I have received several E-mails over the last few weeks that suggest that the economics…

US labour market in decline – leadership gone missing

The US Bureau of Labor Statistics published the latest labour force data on Friday and the results can be summarised in one word – shocking. Meanwhile the so-called US political leadership met at the White House to determine how they could make sure the US labour market deteriorated even faster than the latest BLS data shows it is. Other senior White House officials appeared on American TV networks engaging in what can only be related to early teenage male behaviour – ours will be bigger than our opponents. The ours being the trillions they plan to cut from the US federal deficit. With the US labour market in clear decline and the top level talks being about trillions of cuts in public spending you can only conclude one thing – the US leadership has gone missing.

Take a look at the failed leadership of the US. This picture shows President Obama and the congressional leadership at the White House on July 7, 2011 sipping tea and other drinks while discussing how they can make the labour market even worse than it currently is by large cuts in net public spending. None of these people deserve to be in public office.

On the US program Meet the Press (July 10, 2011), the US Treasury secretary made the following comment when discussing the deficit reduction talks. It disqualifies him from his job on the basis of not being qualified:

SEC’Y GEITHNER: Well, this is hard. You know, it’s politically very hard. But this is a grave moment for the country, and we need to do something very big, very substantial to bring our long-term deficits down over time. We have to do that in a way that’s good for the economy, so we give more support to this economy that’s still healing from the great recession. And it’s going to require both sides to compromise. The president’s bringing leaders together again at the White House this evening to try to figure out how, how to move forward …

The president wants to do the right thing for the country and he recognizes to do the right thing, you have to try and do the biggest, most substantial deal possible, the deal that’s going to be best for the economy.

The credit rating agencies around the world have said if Congress doesn’t act by the 2nd, they will put our–they will downgrade our credit, first time in history, and if that happens, you’re going to see catastrophic damage across the American economy and across the global economy.

He also said that “We still have millions and millions of Americans out of work, and the most important thing we can do is to make sure we’re taking steps to get people back to work as quickly as we can”.

And how does the Administration plan to get people in work as quickly as possible? Another senior White House official turned his hand to the question.

Over on the rival network ABC during the This Week program (July 10, 2011) the White House chief of staff Bill Daley was also making a fool of himself and publicly disqualifying himself from further duty on the basis of not being qualified.

He said that:

This president is committed to bringing economic soundness to this country, and that takes a big deal … [a bigger deficit reduction than proposed by the Republicans and] … this is the time to do it. Everyone agrees that a number around $4 trillion is the number that will make a serious dent on our deficit … It will send a statement to the world that the U.S. has gotten hold of their problems, fiscal problems, and they’re moving forward. And it’ll give confidence to the American people, give confidence that we can then move forward over the next number of years to bring economic soundness.

And to top that he said:

Everyone agrees that a number around $4 trillion is the number that will make a serious dent in our deficit … He didn’t come to this town to do little things. He came to do big things.

How do you respond to that lunacy? Neither senior official demonstrates that they grasp basic macroeconomics:

1. Spending equals income. If private spending is lagging then public spending has to fill the gap. Otherwise output and employment growth will be sluggish if not negative.

2. To eat into the large idle labour pool, employment growth has to be faster than labour force growth, which means that real GDP growth has to be faster than the sum of labour force and labour productivity growth.

These facts a very simple and indisputable. Cutting public spending “at this time” is the last thing the US government should be doing.

Especially when you consider the latest labour market data from the BLS.

I last calculated what economists call Transition Probabilities for the US labour market in April 2011 (once the data for March 2011 was released by the US Bureau of Labor Statistics was released). Please read my blog – Are things improving for US workers? – for more discussion of that analysis. To fully understand the way gross flows are assembled and the transition probabilities calculated you might like to read these blogs – What can the gross flows tell us? and More calls for job creation – but then. For earlier US analysis see this blog – Jobs are needed in the US but that would require leadership

Transition probabilities are calculated from Gross labour flows data which is available from the US Bureau of Labor Statistics. By way of refreshing your understanding, gross flows analysis allows us to trace flows of workers between different labour market states (employment; unemployment; and non-participation) between months. So we can see the size of the flows in and out of the labour force more easily and into the respective labour force states (employment and unemployment).

The various inflows and outflows between the labour force categories are expressed in terms of numbers of persons which can then be converted into so-called transition probabilities – the probabilities that transitions (changes of state) occur. We can then answer questions like: What is the probability that a person who is unemployed now will enter employment next period?

