It's Wednesday, and as usual I scout around various issues that I have been thinking…

You couldn’t make all this stuff up

Its hard to know where to start today. I opened my hard copy version of the Financial Times this morning and every page was “Greek yields off the scale”; “Greece default talk”; “Number of Americans in poverty at highest in 50 years”; “Rome set to identify next asset sales”; Fears of Greek collapse prey on French banking”; “Brics to debate possible eurozone aid”; and so it went. You couldn’t make this stuff up. To avoid sinking into an inconsolable depression, I closed the orange pages and, maybe foolishly, turned my attention to the Wall Street Journal. That came up with gems such as “Limiting the Damage of a Greek Default”; “Exit Strategy Goes Right Out the Door for Euro-Zone States”; “Yields in Italian Bond Auction Highlight Financing Challenge”; “China Not Seen as Knight Riding to Rescue of Italy”; at which point I wondered – given my current geographic location – what happens if I get stuck here? And then, to ease the day’s burden I wondered why the WSJ spells the Eurozone with a hyphen. That seemed to calm things down. Researching the use and mis-use of hyphens splitting words in two. But the thought kept lingering – this is so bizarre that you couldn’t make all this stuff up.

Okay, I thought, at least I can read the Australian news – and our economy is still sort of growing. Mistake! The ABC News reports that Australians in denial of their growing waistlines and said that “When it comes to health, Australians are fat, unhappy and leading the world in self-deception. The latest global survey by medical insurer BUPA has found half the Australians who are overweight do not realise it, and men are more likely to be in denial about their weight.” Hmm, fat and dumb! Well at least I am not fat I thought :-).

Then there was the story in the Sydney Morning Herald (September 14, 2011) – Core inflation revised down – which reported that the Australian Bureau of Statistics had “revised second quarter inflation lower, suggesting price growth is not as strong as previously expected”. All the hyperinflationists that were outside baying at the full moon – suddenly didn’t understand any more. What the f*x@, inflation is low and safely within the RBA’s target range (at the lower end no less) yet there are these gaping deficits? As they try to make sense of their world crashing down in front of them, the foreign currency traders decided to sell. Why? Answer: once again the RBA has probably overcooked the economy with its bolshie interest rate hikes.

All we were hearing earlier in the year was the full employment economy about to inflation out of control courtesy of a once-in-a-hundred-years mining boom. It is now August and growth is slowing, unemployment is rising sharply and inflation is low. Meanwhile the Australian government – like a needle that is stuck on a record – says it will work even harder to generate their dreamed for budget surplus. As they work harder, an increasing proportion of the rest of us work will less or not at all.

So where do I start today with all that going on? Well with education which has been a dominant topic in my life. Education is at the heart of the development process no matter what the ideologues who claim the centrality of “finance”. Most of the financial market transactions are totally unproductive and could be eliminated without the slightest dent in productivity and future (and current) prosperity being observed.

Indeed, if we don’t eliminate much of the financial sector – through regulation and law – then the dents in productivity and prosperity that it has already caused will magnify and persist.

Apart from the technical errors in the current debate about fiscal and monetary policy that pervade the debate the thing I find most astonishing is that the simple aspects of the economy – like it isn’t rocket science or anything – are overlooked in favour of elaborate scams and non-issues – which just make it harder to solve the genuine issues relating to restoring and maintaining prosperity in a world with finite natural resources and growing populations.

I actually liked the opening paragraph in Thomas Friedman’s article – Is It Weird Enough Yet? – (September 13, 2011) where he is referring to the high profile Republican candidates in the US:

Every time I listen to Gov. Rick Perry of Texas and Representative Michele Bachmann of Minnesota talk about how climate change is some fraud perpetrated by scientists trying to gin up money for research, I’m always reminded of one of my favorite movie lines that Jack Nicholson delivers to his needy neighbor who knocks on his door in the film “As Good As It Gets.” “Where do they teach you to talk like this?” asks Nicholson. “Sell crazy someplace else. We’re all stocked up here.”

While he is referring to their climate change invocations, the same goes for the vast majority of commentators in the economics debate. As each day goes by the debate (as per the headlines in the introduction) get crazier while the underlying problem and the most effective solution path remain unchanged. In denying the problem and its straightforward solution, the policy makers just make the problem worse.

If we give the neo-liberals the best intentions then we might conclude that their issue with government deficits and public debt is that they consider it undermines the future prosperity of their children and, in turn, their children. So the motivation is sound but the reasoning is flawed.

