Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – August 13, 2011 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

In the recent British riots, a common claim has been that the rioters were unemployed youth on income support benefits who were living off the hard work of those who pay taxes. This claim has validity.

The answer is True.

Dispensing with the emotional trappings that this sort of claim might invoke (that is, judging individual motivation etc), this question explores the true relevance of the dependency ratio, which will rise as demographic changes age our populations. It also aims to disabuse the reader of the notion that the income support benefits are paid for by taxes that those in employment (and other income generating activities) might pay.

Initially, we have to be very clear as to what “living off the hard work of those who pay taxes” means. In this sense, it is not a focus on the “income” that the non-workers receive but the command over real good and services that that income provides them with. We will come back to the “funds” issue soon.

So the focus has to be on the real side of the economy because that is, ultimately, the only way our material living standards can be expressed. Nominal aggregates mean very little by themselves.

Income support recipients (who do not work – for whatever reason) clearly command real resources that they have not themselves produced. These real goods and services are produced by those who do work (and the presumption is that most workers pay taxes of some sort or another).

The use of the emotive term “living off the hard work” was deliberate and designed, as a foil, to invoke the idea that governments have created welfare states which provide unsustainable benefits to the poor and marginalised at the expense of those who are materially successful – the classic conservative argument against government welfare provision.

But it doesn’t alter the truth of the statement.

A slight complicating factor is that the income support recipients also pay taxes if there are indirect tax systems in place but that doesn’t alter the story about the provision of real goods and services.

Now the second part of the answer relates to the question of funding. In terms of where the funds come from to provide the income support for those who do not work the answer is simple: no-where.

While taxation raises revenue for national governments it doesn’t “fund” its spending. Currency-issuing governments can spend without revenue should they wish to.

Abba Lerner’s 1951 book The Economics of Employment was really a rewritten version of the 1941 article The Economic Steering Wheel where he elaborated his version of Keynesian thinking. He conceptualised macroeconomic policy as being about “steering” the fluctuations in the economy. Fiscal policy was the steering wheel and should be applied for functional purposes. Laissez-faire (free market) was akin to letting the car zigzag all over the road and if you wanted the economy to develop in a stable way you had to control its movement.

This led to the concept of functional finance and the differentiation from what he called sound finance (that proposed by the free market lobby). Sound finance was all about fiscal rules – the type you read about every day in the mainstream financial press. Sound finance is about balancing the budget over the course of the business cycle and only increasing the money supply in line with the real rate of output growth; etc – noting the approach erroneously assumes the central bank can control the money supply.

Lerner thought that these rules were based more in conservative morality than being well founded ways to achieve the goals of economic behaviour – full employment and price stability.

He said that once you understood the monetary system you would always employ functional finance – that is, fiscal and monetary policy decisions should be functional – advance public purpose and eschew the moralising concepts that public deficits were profligate and dangerous.

Lerner thought that the government should always use its capacity to achieve full employment and price stability. In Modern Monetary Theory (MMT) we express this responsibility as “advancing public purpose”. In his 1943 book (page 354) we read:

The central idea is that government fiscal policy, its spending and taxing, its borrowing and repayment of loans, its issue of new money and its withdrawal of money, shall all be undertaken with an eye only to the results of these actions on the economy and not to any established traditional doctrine about what is sound and what is unsound. This principle of judging only by effects has been applied in many other fields of human activity, where it is known as the method of science opposed to scholasticism. The principle of judging fiscal measures by the way they work or function in the economy we may call Functional Finance …

Government should adjust its rates of expenditure and taxation such that total spending in the economy is neither more nor less than that which is sufficient to purchase the full employment level of output at current prices. If this means there is a deficit, greater borrowing, “printing money,” etc., then these things in themselves are neither good nor bad, they are simply the means to the desired ends of full employment and price stability …

Mainstream advocacy of fiscal rules that are divorced from a functional context clearly do not make much sense even though their use dominates public policy these days. It may be that a budget surplus is necessary at some point in time – for example, if net exports are very strong and fiscal policy has to contract spending to take the inflationary pressures out of the economy. This will be a rare situation but in those cases I would as a proponent of MMT advocate fiscal surpluses.

