I have received several E-mails over the last few weeks that suggest that the economics…

The coalition of the willing

When the Liberal Democrats went into coalition with the British Tories I was surprised how readily and brazenly their leadership was prepared to compromise the underlying principles of the party for power. While the Party Constitution claims they stand for – “a fair, free and open society” balancing “the fundamental values of liberty, equality and community, and in which no-one shall be enslaved by poverty, ignorance or conformity” and “that the role of the state is to enable all citizens to attain these ideals, to contribute fully to their communities and to take part in the decisions which affect their lives” it is clear that they have become partners in a policy regime that is the anathema of those ideals. By entering the coalition they have allowed a pernicious regime to be inflicted on the British people – one which is driving unemployment up and incomes down. The Liberal Democrats are having their Annual Conference this weekend in Birmingham and it is clear if the utterances of some of their members are anything to go by that the Party is struggling with their identity. The Deputy Leader for example said (September 17, 2011) that the job of the Liberal Democrats was “to rein in the ruthless Tories”. The reality is that it is the government that is ruthless and the Liberal Democrats are part of that government and give it the air it needs. I was unfortunate to listen to a BBC interview today with Liberal Democrats leader Nick Clegg and it left me with the impression that there is little to distinguish the coalition partners on the main economic issues. Both parties are infested with neo-liberalism and both fail to understand basic macroeconomics – that spending creates income.

You can read the Transcript of the BBC interview with the Deputy Prime Minister for yourself – it was on the “Andrew Marr Show” on Sunday morning.

The BBC interview began with the topic of growth and the Euro:

ANDREW MARR: Let’s talk, to start with, about hard times. We have the euro crisis all around us … and the latest figures suggest that we may either have a completely flat period in the economy or things might actually return to recession. So talk us through just how bad you think, how worried you are about the economy, first of all.

NICK CLEGG: Well I think the situation is very serious. You know we are a very open economy. We are hugely dependent on what happens around us, particularly on the Eurozone. Forty per cent of our exports and more go into the Eurozone, so if things are spluttering there – as they are very seriously – then of course that affects us massively, which is why you know it’s hugely in our national interest to make sure that the Eurozone is strong. But that doesn’t mean there aren’t things we can do at home. Now of course we’re balancing the books, everyone knows that; we’re reducing the burden on businesses – less red tape, less tax. But I think there are more things we can do to create jobs today and build for tomorrow, and that’s why you know last week I made a speech about how we’re giving priority to infrastructure projects. Danny Alexander today has talked about £500 million being set aside for local infrastructure projects. What does infrastructure mean? Broadband, housing, rail, roads. And you know Vince Cable has also been talking about the need to do that – to kind of really, to really make sure that we foster confidence where we can even though, you’re right, the wider context is really tough.

There is never any excuse for a sovereign nation (one that issues its own currency and floats it on international markets) to allows its domestic economy to falter when its export markets shrink. Clearly, the crisis in the Eurozone is impacting on British exports – which by the way accounts for around 60 per cent of British exports rather than “forty percent … or more” as the Deputy Prime Minister estimated.

But the impact is on aggregate demand (Britain typically runs a small external surplus against the Eurozone) can be replaced by domestic demand – private households and firms and government. When the recession began in earnest in 2008, the Chinese government, facing a sharp drop in export earnings, quickly used its fiscal capacity to stimulate domestic spending. They very successfully switched demand from exports to public infrastructure development and kept growing.

The western governments initially followed suit but quickly came under conservative pressure and abandoned their stimulus attempts far to early. As the

But the Liberal Democrat leader is correct – “there are more things we can do to create jobs today and build for tomorrow” – the only problem is that the British Government is doing exactly the opposite and that is why the economy, which was recovering as a result of the stimulus in 2008-09, is now faltering and unemployment is rising.

As the Liberal Democrat leader says “they are balancing the books” – which should be expressed as the Government is attempting to balance the books. What they are learning is that the non-government spending will ultimately determine whether they balance the books or not. The budget outcome is not totally in the Government’s control and if they continue to undermine growth then the automatic stabilisers will work against their balancing aims.

The BBC interview proceeded:

ANDREW MARR: I want to come back to the wider context in a minute, but there’s a sort of simple question which is you’re cutting expenditure, taxes remain high in order to balance the books, so where possibly is the money going to come from for the kind of substantial infrastructure projects that would actually get unemployment down?

NICK CLEGG: Well let me just first a little bit of perspective. We as a government are still spending £700 billion a year. That is … (Marr tries to interject) No but hang on …

ANDREW MARR: None of us understand what that means. That’s the trouble.

