It's Wednesday, and as usual I scout around various issues that I have been thinking…

What if economists were personally liable for their advice

Economists have a strange way of writing up briefing documents. There is an advanced capacity to dehumanise economic advice and ignore the most important economic and social problems (unemployment and poverty) in favour of promoting non-issues (like public debt ratios). It reminds me sometimes of how the Nazis who were brutal in the extreme in the execution of their ideology sat around getting portraits of themselves taken with their loving families etc. The training of economists creates an advanced state of separation from human issues and an absence of empathy. Such is the case in a October 21, 2011 document – Greece: Debt Sustainability Analysis – which is labelled STRICTLY CONFIDENTIAL by its authors and was intended as input to the upcoming meeting of the Eurozone leaders – which is in fact the EU/ECB/IMF – aka and hereafter referred to as the “Troika”. As I read the document – in all its luridly obscene detail – I wondered what if economists were personally liable for their advice? The jails would be full of bankrupted economists. I am sure that the Troika economists would plead “only following orders” but then we have heard that before too.

The document in question was “leaked” and made public by the Società Editoriale Linkiesta which is a new publication – “an independent Italian online newspaper of investigative journalism, in-depth analysis and commentary” – launched earlier this year.

Further investigation reveals that the “governance rules” of the new publication “state that nobody can own more than 5% of the capital stock” which according to the editor means there will be “Many shareholders and no bosses … nobody can exert individual influence on the editorial line”.

Linkiesta say:

Greece has failed. To say this is not another report of investment banks or research centers, but directly Troika officials who have just completed their review on Hellenic public finance. Linkiesta is in possession of the entire report of the troika, composed of officials from the International Monetary Fund (IMF), European Central Bank (ECB) and European Commission.

I have a rule of thumb that I use when considering documents such as these. The rule is to assess how strong the concern for unemployment is. How often is unemployment mentioned? The answer is zero. The document never mentions the word or concept.

So obsessed are the Troika and their bean counters about public debt stabilisation that they have completely lost sight of one of the worst problems an economy can encounter – the failure to generate work for all.

But the document itself is a statement – an admission – of abject and total failure. Yet after opening with that gambit the authors quickly get back into lock-step and just revise the intensity of the Greek recession and extend its duration and claim that the austerity will have to become more intense and for longer – like many years longer.

Even in that context, you have to search all the twisted Troika prose in this document to find any major policy advice. And what you read is that:

… ultimately sustainability depends on the strength of the official sector commitment to Greece.

That is, Greece needs central fiscal support indefinitely. Further, as a result of the EU designers deliberately avoiding creating that essential capacity (for ideological reasons) – ad hoc arrangements via the ECB (principally) have to be put in place.

But if the existing approach is making things worse (their admission) and “ultimately” fiscal-type support is required, why impose the harsh austerity on the people of Greece? Answer: silence. That question is too hard for these characters to address.

The opening point (1) in the leaked document provides a classic example of the twisted way in which economists spin their arguments. I will quote it in full so you can immerse yourself in the language of my dysfunctional profession. Then I will provide an interpretation in English of what is being said:

Recent developments call for a reassessment of the assumptions used for the debt sustainability analysis. Since the fourth review, the situation in Greece has taken a turn for the worse, with the economy increasingly adjusting through recession and related wage-price channels, rather than through structural reform-driven increases in productivity. The authorities have also struggled to meet their policy commitments against these headwinds, and due to administrative capacity limitations in the Greek government. The growth and fiscal policy adjustments assumed under the program individually have precedent in other countries’ experience, but experience to date under the program suggests that Greece will not be able to set a new precedent by realizing at the same time and from very weak initial conditions a large internal devaluation, fiscal adjustment, and privatization program.

Which means:

1. Our models are so poor and our understanding of macroeconomics is so ideologically tainted that we were in denial of the obvious – that imposing harsh public spending cuts at a time the Greek economy was contracting due to a collapse in private spending would worsen the recession and undermine the capacity of the economy to enjoy increased productivity.

2. All our forecasts were wrong – the situation is much worse and poverty and unemployment is rising and the savings of many private citizens are being wiped out directly because of our mistakes.

3. We have no real understanding of why this happened but the data is clearly showing all our predictions were wrong and what we said wouldn’t happen happened.

