I have received several E-mails over the last few weeks that suggest that the economics…

When will we ever learn?

It is going to be brief today – it is a holiday in Australia. Queen’s Birthday no less. Can you believe that we are still under the yoke of our colonial masters? Anyway, a winter’s holiday – pouring rain and cold. But I read a couple of things today which I thought were worth interrupting other work to write about as they establish some general principles relevant to understanding Modern Monetary Theory (MMT). The discussion also highlights the recurrent nature of the prophecies of doom – that come from the likes of the Peter G. Peterson foundation now but others in the past. We were told in the 1930s that profligate governments would go bankrupt. They didn’t but when they cut back there economies went broke. The Japanese government was predicted to become insolvent in the 1990s along with hyperinflation and skyrocketing interest rates. Nothing happened other than the fiscal austerity that was imposed as a result of the political pressure arising from these predictions sent the economy back into recession. Same as now … fiscal austerity – imposed because allegedly budgets are unsustainable – will drive economies back towards and into recession. When will we ever learn?

I thought I might start with this YouTube video which is taken from a 1965 address by Republican Senator from Illinois Everett Dirksen. He was pro McCarthy in the 1950s and a fiscal conservative throughout his career. He also was a war monger supporting the disastrous Vietnam campaign.

The video is only one and a half minutes long but hysterical nonetheless. If we updated the numbers to 2011 scales then the speech and prophecy of doom could be delivered by any number of Democrat or Republican members of Congress now. As then, the predictions of doom will come to nothing.

Having enjoyed that comedy sketch we can consider the topic for today.

In the Financial Times yesterday (June 12, 2011), former US Treasury Secretary Lawrence Summers provided advice on – How to avoid our own lost decade – “our” being the US but could just as well be applied to most nations currently contemplating or engaging in fiscal austerity.

I thought his opening comment was salient and mostly forgotten as US politicians aided and abetted by a raucos lobby of mainstream commentators, economists mostly funded in one way or another by billionaires urge the US government to cut net spending. Summers wrote:

Even with the 2008-2009 policy effort that successfully prevented financial collapse, the US is now half way to a lost economic decade. In the past five years, our economy’s growth rate averaged less than one per cent a year, similar to Japan when its bubble burst. At the same time, the fraction of the population working has fallen from 63.1 to 58.4 per cent, reducing the number of those in jobs by more than 10m. Reports suggest growth is slowing.

The Lost Decade refers to the period 1991 to 2001 when the Japanese economy was enduring the fallout from a spectacular property market crash. I think the term is somewhat of a misnomer because it was the economy actually was recovering by the mid-1990s but was then plunged back into recession again in 1997-98 after the conservatives pressured the government to impose fiscal austerity because of fears about “public debt solvency”. Yes, we have been there before! Also 1937 – Stateside!

But Summers’ point emphasising that the crisis began in 2007 and it is now mid-June 2011 is worth remembering always. This has been a long drawn out crisis – unnecessarily drawn out by politicians acting in conflict with the best interests of their nation. And now, the US Congress is poised to send the US economy backwards again because they claim there are “public debt solvency” issues. As noted – been there before.

While the US politicians (and politicians everywhere) argue the toss about how harsh the fiscal austerity should be they ignore the fact that there are huge daily losses in foregone income and output that they are overseeing which are accumulating. These losses will never be regained and the longer the slowdown endures the greater will be the damage.

While they are arguing about predictions of doom (hyperinflation, sovereign default, soaring interest rates etc) which will never transpire, the real prosperity of their nations is being lost.

I also read this article in the same session as this Bloomberg opinion piece (June 13, 2011) – Is Biggest Short Sale Hiding in Plain Sight? – by William Pesek.

Pesek reports that US “hedge-fund manager J. Kyle Bass” has indicated to him (in an interview) that:

… his bet against Japanese government bonds is even “more compelling” than his gamble to sell short U.S. subprime-mortgage debt, which earned him $500 million in 2007 … [Japan’s] … collapse is inevitable, making Japan’s 10-year bonds — they yield 1.3 percent, among the lowest in the world — a natural for a bear investor … [and that the] … price tag for the earthquake and its effects will … push … the country over the edge.

If I was a betting person as Bass is and had his resources then I would be more than happy to take the counter-party to his speculative bet. It would make me very comfortable (in material terms) indeed in my retirement with plenty to spread around to others. We would have a continuous party for years to come.

But Bass’s predictions have all been played out previously. During the “lost decade” plenty of commentators predicted hyperinflation, bond default and worse when considering Japan’s situation.

None of their predictions came true and the current plethora of disaster scenarios will come to a similar end.

