I have received several E-mails over the last few weeks that suggest that the economics…

Worse than asinine!

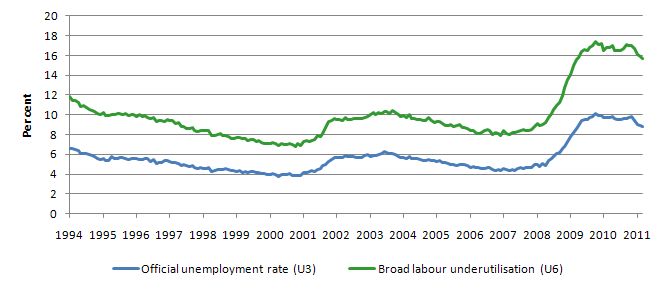

The US Congress is about to debate whether they raise the legal limit on government borrowing. The limit expires on May 16, 2011. The political sentiment at present is that more net spending cuts will be demanded by the majority in the government in order to approve any new limits. A stalemate is likely for some period while the conservatives (in both parties) posture in the media about how tough they are. The reality is that the whole debate is pathetically ill-informed. I think it is always better to focus the mind of what is important when entering these debates. The US Bureau of Labor Statistics started compiling their “>Alternative measures of labour underutilization in January 1994. They publish 6 measures (U-1 to U-6) on a monthly basis as part of their Labour Force data releases. U-3 is the official unemployment rate (total unemployed as a percent of the civilian labor force) whereas U-6 is their broadest measure and is defined as:

… total unemployed, plus all marginally attached workers, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all marginally attached workers.The following graph compares the official unemployment rate (U-3) with the broader measure (U-6) since January 1994. The impact of the two recent recessions (2001 and 2008-09) is apparent. The unemployment rate rises and then stalls before growth slowly reduces it. The length of the current recession is very striking. The unemployment rate has barely moved since it started to increase sharply in early 2009. I wondered about that level of inertia – which is a common characteristic of the way labour markets tend to operate elsewhere.

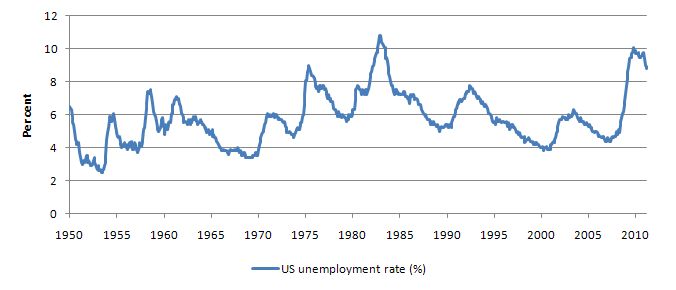

The following graph extends that observation. It shows the national US unemployment rate (U3 measure) from 1950 to 2011. There have clearly been periods when the unemployment rate has soared. But while persistence is a characteristic of advanced nation labour markets the US labour market has typically recovered more quickly. Se how quickly the peak unemployment rate turns.

However, it is clear that in the two recent recessions (the apex of the neo-liberal era) that has not been the case. Much of that, in my view, has been due to the increasing constraint that the political process is putting on the capacity of fiscal policy to respond and the excessive reliance on monetary policy as the primary counter-stabilisation tool.

You only have to think back to the Press conference last week held by the Chairman of the US Federal Reserve where he expressed his concern over the size of the fiscal deficit and the hope that “loose” monetary policy would provide enough jobs to bring down the unemployment rate to realise how skewed the policy debate is in the current ear. Please read my blog – US Federal Reserve chairman loses his independence – for more discussion on this point.

The following graph extends that observation. It shows the national US unemployment rate (U3 measure) from 1950 to 2011. There have clearly been periods when the unemployment rate has soared. But while persistence is a characteristic of advanced nation labour markets the US labour market has typically recovered more quickly. Se how quickly the peak unemployment rate turns.

However, it is clear that in the two recent recessions (the apex of the neo-liberal era) that has not been the case. Much of that, in my view, has been due to the increasing constraint that the political process is putting on the capacity of fiscal policy to respond and the excessive reliance on monetary policy as the primary counter-stabilisation tool.

You only have to think back to the Press conference last week held by the Chairman of the US Federal Reserve where he expressed his concern over the size of the fiscal deficit and the hope that “loose” monetary policy would provide enough jobs to bring down the unemployment rate to realise how skewed the policy debate is in the current ear. Please read my blog – US Federal Reserve chairman loses his independence – for more discussion on this point.

I was interested to read this story – Warren Buffett: Failure to Raise Debt Limit Would Be ‘Most Asinine Act’ Ever By Congress – (Saturday, April 30, 2011).

The report quotes Buffett as saying that he:

I was interested to read this story – Warren Buffett: Failure to Raise Debt Limit Would Be ‘Most Asinine Act’ Ever By Congress – (Saturday, April 30, 2011).

The report quotes Buffett as saying that he:

… doesn’t want the nation to keep increasing its debt relative to GDP … [but that] … there shouldn’t be a legislated debt limit to begin with, because circumstances change.Yes, the business cycle is uncertain. Locking the government into artificial rules that continually restrict its capacity to respond to the vagaries of the business cycle is poor policy. Buffett said that the US will not:

… have a debt crisis of any kind as long as we keep issuing our notes in our own currency.100 per cent agree. If the government surrenders it currency-issuing monopoly and thus becomes non-sovereign in the US dollar then default risk would be something to worry about. The Washington Post used to be a paper worth reading (even getting the hard copy delivered to Australia before the Internet came along). Think back to the 1970s and its work in exposing the corrupt Nixon regime. But those days are long gone. Now it seems to be a place for ill-informed journalists who rehearse the usual myths about the impending financial demise of the US government on an almost daily basis. On May Day when the people of the world should be marching in the streets – this article appeared in the Post – Running in the red: How the U.S., on the road to surplus, detoured to massive debt. The title tells you most of what you could then write. Who needs a journalist these days – I could program a computer to write the daily financial news – all we would need is to seed the code with one or two keywords and the story would be produced in milli-seconds. But this story was actually written by a human which makes it more sad. We read that “(t)he nation’s unnerving descent into debt began a decade ago with a choice, not a crisis” and:

In January 2001, with the budget balanced and clear sailing ahead, the Congressional Budget Office forecast ever-larger annual surpluses indefinitely. The outlook was so rosy, the CBO said, that Washington would have enough money by the end of the decade to pay off everything it owed.Which just goes to show how poorly informed the CBO was. It was clear to the people I speak to regularly (MMT types) that the US was going to hit the wall in 2001. We talked about that as we saw the Clinton surpluses expand and private debt increase. It was only a matter of time. When the 2001 recession hit it was just a case of how bad it would be. As it turned out it was a relatively small recession and the unemployment rate went from 3.8 in April 2000 to 6.3 in June 2003. That was bad enough but of-course, worse was to come. The fiscal response of the then government (Bush) was to cut taxes and increase spending. There is a legitimate debate to be had about the targetting of both (and I clearly think too much of the bounty went to the top-end-of-town at the same time that the deregulation was also moving real income to them). But the fiscal injection clearly helped bring the 2001 recession to a more rapid end than otherwise. The Washington Post article seems to think that the Clinton surpluses could have been maintained forever. In relation to the fiscal reaction to the 2001 recession the article says:

Now, instead of tending a nest egg of more than $2 trillion, the federal government expects to owe more than $10 trillion to outside investors by the end of this year. The national debt is larger, as a percentage of the economy, than at any time in U.S. history except for the period shortly after World War II.Yes, and the collapse in private spending is also rarely seen in the history of the US. But what exactly is this “national debt”? It is wealth and income owned and received by the non-government sector. In part, by foreigners (for example, bond holders in China and Japan) who have sent more real goods and services to the US than they have received in return. In doing so, they have enhanced the real standard of living of the US residents – through totally voluntary exchanges. The domestic bond holders enjoy a safe haven for their wealth and receive a guaranteed annuity (income flow) each year. I fail to see anything bad about that. The US government is “us” (being the “non-government sector”). It does not have any “resources” of and by itself. It has a power – to issue the currency that non of “us” enjoy. It can use that power to enhance the incomes of private citizens and allow them to increase and store wealth. The national debt is just an accounting expression of the cumulative budget deficits. Even when a deficit is rising as private economic activity is collapsing – the net public spending is helping us boost our material standards of living. It would be better for deficits to contribute to growth when private spending was strong – because then it would be delivering and maintaining full employment, while providing demand support for output to allow the private sector overall to save and allowing the nation to enjoy an eternal deficit. The notion that a budget surplus represents a “nest egg” is totally false. When the government runs a surplus it destroys net financial assets held in the non-government sector (manifest as reduced purchasing power). The “money” accounted for by the surplus goes no-where. It is purchasing power which is destroyed. The surplus does not provide the government with any “extra” capacity to spend next period. It has infinite (minus 1 cent) capacity to spend in a financial sense. Running a surplus just undermines private sector wealth and future income potential. The idea that a budget surplus represents national saving is thus spurious and until that myth is broken people will struggle to realise that surpluses are typically destructive (with recessions following soon after typically) and deficits are virtuous. That is not always the case but it is standard. The Washington Post article rehearses all the flawed ideas that pertain to surpluses. In discussing the Clinton years it says:

In the typical American household, a surplus comes as welcome news. But the White House is not a typical household. When Treasury Secretary Robert Rubin saw the budget shift into the black in 1998, he immediately warned President Bill Clinton that, politically, it was a mixed blessing. Rubin wanted to use the surplus to start repaying the debt, which was then just more than $3 trillion.Instead of writing – “the White House is not a typical household” – the author should have been categorical – “The US government is nothing like household”. The household uses the currency the government issues. The former is thus financially constrained in that currency, the latter, as Warren Buffet notes above – is never financially constrained. But this erroneous association (between household and government) leads to further nonsense. The debate in the US at the time was about paying back debt or “saving Social Security first”. Another erroneous idea – that somehow the ageing population would bankrupt the pension system. How can it? The US might not be able to feed all its ageing citizens at some point (doubtful) but the government will clearly be able to sign the cheques that will allow the pensioners to buy what food is available. Yes, there might be declining real standards of living if their is inflation. But that is a different story. I note that a lot of conservatives (and some commentators on my blog) are claiming that – it is true the government can “print” its way out of insolvency but the inflation represents the way it defaults. Once you get down to this level of argument you realise how ridiculous the claims are. There is constant inflation – low but constant. It varies year to year. All debtors benefit from that in real terms for all their nominal debt contracts. That is not exclusive to government debt. What you have to run is an argument that government deliberately inflates to reduce its real debt obligation. Why would it do that if their is no “burden” anyway? What is the evidence that governments deliberately do that? None! The Washington Post constructs the response to the 2001 recession as:

… the abandonment of fiscal discipline in the wake of the surpluses …Which begs the question? What do they think would have happened? They admit that the in relation to the Bush tax cuts and spending increases the “(g)ood times masked the impact, as surging tax revenues reduced the size of year-to-year deficits during the first three years of his second term”. But then they say:

… after the economy collapsed during Bush’s final year in office, deficits – and therefore the debt – began to explode as Obama sought to revive economic activity with more tax cuts and federal spending.As if the fiscal expansion in response to the 2001 meltdown caused the latter collapse. There were many policies of the Bush government that caused the financial crisis in 2008. But the response (in aggregate terms) to the 2001 recession was correct although the deficit increase was not large enough at the time. Reflect back on the unemployment graph above. Further, the issue now is not the deficit but the real hangover from the private spending collapse. There was no mention in this Washington Post article of unemployment. The public debt build-up is just a “canary” telling us that unemployment has risen dramatically. The latter is what we should be worried about not the former. Not lifting the debt limit would be worse than asinine. It would be a cruel and irresponsible decision to make and would represent the abandonment of leadership in the United States. GDP trends in the US Which brings me to the US National Accounts results released by the US Bureau of Economic Analysis last week. The data shows that the US economy is slowing rapidly in the March 2011 quarter with consumer spending falling and government action destroying growth. The annualised real growth rate has fallen to 1.8 per cent (down from the fiscal-driven 3.1 per cent in the December 2010 quarter). Last Thursday (April 28, 2011) the US Department of Labor published their latest Unemployment Insurance Weekly Claims Report. The Report says that:

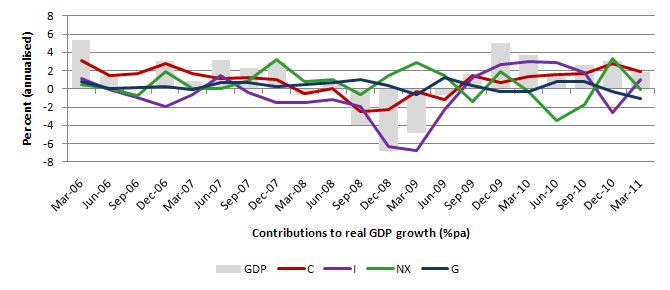

In the week ending April 23, the advance figure for seasonally adjusted initial claims was 429,000, an increase of 25,000 from the previous week’s revised figure of 404,000. The 4-week moving average was 408,500, an increase of 9,250 from the previous week’s revised average of 399,250.Why didn’t the Washington Post mention this in its commentary on the current state of fiscal policy in the US? To see the reason that real GDP growth has slowed you can consult the following graph (from BEA data). It shows the contributions to real GDP growth since the March quarter 2006 split into the major National Accounts components – C = Personal consumption expenditures, I = Gross private domestic investment, NX is Net exports of goods and services and G is Government consumption expenditures and gross investment. The negative contributions of the government in December 2009 and March 2010 was due to the states. The federal government continued to make a positive contribution in these quarters. But in the December 2010 and March 2011 quarters, the overall contribution of government has been negative and this has been driven by the negative federal government contribution. You can also see that private consumption (C) has tapered off in the March 2011 quarter as have net exports. Obama was hoping for an export-led boom and notwithstanding the falling US dollar there is no hint that the external sector will replace the declining (now negative) contribution of the government.

The point is obvious. The public spending cuts that are being debated in the US Congress at present will severely curtail economic growth in the US. The contribution of the US government (federal and states individually) to real GDP growth in the first three months of this year is already negative.

Conclusion

I have to catch a plane now. But the message is clear. As an economists dealing with data and theories it is easy to divorce the material under study from the context – human well-being. I thus always try to keep a focus on what really matters – things that affect human welfare.

I know from my work and experience that unemployment is the worst economic affliction there is. It feeds a number of highly destructive pathologies. It is the exemplar of waste and inefficiency. It is the principle cause of poverty. It beggars belief that the US Congress would be even considering not extending unemployment benefits or raising the debt limits right now.

It is even more ridiculous that the debate is so heavily skewed to further cutting the contribution of the government to real GDP growth when that growth rate is falling and unemployment claims are rising.

The behaviour of the US political leadership is worse than asinine. What goes on inside these characters’ heads?

That is enough for today.]]>

The point is obvious. The public spending cuts that are being debated in the US Congress at present will severely curtail economic growth in the US. The contribution of the US government (federal and states individually) to real GDP growth in the first three months of this year is already negative.