So if a transition probability for the shift between employment to unemployment is 0.05, we say that a worker who is currently employed has a 5 per cent chance of becoming unemployed in the next month. If this probability fell to 0.01 then we would say that the labour market is improving (only a 1 per cent chance of making this transition).

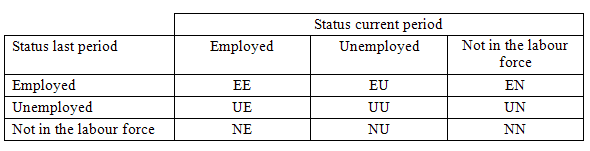

The following table shows the schematic way in which gross flows data is arranged each month – sometimes called a Gross Flows Matrix. For example, the element EE tells you how many people who were in employment in the previous month remain in employment in the current month. Similarly the element EU tells you how many people who were in employment in the previous month are now unemployed in the current month. And so on. This allows you to trace all inflows and outflows from a given state during the month in question.

The transition probabilities are computed by dividing the flow element in the matrix by the initial state. For example, if you want the probability of a worker remaining unemployed between the two months you would divide the flow (U to U) by the initial stock of unemployment. If you wanted to compute the probability that a worker would make the transition from employment to unemployment you would divide the flow (EU) by the initial stock of employment. And so on.

So for the 3 Labour Force states we can compute 9 transition probabilities reflecting the inflows and outflows from each of the combinations.

Analysing movements in these probabilities over time provides a different insight into how the labour market is performing by way of flows of workers.

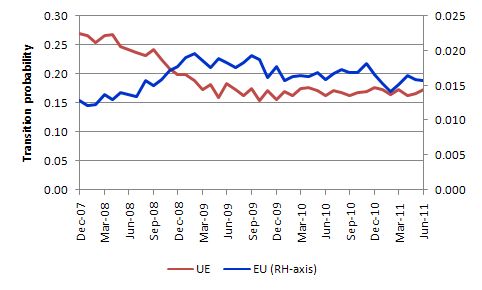

I thought this graph was interesting – it shows the transitions for EU and UE from December 2007 (when the crisis hit the US labour market) up to June 2011.

What you see in that graph is that the probability of an American (in general) losing their job if employed (blue line) rose throughout 2008 and then slowly evened out and is stuck at around 1.6 per cent (after reaching a high of 1.9 per cent in May 2009). The chance of an unemployed American worker gaining employment fell over the same period and has scudded along at around 17 per cent since early 2009. However, in recent months that likelihood has fallen sharply.

When I see behaviour like this the only conclusion is that the recovery has stalled and America is stuck in a vicious cycle of flat private spending and confidence and an unwillingness of the US government to stimulate sufficiently to fill the gap and create work.

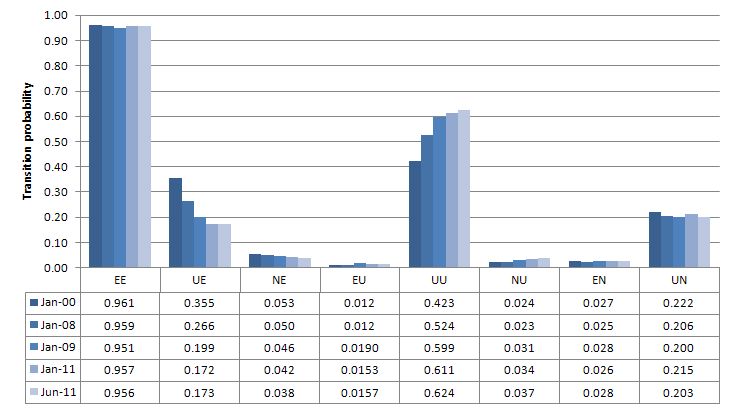

The second graph compares the US transition probabilities for various months during the crisis up until Hy 2011 (see the accompanying Table for values). The data is from the US Bureau of Labor Statistics. I also include the January 2000 observation which is the month when the chances of leaving unemployment for employment (UE) was the highest in this data set (since 1990).

Several points by way of interpretation can be made.

First, the data shows that the slight improvement in the EE probability over 2010 – that is, the likelihood an employment person will remain employed in the next month (not necessarily with the same employer though) – is now reversing. So the probability of remaining employed is falling once again..

Second, in terms of the previous graph which showed that the probability of EU (employment to unemployment) had fallen slightly in 2011, the way to understand these two trends is to realise that the probability of EN has also risen over 2011.