As Pesek argues that apart from the fact that “Japan’s postal system controls the world’s largest bank; households are sitting on savings in the neighborhood of $15 trillion; the country holds $1.06 trillion in currency reserves, second only to China; the unique structure of Japan’s bond market keeps about 95 percent of public debt in domestic hands” the more telling point is that the Japanese government would simply

The central bank would be sure to purchase loads of debt to keep yields from surging.

That is, Japan is a fully sovereign nation and can finance any spending it deems necessary at low yields without recourse to private financial markets.

I have noted some discussion in our private E-mail lists recently about the use of the term sovereign. It is a very mis-used and misunderstood term. From the perspective of Modern Monetary Theory (MMT), sovereignty has an exact meaning – a national government that issues its own currency and floats it on international markets (and does not borrow in foreign currency denominations).

In that context, the EMU nations are not sovereign – they all use a foreign currency for all their transactions. I think as long as we understand that distinction the sovereign-non sovereign distinction has traction. But I am also very aware that the mainstream press talk about “sovereign debt crises” when considering the case of Greece. But equally, the same commentators present tables ranking the US, UK, Japan and various EMU nations and predict that the US (for example) is only x steps away from becoming Greece.

That sort of conflation is the reason why the conservatives are pushing the US Congress to act as if the US is non-sovereign and lo and behold they will get the same outcomes as the conservatives generated in 1997 in Japan (more about which later) – fiscal austerity generating a recession as growth was starting to respond to fiscal stimulus.

Pesek at least understands the folly of this sort of reasoning:

While there are angles for short-sellers to exploit, Japan isn’t the next Greece. The next few years won’t be pretty or smooth, but the idea that they will end in default and economic devastation seems farfetched.

Exactly, which is why I would be a willing counterparty to Mr Bass’s short sell as noted above.

But while Larry Summers gets some things correct, you know lurking below the narrative is a poorly formed logic that is part of the problem not the solution.

He introduces phrases like:

Reduced income and tax collections are the most critical cause of unacceptable budget deficits now and in the future.

Yes to the first point – deficit rise when economic activity falls (incomes and tax revenue declines). But a rising budget deficit is neither acceptable nor unacceptable per se because the budget balance should never be a goal in itself. A rising budget deficit might signal that private spending has declined and the automatic stabilisers are pushing out net public spending which would be a cause for concern because it means private employment growth is likely to be falling.

Equally, a rising budget deficit could reflect discretionary choices by government to fund private saving desires (by keeping spending and incomes high) which would be consistent with full employment.

But taken alone – a budget deficit outcome – is without interest.

I agree with Summers that:

You cannot prescribe for a malady unless you diagnose it accurately and understand its causes. That the problem in a period of high unemployment, as now, is a lack of business demand for employees not any lack of desire to work is all but self-evident …

And the evidence he cites is overwhelming (“the propensity of workers to quit jobs and the level of job openings are at near-record low; rises in non-employment have taken place among all demographic groups; rising rates of profit and falling rates of wage growth suggest employers, not workers, have the power in almost every market”).

Spending creates income which supports employment growth. At any point in time, private spending is whatever it is and reflects the different choices households and business firms make about the future.

Once we realise that government spending is not revenue-constrained then we have to analyse the functions of taxation in a different light. MMT considers that taxation functions to promote offers from private individuals to government of goods and services in return for the necessary funds to extinguish the tax liabilities.

The orthodox conception is that taxation provides revenue to the government which it requires in order to spend. In fact, the reverse is the truth. Government spending provides revenue to the non-government sector which then allows them to extinguish their taxation liabilities. So the funds necessary to pay the tax liabilities are provided to the non-government sector by government spending.

It follows that the imposition of the taxation liability creates a demand for the government currency in the non-government sector which allows the government to pursue its economic and social policy program.

This insight allows us to see another dimension of taxation which is lost in mainstream macroeconomic analysis. Given that the non-government sector requires fiat currency to pay its taxation liabilities, in the first instance, the imposition of taxes (without a concomitant injection of spending) by design creates unemployment (people seeking paid work) in the non-government sector.

The unemployed or idle non-government resources can then be utilised through demand injections via government spending which amounts to a transfer of real goods and services from the non-government to the government sector. In turn, this transfer facilitates the government’s socio-economics program.

While real resources are transferred from the non-government sector in the form of goods and services that are purchased by government, the motivation to supply these resources is sourced back to the need to acquire fiat currency to extinguish the tax liabilities. Further, while real resources are transferred, the taxation provides no additional financial capacity to the government of issue.

Conceptualising the relationship between the government and non-government sectors in this way makes it clear that it is government spending that provides the paid work which eliminates the unemployment created by the taxes.

So it is now possible to see why mass unemployment arises. It is the introduction of State Money (which we define as government taxing and spending) into a non-monetary economics that raises the spectre of involuntary unemployment.

