It was only a matter of time I suppose but the IMF is now focusing…

It was some sort of bazooka – aimed at themselves

The only question I have been toying with today apart from all the other ones is whether it was the big bazooka or not. The Melbourne Age article (October 28, 2011) – Euro summit fires ‘bazooka’ at debt monster – lead me to believe that the big one had come out, but then the Financial Times article (October 28, 2011) – Merkel’s mantra works without ‘big bazooka’ – suggested the bazooka was left in the rack. Perhaps the bazooka was brought into action but the big bazooka was left at home. That conclusion would reconcile things nicely. It is very confusing though isn’t it. About as confusing as trying to work out what the EMU leaders might define as leadership. The way I understand it the only bazooka that the EMU has at their disposal refused to play ball and stayed at home in Frankfurt. The result – no matter what the political spin is and no matter how much the governments pledge to put into the EFSF or claim they can get from the Chinese the situation remains – they are recursing back to insolvency. None of the member governments can ultimately stump up the euros when Italy, then France or any other member state requires bailing out. In the end, they will be picked off one by one. I guess they did bring out some sort of bazooka – but just aimed it at themselves.

For starters, imagine that you come down from Mars and have studied basic macroeconomics. You thus know the following:

1. Spending equals income equals output which drives employment.

2. Employment growth drives tax revenue and reduces welfare outlays.

3. Budget balances are the difference between spending and revenue.

4. You note that governments issue debt to the non-government sector which matches their budget deficits although you wonder why they would do such a thing given they issue the currency that everyone uses. You muse to yourself (not being rude) – “Why do these Earthlings do such a curious thing?”.

5. You also note that some governments (over in Europe) delight in making life harder for themselves and their citizens by deliberately refraining from issuing their own currencies and instead, ceding that authority to some faceless, unelected people who are located in Frankfurt. But being polite you duly note the idiocy of this arrangement and worry about the citizens whose welfare it retards.

You land in Brussels on October 26, 2011 and the Earthling leaders (Angie, Nick, George and some others) ask you for some advice: They want smaller budget deficits although their reasoning is somewhat odd.

They think that by reducing budget deficits they will have lower interest rates, even though you tell them they already have relatively large deficits and virtually zero interest rates and show them some data from the Bank of Japan that you picked up which suggests they have had the same for 2 decades.

Not to be daunted they tell you that the other major concern is that if they don’t get the budget deficits down they will face accelerating inflation. You note again that the deficits are historically large and inflation is mostly falling. Again, you tell them that Japan has faced deflation with high budget deficits for two decades.

But then they tell you that the bond markets are attacking some of the governments under their leadership. This is a problem because these governments signed away their capacity to generate their own funds and if the bond markets don’t lend to them they cannot pay their daily bills. The bond markets are rightfully worried that they might not get their money back without some haircut because they know the governments in question do not issue their own currency. Its a no-brainer!

The terminology is curious – the earthlings keep talking about haircuts – as if they are obsessed with appearances instead of substance.

At any rate, the message is clear – they want smaller budget deficits and lower public debt so the bond markets will keep lending them money so they can keep paying their bills.

Okay, you ask them their plan. It is a polite question – because you anticipate they will say that their overriding strategic imperative is to stimulate economic growth to ensure they have enough jobs for all that want them. You are sure they will note that private spending is very flat and so they will need to replace it with public spending.

You are sure they understand that even if the budget deficit rises in the short-run, it will always come down again as GDP grows because more people pay taxes and less people warrant government welfare support. Everyone knows that you think.

You feel that – despite designing a system where the currency power lies with an unelected group that works in a building in Frankfurt and the workers in that building appear to read German economic history literature from the 1920s almost constantly but ignore the literature of the 1930s when the economy grew strongly – the Earthling leaders will tell you that they don’t really have to worry about the private bond markets anyway.

