I have received several E-mails over the last few weeks that suggest that the economics…

I don’t wanna know one thing about evil

Yes, I only want to know about love … which brings me to the royal wedding today which seems to be dominating the media over here. So I am focusing on Britain today. The British monarchy has banned Australian comedians making any commentary on the wedding which seems to miss the point. I wish the couple well as I do all wedded couples – marriage is a great institution – but at the same time there’s something base about millions of public dollars going into this flippancy at the same time as the British government is undermining the prosperity of its own nation and committing millions to remain jobless and moving towards poverty. So here’s my royal wedding commentary which can be summarised by – I don’t wanna know about evil …

The title of-course is not mine. I recommend that David Cameron and George Osborne take a few days off and listen to the message in the fabulous song from John Martyn. Martyn is unfortunately no longer with us – enchanting us with his slurred vocals and beautiful guitar playing.

You might also like version from Dr John which is used in the closing credits from the great HBO show – True Blood – which puts the question of minorities in a very stark light. I recommend it.

Anyway, George, David, start thinking about love and stop the evil.

The British Office of National Statistics put out the latest National Accounts data this week which showed that Britain has virtually stopped growing.

The ONS said:

Gross Domestic Product (GDP) increased by 0.5 per cent in the first quarter of 2011, following a decrease of 0.5 per cent in the fourth quarter of 2010 … GDP is estimated now to have returned to the level in the third quarter of 2010.

The following graph is taken from the ONS time series data and shows the quarterly and annual percentage real GDP growth from March 2005. The colours are my tribute to the nuptials.

The graph tells a very stark story and for a government that was elected 12 months ago (about) who came to power promising growth and stability – the data to date suggests they have failed badly.

Anyway, I have been delving into the British Budget documents this week – to check on a few things. It makes sorry reading. Evil comes to mind.

If you read the official British Treasury documents from the Budget 2011 you will see a lot of reference to debt.

Under the heading “A strong and stable economy” (Page 7) you read:

… Over the pre-crisis decade, developments in the UK economy were driven by unsustainable levels of private sector debt and rising public sector debt. Indeed, it has been estimated that the UK became the most indebted country in the world … Households took on rising levels of mortgage debt to buy increasingly expensive housing, while by 2008 the debt of nonfinancial companies reached 110 per cent of GDP. Within the financial sector, the accumulation of debt was even greater. By 2007, the UK financial system had become the most highly leveraged of any major economy … This model of growth proved to be unsustainable …

This discussion is in the context of a vulnerable and unbalanced economy relying too much on private sector indebtedness for growth and being very sensitive to housing price movements.

I agree that a growth strategy that relies on the private sector increasingly funding its consumption spending via credit is unsustainable. Eventually the precariousness of the private balance sheets becomes the problem and households (and firms) then seek to reduce debt levels and that impacts negatively on aggregate demand (spending) which, in turn, stifles economic growth.

When those adjustments are stark – as they have been in the recent financial crisis – especially when housing prices collapse – the consequences are wide-ranging and very damaging. A recession induced by a private debt crisis is usually deeper and harder to resolve than a downturn arising in the real sector from, for example, a loss of consumer confidence.

When there are unsustainable stocks of private debt to deal with the adjustment becomes more complex.

But that is the only reference to household debt (or private debt) in the Budget documents. What follows is an obsessive coverage of the evils of public debt and the need to reduce it. The justification for the harsh austerity program which is now beginning to really eat into growth despite the rhetoric of the ideologues to the contrary is all tied up in the public debt arguments.

Soon after the only reference to private sector debt in the Budget 2011 Document you read that the “The Government’s economic policy objective is to achieve strong, sustainable and balanced growth that is more evenly shared across the country and between industries”

So as a person who understands the way national accounts work and the underlying economics that drive the data I can appreciate that you may succeed in a strategy of private sector debt reduction (given the Budget papers recognises it as a major problem) and public sector debt reduction (to satisfy the ideologues) while maintaining the sort of growth estimates that appear in the Budget under one condition.

The external sector has to come up trumps and provide the demand stimulus to the economy capable of (more than) offsetting the net saving desires of the private domestic sector and the fiscal drag coming from the public austerity program. If that doesn’t occur then the economy will shrink.