As a matter of accounting, for aggregate output to be sold, total spending must equal total income (whether actual income generated in production is fully spent or not each period). Involuntary unemployment is idle labour offered for sale with no buyers at current prices (wages).

Unemployment occurs when the private sector, in aggregate, desires to earn the monetary unit of account through the offer of labour but doesn’t desire to spend all it earns, other things equal. As a result, involuntary inventory accumulation among sellers of goods and services translates into decreased output and employment.

In this situation, nominal (or real) wage cuts per se do not clear the labour market, unless those cuts somehow eliminate the private sector desire to net save, and thereby increase spending.

So, the purpose of State Money is to facilitate the movement of real goods and services from the non-government (largely private) sector to the government (public) domain.

Government achieves this transfer by first levying a tax, which creates a notional demand for its currency of issue. To obtain funds needed to pay taxes and net save, non-government agents offer real goods and services for sale in exchange for the needed units of the currency. This includes, of-course, the offer of labour by the unemployed.

The obvious conclusion is that unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save.

This analysis also sets the limits on government spending. It is clear that government spending has to be sufficient to allow taxes to be paid. In addition, net government spending is required to meet the private desire to save (accumulate net financial assets).

It is also clear that if the Government doesn’t spend enough to cover taxes and the non-government sector’s desire to save the manifestation of this deficiency will be unemployment. Keynesians have used the term demand-deficient unemployment.

In the terminology of MMT, the basis of this deficiency is at all times inadequate net government spending, given the private spending (saving) decisions in force at any particular time.

For a time, what may appear to be inadequate levels of net government spending can continue without rising unemployment. In these situations, as is evidenced in countries like the US and Australia in the pre-crisis period, GDP growth can be driven by an expansion in private debt.

The problem with this strategy is that when the debt service levels reach some threshold percentage of income, the private sector will “run out of borrowing capacity” as incomes limit debt service. This tends to restructure their balance sheets to make them less precarious and as a consequence the aggregate demand from debt expansion slows and the economy falters. In this case, any fiscal drag (inadequate levels of net spending) begins to manifest as unemployment.

The point is that for a given tax structure, if people want to work but do not want to continue consuming (and going further into debt) at the previous rate, then the Government can increase spending and purchase goods and services and full employment is maintained. The alternative is unemployment and a recessed economy.

That is the context in which I agree with Summers about the cause of the current economic malaise.

In that sense, the concept of fiscal austerity is nonsensical in the extreme. It has to erode demand given that private spending is confidence driven and a declining economy saps confidence.

Further the widespread (global) nature of this crisis means that an export-led recovery is unlikely for any nation. Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

Summers then moves on to question why the US economy, which has previously “recovered robustly from recession as demand has been quickly renewed” not been able to do that this time.

His main hypothesis is that there is now “a glut of capital caused by over-investment during the period of confidence” and consumers with “less wealth than they expected, less collateral to borrow against and are under more pressure than they expected from their creditors”. In other words there is no incentive to spend by private households or firms.

His argument then establishes the case for the conservatives:

What, then, is to be done? This is no time for fatalism or for traditional political agendas. The central irony of financial crisis is that while it is caused by too much confidence, borrowing and lending, and spending, it is only resolved by increases in confidence, borrowing and lending, and spending. Unless and until this is done other policies, no matter how apparently appealing or effective in normal times, will be futile at best.

So after cataloguing the damage done by over-exuberant private borrowing driven by unrealistic expectations of long-term wealth – the narrative that the mainstream economists weaved in the pre-crisis period – Summers think that nothing can be done before that sort of confidence returns.

I completely disagree with that assessment.

The millions that have been rendered unemployed by the collapse in private spending and the inadequate fiscal response are lacking in confidence because they have no incomes. Their confidence picks up as soon as they have a job and a steady income.

The firms that might usually sell goods and services to this cohort are either bankrupt or bunkered down (not investing) because they have lost those sales. Their confidence picks up once their customers start coming back into their shops and factories receive orders again.

We do not need a renewed private debt spiral – credit binge – to make that happen.

Historically, when private spending has been flat and confidence subdued the gap has been filled by net public spending. The fiscal stimulus provided support for demand and kept people working. The direct public spending also helped firms maintain activities and stimulated confidence. The recovery then would move into overdrive as the firms began investing again.

Whenever fiscal austerity has been imposed at at time of general private spending malaise economic activity goes backward.

What is lacking at present is an adequate fiscal response – to target employment and provide the unemployed with jobs so they can spend and stimulate order books.

The US government could very effectively kick-start confidence by introducing a Job Guarantee – which would provide a socially reasonable minimum wage to any worker who wanted to work and couldn’t find a job. Please see the blogs that this search string generates for more information.