How do they explain successive generations becoming more prosperous while budgets have typically been in deficit? How do they explain the obvious role that public health, education, and infrastructure play in the development process. Nations do not develop without strong public sector infrastructure. Nations that do not have strong public sectors fail to develop.

The neo-liberals might like to consider America as a free market economy now being tainted by an outbreak of deficits. But the US has run deficits at the federal level 85 per cent of the years since 1930. And as I noted the other day in this blog – It is easy to create jobs – the US public sector accounts for around 15 per cent of total employment (about the OECD average).

I regularly given public talks and over the last 5 years or so (pre-crisis that is) I have proposed that the current adult generation is likely to become the first in recorded history to collectively leave their children poorer in a material sense than they were. It is actually an interesting way to quickly raise the heckles of the audience. The neo-liberals go crazy quickly – well, sorry, they are already crazy, it is just they become excessively vocal quickly and accuse me of not knowing anything.

I know very little about the Universe much to my continued frustration and despite my efforts but there is emotion and then there is data. The neo-liberals have believed their own ridiculous rhetoric that if only the government deregulated markets and allowed them to self-regulate (meaning do what they like) then we would live a bountiful life of optimal wealth and fortitude. The governments progressively followed their instructions and deregulated labour and financial markets to the point where financial oversight all but disappeared.

The “bankers” went crazy. Increasing proportions of the rest of us, after tallying up some rising paper wealth for a short time and building our dreams on those “numbers”, then became unemployed and then saw the value become a fiction before our eyes. Not much happened to the bankers – who after entreating the government to expand fiscal policy and push billions to save the banking system – pocketed the funds and resumed business – quietly and seemingly profitably – while Rome burned.

The neo-liberal fiction has been exposed categorically and unambiguously. Okay, long live the fiction. That is where we are at it seems.

But emotion is one thing and facts are another. The neo-liberals operate on emotion – an ideological hankering for a ideal world which is sketched fairly crudely in the mainstream economics textbooks which they revere on the same level as hard-line Christians embrace the Bible.

Joan Robinson once said that orthodox economics was a branch of theology – “it is all a matter of faith”. She also said that you had to differentiate the capacity of economic analysis to produce objective knowledge and the theological branch that is designed to perpetuate the ruling ideology and is used as “an instrument of social control”.

In her Contributions to Modern Economics, Joan Robinson says (Page 75):

To make good use of an economic theory, we must first sort out the relations of the propagandist and the scientific elements in it, then by checking with experience, see how far the scientific element appears convincing, and finally recombine it with our own political views. The purpose of studying economics is not to acquire a set of ready-made answers to economic questions, but to learn how to avoid being deceived by economists.

Note: checking with the evidence. Imre Lakatos noted that a degenerating research program (which is a collection of common ideas) was one that is “lack of growth, or growth of the protective belt that does not lead to novel facts”. The protective belt is a set of auxiliary hypotheses which may be refuted by evidence without endangering the “hard core” of the theory, which is usually cast in such a way that it evades empirical scrutiny.

However, when a paradigm (research program) continually responds to empirical anomaly by altering its hypotheses and fails to account for the world before it then it starts to degenerate. Mainstream macroeconomics degenerated from day one and only holds sway as a result of the power elites domination of hiring, publication, and promotions within the academy. It is aided and abetted financially by conservative corporate interests including the media.

Modern Monetary Theory (MMT) is what Lakatos would call a “progressive research program” because it is “marked by its growth, along with the discovery of stunning novel facts, development of new experimental techniques, more precise predictions”.

The MMT predictive capacity is extremely sound and has been definitely tested over the last decade by the sheer volality and quantum of the changes in the key macroeconomic variables which are at the core of MMT. The mainstream macroeconomics research program failed to see the crisis coming, has no credibly approach to resolve it, and is busily adding financial sectors to their DSGE New Keynesian models.

Evidence is a very harsh test for a set of theoretical propositions. Think about the concern for the future. Essential developments we would want to see in place are growing prosperity as each generation grows into adulthood and strong investment in education.

In the last week, there has been a raft of new evidence which tell us that the neo-liberal research program and the policies that have resulted from it have categorically failed to deliver on their promises.

First, the US Census Bureau released (September 13, 2011) – Income, Poverty, and Health Insurance Coverage in the United States: 2010 – which should be sending shock waves through Congress.