NICK CLEGG: Okay well let me … The thing is there is this ludicrous caricature that because we’re balancing the books government can’t do anything, that somehow we’re turning the clock back to the 80s or the 30s. Do you know as a proportion of the country’s wealth, this government will be spending more in public spending at the end of this parliament, after all these cuts, than Tony Blair and Gordon Brown were when they came into power. So there’s a lot that government can still do – not only through direct spending on Broadband, on housing, on road, on rail, but some of the innovations. We’re setting up the first green investment bank, which is an investment bank which takes public money, taxpayers’ money, and then gets private investors’ money into, for instance, renewable energy.

ANDREW MARR: (over) So coming back to my …

NICK CLEGG: (over) That makes a big difference in actually creating jobs today, but, as I say, building for the future as well.

ANDREW MARR: So where does the money come from for these big projects, and how much money will there be?

NICK CLEGG: Well there will be literally billions of pounds of investment, which we’d already planned, but what we’re making sure is that the ones which stimulate growth most effectively now and help for instance employ young people, young men who at the moment can’t find a job, that they are given real priority.

It was very frustrating listening to this. How the British public finds Nick Clegg likeable is beyond me. But personalities aside (which are less important anyway), it is clear that the macroeconomics of the current situation in Britain escaped the Liberal Democrat leader.

You can access British government spending and revenue data from the British Treasury. Particularly useful is their Public Finances Databank.

For the record, Blair took over in May 1997 and the Labour Party lost power in May 2010.

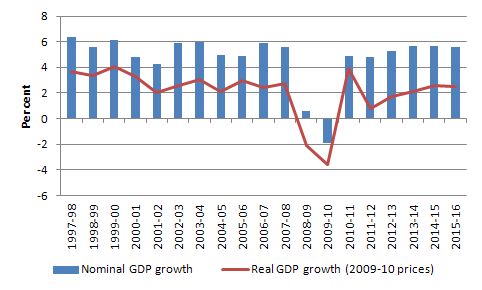

If you examine the Treasury forecasts you will see they are projecting what seems to be robust nominal GDP growth over the forecast period (to 2015-16). But when you examine them in real terms (by deflating them), the forecasts are much more modest.

The following graph captures the difference between the forecasts for nominal GDP (blue line) and real GDP growth. You can see that in 2011-12, real GDP is forecast to shrink back to 0.8 per cent and then recover slowly.

The reality is that it is likely given the current trajectory that real GDP growth will be close to zero or even cross the zero line in the coming year. The ideological faith the British government had in the recovery of private spending plus a net export-led recovery were always going to be gross overestimates of what will happen.

That means that the output gap estimates in the Budget will be biased downwards which makes it more imperative that the government increases real spending growth rather than cut it.

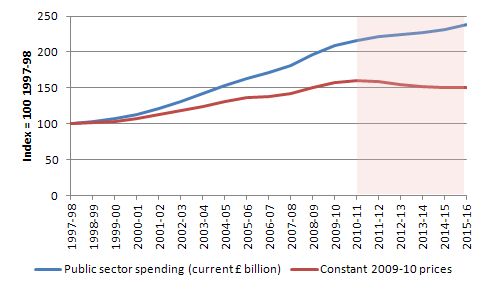

What about the Liberal Democrat leader’s public spending claims above? I did some analysis of the data as one would.

Total public sector spending in 2010-11 is £691.7 billion with the central government spending being £502.7 billion. So when Mr Clegg says “we” are spending 700 billion pounds he is being very “liberal” with his definitions.

But if you then consider the real spending, you get quite a different picture. Output gaps are real concepts – that is, the percentage shortfall in real output from potential output. The Treasury data allows one to project the real spending until 2015-16. While they provide a GDP deflator (to allow the real series to be computed) up to 2010-11, I extended it by assuming that inflation was 4 per cent in 2011-12, 3.5 per cent in 2012-13 and 2013-14 hen 3 per cent for the remainder of the Treasury forecast period to 2015-16.

I don’t think the inflation assumptions are particularly unrealistic or likely to distort the main conclusion – that real spending is falling under the current British government.

The following graph shows you the evolution of total public sector spending in £ billions indexed at 100 for the 1997-98 year (Blair’s first budget) until 2015-16 based on actual data and Treasury Budget forecasts.It also shows total real public spending over the same period (at 2009-10 prices). The truth is revealed. The British public sector is forecast to contract significantly in real terms over the coming years.

