I have received several E-mails over the last few weeks that suggest that the economics…

Britain is tracking Ireland down the drain

I have noted in recent weeks how the deficit terrorists have started to suggest that Ireland, which led the world into enforced fiscal austerity, is now demonstrating how such a policy can spawn growth. I don’t know what planet these commentators live on but when you examine the most recently available data and understand what it is saying you would not conclude that Ireland is emerging as a picture of health. What I learn from the daily data that is coming out from that part of the world is that fiscal austerity is ensuring that Britain is tracking Ireland down the drain.

The data from Britain this week continues to point in one direction – they are heading back into recession courtesy of the ill-conceived and ideologically-driven fiscal austerity program.

The UK Guardian article by Larry Elliot (September 5, 2011) – Services sector: Bank of England must act while Osborne won’t – talks about the “appalling PMI data” which came out yesterday.

Larry Elliot notes that:

George Osborne was cock-a-hoop when the monthly health check of Britain’s services sector was published a month ago. The July findings from purchasing managers were surprisingly upbeat and within minutes the chancellor’s aides were spreading the news that the government’s tough love remedy for the economy was working.

Needless to say, there were no instant text messages this month. The August services PMI, published on Monday, was an absolute shocker, with the index of activity dropping from 55.4 to 51.1 – a sharper monthly fall than seen during the worst of the financial crisis in late 2008.

The data clearly shows that firms are reporting “less business coming in” and are cutting “jobs at a faster rate than they did the previous month”. Business confidence is “at its lowest in more than a year”.

I most recently examine the British data in this blog – The impossible equation. The situation has deteriorated in the week or so since I wrote that blog.

The British government touted the predictions of the mainstream macroeconomics paradigm that net public spending cuts (and the advanced notice to the public of the intention to make these cuts) would stimulate private spending. They claimed that British consumers and firms are “Ricardian agents” and that private spending remained weak because the private sector was scared of the future tax implications of the rising budget deficits.

In this fantasy, cutting public spending leads to a resurgence of private spending and the economy resumes trend growth.

Modern Monetary Theory (MMT) predicted the fiscal austerity plans would push the British economy towards a double-dip recession as private consumers and firms cut back on their own spending driven strongly by the fear of unemployment and flat sales conditions that accompany that situation.

MMT also predicted that an export-led growth strategy in a international environment of declining growth driven by similar fiscal austerity programs elsewhere would fail.

Please read my blogs – Deficits should be cut in a recession. Not! and Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

All sides of the debate clearly scan the data releases every day around the world seeking evidence which might support their predictions. Remember the boasting by George Osborne that “as a result of his austerity programme, the UK was out of the danger zone”.

The facts speak for themselves. In the last nine months the British economy has barely grown (0.2 per cent in real terms). All the main data releases in Britain over the last year favour the narrative that says austerity is killing the economy.

Larry Elliot notes that the evidence to date:

… adds up to an economy smack on course for a double-dip recession. Consumer confidence is at rock-bottom levels. Businesses are not investing. Britain’s main export markets are slowing fast. All this at a time when government spending is being squeezed in an attempt to bring down Britain’s budget deficit.

The problem is that the debate is now focusing on what the Bank of England might do “when its monetary policy committee meets later this week”. About all they can do is introduce another round of quantitative easing, which fundamentally failed to stimulate aggregate demand last time.

It is clear that George Osborne will not do “a U-turn on fiscal policy” although the automatic stabilisers are going to push against the austerity drive.

It is going to be a hard winter in Britain. But think about Ireland – they are approaching their third winter of austerity and still the message is bad.

Remember back in 2006 when George Osborne wrote this Times article (February 23, 2006) – Look and learn from across the Irish Sea – as Shadow Chancellor.

He called it the “Irish miracle” and claimed:

A generation ago, the very idea that a British politician would go to Ireland to see how to run an economy would have been laughable. The Irish Republic was seen as Britain’s poor and troubled country cousin, a rural backwater on the edge of Europe. Today things are different. Ireland stands as a shining example of the art of the possible in long-term economic policy making, and that is why I am in Dublin: to listen and to learn.