The accompanying Press Release summarises the findings of the Report, although I would urge you to read the Report and if you are Americans then challenge your representative for answers and tell them that anyone who proposes to cut the deficit at present will lose electoral support including financial donations. Go on, do it!

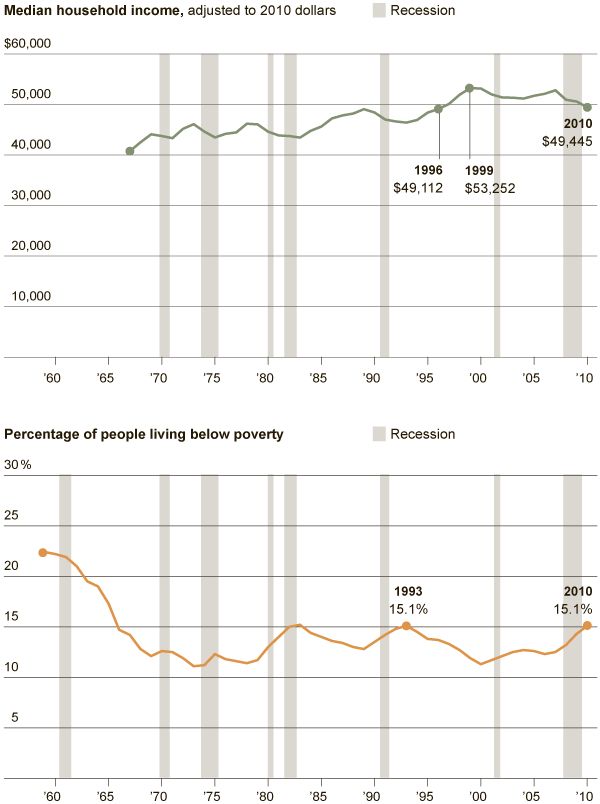

The results have been widely disseminated in the press today. For example, this New York Times report (September 13, 2011) – Soaring Poverty Casts Spotlight on ‘Lost Decade’ – is illustrative and I took this graphic from it.

It shows that “median household income adjusted for inflation fell to $49,445 in 2010, a 7 percent decrease from a peak in 1999. The last time American households earned less than a median of $50,000 was in 1996. Meanwhile, the nation’s poverty rate reached 15.1 percent in 2010, the highest level since 1993.”

The US Census Report shows that a further “2.6 million people slipped into poverty in the United States last year” and that:

… the number of Americans living below the official poverty line, 46.2 million people, was the highest number in the 52 years the bureau has been publishing figures on it.

The trend is obvious – more Americans are being impoverished.

The NYT article quoted a Harvard professor who said the data showed that:

This is truly a lost decade … We think of America as a place where every generation is doing better, but we’re looking at a period when the median family is in worse shape than it was in the late 1990s.

Read that again: this generation is leaving our children poorer than us.

The neo-liberal period has not only seen inequality rise – the gap between the high and low income earners is rising – but has also now undermining middle-class income capacity.

What is the main driving force of these trends? Answer: “Joblessness was the main culprit pushing more Americans into poverty”.

Read that again: persistent unemployment where “48 million people” between the ages of “18 to 64 did not work even one week out of the year, up from 45 million in 2009” is the main culprit.

Who is the most disadvantaged? Answer: “Those who do not have college degrees were particularly hard hit”.

Last year, we learned courtesy of the Program for International Student Assessment (PISA) – that the US students were producing inferior outcomes relative to nations such as as Finland, South Korea, and China – of the 34 countries in the study, the US achieved 14th place in reading, 17th place in science and 25th place in mathematical skills.

This is published by the Organisation for Economic Cooperation and Development. The OECD mostly produces neo-liberal propaganda and you have to be very careful reading the underlying modelling in most of their reports to work out the direction of the biases in the conclusions. They are typically so patent that it doesn’t take much to work out. But sometimes they produce benign statistically-based reports that provide a reasonable summary of what is going on out there.

The official response (December 7, 2010) from the U.S. Secretary of Education Arne Duncan was:

Today’s PISA results show that America needs to urgently accelerate student learning to remain competitive in the global economy of the 21st century. More parents, teachers, and leaders need to recognize the reality that other high-achieving nations are both out-educating us and out-competing us. Our educational system has a long way to go to fulfill the American promise of education as the great equalizer.