Further, as a percentage of GDP, public expenditure peaked at 47.6 per cent in 2009-10 as the output gap rose from 1 per cent in 2008-09 to 4.2 per cent in 2009-10. In the 2010-11 year, it had dropped to 47 per cent despite slowing GDP growth. The Treasury forecasts suggest a rising output gap this year (2011-12 to 3.9 per cent) but public spending will comprise a smaller proportion (46 per cent). It is then forecast to drop to 39.9 per cent by 2015-16 (about the same proportion that Blair inherited in 1997).

So the “we are spending our heads off” claim by the Liberal Democrat leader are less than true. Both real current and real net investment spending is projected to decline over the next several years.

Even if the Government is still spending (a flow) £700 billion a year the output gap suggests they should be spending much more than that. There is no real consensus on the size of the output gap but it is an important concept because it conditions the way the Government estimates its structural deficits.

By way of summary, the actual deficit outcome is composed of the structural component – the discretionary policy stance; and the cyclical (automatic stabiliser) component which indicates the departure from some “full employment” level of output. The wider the output gap the larger will be the cyclical component of the budget outcome.

The cyclical component results from the fact that as the economy moves away from full employment tax revenue falls and welfare spending rises which push the budget deficit up automatically (or reduces a surplus).

The structural deficit is thus measured at what is deemed to be “full capacity” or potential output. So a structural deficit of 2 per cent of GDP would reflect an expansionary fiscal stance whereas an overall budget deficit of 2 per cent may, in fact, reflect a contractionary fiscal stance if the cyclical component was, say, 3 per cent of GDP.

A further point is that a structural deficit is not necessarily inappropriate. If non-government overall saving desires are equal to say 2 per cent of GDP then a structural deficit of 2 per cent would be required to maintain income growth at potential and fill the non-government spending gap.

It is highly likely that the structural deficit estimated by the UK Treasury is biased upwards. Please read my blogs – Structural deficits – the great con job! and Structural deficits and automatic stabilisers – for more discussion on this point.

But even if the current structural deficit estimates are accurate, there is no case that can be made for real spending cuts in the UK at present. Rising unemployment is a sure sign that the budget deficit is too low.

Despite what the Liberal Democrat leader constructs as a “ludicrous caricature that because we’re balancing the books government can’t do anything” – the reality is very clear. Clearly with a balanced structural budget balance the government is still spending and pursuing its program. But that misses the point – the British government needs to be expanding its budget deficit. There needs to be more spending. Changing the composition of declining spending may divert funds into more desirable areas of activity but at current productivity levels will not expand employment to any extent.

Further, when the Liberal Democrat leader uses terms like government spending “as a proportion of the country’s wealth” you know how confused they are about macroeconomics. There is no meaningful concept linking government spending (a flow) to national wealth (a stock). What he means is national income which is a flow like spending. But the looseness of the language is indicative.

Then we came to this interchange after Clegg was boasting about how much money they plan to spend on Broadband:

ANDREW MARR: But this is not new money, is it? This is something you’ve announced already.

NICK CLEGG: Well let’s be clear. Quite a lot of it is money that was already in the system, but, crucially, we will actually by 2014/15 be spending a little bit more on what they call capital spending – on these big, big projects …

By 2014/15 real net investment will be £20.9 billion (2009-10 prices) compared to £30.3 billion pounds (2009-10 prices) in 2011-12. It is a lie to say they will be spending more in real terms, which is the only measure that is relevant given that inflation eats away the growth in nominal spending.

But you can see the interviewer is pushing Clegg to talk about the direction of change in aggregate demand rather than the existing level of spending.

A short-time later, the BBC interviewer said:

ANDREW MARR: And yet you know that out there, there are no signs of growth. I mean the private sector is not racing to the rescue, as you might hope, and indeed everyone’s looking at the global picture and shivering and retrenching rather than spending more. So what else can you do? What about looking again at the tax system for small businesses? What about tearing up some of the old planning rules to make it easier for house builders and other people to … [after some to and fro Clegg then said]

NICK CLEGG: … economists talk about numbers and they talk about percentages and billions here and billions there. At the end of the day what this is all about is something much more elusive and much more delicate, which is just confidence. It’s confidence to get people to start building that first house, confidence that the business uses money they’ve got to create a new job, confidence to households to go out and actually spend a bit of money in the high street. And that’s a delicate thing. It’s affected by international circumstances, over which we only have limited control – we have influence but not control – but we can also do things in the way that I’ve described to boost confidence at home.

I agree that confidence is crucial to private spending recovery. But the numbers he refers to, in part, relate to orders coming into firms, incomes coming to workers, decisions to spend, decisions to save. Confidence in a capitalist market economy reflects how much profit can be made from the sales of goods and services, and for workers how secure their jobs and incomes are. Firms will not employ if they do not think they can sell. Workers will not expand their spending if they are worried about losing their jobs.

