It was only a matter of time I suppose but the IMF is now focusing…

The first act of fiscal consolidation – terminate the IMF funding

I am back in the land of semi-austerity and the sun is shining warmly. That is one of the advantages of living in Australia. We have mindless politicians like everywhere else but at least one can luxuriate near the beach in the sun. Let me just say at the outset that I am not against forecasting. I do it myself almost everyday and acknowledge that it is an art rather than a science – in other words forecast errors are par for the course. But a problem arises when ideology drives the forecasting process and that the forecasts are then used to perpetuate that ideology via policy development. If the underlying model of the economy that is reflective of that ideology is indelibly wrong then the policies advocated may damage the economy rather than improve it. The forecast errors will also be a sign that the underlying theory is deficient. That is exactly what occurs when the IMF produces its World Economic Outlook. If you trace the WEO forecasts for the last several years you will see how inaccurate they have been. But that hasn’t stopped the IMF from demanding fiscal austerity which has worsened the crisis. They continue to strut the world stage – bullying and claiming authority. The participating governments should terminate the IMFs tenure immediately by writing to the IMF saying that the first act of fiscal consolidation is to terminate their funding. The organisation serves no useful purpose.

You get a flavour of the IMF approach from the Press Conference yesterday (September 22, 2011) given by the new IMF head (fresh from her previous role as one of the deficit terrorists in the Eurozone). It once again demonstrated how the ideology of the IMF gets in the way of providing any constructive solution to the world slowdown.

After acknowledging that the “the current economic situation is entering a dangerous phase” she said the “recovery that one was expecting has weakened”. One being the IMF and its sycophantic chorus of conservatives who were in too much of a rush to withdrawn the only thing keeping most economies going – the various fiscal stimulus packages.

She proceeded to outline her four Rs for progress which after reading the proposed path the four Rs must have been wRong, wRong, wRong and wRong – in that order.

She held party line:

… if we look first of all at the advanced economies, we know that there is this heavy debt of sovereigns, households, and bank risks that could actually suffocate the recovery.

Why is sovereign debt in the US or Japan preventing growth? No answer can be found in the IMF’s recent World Economic Outlook which she referred to throughout her speech.

As to Europe, the debt of the member nations is not sovereign debt. They surrendered their currency sovereignty when they joined the EMU. EMU member nation debt is denominated in a foreign currency (euro) and renders then exposed to insolvency – given they cannot create Euros in the same way that Japan can create yen whenever it wants to.

The problem is actually very simple. The EMU is dysfunctional and needs to be disbanded and currency sovereignty restored so that adequate fiscal stimulus can be provided to support the precarious private sector balance sheet adjustment to less debt.

For all other nations that are struggling now as their fiscal stimulus packages are withdrawn – the solution is to stop withdrawing them. Simple as that.

She noted that:

We are in this together and we can pull out of this together, because from the Fund’s perspective our analysis says that there is a path for recovery. There is a path for recovery. It is narrower than it was three years ago when we first were hit by the financial crisis, but there is a path for recovery.

We are all in this together means that if all nations are cutting public spending at the same time, when private spending is flat then there cannot be an “export-led” recovery, being the IMF’s darling option.

Moreover, the recovery path is not narrower than it was three years ago. That is just doctrinaire nonsense based on the notion that higher deficits make it harder for the government to run even higher deficits next year.

For the EMU, the ECB can support whatever size deficits are necessary across the member-space without worrying about what the private bond markets might do. The ECB has the capacity to deal the bond markets out of the equation. Will the politicians allow that? Probably not but then they become the problem not the fact that deficits have risen.

For sovereign nations, the current deficits do not determine next year’s fiscal capacity. The governments can run whatever deficits they choose.

The fact is that the degree to expand now is larger than it was three years ago because unemployment and idle capacity is higher. The reason is because the governments – acting under the advice and pressure of bodies like the IMF – have starved their economies of effective demand.