Conclusion

I have to catch a plane now. But the message is clear. As an economists dealing with data and theories it is easy to divorce the material under study from the context – human well-being. I thus always try to keep a focus on what really matters – things that affect human welfare.

I know from my work and experience that unemployment is the worst economic affliction there is. It feeds a number of highly destructive pathologies. It is the exemplar of waste and inefficiency. It is the principle cause of poverty. It beggars belief that the US Congress would be even considering not extending unemployment benefits or raising the debt limits right now.

It is even more ridiculous that the debate is so heavily skewed to further cutting the contribution of the government to real GDP growth when that growth rate is falling and unemployment claims are rising.

The behaviour of the US political leadership is worse than asinine. What goes on inside these characters’ heads?

That is enough for today.]]>

Bill the employment situation in the USA is a little bit worse when you examine labor force participation, % population employed and so on. The unemployment data can drop faster than employment rises simply because people get defined away as not looking for work.

In Australia there is much talk about low unemployment but you are defined as employed here if you work one hour per week. Clearly you can live on one hours income. Do we have a U6 equivalent or do we have to infer the under-employed numbers from things like distributions of average hours worked and so on?

If the idea of economic and pubblic expenditure remains unchanged in the coming years we will see thanks to’ the technology a holocaust in the world of workers. bill thanks for your impeccabile analisis

I’m a newcomer to this site and have found it extremely helpful in my understanding of the economic world around me.

I’m always interested in the history of a topic and have wondered about the historical policy choices that got us into the mess we now find ourselves. Recently, I found this presentation, by Thomas Palley, of the effects of policy choice on the U.S. economy. It seemed to me the presentation provided a kind of primer on what has happened in the post war period. It also seemed like much of his thinking is generally consistent/complimentary with what is being offered on this site. What I thought was useful was the overview it provided of events of the last 60-70 years which have contributed to our current predicament.

Here is the link – http://newamerica.net/events/2009/americas_bubble_addiction

If you choose to view/listen, scroll to the bottom of the screen and download the PowerPoint presentation first.

I would appreciate hearing some perspectives on Palleys presentation.

Cheers

Mike, the info is out there somewhere, Bill usually states a 12ish% total unemployment rate, looking at part-time and those not seeking work, I think.

I just read an article by Frederick Kaufman about how food inflation is being caused by Goldman Sachs’ commodity index fund. According to Mr. Kaufman the fund is set up in a way that speculators can only buy and never sell and the set up is causing food inflation that will only get worse as time passes. As I understand it supply and demand is not as important as the speculation.

If that is the case will the neo-liberals not use the commodity inflation as an excuse to cut the deficit?

I recently came across a mention of a jobs program started by Jimmy Carter called CETA (Comprehensive Employment and Training Act) that at its peaked employed more than 700,000 people. I’ve searched Bill’s blog and some of his papers on the Job Guarantee, and I can’t find any mention of it!

Why the silence on this potentially relevant example? What are the lessons learned and the things that should be done differently, if any?

From wikipedia: “a United States federal law enacted in 1973 to train workers and provide them with jobs in the public service… The program offered work to those with low incomes and the long term unemployed… The intent was to impart a marketable skill that would allow participants to move to an unsubsidized job. It was an extension of the Works Progress Administration program from the 1930s. The Act was intended to decentralize control of federally controlled job training programs, giving more power to the individual state governments.”

An opinion writer at politicsdaily that came up in my quick search results says: “That was the crux of the policy dilemma: The voters did not want make-work and the unions did not want real work.” And, “CETA employees did perform useful work — from asbestos removal to assisting in libraries and senior citizen centers.” And, “Following the questionable gospel that state and local governments always know best, CETA programs were decentralized.” And, “But the problem with CETA was not that it embodied Big Government, but that it was not big enough.”

That’s just a sampler from one observer (and I have not done enough research to draw my own conclusions), but I am really curious as to Bill’s take if he ever decides to take on this topic in a blog post. At a glance, it sounds like the program’s design shared many (but not all!) of the same goals as Bill’s JG proposals, but that it ultimately failed in the public eye. Is that outcome probable with respect to future job programs, and if not, what changes are needed?

Bill, how would you respond to Krugmans recent assertion that budgets must be balanced over business cycle? http://krugman.blogs.nytimes.com/2011/05/02/hard-keynesianism/

Is there any study that proves that in normal times private sector needs constantly new financial assets from the government, or is it just pure theoretical reasoning? I mean, logic is simple but how do you prove such a thing?

Bill

Enjoying your blog a great deal and I’ve been catching up with some of the archives/primers as time allows.

I’m interested in your thoughts here (please forgive any incorrect terminology, I hope my point is clear):

“The fiscal response of the then government (Bush) was to cut taxes and increase spending. There is a legitimate debate to be had about the targetting of both (and I clearly think too much of the bounty went to the top-end-of-town at the same time that the deregulation was also moving real income to them).”

You have stated that “increasing deficits” should be used as policy to reverse economic downturns but do you consider that there are better/worse ways of doing this? Obviously Bush increased the deficit but did so via tax cuts for the very wealthy. Assuming you don’t subscribe to ‘trickle down’ or ‘supply side’ or whatever name the right has come up lately with for giving cash to the rich to the detriment of the wider economy, will this policy have as beneficial an effect on demand/activity/GDP as a modest pay rise to govt workers, a modest tax cut to general workers (more likely to spend it than the rich) or a series of infrastrucure/public works projects assuming that the deficit impact is the same?

As a deficit is the outcome of various policy choices rather than a decision in itself is it important what these choices are in influencing demand and will the multiplier effect on the economy be different according to a govt’s policy choices?

Thanks

Hi, new to all this and trying to understand this MMT model, I have gone through the primers and it is certainly eye opening. Please correct my understanding though, clearly government money and private money work under different rules, but I do have a silly question. If government deficit creates private savings and hence wealth, why do we need taxation at all in this system as government can just print money to fund whatever spending it wants. Why does it need to bother taking some of its money back? it certainly doesn’t need it.

Mike…

abs.gov.au………series ID is A3345835R

GLH, Saving by commodity hoarding seems to now be a cyclic activity. Once equities are too overpriced, commodity hoarding becomes the next choice as a repository for the “leakage to savings” that MMTers say must be indulged. That ramps up the cost of commodities until firms can no longer make a profit (as there is limited scope for passing the price on to consumers). Then equity and then commodity prices crash. Then equity prices are once again attractive until they get inflated and so on. Many commodity prices are only now approaching the 2008/2009 high points. Price cycling like that can be said to not really be inflation but that seems to me neither here nor there. Having people starve as they did in the food price spike in 2009 seems to me the worst form of economic failure, on a par with Stalin and Mao’s fiascos.

@Irving

>”…why do we need taxation at all in this system…”

(1) The US$ (coins, paper, digital tokens) has no intrinsic value. By coercing the private sector to extinguish its tax liabilities in US$ the government assigns “value” to its FIAT currency. The private sector aspires to exchange real stuff for nominal stuff because it needs US$ to pay taxes. Thus taxes create private-sector demand for a non-convertible FIAT currency (except your preference are long holidays in jail).

(2) Nominal demand might spin out of control versus the overall real output capacity of the economy. Which means inflation. Taxes destroy private sector financial assets and thus lower nominal demand of the private sector. Furthermore the government might want a larger pie of real stuff for reasons of public purpose. Taxation ensures government has access to real stuff as it seems fit without causing inflation.

(3) What taxation doesn’t do: it does NOT fund government expenditure.

@stephan thanks for the quick reply.

1) How does tax cause demand for money? Surely income has to be earned first before taxes can be levied or are you saying everybody just gets slugged the same amount irrespective of income and then look for ways to pay it? surely the government has monopoly and passed laws on what is valid currency so there is not likely to be any competition to currency.