I conclude from that that George Osborne is a slow learner.

He should consult the data from Ireland which is where Britain is now heading. The most recent National Accounts data (first-quarter 2011) for Ireland are available from the Irish Central Statistics Office (CSO). The second quarter Eurostat flash estimates do not include data for Ireland.

I have read several articles in recent weeks claiming that Ireland is coming out of the mire and that the new story will be “austerity works”. I think the deficit terrorists better understand the national accounts data before they claim

The CSO said in their release that:

Initial estimates for the first quarter of 2011 show an increase, on a seasonally adjusted basis, of 1.3 per cent in GDP and a decline of 4.3 per cent in GNP compared with the previous quarter. In comparison with the corresponding quarter of 2010, GDP at constant prices was marginally up (+0.1%) while GNP was 0.9 per cent lower.

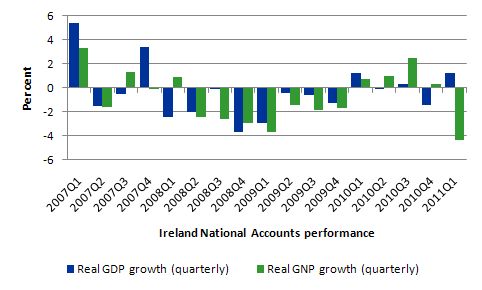

The following graph shows quarterly growth rates in real Gross Domestic Product (GDP) and Gross National Product (GNP) from the first quarter 2007 to the June 2010 quarter. Clearly the GDP growth in the June 2010 quarter is what everybody is focusing on. The most recent quarter shows a 2.7 per growth although GNP continues to be negative.

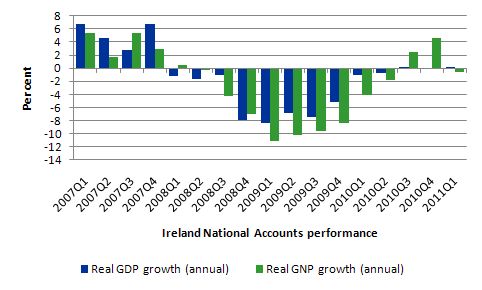

The next graph shows the same data converted into annualised growth rates.

The commentators are pointing to the growth in real GDP of 1.3 per cent for the first quarter 2011 signalled that the Irish economy is coming back and austerity is working.

It is true that the quarterly growth gives a guide to the most immediate direction of the economy as opposed to annual rates. The annual figures show you how bad the recession has been Ireland.

The annualised growth in real GDP was zero in the same quarter and has been shown no signs of growth (bar September quarter 2010) since the crisis began in early 2008.

But then consider the sharp decline in Gross National Product (-4.3 per cent in the first quarter 2011). To understand what means we have to first understand the difference between GDP and GNP. I outlined this in some detail in this blog – The Celtic Tiger is not a good example and I largely update the analysis here.

To understand how GDP and GNP interact, Wikipedia is a reasonable place to start in this respect (but not always). A more thorough (very) understanding of these concepts is provided in the excellent publication from the Australian Bureau of Statistics – Australian National Accounts: Concepts, Sources and Methods, 2000

The two National Accounting concepts are defined as such:

- Gross domestic product (GDP) is defined as the market value of all final goods and services produced in a country in any given period”.

- Gross National Product (GNP) is defined as the market value of all goods and services produced in any given period by labour and property supplied by the residents of a country.

The Irish CSO publication says that GNP = GDP + Net factor income from the rest of the world (NFI). NFI is defined as:

Net factor income from the rest of the world (NFI) is the difference between investment income (interest, profits etc.,) and labour income earned abroad by Irish resident persons and companies (inflows) and similar incomes earned in Ireland by non-residents (outflows). The data are taken from the Balance of Payments statistics. However the components of interest flows involving banks in this item in the national accounts are constructed on the basis of “pure” interest rates (that is exclusive of FISIM) whereas in the balance of payments the FISIM adjustment is not carried out. There is an equal and opposite adjustment then made to the imports and exports of services in the national accounts which is not made to these items in the balance of payments. The deflator used to generate the constant price figures is based on the implied quarterly price index for the exports of goods and services. In some years exceptional income payments have had to be deflated individually.

