It is a public holiday in Australia today for some reason and I had to…

Travel interrupts blog

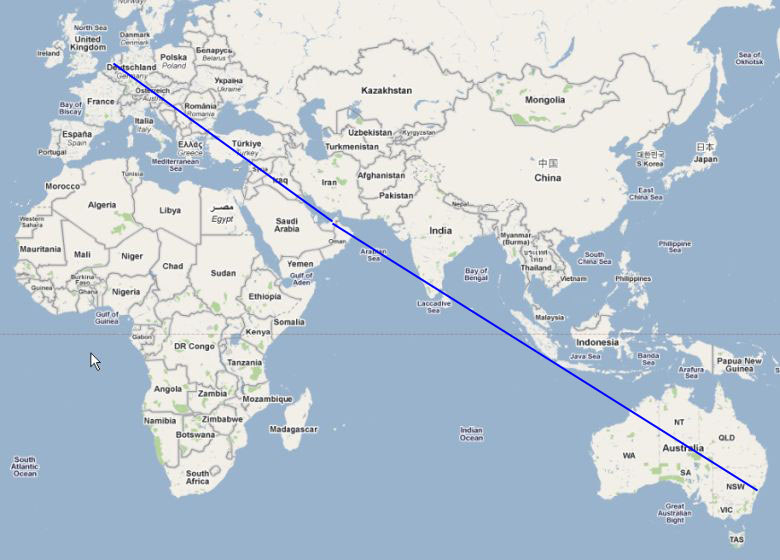

No blog today as I am travelling to the lands of austerity. Normal service will resume on Tuesday.

For the next 2 weeks I will be in Maastricht (Netherlands) or thereabouts working at CofFEE-Europe, a sibling of my research centre at the University of Newcastle.

I will not be in contact with my servers much before early Monday (Europe time) and as a result moderation of any comments may be delayed. As a note, whenever you post a comment that has an external link then it will always goes into the moderation queue. I will be able to approve some such comments during a stopover in the Middle East but there might still be delays for which I apologise. Patience is the key! Thanks.

If anyone wants to organise a storming of the EU Administration buildings while I am near Brussels this week please let me know and I will come down 🙂

Say Hi to Joan for us all (No I don’t know her, just through your collaboration)

Senexx,

As you can see – http://www.merit.unu.edu/about/profile.php?id=41 – Joan Muysken is a /man/. The mistake, however, is understandable.

ps. Professor Mitchell, while in Maastricht, can you and professor Muysken not write an op-ed to a national newspaper?

What Rik said. If you do a piece I might be able to do a spin-off for an Irish newspaper website…

Well at least I didn’t make that mistake with Jan Kregel

This bothers me more than I thought (perhaps because I was careless) but hey I once knew a person called Qantas – yes that was their actual name.

So is Qantas a boy or a girl?

Whatever…… Just hope they are in it for the long haul.

Safe travel!

I’d like to ask a question – it’s something I have tried to find the answer to, but failed (prospective answers never address the actual nub of the question).

Is there any legal impediment to the US government “printing money” without issuing bonds?

I ask because I’m interested in American conspiracy theory (as a critic!) There are always floods of comments from American posters on the net which blab on about “debt-dollars” (all related to their stupid FED conspiracies). This in a context which usually holds that not only does “printing money always cause inflation”, but also that the money is “worthless”. (Why do they complain about the debt if it is ‘worthless’?)

Anyway, a counter trend in this conspiracism is beginning to gain ground, namely that the American government could issue “greenbacks” (or some such) which would be ‘debt-free’. My contention is that this could happen anyway, that the impediment is rather a political one, and one of economic orthodoxy – not a condition of the technical relationship between the US FED and the exchequer.

But are there any definite legal impediments to the USA printing (and spending!) money (say, on huge infrastructure projects) without issuing bonds to raise the cash from markets? I know of no such legal impediment. Anyone know the definitive answer?

Bill,

I have always said that as a result of the austerity nonsense, homelessness will rise, as will the rate of suicide. In the UK, government has conveniently decided to change the way homelessness is measured, thus making it impossible to compare with previous periods. Suicides should be harder to fake.

Have you considered looking at suicide rates between countries, and across periods, from, say, 2000 onwards?

Have a safe and good trip!

Last name left, As I understand it, the US Treasury cannot print greenbacks, and same goes for treasuries in most countries. What treasuries can do is to borrow from the private sector and issue bonds in return. The central bank can then print money and buy those bonds.

The alleged logic here is that it keeps politicians hands off the dollar bill printing press. But it doesn’t stop politicians “printing” debt. So it’s a daft arrangement, in my view. It helps explain the shambles currently taking place in Congress over debts, deficits, etc. The shambles in other countries is only slightly less ridiculous.

A better arrangement I think would be to have government issue no interest paying debt at all. (Milton Freidman advocated this.) Net additions to the money supply would take place when some independent committee of economists (maybe part of the central bank) decided that inflation was subdued enough to warrant printing and spending this extra money.

Ralph Musgrave, you are just repeating mainstream theory there, that is not what MMT says. Mainstreams understanding of the monetary operations is frozen in the bretton-woods era.

PZ, What’s MMT got to do with it? I didn’t mention MMT did I? And nor did Last_name_left whose queries I was answering.

Thanks for the reply Ralph, however your reply

“the US Treasury cannot print greenbacks”

is simply restating one of the points I was questioning. **Why** can it not do so, if such is the case?

The US Treasury surely can issue new money but is there a legal requirement that it be generated by borrowing? Borrowing creates a liability ie debt, whereas “printing money” and directly spending the money into circulation does not. As I see it, there’s much less point in increasing money supply whilst creating an associated (and greater) liability of public debt, as compared to the government employing people to build infrastructure, and simply issuing the cash to fund it and pay wages directly itself.

Anyway, my question was really concerning the claims of segments of American opinion (conspiracists, mostly) that a new mechanism is needed to create “debt-free” dollars. To my mind, unless there’s a legal obligation to fund borrowing from debt rather than simply financing infrastructure projects etc by “printing money” then there is no need for new forms of “greenbacks” or anything else to raise spending without raising debt. Rather the issue would be about political will and economic orthodoxy as opposed to some technical/legal impediment.

It seems there’s an assumption the US can’t simply “print money” without raising debt, yet without any justification for such a belief it would appear to be a myth in support of the prevailing political/economic orthodoxy.

Maybe to MMT the point is immaterial but nevertheless I just wanted to know the facts and I still haven’t found a definitive answer.

I’d really appreciate some feedback on this point, hopefully someone can provide the definitive answer (there surely must be one).