And so what is the policy path? Be prepared for the most tortured mumbo jumbo where the ideologue just cannot let go of the religious musings long enough to see that they are incompatible with what common-sense is telling her:

Fiscal consolidation is a matter of priority. Equally, consolidating too fast, too heavy for some countries is going to be harmful for the potential growth that we see.

So what is the option? It is not a dilemma. It is a question of timing. It is a question of confidence. What needs to happen is that medium-term, long-term, solid, well-anchored measures that will actually aim at restoring good public finances, by reducing deficits, by stabilizing debt and gradually reducing it, has to be first and at the forefront of any agenda in those economies.

But having said that, as long as in the medium term and long term this is well-anchored, some countries can accommodate growth in the short term. If you are asking me which countries? Clearly, the United States is one that comes to mind right away. But it is a balancing act once again and there has to be a parallel track of what can accommodate growth in the short term by slowing down the pace of consolidation, and how strongly and definitely and well-anchored are the measures that will deliver deficit reduction in the longer term.

Repair, again, is not just about the sovereign debt and the public finances situation, although that is the first that comes. The second is the repair of the household balance sheets, and repair, also, of the banks’ balance sheets. Not all of them, but clearly quite a few of them.

That was excruciating. Bodies like the IMF just cannot admit they have been drastically wrong – repetitively. They always have to open with the mantra – the prayer – “fiscal consolidation is a matter of priority”.

The priorities are real growth, lower unemployment, lower underemployment, and higher real wages. Fiscal consolidation is a non-priority because it doesn’t mean anything independently of the real priorities.

The “public finances” will largely take care of themselves if real growth is achieved. Trying to announce fiscal cutbacks in 2013 or 2014 while also stimulating the economy in 2011 and 2012 is a ridiculous strategy. Most if not all economies are short of effective spending. There are millions of workers in need of jobs and/or more hours of work. The scope for expansion is massive. Most of the deficits at present are cyclical and there is simply no imperative to directly try to engineer a lower deficit independent of growth.

The IMF approach – to start with some fiscal trajectory and then see if you can fit in some short-run growth is what has caused the world economy to slow again.

She should resign immediately and go back to bankrupting France. She was of-course just mimicking the discussion in the latest World Economic Outlook update which was released on Tuesday (September 20, 2011). There is a summary page accompanying the more detailed research report (although I am not sure I would deign to call the trash the IMF put out as “research”.

The Foreword of the September WEO was written by the Olivier Blanchard, who was the Chief Economist at the IMF but is now listed as Economic Counsellor and Director, Research Department of the IMF. The Foreword provides more IMF-style massaging (torturing) of prose.

For example, to explain why they seriously under-estimated the slowdown that is now clear in the advanced economies (which was clearly predicted by MMT proponents) , Blanchard says:

What was going on was the stalling of the two rebalancing acts, which we have argued in many previous issues of the World Economic Outlook are needed to deliver “strong, balanced, and sustainable growth.” Take first internal rebalancing: What is needed is a shift from fiscal stimulus to private demand. Fiscal consolidation is indeed taking place in most advanced economies (although not in Japan). But private demand is not taking the relay. The reasons vary, depending on the country. But tight bank lending, the legacy of the housing boom, and high leverage for many households all turn out to be putting stronger brakes on the recovery than we anticipated.

All the “reasons” were apparent before governments started listening to the IMF and other world bodies and being ambushed by manic conservatives – that is, private demand was never going to pick up at the speed the IMF predicted.

Their urging that export-led growth would allow economies to moderate the effect of fiscal withdrawal was also a pipe dream. For a start, when most domestic markets are in decline import growth will always fall as well. A nation cannot export unless there is import demand from others. The cases that the IMF and the conservatives wheeled out to “prove” that fiscal consolidation can be successful with a rise in net exports were isolated (for example, Denmark) and in times when the rest of the world was growing.

Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

The conservatives seemed to think that as the government withdrew spending from the economy the private sector would add $ for $ and then some to maintain the growth that the fiscal interventions had spawned after the collapse of private spending.

