I have received several E-mails over the last few weeks that suggest that the economics…

We should ban financial speculation on food prices

The Great Hunger Lottery report shows how such speculation on food has impacted on the poor around the world. Hunger and starvation escalated between 2007 and 2008 with over 1 billion people considered chronically malnourished at the time they prepared the Report. The major players in creating this havoc are Goldman Sachs, Bank of America, Citibank, Deutsche Bank, HSBC, Morgan Stanley and JP Morgan. In my view, this speculation creates no widespread good and should be declared illegal. We should ban financial speculation on food prices. There is a branch of econometrics called intervention analysis. A famous article in the field – Box and Tiao (1975) ‘Intervention Analysis with Applications to Economic and Environmental Problems’, Journal of American Statistical Association, 70(1): 70-79 – defines the task of intervention analysis as:

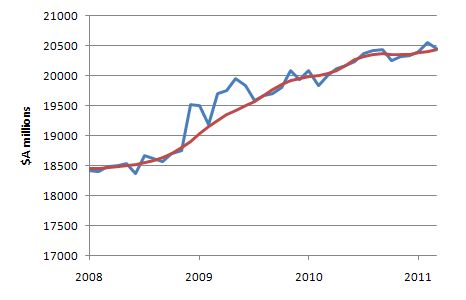

Given a known intervention, is there evidence that change in the series of the kind expected actually occurred, and, if so, what can be said of the nature and magnitude of the change?Intervention analysis has been used to study the impacts of traffic laws; decriminalization; gun control laws; air pollution control laws; changing political realignments; terrorist measures and much more. It always follows a standard pattern – define a postulated event (for example, a change in law), define a reaction event, assess the impact (including testing for causality). It gets quite complicated in a time series setting but that is the nub of it. So when I see a time series like this one – in the graph that follows – I am interested to know what happened to cause those two humps. The graph is of Australian retail sales – the red line is trend and the blue line is the seasonally adjusted series. The two humps occurred in December 2008 and February/March 2009. What happened then? The two large fiscal stimulus packages were introduced by the federal government and were targetted to consumers and sharply tapered (for example, the December intervention was a cash handout). More advanced study of that data would formally attribute (that is, find statistical significance) the jumps in the time series to the policy change. This would substantiate a case that fiscal policy was effective in positively changing the level of economic activity at that time which go against the mainstream macroeconomics story that fiscal policy is largely ineffective and should give way to monetary policy. The crisis has taught us that the exact opposite to what the mainstream have argued for years is the case.

So what would we think when we saw a graph like this?

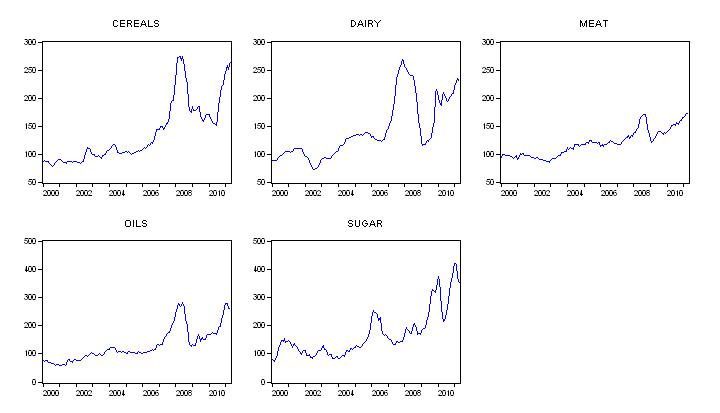

The data comes from the Food and Agriculture Organisation, which is a part of the UN and is based in Rome. In particular, they publish excellent data at their Food Price Index page.

The graph shows the FAO Food Price Index (using their monthly time series data) from January 2000 to April 2011. Prior to 2000 the series was slowly increasing but without any large jumps.

So how do we explain that sort of jump?

So what would we think when we saw a graph like this?

The data comes from the Food and Agriculture Organisation, which is a part of the UN and is based in Rome. In particular, they publish excellent data at their Food Price Index page.

The graph shows the FAO Food Price Index (using their monthly time series data) from January 2000 to April 2011. Prior to 2000 the series was slowly increasing but without any large jumps.

So how do we explain that sort of jump?

