Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – May 28, 2011 – answers and discussion

Question 1:

A sovereign national government has to raise tax revenue to allow it to fulfill its political mandate.The answer is True. First, to clear the ground we state clearly that a sovereign government is the monopoly issuer of the currency and is never revenue-constrained. So the question is not about the tax revenue per se but rather the role taxes play in the monetary system. A sovereign government never has to “obey” the constraints that the private sector always has to obey. The foundation of many mainstream macroeconomic arguments is the fallacious analogy they draw between the budget of a household/corporation and the government budget. However, there is no parallel between the household (for example) which is clearly revenue-constrained because it uses the currency in issue and the national government, which is the issuer of that same currency. The choice (and constraint) sets facing a household and a sovereign government are not alike in any way, except that both can only buy what is available for sale. After that point, there is no similarity or analogy that can be exploited. Of-course, the evolution in the 1960s of the literature on the so-called government budget constraint (GBC), was part of a deliberate strategy to argue that the microeconomic constraint facing the individual applied to a national government as well. Accordingly, they claimed that while the individual had to “finance” its spending and choose between competing spending opportunities, the same constraints applied to the national government. This provided the conservatives who hated public activity and were advocating small government, with the ammunition it needed. So the government can always spend if there are goods and services available for purchase, which may include idle labour resources. This is not the same thing as saying the government can always spend without concern for other dimensions in the aggregate economy. For example, if the economy was at full capacity and the government tried to undertake a major nation building exercise then it might hit inflationary problems – it would have to compete at market prices for resources and bid them away from their existing uses. In those circumstances, the government may – if it thought it was politically reasonable to build the infrastructure – quell demand for those resources elsewhere – that is, create some unemployment. How? By increasing taxes. So to answer the question correctly, you need to understand the role that taxes play in a fiat currency system. In a fiat monetary system the currency has no intrinsic worth. Further the government has no intrinsic financial constraint. Once we realise that government spending is not revenue-constrained then we have to analyse the functions of taxation in a different light. The starting point of this new understanding is that taxation functions to promote offers from private individuals to government of goods and services in return for the necessary funds to extinguish the tax liabilities. In this way, it is clear that the imposition of taxes creates unemployment (people seeking paid work) in the non-government sector and allows a transfer of real goods and services from the non-government to the government sector, which in turn, facilitates the government’s economic and social program. The crucial point is that the funds necessary to pay the tax liabilities are provided to the non-government sector by government spending. Accordingly, government spending provides the paid work which eliminates the unemployment created by the taxes. So it is now possible to see why mass unemployment arises. It is the introduction of State Money (government taxing and spending) into a non-monetary economics that raises the spectre of involuntary unemployment. As a matter of accounting, for aggregate output to be sold, total spending must equal total income (whether actual income generated in production is fully spent or not each period). Involuntary unemployment is idle labour offered for sale with no buyers at current prices (wages). Unemployment occurs when the private sector, in aggregate, desires to earn the monetary unit of account, but doesn’t desire to spend all it earns, other things equal. As a result, involuntary inventory accumulation among sellers of goods and services translates into decreased output and employment. In this situation, nominal (or real) wage cuts per se do not clear the labour market, unless those cuts somehow eliminate the private sector desire to net save, and thereby increase spending. The purpose of State Money is for the government to move real resources from private to public domain. It does so by first levying a tax, which creates a notional demand for its currency of issue. To obtain funds needed to pay taxes and net save, non-government agents offer real goods and services for sale in exchange for the needed units of the currency. This includes, of-course, the offer of labour by the unemployed. The obvious conclusion is that unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save. This analysis also sets the limits on government spending. It is clear that government spending has to be sufficient to allow taxes to be paid. In addition, net government spending is required to meet the private desire to save (accumulate net financial assets). From the previous paragraph it is also clear that if the Government doesn’t spend enough to cover taxes and desire to save the manifestation of this deficiency will be unemployment. Keynesians have used the term demand-deficient unemployment. In our conception, the basis of this deficiency is at all times inadequate net government spending, given the private spending decisions in force at any particular time. So the answer should now be obvious. If the economy is to fulfill its political mandate it must be able to transfer real productive resources from the private sector to the public sector. Taxation is the vehicle that a sovereign government uses to “free up resources” so that it can use them itself. But taxation has nothing to do with “funding” of the government spending. To understand how taxes are used to attenuate demand please read this blog – Functional finance and modern monetary theory. The following blogs may be of further interest to you:

- The budget deficits will increase taxation!