Private spending would resume very quickly and shops would start ordering again and confidence would improve. There is no doubt about that.

Handing out massive amounts to Wall Street bankers to keep their speculative activities intact is not a good way to stimulate private sector confidence.

Summers then goes from bad to worse even though he is trying to be “progressive”.:

The fiscal debate must accept that the greatest threat to our creditworthiness is a sustained period of slow growth. Discussions about medium-term austerity need to be coupled with a focus on near-term growth. Without the payroll tax cuts and unemployment insurance negotiated last autumn we might now be looking at the possibility of a double dip. Substantial withdrawal of fiscal stimulus at the end of 2011 would be premature. Stimulus should be continued and indeed expanded by providing the payroll tax cut to employers as well as employees. Raising the share of payroll from 2 to 3 per cent is desirable, too. These measures raise the prospect of sizeable improvement in economic performance over the next few years.

This is the “progressive” – Peter G. Peterson style – Roosevelt Institute style – Economic Policy Institute style.

There is no “threat” to US government creditworthiness. Summers is just joint the cacophony of idiots who want to beat up nothing to further their own aims.

There is no case to be made for fiscal austerity – now or later. The two dangers of poorly calibrated fiscal policy are: (a) mass unemployment – if deficits are too low – as they are now; (b) inflation – if deficits are too large.

Too low and too large in relation to what? Private spending and external spending. There is no sense that we can consider budget deficits as being too large or too small without reference to the state of private and external spending.

Trying to “judge” budget deficits in terms of some erroneous notion of fiscal solvency – which the current debate has become totally obsessed about while real issues like the entrenched unemployment are sidelined in the public debate – is a futile task. There is no threat of fiscal insolvency in the US arising from the intrinsic characteristics of the monetary system so why even spend any time debating it?

The politicians are engineering the growing possibility of a voluntary default (with all the negative consequences that that will bring) because they are actually advancing an ideological preference for small government. However, the underlying processes of the macroeconomy don’t dance to this ideology.

The macroeconomic health of a nation dances to spending and it doesn’t discriminate between private and public spending. How many times have you been asked when you go to the check out in the supermarket whether you work for a private employer or a public employer? Whether the dollars you are tendering were derived from a welfare cheque or a private salary? etc etc. Answer: never.

I thought it might be good to be reminded of some empirical matters given that Summers mentioned the closeness of the current US experience with that of Japan in the 1990s. We can agree with his analogy for the sake of discussion even though the similarities are not as close as he would suggest. The US is probably in much worse shape than Japan was in the early 1990s.

The latter was in a much stronger net exports position and was able to maintain relatively low unemployment. The US has not been able to maintain either.

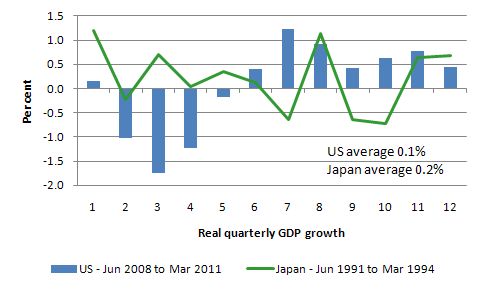

The following graph (taken from National Accounts data available from the US Bureau of Economic Analysis and the Japan’s Central Statistics Agency) show real quarterly GDP growth for the first 12 several quarters (the dates are shown). The data shows that Japan was able to growth at twice the rate (still very weak) of the US during the first three years of their “lost” decade and the amplitude of the downturn was more muted.

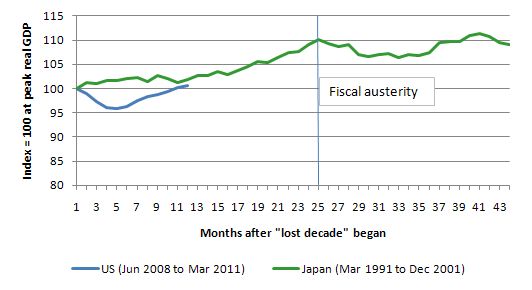

The following graph shows the evolution of real GDP growth for Japan and the US in index numbers. For the US the base year (100) was June 2008 (and the sample extends to March 2011) whereas for Japan it was March 1991 extending to December 2001 (that is, the lost decade).

The interesting aspect of this data is that the “lost decade” only became so around 1997 when the conservatives finally forced the government to invoke fiscal austerity (tax rises in this case were the most prominent manifestation).

The Japanese economy plunged back into negative growth and the automatic stabilisers drove the budget into a significant deficit. It was only after several more years of fiscal stimulus (re-applied) that the economy started growing again (only to be brought down by the global financial crisis).

