it has an impact on the overall holdings of assets held by the non-government sector. Why does MMT insist on the opposite?

Ramanan: “The CB increased it’s reserve liabilities by $100, while the Treasury reduced it’s liabilities by $100. So, no net change in govt NFA or non-govt NFA. Check.”

Nope. Extra $100 comes from CB capital.

Sergei,

Didn’t say that. You are quoting ParadigmShift.

Paradigm,

I assume you are saying that the Fed bought $1000 of bonds and sold it later for $900. And these were outright purchases and sales.

The Fed makes a capital loss and the private sector gained $100 due to this.

However in this you have already assumed that the prices of the bonds fell and hence that already reduces the net financial assets of the private sector. This $1000/$900 transaction is just a small transaction compared to the amount the private sector holds and had holding losses.

On the other hand, I think I know what you are aiming at. 🙂

Let me phrase it this way –

You are saying something like “… if lets say bond prices were to fall and we continue to valuate these at par, then there is some sort of internal inconsistency in the whole argument. Right ? For let us suppose that the Fed were to buy a bond at $1000 and we have the rule (the Fed just exchanges one asset for another) and then prices drop and the Fed sells it for $900 and the price goes back to $1000. In this scenario, when we are kind of back to square one, but the private sector gained $100 and this is some sort of self-contradiction”

… something along those lines … or slightly similar …

To clarify: if you simplify and add (I – S) + (X – M), with positive (I-S) meaning deficit and positive (x-m) meaning surplus, then what does it mean when (I – S) + (X – M) on a whole is negative? Is positive?

Ramanan

Gotta go to work now, so will expand later, but yes, I’m trying to tease out a contradiction, one way or the other .

Later

PS

Ramanan

Your last paragraph was very close to what I was getting at. Sorry, I realise my last paragraph wasn’t very clear. If we assume the scenario where CB (1) buys via POMO at $1000, (2) market value falls to $900, (3) CB sells via POMO at $900, then (4) market value rises back to $1000, then we have the situation where NFA has been transferred from govt to non-govt, just as if the CB had originally paid more than the market price of the bond. So this is all as it should be.

What I’m getting at is that if we value the bond at $1000 throughout, but assume that the CB transacts at market price (buying at $1000 and selling at $900), then after steps (1)-(3) above, NFA (nongovt) is increased by $100 and NFA (govt) is decreased by $100, but this is inconsistent since none of steps 1, 2 or 3 can change govt or nongov NFA. (Note the reason I say Step 2 can’t change sectoral NFA is because the market value of the bond changes while it is on the govt side of the ledger as a CB asset). OTOH, if we assume revaluation of the bond throughout, steps 1-3 don’t change sectoral NFA, while step 4 does, leading to the correct result.

I’m probably belabouring this a bit, apologies to all.

“The CB increased it’s reserve liabilities by $100, while the Treasury reduced it’s liabilities by $100. So, no net change in govt NFA or non-govt NFA. Check.”

Nope. Extra $100 comes from CB capital.

Sergei, CB NFA decreases by $100, but under the revaluation assumption, NFL of Treasury also decreases by $100, so no net change in (consolidated) govt NFA, provided we also revalue the Treasury liabilities.

Paradigm Shift @Tuesday, April 12, 2011 at 21:06

Yes I understand your point.

It is inconsistent to value bonds at the par value even if they are government bonds. Repo rules are one thing (though supportive of the market value rule) but the Fed purchases the bonds at market price itself (in their Large Scale Asset Purchase program – QE) through reverse auctions. Of course this itself moves prices but that is a different matter. Even in the extreme case if one were to talk of situations where the Fed and the Treasury control the whole yield curve, it makes sense to do value them at current market prices, instead of valuing bonds at par even though (and because) these institutions in that case are determining the market value.

And yes if revaluations are used – and they should be – even the government liabilities will have revaluations.

This accounting is also as per G/L’s book.

Paradigm, you just have proved that when a sovereign government issues debt it has an impact on the overall holdings of NFAs held by the non-government sector.

Horizontal transactions have no impact on NFAs, but vertical transactions do.

So the answer to question 3 should be False.

MamMoTh,

Not sure if you have understood ParadigmShift well …

At the time of auction of G-Secs, other sectors’ net worth doesn’t change. However, during other times price movements do change the net worth of the private sector even if the official sector (CB+Treas) is not involved in the *transactions*.

Q3 – the question and answer true/false is right. We are discussing other things in the discussion of the answer.

Ramanan, if government issuing debt didn’t have an impact on the overall holdings of NFAs held by the non-government sector, then there would have been no discussion to start with.

MamMoth,

There are two things. Government expenditures/receipts and auctions of G-Secs. Its the net expenditures which change the Net Financial Assets of the other sectors. At the time of issuance of securities, there is no change of the net financial assets of the private sector.

However, the point I am making is that away from the issuance, there are price changes and this affects the private sectors financial assets.

We are talking of the event which changes the NFA and which doesn’t – expenditures or auction process.

If you look at the the auction followed by the expenditures as one, then clearly the financial assets change.

And I am saying that since debt issuance changes the composition of NFAs held by the private sector, then debt issuance has an impact on them.

The fact that the price of bonds fluctuate shows that debt issuance has an impact on the value of NFAs held by the private sector.

If that weren’t the case, we wouldn’t be discussing it. Actually there would be no debt issuance.