- Will we really pay higher taxes?

- A modern monetary theory lullaby

- Functional finance and modern monetary theory

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

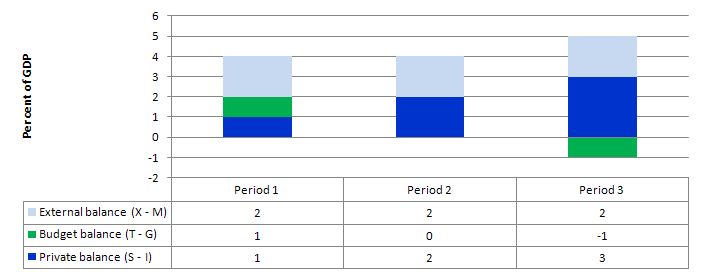

Assume that the national accounts of a nation is reveal that its external surplus is equivalent to 2 per cent of GDP and the private domestic sector is saving overall 3 per cent of GDP. We would also observe:: (a) A budget deficit equal to 1 per cent of GDP. (b) A budget surplus equal to 1 per cent of GDP. (c) A budget deficit equal to 5 per cent of GDP. (d) A budget surplus equal to 5 per cent of GDP.The answer is Option (a) – A budget deficit equal to 1 per cent of GDP. This question requires an understanding of the sectoral balances that can be derived from the National Accounts. But it also requires some understanding of the behavioural relationships within and between these sectors which generate the outcomes that are captured in the National Accounts and summarised by the sectoral balances. Refreshing the balances (again) – we know that from an accounting sense, if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the accounting rules. The important point is to understand what behaviour and economic adjustments drive these outcomes. So here is the accounting (again). The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances. From the sources perspective we write: GDP = C + I + G + (X – M) which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M). From the uses perspective, national income (GDP) can be used for: GDP = C + S + T which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made. Equating these two perspectives we get: C + S + T = GDP = C + I + G + (X – M) So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts. (I – S) + (G – T) + (X – M) = 0 That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

The following blogs may be of further interest to you:

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

While bank lending is capital constrained a further constraint on excess lending would be created by regulators if a 100 per cent reserve ratio (that is, all loans had to be backed by reserves) was imposed.The answer is False. In a “fractional reserve” banking system of the type the US runs (which is really one of the relics that remains from the gold standard/convertible currency era that ended in 1971), the banks have to retain a certain percentage (10 per cent currently in the US) of deposits as reserves with the central bank. You can read about the fractional reserve system from the Federal Point page maintained by the FRNY. Where confusion as to the role of reserve requirements begins is when you open a mainstream economics textbooks and “learn” that the fractional reserve requirements provide the capacity through which the private banks can create money. The whole myth about the money multiplier is embedded in this erroneous conceptualisation of banking operations. The FRNY educational material also perpetuates this myth. They say:

If the reserve requirement is 10%, for example, a bank that receives a $100 deposit may lend out $90 of that deposit. If the borrower then writes a check to someone who deposits the $90, the bank receiving that deposit can lend out $81. As the process continues, the banking system can expand the initial deposit of $100 into a maximum of $1,000 of money ($100+$90+81+$72.90+…=$1,000). In contrast, with a 20% reserve requirement, the banking system would be able to expand the initial $100 deposit into a maximum of $500 ($100+$80+$64+$51.20+…=$500). Thus, higher reserve requirements should result in reduced money creation and, in turn, in reduced economic activity.This is not an accurate description of the way the banking system actually operates and the FRNY (for example) clearly knows their representation is stylised and inaccurate. Later in the same document they they qualify their depiction to the point of rendering the last paragraph irrelevant. After some minor technical points about which deposits count to the requirements, they say this:

Furthermore, the Federal Reserve operates in a way that permits banks to acquire the reserves they need to meet their requirements from the money market, so long as they are willing to pay the prevailing price (the federal funds rate) for borrowed reserves. Consequently, reserve requirements currently play a relatively limited role in money creation in the United States.In other words, the required reserves play no role in the credit creation process. The actual operations of the monetary system are described in this way. Banks seek to attract credit-worthy customers to which they can loan funds to and thereby make profit. What constitutes credit-worthiness varies over the business cycle and so lending standards become more lax at boom times as banks chase market share (this is one of Minsky’s drivers). These loans are made independent of the banks’ reserve positions. Depending on the way the central bank accounts for commercial bank reserves, the latter will then seek funds to ensure they have the required reserves in the relevant accounting period. They can borrow from each other in the interbank market but if the system overall is short of reserves these “horizontal” transactions will not add the required reserves. In these cases, the bank will sell bonds back to the central bank or borrow outright through the device called the “discount window”. At the individual bank level, certainly the “price of reserves” will play some role in the credit department’s decision to loan funds. But the reserve position per se will not matter. So as long as the margin between the return on the loan and the rate they would have to borrow from the central bank through the discount window is sufficient, the bank will lend. So the idea that reserve balances are required initially to “finance” bank balance sheet expansion via rising excess reserves is inapplicable. A bank’s ability to expand its balance sheet is not constrained by the quantity of reserves it holds or any fractional reserve requirements. The bank expands its balance sheet by lending. Loans create deposits which are then backed by reserves after the fact. The process of extending loans (credit) which creates new bank liabilities is unrelated to the reserve position of the bank. The major insight is that any balance sheet expansion which leaves a bank short of the required reserves may affect the return it can expect on the loan as a consequence of the “penalty” rate the central bank might exact through the discount window. But it will never impede the bank’s capacity to effect the loan in the first place. The money multiplier myth leads students to think that as the central bank can control the monetary base then it can control the money supply. Further, given that inflation is allegedly the result of the money supply growing too fast then the blame is sheeted home to the “government” (the central bank in this case). The reality is that the reserve requirements that might be in place at any point in time do not provide the central bank with a capacity to control the money supply. So would it matter if reserve requirements were 100 per cent? In this blog – 100-percent reserve banking and state banks – I discuss the concept of a 100 per cent reserve system which is favoured by many conservatives who believe that the fractional reserve credit creation process is inevitably inflationary. There are clearly an array of configurations of a 100 per cent reserve system in terms of what might count as reserves. For example, the system might require the reserves to be kept as gold. In the old “Giro” or “100 percent reserve” banking system which operated by people depositing “specie” (gold or silver) which then gave them access to bank notes issued up to the value of the assets deposited. Bank notes were then issued in a fixed rate against the specie and so the money supply could not increase without new specie being discovered. Another option might be that all reserves should be in the form of government bonds, which would be virtually identical (in the sense of “fiat creations”) to the present system of central bank reserves. While all these issues are interesting to explore in their own right, the question does not relate to these system requirements of this type. It was obvious that the question maintained a role for central bank (which would be unnecessary in a 100-per cent reserve system based on gold, for example. It is also assumed that the reserves are of the form of current current central bank reserves with the only change being they should equal 100 per cent of deposits. We also avoid complications like what deposits have to be backed by reserves and assume all deposits have to so backed. In the current system, the the central bank ensures there are enough reserves to meet the needs generated by commercial bank deposit growth (that is, lending). As noted above, the required reserve ratio has no direct influence on credit growth. So it wouldn’t matter if the required reserves were 10 per cent, 0 per cent or 100 per cent. In a fiat currency system, commercial banks require no reserves to expand credit. Even if the required reserves were 100 per cent, then with no other change in institutional structure or regulations, the central bank would still have to supply the reserves in line with deposit growth. Now I noted that the central bank might be able to influence the behaviour of banks by imposing a penalty on the provision of reserves. It certainly can do that. As a monopolist, the central bank can set the price and supply whatever volume is required to the commercial banks. But the price it sets will have implications for its ability to maintain the current policy interest rate which we consider in Question 3. The central bank maintains its policy rate via open market operations. What really happens when an open market purchase (for example) is made is that the central bank adds reserves to the banking system. This will drive the interest rate down if the new reserve position is above the minimum desired by the banks. If the central bank wants to maintain control of the interest rate then it has to eliminate any efforts by the commercial banks in the overnight interbank market to eliminate excess reserves. One way it can do this is by selling bonds back to the banks. The same would work in reverse if it was to try to contract the money supply (a la money multiplier logic) by selling government bonds. The point is that the central bank cannot control the money supply in this way (or any other way) except to price the reserves at a level that might temper bank lending. So if it set a price of reserves above the current policy rate (as a penalty) then the policy rate would lose traction for reasons explained in the answer to Question 3. The fact is that it is endogenous changes in the money supply (driven by bank credit creation) that lead to changes in the monetary base (as the central bank adds or subtracts reserves to ensure the “price” of reserves is maintained at its policy-desired level). Exactly the opposite to that depicted in the mainstream money multiplier model. The other fact is that the money supply is endogenously generated by the horizontal credit (leveraging) activities conducted by banks, firms, investors etc – the central bank is not involved at this level of activity. You might like to read these blogs for further information:

- Lending is capital- not reserve-constrained

- Oh no … Bernanke is loose and those greenbacks are everywhere

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- 100-percent reserve banking and state banks

- Money multiplier and other myths

Recipients of income support provided by the national government are living off the hard work of those who pay income taxes.The answer is True. This question explores the true relevance of the dependency ratio, which will rise as demographic changes age our populations. It also aims to disabuse the reader of the notion that the income support benefits are paid for by taxes that those in employment (and other income generating activities) might pay. Initially, we have to be very clear as to what “living off the hard work of those who pay taxes” means. In this sense, it is not a focus on the “income” that the non-workers receive but the command over real good and services that that income provides them with. We will come back to the “funds” issue soon. So the focus has to be on the real side of the economy because that is, ultimately, the only way our material living standards can be expressed. Nominal aggregates mean very little by themselves. Income support recipients (who do not work – for whatever reason) clearly command real resources that they have not themselves produced. These real goods and services are produced by those who do work (and the presumption is that most workers pay taxes of some sort or another). The use of the emotive term “living off the hard work” was deliberate and designed, as a foil, to invoke the idea that governments have created welfare states which provide unsustainable benefits to the poor and marginalised at the expense of those who are materially successful – the classic conservative argument against government welfare provision. But it doesn’t alter the truth of the statement. A slight complicating factor is that the income support recipients also pay taxes if there are indirect tax systems in place but that doesn’t alter the story about the provision of real goods and services. Now the second part of the answer relates to the question of funding. In terms of where the funds come from to provide the income support for those who do not work the answer is simple: no-where. While taxation raises revenue for national governments it doesn’t “fund” its spending. Currency-issuing governments can spend without revenue should they wish to. Abba Lerner’s 1951 book The Economics of Employment was really a rewritten version of the 1941 article The Economic Steering Wheel where he elaborated his version of Keynesian thinking. He conceptualised macroeconomic policy as being about “steering” the fluctuations in the economy. Fiscal policy was the steering wheel and should be applied for functional purposes. Laissez-faire (free market) was akin to letting the car zigzag all over the road and if you wanted the economy to develop in a stable way you had to control its movement. This led to the concept of functional finance and the differentiation from what he called sound finance (that proposed by the free market lobby). Sound finance was all about fiscal rules – the type you read about every day in the mainstream financial press. Sound finance is about balancing the budget over the course of the business cycle and only increasing the money supply in line with the real rate of output growth; etc – noting the approach erroneously assumes the central bank can control the money supply. Lerner thought that these rules were based more in conservative morality than being well founded ways to achieve the goals of economic behaviour – full employment and price stability. He said that once you understood the monetary system you would always employ functional finance – that is, fiscal and monetary policy decisions should be functional – advance public purpose and eschew the moralising concepts that public deficits were profligate and dangerous. Lerner thought that the government should always use its capacity to achieve full employment and price stability. In Modern Monetary Theory (MMT) we express this responsibility as “advancing public purpose”. In his 1943 book (page 354) we read:

The central idea is that government fiscal policy, its spending and taxing, its borrowing and repayment of loans, its issue of new money and its withdrawal of money, shall all be undertaken with an eye only to the results of these actions on the economy and not to any established traditional doctrine about what is sound and what is unsound. This principle of judging only by effects has been applied in many other fields of human activity, where it is known as the method of science opposed to scholasticism. The principle of judging fiscal measures by the way they work or function in the economy we may call Functional Finance … Government should adjust its rates of expenditure and taxation such that total spending in the economy is neither more nor less than that which is sufficient to purchase the full employment level of output at current prices. If this means there is a deficit, greater borrowing, “printing money,” etc., then these things in themselves are neither good nor bad, they are simply the means to the desired ends of full employment and price stability …Mainstream advocacy of fiscal rules that are divorced from a functional context clearly do not make much sense even though their use dominates public policy these days. It may be that a budget surplus is necessary at some point in time – for example, if net exports are very strong and fiscal policy has to contract spending to take the inflationary pressures out of the economy. This will be a rare situation but in those cases I would as a proponent of MMT advocate fiscal surpluses. Lerner outlined three fundamental rules of functional finance in his 1941 (and later 1951) works.

- The government shall maintain a reasonable level of demand at all times. If there is too little spending and, thus, excessive unemployment, the government shall reduce taxes or increase its own spending. If there is too much spending, the government shall prevent inflation by reducing its own expenditures or by increasing taxes.

- By borrowing money when it wishes to raise the rate of interest, and by lending money or repaying debt when it wishes to lower the rate of interest, the government shall maintain that rate of interest that induces the optimum amount of investment.

- If either of the first two rules conflicts with the principles of ‘sound finance’, balancing the budget, or limiting the national debt, so much the worse for these principles. The government press shall print any money that may be needed to carry out rules 1 and 2.

- I just found out – state kleptocracy is the problem

- Functional finance and modern monetary theory

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

Assume the current public debt to GDP ratio is 100 per cent and that the nominal interest rate and the inflation rate remain constant and zero. Under these circumstances it is impossible to reduce a public debt to GDP ratio, using an austerity package if the rise in the primary surplus to GDP ratio is always exactly offset by negative GDP growth rate of the same percentage value.The answer is True. First, some background. While Modern Monetary Theory (MMT) places no particular importance in the public debt to GDP ratio for a sovereign government, given that insolvency is not an issue, the mainstream debate is dominated by the concept. The unnecessary practice of fiat currency-issuing governments of issuing public debt $-for-$ to match public net spending (deficits) ensures that the debt levels will rise when there are deficits. Rising deficits usually mean declining economic activity (especially if there is no evidence of accelerating inflation) which suggests that the debt/GDP ratio may be rising because the denominator is also likely to be falling or rising below trend. Further, historical experience tells us that when economic growth resumes after a major recession, during which the public debt ratio can rise sharply, the latter always declines again. It is this endogenous nature of the ratio that suggests it is far more important to focus on the underlying economic problems which the public debt ratio just mirrors. However, mainstream economics starts with the flawed analogy between the household and the sovereign government such that any excess in government spending over taxation receipts has to be “financed” in two ways: (a) by borrowing from the public; and/or (b) by “printing money”. Neither characterisation is remotely representative of what happens in the real world in terms of the operations that define transactions between the government and non-government sector. Further, the basic analogy is flawed at its most elemental level. The household must work out the financing before it can spend. The household cannot spend first. The government can spend first and ultimately does not have to worry about financing such expenditure. However, in mainstream (dream) land, the framework for analysing these so-called “financing” choices is called the government budget constraint (GBC). The GBC says that the budget deficit in year t is equal to the change in government debt over year t plus the change in high powered money over year t. So in mathematical terms it is written as:

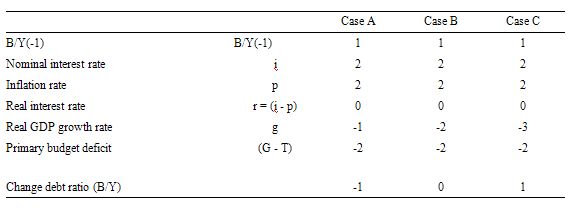

- Current public debt to GDP ratio is 100 per cent = 1.

- Nominal interest rate (i) and the inflation rate (p) remain constant and zero, which means the real interest rate (r = i – p) = 0.

- Case A – primary budget surplus to GDP ratio exceeds the negative GDP growth rate.

- Case B – primary budget to GDP ratio is equal to the negative GDP growth rate.

- Case C – primary budget to GDP ratio is less than the negative GDP growth rate.

As long as the primary surplus as a per cent of GDP is exactly equal to the negative GDP growth rate (Case B), there can be no reduction in the public debt ratio. This is because what is being added proportionately to the numerator of the ratio is also being added to the denominator.

Under Case C where the primary budget surplus is 2 per cent and the contraction in real GDP is 3 percent for the debt ratio rises by the difference.

How likely is it that Case A would occur in the real world when the government was pursuing such a fiscal path? Answer: unlikely.

First, fiscal austerity will probably push the GDP growth rate further into negative territory which, other things equal, pushes the public debt ratio up. Why? The budget balance is endogenous (that is, depends on private activity levels) because of the importance of the automatic stabilisers.

As GDP contracts, tax revenue falls and welfare outlays rise. It is highly likely that the government would not succeed in achieving a budget surplus under these circumstances.

So as GDP growth declines further, the automatic stabilisers will push the balance result towards (and into after a time) deficit, which, given the borrowing rules that governments volunatarily enforce on themselves, also pushed the public debt ratio up.

So austerity packages, quite apart from their highly destructive impacts on real standards of living and social standards, typically fail to reduce public debt ratios and usually increase them.

So even if you were a conservative and erroneously believed that high public debt ratios were the devil’s work, it would be foolish (counter-productive) to impose fiscal austerity on a nation as a way of addressing your paranoia. Better to grit your teeth and advocate higher deficits and higher real GDP growth.

That strategy would also be the only one advocated by MMT.]]>

As long as the primary surplus as a per cent of GDP is exactly equal to the negative GDP growth rate (Case B), there can be no reduction in the public debt ratio. This is because what is being added proportionately to the numerator of the ratio is also being added to the denominator.

Under Case C where the primary budget surplus is 2 per cent and the contraction in real GDP is 3 percent for the debt ratio rises by the difference.

How likely is it that Case A would occur in the real world when the government was pursuing such a fiscal path? Answer: unlikely.

First, fiscal austerity will probably push the GDP growth rate further into negative territory which, other things equal, pushes the public debt ratio up. Why? The budget balance is endogenous (that is, depends on private activity levels) because of the importance of the automatic stabilisers.

As GDP contracts, tax revenue falls and welfare outlays rise. It is highly likely that the government would not succeed in achieving a budget surplus under these circumstances.

So as GDP growth declines further, the automatic stabilisers will push the balance result towards (and into after a time) deficit, which, given the borrowing rules that governments volunatarily enforce on themselves, also pushed the public debt ratio up.

So austerity packages, quite apart from their highly destructive impacts on real standards of living and social standards, typically fail to reduce public debt ratios and usually increase them.

So even if you were a conservative and erroneously believed that high public debt ratios were the devil’s work, it would be foolish (counter-productive) to impose fiscal austerity on a nation as a way of addressing your paranoia. Better to grit your teeth and advocate higher deficits and higher real GDP growth.

