I have received several E-mails over the last few weeks that suggest that the economics…

The unemployed cannot find jobs that are not there!

The unemployed cannot find jobs that are not there! I have written about that topic extensively. So today I have been examining what vacancy data is telling us about the labour market. The relationship between unfilled job vacancies and unemployment (the so-called UV ratio) is well entrenched in economics. The UV ratio is a good indicator of the state of the labour market because it tells us (approximately) how many people there are for each unfilled job. Of-course, it understates the degree of slack because it fails to include underemployment. Anyway, you can also determine whether there are significant supply-side issues going on which would require supply-side policies. As you will see in the following graphs – it is all demand side! Which tells us, yet again, that job creation is required.

Unemployment is now rising again. Despite the long period of growth (1992-2008) the unemployment rate never returned to the full employment lows that we enjoyed in the 1960s. The persistent high levels of unemployment have been explained by neo-liberal economists as being indicative of supply-side shifts in the labour market, hypothesising that full employment now occurs at much higher unemployment rates than in the past.

There is a lovely quote from Michael Piore (1979: 10) that helps to remind us of the neo-liberal chicanery in this context and drives home the message of this blog:

Presumably, there is an irreducible residual level of unemployment composed of people who don’t want to work, who are moving between jobs, or who are unqualified. If there is in fact some such residual level of unemployment, it is not one we have encountered in the United States. Never in the post war period has the government been unsuccessful when it has made a sustained effort to reduce unemployment. (emphasis in original).

The number of unfilled job vacancies is used by economists to proxy excess demand for labour, that is, how strong the labour market is. If there are a large number of job vacancies being posted then we consider that a healthy sign and vice versa. The Australian Bureau of Statistics (ABS) defines a job vacancy as “a job available for immediate filling at the time of the survey and for which recruitment action had been taken.” The ABS had collected this data for 25 years. Prior to that vacancy information was gleaned from records kept by the then public employment service.

The tragedy is that the ABS decided in May 2008 to stop collecting the data on Job Vacancies (Cat no 6354.0) because of budget cuts imposed by our so-called “evidence-based” federal government. So the strand of research – called UV (unemployment-vacancy) analysis – which gave important insights into cyclical and structural developments in the labour market is now becoming difficult.

As an aside, the previous federal government censored vital wage data which made an in-depth analysis of wage movements also very difficult. Of-course, their motivation then was to disguise what was happening under Work Choices! As if we didn’t know anyway. So much for the information age! As a further aside, these areas of research just happened to be two areas I was well known for!

Anyway, as always in research, innovation is required! There is another shorter time series available on job advertisements (the ANZ series) and the correlation between the ABS Job Vacancy series and the ANZ Job Ads series is 0.96, that is, high. So to extrapolate the ABS series out to the first quarter 2009 I estimated a regression model linking the two and then forecasted out the extra values based on the known recent values for the ANZ series. The reason I want to use the ABS series is because it is much longer in time span – having been spliced originally to the CES data. We can go back until 1966 for a continuous quarterly dataset. So for this exercise that is what I use.

UV ratio

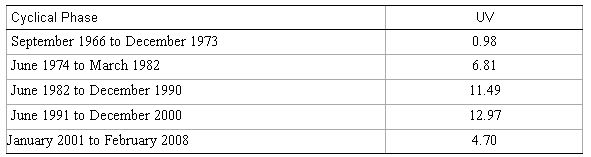

The following Table shows the averages for the unemployment-unfilled vacancies ratio (UV) in Australia for the period of full employment up to the December 1973 peak, and then for the trough to peak periods 1974-1982, 1982-1990, and 1991-2000; and then for the next phase of the modern growth period up to February 2008. Underlying these averages is the fact that not once since the December 1974 trough has the UV ratio been below 2 and has averaged 9.2 unemployed persons per unfilled vacancy since June 1974. Even in the growth boom over the last 8 years, where we were told full employment had been reached and we were short of labour the UV average 4.7.

The following graph plots the UV ratio for Australia from the August quarter 1966 to February quarter 2009. The red is showing the current downturn in highlight. You can clearly see the full employment period prior to 1974 when unfilled vacancies often exceeded the number of (available) unemployed workers. This put pressure on the employers to offer training to anyone they could get their hands on to ensure they kept their market share. Notwithstanding sectoral variations, at first blush, we are dealing with a heavily demand-constrained economy.

I have a saying in relation to supply-side remedies such as the Job Network, that is apt here: The unemployed cannot find jobs that are not there!

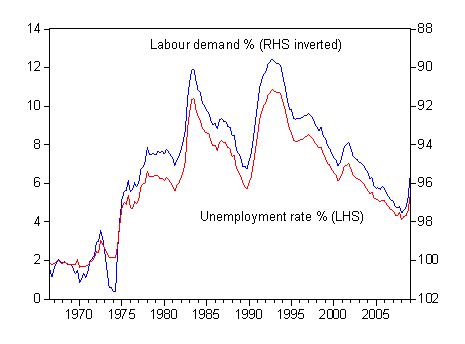

Here is an interesting graph. It shows the unemployment rate on the left hand scale plotted against the sum of employment and vacancies (as a percentage of the labour force) as a measure of labour demand on the right hand scale (inverted). So when the blue line falls, labour demand is stronger and vice-versa (as a result of inverting it). The inversion of labour demand is to show you how close the cyclical movements between labour demand and the unemployment rate are.

The correspondence between the two series is striking and a major part of the variation in the unemployment rate appears to be associated with the evolution of demand. Every time unemployment rises, you can trace it to a sharp drop off in the number of positions available. You can also see that when the unemployment rate was at the full employment levels in the 1960s labour demand was in excess of 100 per cent of the labour force (as a result of unfilled vacancies outstripping the level of unemployment). We have never regained that sort of labour market strength in the neo-liberal era.