I raised this issue because many readers have been writing in asking me about price manipulation in international commodity markets – which is aka how financial markets caused a jump in world starvation and death. Many readers are somewhat uncertain of the way that the financial markets achieved their ignominious feats in this regard.

It came up again in the last few days, when an Australia was one of the first ever charged by authorities for price manipulation of international commodity markets. In this case, it was the – US Commodity Futures Trading Commission – which began proceedings for “Price Manipulation in the Crude Oil Market” on May 24, 2011 against some companies and some individuals for violations of the Commodity Exchange Act. You can see all the details of the enforcement action – HERE.

The action alleges that:

I raised this issue because many readers have been writing in asking me about price manipulation in international commodity markets – which is aka how financial markets caused a jump in world starvation and death. Many readers are somewhat uncertain of the way that the financial markets achieved their ignominious feats in this regard.

It came up again in the last few days, when an Australia was one of the first ever charged by authorities for price manipulation of international commodity markets. In this case, it was the – US Commodity Futures Trading Commission – which began proceedings for “Price Manipulation in the Crude Oil Market” on May 24, 2011 against some companies and some individuals for violations of the Commodity Exchange Act. You can see all the details of the enforcement action – HERE.

The action alleges that:

… during the relevant period defendants traded futures and other contracts that were priced off of the price of West Texas Intermediate light sweet crude oil (WTI) … defendants conducted a manipulative cycle, driving the price of WTI to artificial highs and then back down, to make unlawful profits.So how is it alleged that they did that? The CFTC say that between January and March 2008 the “defendents” made profits exceeding $US50 million by:

First, they purchased large quantities of physical WTI crude oil during the relevant period, even though they did not have a commercial need for crude oil. They purchased the oil pursuant to their scheme to dominate and control the already tight supply at Cushing to manipulate the price of WTI upward and to profit from the corresponding increase in value of their WTI futures and options contracts (WTI Derivatives) on NYMEX and IntercontinentalExchange (ICE). Next, once WTI reached artificially high prices and they had taken profits from their long WTI Derivative position, defendants allegedly engaged in additional trading activity – selling more WTI Derivatives short at the artificially high prices. Finally, defendants allegedly strategically sold off their physical holdings of WTI, mostly all on one day, to drive the WTI price back down and to profit from their short WTI Derivatives position.Cushing (Oklahoma) is a major crude oil delivery point. It isn’t rocket science is it. These geniuses just get some cash together buy up big and create an artificial shortage. But before they do that they take out some forward contracts (their “long” positions) which allow them to profit from rising prices for assets they hold. Then they take out further contracts which were basically bets that the price would fall. So in the same act of taking the profit from liquidating their long positions (made profitable by the shortage they had created) they also profitted from the short positions (the bets that the price would fall) they had taken. Why? Because in liquidating their extensive holdings of the physical commodity they caused the price to plummet. That is why the CFTC called it “a manipulative cycle”. For readers who are not sure of all this terminology here is a quick explanation. A long position arises when you already hold an asset and profit is gained by selling the asset when the price rises. Similarly, a long position in a futures contract or similar derivative means that the holder of the position will profit if the price of the futures contract or derivative goes up. Note that it is important to consider the value of the option, not the value of the underlying instrument, as the value of a put option will increase when the value of the underlying instrument decreases. This is in contrast to short selling. A short position arises when you take out a forward contract to sell a commodity at a specified price (that is, to deliver the commodity as some specified future date at that price) but you currently do not own that commodity. You are thus speculating that the price will fall in the period prior to the delivery and so you can come in and buy at the lower spot price (the price in the market on any particular day) and pocket the difference. Short selling may also involve borrowing a commodity (asset) and selling them at the current price (which drives the price down). The short seller then uses the proceeds of the original sale to buy back the commodity (at the lower price) and then is able to close the debt down (delivering the commodity) and pocketing the difference. There are all sort of variations on the same theme. So while it is alleged that these scammers were making huge daily profits, the rest of us were having to pay significantly more for petrol at the bowser and industry costs rose (causing a minor spike in inflation). The global financial crisis interrupted that price cycle. But the same sort of behaviour is also rife in food commodity markets and then the consequences are lethal. The following graph is taken from the individual food price indexes compiled by the FAO. I made the vertical scales on each row the same for the graph sequences (so row 1 has the same scale for Meat, Dairy and Cereals; and row 2 has a same scale for Oils and Sugar). These indexes are sub-components of the overall index in the graph shown above.