4. We had no historical precedent for imposing such a harsh multi-dimensioned program of austerity on Greece – but, hey, a few million Greeks, what do they matter. The experiment will provide us with experience for future policy advice.

The prose is fascinating – “the economy increasingly adjusting through recession and related wage-price channels, rather than through structural reform-driven increases in productivity”.

The economic advice the EU bosses have been getting in these briefing documents clearly held out that all they had to do was cut government spending, flog off all the public assets, cut workers wages and pensions, allow the unemployment rate to increase and – hey presto – productivity will boom and the increased external competitiveness will see an export-led growth boom.

That might work out in textbooks written by free market economists who have no understanding of human psychology and the impact of unemployment and harsh spending cuts on innovation and spending nor who seem to understand that when all your trading partners are also contracting or barely growing then no matter how “cheap” your exports become – exports are not going to boom.

Even the most basic understanding of macroeconomics would predict that the Greek economy would be “increasingly adjusting through recession and related wage-price channels” in the face of rising unemployment (highly deflationary) and major cuts to spending or changes to policies that undermine the private sector’s capacity to spend.

It was obvious that this would be the outcome.

Increasingly, these IMF-OECD-type economists are also using terms like “headwinds” to describe growth barriers as if the change in wind was unrelated to the human decisions and actions. The headwinds in Europe are all person-made. They were created by the misguided policy framework that the “Troika” imposed on the democractically elected member states to further the ideological remit of the elites.

The policies had no grounding in the macroeconomics that applies to the real world which tells you that spending equals income and income growth equals output growth which generates employment growth. A nation cannot grow if you undermine public spending directly and private spending indirectly via enforced unemployment and wage and pension cuts.

The Troika claim that their thinking was influenced by observing that “a large internal devaluation” or “fiscal adjustment” or a “privatization program” had “individually” worked in other countries in the past according to their expectations.

And so we had a little experiment in Greece just to see if the “a large internal devaluation, fiscal adjustment, and privatization program” all imposed together without any prior experience of such a harsh austerity program would work and ” set a new precedent” . The evidence is that it didn’t work. We were wrong and imposed enforced unemployment unnecessarily.

First, it is unclear what “experience” they are calling on to guide them in their conclusion that prior policy changes based – individually – on “a large internal devaluation” or “fiscal adjustment” or a “privatization program” had worked in other countries. What does worked mean in this case?

The historical record suggests that some countries have been able to grow under the weight of fiscal drag coming from a classic IMF fiscal consolidation but those policies were imposed at a time when their trading partners were growing strongly which allowed them to replace the lost public spending with export income.

There is absolutely no historical evidence which shows that when all nations are contracting or stagnant and private spending is flat (or contracting) that cutting public spending will create growth.

So why did these economists think that a nation would grow when all components of spending were strongly indicated to fall or were being actually cut? The answer lies in acknowledging that they operate in an ideologically blinkered world and are never taken to account for their policy mistakes. They are unaccountable and do not suffer income losses when the nations they dispense advice to and impose policies on behave contrary to the “expectation” which results in millions being unemployed.

In my view, my profession should be liable for the advice it gives and economists should be held personally liable for damages if their advice causes harm to other individuals. If the economists in the IMF and elsewhere were held personally responsible then the advice would quickly change because they would be “playing” with their own fortunes and not the fortunes of an amorphous group of Greeks that they have never met

The Troika now admit the following – each admission should be a headline in the major World media outlets:

1. “A slower recovery” – “A longer and more severe recession is thus assumed, with output contracting by 5½ percent in 2011, and by 3 percent in 2012”. They claim that growth will now not begin until 2013-14 – that is nearly, two more years of substantial recession.

They are now admitting that real GDP growth will be “cumulatively 7¼ percent lower through 2020, versus the projections made at the time of the 4th Review”.

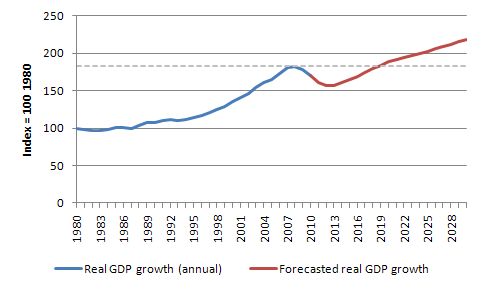

The lost income is huge. The following graph compares the actual real annual GDP growth path since 1980 (to 2010) (blue line) with the Troika’s revised baseline out until 2030. The dotted line is the 2008 peak (achieved in the September quarter). According to the Troika’s overly optimistic (but still dire) forecasts, real GDP doesn’t return to that 2008 level until 2019. So more than a decade of going backwards. I consider the implications of that for unemployment later.