That is obvious from even the most casual observation of their system – as a result of the fact that those Frankfurter-based bankers can always deal the private bond markets out of the game by providing the necessary euro support to allow the member governments to promote growth and introduce employment guarantees etc.

So obviously, you expect them to say that the Frankfurter-based bankers will be busy crediting relevant bank accounts and doing everything that they can to ensure economic growth is strong and everyone is able to work. That will ensure all the member states achieve the leader’s goals of reducing the budget deficits and fulfilling (you presume) their major responsibility to advance the welfare of their citizens. Who would think that government would do anything different?

You realise they are a bit precious about the curious monetary arrangements they have in place but realise they can minimise the negative consequences of putting the democratically-elected leaders in the various nations into a strait-jacket by letting the Frankfurter-based bankers use their currency monopoly appropriately.

And you clearly expect them to keep their own hair in neat shape with the occasional hair cut but you clearly don’t mind someone preferring some dreads or some other hair-do. But the last thing you would expect them to do is to force the private banks that did invest funds in these member governments in good faith to cut their investments in half.

No reasonable person who understood anything about market sentiment would consider that to be a sensible signal to send to the private bond markets given that you hope that they will continue to provide loans to these artificially strait-jacketed member states into the distant future.

You would also not expect them to suggest that they will solve their problem by insisting that all member states guarantee some central fund contributions in the currency that none of them issue and who ultimately might need to call on should the bond markets not feel very good about having half their hair cut off.

Prior to meeting the Earthling leaders, you had a brief visit to the empty housing estates surrounding Dublin and being briefed by the New Beginning Organisation in Ireland where you learned that there are “621 ghost estates across the Irish Republic now … One in five Irish homes is unoccupied”.

You also spent a day or two in Athens where you learned that the suicide rate in Greece has doubled in the last year.

So you wonder how this crisis persisted for so long when everywhere you go there are idle people, boarded up buildings and factories and no apparent reason why all these workers and machines shouldn’t be working to their potential.

Anyway, then they tell you about their bazooka – or whatever it is – that took them hours behind closed doors to come up with. Upon hearing the plan you immediately send a text message back to your fully-employed and well-paid mates back on Mars which Google would translate as:

These Motherfu#%ing fuc@#ers are %@cked. Earthlings are imbeciles.

The Melbourne Age article – Euro summit fires ‘bazooka’ at debt monster – told us that:

After more than eight hours of heated talks that went to the brink of collapse, European leaders have hammered out a financial rescue plan for the euro that they hope will stave off a double-dip recession.

The deal includes creditors agreeing to halve Greek debt, a plan to recapitalise the region’s banks to protect them against losses and the boosting of the main bailout fund into a €1 trillion ($1.32 trillion) “bazooka”.

The only problem is that they aimed the bazooka at themselves. The real bazooka that could have been brought into play to stop this crisis immediately stayed in its shed in Frankfurt.

The French President was quoted as saying:

Because of the complexity of the issues at stake it took us a full night. But the results will be a source of huge relief worldwide.

The economic issues are not complex at all. The Eurozone leaders deliberately built a monetary system that was not capable of withstanding a major asymmetric demand shock across its regional space.

They also introduced a Stability and Growth Pact (SGP) which has been neither stabilising nor supportive of growth.

As an aside, the Germans only wanted to call the SGP the Stability Pact, reflecting the fact that their collective memory conveniently stopped accumulating data after about 1926. I guess they would want to wipe the next 20 years out but they should just get over their obsession – it helps no-one.

Then a major negative demand shock hits the system and some governments face insolvency because they signed away their currency powers. The reasons for why some nations are in dire trouble and other EMU nations are not in as much trouble (yet) shouldn’t really be the issue.

The whole region needs to grow. But our erstwhile Euro leaders decide to do the exact opposite and kill growth – which is the only way out of this mess. The bond markets realise that austerity is likely to worsen their prospects of getting their money back and so rebel.