That strategy would also be the only one advocated by MMT.]]>

Well, it’s not that clear what 100% reserves is actually meaning. If it would mean that deposits would have to be fully backed by reserves or treasury bonds, lending could not exceed the actual stock of bank capital, and would thus be severly constraint. (Of course, the CB could still lend more reserves, but it would do so without securities – assuming that all other bank assets would be considered of inferior quality – thus no reserves) So, the central bank would actually have to break the rules…

“Loans create deposits which are then backed by reserves after the fact.”

“Loans create deposits …”

I want to rephrase that from a medium of exchange standpoint. The “central bank credo” is that all new medium of exchange (demand deposits) has/have to have a loan attached. That means it has to be borrowed into existance with an interest rate attached, repayment terms attached, and brings something from the future to the present.

“which are then backed by reserves after the fact.”

I disagree with that. It seems to me that the central bank reserves can be after the fact, during the fact, or before the fact. Notice the timing difference. In the USA right now, it is before the fact. They are hoping for more private debt.

“They can borrow from each other in the interbank market but if the system overall is short of reserves these “horizontal” transactions will not add the required reserves. In these cases, the bank will sell bonds back to the central bank or borrow outright through the device called the “discount window”.

And, “The major insight is that any balance sheet expansion which leaves a bank short of the required reserves may affect the return it can expect on the loan as a consequence of the “penalty” rate the central bank might exact through the discount window. But it will never impede the bank’s capacity to effect the loan in the first place.”

Can the fed just lower the reserve requirement or find a way to lower the effective reserve requirement (sweeps accounts)?

“If the reserve requirement is 10%, for example, a bank that receives a $100 deposit may lend out $90 of that deposit. If the borrower then writes a check to someone who deposits the $90, the bank receiving that deposit can lend out $81. As the process continues, the banking system can expand the initial deposit of $100 into a maximum of $1,000 of money ($100+$90+81+$72.90+…=$1,000).”

I agree with bill that the demand deposits are NOT lended out. There is no demand deposit(s) multiplier.

However, if the reserve requirement is 10%, enforced, and the fed allows the fed funds rate to rise, would that mean the maximum amount of debt that can be created is a factor of 10?

“What constitutes credit-worthiness varies over the business cycle and so lending standards become more lax at boom times as banks chase market share (this is one of Minsky’s drivers).”

Does the value of the collateral matter here too?

Good Habit “Well, it’s not that clear what 100% reserves is actually meaning.”

If the proposal is to prevent “bank style” money creation so as to avoid credit cycles, then apparently “equity only banking” is the understood terminology. Under such an equity only system, loans would have to be funded by the loan company selling bonds or issuing shares. Deposits would be kept in a giro bank that would not be able to make loans. In effect such a system would do away with banks as we know them as well as any requirement for a central bank. To my mind the financial inovation of the current banking system is an attempt to wriggle around the potential strangle hold that money holders would otherwise exert. Howerever the banking system has created a whole new set of problems of its own especially the need for the gov to guarentee depositors which leads to reckless lending, asset bubbles and exorbitant banking profits. To my mind a better solution would be to combine an equity only system with a whole-scale wealth redistribution (via an asset tax and citizens dividend) so that the “money holders” meant everyone. The danger of “money holders” having a strangle hold is only an issue if wealth is concentrated.

Stone “would do away with banks as we know them as well as any requirement for a central bank”

Well, there should still be a Central Bank as clearing house for interbank payments, and as the issuer of curre bncy (Unless there would be a monopolistic bank, but then there are no constraints at all anymore) But certainly – as long as private sector debt can serve as a collateral for the CB to lend bankreserves, there can’t be no meaningful claim that loans are 100 % backed by reserves – they would then back each other, so that we have circular money creation, and no 100 % reserves.

“Recipients of income support provided by the national government are living off the hard work of those who pay income taxes.”

I knew that question was a trap, but I still walked into it.

I’m waiting now for “the government is wasting taxpayer’s money”.

True of course…chick, chick, bang !