The close evolution of the demand-side and the unemployment rate should also dispel any claims that structural shifts on the supply-side of the labour market drive unemployment, which is the centrepiece of the neo-liberal mythology. The myth also provides continued justification for the supply-side approach to labour market policy which is exemplified in Australia in the failed Job Network.

Most neo-liberal economists, and certainly the major researchers who have influenced the OECD in designing their active labour market programs regime (from which ideology the Job Network was construed), argue that the unemployment rate is higher now for a given level of vacancies because of structural shifts in the labour market. So they say the full employment unemployment rate is now higher than it was, say, in the 1960s because workers are less inclined to work (among other reasons associated with worker attitudes and preferences).

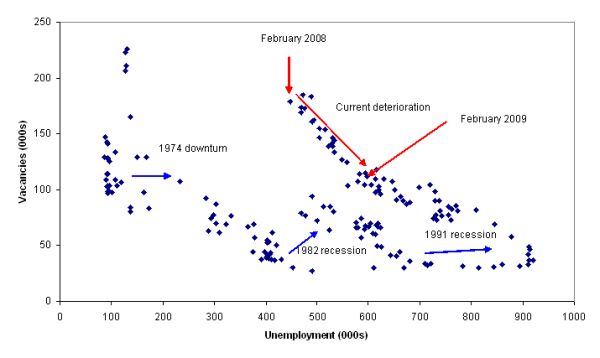

The final graph is the famous UV curve where total vacancies (in 000s) is plotted against total unemployment (in 000s) from Second Quarter 1966 to the First Quarter 2009. Much has been made of the shifts in this relationship over time. The outward shifts are clearly shown in the graph.

Representative of the supply-side emphasis and probably the most influential researchers in terms of the evolution of the OECD Jobs Study agenda, Layard, Nickell and Jackman (1991: 4, 38), explained the outward shift in the European Beveridge curve by “a fall in the search effectiveness … among the unemployed” LNJ (1991: 268) also claim that the UV shift has been due to “rise in long-term unemployment, which reduces search effectiveness …” What does this mean? LNJ (1991: 38) offer the following explanation:

Either the workers have become more choosey in taking jobs, or firms become more choosey in filling vacancies (owing for example to discrimination against the long-term unemployed or to employment protection legislation.

They suggest that the first reason dominates. There is clearly an observational equivalence problem in attempting to test for this. Search time will lengthen when there are large cyclical downturns and the probability of gaining a job decreases. With UV ratios averaging 9.2 unemployed persons per vacancy over the last 35 years, it is a fallacy of composition to conclude that if all individuals reduced their reservation wage to the minimum (to maximise supply-side search effectiveness) that unemployment would significantly fall (given the small estimated real balance effects in most studies).

Further, unless growth in labour requirements is symmetrical and labour force growth steady on both sides of the business cycle, the pool of unemployed can rise and remain persistently high. But it is impossible to directly test changes in the motivation of individuals independent of the hypothesis that the shifts are collateral damage of severe recessions. Note that there have been three noticeable outward shifts in the Australian UV curve shown in graph. The shifts occurred in 1974, 1982, and in 1991. It is no surprise that these shifts are driven by cyclical downturns rather than any autonomous supply side shifts. In early work (Mitchell, 1987), I showed that structural imbalances (supply constraints) can be the result of cyclical variations and can be resolved, in part, by attenuating the amplitude of the downturns. In other work I showed that the claims about the impacts of the rising long-term unemployment were false.

Conclusion

So to cut to the chase: the mainstream economics assessment of what drives unemployment has a problem with the available evidence. If I was the Federal government and I was out there claiming I wanted evidence-based policy as they have been then I would take some time to actually study the same. They used this “evidence-based” ruse to try to claim the previous regime was ideologically driven (which they were) and that somehow, as the new government, they would be driven by research.

So far their labour market policies don’t tell me that there has been much change at all!

References

Layard, R., Nickell, S. and Jackman, R. (1991) Unemployment, Macroeconomic Performance and the Labour Market, Oxford University Press, Oxford.

Mitchell, W.F. (1987) ‘The NAIRU, Structural Imbalance and the Macroequilibrium Unemployment Rate’, Australian Economic Papers, 26(48), 101-118.

Piore, M.J. (ed.) (1979) Unemployment and Inflation, Institutionalist and Structuralist Views, M.E. Sharpe, Inc., White Plains.

Digression: BBC interview

Today I did a TV interview for the BBC on the state of the economy here. They wanted to talk about the coal industry and where things were heading. We did the interview up on the knoll overlooking the ocean near Newcastle beach – Google image. This is a spot where you can look out over the ocean and count the ships in the queue waiting to enter the coal loaders in the Port of Newcastle, which is the World’s largest coal export port.

I consider this queue to be an informal indicator of the state of the World economy. In 2007, you could go to the knoll and count 70 odds ships waiting to get into the Port. This is sort of what it looked like then. Today I took this photo and counted about 7! Times are tough!

Your photos are a mirror image of what is occuring here in Gladstone Bill. 12 or 18 months ago, if you wanted to head out to the reef, you had to go past dozens of ships at anchor, all waiting their turn to be allowed into the harbour to load. We went and had dinner the day before yesterday with some visiting relatives at a small seaside town just outside of Gladstone that looks out to sea past the anchorage points.

3 ships anchored. It’s getting pretty crook!

Dear Bill,

another couple of informal indicators of the state of the economy are 1. the large numbers of cars up for private sale on the edge of roads, and 2. the increasing number of old coins in circulation. In good times it appears that many people throw their coins into some container rather than lumping it around but when times get tough then every penny counts.

Cheers

Graham