The Euro leaders impose more austerity. The situation gets even more dire. And the Euro leaders have to stay up all night to work out a plan which will make the current situation worse!

This is all because they refuse to order the ECB to take the responsible role of funding growth right across the region – which means they have to fund every member state’s budget deficits and those deficits have to be as large as is required to fill the spending gaps in their respective economies.

The economics is not complex at all. The politics is the problem and the cultural differences.

The EC President was quoted as saying:

These are exceptional measures for exceptional times … Europe must never again find itself in this situation.

They are half-baked measures for dire times and unless these power elites take an ego loss and redesign or abandon their monetary system – Europe will certainly find itself in that situation again and meanwhile they will be impoverishing their citizens.

The Greek Prime Minister was quoted as saying:

We can claim that a new day has come for Greece, and not only for Greece but also for Europe.

The sun rises each day. But the Euro leaders have nothing to do with that thank g#d! If they could get their incompetent hands on the Earth’s path around the Sun who knows what would happen.

The deal ensures that the Greek government continues to punish its people in a most extreme manner and cede democracy to the power elites in Brussels.

Apparently our famous Euro leaders threatened the private banks with “the nuclear option” which would involve Greek bankruptcy. I find this a most repugnant part of the deal.

These champions of free markets and entrepreneurship then put on their jack boots and bludgeon the banks and insurance funds, who we have no reason to assume didn’t invest in good faith, into taking losses. What would you do if you were a funds manager as a result of that bullying nonsense?

Given you owe your “investors” due diligence and have a fiduciary duty to them, would you be so keen to invest in these governments again any time soon? Especially when the outlook is to have very low growth rates into the distant future?

I believe it is the right of the people of a nation to democratically decide to restore its own currency and offer creditors re-negotiated arrangements in that new currency. It is then up to the creditors to determine whether they want to convert. If not, bad luck. Their participation is not required anyway.

But it is entirely different for a group of elites to bludgeon investors in this way, especially when the real bazooka is sitting smugly by in Frankfurt hold farewell parties for their outgoing boss and crowing on about how successful the EMU has been since inception.

You would not be able to write fiction with as much farce and tragedy and comedy as this sort of stuff provides.

The most reasonable path would have been to fully nationalise all the exposed banks using the ECB to capitalise them, writing down all debts in the public interest and fully funding growth policies in the member-state economies.

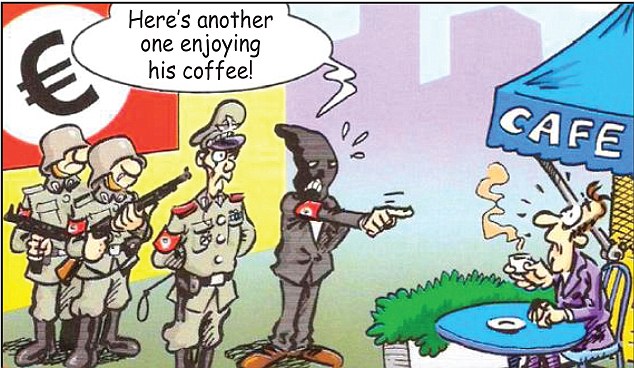

Who cares if the Germans think the Greeks are lazy or that Greeks are continually being reminded by Greek daily Eleftherotypia cartoonist Stathis that they haven’t left their past behind.

For example, this cartoon is typical of the cultural wars that the crisis has spawned:

They all need growth and starving the periphery will starve the whole system.

The Financial Times article – Merkel’s mantra works without “big bazooka” – said that:

The outcome was not a big “bazooka”, with trillions of euros designed to spread shock and awe through the markets. It will not be a one-off solution to the crisis, for much still depends on other players, including international banks and bondholders, and on other governments in the eurozone. But there is German handwriting all over the conclusions, reinforcing budget discipline and strengthening the rules for future behaviour. All the partners in the common currency have now committed themselves to putting a German-style “debt brake” – requiring a balanced budget – into their constitutions, or the legal equivalent.