Lerner outlined three fundamental rules of functional finance in his 1941 (and later 1951) works.

- The government shall maintain a reasonable level of demand at all times. If there is too little spending and, thus, excessive unemployment, the government shall reduce taxes or increase its own spending. If there is too much spending, the government shall prevent inflation by reducing its own expenditures or by increasing taxes.

- By borrowing money when it wishes to raise the rate of interest, and by lending money or repaying debt when it wishes to lower the rate of interest, the government shall maintain that rate of interest that induces the optimum amount of investment.

- If either of the first two rules conflicts with the principles of ‘sound finance’, balancing the budget, or limiting the national debt, so much the worse for these principles. The government press shall print any money that may be needed to carry out rules 1 and 2.

So in an operational sense, taxation serves to reduce the spending capacity of the non-government sector to ensure that there is non-inflationary space for government to deliver public services. It doesn’t fund anything.

You might like to read these blogs for further information:

- I just found out – state kleptocracy is the problem

- Functional finance and modern monetary theory

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

Question 2:

The automatic stabilisers operate in a counter-cyclical fashion and ensure that the government budget balance, which rises during a recession, returns to its appropriate level once growth resumes.

The answer is False.

The factual statement in the proposition is that the automatic stabilisers do operate in a counter-cyclical fashion when economic growth resumes. This is because tax revenue improves given it is typically tied to income generation in some way. Further, most governments provide transfer payment relief to workers (unemployment benefits) and this increases when there is an economic slowdown.

The question is false though because this process while important may not ensure that the government budget balance returns to its appropriate level.

The automatic stabilisers just push the budget balance towards deficit, into deficit, or into a larger deficit when GDP growth declines and vice versa when GDP growth increases. These movements in aggregate demand play an important counter-cyclical attenuating role. So when GDP is declining due to falling aggregate demand, the automatic stabilisers work to add demand (falling taxes and rising welfare payments). When GDP growth is rising, the automatic stabilisers start to pull demand back as the economy adjusts (rising taxes and falling welfare payments).

We also measure the automatic stabiliser impact against some benchmark or “full capacity” or potential level of output, so that we can decompose the budget balance into that component which is due to specific discretionary fiscal policy choices made by the government and that which arises because the cycle takes the economy away from the potential level of output.

This decomposition provides (in modern terminology) the structural (discretionary) and cyclical budget balances. The budget components are adjusted to what they would be at the potential or full capacity level of output.

So if the economy is operating below capacity then tax revenue would be below its potential level and welfare spending would be above. In other words, the budget balance would be smaller at potential output relative to its current value if the economy was operating below full capacity. The adjustments would work in reverse should the economy be operating above full capacity.

If the budget is in deficit when computed at the “full employment” or potential output level, then we call this a structural deficit and it means that the overall impact of discretionary fiscal policy is expansionary irrespective of what the actual budget outcome is presently. If it is in surplus, then we have a structural surplus and it means that the overall impact of discretionary fiscal policy is contractionary irrespective of what the actual budget outcome is presently.

So you could have a downturn which drives the budget into a deficit but the underlying structural position could be contractionary (that is, a surplus). And vice versa.

The difference between the actual budget outcome and the structural component is then considered to be the cyclical budget outcome and it arises because the economy is deviating from its potential.

In some of the blogs listed below I go into the measurement issues involved in this decomposition in more detail. However for this question it these issues are less important to discuss.

The point is that structural budget balance has to be sufficient to ensure there is full employment. The only sensible reason for accepting the authority of a national government and ceding currency control to such an entity is that it can work for all of us to advance public purpose.

In this context, one of the most important elements of public purpose that the state has to maximise is employment. Once the private sector has made its spending (and saving decisions) based on its expectations of the future, the government has to render those private decisions consistent with the objective of full employment.

Given the non-government sector will typically desire to net save (accumulate financial assets in the currency of issue) over the course of a business cycle this means that there will be, on average, a spending gap over the course of the same cycle that can only be filled by the national government. There is no escaping that.