They wheeled out economists who preached Ricardian Equivalence which is a fantasy based on the notion that the central problem for consumers and firms is the budget deficit. They apparently “know” that a budget deficit “has to be paid back with higher taxes” and so start saving to ensure they can pay those taxes. Once the government announces a serious fiscal cutback., the private agents then realise taxes will not have to ride and so they spend up big.

This nonsensical part of mainstream economics is built on assumptions that never hold and that alone negates the theoretical consistency. But even as an empirical statement – it has never predicted the evolution of the economy to any degree of accuracy at any point in history.

Please read my blog – Pushing the fantasy barrow – for more discussion on this point.

But undaunted by 2009 into 2010 we had the growing chorus of “fiscal contraction expansionists” including the IMF urging governments to “adopt credible fiscal consolidations” aka cut the budget deficit by pro-cyclical spending cuts.

It is clear that to sustain and build on the growth created by the fiscal stimulus that if there was to be a withdrawal of the latter then there had to be a shift to private demand. That statement acknowledges the first truth of macroeconomics (mostly denied by mainstream macroeconomists) that spending equals income and the sum of spending is the sum of public and private (with external spending being distributed between the two).

Many mainstream economists attempt to deny that public spending actually adds to demand and employ torturous and lying models about crowding out whereby every dollar spent by the public is a dollar not spend by the private sector – a partner to Ricardian Equivalence notions.

Of-course, the fiscal consolidation (as they call it) and private demand are intrinsically linked but not in any way that the mainstream macroeconomics identifies. One of the roles that fiscal policy should play is to fill spending gaps that appear when private spending withdraws. This has the advantage of ensuring the disruption to output and employment growth is minimised although clearly compositional issues arise which mean that any collapse in private spending will have negative consequences.

However, private spending contractions are usually associated with expectational changes by firms and/or households. The former will only invest in new productive capacity if they feel that the extra goods and services that will be forthcoming will be sold. That is, they require aggregate demand to grow in line with the growth of productive capacity. If they form the view that spending will fall short of that growth in the period ahead they will restrain from investing.

Even if the cost of capital falls in the meantime, investors will be very cautious if current capacity utilisation rates fall. So monetary policy has very limited capacity to stimulate investment when the “animal spirits” are negative – that is, when firms do not have a very positive outlook.

Further, households manage risk by saving. If they fear rising unemployment they will curtail spending until the fear passes. In that way household and firm expectations impact on each other and result in reduced private spending overall.

Once an under-full employment equilibrium is established – where firms have cut back production but are selling all they produce and households are realising their saving desires – there is nothing the private market can do to disturb that malaise.

So the other major role for fiscal policy is to disturb that equilibrium and push aggregate demand along which signals to firms and households that improved outcomes are to be expected. As the economy starts to grow faster again, the negative sentiment and fears give way to optimism and at that point – private spending growth starts to increase.

It is at that point that the rebalancing of emergency fiscal intervention and private demand starts to occur.

By imposing a premature fiscal contraction on a fragile economy with lagging private demand, the government undermines the positive expectational effects that the fiscal expansion may have had. They send a signal to households and firms that spending will be tight and sales and orders will decline and unemployment will rise. The private sector responds accordingly by further battening down the hatches.

It is that causality that links fiscal policy to private demand. The IMF’s blithe assertion that the “rebalancing” didn’t occur as they thought is an admission of the vandal who throws the stone and then is surprised the window breaks.

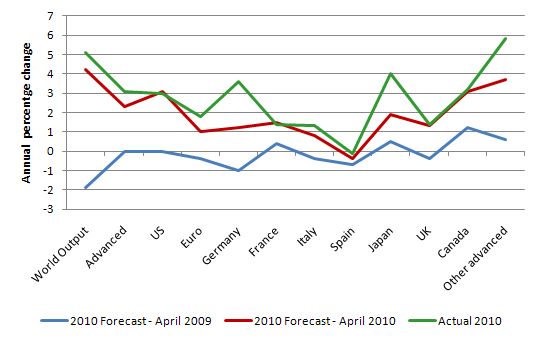

I put together some of the forecasts from earlier WEO editions and compared them. The following graph shows some of the evolution of the IMF WEO forecasts for 2010 – blue was its April 2009 estimate for 2010, read its April 2010 estimate for 2010 – and the green line shows the actual outcome.