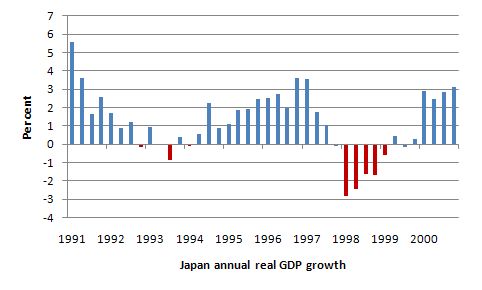

The impact of the 1997 fiscal austerity in Japan are clearly shown in this graph which charts real GDP growth (annually) from March 1991 to December 2000. The initial impact of the collapse of the property boom on real GDP growth was significant but dwarfed by what happened in 1997-98 when the Japanese government imposed fiscal austerity on the economy, which was still relatively weak as a result of the earlier crisis.

There is no doubt (from the credible research literature) that the fiscal multiplier was greater than one and by imposing austerity on the nation, the Japanese government undermined the growth rate and ensured that the 1990s would indeed become the “lost decade”.

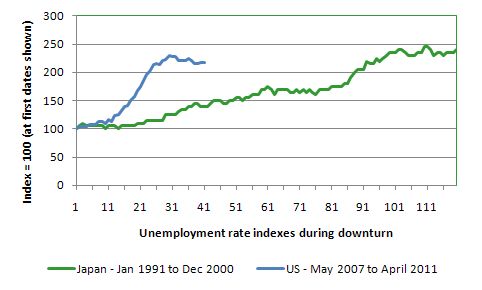

Finally, the following graph shows the unemployment rate comparison. These are indexes starting at 100 in January 1991 for Japan and May 2007 for the US. The period for Japan ends in December 2000 while for the US it is April 2011.

There is no doubt that unemployment rose in Japan and accelerated during the 1997 fiscal austerity phase. But in relative terms the deflation coming from the US unemployment situation compared to the 1990s experience of Japan is massive and a significant difference.

Providing jobs for the unemployed and preventing job loss should be a priority in any fiscal design. The US government failed badly in the current crisis in that regard. It should design a new fiscal stimulus which is jobs rich and targetted at the unemployed. The rest of the public debate at present is irrelevant to that requirement.

Conclusion

The lesson is there for other nations to follow. While Japan has many interesting (and special) cultural aspects that separate it from the West, there is nothing particularly special about way the Japanese economy reacts to aggregate demand fluctuations. Spending creates income and when it collapses – private or public – aggregate activity slumps and real output contracts.

At least the good news is that Mr Bass will be losing on his Japan bet.

That is enough for today!

“It is going to be brief today – it is a holiday in Australia. Queen’s Birthday no less. Can you believe that we are still under the yoke of our colonial masters?”

Look on the bright side. In the UK we’re subjects. We don’t even get a public holiday.

That was brief ?

On a slight tangent, can anybody with more knowledge of central bank balance sheets explain what is going on here.

http://blogs.cfr.org/geographics/2011/06/06/ausdollars/

Clearly there is an error of interpretation, but I’m not sure what it is.

Very interesting. So once the Japanese had a taste of austerity they obviously don’t fancy another round. The fiscal stimulus crowd can’t get a consensus to move forward either. A political stalemate with unemployment on a protracted plateau.

Has to be the template for what will happen in the US and UK. Human behavior is predictable, my major concern being the propensity to forment a major war under the circumstances.

Bill, Good post, but speaking as one of Her Majesty’s more argumentative subjects, I don’t agree that “the imposition of the taxation liability creates a demand for the government currency in the non-government sector which allows the government to pursue its economic and social policy program.”

Local governments impose a tax liability in most countries, and “pursue their social programs” without local government having its own currency, as do national governments in common currency areas. The power of local governments to do this stems from a general agreement, enshrined in the law, and agreed on by most of the population, that local government should have this power.

The state’s insistence that tax be paid in the state’s money certainly drives potential competitor currencies out of business, unless the state manages its currency in an incompetent manner, as was the case in Zimbabwe till recently. There, a sizeable proportion of business was done in U.S. Dollars, and so on. I.e. the above “insistence” just means the state’s money is dominant in the country concerned. But that’s it.

You also say “taxation functions to promote offers from private individuals to government of goods and services in return for the necessary funds to extinguish the tax liabilities.” I doubt that any building contractor or stationary supplier consciously bids for government contracts so as to extinguish their tax liabilities – they may not even have any such liabilities. They bid because they aim for profit.

It is true that the private sector has to acquire the state’s money so as to pay its taxes. But if the state offered below market price for the goods and services offered by the private sector, and used its powers to imprison private sector entities not paying tax in the state’s money, we’d get riots and revolution. Thus I don’t think the state’s power to extract tax “promotes offers from private individuals . . .” to supply the state with goods and services.

Neil, Its not an exchange rate thing is it?