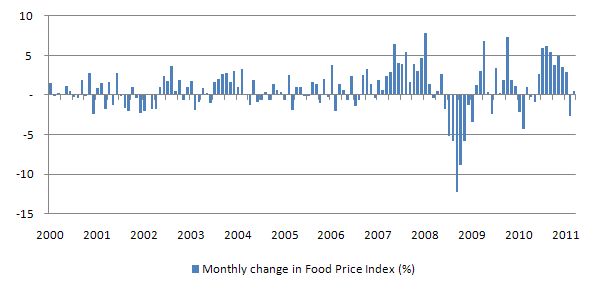

You get another perspective of the price manipulation when you examine the monthly percentage change in prices for the overall Food Price Index as depicted in the next graph (from February 2000 to April 2011).

The rapid serial escalation in prices (starting around April to May 2007 and finishing in February 2008) followed by a serial plunge in prices is a classic sign that commodity price manipulation is occurring.

You get another perspective of the price manipulation when you examine the monthly percentage change in prices for the overall Food Price Index as depicted in the next graph (from February 2000 to April 2011).

The rapid serial escalation in prices (starting around April to May 2007 and finishing in February 2008) followed by a serial plunge in prices is a classic sign that commodity price manipulation is occurring.

Some might argue that these movements just occurred because of the famous agricultural hog cycle which economists explain using the cobweb model. It is easy to understand and basically is a series of supply lags and overshoots in response to demand changes which drive prices in a cycle.

But while rice when up around 206 per cent between May 2007 and May 2008 – see FAO Rice Price Monitor – while the rice production was still fairly robust – there was not a farm shortage that is.

So the standard explanations from economists regarding the cobweb cycle do not hold. Instead it was the actions of the banks and hedge funds that were behind the price hikes.

There is evidence emerging that when the housing market collapsed in the US (early 2007), the speculators (our trusty banks etc) started to move their focus into primary commodities like food.

This Report – Commodity Speculation and the Food Crisis – prepared for the World Development Movement by Indian economist Jayati Ghosh is very interesting reading.

She says that:

Some might argue that these movements just occurred because of the famous agricultural hog cycle which economists explain using the cobweb model. It is easy to understand and basically is a series of supply lags and overshoots in response to demand changes which drive prices in a cycle.

But while rice when up around 206 per cent between May 2007 and May 2008 – see FAO Rice Price Monitor – while the rice production was still fairly robust – there was not a farm shortage that is.

So the standard explanations from economists regarding the cobweb cycle do not hold. Instead it was the actions of the banks and hedge funds that were behind the price hikes.

There is evidence emerging that when the housing market collapsed in the US (early 2007), the speculators (our trusty banks etc) started to move their focus into primary commodities like food.

This Report – Commodity Speculation and the Food Crisis – prepared for the World Development Movement by Indian economist Jayati Ghosh is very interesting reading.

She says that:

It is now quite widely acknowledged that financial speculation was the major factor behind the sharp price rise of many primary commodities, including agricultural items over the past year … there is no evidence that actual volumes of commodity transactions mirrored these price movements.This is supported if you follow the FAO Global Food Monitor on a regular basis. The OECD have argued the contrary position (as you would expect) emphasising that the price jumps were about “fundamentals” or as Ghosh termed it “real if temporary changes in demand and supply, such as sudden supply shocks in particular areas, as well as the associated impact on panic buying or bans on selling such as export bans in the world trade market”. In a consulting paper they released April 2010 Report – The Impact of Index and Swap Funds on Commodity Futures Markets – you will see a pale defence of the proposition that speculators did not cause any problems in food markets. You can also see the Annexe – Speculation and Financial Fund Activity – to this document which explains the econometrics used. There are serious problems with the modelling but that would take me to long today to explain. The data does not suggest sudden physical shortages occurred other than those artificially created by hedge funds. At the time this was happening I was in the US and told (by those who know) that a growth industry in Texas was physical storage capacity. The US Senate Committee on Homeland Security and Governmental Affairs held a hearing – Financial Speculation in Commodity Markets: Are Institutional Investors and Hedge Funds Contributing to Food and Energy Price Inflation? in May 2008 which provided a wealth of evidence to support the view that speculation had manipulated the commodity price cycle. The evidence from financial market insider Mike Masters is very telling. The mainstream argue that speculation actually smooths out prices and reduced volatility. This works because, allegedly, speculators buy low and sell high which means that commodity volumes shift in a way that reduces price variability. Speculation in futures markets also is meant to to work in this way. This UK Guardian article (January 23, 2011) – Food speculation: ‘People die from hunger while banks make a killing on food – interviewed Masters and quoted him as saying:

When you looked at the flows there was strong evidence. I know a lot of traders and they confirmed what was happening. Most of the business is now speculation – I would say 70-80% … Let’s say news comes about bad crops and rain somewhere. Normally the price would rise about $1 [a bushel]. [But] when you have a 70-80% speculative market it goes up $2-3 to account for the extra costs. It adds to the volatility. It will end badly as all Wall Street fads do. It’s going to blow up.In the following blogs – Operational design arising from modern monetary theory and Asset bubbles and the conduct of banks – I mooted some ideas that should be applied to banking reform. Those reforms would outlaw any speculative behaviour in food markets. Conclusion I have run out of time today and have to catch a flight home. So … that is enough for today! The Saturday Quiz will be back tomorrow sometime.]]>

Similarly on the London Metals Exchange investment banks were allowed to come along and buy warehouses for metal storage. Only now are the regulators questioning the role of these entities in price manipulation (see FT Alphaville recently: last week or so). And of course there is the silver market!

Bill,

Very interesting.

In this respect a quick look at George Soros’ behaviour offers a look at what ordinary people like the Haitians are up against when faced with the Economic system currently.

Soros is a self styled “Philanthropist”. His Open Society institute has been very active with many investments in Haiti. This group was behind the much heralded, industrial park and free-trade zone, in the impoverished outskirts of Haiti’s capital Port-au-Prince. The local Soros NGO is called the Fondation Connaissance et Liberte, or Fokal. By boasting that Labor costs are among the lowest in the manufacturing world Soros’ group are hoping to attract US Corporations into their giant sweatshop complex, which they hope will house roughly 40 manufacturing facilities and warehouses.

This is something of a very sick joke.

George Soros has made his billions as one of the most ruthless financial speculators gorging on the system. Amidst the fears of the financial crisis in 2008 most people missed the more devastating food crisis Bill highlights here. The food crisis erupted first and most dramatically in Haiti. The poor starved because they could no longer afford to buy rice, which had risen in price internationally. Many were forced to eat mud in order to survive. Haiti, due to the Economic system, has been forced to import its rice form the US. This led to the destruction of Agriculture in Haiti. Rice growing farmers could not compete with US agribusiness in receipt of huge subsidies from the government. This is the ‘Free Market’, which Soros manipulates to his advantage.

So by 2008, Haiti had lost the capacity to feed itself. This leaves the people highly vulnerable to food price fluctuation, the immediate cause of the 2008 food crisis.

The UN report entitled “The Global Economic Crisis: Systemic Failures and Multilateral Remedies,” (not sure if i can link but available here http://www.unctad.org/Templates/webflyer.asp?docid=11200&intItemID=2068 ) released in March 2009, found that Food price fluctuation was driven by financial speculation. The report blames the hunger and starvation of the poor in Haiti directly on the greed of people like George Soros, the great philanthropist.

Sorry about the rant.

Kaiser

There is ‘good’ speculation and ‘bad’ speculation?

“There is a crucial distinction between Traditional Speculators and Index Speculators:

Traditional Speculators provide liquidity by both buying and selling futures.

Index Speculators buy futures and then roll their positions by buying calendar spreads. They never sell. Therefore, they consume liquidity and provide zero benefit to the futures markets.

Index Speculators provide no benefit to the futures markets and they inflict a tremendous cost upon society. Individually, these participants are not acting with malicious intent; collectively, however, their impact reaches into the wallets of every American consumer.”

http://hsgac.senate.gov/public/_files/052008Masters.pdf

That’s a great link Postkey. I infer from the graphs the index speculators are partly responsible for the general rising trend. The so called ‘good’ speculators are not really good though. They are contributing to the spikes that are killing people. The traditional mob have been joined by the ever expanding trading departments of big banks. Companies like Glencore and hedge funds have probably been attracting bigger war chests too.

So we have yet another speculative bubble brewing up. I’m getting fed up of it.