When unemployment rises it reduces the confidence of households. When households reduce spending, firms do not approach the future in an optimistic way.

It is true that measuring “confidence” is difficult. But there are enough surveys around that seek to calibrate shifts in sentiment and they all verify that firms and households are very cautious at present and that uncertainty about jobs and the loss of spending from public sector cutbacks are key factors driving this conservatism.

There is no evidence to support the Ricardian Equivalence postulate that the British government has based its fiscal austerity program on – the claim that private spending will rise once governments attack the deficit because firms and households will believe their future tax burdens will be lower. There has never been any empirical evidence to support that claim.

The British government has a major influence on the state of confidence in their economy – and the evidence supports the fact that they are currently undermining it.

After some discussion about increasing taxes on the high income earners and some motherhood stuff about the Eurozone, the Liberal Democrat leader was then probed about the coalition agreement which has tied the Liberal Democrats into the fiscal austerity obsession of the Tories:

ANDREW MARR: Is there any part of you, looking at the terrible economic circumstances which may be ahead, that thinks actually we do have to go a little bit slower and cut a little bit less hastily?

NICK CLEGG: Oh I think people who advocate that just need to think this through.

ANDREW MARR: (over) So the answer is no?

NICK CLEGG: Well does anyone seriously think by ripping up the plan to balance the books that somehow you’ll create growth by next Tuesday? It’s a complete illusion. Actually what you create is outright market panic, higher interest rates and more unemployment.

The interview ended at that point. It was clear that the Liberal Democrat leader has taken on all the neo-liberal myths that the Conservatives perpetuate. It is a fact that if the British government ripped up its plan and maintained fiscal support for the private deleveraging process that recovery would have continued. It was a relatively modest recovery but since the austerity has been progressively introduced it is clear that the recovery has stalled and is now going backwards.

It is also a fact that if the British government announced a wide-scale public sector job creation program and offered anyone a job at a minimum wage that it would change the direction of the British economy dramatically. If they announced it today (Monday) and offered to pay a wage from Tuesday for anyone who turned up for work – I predict hundreds of thousands of workers would register for work within 24 hours. If the wages were paid within a week – then I predict there would be an instant spike in retail spending.

If the government indicated they would maintain the jobs until the private sector had recovered I predict private investment would rise quickly in the coming months. I also predict that within a year there would be very few workers left in the public job creation programs.

So there is something the government can do immediately – with immediate effects. Expand government spending in the form of wages for workers employed in public sector job creation programs. It doesn’t even matter if the government departments need some time to design and implement the job creation program. As long as the wages started flowing immediately, the economy would start responding immediately. Spending creates income whether the wages come from public sector job creation programs or are given to some banker in the “City”.

Further, the final throwaway line about “outright market panic, higher interest rates and more unemployment” is just neo-liberal jabber. At that point, the interviewer should have asked Clegg to explain the experience of Japan over the last 20 years.

He might have also asked how Clegg explained the low interest rates in Britain. Like “who sets interest rates”?

Like – bond yields remain very low and markets cannot get enough of government bonds – how do you explain that?”

Like – the same applies to all the advanced nations outside of the EMU – how do you explain that?

Like – how does market panic actually occur when the government is issuing its own currency and the central bank is setting interest rates (and yields)?

Like – please give an instance where a nation has been destroyed by market panic and unemployment has risen when that same nation bestows a currency-issuing monopoly on its national government and that government only has liabilities in its own currency?

The UK Guardian (September 18, 2011) covered the interview in this article – Lib Dem conference: Nick Clegg denies plan to step down in 2015.

The Guardian decided to highlight the speculation that Clegg would be a one term leader, which he denied in the interview. They also highlighted the falling popularity of the Liberal Democrats which suggests they will be wiped out at the next election – and deservedly so.

Conclusion

While the Liberal Democrat leader is trying to differentiate himself and his party from the mayhem that the “ruthless” Tories are now inflicting on Britain the reality is the polls will sort his lot out.

The coalition agreement has allowed the government to impose job cutting austerity on Britain at a time that it was showing signs of recovery. All the parties to that agreement will be held responsible for the results.

They are the coalition of the willing.

That is enough for today!