2) I certainly agree that taxes destroy private sector financial assets so I am wondering why do we want to destroy people’s savings through taxes when government determines how much spending it does and hence can control inflation by varying its spending. or by interest rates which more directly affect investement and consumption decisions.

3) since tax does not fund government expenditure and has serious negatives. would it make more sense to aim for zero tax and introduce it if inflation appears or is the aim just to prevent people from saving?

“How does tax cause demand for money?”

A tax is a tithe that is enforceable by force of law. A protection racket essentially. It can be in any item, real or imaginary, that those controlling the force of law require.

If I can imprison you, excommunicate you, force you to watch endless X factor repeats or anything else that you find unpleasant then I can get you to supply me with something to avoid you having to do that. If that happens to be 300 wibbles a month, then very likely you will try and get hold of some wibbles.

And even if you don’t I’d have to pay somebody else to force you to watch those X Factor repeats, and since they’d be under the same wibble protection racket it would make sense to pay them in wibbles.

“and hence can control inflation by varying its spending”

It can only do that with discretionary spending. You can’t very well say that you’re not funding the army this month despite being in a war zone because aggregate demand is too high.

” would it make more sense to aim for zero tax and introduce it if inflation appears or is the aim just to prevent people from saving?”

Taxation makes room for public spending when the economy is at full capacity. You can only have zero taxes if there is no public spending, or there is non-government net-savings sufficient to allow the government to spend.

The amount of taxation, the amount of government spending and the use of interest rates to stop the private sector spending are all very much up for debate. I’ve not seen any evidence presented that any of those elements are better than each other. So at that point it becomes a political preference rather than an economic one based on your view of government as a force for public good.

I still don’t see how tax creates a demand for money. Maybe in pre-industrial times when people wanted to pay tax in chickens and pigs tax creates a demand for money but that doesn’t seem to be the case anymore where taxes are levied after income that is already paid in currency…

I would have thought the demand for currency in a modern system is to provide a ruler for value to facilitate exchange of goods and services not to pay taxes

“Taxation makes room for public spending when the economy is at full capacity”.

I presume that by just printing money in a full economy to pay for public spending the result is inflation. Yes?

So following this idea further, would it be fair to say that in a full economy a government can’t just spend above its tax base to create a deficit that allows savings in the private sector because the resulting inflation erodes the value of that savings anyway? Nor can it borrow money to fund deficit spend since the interest/balance would become a future tax burden again eroding savings.

In that case I can’t help but think that deficits are form of redistribution from savers to speculators (ie the wealthy) which erode saver’s real prosperity.

Which in a roundabout way seems to lead back to balanced government budgets doesn’t it?

“Which in a roundabout way seems to lead back to balanced government budgets doesn’t it?”

No. The balance is across all the sectors.

For example there is no way the US can run a balanced budget while it remains the reserve currency. Too many foreigners are saving US dollars which causes a trade deficit.

Irving J “In that case I can’t help but think that deficits are form of redistribution from savers to speculators (ie the wealthy) which erode saver’s real prosperity.”

-I think the redistribution is from wage earners, cash holders and people currently buying assets to people who already hold assets. It is complicated by the fact that asset price inflation spawns asset price volatility (bubbles and crashes). Asset price volatility further redistributes to the most sophisticated speculators and away from inept speculators. Balancing budgets by taxing assets (including cash) rather than income or sales would mean that taxes were only drawn from money that had already “leaked to savings” and so would not impinge on genuine economic activity.

What Neil Wilson describes about the reserve currency (Triffin’s dilema) makes the case that using a national currency as a global reserve currency is unsustainable. That seems to me something distinct that also needs specific addressing.

Irving, if the government sends you a letter demanding $1000 in tax, and you don’t have it, you certainly have a strong desire for money. Taxation is the ultimate driver of demand for money. It becomes a medium of exchange because of this demand, and then people desire to save it, because of it is highly useful as a store of wealth. All this happened thousands of years ago, in Sumeria at the latest.

After “So following this idea further” – no that is wrong. In a full employment economy the government will probably be printing money, running a deficit, “spending above its tax base” to satisfy savings desires. This will not be inflationary precisely because of these savings. If it went significantly beyond this full employment deficit, yes, the spending could be inflationary. The “borrowing money to fund deficit spending” phrase contains too many confusions to treat simply. And the idea that the interest on national debt can be a future tax burden contains even more. Better to just think of simply printing money at first. It is likely the least inflationary option.

Deficits essentially can’t be redistribution from savers to wealthy speculators, because without deficits, who can save? On the contrary, the USA saw great flattening of income distribution with big deficits under FDR. The only truth there could be in that is if a government intentionally deficit-spent to create hyperinflation, which does not really happen. The flaw in your reasonings is that you are combining different effects which apply in different situations – the logic definitely does not lead to balanced budgets.

@Some Guy, why would the government send me a letter for $1000 tax if I didn’t already earn some money??? methinks you are putting the cart before the horse. I am not trading chickens for pigs here, I get paid in money and the government takes a slice after the fact not before. Hence zero motivator.

In regards to savings, are you talking about savings as money under the mattress or savings in a bank? In fractional reserve banking, money saved keeps moving out into the economy, it doesn’t sit there doing nothing. Aren’t savings subject to some sort of multiplier which ensures plenty of opportunity for price signals and hence must over time attract a reaction in the marketplace?

The only way that “savings desire” would not be inflationary I can see is if savings are hidden under the mattress which I don’t think is common enough to include in the discussion, or government is printing money into a deflationary enviroment. Perhaps you have some other insight?

“Deficits essentially can’t be redistribution from savers to wealthy speculators, because without deficits, who can save”

This is circular logic. In a real economy some people save in either deficits or surpluses. its savings as a micro phenomena not a macro phenomena we are talking about.

My observation was simply that erosion of savings encourages people to speculate as money sitting in the bank is earning very little if not actually going backward. Speculation is a game well managed by the rich, where the little guy generally gets burned.

“why would the government send me a letter for $1000 tax if I didn’t already earn some money???”

To make sure you sell your service in US dollars, not Icelandic Krona.

Think why you accept US dollars in exchange for your services when US dollars are literally worthless.

Some Guy “the USA saw great flattening of income distribution with big deficits under FDR”

-At that time income tax for the wealthy was 90% and zero for the vast majority of Americans. I think the ratio of asset price inflation to wage inflation is the key driver of wealth inequality. The type of taxes used have a huge influence on that as does the type of spending. If all taxes were sales taxes and payroll taxes and the gov deficit spends, then all the inflation will be cycles of asset price and commodity price inflation depending on where the speculative herd is turning its attention. Similarly if the gov spending is on bond interest and the bond holders reinvest the bond interest by buying more assets, then all the inflation will be in the form of asset price inflation. That is why as more treasury bonds are issued, yields fall as bond holders get more and more interest money and use it to bid up the prices of bonds (as well as other assets).

If all taxes were asset taxes and the gov deficit spends, then aggregate demand could get pushed to the point of causing consumer price inflation.

Wasn’t WWII what really rebooted the world economy rather than FDR? Since Regan the massive deficits have coincided with the richest 0.1% gaining an ever greater proportion of America’s wealth. I think it is mistaken to say that a consumer price hyperinflation scenario is the only situation where deficits fuel wealth redistribution to the wealthy.

“Since Regan the massive deficits have coincided with the richest 0.1% gaining an ever greater proportion of America’s wealth. I think it is mistaken to say that a consumer price hyperinflation scenario is the only situation where deficits fuel wealth redistribution to the wealthy.”