Speculation might be harming consumers, but food producers are benefiting from it.

Especially our role model Argentina with its export-driven growth policy, and our not role model Uruguay.

Kaiser,

Soros I believe is a big sponsor of the organization so-called “new economic thinking”…. in contrast to Bill’s writings here, I literally cannot understand anything that they put out. When I read it it looks like this: “Cum esse alterum quaestio ad, augue bonorum euripidis te eam. Mazim audire ut ius, feugiat officiis dissentiunt ea usu. Id mundi convenire referrentur has. Eu duo dolorum i” (In any case very hard to grasp what they put out, and it certainly doesnt sound “new” to me anyways 😉 .

Do you have any info on whether Egypt has displaced food production with the production of the export “Egyptian Cotton” ? As the west is pretty well supplied domestically with food, the leadership of these countries outside the mainstream of the west

seems to displace domestic food production with other crops more suitable for export to the west in their zealous pursuit of western financial assets….

Resp,

Mammoth “Speculation might be harming consumers, but food producers are benefiting from it.”

-I’m not sure that is entirely true. The speculation is driving volatility more then it is driving long term price. Volatility just leads to malinvestment by the producers. One minute everyone is buying tractors, next minute prices have crashed and no-one is able to make the payments on the tractors they bought. It is also not true that index speculators never sell. They do sell whenever they need to re-balance the portfolios they manage such as when stocks or bonds crash in price or whenever they get worried that commodities are about to crash 🙂 . Commodity prices crashed in the 2008 crisis. There was a flash mini-crash in oil just last month. I hope restrictions put on position limits etc will cure this but I wonder whether the problem is really one of the growth of managed money. Even genuine producers will get embroiled in speculation if money has no cost. Shell says that last year was disappointing for their oil trading division because volatility was lower than in the previous year giving less scope for speculative profits. I think the problem is just a spreading of the asset price inflation that results when the desire to net save is accommodated.

Soros’ Open Society Institute (named after Karl Popper’s “The Open Society and Its Enemies”) is NOT involved in any investments in Haiti or anywhere else. George Soros may be, but not the Institute. The Institute only concerns itself with the advancement of open democratic elections in countries which do not have them.

Right wingers who hate these kinds of elections, of course, like to disparage the Institute, suggesting that it is actually out to hurt the people it is trying to help. The same way James O’Keefe did with ACORN.

Did you hear that O’Keefe was just granted non-profit status for his crap? Project Veritas, it’s called. Truth. My ass.

Benedict@Large,

“The Institute only concerns itself with the advancement of open democratic elections in countries which do not have them.

Right wingers who hate these kinds of elections, of course, like to desparage the Institute, suggesting that it is actually out to hurt the people it is trying to help.”

Thank you George Soros for all your help but please take back your toys and go playing elsewhere – you can afford a rocket to the Moon and this is the right place to build an Open Society or two. Or you may try in China starting from the Gobi desert – good luck with that.

The label “right wingers” is very funny in this case – so because the opponents of Soros are “right-wingers” Soros is left (or rather all-right) I presume…

The Soros’ puppets (the so-called Stefan Batory Foundation) control virtually all the intellectual processes in Eastern Europe together with the more openly right-wing but Euro-centric Robert Schuman Foundation. Their main opponents are in Poland some members of the Catholic Church hierarchy whom I don’t like either.

BTW this is funny and shows who’s “right winger”

“In the spring of 1989, a Hungarian student radical named Viktor Orban made a shocking public demand: Russian soldiers, go home. Many Hungarians feared bloody Soviet reprisals. Instead, the tearing down of the Iron Curtain a few months later made the 26-year-old anti-communist agitator a national hero.”

…

“In 1990, Orban quit Oxford University, where he had won a scholarship provided by financier George Soros’ Open Society Foundation, to return to Budapest and win a seat in Hungary’s first post-communist parliament.”

(source: BusinessWeek: June 15, 1998)

So who is now the PM of Hungary, the most right-wing government in Central Europe? His name is… Viktor Orban. Yes, the same person.

It was Soros who pushed for the shock therapy in Poland (and in the other countries of the region) in 1989 and 1990. He actually invented it. 16% unemployment and a dramatic drop in GDP which followed shortly was his personal achievement.