Being average in reading and science — and below average in math — is not nearly good enough in a knowledge economy where scientific and technological literacy is so central to sustaining innovation and international competitiveness. The results are especially troubling because PISA assesses applied knowledge and the higher-order thinking skills critical to success in the information age.

So what has been happening in the US under the increasing deficit terrorist tyranny of the US Congress? We know that budget-constrained states are closing schools and sacking teachers in the name of some fiscal target that is meant to be protecting the future prosperity of the nation. None of that is necessary, given that the federal government could provide the revenue-depleted states with enough funding to ensure their public education systems grow rather than contract.

Education is the future but it has to be maintained now.

Move on a year and there has been more evidence forthcoming in the last week courtesy of the Education at a Glance 2011: OECD Indicators.

What do we learn now? A news summary tells us that:

The US is losing its advantage in the global talent pool as the number of adults gaining college degrees in countries such as China and South Korea increases rapidly … One in four adults with a higher education degree is in the US, but industrialised and emerging economies are catching up. China has 12 percent of all college graduates, but among young adults, its share is much higher. Of those ages 25 to 34, 18.3 percent of college graduates are in China compared to 20.5 percent in the US …

The OECD Report finds that the US has the highest tuition fees but “the percentage of public spending on higher education in the U.S. that goes toward subsidies such as scholarships, grants and loans is about the same as the other countries examined”. The Report also found that:

… many U.S. students are academically unprepared for the challenges of higher education, with 42 percent of 15-year-olds scoring less than a proficiency level three in the PISA reading exam, compared to 17.3 percent of students in Shanghai.

The solution of the US government – close schools, entrench long-term unemployment and thereby ensure that disadvantage is passed on down the generations at an accelerating rate.

A Modern Monetary Theory (MMT) perspective

From the perspective of MMT perspective, national government finances can be neither strong nor weak but in fact merely reflect a “scorekeeping” role. We have learnt that when Government boasts that a $x billion surplus, this is tantamount to saying that non-government $A financial asset savings recorded a decline of $x billion over the same period.

Thus if the Government is really intent on pursuing a surplus “to provide for the future” then they must simultaneously be be wanting the non-government $A financial asset savings to decline by an equal amount. That is, have less capacity to “provide for the future”.

Given that the US (like most nations) run current account deficits, the fiscal austerity proponents must be defining “fiscal responsibility” as being a policy stance that drives the private domestic sector (as a whole) into further indebtedness. That is a consequence of their intended actions.

Of-course, it is highly unlikely that a nation in economic decline with a private domestic sector intent on improving its balance sheet (reducing debt levels) via increased saving would generate budget surpluses via fiscal austerity. It would require the external balance to generate large surpluses which is not likely at all and, by definition, cannot be a solution for all nations simultaneously.

Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

So the consequences of a policy strategy that aims to generate budget surpluses under these circumstances will be chronic slowdown in growth and rising or persistently high unemployment.

The ambition which seeks to reduce net public debt is also equivalent to saying that non-government holdings of government debt will fall by the same amount over this period. In other words, private sector wealth will be destroyed in order to generate the funds withdrawal that is accounted for as the surplus.

In a financial sense, this is madness.

Once we appreciate these equivalents we would conclude that this draining of financial equity introduces a deflationary bias that will constrain output and employment growth and keep unemployment and underemployment at unnecessarily high levels. It will clearly also force the non-government sector to rely on increasing debt to sustain consumption.

It is an unsustainable growth strategy and the last thing you should be doing when faced with the rising dependency ratios.

In terms of the stated aims – to improve the fortunes of the next generation – the strategy is culpably criminal.

Financial commentators often suggest that budget surpluses in some way are equivalent to accumulation funds that a private citizen might enjoy. This idea that accumulated surpluses allegedly “stored away” will help government deal with increased public expenditure demands that may accompany the ageing population lies at the heart of the intergenerational debate misconception. While it is moot that an ageing population will place disproportionate pressures on government expenditure in the future, it is clear that the concept of pressure is inapplicable because it assumes a financial constraint.

A sovereign government in a fiat monetary system is not financially constrained.

There will never be a squeeze on “taxpayers’ funds” because the taxpayers do not fund “anything”. The concept of the taxpayer funding government spending is misleading. Taxes are paid by debiting accounts of the member commercial banks accounts whereas spending occurs by crediting the same. The notion that “debited funds” have some further use is not applicable.