The keyword is “coincided”. Correlation isn’t the same thing as causality. If they truly correlate, that would mean a rise in year-on-year inflation would also mean a rise in the year-on-year GINI increase and vice versa. Try finding statistics for that. And even if such a correlation was found, it might not be the inflation that is the cause and the inequality the effect.

@Neil Wilson: “Think why you accept US dollars in exchange for your services when US dollars are literally worthless”

We were discussing the claim that “tax drives demand for money”. So I don’t know why we are now talking about foreign currencies.

I earn money in the currency of the land which is taxed after the fact by government taking a percent!

Percentages can’t be levied until the money is earned. The only possible conclusion is that tax is not a driver of demand for money. If someone has an argument that isn’t a straw man or circular argument I would be most interested in hearing it. Otherwise the claim that tax drives demand for money in a modern economy has to be discarded.

In relation to claims of causation from government deficits to savings/incomes flattening, Olov is entirely correct, correlation is not causation.

I can tell you that if you go and beat a drum when there is an eclipse, I guarantee the sun will return. That is a very strong correlation and if such a tradition develops, it would be self-reinforcing, but in this trivial example we know its total BS.

The case for positive benefit from government deficits is not only extremely weak but defies basic logic and analysis.

The government is not a wizard that produces gold; he is producing rulers whose length, but not unit of measurement is dependent on all other rulers. A bit more like Einstein’s theory of relativity, the length of the rulers depend on its speed through the economy in relation to all the other rulers. This wizard cannot just produce an infinite number of rulers to create unlimited value, because the more rulers he produces the smaller they get even though they still have the same numbers on them.

It’s the underlying value in the economy the rulers represents that is the key factor. The number of rulers relative to this underlying value does not alter the underlying value. Which is the total value the population in the economy is generating for each other over time. In a fiat currency system the backing for currency is this underlying value which money purports to measure and why people are willing to use money as a medium of exchange.

My claim is simply that in a modern economy money is a measure of value and that the true value of a unit of measure of money is relative to all other measures and speed through the economy of that money relative to the underlying value being generated by the population, where value is subjective.

In relation to outcome inequality, I have looked into this and surprisingly in a free society the result is unequivocally here to stay.

Wealth distribution in a free society takes the shape of a Pareto curve (strictly speaking exponential and power law distributions, but I will just call them Pareto for simplicity). Its cause is that a slight difference in benefit from products and services in a market, which is a network, produces big differences in outcome i.e. profits. Pareto curves pop up all over nature and are a natural outcome of differences in a network. Pareto distributions are found in such diverse areas as temperatures, particle interactions, chemical processes, genetic diversity, city sizes, and wealth distribution. Etc. etc.

Think about it this way, in a market which is a network of buyers and sellers, a slight edge in a product or services will attract more buyers and possibly a premium over competitors, resulting in a non-linear distribution of profits. In a roundabout way this is actually a good thing because it shows that benefits, i.e. better services and products spread to many people and it encourages innovation. The only way to avoid a Pareto distribution is to violate people’s freedoms and rights, by preventing competition and killing innovation. Aggressive taxation at the back end also acts to stifle innovation and only slows the formation of Pareto curves and does not prevent them.

I was quite shocked by these findings when they first came out and corresponded with the scientists who discovered the link between networks and Pareto distributions. They were equally surprised by the implications. If you put any value on freedom and rights then vastly unequal distributions are here to stay. We could of course move towards totalitarian states again but the shortcomings of these systems are well documented.

Given that outcome inequality is an inevitable result of freedom, rights and diversity in a networked society, the choice for me at least was crystal clear, get over it, as a result I am fan of micro-credit to push people up the Pareto curves. It would be nice if there was a magic pill which would alleviate income and outcome inequality but the science is clear: there isn’t. The problem is akin to trying to stop the Pareto distribution of city sizes, clearly it involves violating people’s freedom of choice and stopping them from gravitating to places they perceive holds greater value for them. The question that needs to be asked is; just what is the real point of wanting a linear or flat distribution of city sizes? the answer is personal preference ie one opinion against the sum of the individual opinions. To create a flat distribution of city sizes would require a totalitarian imposition of one person’s view against the freedom of choice of the many. The same analysis apply to wealth distribution.

I do, however, strongly suggest you don’t take my word for it and do your own research and reach your own conclusions.

Irving J:

re taxes and demand for money. There are plenty of asset-based taxes even these days. There were even more of those on the old days. Even if you do not earn income you still need to pay them. Even (private) car insurance creates demand for (national) money.

re income inequality and so called “inevitable result of freedom”. Human beings live in a society which sets the rules. These rules can be whatever the society wants. Americans are brain-washed on freedom and liberty values and accept lots of personal pain for low and ever decreasing probability of personal gain. These are the rules that they have setup. Scandinavian countries and continental Europe has different rules. And the famous Mittelstand in Germany shows that the probability of personal gain (American Dream) is much higher in Germany and comes without the associated American pain.

“It would be nice if there was a magic pill which would alleviate income and outcome inequality but the science is clear: there isn’t. ”

Yes, there are. If you stop taking brain-washing pills. You need to ask right questions to get to the right answers.

“We were discussing the claim that “tax drives demand for money”. So I don’t know why we are now talking about foreign currencies.”

Yep you don’t. And that is the reason you can’t see why tax drives the demand for fiat money.

“There are plenty of asset-based taxes even these days.”

That’s a diversion anyway. Simply valuing your output in the currency of taxation and enforcing that is sufficient. In the UK much trade is done in the Euro, yet the VAT on it is always charged in Sterling. Even the mechanism to pay your taxes in Euros is really just the tax office doing the FX transaction for you.

Interesting discussion about chickens and eggs, taxes and money.

Has there ever been a fiat money system that has only ever existed as a fiat money system, i.e. was not previously a gold standard or some other fixed exchange convertable system?

Notwithstanding some of the points made above, isn’t there a behavioural conditioning part to the acceptance of fiat money? People got conditioned to accept paper when it was redeemable in gold etc. When fiat money came along they did not make any conscious changes to behavior, just kept on using paper etc.

If the government mandated payment of taxes in shells, for example, it appears from comments above that we would/should expect eventually to see people trade shells for goods and services and paper money disappear. Have there ever been any real world examples of these sort of switches and usage changes i.e. any empirical data?

thanks

Mike

Niel Wilson “Yep you don’t. And that is the reason you can’t see why tax drives the demand for fiat money.”

Obviously it seems to be a well kept secret which nobody wants to share. Are you claiming that getting rid of taxes would mean there would be no demand for money?

Sergei: “You need to ask right questions to get to the right answers.”

what questions might they be exactly?

“Are you claiming that getting rid of taxes would mean there would be no demand for money?”

That’s called an excluded middle argument and is logical baloney.

Bill explains the demand argument in his business card teaching model: https://billmitchell.org/blog/?p=1075

“Have there ever been any real world examples of these sort of switches and usage changes i.e. any empirical data?”

How about all the new money type that come about in busted countries? The Brazilian Real would be a good example as would the various German marks. Even the Euro arguably.

Even the failure of the UK to move to the Euro despite 50% of external trade being with the Eurozone.

Olov ‘If they truly correlate, that would mean a rise in year-on-year inflation would also mean a rise in the year-on-year GINI increase and vice versa.”

-It is asset price inflation not consumer price inflation that has driven inequality in the USA since 1980. The type of inflation that deficits get transformed into depends on the pattern of spending and tax. A system based on sales tax and spending on bond interest or lucrative defense contracts is going to cause asset price inflation rather than consumer price inflation.

Irving, I share your skepticism about considering money as tax-driven. There might be some truth to it, and it’s a very interesting philosophical question. However I don’t think it is nearly as fundamental a part of MMT as sometimes it looks like for practical purposes.