Soros was also openly bragging about spending USD42mln on the Georgian revolution. The war with South Ossetia followed that shortly so that little investment did not pay off. He bankrolled the Orange revolution in Ukraine. Again this didn’t succeed and no new eternally happy human race was created.

He is just one of the few truly puppet-masters together with the Koch Bro and Rupert Murdoch. We don’t have the Chinese Communist Party in power in the West (yet). We have these guys who not-so-covertly manage our societies and test their enlightened ideas on us. The only idea which has not been tested by Soros as it is too difficult to swallow is to ban financial speculation. Guess why he is not interested in exploring this idea…

It is irrelevant whether the puppets are painted red, orange or blue. The puppets are puppets – they cannot have large brains.

@Postkey

the problem seems to be that while in traditional models speculators provide liquidity to the market, in the real world speculators ARE the market, i.e. entities with a physical interest in the underlying commodity are dwarfed by the volume of speculative trades. So we end up with a casino.

stone: The speculation is driving volatility more then it is driving long term price.

I agree volatility is indeed a problem. Food producers are benefiting from rising prices in the recent years not from volatility, unless they are successful speculators too. But are speculators responsible for the market volatility or also for this trend of rising prices in commodities?

MamMoTh,

“are speculators responsible for the market volatility or also for this trend of rising prices in commodities?”

There is no dividend or interest on commodities, there is no value to add, so there are definitely no investors in the game. These people generally do not take delivery and they are not end users.

While it is true there is rising demand for commodities. The demographics, growth rates and supply factors are pretty well known. New information is not constantly coming in to justify this severity of exponential curve.

It’s fairly obvious this is just another asset class being heavily marketed by the financial industry as the next hot thing. It is getting a lot of media exposure. Same old story, as soon as the shoe shine boy offers you a stake in that gold mine it’s all over red rover.

Benedict,

If you want to waste 9:53 of your life, watch this video of George Soros and Rob Johnson of the so-called INET intro the organization here at this youtube video:

http://www.youtube.com/watch?v=0DL7aFbsD-A&feature=player_embedded#at=191

This is a prime example of two people talking for 10 minutes without saying anything.

I predict that whatever this organization comes up with over how many YEARS they are at it, Bill here at his blog could come up with more meaningful truly NEW economic thinking in an afternoon of writing in his spare time between flights while he is traveling somewhere than these blowhards will ever come up with.

Soros = Sophistry

Resp,

Thanks for enlarging my vocabulary Matt.

Do you have a word for telling the truth that nobody believes?

King James Bible <>

And because I tell [you] the truth, ye believe me not.

Aren’t you folks tired of all the conspiracy theories floating around? I, for one, am bored to tears seeing the name ‘Soros’ linked to everything in the news, from the tsunami in Asia to the DSK scandal.

How about going for Occam’s razor every time? Sure, there are “dark” interests in the world, and, sure enough, they will always try to do “evil deeds”. But all this obsession with what’s behind the curtain blinds us to what’s this side of the curtain – and this where the real, tangible problems facing the world today happen! This deluge of every possible “explanation” under the sun is unavoidable perhaps, given the technology of instant communication and information, in tandem with the huge numbers of people now accessing it. But all it does is bury legitimate, clear-minded, simpler explanations. You now often have to dig under tons of protocols of Zion, Soros’ evil works, freemasons’ black sabbaths, and poison-in-the-water-tanks to reach a few lines of somber, clear-eyed and non-distracted analysis. The oases are getting fewer and fewer.

It does not take any kind of Bass-like conspiracy (remember Silver?) to corner the market for unhinged and unimpeded speculation to create destructive volatility in whatever the underlying subject is, be it pork bellies or stock indexes. We do need the liquidity but must limit speculative volatility – particularly in essential sectors, such as food items. We don’t need to discover conspiracies behind the speculation to aim for that, do we?

In Australia so called food producers / growers make sweet FA. It’s the agents that buy from them and sell it to the supermarkets / retail outlets that get the lions share.

The average farmer wouldn’t make in a year what these agents make in a week.

Bill –

You seem to be blaming speculators for what are actually real supply and demand fluctuations. It’s possible that oil futures traders increased oil price volatility slightly, but they did not cause Peak Oil!