So then the national government has a choice – maintain full employment by ensuring there is no spending gap which means that the necessary deficit is defined by this political goal. It will be whatever is required to close the spending gap. However, it is also possible that the political goals may be to maintain some slack in the economy (persistent unemployment and underemployment) which means that the government deficit will be somewhat smaller and perhaps even, for a time, a budget surplus will be possible.

But the second option would introduce fiscal drag (deflationary forces) into the economy which will ultimately cause firms to reduce production and income and drive the budget outcome towards increasing deficits.

Ultimately, the spending gap is closed by the automatic stabilisers because falling national income ensures that that the leakages (saving, taxation and imports) equal the injections (investment, government spending and exports) so that the sectoral balances hold (being accounting constructs). But at that point, the economy will support lower employment levels and rising unemployment. The budget will also be in deficit – but in this situation, the deficits will be what I call “bad” deficits. Deficits driven by a declining economy and rising unemployment.

So fiscal sustainability requires that the government fills the spending gap with “good” deficits at levels of economic activity consistent with full employment – which I define as 2 per cent unemployment and zero underemployment.

Fiscal sustainability cannot be defined independently of full employment. Once the link between full employment and the conduct of fiscal policy is abandoned, we are effectively admitting that we do not want government to take responsibility of full employment (and the equity advantages that accompany that end).

So it will not always be the case that the dynamics of the automatic stabilisers will leave a structural deficit sufficient to finance the saving desire of the non-government sector at an output level consistent with full utilisation of resources.

The following blogs may be of further interest to you:

- A modern monetary theory lullaby

- Saturday Quiz – April 24, 2010 – answers and discussion

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

Question 3:

A potential problem with running continuous budget deficits is that the spending builds up over time which adds to inflationary pressures.

The answer is False.

This question tests whether you understand that budget deficits are just the outcome of two flows which have a finite lifespan. Flows typically feed into stocks (increase or decrease them) and in the case of deficits, under current institutional arrangements, they increase public debt holdings.

So the expenditure impacts of deficit exhaust each period and underpin production and income generation and saving. Aggregate saving is also a flow but can add to stocks of financial assets when stored.

As long as the flow of net spending from the public sector is consistent with filling the non-government spending gap then a nation can absorb continuous budget deficits without inflationary pressures building.

Under current institutional arrangements (where governments unnecessarily issue debt to match its net spending $-for-$) the deficits will also lead to a rise in the stock of public debt outstanding. But of-course, the increase in debt is not a consequence of any “financing” imperative for the government. A sovereign government is never revenue constrained because it is the monopoly issuer of the currency.

The following blogs may be of further interest to you:

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

- Fiscal sustainability 101 – Part 1

- Fiscal sustainability 101 – Part 2

- Fiscal sustainability 101 – Part 3

Question 4:

In recent days we have observed falling government bond yields in most non_EMU nations which suggests that investors are viewing sovereign debt less favourably since the downgrading of the US rating.

The answer is False.

In macroeconomics, we summarise the plethora of public debt instruments with the concept of a bond. The standard bond has a face value – say $1000 and a coupon rate – say 5 per cent and a maturity – say 10 years. This means that the bond holder will will get $50 dollar per annum (interest) for 10 years and when the maturity is reached they would get $1000 back.

Bonds are issued by government into the primary market, which is simply the institutional machinery via which the government sells debt to “raise funds”. In a modern monetary system with flexible exchange rates it is clear the government does not have to finance its spending so the the institutional machinery is voluntary and reflects the prevailing neo-liberal ideology – which emphasises a fear of fiscal excesses rather than any intrinsic need.

Once bonds are issued they are traded in the secondary market between interested parties. Clearly secondary market trading has no impact at all on the volume of financial assets in the system – it just shuffles the wealth between wealth-holders. In the context of public debt issuance – the transactions in the primary market are vertical (net financial assets are created or destroyed) and the secondary market transactions are all horizontal (no new financial assets are created). Please read my blog – Deficit spending 101 – Part 3 – for more discussion on this point.

Further, most primary market issuance is now done via auction. Accordingly, the government would determine the maturity of the bond (how long the bond would exist for), the coupon rate (the interest return on the bond) and the volume (how many bonds) being specified.