Dear Sir: Please provide a concrete description of “a wide-scale public sector job creation program (that) offered anyone a job at a minimum wage” for an indefinite time, perhaps a lifetime, suitable for all comers no matter their skills and experience, age, sex, physical condition, education, language spoken, personal history (ex-felon, dishonorable discharge, child abuse, etc.), willingness being the only qualification. I have yet to encounter such a description in the MMT literature I have seen. This seems to me to be a serious oversight that hinders the acceptability of the “100% employment” feature of many MMT presentations. For myself, I must regard 100% employment as a perhaps desirable feature that is not a part of MMT, either as a promise or a goal, until I am convinced of its feasibility.

The story about the UK economy is dominated by a very simple graph of net oil exports:

http://mazamascience.com/OilExport/output_en/Exports_BP_2011_oil_bbl_GB_MZM_NONE_auto__.png

From 1980 to 2010 the pound and asset prices in the UK have been boosted by the UK being a net oil exporter, and one can read the politics of the UK in that graph. Now the UK is increasingly a net oil importer, and the UK does not have an export oriented economy, and therefore the only the only possible outcome is a dramatic cut in living standards for most people, via much higher import prices and wage compression.

In real terms the UK GNP is still around 5% below what it was a few years ago, and accordingly incomes must be cut by at least 5%, either by making some more than 5% of workers unemployed, or by letting prices run ahead of wages. There is more to come, as the oil deficit is set to grow even if consumption is compressed, because production is falling faster.

Then UK middle classes have voted themselves for 30 years a cornucopia of asset price bubbles and make-believe non-export-oriented jobs thanks to the rent from oil exports, and this is ending.

I suspect that the tory-libdem government is deliberately suppressing economic activity and keeping unemployment high to avoid surging oil imports blowing up the current account if there is a recovery, for as long as it takes to make median incomes fall by 10-15% in real terms, and only then the government will resume employment-oriented policies.

At to the politics, the LibDems went into government for two reasons, the most important of them to get a referendum on moving away from first-past-the-post elections, which was worth everything to them. Had they won the referendum, they could have renegotiated anything they wanted. But they lost the referendum, so pretty bad news. And it is now obvious that the tories are trying to destroy the libdems as a party. The second reason is that a tory-libdem coalition is the only one that can work arithmetically, so both parties have to do it, or else be blamed by voters for a second selection, which might have the same result.

«make-believe non-export-oriented jobs»

The main problem of most first-world economies is massive underemployment, as most productive jobs have moved to countries with higher returns to capital, because of a lower capital intensity, a lower cost base and higher growth prospect.

As a result most first first-world governments have been trying to hide the lack of job by various means, including boosting the prison population, getting more people into university, “managing” the definition of unemployment, and creating fake jobs.

I had a look at the employment stats by sector for the UK in the past 30 years:

http://www.statistics.gov.uk/downloads/theme_labour/LMS_FR_HS/WebTable6.xls

http://webcache.googleusercontent.com/search?q=cache:PIBKD7MKxHgJ:www.statistics.gov.uk/downloads/theme_labour/LMS_FR_HS/WebTable6.xls

And I have summarized the changes in the following table with changes between March 1978 and March 2011 and numbers (in thousands) as of the latter date, sorted by absolute change betwen those two dates:

change %change Mar-11

2,172 114% 4,084 health

1,625 212% 2,393 professional

1,339 133% 2,342 administration

1,070 66% 2,686 education

734 18% 4,816 distribution

682 56% 1,899 hospitality

387 86% 835 other

377 75% 877 entertainment

337 42% 1,146 finance

282 31% 1,187 ICT

263 149% 440 real estate

186 10% 2,105 construction

123 9% 1,486 transport

-4,100 -62% 2,543 manufacturing

-368 -86% 60 mining

-342 -17% 1,705 public

-138 -24% 437 agriculture

-98 -40% 146 power

-39 -19% 167 water

4,492 17% 31,354 total

9,049 54% 25,896 services

There are many interesting changes in the above, for example that most of the gigantic surge in health employment does not generate value added, never mind exportable value added, because it represents merely a shift of the burden of care of old people from families to the health system, the large increase in education employment is to support the enormous expansion in university education whose main purpose is to remove an ever larger percentage of potential young workers from the job market and unemployment statistics for 2-4 years, and that the enormous increase in professional and administrative jobs follows from the increasing financialisation of the economy driven by the real estate bubble, and we know how well that worked.

Among the interesting stories note that many of the jobs in professional, administration and probably also distribution are related to finance, and that essentially all job growth has been in “staff”, non-export, sectors and essentially all job destruction in “line”, exportable, sectors.

Cal Zethraeus:

Here is a detailed document regarding the Job Guarantee:

http://e1.newcastle.edu.au/coffee/pubs/reports/2008/CofFEE_JA/CofFEE_JA_final_report_November_2008.pdf

Skip to page 226 for the actual JG part.