You may see rice production as robust, but when drought forces Australia to go from being the biggest rice exporter to being an importer of rice, I don’t think that’s a valid conclusion. Once stocks of Aussie rice are used up, of course there’s going to be a price rise. Also demand for biofuels was pushing crop prices up. And once the GFC came, there was less money about so it’s hardly surprising that crop prices fell.

Rather than banning financial speculation on food prices, we should do more to ensure that poor farmers can access the guaranteed high prices that these futures contracts can bring.

MamMoTh “But are speculators responsible for the market volatility or also for this trend of rising prices in commodities?”

Vassilis Serafimakis “It does not take any kind of Bass-like conspiracy (remember Silver?) to corner the market for unhinged and inimpeded speculation to create destructive volatility in whatever the underlying subject is, be it pork bellies or stock indexes. We do need the liquidity but must limit speculative volatility”

The algarithms many speculators use incorporate price momentum. That is a positive feedback. It is bound to lead to wild volatility. To cut out the speculators in principle the commodity exchange could itself act as a market maker buying from farmers and selling to food processors. If you look at the web site for “bullion vault” it looks as though that exchange for retail gold hoarders does just that. I realise that the scale is totally different but I think the same principles apply. The key thing is that you would have to be a registered farmer or food processor to participate on the exchange. The issue is whether McDonnalds or Krusty Kreme would start morphing into derivative brokers acting as a conduit for external speculators. I worry that in the current financial climate they would. If global asset values are so high relative to the size of the global non-financial economy, then return on investment will be negligible. That means that there is no opportunity cost in hoarding commodities. Commodities pay no dividend and I presume people buying the GoldmanSachsCommodityIndex do not expect long term returns. BUT they also do not expect long term returns from shares or bonds or land or anything else. They expect volatility from everything and hope that some asset class or other will show a negative correlation with the others when it matters. If an asset price doubles and halves every couple of years and you can find another asset class that doubles and halves out of step with it to rebalance against then its a free lunch (or an appropriated lunch). To my mind the only way to avoid this escalating is to have the tax burden transferred to being an asset tax such that there is no net saving across the economy. If shares were valued such that they paid 10% dividends and those dividends were taken by an asset tax, then no-one would buy a GoldmanSachsCommodityIndex that also was subject to the same asset tax.

My worry is that even if trading in agricultural commodities were limited to producers and food processors this problem would continue to raise its ugly head. To my mind the issue has sprung up because assets are now so over-valued that conventional asset classes such as shares, bonds and land fail to yield long term above inflation returns. Whilst that is the case, money managers will devote all their efforts to ferreting out ways to exploit price volatility. Agricultural commodities appeal to them because real world seasons and calamities act to create price swings that are out of step with the typical asset classes. Increasingly the prices of all the traditional asset classes move together in lock step- not surprising since a whole industry is devoted to rebalancing across them. Having an asset class that fails to correlate with others is so valuable that ways to get round rules will keep cropping up. Food companies will get co-opted into becoming derivative brokers for external speculators etc. To my mind this situation will continue to worsen so long as net saving across the economy is accommodated. It would be eliminated if the tax burden was transferred to being an asset tax that balanced dis-saving and saving. If shares were valued lower such that they yielded 10% dividends that paid for an asset tax, then no one would contemplate buying the Goldman-Sachs-Commodity-Index that yielded no dividends and yet was subjected to the same asset tax.

Dear Bill

I certainly don’t like speculators, but I’m not sure that specualtion in food can be stopped because food is such a global market. As a rule, the more globalization there is, the less control governments have. Just think of Icesave.

One problem with both food and energy is that they are highly inelastic. Small drops in supply can cause big price increases. To compound matters, the rich spend a much smaller fraction of their income on food. Let’s suppose that Peter has an income of 2500 and spends 2000 of it on food while Paul has an income of 55,000 and spends 5000 of it on food. An increase of 10% in food prices means that Peter will have to sacrifice 40% of his non-food expenditures, which are already insignificant, if he wants to continue to eat as before while Paul has to sacrifice only 1%. As a result, rising food prices means that it is people who eat the least who are most likely to reduce their food consumption.

Although speculators can cause a lot of damaging volatility, they can’t influnce long-term trends. If the world will have 4 bumper crops in a row, no speculator can cause food prices to rise.