Concerning inequalities in income I think you are right to point out they are an inevitable outcome in a free market. But even if the income/wealth (or city size) distribution is inevitably described by some exponential or Pareto law, that doesn’t mean coefficients don’t matter and can’t be altered in order to reduce the inequalities, nor that doing so would necessarily stifle innovation.

Irving J “Obviously it seems to be a well kept secret which nobody wants to share. Are you claiming that getting rid of taxes would mean there would be no demand for money?”

-If you google “hut tax” there are good examples of where colonialists in Africa imposed a tax on each hut that had to be paid in hut tax tokens that would be paid out in return for labour or goods. The colonized people then used the hut tax tokens as money. I read something though saying that continued use of the Austrian Maria Theresa thaler coins in Africa long after they stopped being legal tender in Austria or accepted for tax payments anywhere shows that currency can work purely on the basis of convention. So people will accept payment in that money purely because they believe other people will accept it from them. That argument seems to me a bit muddied by the fact that the Maria Theresa coins contained silver and so had some commodity value. Cowery shells perhaps are closer to being a “convention driven” rather than “commodity driven” money (see the wiki artical on shell money) but I think the issue is very muddy. Silver has historically had much higher relative value when it was being used as money. Cowery shells gained importance as a decorative commodity when they were in use as money. I’ve got a wooden carving from Nigeria that has a decorative inlay of copper colonial coins and cowery shells. I’ve also been to a Sikh wedding where £GBP bank notes were used as decorative garlands -so even use of paper as money can confer on it some role as a decorative commodity.

The danger of a convention driven currency is that conventions can change leaving a currency worthless. I guess a certain level of taxation is a good safety net to prevent such currency slide hyperinflation.

Irving J, I think it is very dangerous to give credence to a political position on the basis of it being “scientific” ie following some pattern seen in natural systems. There is a fabulous variety of natural systems ranging from the moon to rain forests to super nova to cancer. Any political position however stupid or sensible or just nasty or can find some natural phenomena as a “scientific” rationalization. Human history has been hundreds of thousands of years of social equality and zero economic or population growth followed by 5000 years of erratic spikes in local “civilization” merging over the last few hundred years into a global parabolic increase in inequality, city sizes, economic growth, population growth etc etc. The proportion of the worlds population who are staving is not improving. If you want a “natural scientific” parallel to that process you could start with imagining that humans in the world are like cells in the human body. The initial hundreds of thousands of years of human existence could be like a healthy person and the advent of civilization could be like tumorgenesis :).

Neil Wilson May 5 @ 22:10

The context of my question was regarding the discussion of why people accept money. The answer in these comments has been that they accept it because the government requires payment of taxes in their fiat money.

Your examples are of cases where a government replaces the existing currency with a new one. I was looking for cases in which a currency existed but the government turned around and required taxes in some other form but did not withdraw the paper money. In that cases we should see citizens abandoning the existing money all together and trading with the “shells” right?

What about countries in which US dollars a freely accepted in exchange for goods and services even though payment of taxes is required in the national currency — whatever that may be? It seems to me that rather than wanting the US dollars to pay taxes they would like them to avoid taxes yet the dollars still act as money right?

Stone

thanks for your reply to Irving J with the examples of convention currency. As someone new to this when trying to consider the tax driven idea it just seems to me that the convention already existed when the currency became fiat — in Australia at least.

Irving:I earn money in the currency of the land which is taxed after the fact by government taking a percent! Percentages can’t be levied until the money is earned. The only possible conclusion is that tax is not a driver of demand for money. There isn’t even an argument here – just a claim of “the only possible conclusion” which is a non sequitur. MMTers/Chartalists would insist on the first two sentences more or less – taxation has to come after government expenditure – how could the government take something away which its citizens don’t yet have? Note we are not saying that every individual’s demand for money is driven by the taxes he himself must pay, but that the general demand for money is, ultimately. (This is relevant to Mike’s example of dollar usage outside the USA too.) What is necessary is the ability and will of a government to levy taxes, not that they be levied at one particular moment or on every person. The US could announce it will collect no taxes next month and resume the month after; this would not destroy the value of the dollar, but might stimulate the economy.

Some Guy, does it follow from the MMT explanation that if taxes were zero, not just transiently but permanently, that paper money would be …I don’t know, valueless or not used for exchange of goods and services? What outcome would you predict if the country you live in announced it was permanently abolishing taxes? BTW there are some zero tax countries aren’t there, or have been??

See I kind of think that the use of paper money is ingrained by convention/behaviour, e.g. its use preceded fiat money.

stone: “It is asset price inflation not consumer price inflation that has driven inequality in the USA since 1980”

its freedom of choice in a network of buyers and sellers that inevitably drives inequality. various factors as MamMoth has pointed out can change the size and depth of the curve but not its fundamental shape: vast inequality.

only totalitarianism, as history shows can eradicate inequality by reducing everyone to lowest common denominator.

I know its a difficult paradigm shift for people, as it was for me, but it’s indisputable. Do some research, look at the shape of the Pareto curve with various exponents on Wikipedia, it’s still a curve of vast inequality! You have to squash it out of existence to flatten it.

if you don’t agree, do tell us which evil economic factor drives unequal distributions of city sizes? how would you create a flat distribution of city sizes? You can’t without violating everyone’s freedom of choice.

Mike: “its use preceded fiat money” you are spot on.

Neil Wilson: “Bill explains the demand argument in his business card teaching model: https://billmitchell.org/blog/?p=1075”

This teaching model shows that in a totalitarian state where the government controls prices (the only consumption here is through fixed government prices) deficits create savings, but in a free society where government doesn’t control prices inflation would erode all the savings.

Do you actually have a realistic model to make your case?

Pareto curve shape is here: wikipedia: Pareto Distribution

Look closely what happens when you squash the curve down you shift more people further down into the poverty end of the curve!

As you let curve rise more people are pushed up away from poverty and a few aquire great wealth.

The math’s is unequivocal.

In a free market i.e. a network of buyers and sellers with free choice, small variations in products and services create vast inequality of outcome in the shape of exponential and powerlaw distributions (apparently depending on reinvestment).

To be honest the whole idea of left wing (representing the tail of the Pareto curve) and right wing (representing the head of the Pareto curve) to me is now meaningless and a new paradigm has to emerge that represents the entire spectrum.

Err…..Progressive taxation and redistributive payments is the best defense we currently have against inequality. More of a band aid than a cure though.

“In that cases we should see citizens abandoning the existing money all together and trading with the “shells” right?”

No. A statement does not necessarily imply the negative.

The UK example is perhaps the most instructive. Without Sterling taxation it is likely that the country would drift over a period of time to using the Euro for trade – simply due to convenience. You see that in weak taxation countries where the preference is often to trade in US dollars.

Convenience and convention is the apparent reason why people use money every day. That’s like the electrical laws of physics explaining why your light switches on. However underlying that is the taxation in the currency which explains why it keeps going like that, much like the underlying quantum theory explains why electricity continues to work.

So none of the reasons are wrong, they are just at different levels of abstraction. But mathematically you can show how a fiat currency can be forced to start via the imposition of an enforceable liability denominated in that currency. After that you get emergent behaviour layered on top.

“Convenience and convention is the apparent reason why people use money every day. That’s like the electrical laws of physics explaining why your light switches on. However underlying that is the taxation in the currency which explains why it keeps going like that, much like the underlying quantum theory explains why electricity continues to work.”

Sorry but this seems very circular. You are asserting that taxation is why the form of money works. An assertion is not an explanation.