That is, workers are not as likely to retain employment now relative to earlier in 2011 but are now increasingly likely to flow out of the labour force once they lose their jobs – that is, they become hidden unemployed.

Third, the likelihood of a new entrant getting a job (NE) has now falling quite dramatically relative to earlier this year. The new entrants are much more likely to become unemployed (NU) than employed (NE).

Fourth, the probability of an unemployed worker remaining unemployed (UU) has risen sharply in recent months. Compared to January 2000 when the probability was 42.3 per cent, the value is now 62.4 per cent and rising. That is a very bleak outlook.

Fifth, relative to the start of 2011, the likelihood of an employed worker losing their job has risen sharply.

But the important point to note is that the value for January 2000 was a peak (0.355) and the transition probability has been declining in waves since then. A worker now has around 1/2 the chance of gaining work compared to that peak.

In Australia this probability is currently around 25 percent.

Overall, the data suggests the slight improvement in the US labour market during 2010 is evaporating.

The BLS Employment Situation data for June 2011 showed that:

- Nonfarm payroll employment was essentially unchanged in June

- In June, average hourly earnings for all employees on private nonfarm payrolls decreased by 1 cent to $22.99

Moreover, the BLS reported that:

The change in total nonfarm payroll employment for April was revised from +232,000 to +217,000, and the change for May was revised from +54,000 to +25,000.

In other words, the previous “optimism” was based on inflated data estimates.

This data is based on the establishment survey. The BLS also conduct a population-based survey – the CPS – to provide estimates of the labour market performance.

The BLS explain why there are two monthly measures of employment.

The household survey and establishment survey both produce sample-based estimates of employment and both have strengths and limitations. The establishment survey employment series has a smaller margin of error on the measurement of month-to- month change than the household survey because of its much larger sample size. An over-the-month employment change of about 100,000 is statistically significant in the establishment survey, while the threshold for a statistically significant change in the household survey is about 400,000. However, the household survey has a more expansive scope than the establishment survey because it includes the self- employed, unpaid family workers, agricultural workers, and private household workers, who are excluded by the establishment survey. The household survey also provides estimates of employment for demographic groups.

If you examine the Current Population Survey (CPS) estimates the following results are apparent:

1. CPS employment was 139779 thousand in May but fell to 139334 thousand in June – that is a fall of 445 thousand net jobs.

2. CPS estimates of unemployment rose from 13,542 thousand in March 2011 to 14087 in June 2011 – a rise of 545 thousand. In the last month alone 173 thousand extra workers have been added to the unemployment queue.

3. CPS Labour participation rate estimates fell from 64.2 per cent to 64.1 per cent – the lowest since 1984.

4. The unemployment rate for teenagers is 24.5 percent in June 2011.

5. The employment-population ratio decreased by 0.2 percentage point to 58.2 percent.

That is a very bad sign – falling participation (that is, rising hidden unempoyment – refer back to the flows analysis above) and falling employment growth. The combination of those developments signals a failing labour market.

My conclusion – the current policy framework – emphasising fiscal austerity – has failed. There is not enough public spending targetted on creating jobs.

You might also like to read this blog by Marshall Auerback – Time to Panic – which analyses the same data.

You may also like to read this BLS publication (released May 2011) – How long before the unemployed find jobs or quit looking? which bears on our discussion here.

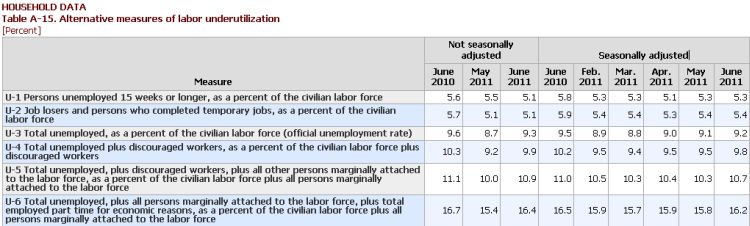

Finally, the BLS – Table A-15. Alternative measures of labor underutilization show that in terms of broader indicators of labour wastage the US is heading back to where it was mid-2010 and the situation is deteriorating fast.

This data is consistent with the trends in the transition probabilities discussed above – there is now more activity going on of a negative type between the “labour force” and “not in the labour force” categories as workers give up looking for jobs that are not being created.

The rise in hidden unemployment completes the vicious cycle of inadequate growth, rising unemployment and falling participation rates.