In this blog – The sick Celtic Tiger getting sicker – I argued that the so-called “Celtic Tiger” growth miracle was an illusion and was driven by major US corporations evading US tax liabilities by exploiting massive tax breaks supplied to them by the Irish government. The reality is that around 1/5 of Irish GDP is transfers of profits to foreign companies. Boone and Johnson concluded that:

… the Irish miracle was a mirage driven by clever use of tax-haven rules and a huge credit boom that permitted real estate prices and construction to grow quickly before declining ever more rapidly. The biggest banks grew to have assets twice the size of official G.D.P. when they essentially failed in 2008.

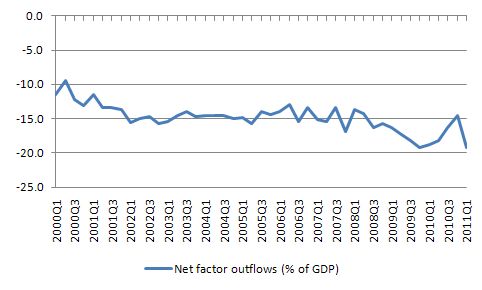

The following graph shows the net factor outflows since 2000 for Ireland as a percentage of GDP. Since they entered the Euro, the net outflows have increased.

The CSO noted in the first quarter 2011 National Accounts that:

Net factor outflows increased by close on €2 billion seasonally adjusted between Q4 2010 and Q1 2011. Increased profit outflows from Ireland and a decline in the overseas profits earned by foreign Public Limited Companies headquartered in Ireland were the major contributors to this.

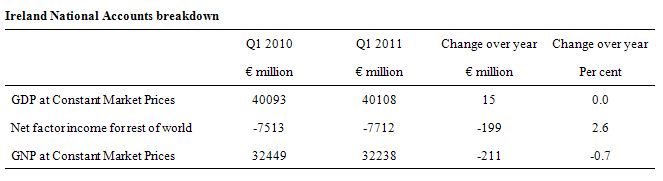

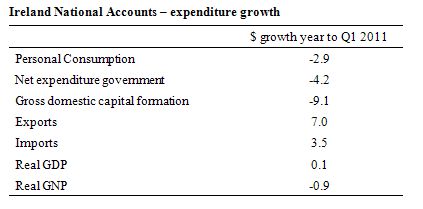

I created the following Table to show you the breakdown between these aggregates and their evolution between Q1 2010 and Q1 2011 for Ireland using the CSO National Accounts data.

So the growth in real GDP has spawned a rapid fall in real GNP as net factor outflows have spiked up again (by over 2 million euros). What is the significance of this?

The recent growth is coming exclusively from exports (which is signalled by the GDP figure). The first quarter 2011, CSO National Accounts publication says:

Net exports (exports minus imports) grew by €1,557m (20.6%) at constant 2009 prices between the first quarter of 2010 and the first quarter of 2011. Domestic demand, on the other hand, declined by €990m (-3.1%) over the same period with personal consumption down by 2.9 per cent. On the output side of the accounts Agriculture, Forestry and Fishing (+3.9%) and Industry excluding Building and Construction (+1.1%) were the only sectors to record annual growth. However, the Other Services sector, which accounted for almost a half of GDP at factor cost in Q1 2011, declined at a more moderate rate than in previous quarters.

The following Table shows you the breakdown of the annual real growth in the expenditure components since quarter 1 2010. Domestic demand is negative by a long way as the Irish population slump further into recession.

However, the domestic economy is still declining with unemployment rising further.

By excluding the expatriated profits of foreign multinationals, GNP provides a better picture of how the domestic economy is delivering welfare improvements to its residents. The fact is that Ireland continues to go backwards in this regard.

So they are exporting real goods and services which are a cost to the domestic economy (forgoing local use) to generate growth and the growth dividend is then being expatriated to foreigners as rising income.