2. “Lower privatization proceeds” – they acknowledge that “adverse market conditions” will not allow their projected revenue to be achieved. But undaunted they claim that their revised estimates are based on a “still suitably ambitious path”.

The difference to 2020 is that “total privatization proceeds would amount to €46 billion, instead of the €66 billion”.

They also say that “bank recapitalization will likely create additional assets to be disposed of”.

The language is shocking when you think about it – unashamed. So public wealth will be sold off to bail out the private banks who could not manage their books properly and in some cases cheated and lied.

What would be interesting to know is which private sector lawyers, management consultants, brokers etc have already pocketed millions from their involvement in the privatisation program to date? Who will be paid in the future and how much?

The record is clear. Those who service the privatisation programs always receive large payments for their services.

3. “Reduced fiscal adjustment needs” so that the:

… the primary surplus is assumed to improve further until it reaches 4½ percent of GDP for the period 2014-16. The primary surplus steps down to 4¼ percent of GDP in 2017-20 and to 4 percent of GDP in 2021-25 (a level which in the past Greece has been able to sustain). Since few countries have been able to sustain a 4 percent primary surplus, it is assumed that from 2026 onwards, the primary surplus is maintained at 3½ percent of GDP. Under this path, which requires sustained and unwavering commitment to fiscal prudence by the Greek authorities, the overall fiscal balance would not drop below 3 percent of GDP until 2020.

First, the Troika are still intent on inflicting the damage which has led to their earlier predictions being grossly innaccurate. They still hold onto the claim that structural adjustment will outpace the negative effects of prolonged recession – only that it will take longer.

My prediction is that productivity growth will not recover anywhere near the pace they predict and a deep, chronic malaise will overcome the Greek economy as long as fiscal policy is so strongly pro-cyclical.

Second, the claim that “in the past Greece has been able to sustain” very large primary surpluses is misleading as much as it is extraordinary. It has never been able to sustain such fiscal drag for very long and never during a period of contraction or slow growth.

It has never been able to do that when its major trading partners are also experiencing stagnant growth and rarely has it been able to do that in the context of the monetary union.

Data available from Eurostat suggests that Greece ran primary surpluses between 1992 and 2002 at a time when real GDP growth was booming at well above 4 per cent per annum.

In this Eurostat document we read that the cyclically-adjusted budget balance averaged -6.3 as a percentage of GDP between 1992 and 2005. Now this is not the primary balance because it includes interest payments on debt.

But during this period, Greek public debt was very low. Now the interest payments on its outstanding debt will be much larger and the the projected primary balances will be very harsh – but unachieveable in my view.

I simply do not believe that the Greek economy can get back onto the growth path projected with that much fiscal drag and the implied level of entrenched unemployment.

We will read further recanting in 12 months or so of how the adjustments didn’t quite work out as projected in this leaked document.

4. “Delayed access to market financing” – the Troika claims that:

The issue of when market financing will be restored is inherently uncertain. For the purposes of this analysis, new market financing is assumed to become available only once Greece has achieved 3 years of growth, three years of primary surpluses above the debt stabilizing level, and once debt drops below

150 percent of GDP. This is admittedly an arbitrary rule, and is used for illustrative purposes to give an indication of the scale of official support that could be needed to fill any financing gap until market access is restored in 2021.

In other words, Greek will require support from outside the private bond markets until 2021.

If you examine the revised baseline projections presented in Appendix “Table A1. Greece: Public Sector Debt Sustainability Framework Revised Baseline Scenario, 2008-2030” you won’t find any mention of employment or unemployment. There are a lot of financial projections but not a clue as to what the unemployment rate will rise to.

There are some curious numbers in Table A1. For example, they claim the “historical average” real GDP growth rate for Greece is 3.2 per cent. A check of the OECD Main Economic Indicators databse shows that since joining the Eurozone, Greece real GDP has grown on average at 2.2 per cent, a much slower rate than the claimed average in the Troika briefing. The IMF World Economic Outlook data shows an average growth over the same period of less than 2 per cent.