Apart from all the anti-democractic “(i)ntrusive surveillance of national spending plans” that “will be the norm from now on” and the EC “given new powers to blow the whistle on national profligacy”, the Summit result fails to address the fundamental problem – the need for growth.

The French suggestion to have “the European Central Bank … provide the EFSF with unlimited liquidity” was rejected. As noted above and given the already flawed design of the EMU, the French suggestion really was the only viable medium- to long-term solution (that is, without all the austerity tacked onto it).

The Summit also accepted the logic of the German fiscal obsession and they will now talk more about:

… amending European treaties to set budget discipline in European law …

So they will call meetings and serve sumptuous meals and drink fine wines and waste more time designing anti-growth measures.

I agree with the line that Financial Times columnist Wolfgang Münchau took today in his blog – Half measures will not end the crisis – who concludes that “none of this is going to end the crisis”.

First, he concludes that the haircut deal is not binding on the banks and that “(m)any banks would be better off if the haircut was involuntary, given their offsetting positions in credit default swaps”.

Second, he doesn’t believe the EU forecasts which have been used to model the public debt to GDP ratios that have been central in this deal. He says that:

They misjudged the impact of austerity on economic growth and public sector deficits. This misjudgement is the reason why the voluntary bank haircut of 21 per cent, agreed in July, has now grown to 50 per cent. What happens if the outlook were to deteriorate further? There is no sign yet of a turnaround.

The whole plan is anti-growth because it doesn’t reverse the austerity. It just keeps the dependency of the member nations on the private bond markets at bay for some time yet. The ECB has been doing that anyway via their secondary bond market purchases. The scale will ramp up if the bond markets turn on Italy and France (and there are signs that is now happening). In that case the EFSF will not be sufficient no matter how much they put in. It will be left to Germany as the system recurses back to total insolvency.

Münchau reinforces this point by saying that the EFSF has only limited capacity:

Banks can only do this because central banks and governments act as ultimate guarantors of the financial system. There exists an implicit insurance of unlimited liability. In the case of the European financial stability facility the very opposite is the case: there is an explicit insurance of limited liability. Germany wants its exposure capped to a maximum of €210bn. I doubt that global investors will rush into the tranches of the special purpose vehicle through which the eurozone wants to leverage the EFSF. I struggle to see how this structure can lead to a significant and sustained fall in bond spreads.

Especially when the Euro leaders are trying to enforce losses on the very investors they want to duchess.

Münchau also notes that the EFSF can only work “if the eurozone were willing to provide an unlimited backstop. This would be either in the form of an explicit lender-of-last-resort guarantee by the European Central Bank, or through a eurobond – or ideally both”.

He calls that “a comprehensive agreement” but because the Euro leaders do not have the capacity to embrace it the “crisis, meanwhile, continues”.

My final comment relates to the Euro leaders now thinking they can solve the problem by borrowing abroad. As if they don’t understand the limitations that they already have placed on their member governments they are now hunting around the world (China and Brazil – courtesy of the IMF) to see if they can worsen the problem by borrowing in foreign currencies.

Conclusion

Bad way to head into the weekend.

And need I make it worse by noting that UK consumer confidence hits 2-year low. They are categorically proving they are not the Ricardian agents that my profession eulogises – in the fiction world of mainstream macroeconomics.

Tomorrow I will be speaking at the – Building a Creative Economy Conference – in Sydney from around 14:00. Hope to see some Sydney-siders there.

Psychological advice for the goldbug who is struggling

This is for all those goldbugs out there who are feeling a little wan because they have been taking losses as the price of gold started tumbling in early September (2011).

You can now have a single coin worth $A50 million and know that it is the largest gold coin around (1,012 kgs and 99.99 per cent pure gold).

This ABC news story (October 27, 2011) – Perth Mint unveils world’s biggest gold coin – tells all.