The issue would then be put out for tender and the market then would determine the final price of the bonds issued. Imagine a $1000 bond had a coupon of 5 per cent, meaning that you would get $50 dollar per annum until the bond matured at which time you would get $1000 back.

Imagine that the market wanted a yield of 6 per cent to accommodate risk expectations (inflation or something else). So for them the bond is unattractive and they would avoid it under the tap system. But under the tender or auction system they would put in a purchase bid lower than the $1000 to ensure they get the 6 per cent return they sought.

The mathematical formulae to compute the desired (lower) price is quite tricky and you can look it up in a finance book.

The general rule for fixed-income bonds is that when the prices rise, the yield falls and vice versa. Thus, the price of a bond can change in the market place according to interest rate fluctuations.

When interest rates rise, the price of previously issued bonds fall because they are less attractive in comparison to the newly issued bonds, which are offering a higher coupon rates (reflecting current interest rates).

When interest rates fall, the price of older bonds increase, becoming more attractive as newly issued bonds offer a lower coupon rate than the older higher coupon rated bonds.

Further, falling yields indicate that the demand for bonds is rising which suggests that investors are viewing them more favourably (relative to other investment products).

The following blogs may be of further interest to you:

- Saturday Quiz – April 17, 2010 – answers and discussion

- Time to outlaw the credit rating agencies

- Studying macroeconomics – an exercise in deception

- Time for a reality check on debt – Part 1

- Will we really pay higher interest rates?

Premium Question 5:

If private domestic investment is less than private domestic saving and the current account is draining aggregate demand then the government budget has to be in deficit no matter what level of GDP is produced.

The answer is True.

This question requires an understanding of the sectoral balances that can be derived from the National Accounts. But it also requires some understanding of the behavioural relationships within and between these sectors which generate the outcomes that are captured in the National Accounts and summarised by the sectoral balances.

Refreshing the balances (again) – we know that from an accounting sense, if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the accounting rules.

The important point is to understand what behaviour and economic adjustments drive these outcomes.

So here is the accounting (again). The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

So what about the situation posed in the question?

If the external sector is draining aggregate demand it must mean the current account is in deficit. That is , spending flows out of the local economy are greater than spending flows coming into the economy from the foreign sector.

If private domestic investment is less than private domestic saving, then the private domestic sector is running a surplus overall – that is, they are spending less than they are earning.

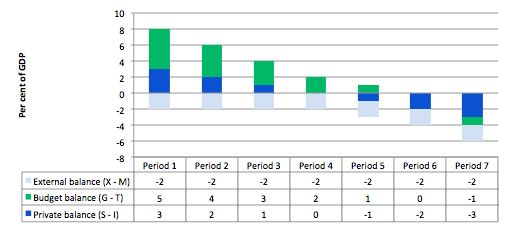

The following graph shows the sectoral balances for seven periods based on different levels of the private balance (as a per cent of GDP) and a constant external deficit (to keep things simple).

You can see that in Periods 1 to 3, the private sector is in surplus while the external sector is in deficit. The budget (G – T) is in deficit in each of those periods. The budget only goes into surplus (with a 2 per cent of GDP external deficit) when the injection into aggregate demand from the private domestic sector is greater than the spending drain from the external sector (Period 7).

The reasoning is as follows. If the private domestic sector (households and firms) is saving overall it means that some of the income being produced is not be re-spent. So the private domestic surplus represents a drain on aggregate demand. The external sector is also leaking expenditure. At the current GDP level, if the government didn’t fill the spending gap resulting from the other sectors, then inventories would start to increase beyond the desired level of the firms.

The firms would react to the increased inventory holding costs and would cut back production. How quickly this downturn occurs would depend on a number of factors including the pace and magnitude of the initial demand contraction. But the result would be that the economy would contract – output, employment and income would all fall.

The initial contraction in consumption would multiply through the expenditure system as laid-off workers lose income and cut back on their spending. This would lead to further contractions.

Declining national income (GDP) leads to a number of consequences. Net exports improve as imports fall (less income) but the question clearly assumes that the external sector remains in deficit. Total saving actually starts to decline as income falls as does induced consumption.