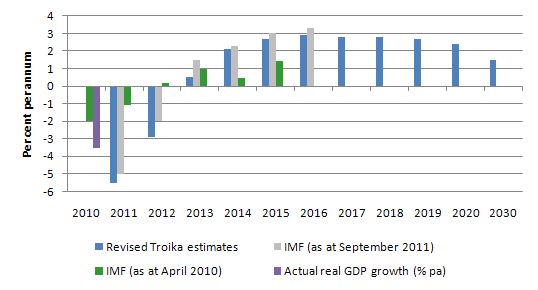

I produced this graph which combines the revised baseline projections for real GDP growth in Greece (from 2011) with the IMF World Economic Outlook projections as at April 2010 (green bars) and as at September 2011 (the most recent) (grey bars). The purple bar shows the actual real GDP growth rate in 2010 which was much worse than the IMF had predicted earlier in that year.

You can see that as the crisis unfolded the near-term projections (2011, 2012, 2013) have been becoming increasingly worse.

It is also interesting that the IMF upgraded their growth outlook for 2013-2014 in September 2011 relative to what they thought in April 2010 which I suspect was to make the fiscal austerity they were promoting more palatable to the politicians. Given the data available at the time there was nothing to justify that heightened optimism.

The revised baselines from the Troika recognise that the growth forecasts were inflated. However, in my view, even these revised estimates of growth are excessive. But even taken them at face value, it is a very bleak scenario.

The unstated implication is that employment growth and unemployment will continue to rise until at least 2015. How do I reach that conclusion? Answer: using some simple arithmetic.

In this blog – The aftermath of recessions – I outlined the so-called Okun’s Law arithmetic (after the late Arthur Okun) which was developed to estimate how deficient real GDP growth leads to rising unemployment rates. Okun’s Law (it was in fact a statistically estimated relationship with stochastic variation) is the relationship that links the percentage deviation in real GDP growth from potential to the percentage change in the unemployment rate.

It provides a “rule of thumb” which relates the major output and labour-force aggregates to form expectations about changes in the aggregate unemployment rate based on output growth rates. The “rule of thumb” helps us make guesses about the evolution of the unemployment rate based on real output forecasts.

Take the following output accounting statement (which is true by definition and not a matter of opinion or conjecture):

(1) Y = LP*(1-UR)LH

where Y is real Gross Domestic Product, LP is labour productivity in persons (that is, real output per unit of labour), H is the average number of hours worked per period, UR is the aggregate unemployment rate, and L is the labour-force. So (1-UR) is the employment rate, by definition.

Equation (1) just tells us the obvious – that total output produced in a period is equal to total labour input [(1-UR)LH] times the amount of output each unit of labour input produces (LP) .

Using some simple calculus you can convert Equation (1) into an approximate dynamic equation expressing percentage growth rates, which in turn, provides a simple benchmark to estimate, for given labour-force and labour productivity growth rates, the increase in output required to achieve a desired unemployment rate.

Accordingly, with small letters indicating percentage growth rates and assuming that the hours worked is more or less constant, we get:

(2) y = lp + (1 – ur) + lf

Re-arranging Equation (2) to express it in a way that allows us to achieve our aim (re-arranging just means taking and adding things to both sides of the equation):

(3) ur = 1 + lp + lf – y

Equation (3) provides the approximate rule of thumb that if the unemployment rate is to remain constant, the rate of real output growth must equal the rate of growth in the labour-force plus the growth rate in labour productivity.

Remember that labour productivity growth reduces the need for labour for a given real GDP growth rate while labour force growth adds workers that have to be accommodated for by the real GDP growth (for a given productivity growth rate).

It is an approximate relationship because cyclical movements in labour productivity (changes in hoarding) and the labour-force participation rates can modify the relationships in the short-run. But it should provide reasonable estimates of what will happen once all the cyclically-sensitive components of the economy return to more usual values.

Labour force growth is close to zero in Greece at present (actually negative) as workers give up looking for work in a climate of declining vacancies.

The stagnant labour force growth is one factor that is attenuating the rise in unemployment given the parlous real GDP growth rate.

Productivity growth is also negative at present despite all the claims by the Troika that a harsh domestic deflation would lead to a spur in such growth.