The only conclusion you can draw at this stage is that the austerity package is further impoverishing the local residents and handing over increasing quantities of Ireland’s real resources to the benefit of foreigners. That doesn’t sound like a very attractive option to me

Other recent data shows:

1. Retail Trade volumes fell by -2.6 per cent in the year to July 2011. So this data is much more recent that the first quarter National Accounts data.

2. Industrial new orders was slowed in July 2011.

3. The decline in Construction output accelerated in first quarter 2011 dropping a staggering -11.4 per cent.

4. The unemployment rate rose from 13.5 per cent in August 2010 to 14.4 per cent in August 2011.

Conclusion

The real GDP growth in Ireland in first-quarter 2011 was driven by net exports with domestic demand still declining sharply quarter by quarter. Some conservatives are now claiming this growth is because the austerity measures deflated the economy sufficiently to lift its competitiveness.

But the reality is more like the exports growth was coming from the residual growth around the world following the fiscal stimulus injections between 2008 and 2010.

From an MMT perspective, the austerity push is draining the domestic capacity of the Irish economy to engender growth.

There is no growth in the labour market coming from the export drive and the latter is dependent on the British and the US economies for any sustainability. The reality is now setting in for Britain too – the export markets are now in sharp decline as global austerity pushes start to take their toll.

Last year I predicted that the export markets would start slowing and defeat growth strategies that relied on harsh domestic deflation and expanding export markets.

Please read my blogw – Fiscal austerity – the newest fallacy of composition and Export-led growth strategies will fail – for more discussion on this point.

So I would not be holding Ireland out as an example of a succesful outcome for austerity. Things are very dire there indeed.

The problem is that the Irish government has no real options while they remain constrained by the Maastricht Treaty and their lack of sovereignty.

That is enough for today!

Dear Bill

You must know the joke: What is the difference between Iceland and Ireland? Answer: 6 months and one letter. Well, according to your good friend and fervent admirer Paul Krugman, the man who brought MMT to my attention, the difference between Iceland and Ireland is now that Iceland has rejected austerity orhtodoxy. As a result, Iceland is now doing much better than Ireland. Of course, Iceland still has its own currency.

Cheers. James

It’s good to see that the tide may be slowing turning: http://www.guardian.co.uk/business/2011/sep/05/home-economics-global-crisis

Now also the true capitalists have confirmed how it works, they are true MMT:ers. Johan Javeus

Chief Strategist, Head of Trading Strategy – SEB (Skandinaviska Enskilda Banken AB) on one of Swedens largest business banks, the financial arm of the dominant Swedish capitalist family Wallenberg was commenting on public radio the Swizz decision to suppress their currency.

My wobbly translation:

“How probable is it that this will succeed?

– It is very likely they will succeed. What Swizz does is that they pledge to sell its own currency and buy foreign currency to keep its currency at a certain level.

Then the fact is that Swizz central bank can print unlimited amounts of Swizz francs can they never be short of money, there is no risk that the money supply will drain.

What risk are there?

In the long run there can be tendency when one print more and more money that it create intrinsic inflation risk in the economy. But the inflation is very low in Swizz so de risk is limited. As it is there is risk of to low inflation.”

Isn’t that capitalist wage slave a true MMT:r? Unlimited money supply and no risk of inflation, he must have delirium our capitalist friend.

But I could bet on that the same fellow would have been close to panic and hysteria if this unlimited money supply had anonuced to be used to alleviate unemployment and misery among the masses, the inflation risk have been imminent and there hadn’t been any unlimited supply of money without dire consequences.

Oh, thank heaven it wasn’t really an equation (sign-in) as I remember them from 8th grade algebra! My head might have exploded, as it is full of MMT in a riot of disorganization.

Please forgive what could be considered a hijack of this thread. I feel I have grasped enough finally to be able to ask some dumb questions, and I don’t see another place for that with recent posts. If ya’ll feel it’s an imposition, I’ll just go away, but I think it will be worth your time.

You see, I reside on the cusp between the affluent and the almost-poor middle classes. I have a multi-trade home repair/maintenance/improvement business, working for the former, subcontracting the latter when physical demands or skills are beyond my capabilty to work alone.