I explored this issue a bit further.

From Page 89 of the Budget paper (Section C) you can see the forward estimates which were prepared for the Government by the Office for Budget Responsibility (OBR). The OBR “was formed in May 2010 to make an independent assessment of the public finances and the economy, the public sector balance sheet and the long term sustainability of the public finances”. It is not an independent organisation at all – as it is stacked with neo-liberals who religiously believe in the mantras of fiscal consolidation etc.

Anyway in Annex C you can read “the OBR’s key projections for the economy and public finances”. The Budget Annex says that “(f)urther detail and explanation can be found in their report”. They might have added “IF YOU CAN FIND IT”.

But from Table C.1 you see very optimistic forecasts for Household consumption and net exports over the period 2011 to 2015. However, even if the net exports were to come in at forecast, the real GDP growth forecast would also requred the very strong recovery in household consumption that is forecast.

Interesting I thought, especially given that growth in Real household disposable income was forecast to be negative this year and then sluggish in the following years of the forecast horizon.

Are you guessing what I found out?

If you then consult some of the OBR papers you will come across this document (published April 21, 2011) – Household debt in the Economic and fiscal outlook.

You will read the following March 2011 household debt forecast which is the OBR input for the “household debt projection in the Economic and fiscal outlook” (that is, the Budget):

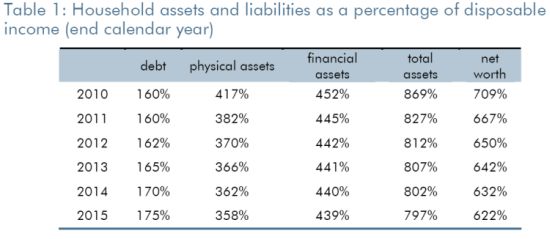

Our March forecast shows household debt rising from £1.6 trillion in 2011 to £2.1 trillion in 2015, or from 160 per cent of disposable income to 175 per cent. Essentially, this reflects our expectation that household consumption and investment will rise more quickly than household disposable income over this period. We forecast that income growth will be constrained by a relatively weak wage response to higher-than-expected inflation. But we expect households to seek to protect their standard of living, relative to their earlier expectations, so that growth in household spending is not as weak as growth in household income. This requires households to borrow throughout the forecast period.

The following Table is taken from the OBRs Table 1 and shows the forecasts for household assets and liabilities as a percentage of disposable income. It tells a particularly nasty story.

The OBR says that “net worth is forecast to decline as a percentage of income as the household debt ratio is expected to rise and the household assets ratio is expected to fall”.

So how are we to assess this?

Why is the British government making a fuss about the debt levels – both public and private – when its own growth strategy is contingent on the private sector taking on a rising debt burden over the forecast period and becoming relatively poorer?

Why isn’t that up-front in the Budget papers?

What the British government’s strategy amounts to is reducing public debt at the expense of more private debt. Prudent fiscal management requires that exactly the opposite is the case when the economy is floundering – given current conventions about matching budget deficits with public debt issuance.

It is totally unsustainable to create a growth strategy that relies on increased private sector indebtedness when that sector is already burdened by crippling levels of debt.

I see this “sleight of hand” – as a gross act of dishonesty from the British government. I am sure the public is not well informed about these issues given that all the rhetoric has been about reducing all debt.

The other obvious point, given this week’s first quarter 2011 National Accounts data is that the austerity strategy – the “fiscal contraction expansion” – is failing in a comprehensive way.

All the key economic indicators are poor in the UK at present. Let’s go through some of the data releases.

The ONS data for the Balance of Payments show that:

The UK current account recorded a deficit of £10.5 billion in the fourth quarter of 2010, increased from a revised deficit of £8.7 billion (originally published as a deficit of £9.6 billion) in the previous quarter. The fourth quarter balance is equivalent to -2.9 per cent of GDP, compared to -2.4 per cent in the previous quarter.

Conclusion: the much vaunted net exports boom which would ride in and save the British economy is missing in action. The BOPs are deteriorating not improving.

Data from the Bank of England – Trends in Lending – April 2011 – show that credit demand in Britain remains weak putting in doubt the OBR’s cynical optimism that in the face of harsh public spending cuts, British households will just substitute the lost disposable income with increased debt and happily go on consuming.