When taxes are levied the revenue does not go anywhere. The flow of funds is accounted for, but accounting for a surplus that is merely a discretionary net contraction of private liquidity by government does not change the capacity of government to inject future liquidity at any time it chooses.

The standard government intertemporal budget constraint analysis that deficits lead to future tax burdens is ridiculous. The idea that unless policies are adjusted now (that is, governments start running surpluses), the current generation of taxpayers will impose a higher tax burden on the next generation is deeply flawed.

The government budget constraint is not a “bridge” that spans the generations in some restrictive manner. Each generation is free to select the tax burden it endures. Taxing and spending transfers real resources from the private to the public domain. Each generation is free to select how much they want to transfer via political decisions mediated through political processes.

When modern monetary theorists argue that there is no financial constraint on federal government spending they are not, as if often erroneously claimed, saying that government should therefore not be concerned with the size of its deficit. MMT does not advocate unlimited deficits. Rather, the size of the deficit (surplus) will be market determined by the desired net saving of the non-government sector.

This may not coincide with full employment and so it is the responsibility of the government to ensure that its taxation/spending are at the right level to ensure that this equality occurs at full employment. Accordingly, if the goals of the economy are full employment with price level stability then the task is to make sure that government spending is exactly at the level that is neither inflationary or deflationary.

This insight puts the idea of sustainability of government finances into a different light. The emphasis on forward planning that has been at the heart of the ageing population debate is sound. We do need to meet the real challenges that will be posed by these demographic shifts.

But if governments continue to try to run budget surpluses to keep public debt low then that strategy will ensure that further deterioration in non-government savings will occur until aggregate demand decreases sufficiently to slow the economy down and raise the output gap.

The mainstream economists believe rising dependency ratios will undermine the financial position of the government. However, this logic is based on false notions of the government budget constraint. The myth is as follows: a rising dependency ratio leads to a reduced tax base and hence an increasing fiscal crisis given that public spending will rise to accommodate increased demand for health care and pensions.

They then conclude that if the ratio of economically inactive rises compared to economically active, then the economically active will have to pay much higher taxes to support the increased spending. So an increasing dependency ratio is meant to blow the deficit out and lead to escalating debt.

These myths have also encouraged the rise of the financial planning industry and private superannuation funds which blew up during the recent crisis losing millions for older workers and retirees. The less funding that is channelled into the hands of the investment banks the better is a good general rule.

But all of these claims are not in the slightest bit true and should be rejected out of hand.

However, the ageing society will not present a financial crisis for government but a “real” one. The question that has to be answered by policy makers is whether there will be enough real resources available to provide aged-care at an increasing level? But the deficit terrorists never pose that question.

They just worry about public outlays rising. It is true that if there is increased demand for public services in the future then more real resources will be required “in the public sector” than previously.

But as long as these real resources are available there will be no problem. In this context, the type of policy strategy that is being driven by these myths will probably undermine the future productivity and provision of real goods and services in the future.

It is clear that the goal should be to maintain efficient and effective medical care systems and first class education systems. Further, productivity growth comes from research and development and typically strong public sector investment is needed to ensure innovation rates are high.

For all practical purposes there is no real investment that can be made today that will remain useful 50 years from now apart from education and health care. Unfortunately, tackling the problems of the distant future in terms of current “monetary” considerations which have led to the conclusion that fiscal austerity is needed today to prepare us for the future will actually undermine our future.

The irony is that the pursuit of budget austerity leads governments to target public education almost universally as one of the first expenditures that are reduced.

Most importantly, maximising employment and output in each period is a necessary condition for long-term growth. The emphasis in mainstream integenerational debate that we have to lift labour force participation by older workers is sound but contrary to current government policies which reduces job opportunities for older male workers by refusing to deal with the rising unemployment.

Anything that has a positive impact on the dependency ratio is desirable and the best thing for that is ensuring that there is a job available for all those who desire to work.

Undermining income earning opportunities and impoverishing an increasing proportion of a population is not a forward-looking strategy. It not only undermines the capacity of the private sector to provide for themselves in retirement but also imposes further real resource strains on the nation as a whole as productivity growth lags behind need.

Further encouraging increased casualisation and allowing underemployment to rise is not a sensible strategy for the future. The incentive to invest in one’s human capital is reduced if people expect to have part-time work opportunities increasingly made available to them.

But all these issues are really about political choices rather than government finances. The ability of government to provide necessary goods and services to the non-government sector, in particular, those goods that the private sector may under-provide is independent of government finance.