I’m able to talk politics with customers and workers of all persuasions without causing any ill will. I’d like to be able to explain what’s wrong with our economy and what ordinary people can do about it. MMT gives a new framework on which to build the political and social arguments.

What I’ve digested of MMT aligns with my values, which is why I’ve invested about 20 hours so far trying to understand it. I’m having trouble applying it. I’m sure the reason I’m struggling is a lack of background and sophistication in both economics and accounting. So let me try to be as clear as possible with my questions, with the caveat that I might misuse technical terms out of ignorance.

1. Does MMT explain why the financial sector is booming while the “real” economy feels like we’re in a deepening depression? Or the related concern that wealth distribution is now so extremely one-sided?

2. Could it be fairly said that the making of derivatives markets in the private sector is a usurpation of the vertical function of government’s ability to create and destroy money?

3. Am I getting it if I think: Having the Treasury Dept. and the Federal Reserve within government, rather than a monolithic entity that handles money, means accounting has to enter into the simple process of creating and destroying money, and that’s why Treasury bonds and reserve funds have to exist?

I have lots more questions, but some of them might resolve if I understand the answers to these 3 to start. Thanks in advance for any response anyone is kind enough to give.

RM Weston and about 1. :

savings of the rich = dissavings of the gov’t (preferably with debt) plus dissavings of the lower and middle class (preferably with debt)

https://billmitchell.org/blog/?p=277

The origins of the economic crisis

bill, for some reason I am NOT getting the anti-spam math question. The picture is showing up with an X, meaning it is not being downloaded. Thanks!

Thanks, Fed Up (great moniker)

The blog post link was most helpful, and that is the way I already understood it from my main source of economics knowledge – my Dad via FDR with some recent Krugman thrown in. There’s nothing about the conclusions of MMT that’s very different in this area, right? There is some difference in the models (which I interpret as being the data analysis, right) used, I think, but those are beyond me.

It’s amazing how closely my personal experience follows this narrative. The more you work to get ahead, the farther behind you fall. You just know it’s gonna get better. I mean, this is America, home of the entrepreneur, and the government numbers sound really great. Plus credit is cheap, so you go ahead and buy better tools, keep more inventory to lower the daily stress level, take a little less for yourself to pay the subs a fair wage, and puzzle as to why you can’t get small price increases to stick. You know cash flow is what’s keeping things from tanking, but you just know it won’t be long until more of it starts falling into your pocket. Heck, dinner around the firepit at home’s a lot more fun than going out to some snooty restaurant where you have to dress up anyhow.

So, I can truthfully say that government policy changes that favor making one’s money from investment rather than work are the root cause of our problems. Oversimplified, I know, but I need a story to tell in layman’s terms to convince folks we’re on the wrong path. I need to understand the technicalities so I can answer questions that come up in a logical but simple way.

Looking forward to more of this education. Thanks again.

RM Weston said: “There’s nothing about the conclusions of MMT that’s very different in this area, right?”

Not sure what you are asking there.

And, “There is some difference in the models (which I interpret as being the data analysis, right) used, I think, but those are beyond me.”

If you can add, subtract, multiply, divide, compound, do some algebra, and have real world assumptions, then you should be able to pick up on the models.

And, “It’s amazing how closely my personal experience follows this narrative. The more you work to get ahead, the farther behind you fall. You just know it’s gonna get better. I mean, this is America, home of the entrepreneur, and the government numbers sound really great. Plus credit is cheap, so you go ahead and buy better tools, keep more inventory to lower the daily stress level, take a little less for yourself to pay the subs a fair wage, and puzzle as to why you can’t get small price increases to stick.”

Are you experiencing negative real earnings growth by your budget (not the gov’t price inflation numbers) or positive? If negative, are you using debt to make up for negative real earnings growth?

And, “Oversimplified, I know, but I need a story to tell in layman’s terms to convince folks we’re on the wrong path.”

You can start with too much debt (BOTH private and gov’t). That is actually a medium of exchange problem. The medium of exchange supply trades relative to the prices of goods/services. That means too much of it leads to price inflation and too little of it leads to price deflation. It can also be thought of as the stock that flows around in the economy. You also need to account for savings in the medium of exchange itself or as financial assets.