Also check out these blogs: https://billmitchell.org/blog/?cat=23

Bill defines full employment as 2% unemployment and no underemployment. I assume the pedos and murderers fall into that 2% – and that’s 2% of people looking for work (the labor force) not the entire population.

“I assume the pedos and murderers fall into that 2%”

No, everybody.

If you have a compassionate system without a death penalty, which thankfully we still have in the UK, then you cannot get rid of the people no matter who they are or what they’ve done previously.

Therefore you have to deal with the people as they are – not as you want them to be.

Anybody convicted of a crime goes to prison – which gives them something to do. Anybody who has served their time in prison and has been released then requires a job, and income and resources like every other citizen of the United Kingdom.

As for the Job Guarantee it is very simple. The state pays the wages and then distributes as many as it can to volunteer and social enterprises. That will deal with the vast majority of the people.

The more difficult cases require more inputs, not less, which has the side effect of employing more people in resolving those difficulties.

That is why the current policy to rundown the ‘Remploy’ operation is nothing short of criminal.

Bill,

Great post. Just wanted to say that although Nick Clegg was popular for about two weeks before last years election, he is now pretty much the most hated politician in Britain (and that takes some doing). The word clegg now appears in the urban dictionary. Definition – ‘To Clegg is to betray everything you once stood for in a dash of opportunism and stupidity.’

Slightly off-topic, but at the moment in the UK, the ground is being laid for a further round of QE. The Bank of England has just published a bulletin on the likely impact of the first round of QE (found here):

http://www.bankofengland.co.uk/publications/quarterlybulletin/qb110301.pdf

They are claiming the impact on real GDP was to raise it by 1.5%-2%, and I was wondering if anyone had any thoughts about how realistic this estimate is, as the MMT position as I understand it is that QE has no discernable macro-economic impact.

I agree with Neil that the JG idea is “very simple”. A ten year old can grasp the basic idea. Unfortunately the idea is stuck between a rock and a hard place, as follows. If JG employs largely ex-dole queue labour, AND if it employs little by way of capital equipment and materials, then output per head will be hopeless.

Alternatively, if it employs more normal ratios of unskilled / skilled labour / capital equipment / materials, it becomes little different to a normal employer. Indeed, some WPA schemes in the US in the 1930s were quite efficient, but this gave rise to accusations of unfair competition from existing or normal employers.

There is also the problem that if a JG scheme DOES employ significant amounts of skilled labour, capital equipment and materials, the latter have to be ordered up from the rest of the economy, and that means extra demand. Now if inflation is subdued enough to allow extra demand, why not just go for extra demand – period – full stop? I.e. why bother with JG?

I live in a group of houses which are served by an unmade up road, which constantly gets pot holes in it. Filling in hose holes is a nice simple job which a JG type scheme ought to be able to manage. But I have never tried to get any of the JG type schemes in the UK to do the work. I’d just waste time dealing with bureaucrats, time-wasters, health and safety officials, and jobs-worths. And when the JG scheme got going, half the people who were supposed to turn up would not turn up. And those that did turn up would make a hash of the work. I know because I’ve actually worked in JG type schemes. So I just do the work myself with help from the neighbours.

“Spending creates income whether the wages come from public sector job creation programs or are given to some banker in the “City”.”

If this statement means that it doesn’t make any difference where the money from deficit spending goes, then I can’t agree. The reason I don’t agree is that when the government spends it creates debt – I understand MMT, but presently the government still creates debt- and if the benefits of a budget deficit go to anyone making more than he is spending, then it is reasonable to assume that a portion of that money will go into government debt. My question is how does saving in government debt put people to work? I can see how money going to the rich would work if there no government debt is issued, but I don’t see any stimulative effect to government debt. Someone please enlighten me.

“And when the JG scheme got going, half the people who were supposed to turn up would not turn up.”

They would if they didn’t get paid unless they did.

Ben,

It’s very simple. All the financial wizards at the BoE had to do was beg a few questions, take a leaf or two out of the Goebbels manual of report production and then state the outcome they believe happened as though it was fact.

I don’t think I’ve seen so many ‘mights’, ‘shoulds’, ‘coulds’ and ‘assumes’ in any supposed analysis I’ve seen before.

Of course when you actually look at what happened with the data (by simply observing the size and composition of the Bank balance sheet) all you find is that the reverse repos that were in place to deal with the crisis were replaced with actual gilt purchases as they expired.

QE does reduce interest rates though so you would expect something to happen. I’m not sure that 1.5% to 3% can be claimed, other than by comparing it to the previous 4.5% to 0.5% cut which frankly did very little.