Saturday Quiz

The regular Saturday Quiz will also be back tomorrow – and will be easier than usual because I am worried that too many people are not escaping the neo-liberal ranks quickly enough! We need a solid MMT army not stragglers struggling with the demons of the past (-:

That is enough for today!

Austerity does work eventually though, if the population remains subdued. The cost is borne by those losing their jobs and trying to eke out an existence.

As long as you don’t mind the collateral damage to sound private sector investment or the human suffering of course.

First, let me say I read your column every day and I appreciate your comments and perspectives. But,

I find it hard to feel sympathy for the banks and pension funds that bought the Greek debt or any other debt that pays such a wide spread. The high interest rates indicate high risks. I wouldn’t have nor will I put any money into those bonds nor with anybody that does. To me those bonds are junk bonds and the creditors knew it, they just expected the authorities to work things out and they would be paid their ill gotten gain. I think Michael Hudson calls it economic rent.

Regardless, I wanted to ask if you if you think that forcing a haircut for the banks might cause the interest rates to skyrocket, or maybe even the drying up of liquidity even sooner than it otherwise would? It would seem that the creditors would be even more cautious about buying their bonds now.

Also, I understand that this action is just trying to deal with a liquidity crises, so if that is correct, can there be growth in Europe without the creation of a European fiscal authority?

Angrier than usual Bill! Loved the pope song 🙂

“Earthlings are imbeciles.”

That’s invariably the summary report of 99 in 100 observation missions. 🙂

Intelligence takes evolutionary time to build up…

The EU needs a snappy slogan to bring the public around. “Austerity will set you free” seems to catch the spirit.

The interview of Ed Kane on Friday, October 28, 2011 at Nakedcapitalism.com provides commentary on the problem with macroeconomics from his perspective:

Debunking the “Paid Back the TARP” Myth: Banks Should be Paying Over $300 Billion a Year in Systemic Risk Insurance

http://www.nakedcapitalism.com/2011/10/debunking-the-paid-back-the-tarp-myth-banks-should-be-paying-over-300-billion-a-year-in-systemic-risk-insurance.html

He mentions that the problems he saw with macroeconomics 50 years ago (publication problems set up by an ‘establishment’ which has always been only been interested in obfuscation [by focusing on minutia] rather than real economic concerns) prompted his change to the field of finance. The rest of the discussion simply deals with the ineptness of federal government employees who fall for bankster schemes.

… and what did “The Markets” do? Well they celebrated!! In support of this stupidity… a sucker’s rally no doubt, the profit-taking from which will help to pay for someone’s “haircut”. It’s like an infinite loop of idiocy. Is it too much to dream of a Modern Money Economy?

“We need a solid MMT army not stragglers struggling with the demons of the past (-:”

We need an effin miracle.

All the Germans I talk to keep going on about how the rest of europe needs to follow the rules and everything will be fine. Discipline 007. Discipline.

I always thought that their national streotype was a myth but when I ask them why they don’t appear to have one iota of compassion for the greek people they just point out again that they didn’t follow the rules. End of.

I always thought the national sterotype was a myth. Finding out that it isn’t left me needing a very large drink.

Pebird, good call!

“Strenge mach frei”.

and put this gate in Brussels (or Frankfurt?)

http://media.photobucket.com/image/arbeit%20macht%20frei/frulaopperheim/arbeit_macht_frei.jpg

GHL: I find it hard to feel sympathy for the banks and pension funds that bought the Greek debt or any other debt that pays such a wide spread.

You realize the problem of this once you remember that issuance government bonds are part of monetary policy run by ECB. In old good times banks had no choice but to buy government bonds (now they can keep deposits at ECB). And given that there is only so much German bunds banks naturally had to look at other governments as well. This is not to say that banks are innocent, but in the case of government bonds in eurozone the haircut on Greek debt is a major nail in the coffin of the current setup of the system. As long as amateur politicians decide on haircuts noone is going to buy any government debt.