Lastly, am I the only one having trouble with the anti-spam math question coming up?

The answer is 10 (4 + 6). Of course, as soon as I post about it, it decides to reappear.

Has anyone considered the intention is to have low (or negative) growth so that the BoE can introduce more quantitative easing and then quietly “retire” more of Britain’s debt by purchasing it with the new money? That way when the economy does recover debt service (which I know is voluntary but still!) will not strangle the economy.

Just a thought…

Dear Fed Up

Thanks for pointing out the problems with the anti-spam gateway. I have been doing a lot of updating of the packages on the server that runs the blog – and by upgrading php I delinked some of the other packages that were being relied on. It has taken a little while to work out all the dependencies and get everything consistent again.

Sorry for the inconvenience to you and others.

The Contact page is also working again as a result of the same sort of changes.

best wishes

bill

Thanks, bill. It seems to be working. I was beginning to think it was just me or just my broswer.

Updates can be challenging.

Alex, it seem to me the debt is NOT being retired. If the so-called “crisis” ended, would the central banks just sell the debt back to the private sector?

Thanks, again, Fed Up-

1. The following from https://billmitchell.org/blog/?p=277 show me that MMT and FDR-era thinking and conclusions aren’t all that different. Just wanted confirmation I wasn’t making a big mistake.

“The government balance has to be in deficit for the private balance to be in surplus given a relatively stable external balance.” and

“Real wages fell under the Hawke Accord era which was a stunt to redistribute national income back to profits in the vein hope that the private sector would increase investment. It was based on flawed logic at the time and by its centralised nature only reinforced the bargaining position of firms by effectively undermining the traditional trade union movement skills – those practised by shop stewards at the coalface.” (Australian and American policy very similar) and

“The trick was found in the rise of “financial engineering” which pushed ever increasing debt onto the household sector. ” and

“Further, the first thing the Federal government should purchase is all the labour that no-one wants. By introducing a Job Guarantee they could offer a minimum wage to all those who wanted work and therefore restore full employment at a fraction of the investment they are proposing to make by way of fiscal stimulus.”

2. You said, “If you can add, subtract, multiply, divide, compound, do some algebra, and have real world assumptions, then you should be able to pick up on the models.”

All models appear to require leaving out assumptions about things that are too variable in order to actually work as models. I guess I don’t yet know how to use anyone’s models to decide who’s making the highest good-faith effort.

3. You asked: “Are you experiencing negative real earnings growth by your budget (not the gov’t price inflation numbers) or positive? If negative, are you using debt to make up for negative real earnings growth?”

If having to take less than half 2007’s price for the same job now is negative earnings growth, well, yeah! My state actually entered recession in mid-2006, which meant fewer and smaller contracts than during 2000 – 2005. I started using credit more in 2006 to finance materials and labor that had previously been financed out of cash flow. I thought that would work out because the gov’t said the economy was doing fine, and I’d clear the debt when things picked up. Now I’m actually “financing” profits with debt so I can live, hoping against hope both volume and profits will return before I’m bankrupt. Que sera, sera.

4. OK, you lost me here: “You can start with too much debt (BOTH private and gov’t). That is actually a medium of exchange problem. The medium of exchange supply trades relative to the prices of goods/services. That means too much of it leads to price inflation and too little of it leads to price deflation. It can also be thought of as the stock that flows around in the economy. You also need to account for savings in the medium of exchange itself or as financial assets.”

The medium of exchange “trades”? You mean currency trading? Or do you just mean supply and demand – the old “too much money chasing too few goods” inflation?

I’m gonna risk being stupid here, but I think MMT would tell us that savings in financial assets (i.e. derivatives notional value) is sucking up too much of the medium of exchange, so we are experiencing deflation, which makes debt worth more, and payments of debt worth less. How’d I do?

You stopped looking at Ireland too soon IMO-Quarter by quarter growth in 2014: +3.8, +7.2, +4.1, +4.1. Projected 3.6% and 3.5% for 2015 and 2016, respectively. Looks to me as austerity works better than stimulus.