Physical sciences analogies may not be appropriate to make the point since e.g. models such as quantum mechanics are tested by experiment, but for clarity:

What conditions/evidence would be required to falsify the relationship between taxation and money that is being put forward in this thread.

Andrew: “Err…..Progressive taxation and redistributive payments is the best defense we currently have against inequality. More of a band aid than a cure though”

That’s the point it’s not even a Band-Aid, it does not work and it’s self-defeating. It in no way prevents inequality, being a relative not an absolute concept and almost certainly aggravates it. The rich are quite capable of gaming the system to avoid the brunt of “progressive” taxation while unfairly targeting rising competitors to the rich who don’t have the resources to avoid “progressive” taxation. In other words entrenching the status quo while incentivising the poor to keep their hands out for freebies. That’s the strange thing about government solutions they frequently make the problem worst.

As an example, the Housing Affordability Mandate which was supported by Clinton *and* Bush, has actually done far more to hurt low income families than doing nothing would have. Sounds noble, warm and fuzzy to give a mandate to banks that they must provide credit for low income home ownership, but it induced a massive property bubble, set the banks into a feeding frenzy on people who could not afford houses, and resulted in the worst crash since the great depression.

I am sure someone smart can find an application of Schrodinger’s law as a phd thesis on how government help usually has the opposite effect.

IMO micro-credit would have done far more for low income affordability of housing without blowing a property bubble and crashing the entire financial system.

in regard to the tax driven demand for money

from http://www.cfeps.org/pubs/wp-pdf/WP46-Tcherneva.pdf

“Taxation today functions to create demand for state

currencies in order for the money-issuing authority to purchase requisite goods and

services from the private sector. Taxation, in a sense, is a vehicle for moving resources

from the private to the public domain. Government spending in sovereign currency

systems is not limited by the ability of the state to ‘raise’ revenue.”

The correct “chartalist” view is that tax driven money is in fact for the government to spend and inject money into the system. The idea that government taxes drive people to work is wrong. This may have been valid when people exchanged chickens and pigs but is not correct today. When MMT says tax-driven money it does not imply taxes make the system go around, it is an inaccurate description.

further from the same document:

“Lerner proposed two principles of

functional finance, which inform decisions on the requisite amount of government

spending and the manner of financing it. More specifically, the first principle provides

that total government spending should be ‘neither greater nor less than that rate which at

the current prices would buy all the goods that it is possible to produce’ (Lerner 1943: p.

39). Spending below this level results in unemployment, while spending above it causes

inflation. The goal is to keep spending always at the ‘right’ level in order to ensure full

employment and price stability. The second principle states that government spending

should be ‘financed’ through the issue of new currency. This second ‘law’ of functional

finance is based on Lerner’s recognition that taxation does not finance spending but

instead reduces private sector money hoards”

It’s clear there is a strong relationship between tax and government spending, it may not 1:1 but it’s rarely far from it.

The idea of a balanced budget then becomes the point at which employment is maximised and inflation is kept under control. However I am bothered by the fact tax reduces private prosperity.

Irving J, I don’t think any totalitarian societies have succeeded at reducing inequality (even if they ever intend to). Some “primitive” societies seemed to have had a good deal of equality and to have been extremely stable. I think a big problem is that capitalism with a positive return on capital causes wealth condensation and escalating inequality. Perhaps capitalism works best immediately after having been rebooted by war etc. When war has leveled the playing field then capitalism does a great job at driving reconstruction and a resumption of prosperity. Then inequality leads to escalating inefficiencies as the means of production become separated from those who would make use of them. I think the key role of taxation should be to ensure that anyone capable of doing beneficial work has the opportunity to do so. You seem to suggest that taxation can not aid that. I think it can by eroding the capacity for financial oppression by the wealthy. If you let oligarchy rip unfettered then you will get an economy run by the oligarchs. They won’t care whether things work overall so long as they maintain power and live a pampered life. You make an important point about the rich being able to avoid taxes. That is why I think the tax system needs to be extremely simple- just a flat asset tax applied to all assets.

Irving J, it is because you can affect the shape of the Pareto curve that it is not self-defeating, unless your goal is total income inequality. It is definitely not the same if for every person with an income X, there are 10, 100 or 1000 people with an income 10/X even if you can’t avoid having a Pareto distribution of incomes. Progressive taxation is no silver bullet, but correctly applied will help achieve a less unequal distribuition, which might be enough or not depending on your personal values.

The same applies to city sizes. A good planning with the right incentives and disincentives might help change the shape of the distribution. Look at Holland, they are about 20 million packed in a handkerchief with no city above a million people. Compare that to the laissez-faire unplanned cities in latinamerica where half the population ends up living in one or two cities consisting mostly of slums.

where it says people with an income 10/X it should say people with an income X/10

Stone, capital concentration is necessary, it has produced the railways, the car, electricity networks, the internet. Without capital concentration we would still be in agriculture beholden to feudal lords. I don’t have a problem with capital concentration.

stone: “Then inequality leads to escalating inefficiencies as the means of production become separated from those who would make use of them.”

How so? Henry ford said he needed to pay his workers more so they could afford to buy his cars. The head of a pareto distribution and the tail have a symbiotic relationship, rich people can’t become rich unless there are people who can afford to buy their products. People benefit from having access to innovative products that capital concentration produce.

You have to distinguish abuse of power from just holding wealth. Holding wealth does not necessarily lead to abuse of power. Can Buffet who sits right near the top of the pareto curve, be accused of abuse of power? hard to say isn’t it. What about Soros? again no easy answer.

What about Bush and Rumsfeld, they are nowhere near the top of a pareto curve. What about the local town planner who accepts gratuities?

I think there are two strands here that need to be unwound, power and money, these are not the same thing.

MamMoth: “will help achieve a less unequal distribution, which might be enough or not depending on your personal values”

An exponential distribution is a straight line on a logarithmic graph. A Pareto distribution is an exponential line on a log graph. That should give you an idea how steep it is. According to Moshe Levy’s work, market efficiency is necessary condition of Pareto distributions.

In a corporate context many firms producing very similar products is not efficient as it replicates similar infrastructure many times over, consolidation via the driver of efficiency, again helps to yield Pareto distributions of assets.

The notion of wealth is a relative concept to the overall size of the economy and the population. Compared to the vast bulk of people in Africa, you and I are extremely wealthy, should your wealth and mine be reduced to the african mean?

Different exponents for a pareto curve are still pareto curves and still produce exponential curves on log graph! No matter how you slice and dice it, there is no other way to perceive it other than vast inequality. Even an exponential curve is vast inequality.

If capital concentration drives innovation, so what if there is vast inequality?

One of the presumptions maybe is that overall wealth is a zero sum game and for people to become rich, others must loose, but this is wrong, as people increasingly produce value, the economy and the money supply grow. Wealth is not a zero sum game. It’s up to the government to grow the money supply in line with the growth of value creation.

A similar myth is that we are transferring wealth to china, we are not. The chinese are creating value for which we are paying, the money supply needs to grow to cover the value the chinese are creating since we are buying in our currency. This value creation as represented by money is then sent back home, in the case of the US through treasuries.

I do think you have hit the nail on the head in that Personal Values are the crux, do we decide for ourselves where we want to fit in a pareto curve, given vast inequality is inevitable, or do we let others decide for us based on their personal values?