The fact is the estimates were consistently conservative which I put down to the use of models that deny the strength of fiscal policy (and the related multipliers).

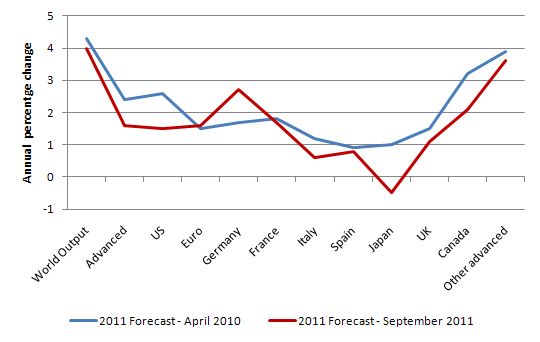

This bias also works in reverse as the next graph suggests. Their constant advocacy of fiscal consolidation was based on their view that private sector spending was tied to public spending but mostly in an inverse manner (Ricardian equivalence and crowding out).

Applying that erroneous causality then would lead them to be excessively optimistic at a time of fiscal contraction. I exclude the error associated with Japan from that assessment given it was clearly based on an unforeseen tsunami.

The final (actual) 2011 outcome will be well below the read line.

I could show a systematic bias in the IMFs forecasts over a long period.

I thought this UK Guardian article (September 22, 2011) – The IMF warning reveals just how extreme George Osborne’s austerity is – was largely accurate and relevant to today’s blog.

It said:

It is only a few months ago that the chancellor, George Osborne, was preening himself on the International Monetary Fund’s clean bill of health for the UK. The IMF’s inspectors had given his slash-and-burn economics their seal of approval.

How times change. The IMF has revised its growth forecasts for UK downwards three times in 2011, from 2% at the start of the year to 1.1% on Tuesday. It has, in an exceptional move, warned of the consequences of too great a rush to cut.

But of-course the damage of the more extreme forecasts and policy advice is now evident. The IMF have been guilty many times before of forcing nations into penury by asserting its neo-liberal biases.

At some point the poverty of their approach will be recognised by all and participating governments will be pressured by their electorates to withdraw their funding. You can find out more about where the IMF gets its funding from via this Financial Factsheet. Be prepared to dig though to get a full disclosure of what each member nation contributes.

The Guardian article pinpoints the problem that has emerged since the IMF re-invented itself after the breakdown of the Bretton Woods system of fixed exchange rates:

The IMF was a peculiar international midwife for a new style of economic management that came to be known as “neoliberalism”. Public spending was to be cut. Financial markets would be liberated. The state itself would be rolled back, making room for entrepreneurs. A harsher but more dynamic world would result.

Prior to that the IMF’s role was strictly limited to making emergency loans to countries that were finding it difficult to maintain their fixed exchange rate parity. It was not intended to be an international ideological warrior.

When the Bretton Woods system collapsed in 1971 (and not before time), the IMF had to rethink its role because it effectively became redundant (and should have become so).

The Guardian says:

… the fund reinvented itself. From docile guardian of international monetary stability it became the gung-ho enforcer of domestic fiscal discipline. There is no convincing connection between the two roles. The period in which the prescriptions of neoliberalism came to dominate is punctuated by successive financial crises, culminating in the spectacular global collapse of September 2008.

The IMF has provided no productive input since 1971 but has done a lot of damage since then – and is responsible, no doubt, for many people dying from poverty.