Both currencies seemed to have crashed against the USD at the same time.

Did all the foreign assets just dive in value?

You say that taxation is the cause of unemployment but doesn’t rent collection by an “owning class” in the private sector act to reduce aggregate demand and create unemployment in exactly the same way? If taxes act to reduce the power to collect rent; then taxes could act to increase aggregate demand and reduce unemployment. Likewise increasing the deficit by cutting taxes in a way that further unleashes rent collecting could actually worsen unemployment. Lumping all types of taxes together makes no sense to me and so saying increasing the deficit helps employment makes no sense to me. What matters is the reduction in rent and tax together in aggregate and the type of tax is what determines that as much as the amount of tax.

Ralph;

I also had to scratch my head pretty hard when I first read this component of the theory. But it turns out to be foundational to the whole thing. It answers the otherwise unanswerable question as to why people accept the state’s intrinsically worthless money in the first place. (The mainstream answer – people accept it because other people accept it – is obviously no answer at all.)

Local taxation is out of scope – not at issue here. The issue is that the taxing authority of the central government – and the implicit threat of sanctions for non-payment – creates a stable, durable, predictable demand for the state’s fiat currency. And because everyone knows there will be such a demand for it, everyone (cranks and goldbugs notwithstanding) accepts it as the default store of value and medium of exchange.

I agree that the language seems awkward. I wish I could think of a better way to express it than through concepts like “creating unemployment by design”, which imputes consciousness to a process that doesn’t logically require conscious “design.” I’m pretty sure chartalist money predates chartalist consciousness, and the scarcity of MMT advocates in the public square is more than adequate testimony to a current rather acute shortage of the latter. But we have to express this somehow. The existence of the tax liability means that no one can do without the state’s fiat money. Everyone, without exception, must offer either existing real wealth or else labor in exchange for it. And since few people are wealthy, most are thereby rendered, however temporarily, “unemployed.” They must seek or undertake work remunerated in the currency of issue or face state sanctions.

Similarly, it is not the mindset or psychological state of any particular contractor or supplier that determines their collective economic relation to the state or its money. The question is why *anyone* is willing to fork over perfectly good stationary (or paint the Golden Gate bridge) in return for a number on a piece of worthless paper – or even just a number glowing dimly in a spreadsheet maintained by some bank. And again, whatever the proximate conscious motivation may be, the ultimate economic reason is that same stable, durable predictable demand for the only medium the state will accept at tax time. Sorry, no gold, silver, salt, cattle or cowrie shells.

I’m all for revolutions and think we need more of ’em, not less, so I won’t seek to dispute your final point. But just because modern-day governments don’t imprison very many people for non-payment, or use state repression to set a monopoly price, doesn’t mean it hasn’t frequently been done in the past. And this too is, I think, largely out of scope. I think governments can be just about equally repressive under a gold standard as they can be with a fiat monetary system.

Cheers

Bill,

Thank you so much for this blog! Recently I read more on what the mainstreamers think about macro (example: Mankiw’s paper about deficits: http://www.kansascityfed.org/publicat/sympos/1995/pdf/s95manki.pdf ), it is amazing how confused they are, and that I can see it so clearly. Thanks to this blog!

Keep up the great work.

How does MMT compare to Dani Rodrik’s thesis “The Globalization Paradox” ?

Seems one can become “sovereign” only by refusing to sign GATT ?

“They must seek or undertake work remunerated in the currency of issue or face state sanctions.”

In a modern economy you need paid work just to survive, to purchase food and shelter. Most people are not self-sufficient. Taxes help to explain why the government’s money is the preferred money, but it doesn’t have much to do with creating unemployment.

A nitpick on the Euro issue: all Euro zone countries are not the same. Germany, at least, is “sovereign” since German bonds are implicitly backed by the ECB (no matter what anyone says). Maybe French bonds too. It’s only the non-core Euro countries which have given up their currency powers.

Ralph and Dale,

Re: the “imposition of the taxation liability creates a demand for the government currency” as a “foundational” tenet of MMT

To approach your thoughts from a different angle, Ralph’s middle paragragh arrives at the functional essential: that the government is a monopolist currency issuer.

Taxation (and other transactions/conveyances where the government is the private sector’s counterparty, see below) needs to foster sufficient demand for the currency to establish the government as a monopoly currency issuer/supplier. I suppose “sufficient” is, like other goods markets’ establishment, around the point where effective demand for the currency crosses its marginal cost curve. Since a fiat currency is nearly costless for government to produce, the implication is that it doesn’t take ‘much’ of this money demand component to solidify a government’s status as monopoly issuer.