Business firms are also not borrowing which means that they are not investing. The BOE says “The stock of lending to UK businesses overall contracted in the three months to February, as did the stock of lending to small and medium-sized enterprises”.

This is despite continued low interest rates.

And of-course, the most recent – ONS Labour Force Statistics – (published April 11, 2011) shows that the unemployment rate is stuck around 7.8 per cent. It will not be stuck for too long. It will rise in the coming months as the impact of the slowing British economy takes its toll.

I don’t wanna know about evil ….

Conclusion

Everything is going south in the UK. Even the Irish who typically flee to Britain when times are tough are now flying straight to Australia to get work. That is a good indicator of how badly managed the recovery in Britain is at present.

Anyway, in the spirit of the title of today’s blog and the events that are occurring in London today, I advise you all to tune your guitars down (D-tuning) – put the capo on (fret four) and start strumming an Am! If you haven’t a guitar just sing along as all of us play the song and celebrate the royal wedding and wish that David and George were more fit to govern their nation. At least the wedding party doesn’t get to govern – fancy that.

Superman threatens to renounce US citizenship

I loved this story from the UK Guardian (April 29, 2011) – Superman threatens to renounce US citizenship. You can scan the story HERE.

The conservatives and right-wingers are in a blather about it. Advice: go suck!

FAQ

I am starting to develop a FAQ guide to the blog – FAQ.

I am not going to spend a lot of time on it but will add to it slowly as another way of providing effective navigation to the blog which is now quite extensive.

If anyone wants to help me – by posing a common question and then finding key blogs in my archive where I deal with that issue specifically – your efforts would be appreciated. Just send me the data and I will post it in the FAQ page. I will acknowledge help.

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – with even more labyrinthine linguistic layers (LLL) than last week!

That is enough for today!

Bill, That’s a great bit of research. But it’s not only the British economics establishment which is lunatic.

The recession was sparked off by excessive and irresponsible borrowing. So how does every Western country respond? They cut interest rates so as to encourage more borrowing! You couldn’t make it up!

It’s important to note that MMT does not make the above mistake. That is, in a recession MMT just advocates more net spending by the govt / central bank machine, with interest rates (far as I can see) being left to look after themselves. Put another way, the lunatic establishment way to getting households to spend more is to encourage them to go further into debt, whereas MMT boosts household bank balances: that encourages households to spend WITHOUT the need to go into debt.

MMT also does better than conventional policies regarding the objective advocated in the above mentioned British Budget 2011 Document, namely that we need “balanced growth that is evenly shared across the country and between industries.”

Interest rate changes only work via firms that are significantly reliant on variable rate loans (in contrast to those more reliant on equity finance). That doesn’t sound to me like “evenly shared . . . between industries”.

As for quantitative easing, that works only via those who hold securities, i.e. the rich. Again, that does not sound to me like “evenly shared across the country”.

In contrast, MMT stimulus, especially if it comes via Warren Mosler’s payroll tax reduction, is very evenly shared across social groups and industries.

John Martyn plays Don’t Want To Know – Leeds Grand Theatre – July 15 2008

http://www.youtube.com/watch?v=VHtXGaf1Scg&feature=related (Bill’s link.)

And to think I misseed it. $%@!%# I don’t believe it. Beautiful.

The sooner we get rid of the monarchy and the union jack the better for us.

And if the Irish are fleeing to Australia then they should first be held in the detention center just like the SriLankan Tamils and the Afgans. Why the Irish and the English are granted special previleges when it comes to migration to Australia ?

Cheers,

Sriram

I had the same thought this morning. iTunes sent me today their weekly marketing email. Surprise, Surprise! They want me to buy hours of British Royal Wedding Entertainment. I had no idea that there’s so much digital stuff on the subject available? This is really ridiculous. I mean the whole concept of monarchy in the 21st century seems rather archaic to me. The only benefit of having a monarch I can imagine is, that it helps with tourism. On the other hand you can ship your last monarch to some lonely island Madeira and still benefit from monarchy tourism by simply maintaining the real estate legacy. Millions of Japanese laying siege to Vienna are testimony that this strategy works and is far cheaper.