Any attempt to link the two via fiscal policy “discipline:, will not increase per capita GDP growth in the longer term. The reality is that fiscal drag that accompanies such “discipline” reduces growth in aggregate demand and private disposable incomes, which can be measured by the foregone output that results.

Clearly surpluses help control inflation because they act as a deflationary force relying on sustained excess capacity and unemployment to keep prices under control. This type of fiscal “discipline” is also claimed to increase national savings but this equals reduced non-government savings, which arguably is the relevant measure to focus upon.

Conclusion

The idea that it is necessary for a sovereign government to stockpile financial resources to ensure it can provide services required for an ageing population in the years to come has no application. It is not only invalid to construct the problem as one being the subject of a financial constraint but even if such a stockpile was successfully stored away in a vault somewhere there would be still no guarantee that there would be available real resources in the future.

The best thing a government can do is to maximise incomes in the economy continuously by ensuring there is full employment and aligning real wages growth with productivity growth and fostering the latter. This requires a vastly different approach to fiscal and monetary policy than is currently being practised.

If there are sufficient real resources available in the future then their distribution between competing needs will become a political decision which economists have little to add.

Long-run economic growth that is also environmentally sustainable will be the single most important determinant of sustaining real goods and services for the population in the future. Principal determinants of long-term growth include the quality and quantity of capital (which increases productivity and allows for higher incomes to be paid) that workers operate with.

Strong investment underpins capital formation and depends on the amount of real GDP that is privately saved and ploughed back into infrastructure and capital equipment. Public investment is very significant in establishing complementary infrastructure upon which private investment can deliver returns. A policy environment that stimulates high levels of real capital formation in both the public and private sectors will engender strong economic growth.

If we adequately fund our public education systems and foster high rates of productivity then the real burden on the economy will not be anything like the scenarios being outlined in the “doomsday” reports. But then these reports are really just smokescreens to justify the neo-liberal pursuit of budget surpluses and the redistribution of real resources to the elites away from the workers.

That is enough for today!

“And then, to ease the day’s burden I wondered why the WSJ spells the Eurozone with a hyphen. ”

One answer: Microsoft word spellchecker cribs usage of Eurozone but not Euro-zone.

All basic,sensible stuff,Bill. I am not surprised by the stupidity,ignorance and arrogance of our “leadership” class,public and private.One doesn’t have to read too much history to see that Homo Saps has been through all this before in one way or another. We are in the midst of a Great Weirding,yet again.

“These myths have also encouraged the rise of the financial planning industry and private superannuation funds which blew up during the recent crisis losing millions for older workers and retirees. The less funding that is channeled into the hands of the investment banks the better is a good general rule.”

This is an important point Bill. It truly is a shame the amount of resources that get diverted to the financial sector for this purpose. In Canada, policymakers of all stripes blindly promote the interest of the financial planning industry by endorsing policies that have the effect of maximizing the amount of savings. No one ever challenges these ideas. Glad to see you tackling this issue.

LoL Ramanan!

Randy Wray puts the case for: Framing: Morality Trumps Reason When it Comes to Vampire Squids and Other Blood Suckers. Link this to a lack of education (obscuring reality) and a plethora of thoughts replacing understanding (misinformation) and the beast becomes apparent ….

“You couldn’t make all this stuff up”

Indeed,

“truth is stanger than fiction”

I’ve learnt this one the hard way, as I’m sure you have.

My hypothesis is that the “peak oligarchs”, (the richest and most established multi-billionaires) and their key advisers and more intelligent bought politicians, know that MMT or the soft Keynesian approximation of it, is the correct way to run an egalitarian and richer, mixed economy. They simply do not want this ever put into practice. It would be ananthema to them (the peak oligrachs) for the masses to discover what is truly in the masses’ best interests. The peak oligrachs calculation is that they can remain richer under the current system even though the entire economy is poorer overall.

Their program of disinformation, obfuscation, wedge politics, promotion of jingoism, xenophobia and general fear and loathing is quite deliberate. They love that the looney right believes their propaganda and promotes it for them. The looney right then draws all the attention away from the intellectually and politically adriot machievellian oligrarchs who can continue to makes their plans (like the Omega Project) to keep the masses impoverished and controlled.

And then, to ease my day’s burden, I thought about Bill thinking about the WSJ’s odd punctuation choices and then realized Bill covers up his expletives the same way!

If you don’t think the American educational system is in trouble, then just look at the quality of the politicians it is turning out.