I don’t see this institutionally derived money demand component as obviating other functional demand components traditionally posed (e.g. market specified terms of trade requiring a medium of exchange, volume of private sector transactions to be accomodated, a ‘store of value’ asset category, etc.). Indeed, these components would probably normally be expected to comprise the bulk of the currency’s uses observed during a period.

In this vein, ‘catalytic’ might be a better descriptor for the tenet than ‘foundational’.

And, I think it remains to be worked out whether a ‘demand for money’ that encompasses all of these components is of any particular macro-theoretical interest under MMT constructs, as contrasted say with IS-LM diagramatics or the Quantity Theory World.

To explain the ‘government as counterparty’ aside above, I think that Bill could extend the tenet a bit (and change its flavor from purely (bitterly?) coercive–taxation– toward voluntarily (sweetly?) inducive). In particular, governments are grantors of property rights (and sometimes sellers of assets–financial and otherwise) needed to facilitate activity in the private sector. By requiring payment in the currency from those seeking to obtain such rights (e.g. licensures, registrations, corporate protections, ownership validations and property transfers, etc.), an additional ‘catalytic’ component of currency demand is induced.

And Dale, I concur with your scope observations regarding Ralph’s 21:37 comment.

Very nice post Bill. I have been a follower for a couple of years….you converted me from being a believer in the false religion of balanced budgets to lucid insights of Sectoral Balance method and MMT.

There is one very important issue that I wonder if you would address….If a population finally realizes the secret behind money and taxes, meaning that it can be printed at will and does not constrain a government, what rationale or moral suasion can a government use to constrain the demands for ever increasing wages and prices from the public unions it employs and the private contractors it uses. What measures should it use to constrain private credit growth (once the economy reaches a very high level of employment and prosperity is widespread)? The capacity of the real economy to grow is alwasy slower than the growth capacity of debt based inflation.

Thank you for your thoughts.

what rationale or moral suasion can a government use to constrain the demands for ever increasing wages and prices from the public unions it employs and the private contractors it uses.

Forget moral, guns usually do the job.

Dale, You deny that money has value because “people accept it because other people accept it”. I don’t agree.

For example take commodity based forms of money: like those bronze axe heads which were used in the bronze age in Europe as a form of money. Obviously the intrinsic value of the metal contributes to the currency’s value. But the fact that everyone knows that everyone else will accept axe heads in settlement of debts also contributes.

Also, I don’t deny that the state’s power to tax and its insistent that tax be paid in the state’s money gives that form of money its value. I made two points. First, (contrary to what Bill said) it is not the “tax gives money its value” point that enables the state to pursue its social agenda.

As an example, I cited local government, because the latter pursues a social agenda without creating its own currency.

Second, I questioned Bill’s claim that “taxation functions to promote offers from private individuals to government of goods and services”. The flaw in that idea can be illustrated by the fact that private sector businesses would bid for government contracts even if government raised no tax at all, and got all its money from government owned businesses (and/or from seigniorage, which actually forms a small but not totally insignificant portion of modern governments’ incomes).

Put another way, people go out to work to acquire money so as to “promote offers” from supermarkets, house builders, and so on. I.e. tax just happens to be government’s form of income and going out to work is the average person’s source of income. The “promote offers” point is vacuous, I think.

Lee Rosin, I agree with your point that “it doesn’t take ‘much’ of this money demand component to solidify a government’s status as monopoly issuer.” I also I think I agree with your point that the “tax gives the state’s money its value” idea is catalytic rather than foundational. I’m not 100% sure what you mean by that, but what I mean is as follows.

Money arises automatically in any half sophisticated economy. E.g. the above mentioned bronze age axe heads: and in German prisoner of war camps in WWII inmates used cigarettes as money. These forms of money have obvious disadvantages, thus it does not take much for the state to set up a more efficient system, i.e. to build on everyone’s inherent desire for a form of money.

“Money arises automatically in any half sophisticated economy.”

It does, but it also disappears when the economy hits any stress. Since taxation continues that stops the money disappearing under stress points. When not under stress all your other points are of course valid.

Local taxation is a delegated authority and enforcing that ensures there remains a demand for that particular form of money (and therefore a value) even if all the other reasons for money stop working or don’t work so well.

Even taxation by a private entity would do the trick I’d suggest. A church tithe for example.

Taxation is essentially a particular money’s ‘value of last resort’.

@Neil,

Dont know if you have yet recd a respnse to your link..

When Lehman went and the Fed opened the swap lines for USD Sweden was part of it.

I belive the way those worked was banks in sweden posted domestic collateral at the Sweden CB and the Sweden CB arranged for the US Fed to supply the Swedish banks USD. So the Sweden CB domestic assets would rise. Perhaps since the Fed held the Sweden CB reponsible for repayment, the Sweden CB had to book a USD liability so that would net out as lower USD net assets.