Horizontal bond transactions have no impact at all on NFAs held by the private sector no matter how the prize of bonds fluctuate.

Vertical transactions do.

On a second note, isn’t the Private Sector equation (Investment Minus savings) supposed to be (Savings minus investment)?

MamMoTh @6:42 & 6:45,

“And I am saying that since debt issuance changes the composition of NFAs held by the private sector, then debt issuance has an impact on them.”

Yes. Agree

“The fact that the price of bonds fluctuate shows that debt issuance has an impact on the value of NFAs held by the private sector.”

Yes. Agree.

“Horizontal bond transactions have no impact at all on NFAs held by the private sector no matter how the prize of bonds fluctuate.

Vertical transactions do.”

This is incorrect. What is meant by horizontal transactions here is transactions not involving the official sectors. Bond prices fluctuate and hence change the net financial assets held by sectors not involving the CB+Treasury of the country we are discussing.

Lets say for some reason, bond prices fall/rise. It changes the value of the financial assets of the private sector.

Lets take a closed economy. Your reasoning seems to be that it doesn’t matter if prices fluctuate and the government’s promises do not change due to this. Hence you conclude that since the private sector net financial assets is the mirror of the government sector’s liabilities, private sector’s net financial assets does not change. However that is under the assumption of one kind of valuation for the government sector, which is not what national accountants use.

Don’t quite see what you are aiming at.

I am saying that if the price of bonds fluctuate that doesn’t change NFAs of the private sector, there is the same amount of dollars and bonds. It just transfers dollars from some people to others, but it doesn’t create nor destroy NFAs.

Issuing debt creates NFAs at some point in time. That has an impact on the NFAs of the private sector.

I think I see what MamMoTh is getting at. Ramanan is right, though. Not all vertical transactions affect sectoral NFA, and debt issuance is one such transaction, being essentially a swap of reserves for govt debt of equal value. I guess you can argue that, since subsequent evolution of bond prices can alter private sector NFA, that debt issuance produces some volatility in private sector NFA over time that would not exist if there was no debt issuance. And then there’s the matter of interest payments on govt debt adding to private sector NFA.

Not all vertical transactions affect sectoral NFA, and debt issuance is one such transaction, being essentially a swap of reserves for govt debt of equal value.

They all do if they add NFAs, which is what interests on debt does. There is no such thing as swapping reserves for govt debt of equal value. They don’t have equal value, that’s why it fluctuates over time.

Debt issuance has an impact on the private sector NFAs. That’s why auctions don’t fail.

MamMoth,

I am going to give this a miss. While I understand what you are aiming at, you have to do a bit of T-accounts here. You are mixing too many things I believe.

“I am saying that if the price of bonds fluctuate that doesn’t change NFAs of the private sector, there is the same amount of dollars and bonds. It just transfers dollars from some people to others, but it doesn’t create nor destroy NFAs”

This is clearly incorrect. Imagine you have a bond. The price of bonds drop, which can be due to various reasons. It changes your balance sheet and do this for the whole private sector and hence the private sector’s net financial assets.

“Issuing debt creates NFAs at some point in time. That has an impact on the NFAs of the private sector.”

Yes while that is true, the discussion around this point is around the time when bonds are actually issued but not taking government expenditures into account because that is a separate event.

Over time, interest is paid on the debt and this changes the net financial assets of the private sector, of course! My comments are not at all related to these effects, but just on the effect of revaluations due to price changes.

This is clearly incorrect. Imagine you have a bond. The price of bonds drop, which can be due to various reasons. It changes your balance sheet and do this for the whole private sector and hence the private sector’s net financial assets.

I know this is how accounting is done but I disagree with its interpretation. If price of bonds drop, the bonds will still there and there will be the same amount of dollars. If bond holders were to sell their bonds within the private sector, bringing prices further down, at the end of the transaction there will still be the same amount of bonds and dollars. So there is a transfer of dollars from those who bought bonds high and sold them low to those who bought them low, but no change of NFAs.

I think MMTers have to make up their mind and be consistent. Either NFAs are only created and destroyed by vertical transaction, in which case I am right, or they can be created and destroyed endogenously at the horizontal level by revaluation, in which case I am wrong.

while that is true, the discussion around this point is around the time when bonds are actually issued but not taking government expenditures into account because that is a separate event.

This is like saying that if you pushed Ben Bernanke from the top of the Empire State Building then you had no impact on the height at which he was.

When expectations change then the price of bonds changes as well. You as bondholder always and in every moment make a choice between holding a bond and selling it. If you decide to hold it and in the next moment the price of it goes down, the net effect of it is that you gave up the value change to the market and the market increased its purchasing capacity at your expense. However, if you consolidate yourself and the market then nothing changes.

Sergei, actually I agree with you and Ramanan. Reality is what it is, so the question is what is the right way to describe it?

To me there is an inconsistency between the vertical-horizontal view, central to MMT and the one I prefer, that NFAs are only created/destroyed with vertical transactions, and accounting for bonds with fluctuating prices as NFAs which would mean NFAs can be created/destroyed endogenously at the horizontal level.

Not sure if I made myself clear, nor if I wrote enough lines to not be considered a troll…

Am I the only one who sees an inconsistency there?

What I certainly disagree with is with the claim that when a sovereign government issues debt it has no impact on the overall holdings of assets held by the non-government sector.