And to follow up on the point Circuit made, just think if we hadn’t had SS after the GFC, how many people would be left in the streets because of depending on the financial planing industry?

Bill says “Most of the financial market transactions are totally unproductive..”. In that connection I’d like to plug a recent post by an MMT blogger, Rodger Mitchell. He suggests socialising banks. My instinctive reaction, as I’m essentially pro-free market, was “no”. But actually Rodger’s arguments are quite persuasive. See:

http://rodgermmitchell.wordpress.com/2011/09/14/how-about-socialized-banking/

Dear Bill,

I agree with the vast majority of your insights. However, I only ever comment to criticise. As I pointed out in a response to a previous billy blog post, education is not the only investment that can be made that will be giving a return 50 years in the future. Healthcare is also important. I realise that you produce a lot of blog text by the tried and tested technique of cut’n’paste, but would you consider updating the text in this case?

Dear dnm (at 2011/09/15 at 18:38)

Thanks for your criticism. I agree with you and have appended the text just in case I “cut and paste” it again.

best wishes

bill

Ikonoclast: My hypothesis is that the “peak oligarchs”, (the richest and most established multi-billionaires) and their key advisers and more intelligent bought politicians, know that MMT or the soft Keynesian approximation of it, is the correct way to run an egalitarian and richer, mixed economy. They simply do not want this ever put into practice. It would be ananthema to them (the peak oligrachs) for the masses to discover what is truly in the masses’ best interests.

I think that is indubitably the case. TPTB fully understand the intricacies of money, banking, and finance wrt to convertible and non-convertible, fixed and floating rate. To think otherwise is naive. When the world went to a pure fiat system, for example, the previous system had to be re-engineered and it was rigged to mimic a fixed rate system through political restraints in the name of maintaining “fiscal discipline’ with the underlying idea that governments would still be borrowing from the private market to finance themselves rather than through direct issuance. The whole point of this exercise, which is operationally unnecessary, is to leave control in the hands of capital, read the “peak oligarchs.” It is abundantly clear from what has happened to date, and perhaps more importantly, what has not happen or been undermined, that TPTB are acutely aware of how changes in the monetary and financial systems affect their control. This stuff doesn’t just happen, especially when there are armies of highly paid lobbyists pushing this in the halls of government and controlling the media spin. What Warren Mosler euphemistically calls “innocent deadly frauds” are not so innocent at all in my way of thinking.

Some time ago on this very blog a commentator admitted that he objected to MMT policy proposals because he feared that following them would reduce inequality, and consequently he would not be able to “enjoy” the same relative degree of wealth even though he might actually be wealthier. So there is evidence that this type of perverse thinking exists.

Below are some quotes from an article by Elizabeth Drew, long time Congress watcher and reporter, in the current edition of the New York Review of Books, “What Were They Thinking?” about the debt ceiling fight. Drew understands all the ins and outs of politics in Congress and she also understands that focusing on the deficit at a time of (de facto) recession is insane. But she doesn’t know about MMT and takes seriously the threat of default as being an actual possibility that would be calamitous. But James Galbraith, Warren Mosler and other MMT thinkers say that is by definition impossible.

Would you MMT folks write to the Review to straighten this out? This is a preposterous situation that the NYRB, which has been a left wing intellectual leader for over 30 years, has as its regular writer on Congressional politics a reporter who is not clued in on MMT. This is not to blame Elizabeth Drew, whom I’ve admired for years. After all, even Paul Krugman doesn’t get it. If you could get a letter printed in the NYRB it would raise the visibility of MMT enormously.

“Months later, with the threat of a government default if the debt ceiling was not raised by August 2, the Republicans once again seized the agenda and demanded that there be a ten-year budget with major spending cuts. The President had yet to put forward a serious long-term budget of his own. The regular legislative process was then superseded by policy being made, in a room out of sight of the press and the public, by negotiators facing the threat of the United States government going into default. It takes the threat of something awful happening to drive the politicians-fearful of the effect on their careers-to bring deliberations to a close. . . .

With the negotiations stalled and time running out, McConnell, worried that the President had manuevered his party into a position where if there were a default the Republicans would be blamed, introduced his own proposal to break the impasse. The very shrewd McConnell warned his Senate colleagues that if they did not take this way out of the impasse, the party’s “brand would be badly damaged.” McConnell’s proposal handed over to the President the authority to raise the debt ceiling, which his own party had been trying so hard to exploit and never dreamed it would surrender to the President. . . .