@GLH

Actually if you check out bloomberg you ‘ll find out that the Greek 10Y spread to Germany was below 1% till end of 2008. It was also below 1,5% till almost the end of 2009. Since, just a handful of auctions happened after 11/2009 it’s quite a stretch to say that investors (1) knew the outcome for the Greek debt and (2) were earning large premiums for their holdings. Most of them bought the bonds at par and will face substantial losses.

Billy –

You have made my life worthwhile – tormenting me with your quizzes – but this “bazooka” article had me howling with paroxysms of laughter as I now regard our earthling “experts” from the clarity of outer space.

“Truth is stranger than fiction” should be reframed as “truth makes the finest comedy”.

[loud applause – don’t stop!]

I think the Germans and the French fully understand what must be done to fix their system, but it is not politically possible right now. So they create this (temporary) EFSF, which itself will be folded into some other three letter acronym in 2 years time. I think the Germans see the need for further federal integration and ECB money printing, but they can’t do this at all until Greece has been thrown under the train and run over. Greece has to be punished for their profligacy. Greece hired Goldman to hide their debt, and there is no way that the Germans can tolerate Greeks being able to retire at 50 when a German must wait until 67. They must either force Greece into the greatest depression ever, or put them under a Roman Empire style military occupation with mass executions. (One German minister even talked about sending in blue helmets, until someone asked whose troops are those?) Since the EU does not have military command, the first option is the only one. Once Greece has been crushed in depression, the path is clear for “ever closer union”. The EuroZone will have to create a Federal Treasury and revenue system, federal court system, federal prison system, and the EZ Federal Gov’t will have to assume many key governmental functions from its states. Functions like banking supervision and insurance, military command, social security, etc… Things like retirement ages and medical benefits will have to be uniform throughout the EZ to prevent the kind of resentments that motivate the Germans to crush the Greeks.

And the side problem of how to deal with a half-in half-out country like the UK will have to be faced as well. I suspect they will be given the choice of all the way in or all the way out.

You note that governments issue debt to the non-government sector which matches their budget deficits although you wonder why they would do such a thing given they issue the currency that everyone uses. You muse to yourself (not being rude) – “Why do these Earthlings do such a curious thing?”.

I believe it’s on MMTers to show that, for a given budget deficit, not issuing debt would not be inflationary.

“I believe it’s on MMTers to show that, for a given budget deficit, not issuing debt would not be inflationary.”

No. It is for MMTers to show that is completely the wrong way to look at things.

The correct way to look at the system is to target unemployment level with automatic systems that are least likely to hit supply side problems (the Job Guarantee being the case in point), and then to adjust taxation to eliminate any tendency to demand pull inflation rather than demand pull quantity expansion. A land value tax linked to the inflation rate for example.

JG or not. the burden of the proof that, for a given budget deficit, not issuing debt would not be inflationary or devalue the currency, lies on MMTers.

MMT’s job is to prove that issuance of bonds (debt) should not be financing operation for the government, but interest rate management operation.

“Given you owe your “investors” due diligence and have a fiduciary duty to them, would you be so keen to invest in these governments again any time soon? Especially when the outlook is to have very low growth rates into the distant future?”

I’d be saying “Never, but effing never again will I buy those bonds or any that are denominated in that currency, and I sure hope the US doesn’t propel itself into the same kind of mess.”

It is on MMTers to use the right words to frame questions.

A government that fully controls its own fiat currency does not issue debt. It offers saving deposits known as “bonds”.

A government that fully controls its own fiat currency does not deficit (or surplus) spend – as the concept of deficit or surplus is meaningless for a fiat currency issuer. It increases (or decreases) base money.

EZ governments

That should be one of the arguments for banking to be operated entirely in fiat money (base money if you prefer).

Because when the banks have to operate with fiat money they are going to be less inclined to try and tell the government to stop issuing it.