‘As a result most first first-world governments have been trying to hide the lack of job by various means, including boosting the prison population, getting more people into university, “managing” the definition of unemployment, and creating fake jobs…………….

Please explain how unfettred legal and illegal immigration of fast breeders fits into this model?

Lot’s of sources point out that the minimum wage is pretty much the same as being on benefits (though on benefits you also get discounts or paid for council tax etc). In fact lot’s of people complain those on benefits are better of than those on minimum wage (and I have first hand experience of this, but will admit such evidence is anecdotal).

So I would like to understand how putting all the out of workers on minimum wage will actually create much more economic activity, or do you disagree with the first sentence?

Obviously you can’t make these jobs better paying than minimum wage / how will anyone in the private sector manage to hire anyone on minimum wage / inflationary hazards / obvious moral hazards

And this is before we get onto what these people will actually *do*, 3+ million people, half of which are unskilled workers.

I would also be interested to hear your take on the limit such a stimulus should have. Government spending on debt creates inflation and debt interest payments (which from an economic point of view seems akin to burning money).

So at what point does this become a burden that does more harm than good, and at what point are we sitting out now?

«’As a result most first first-world governments have been trying to hide the lack of job by various means, including boosting the prison population, getting more people into university, “managing” the definition of unemployment, and creating fake jobs…………….

Please explain how unfettred legal and illegal immigration of fast breeders fits into this model?»

Ahhh very simply indeed. There are *two* labor markets in the UK, like in many countries, of “good [make believe] jobs” for the insiders/voters, and of “bad [hard work] jobs” for outsiders/nonvoters.

Suppose you are the head of a diversity policy team in the NHS or a retired media studies reader in a random university on a nice middle class income: you want the salaries of low end labor, like nurses, cleaners, shop assistants to go down as much as possible, because those are costs to you, and your income is largely fixed. As The Economist has written, the English middle classes have been delighted by how cheap polish plumbers are, but that’s just one aspect of the situation. Middle class rentiers in England constantly complain how expensive servants and tradesmen have become, and how insufferable are the demands of low paid workers are for higher wages.

“New Labor” ministers have been very clear on this: one has said that large scale immigration from low income countries was meant to reduce the pressure of taxes on middle class voters thanks to saving money to the NHS by driving down the salaries of menial workers (while of course the compensation of consultants, doctors, managers has risen), and another one has stated that citizens on welfare need to compete on jobs and lower wages with immigrants.

This has happened in Great Britain several times before: successive waves of northern, scottish, irish poor in centuries past have driven down wage costs providing fat benefits to the english rentier middle classes, shopkeepers and businessmen who read the Torygraph.

«As The Economist has written, the English middle classes have been delighted by how cheap polish plumbers are, but that’s just one aspect of the situation.»

To give an idea of the popular attitude to this, the immigration situation has generated a small number of press stories of middle-aged middle-class UK shopkeepers hiring a couple of cheap east european replacements to run their shop, and then retiring to France, and coming back to the UK every 2-4 weeks to count the takings of that shop, and paying the wages of their replacements, and living large on the difference.

This is the middle class UK (and USA and Irish and Australian) dream: to live the noble life of the “plantation” owners, with your assets/”plantation” generating a nice rent thanks to the hard work of your servants, and you enjoying the fruits of your superior sagacity in your “manor”/french country home. Where the assets/”plantation” can be a well padded traditional defined benefit pension accrued for the past 30 years, and/or the tax-free capital gains on the tripling of house prices.

How happily these “aspirational” insiders/voters endorsed Thatcher first and Blair after her, as they delivered (1980 to 2010…) the lifestyle they were entitled to!

But this was all funded indirectly by the massive improvement in the terms of trade of the UK dues to the oil exports, and the massive improvement in the UK government’s fiscal position due to oil royalties, and massive asset price bubbles driven by ever expanding leverage ratios.

Now the terms of trade have turned against the UK who has become an increasingly massive importer of oil, and the fiscal position of the government has been severely diminished by the rapidly contracting oil production (and the tory-libdem government has tried to partially compensate for that by trying to increase the percentage levied as volume went down).

Again, the terms of trade of the UK are worsening, MMT cannot do much about it as it is a real-economy effect, and UK living standards have to fall. The only question is whose living standards will fall hardest, and the tory-libdem government are determined to protect and enhance the living standards of the most “highly productive” workers like investment bankers.

Low end immigrants from other EU countries or illegal ones can’t vote, so it is pretty easy to see how they will do.