Far more important than curbing speculation in food, in my opinion, is to prohibit or severely restrict biofuels. Biofuels take food out of the stomach of poor in order to put fuel in the gas tanks of the rich. I can’t think of a more unethical policy than producing biofuels from cropland. Every hectare of cropland used to produce biofuels can no longer be used to produce food. There is of course nothing wrong with biofuels that can be produced without cropland.

Another factor that will make the food supply of the poor less secure is rapidly rising prosperity in populous countries like China and India. When people become more prosperous, they’ll increase their consumption of animal foods. Since each calorie of animal food requires several calories of plant food, this means a rise in the demand for food even though people keep their calorie intake constant.

The increasing use of biofuels and rising prosperity in populous countries are a double whammy for the world’s poor. If nothing is done, we will again see severe undernourishment among a large number of people, speculators or no speculators.

Regards. James

James Schipper “Far more important than curbing speculation in food, in my opinion, is to prohibit or severely restrict biofuels. Biofuels take food out of the stomach of poor in order to put fuel in the gas tanks of the rich. I can’t think of a more unethical policy than producing biofuels from cropland. Every hectare of cropland used to produce biofuels can no longer be used to produce food. There is of course nothing wrong with biofuels that can be produced without cropland.”

-Speculators can cause long term changes in price if they cause a shift to a more wasteful production cycle with periodic gluts causing food spoilage and storage costs as well as malinvestment in uneeded tractors etc.

-The ideal would be to have biofuels from digesting straw and other waste byproducts of the crops. That will require both the crops and the digestion cultures to be further developed. A big impediment is the European public’s fear of “genetic modification”. Personaly I don’t see how it is worse to grow biofuels than to grow cotton. As you say, we grow plenty of food, the problem is wealth inequality. If that was moderated, then no one would go hungry.

James,

So far it doesnt look like they have any problems with protein in Asia:

http://www.aliexpress.com/product-gs/432704836-chicken-cage-factory-for-poultry-farm-wholesalers.html

This looks like they have so much poultry production in Asia that they have decided to offer their surplus poultry equipment production to the west.

Resp,

Am I right in thinking that the mechanics of profiting from price manipulation in the commodities markets depends on the leverage imbedded in the derivative contracts? If a speculator both owns $1B worth of wheat and $1B worth of short contracts, then it is profitable to dump the wheat on the market and crash the price because the contracts have 5:1 ? leverage and so every $ lost from the physical wheat gives a $5 gain on the contracts (and the same for long contracts and hoarding rather than dumping the wheat). I suppose the justification for having leverage imbedded in the contracts is that it is harder for a farmer to borrow money to buy say $1M of unleaveraged contracts than it is for the investment bank that constructs the contracts so that the farmer can get $1M of hedging from only $200k borrowed by the farmer. To my mind what is needed is for position limits to be limited to each market participant’s (farmer or food producer’s) annual production or consumption and no leverage to be imbedded in the derivatives. Those rules might cause problems with liquidity and with farmers not being able to aford the required derivatives. I don’t see why the exchange could not itself act as a market marker to guarentee liquidity and also make available low cost loans for buying unleveraged contracts.

I appologize if my above comment is gibberish- I find this whole subject so confusing. Once a loan is taken out-that is leverage isn’t it :). I do still suspect that the kernal of the problem is that leverage differentially influences the profits/loss consequences of the various forms that the commodities can be traded (futures, options and physical) more than it does the underlying commodity price. Without that differential, speculators would only ever want to buy low and sell high resulting in a moderation of volatility rather than a worsening of it. As it stands, speculators are happy to loose money dumping or hoarding the physical commodity because it is more than compensated for by the leveraged gains in the derivatives particularly around critical derivative expiry dates etc.

I’m wondering whether options are the type of derivative that provides the greatest incentive for price manipulation. If the wheat price is currently high and the supply and demand fundamentals suggest that it will fall over the coming months, then options to buy wheat at twice the current price up until three months time are going to cost very little indeed. A speculator who had lots of such option contracts could extort great profits buy hoarding wheat to cause a price spike and then selling the option contracts. The speculator would also know that because the option has a defined expiry date, the hoard of wheat could be offloaded to a captive market that would have to buy the wheat before the option expiry date or else see their option contracts expire unused.

Rereading this to learn about longs and shorts in light of the gamestop stock craziness in Jan 2021.

Great explanation here.

The wall street clowns should have manipulated the market more fully to prevent getting shafted during their short. (if my understanding is correct).