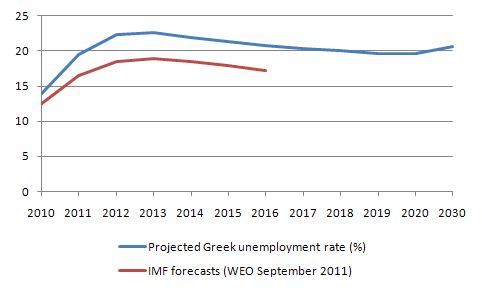

If we assume that both productivity growth and labour force growth are zero for the next two years (2011, 2012) and starts to recover according to the Troika growth estimates – slowly reaching their respective averages (since 2001), then we would project that the unemployment rate will peak around 22.5 per cent in 2013 and then hover around 20 per cent indefinitely.

That is, taken the Troika revised growth forecasts at face value (and I suspect they are over-estimates of what will happen) and assuming average labour force and labour productivity growth rates.

If either growth rate is faster than its recent historical average, then the rise in the unemployment rate will be even larger. If average hours worked rises, the rise in unemployment rate will be larger.

The following graph shows the projections based on the Troika’s latest real GDP growth forecasts and our very conservative assumptions about related labour market and output aggregates.

The red line represents the IMF unemployment rate projection to 2016 in the latest (September 2011) World Economic Outlook and the blue line is the projection using the Troika’s revised real GDP growth to 2030.

The IMF will surely revise their estimates up in the next WEO given that they have consistently underestimated the deterioration in the Greek economy until now.

It is no wonder the leaked document didn’t mention unemployment. How can these world leaders justify an advanced European nation maintaining unemployment rates at these levels for the next two decades or so?

There is more in the leaked document – graphs showing the revised debt adjustment and whatever. It is really an appallingly arrogant document that says “we were hopelessly wrong, but we won’t change our model nor approach, we will just intensify it”.

Conclusion

Medical practitioners are legally liable for their professional outcomes and can be prevented from practising if they are deemed to be unfit as a result of poor judgement etc. Many other certified professionals are equally liable for the quality of their work.

I think it is time that professional economists are certified to practice and are then held responsible for the outcomes that arise from their work. Given that unemployment leads to higher suicide rates and other sources of elevated risk of death – I see my profession as no different from medical practitioners in relation to responsibility for human well-being.

I would have very large fines and jail terms for economists who provide forecasts and produce policy advice that turns out to be wrong. This should be one of the reforms governments pursue as they try to return the economy to a more stable footing.

It should also be one of the demands that Occupiers around the world require from our governments.

I was invited to a Xmas party today and the theme of the gathering is gangsters and molls and we were encouraged to “come in costume”. I thought I might just turn up in my usual attire – my daily “economist” dress – which would appear to be fitting given the emphasis on criminality and moral decline.

That is enough for today.

Bill, much as I like the idea of making economic advice punishable, I am not certain that the field is at a state where this is enforceable. If the field can be characterized as a kind of religious cult or set of religious cults, as contended by Steve Keen, then an empirical test of competence to practice would not work. In such a situation, a Duhem-Quine saving the hypothesis strategy can always be introduced to explain away any “unfortunate” results. And what criterion will one be able to deploy that will independently show that such a Duhemian startegy was misplaced, even otiose?

Very interesting and actual topic was discussed in this post. Actually I myself already for several weeks was thinking to write that we economic and investment analysts should be responsible for the advice we give. Also thank you for such a nice analysis of troikas report

From a rent seelers point of view, the report must be rather appealling. State assets sold off at fire sale prices, onerous, to the point of insanity, debt obligations to be serviced indefinitely and a clear indication that the troika will act as a praetorian guard for their interests until the point of total collapse.

The big question is how long the greek security services will have the stomach to crack their friends and neighbours’ heads. After all, the protestors will have increasingly less to do but protest.

At that point , I suppose Eurogendfor will move in. Their commander,Colonel Cornelis Kuijs, has luckily completed a rather chillingly titled Netherlands Defence Academy course:

Philosophy and excellence in organisations: “Aristotle and Mastership”

(Aristotlean mastership being the science and practice of the ‘rule of slaves’; despotik` in greek)

Just what the greek people need, a technocrat with a gun.

Philip Pilkington sees dark matter in the same tea-leaves: Philip Pilkington: My European Nightmare – An Infernal Hurricane Gathers?