In this context I have no disagreement with Paul Krugman’s (July 10, 2011) – No, We Can’t? Or Won’t? – when he says:

If you were shocked by Friday’s job report, if you thought we were doing well and were taken aback by the bad news, you haven’t been paying attention. The fact is, the United States economy has been stuck in a rut for a year and a half … So let’s summarize: The economy isn’t fixing itself. Nor are there real obstacles to government action: both the bond vigilantes and structural unemployment exist only in the imaginations of pundits. And if stimulus seems to have failed, it’s because it was never actually tried.

Listening to what supposedly serious people say about the economy, you’d think the problem was “no, we can’t.” But the reality is “no, we won’t.” And every pundit who reinforces that destructive passivity is part of the problem.

The national government in a sovereign nation (currency issuing with floating exchange rate) always chooses the national unemployment rate. Not sometimes, but always.

The private sector spending decisions are what they are in any particular period and are based on consumers making decisions about saving and firms forming expectations (guesses) about the decisions being made by consumers, which they then base production and investment decisions on.

Typically, and especially if the current account is in deficit, the separately determined private spending decisions leave space for the government to net spend. Space is defined in terms of real productive resources that the public spending brings into use as opposed to leaving them idle in – unemployment, underemployment, and/or hidden unemployment.

So the national government chooses the unemployment rate. It can always generate enough jobs. There are always enough productive jobs to that can be done – the issue is if they will be funded.

When you hear that – there is no more fiscal room left to provide these funds – you should reject that neo-liberal logic immediately. The only constraints on the national government are the real resources available – US-style labour underutilisation rates (over 16 per cent again) tell us that there are millions of real productive resources available – the American workers who are idle in one way or another!

All other constraints that people allege are ideologically-imposed on the Government by those who have a vested interest in abandoning full employment. All the budget constraints are voluntary.

The big thing that the US government can do is to ensure it is maximising the potential of its population. The sustainable goal should be the zero waste of people! This at least requires the state to maximise employment – which means provide work for all those who desire work at the current wages.

It should not mean anything less than that.

So once the private sector has made its spending based on its expectations of the future, the government has to render those private decisions consistent with the objective of full employment.

The non-government sector typically desires to save over the business cycle. What does this imply? Answer: there will be some drain from current income out of the next aggregate demand (spending) cycle.

Non-government spending gaps over the course of the cycle can only be filled by the government.

The national government always has a choice:

- Maintain full employment by ensuring there is no spending gap – that is run budget deficits commensurate with non-government surpluses; OR

- Maintain some slack in the economy (persistent unemployment and underemployment) which means that the government deficit will be somewhat smaller and perhaps even, for a time, a budget surplus will be possible.

It is here that I always make the distinction between a “bad” versus a “good” deficit and the distinction rests on understanding the automatic stabilisers.

The automatic stabilisers ultimately close spending gaps because falling national income ensures that that the leakages equal the injections – which means that the sectoral balances hold.

But in a period of spending decline, the resulting deficits will be driven by a declining economy and rising unemployment. Fiscal sustainability is about running good deficits to achieve full employment if the circumstances require that. You cannot define fiscal sustainability independently of the real economy and what the other sectors are doing.

The automatic stabilisers make a mockery of rule-driven budget targets. Once we focus on financial ratios – deficit to GDP ratios – public debt ratios – we are effectively admitting that we do not want government to take responsibility of full employment (and the equity advantages that accompany that end). That is why fiscal rules as stand-alone goals are meaningless or ideological.

Any financial target for budget deficits or the public debt to GDP ratio can never represent sensible policy conduct. The budget outcome is largely endogenous and thus driven by private spending decisions. It is highly unlikely that a government could actually hit some previously determined target if it wasn’t consistent with the public purpose aims to create full capacity utilisation.

In discussions of austerity there are often incompatible goals specified by proponents. The classic is their claim that austerity will allow both the private and public sector to reduce debt, when there is an external deficit. That is an impossible troika.

A national government in a fiat monetary system has specific capacities relating to the conduct of the sovereign currency. It is a monopoly issuer, which means that the government can never be revenue-constrained in a technical sense (voluntary constraints ignored). This means exactly this – it can spend whenever it wants to and has no imperative to seeks funds to facilitate the spending.

The real question is what are the limits on government spending? While a sovereign government is not financially constrained it is nonetheless constrained in real terms. It can only buy what is available for sale. Unemployment is a sign that at least one resource is available for sale – basis of buffer stock policies – Job Guarantee.

Conclusion

The American government should go back to basics and learn these simple points. Their nation would be a lot better off if they did.