Irving J, Henry Ford recognised a key flaw in capitalism when he decided to pay his workers more so that they could buy cars. If Henry Ford had had a competitor who was just as good a car maker as he was and that competitor had decided to not increase wages, then the Ford workers would have bought cars from the competitor and Ford would have gone bust. Henry Ford was such a car making genius that he could afford to indulge the privilages that come from such a monopoly position. Capital concentration results in the economy becoming ever more directed towards indulging the richest rather than doing what is needed. I heard Bill Gates talking about the Gates Foundations efforts to eradicate polio and guinea worm. The interviewer commented that it seemed incongerous that poor Africans had mobile phones. Bill Gates answered that poor people had the cast offs from the rich. The poor didn’t get mobile phones because they or anyone else thought that that was what they needed. The issue was that the poor had no financial power to ensure that what they had access to were the things that they needed. The ever increasing proportion of the global economy that is directed towards wealth managment is the ultimate example of how wealth condensation leads to waste. As wealth becomes condensed, the most talented engineers etc stop becoming employed to make real stuff and instead become employed by the finance industry to conduct a zero sum battle to outwit each other.

Even if a rich person has noble intentions, one rich person will not be able to discern the needs of a million poor people anything like as well as the million poor people will themselves.

Irving J “capital concentration is necessary, it has produced the railways, the car, electricity networks, the internet. Without capital concentration we would still be in agriculture beholden to feudal lords. I don’t have a problem with capital concentration.”

I think it is vital to draw a distinction between big projects in general and concentrated ownership. I don’t see why a railway or internet network could not be built with finance from millions of small shareholders. Capitalism may lead to a few people ending up owning everything but I think capitalism does not need a few people to own everything in order to work. In fact capitalism seems to cause its own demise when they do.

It seems to me a big stretch to say that the pre-industrial UK situation of feudal lords and peasants can somehow be equated with using tax to thwart overly concentrated ownership. It is very interesting how that feudal system was disrupted by the industrial revolution. I’d like to know more about that. I guess the influx of new wealth from the burgeoning merchant class engaged in the trans-Atlantic slave trade probably had a big influence.

Very interesting stuff on why people use certain currencies as the medium of exchange. I think it’s pertinent that not only does (e.g.) the US govt insist on receiving $ but it settles its liabilities (public payroll, investment expenditure etc) in $ thus not only increasing demand for $ but supply of $. The same goes for any large western style govt. Provided the citizens trust the medium of exchange (the crux of this area and a reason many in developing economies prefer USD to local money) why would they use another medium when USD are plentiful and circulating because of govt interventions in the economy

Some stuff from Irving I just have to mention:

“Capital concentration produced railways and internet”

Completely wrong – there were many joint stock companies investing in rail in C19th Britain – many failed. The internet was initially developed with govt funding. The joint stock companies themselves boosted middle class (in the US sense) incomes as “commoners” and merchants subscribed, although the lion’s share of profits accrued to banks

“Progressive taxes don’t reduce inequality”

Can be argues that this is not causal but Scandinavian countries have highly prog taxes and high Gini scores whereas more regressive systems (UK, US and especially developing world have much lower Gini)

“Totalitarians can reduce inequalities”

Perhaps true in theory but in any fascist/communist society a small oligarchy has generally controlled most wealth while driving down the poorest (30s Germany and Italy, Mao’s China etc)

“Left and right wing correspond to ends of a Pareto curve of income”

What about very poor people voting for rightist parties or extremely wealthy supporting the left (Gates, Buffett and Soros spring immediately to mind)?

Irving J: only totalitarianism, as history shows can eradicate inequality by reducing everyone to lowest common denominator.

That progressive taxation and government spending can reduce inequality is indisputable. Look at the USA from 1933 onward, to the end of the “golden age” in the 1970s-1980.

In addition, the most important path to great wealth has always been using state power as a tool of enrichment, usually disguised as “the natural order.” Today is no exception, rather it is an extreme example, with the US having an enormous financial sector (along with military-industrial, medical-industrial complexes etc etc) failing at their real functions, parasitically harming the rest of the economy, and controlling the state to its own ends, impoverishing millions.

Mike: Some Guy, does it follow from the MMT explanation that if taxes were zero, not just transiently but permanently, that paper money would be …I don’t know, valueless or not used for exchange of goods and services? What outcome would you predict if the country you live in announced it was permanently abolishing taxes? BTW there are some zero tax countries aren’t there, or have been??

See I kind of think that the use of paper money is ingrained by convention/behaviour, e.g. its use preceded fiat money.

All forms of money are intrinsically and essentially fiat money, credit money. It may have a commodity “backing” but that just means its value is stabilized by the state fixing a price for some commodity.

It is possible that a kind of money could be used for some time after taxes were lifted. What is important is not precisely taxation, but the threat of taxation (Old chessplayer’s maxim: “The threat is stronger than the execution.”) . And that the money would be scarce – if governments, banks, counterfeiters or other authorities continue creating indefinite amounts, it would become valueless. As long as it is scarce, convention could keep it going for a while, Stone gave some examples I think. But in the long run, I don’t think there are any real examples. When the Roman empire fell, the Roman coins were eventually dumped and discarded. You can’t eat silver. The “monetary metals” were used for money precisely because they were otherwise useless.

Some Guy “As long as it is scarce, convention could keep it going for a while”

-I totally agree that the scarcity aspect is what is really crucial. I guess taxation is just another way of ensuring scarcity. Silver gives a sense of scarcity because it is so expensive to mine silver. The “pieces of eight” silver coins made in Bolivia lasted as a global currency from 1500’s until 1800’s. I guess people trusted them partly because they trusted that they would retain their scarcity. Clearly that is to some extent an illusion. Once silver stopped being used as money the commodity value mostly evaporated despite the fact that black and white photography consumed much of the global stock of silver.

stone: \”with using tax to thwart overly concentrated ownership\”

Show me where in the world, this statement is even mildly true. I think some people are having themselves on if they think equality is a low gini coefficient. Low gini coefficient on power law and exponential distributions are still vast inequality.

Scandinavian countries and in fact all “progressive” countries are very good at chasing capital away that’s about it. Three of the four biggest Swedish billionaires, Ingvar Kamprad ($33b 2007) and Birgit Rausing ($19b 2007), Hans Rausing ($9 2007) fled away from Sweden’s tax system. What’s the population of Sweden? (hint around 2007 under 9m), just these three guys accounted for very roughly $6777 of wealth per head of population in Sweden. That is not a typo. $6777 per head of population in Sweden from 3 guys. No wonder gini is “low”.

How many other billionaires and millionaires have fled Scandinavia countries?

This list claims to enumerate the billionaires domiciled in Switzerland http://www.swissbillionaires.fws1.com/

and that’s just Switzerland, add back all the billionaires and millionaires to their respective countries and then show me what the gini coefficient looks like and then tell me progressive taxation “works”.

stone: \”don’t see why a railway or internet network could not be built with finance from millions of small shareholders\”

neither do I, but capital concentration in corporates I think has no less ability to avoid taxes and even greater motivation to lobby, have a look at how much tax GE corporation paid last year.

Chris: What about very poor people voting for rightist parties or extremely wealthy supporting the left (Gates, Buffett and Soros spring immediately to mind)?

I think you will find buffet didn’t give away a single cent for the first 70 years of his life. Given that the US has inheritance tax you can draw your own conclusions, same for Gates. Soros speaks for himself, on youtube, quite a lot really.

But nevertheless that was a sweeping generalization and counter examples don’t detract much from the broad principle, at least on the origins of the major parties, although these days you could be hard pressed to tell the difference between the two major parties… I am waiting for some new paradigm to emerge once progressives wake up and discover they have been take to the cleaners.

Here’s another sweeping generalization for you to sleep on, every time you make a choice as to which product is better for you when you buy something, you contribute to vast inequality.

I think a major driver of what sustained “pieces of eight” silver coins as a global currency for 300+ years was that they were what China would accept as payment for silk, tea, ceramics etc. China ran a huge trade surplus and so determined what currency was used globally- sounds familiar :).