The decline in income then stifles firms’ investment plans – they become pessimistic of the chances of realising the output derived from augmented capacity and so aggregate demand plunges further. Both these effects push the private domestic balance further into surplus

With the economy in decline, tax revenue falls and welfare payments rise which push the public budget balance towards and eventually into deficit via the automatic stabilisers.

So with an external deficit and a private domestic surplus there will always be a budget deficit.

The following blogs may be of further interest to you:

I think you made a mistake (thank God because I thought I was going crazy).

Question 5 over at the quiz page reads (direct cut and paste):

“If private domestic investment is greater than private domestic saving and the current account is draining aggregate demand then the government budget has to be in deficit no matter what level of GDP is produced.”

On this page it reads (direct cut and paste):

“If private domestic investment is less than private domestic saving and the current account is draining aggregate demand then the government budget has to be in deficit no matter what level of GDP is produced. ”

In my understanding the answer to the original would be ‘False’ and the answer to the one on this page, as you said, would be ‘True’.

Dear Philip Pilkington (at 2011/08/14 at 7:45)

Thanks very much for picking up my error. I originally had planned the question to be the other way (private domestic surplus) but then decided to go the deficit route (it is more straightforward) and wrote up the explanation accordingly (as you have discovered) but forgot to change the wording of the question.

I am sorry to have caused anyone one any angst.

best wishes

bill

>> In terms of where the funds come from to provide the income support for those who do not work the answer is simple: no-where.

>>While taxation raises revenue for national governments it doesn’t “fund” its spending. Currency-issuing governments can spend without revenue should they wish to.

But there is a difference between ‘should they wish to’ and ‘funding comes from nowhere’ according to the accounting.

Perhaps Neil Wilson or another person can continue the last conversation i started on this please? I could not understand the last comment made by Neil and asked a question to find what he meant.

https://billmitchell.org/blog/?p=15591&cpage=1#comment-19177

@ Andrewjudd

I think the key point here is:

Bill: “…it is not a focus on the “income” that the non-workers receive but the command over real good and services that that income provides them with.”

@ Philip

Greetings from Cork, I assume you are the same person who guest posted on nakedcapitalism recently? Nice to see someone else from Ireland interested & writing about MMT. (And far better than I can.) I’d like to see you commenting at irisheconomy.ie if you have any time to do that?

Don’t know if you know ‘Ralphonomics’ blog? He seems quite supportive of MMT, but I felt he didn’t seem to understand your nakedcapitalism piece & has blogged here about it:

http://ralphanomics.blogspot.com/2011/08/in-fiscally-united-europe-would-core.html

@ All

Apologies for my off topic post!

1. The first part of the question – the consumption of real goods and services by people who are unemployed (disabled, looking after kids, old etc. etc. etc.) is an ethical/political question rather than a question of when, where, or how exactly the goods and services are produced from which people are fed, or clothed, or housed. Is there anything in MMT that creates an ‘accounting period’ for the consumption of real goods and services? Who knows where and when exactly a real loaf or real shoes, or a real visit to a doctors surgery actually comes from if the government can spend into an economy at any time? The government can spend in a way that offers ‘insurance’ for people here and now, but who knows exactly how it is provisioned over future years. In future years a young unemployed person can work. Isn’t that enough? The goods and services consumed now by the unemployed can as like as not be replaced by their own labour in the future. The moral and political question is ensuring that the ‘accounting period’ belongs to a person’s whole life and who’s to judge if at the end of a life a person owes a couple of loaves and a pair of shoes?

Hi Bill,

for question #3, you state your question as such:

“A POTENTIAL problem with running continuous budget deficits is that the spending builds up over time which adds to inflationary pressures. ” [my emphasis]

And for that very word “potential” was in the question, I had to say “true,” b/c I could conceive of an economy where budget deficits remained constant but private investment and the current account both moved in surplus at a faster and continuous rate. Eventually the budget deficits would add to inflationary pressures. It’s a potentiality, and so I chose true. What do you think? Is that not true?

Thank you either way! Cheers

Dear Mario (at 2011/08/15 at 17:53)

Thanks for your input.

Your explanation is sensible but the point of the question is that budget deficit spending doesn’t build up – it is a flow.

best wishes

bill