But as the Guardian says “the absence of obvious success has done little to diminish the IMF’s overweening enthusiasm for intervention. Quite the opposite. Time after time, it has bloody-mindedly stuck to its principles”. I would suggest we replace “principles” with blind ideology. The IMF is not a principled organisation. It is the central arm of a religious cult that discriminates against the poor and oversees the transfer of what real resources are available into the hands of the wealthy and the corrupt. It has a long history of propping up corrupt and venal military dictatorships.

The reality is that in designing a new policy framework for prosperity governments have to withdraw all funding from the IMF and insist that its remaining assets are distributed in according to contribution and the organisation is dissolved. It has no conceivable role in any viable future for the world. It is a parasitic and destructive organisation.

Conclusion

As I noted in the introduction, it is not the game of forecasting I am against.

Rather it is that a forecasting organisation should be excluded from having policy influence when there is systematic bias in the errors they make which arise from using erroneous models that reflect their free-market ideological leanings rather than capturing the way the economy actually works.

That failure of that ideology has been demonstrated by the crisis and the economics dynamics since the crisis began.

Saturday Quiz

The Saturday Quiz will return sometime tomorrow.

That is enough for today!

Good,the EMU (not the magnificant Australian bird) needs to be hunted down and killed.

The IMF should have a stake driven through its heart and given a burial in an unmarked grave as befits a zombie. Ditto for the World Bank.

Next on the list should be the World Trade Organization.

That all seems like a good start for a reorg.But never mind me.I’m just an old bolshie from the bush.

As a UK national and resident, I find the UK’s national debt positively hilarious. UK inflation is now well above the yield on UK government debt. I.e. holders of this debt are being ripped off big time. But I’m prepared to make these creditors a better offer, as follows.

Send me 100 ounces of gold, and I promise to send you 95 ounces of gold in return in three years time. That’s almost certainly a better deal than you’ll get from the UK government.

“The fact is that the degree to expand now is larger than it was three years ago because unemployment and idle capacity is higher”

Have we made the required government sector contribution higher due to the run down of private sector capacity?

Surely by now otherwise ‘sound’ private sector investment is also failing due to lack of demand. Once a factory or a mine closes it takes a fair bit of effort to get them going again.

So although we can get service sector work going again fairly quickly, ISTM that we’re going to have to hold the stimulus at a high level for a lot longer now to allow the private sector to re-tool.

Which means that the short term time limited tax cut ideas are now completely useless. It has to be a permanent tax cut until demand improves, or substantial sustained government spending.

What would be your take on the single currency adjusting to imbalances through price and wages? Of course, the Greeks will be less wealthy. But, it does seem to be the way the euro is designed to compensate for a fixed exchange rate.

Given this, and the G20 announcement of doing everything possible seems to spur the euro fanciers into believing in a revival of the currency. Bolstered further by some (unannounced as of yet) EU action to restructure Greek, et al, sovereign debt into longer terms. This seems to address the urgency for Greece to repay before the crisis hits home and might offer some relief. Some argue this will persuade the BRIC nations into lending.

As best I can see, this might offer a little hope for the beleaguered currency, even though it does not address it’s fixed exchange rate structure. Lower wages would hurt EU exports into the austere nations, but might bolster trade in foreign currencies provided an economy is still capable of exporting. Further, I see it as more can kicking on the part of the EU. I am sure any PIIGS undergoing restructuring and receiving foreign lending will still be forced into austerity. This can’t bode well.

However, I thought the suggestion was as good as it could be, provided the EU politicians adopt such a measure. Just wanted to get some sound MMT perspective.

@Norme

The Greek people can only be pushed so far. At some point their corrupt leaders will have to bow to the people as they intensify protests. If they stay in the EMU, the only other alternative is ever increasing austerity and a police state to control the ever increasing number of unemployed/poor (who will most likely not stay calm while their living standard worsen).

IMHO, the Eurozone either needs full fiscal integration or to be broken up. Anything in between can only be temporary, and is harmful to the European people. While I like the idea of a federal government of the United States of Europe (yeah I’m a pro Europe guy), realistically, I don’t think it is even remotely achievable.