The British, sorry to say this, are incredibly stupid and it amazes me everytime that these people managed to rule half the world at one point. Walter Bagehot observed long ago, the whole point of monarchy was to act as a ‘disguise’ while the elites ‘carry on’ with government. In short, the monarchy was one big, grand distraction while the living standards of us commoners declines – the Crown was simply the head of our ‘morality’ and bathed with ‘ceremony’. To quote Bagehot:

“[The monarchy] acts as a DISGUISE. It enables our real rulers to change without heedless people knowing it. The masses of Englishmen are not fit for an elective government; if they knew how near they were to it, they would be surprised, and almost tremble.

Of a like nature is the value of constitutional royalty in times of transition…”

“The best reason why Monarchy is a strong government is [because] it is often said that men are ruled by their imaginations; but it would be truer to say they are governed by the weakness of their imaginations”.

Seems to be some truth to this. The French don’t take bullshit from their government and have the best healthcare system in the world. The Finns are happy to kick out their government and vote for people who will restore their national currency and have the best education system in the world. The Germans don’t either up to a point – although they are more likely to elect the bad side. They won the war they may have, but they certainly did not win the peace.

The Brit’s don’t really care what is happening to them and if they did they take things with deference. Monarchy was the magical element of their thought, a hereditary caste of street theatre performers delivered into the world by God to distract the people from governing their own affairs. In short, Bagehot saw the monarchy as a useful propaganda tool. And despite the arrogance and self-satisfied air of his prose, he understood the importance of mass emotional attachments to political and national identity, attachments that would partly explain the popularity of the monarchy for at least a century to come in Australia.

Dear Bill

Debt should not only be seen in light of disposable income but also in light of interest rates. If the debt of the average British household is 160% of disposable income and if interest rates are 4%, then their interest payments are 6.4% of disposable income, which may not be excessively high.

I take it that shares in corporations are part of financial assets, not of physical assets. British households don’t seem to be poor at all. If financial assets are a multiple of debt, then it seems to me that the investment income of the average British household should be higher than interest payments. In that case, why is their debt so burdensome? If I have a disposable income of 40,000, debts of 64,000 and financial assets of 180,000, and if the interest on my debt is 4% and the return on my financial assets is 3%, then my investment income net of interest on my debt is 2,840. Where is the big problem?

Regards. James

What about the unemployed and the underemployed James ? Or don’t they count ?

“What the British government’s strategy amounts to is reducing public debt at the expense of more private debt. Prudent fiscal management requires that exactly the opposite is the case when the economy is floundering – given current conventions about matching budget deficits with public debt issuance.”

It is so wrong that even modern monetary theorists use concepts like public debt, even though sovereign governments don’t really borrow in their own currency. They issue something called bonds which are savings instruments to the private sector. Just imagine how debate would change if deficit terrorist would have to rail their attacks against “public savings” instead of “public debt”.

Spadj,

“The Brit’s don’t really care what is happening to them and if they did they take things with deference. Monarchy was the magical element of their thought, a hereditary caste of street theatre performers delivered into the world by God to distract the people from governing their own affairs.”

I don’t claim to speak for everyone in the Uk, but most ordinary people see the monarchy correctly as having no power whatsoever – we certainly don’t see them as governing the country. They are preserved for the same reason we keep stately homes and castles open to the public – for the tourist industry, and for other academic reasons which are quite important.

In addition, though, they do make some important contributions to the voluntary sector, in shaming the rich into donating money and expertise to often very successful charities. Remember, Diana was largely responsible for generating strong opposition to land mines. They also champion the causes of self-sacrifice and duty to the public – William is a search and rescue helicopter pilot afterall.

I’m told the royals raise about £500m a year for the tourist industry, and if it wasn’t for Cameron’s silly idea of making the wedding a bank holiday, they would have raised another £600m from the wedding – the lost productivity from moving the bank holiday has been estimated at up to £6,000m!

“most ordinary people see the monarchy correctly as having no power whatsoever – we certainly don’t see them as governing the country”

That’s my point mate; the monarchy creates ‘magic’ and ‘mystery’, which diverts attention from the fact career politicans are governing the country and not for the better.