Perhaps the same type of thing occurred in the Australian system.

There seems to be a lot of chatter out there on these issues, Tom posted a link to a Fed Watch blog around a similar issue at Mike’s here:

http://mikenormaneconomics.blogspot.com/2011/06/tim-duy-unemployment-or-currency-crisis.html

@Ramanan, If you have time, can you take a look at the thread at Mike’s please? Resp,

Dear Matt Franko (at 2011/06/14 at 21:17)

I cover these topics in response to Neil Wilson’s request in today’s blog.

best wishes

bill

ps I hope you are still carrying your “sectoral balances” placard wherever you go!

Ralph (@19:30),

‘Catalytic’ in the sense that it may be quantitatively small, and relatively unaffected by the processes swirling around it, but that other elements can not interact or will interact only weakly if it is not present.

With regard to your “Money and Cigarettes” (H/T to Clapton) interpretation closing your post…

“Money arises automatically in any half sophisticated economy. E.g. the above mentioned bronze age axe heads: and in German prisoner of war camps in WWII inmates used cigarettes as money. These forms of money have obvious disadvantages, thus it does not take much for the state to set up a more efficient system, i.e. to build on everyone’s inherent desire for a form of money.”

…I don’t think money ‘automatically arises’ or that it is built upon ‘inherent desires’. I think it is just that societies (even very closed ones like POW camps) develop methods that facilitate human interaction, one facet of which is exchange. That having a medium of exchange makes such interaction (which probably is “inherent”, instinctual) more satisfactory is a (maybe easily?) learned societal trait, as it appears to me. The idea of money, in its many forms and gradations, has been discovered (or found via cultural transfer) to be an extremely useful tool that facilitates exchanges. It is an idea that is now widely and deeply embedded in our cultures, and we can be highly confident that it will appear as a societal solution when methodological frameworks for exchange are instituted, but I don’t think that means it is or was “automatic”. That some form of money will arise as a medium of exchange is just a safe assumption, IMO.

But I also think that we are venturing off blog topic and into Robinson Crusoe-land type swamps by pursuing this ‘ultimate provenance of money’ line of thought. The form of money (fiat) deployed (by a sovereign issuer) is what is central to the MMT perspective, and its catalytic attribute is of functional importance. That is why I tried to identify the various components of a demand for money in my earlier post, because I think the the ‘catalytic’ component explained in an MMT context is both functionally unique and logically precedent to the other components. While the other components may be of interest across a more generalized economics, I don’t yet see how an overall demand for money vs. supply of money analysis is a necessary element of MMT (essentially fiscal) analysis. My hunch (maybe Bill already has this worked out) is that if we extend toward a “general” theory, conditions in the ‘money market’ (and/or a priori money stocks and private sector asset compositions and leverage and bank capitalization and lending rules) have intraperiod feedback or causation relevance with respect to private sector circular flow activity. That hunch is therefore why I also suggested a while back that there could be some very powerful insight to be gained in a more formal synthesis with Minsky/Keen views (the banking system’s credit impulse, net private borrowing (or probably a subset of that amount) as an element of GDP accounting, etc.). I think that path toward generalization will put some policy arrows in the quiver to use on that happy day when we escape the liquidity trap.

Matt,

The graph in “Tim Guy’s Fed Watch” is plotting “Line 55” (Row 66 of in the worksheet “Qtr – NSA” from the workbook from the BEA: http://bea.gov/international/xls/table1.xls

i.e., http://research.stlouisfed.org/fred2/series/BOPIN plotted by Tim Guy takes data from the BEA.

So no stock-flow inconsistency there because these are flows in the financial account. (“Change in Stocks of xyz”).

So it seems like while foreigners, especially central banks were buying Treasuries massively, they (others) were selling other assets.

On the other hand, US was repatriating funds at a massive scale as well. “Line 40” (Row 51 in Excel). This item is usually negative (by convention) and means that the US is purchasing securities issued abroad. It turns positive in 2008 Q2 and is positive for 5 quarters.

Of course there are statistical discrepancies in all this 🙁

@Bill, Sorry I hadnt got to read your new blog for today by the time I posted to Neil, and Yes I still have my sign and now a bumper sticker for my car! and if I can ever win the lottery here in US, I will rent a blimp and fly it over Peterson’s house! 😉 Resp,

@Ramanan thanks, Ramanan, If you look at that xls that flow at line 55 is positive by 273B for the latest quarter (4th q 2010) but I dont believe the US trade deficit for that quarter was $273B, it was much less… so do you know how could foreigners accumulate more USD assets here in the US than the external deficit for the quarter? (I think it is net) Resp,

you have to add line 40 (negative number) to line 55

Matt,

As Anon says, you have to add line 40 to line 55. There are statistical discrepancies – line 71.