In my view, losing the Euro is a shame, because I think it’s one of the rare things that make ordinary people truly feel European (that and the Schengen area), but it is doing more harm than good, and if the price to pay for prosperity is to feel a little bit less European in our every day life, then so be it. I really don’t see the point of defending the currency at all costs. It’s only a currency after all, it should serve the people, not the other way around.

Ann Pettifor of the UK has been criticizing the IMF for its disastrous policies for some years now and will agree with your assessment. She gets some air time, but the IMF appears to be Teflon coated, like Blair.

It seems to me that there’s quite an interesting parallel between the IMF and NATO. As you say, the former’s mandate became redundant with the breakdown of Bretton Woods, whereas the latter’s (ostensible) mandate expired at the same time as the Soviet Union. Both institutions then reinvented themselves as instruments of US world domination.

Bill,

Interesting that all these world /international finance institutions are based in the USA , the reason I believe was Congress as main fund source stipulated this requirement same for the UN.

Interesting article at Street Light highlighting capital flows as probable systemic cause rather than irresponsible state spending by the PIIGS.

Norme

Eurozone as a whole cannot increase it’s exports to the rest of the world. That is because balance of payments balances, as it says in the wiki page http://en.wikipedia.org/wiki/Balance_of_payments

Current account + Capital account + change in reserves = 0.

That means that in the absence of movement in the capital account or reserves EZ is incapable of running current account surpluses, no matter how they would cut their wages, that would only make currency appreciate. And indeed, eurozone’s external balance has been roughly at balance whole time.

After the Japan earthquake Lagarde suggested that Europe could “help” Japan by buying government bonds. (Then of course the bank of Japan intervened to stop yen appreciation).

Politicians: there is just no cure for stupid! In the Middle East they say, “Our Lord Jesus could raise the dead, but he could not cure the stupid.”

Okay, thank you PZ.

@Tristan Lanfrey:

I am a pro-Europe person too, but at the same time, i have a hard time believing anything resembling democracy can be applied to that big an area. Already, the incompetence shines through and some countries get favoured, while others get the blame and austerity. Also, the Euro used to make us feel European and proud of it, but since the crisis started, it makes us feel European and ashamed of it. I believe a continuation of the Euro is detrimental to European cooperation and a Europe that isn’t cooperating is a Europe at war, so actually i’m more afraid of more of the same than an orderly exit from the Euro. How far can Brussels push it before nationalism reaches critical mass and turns Europe into a collection of racist police states with constant fighting in between themselves? That is what i’m afraid will happen and that is why i feel we need to discard the Euro ASAP. I mean, i think we still have a few years to go, but that doesn’t mean we should delay it. I don’t want the 30’s all over again.

Two other films in this genre, both from 2004, and both on Argentina, are the shocking review of IMF exploitation there, “Memoria del saqueo (A Social Genocide)“, and Naomi Klein’s excellent as-it-happened story of a group of workers trying to re-open their shuttered factory, “The Take“. Both are must see films (esp. “Social Genocide”) for IMF critics.

Both are available on YouTube (in segments) and the Internet Archive. You may have to look around for a subtitled version of Social Genocide (it’s available).

My forcast. If I am a bank and I lent money to Greece and I insured the debt with CDO’s I am better off if Greece defaults and I collect say 80% of my capital now via the CDO…..better than a haircut over 10 years anyway. So Greece will default in a rush.

Forcasts dont add up to much when headlines are scaring the average guy into calling up his fund and switching into cash forcing the fund to liquidate causing lower equity prices and more bad headlines scaring the average guy to call his fund…….. A nasty feedback loop that is getting out of controle.

Forcasting how average guy is going to react would be worthwhile but near impossible as he keeps changing his &%^ mind. And average guy is running your fund so watch out for him!

Mandlebrot’s dream of forcasting markets is a long way off yet.