Maybe its more of a mental aberration these guys suffer: problem in the loony-bin with patients dressed up as doctors? Either way: medical or judicial – prevention is better than a cure. No way to that other than the legal and education (science) processes – drag the neanderthal polity and financiers along screaming?? A little kindness and human compassion too, would go a long way. Tough gig …!

“From a rent seelers point of view, the report must be rather appealling.”

I’ve never understood that. Why would you want a large slice of a small pie.

What is so appealing about having the best mud hut on the Savannah?

“What is so appealing about having the best mud hut on the Savannah?”

Feeling better with oneself, as one is so better off than other people.

These are people insecure of themselves to the point that they only feel relief of insecurity if they feel others are clearly worse off than them.

The vast majority of decision-makers over the US and the EMU suffer from this syndrome.

As I listen to the high minded analyst on CNBC discussing what the EU will do to resolve the situation and then watch as they show the riots in the streets it strikes me as odd that the talking heads never seem to realize that the decision is being made outside the windows.

I’ve never understood that. Why would you want a large slice of a small pie.

As a fellow human being, I don’t understand it, but the intra species predators that the troika serve seem perfectly happy with it.

What is so appealing about having the best mud hut on the Savannah?

More like the only high security compound on the savannah. Example given:

The almost pharonic excess of Antilla amid the squalor of Bombay

The article wryly notes:

Ambani does not appear to be influenced by calls by the Indian prime minister, Manmohan Singh, for business leaders to be “role models of moderation”.

…and these creatures seem to follow the business approach expressed by Jimmy Page in ‘The Hammer of the Gods’

From memory:

“The problem is to make as much as you can, when you can”

What if politicians were personally liable for their election promises?

The politicians, economists, and financial manipulators have spent so much of their time and energy lying to others that they no longer recognize even one iota of the truth. Their response to the ultimate anger of the mob will be on the order of: “How can they do this to us? We have been so good to them. Why are they taking us to the guillotine? We offered them cake when they were starving.”

Why do TV media commentators listen to these economists ( and ex-politician turned economist) and take their views seriously? They seem to have the memory of a goldfish. There is rarely any questioning that exposes the true nature of the opinions given in the past. They need to be challenged and exposed.

I suppose its all part of their gravy train. Depressing!

Thanks Bill for an enlightening piece.

What is interesting is this whole argument can be applied to all countries in the world where the focus is reducing debt as a percentage of GDP. What they do not get, and never will, is resources are finite, whether that is raw materials, labour or land, and as such, growth is also finite. The simpler solution for the whole world to take is scrap, all bonds and start again, except this time, remove the speculators from the equation, and try to start out with full employment.

I’m a first-time commenter, or should it be commentator!, although a subscriber to Bill for a couple of months. Not an economist or, in any sense, a professional, just a retired British entrepreneur who has ended up living in Arizona.

Many of Bill’s essays are on the fringe of my potential to understand, from a technical competency point of view, but this one was an exception – it really hit me between the eyes. Bill first grabbed me with, “So obsessed are the Troika and their bean counters about public debt stabilisation that they have completely lost sight of one of the worst problems an economy can encounter – the failure to generate work for all.”

Then the power of Bill saying, “So why did these economists think that a nation would grow when all components of spending were strongly indicated to fall or were being actually cut? The answer lies in acknowledging that they operate in an ideologically blinkered world and are never taken to account for their policy mistakes.”

As Jim comments just above my comment, “What if politicians were personally liable for their election promises?”

We all, in our hearts, sense the answer. Too many of our present population who hold power and influence over others have lost sight of the ‘i’ word – integrity.

Thank you Bill for presenting such a well-argued picture.

Regards to all, Paul

If it wasn’t for the fact that real people (the Greeks, Irish et.al.) are involved I would cheer these idots on until they had ruined the economies they are running and then we would have incontrovertible and very public evidence that it (Austerity, neoliberal economics call it what you will) really doesn’t work. The ECB, IMF, OECD, the British Govemernt and the rest of the shoddy bunch of Economists supporting them would be driven out of town with much deserved derision ringing in their ears. Alas, real people are hurting and the very real tradgedy unfolds. It make you weep.