What the budget document proves is that neo-clasical economists think money grows on trees. How else to account for their unselfconscious inclusion of Table 1 in their projections? Banks are not lending because they see no one credit worthy despite having been swamped with excess reserves and yet the neo-libs are confident enough to project that households will spend beyond their income anyway. Where will this money come from? Trees.

When the economy re-enters a tail spin, however, don’t wait for capitulation from the authors of the OBR report. They will insist that we have to wait out the re-adjustment period while all the surplus citizens the economy has no use for simply die. Then the neo-liberal rebound can begin.

Now look, Bill, Spadj et.al I don’t mind you slagging off our Neo-lib-idiots-that-run-the-country but don’t forget it was Her Maj that asked the one question of our great and good “How come you eejits didn’t see it coming” (I paraphrase, obviously) that has yet to be fully answered (by them).

True she comes from a long line of thieving, land grabbing, Royals that have risen to the giddy heights of the British establishment (and for her Maj the countries richest woman) simply by being born into it. The only thing we lead the world in now is simpering, fawning and obsequiously stomach churning deference to the establishment clots that run the county.

I rest my case, now to the Saturday quiz…

@Sriram

This is an economics blog but since you raised it, the Australian government gives special privileges — as you call it — to people with valid entry visas regardless of where they come from. For example my neighbours are Lebanese and they arrived here in the 1950s under the immigration guidelines of the sovereign government. If you do not have a valid entry visa you are not allowed in under those same immigration guidelines. If you do not have the valid papers to live here you are denied entry or deported if you have already gained entry — this applies to Irish and English also. In fact in a highly publicized case recently a man was deported to the UK (incorrectly IMO but the government makes the rules). Regardless of whether you agree with this, this is not a unique stance in the world — I don’t believe you would be allowed entry into the USA for example, without meeting the conditions laid out by the US government.

I have travelled to lots of countries and always required suitable paperwork — defined by that country — to enter. I have not been to Sri Lanka or Afghanistan but I would imagine that they do not have open borders either, IOW if I did not have the right paper work I would not be allowed in.

You can’t attend Royal weddings without an invitation. You can’t go lots of places or do lots of things without invitations and/or paperwork. International travel and migration is no different.

cheers

Mike

Quote from The Queen:

“Have you been playing a long time?” – Speaking to guitar legend Eric Clapton at a Buckingham Palace reception in March 2005.

http://www.cbc.ca/news/world/story/2010/06/25/f-queen-elizabeth-ii-quotes.html

http://www.guardian.co.uk/uk/2007/dec/22/monarchy.topstories3

http://www.dailymail.co.uk/news/article-504137/The-Queen-philistine-lacks-education-says-David-Starkey.html

Given the royal families history they’d be more familiar with the banjo player from Deliverance.

The current gov may be bad in many ways but they are true to their word in reversing New Labour’s decline in UK manufacturing. Manufacturing has been growing in the UK at its fastest rate for decades. The manufacturing sector is now so small in the UK that even a 2.4% per quarter growth in manufacturing doesn’t impact much on the total growth stats. I’m crossing my fingers and hoping that growth in manufacturing continues and the UK gets more sustainable jobs from that. Germany and Japan do have a better job market thanks to being manufacturing based economies. The New Labour UK model of an economy based wholely on a blend of private sector financial services and ballooning gov bureaucracy was far from satisfactory.

James Schipper.

49% of the population’s savings are only a few thousand pounds, the savings wealth is concentrated in the top 51% upwards.

Whose borrowing at rates of 4% credit and store card debt is north of 20%, 5 year fixed mortgages are 6%. Banks charge all sorts of fees on top of that. Bank loads are north of that, say 9%. When someone’s budget is already overextended because of borrowing then £200 a month is serious.

Mean median wages are £25k and £20k respectively. Money in main residences don’t pay interest. Take home on those salaries is £1,000 to £1,600, so £400 a month is 25-40% of income…I’d say that’s a problem.

All of this puts significant holes in and a damper on your argument.

Great John Martyn song, Bill. Thanks for the link.

Well, well, it’s such a pity that after all the great work by Bill Mitchell, you can see comments that are full of inaccurate nonsense, guesswork and racism, it only goes to show that ignorance is universal.. but then again I’m British and so I’m incredibly stupid… apparently…