@ fake, Monday, September 19, 2011 at 22:55

For your first two questions about JG wage and minimum wage, you can find some information on this previous post: https://billmitchell.org/blog/?p=1541, where you can read:

“To avoid disturbing private sector wage structure and to ensure the JG is consistent with stable inflation, the JG wage rate is best set at the minimum wage level. The JG wage may be set higher to facilitate an industry policy function. The minimum wage should not be determined by the capacity to pay of the private sector. It should be an expression of the aspiration of the society of the lowest acceptable standard of living. Any private operators who cannot “afford” to pay the minimum should exit the economy.”

Also when you say “I would also be interested to hear your take on the limit such a stimulus should have. Government spending on debt creates inflation and debt interest payments (which from an economic point of view seems akin to burning money).”, it has been explained and demonstrated several times by Bill and other MMTers that inflation can occur when demand outstrip supplies, but also that in a demand deficient economy, deficit spending does not necessarily cause inflation (because competition dictates firms to increase output and market shares rather than prices).

As for the inflation that the UK is seeing now, many people here have pointed out the increasing amount of oil that the UK has to import, and Bill also has shown several times – by digging up for us official data and analysing it – that this is mostly due to rising commodity/energy prices about which the UK can do very little (think of the OPEC being a cartel that sets the price of oil, plus increasing demand from the so-called “developping” economies), combined with self-harming austerity measures such as higher VAT (when you go from 17.5% VAT to 20%, you know that the year-on-year inflation rate published every month in the news will be offset by +2.5% for 12 months).

Moreover, governments don’t need to create debt when they spend. Any government sovereign in its own currency could very well decide to pay-back and settle all of its debt denominated in such currency, right here right now if it wanted to, and in any case will always be able to pay-back its creditors when payment is due. More information on deficit spending related to bond issuance can be found here: https://billmitchell.org/blog/?p=15753

“So at what point does this become a burden that does more harm than good, and at what point are we sitting out now?”

A JG is not doing more harm than good, it is doing no harm at all. It just replaces the unemployment buffer with an employment buffer, providing a level below which aggregate demand cannot go (the JG wage sets that level). So I’d say when you consider that it is setting a floor to the race to the bottom that mainstream economics rethoric have engaged us all in, JG is definitely all good.

All in all, pretty much all the questions one could think of have been answered by Bill in previous posts, and I cannot recommend you enough to read these posts (mainly the ones tagged “Debriefing 101”), because it is much better to get the information from Bill’s writings than to read boring and possibly inaccurate replies like mine 🙂

Hope this helps!

@fake:

It is obvious you haven’t been reading any of Bill’s or any other MMT-scholar’s works or blogs. Kindly take some time to do that before you ask questions that have been answered and elaborated on a hundred times before.

@Tristan Lanfrey

Points to think about, however this part just doesn’t seem very well structured.

**The JG wage may be set higher to facilitate an industry policy function. The minimum wage should not be determined by the capacity to pay of the private sector. It should be an expression of the aspiration of the society of the lowest acceptable standard of living. Any private operators who cannot “afford” to pay the minimum should exit the economy.”**

Firstly, putting “afford” in brackets suggests more or a moral stance than a economic one, it “seems” to suggest some mistaken opinion that people who pay minimum wage are just doing so out of greed rather than affordability.

I don’t see how the minimal wage cannot be determined by the capacity of the private sector, if they don’t have the capacity, they don’t have the capacity. If you set this minimal wage above their capacity, you simply destroy their capability to hire . So they should just leave the economy, in fact increasing rather than decreasing private sector employment.

As to setting the JG wage above commercial minimum wage rates, that seems to completely ignore the human element.

What sane person would take on a job at “minimum wage” from a private sector employee, especially in a new business (half of which will fail, perfectly normal), when they can stay on JG for the same or as suggested more.

Many new business start small and on the breadline, I know several people that are basically one man bands, that can’t afford to hire on minimum wage, and so stay one man bands, is it really so hard to accept that you will simply price out the employment pool for many viable start up companies (the main source of new employment).

I kind of like the Idea of JG, but also accept that improperly done it has the potential to completely wreck the economy much more than cutting.

@HarPe

That’s a good attitude to have if you just want to circle jerk with your friends.

“I don’t see how the minimal wage cannot be determined by the capacity of the private sector”

Yes, that is the subsistence level required for simple re-production of workers. Marx has defined it almost 150 years ago.

“Firstly, putting “afford” in brackets suggests more or a moral stance than a economic one”

And while Marx was defining it, the whole subject in question was called *political* economy and it required explicit definitions of moral stance simply because there is no economic one. Economic stance is a bla-bla-bla.