Still, liberal-leaning budget analysts agree that the budget is on an “unsustainable” path, with debt constantly rising as a share of the Gross Domestic Product. As of now, the debt is close to 70 percent of GDP. James Horney of the highly respected Center on Budget and Policy Priorities says that that’s a workable percentage, but that steps should be taken to stabilize it by the end of this decade. That would require, Horney says, a substantial amount of deficit reduction-no easy task-including increases in revenues. . . .

A final deal became exigent for the major players: naturally, Obama didn’t want to preside over a calamity; and just as urgently, the Republican leaders didn’t want to be pinned with the blame for bringing about the calamity-which poll after poll suggested they would be. Thus it was assumed that a deal would be reached not because the Republicans had a sudden surge of responsibility but because they feared the political consequences of not appearing to be responsible.”

“The accompanying Press Release summarises the findings of the Report, although I would urge you to read the Report and if you are Americans then challenge your representative for answers and tell them that anyone who proposes to cut the deficit at present will lose electoral support including financial donations. Go on, do it!”

Really, there is no longer any point in threatening a loss of financial donations from the ordinary citizen. The corporations and the elites can out-donate the ordinary person by $100.000 to $1. There are no limits on financial contributions anymore, thanks to “Citizens United” decision by the Supreme Court.

Also, I don’t think you realize that our elites are out to DESTROY public education, and any child not smart enough to be born into a wealthy family can go to hell as far as they are concerned. They will not be happy with massive cuts to public education – they want to END public education altogether.

Yeah, the future is not looking too good…..

Dear Susan (at 2011/09/16 at 15:16)

Thanks for your comment. I agree with your assessment and the same forces are trying to undermine public education in many nations – including Australia. Clearly the citizenry do not have the financial capacity to counter the elites as you note. But you will also note I said “lose electoral support”.

As naive as I am, Americans still vote and those votes still elect the Congress and the President. So until the elites perfect the ultimate corporate totalitarian state – the citizens have power. I know the media, the lobby groups, the think tanks all conspire to undermine the vote. But you still have it and when each of the voters walk into the polling booth and cast their choices the corporate elites are powerless to change what is written on the voting paper.

The challenge for those who defend public education is to work at that level and force the politicians to listen in the only way that will ultimately matter to them – their electoral success. I know it is a mountain that has to be climbed. But there is always hope.

best wishes

bill

But you still have it and when each of the voters walk into the polling booth and cast their choices the corporate elites are powerless to change what is written on the voting paper.

Well, there is gerrymandering and bogus voter-fraud protection. They can target communities and demographics with districting and voting requirements quite well, while also swaying the many who are prone to believing their propaganda. You only need a light finger on the scale to change the outcome, and they’re making the scale easier and easier to tilt all the time.

I should add two things:

1. I know you already know that. I just needed to write it.

2. This particular post is chock full of money quotes, that is, quotable quotables. Some posts are better than others in that regard. So many of the key concepts are present in clear, concise paragraphs in this one that I may use it as a go-to reference for material when discussing the economy and the government’s role therein.

Okay, three things:

3. So, thanks, bill.

Bill wrote “when each of the voters walk into the polling booth and cast their choices the corporate elites are powerless to change what is written on the voting paper”.

For Australia, I would accept that the above is true. For the US, I am not so sure. I remember a couple of very odd Presidential elections in the USA… the chads fiasco in Florida, the interference of the Governor of Florida, the systematic striking of blacks and other minorities from the rolls, booths in other parts of the country returning very anomolous figures, the most astonishing discrepancies between exit polls and final results, mathematical analyses that of the enormous improbabilities of certain late swings, the Diebold voting machine fiasco (wireless hacking?), the lockdown of voting precincts in Ohio etc etc by TPTB. Need I go on?

Also, what kind of democracy is the USA anyway? They have a very right wing party (Democrats) and an extreme right wing party (Republicans) in what is essentially a two-party, one-ideology crypto-totalitarian state.

“The irony is that the pursuit of budget austerity leads governments to target public education almost universally as one of the first expenditures that are reduced.”

In the U. S., anyway, I suspect that that is not a bug but a feature. First, cutting public school budgets puts pressure on teacher’s unions. Second, an educated proletariat is “dynamite”, as Roger Freeman, aide to CA gov. Reagan and later education advisor to Nixon put it. The right wing does not want that.