The numbers that appear in budget statements are not costs. The cost of a program are the extra real resources required for implementation. Persistently high unemployment means an abundance of underutilised real resources available – which means the opportunity costs are very low to non-existent.

That is enough for today!

As Unemployment Spikes, Obama’s Got a Bigger Problem Than the Debt Ceiling -thenation.com

…

“David Plouffe, the president’s political czar, said on the eve of the release of Friday’s dismal jobs numbers that he does not believe that the high unemployment rate poses a threat to President Obama’s 2012 re-election campaign.

Speaking to reporters this week, Plouffe said, “The average American does not view the economy through the prism of GDP or unemployment rates or even monthly jobs numbers. People won’t vote based on the unemployment rate, they’re going to vote based on: ‘How do I feel about my own situation? Do I believe the president makes decisions based on me and my family?’ ”

…

Obama is toying with the notion of running for reelection as the president who did what George Bush could not: cut Medicare, Medicaid and Social Security.

That calculus suggests that Obama and his team really are out of touch with the electoral dynamic.

…”

It should be clear by now, that President Obama and his minions in the US administration are Undercover Republicans. But Mister Obama must be more careful! Weekly quoting Ronald Reagan might blow his cover.

An off topic question: MMT claims that the market buys bonds because they provide risk free interest above what the reserves pay, so will always be in demand.

But recently, the Treasure sold bonds at 0.000%, while reserve balances earn .25% interest. Why would someone swap a .25% interest paying instrument for slightly less liquid one, paying less interest?

http://mikenormaneconomics.blogspot.com/2011/07/treasury-auctions-24b-in-182-day.html

Thought this was interesting regarding automatic stabalisers in the US at the moment:

http://www.nytimes.com/2011/07/11/business/economy/as-government-aid-fades-so-may-the-recovery.html?_r=2&hp

“An extraordinary amount of personal income is coming directly from the government.

Close to $2 of every $10 that went into Americans’ wallets last year were payments like jobless benefits, food stamps, Social Security and disability, according to an analysis by Moody’s Analytics. In states hit hard by the downturn, like Arizona, Florida, Michigan and Ohio, residents derived even more of their income from the government.”

Well said Bill. Let their be no mistake this is a leadership failure. Policymakers are only as good as the advisors they have around them. Obama will never come up with solutions with the misinformed groupthink of his administration. Operationally his advisors are failures. These are structural failures because they lack understanding of monetary operations and how to properly structure a private banking system. Look at their recommendations and look at where we are. As brother Cullen says, this would be laughable if it wasn’t so painfully. We we are saddled on the back of sheep heading for a cliff. We need James Galbraith, William K. Black, Brother Bill Mitchell and Warren Mosler on the presidential economic advisors committee. Brand names leading us in a brand new direction.

You may recall one Newton D. Baker, attorney for the Fed and numerous banks, with glittering Wilson Progressive credentials. Al Smith, of the DuPonts, couldn’t block FDR, so he started to throw his people to Baker, the fake Progressive, who a lot of bankers liked. That provoked Hearst to pull Garner out of the race and throw it to FDR. In 2008, the bankers put the modern version of Baker over. That’s all. This guy is going to sell everything to anybody with money.

I will, for the first time in my life, not vote in the presidential election, since it’s now clear that it doesn’t matter who I vote for. Both the Republican and the Democratic parties are owned by the economic elites of the country.

@ Peter

I asked Warren Mosler about that. Apparently many market participants — pension funds and the like — don’t have access to reserves that turn over market support-rate revenue. They also cannot put their cash their uninsured bank accounts (above a certain amount of money bank accounts are not insured). So they need safe assets that are reasonably liquid. Hence, short-term treasury bonds often yield 0%.

Hi Bill

can you please offer an explanation as to why your research and enlightened, accurate views have not been taken up by the mainstream? I mean, you are a high-profile economist with obvious national influence, you engage publicly with economics in both the national media and private business and unions seek your counsel. Truly, I don’t understand. If I were a fan of crime fiction, I’d suggest that some subplot of intrigue and subterfuge were hard at work behind the lines to keep you muzzled!! Seriously, though, I don’t get it. You have a wide readership (I know of at least ten others at this uni who read your blog).

Further to what was said in the comments on last Saturday’s quiz page, we do indeed hope the Mitchells come south.

You have many fans down here (it’s a pity more don’t contribute to the debate you facilitate) – but hey, I’ll work on them!!

cheers

Max