And a footnote, from a recent item on Naked Capitalism, see http://www.nakedcapitalism.com/2011/10/philip-pilkington-my-european-nightmare—an-infernal-hurricane-gathers.html

Philip Pilkington, a Dublin writer, wrote, “Every now and then a terrible thought enters my mind. It runs like this: what if the theatre of the Eurocrisis is really and truly a political power-game being cynically played by politicians from the core while the periphery burns?”

Regards to all, Paul

Bill, what do you think about Ireland?

It seems like austerity is working there. GDP is at 1.5%-1.9%

and yield are down at 8% from 14%.

One problem with increasing exports is that you have to have productive capacity in place, ie factors and they don’t build themselves and trained or at least semi trained workers, and products that people want. I don’t suppose these economists looked into these real world things before they embarked on this plan

Jan

In my view, there is always a bottom somewhere and now after some years of very real distress and hardship, the Irish economy has started to go up a little. The population that is left in the country is starting to find ways of improving their lives, but no thanks to the measures taken against them. They have also had an ‘advantage’ in that they were first. Other countries have followed and the heat has been on them rather than Ireland for a significant period. When you consider how far their economy has actually declined, they still have a long way to go and much damage to repair.

The markets, I suspect, have had their attention focused elsewhere. The drop in yield is good, but is still far too high to be a sustainable figure for them in the long term. If there is real big trouble in euroland over the next few days/weeks/months then Ireland may find itself lost in the thick of the woods again. I wonder if any money is being allowed for them in the current discussions? Its all very fragile.

I think punishment is perfectly appropriate. Make each offense punishable by having to read every single page of the largest and most tedious accounting book ever written, with nit-picking quizzes weekly, punishable by supplementary accounting reading and memorization of computer accounting programs if they fail the quizzes.

For particularly egregious economic offenses, even further supplementary readings of “Greek Rural Postmen and their Cancellation Numbers”-published by the Greek Hellenic Philatelic Society of Great Britain, which “exists to encourage the collection of Greek stamps and to promote their study.”

Jan,

Austerity works, if you accept that hundreds of thousands without work and hope for decades is acceptable.

If you run a balanced government budget all the time you can keep all your ratios perfectly in tune with the ideological goals of neo-classical economics. You will have about 60% unemployment, but that can be sorted by exporting the excess people to other countries and letting them have the problem – as Latvia and Ireland show. All you need to do is make life intolerable and they will leave the country.

The social question is whether the size of the unemployed and treating people like boxes of screws – to be shipped around the continent on the whim of businesses – is an acceptable system. The buffer alternatives put forward by MMT allow you to resolve private malinvestment without people having to be thrown out of their houses and forced to roam across Europe.

“One problem with increasing exports is that you have to have productive capacity in place, ie factors and they don’t build themselves and trained or at least semi trained workers, and products that people want. ”

And that’s the line that is always spun. Based on a heavy capital intensive view of the world.

Yet holiday destinations are exports, as are language services, Internet services, software writing, ebay stores, and a myriad of other service businesses that can target foreign markets as easily as domestic ones.

The economy is mostly knowledge and service-based and getting increasingly so as time goes on. This idea that you have to build a massive factory somewhere and train a load of people before you can expand production is one of the most pernicious myths in economics.

With the internet I can hire somebody in Mumbai, Montreal or Madrid as easily as I can somebody in Manchester.

Neil: “You will have about 60% unemployment, but that can be sorted by exporting the excess people to other countries and letting them have the problem – as Latvia and Ireland show. All you need to do is make life intolerable and they will leave the country.”

Precisely what many US towns and cities do with the homeless – make it so tough with things like anti-loitering laws they move on. They even tried this tactic on the OWS protestors to get them out of Zuccotti Park, but it didn’t work, probably thinks to the media coverage. The homeless don’t have that advantage and get shuffled from place to place.

“I think punishment is perfectly appropriate. Make each offense punishable by having to read every single page of the largest and most tedious accounting book ever written”

Like “A compendium of International tax codes” or “The Advanced book of convoluted Bank regulations”?

The bastards actually enjoy this kind of stuff. Make them rewrite all their own crappy books until a class of 11 year old can understand it. They might actually get something correct then.

Prof. Mitchell,

MIT economists are agreeing with you: unemployment is the crisis now, not deficits.

http://web.mit.edu/newsoffice/2011/federal-deficit-panel-1006.html?tr=y&auid=9754887