Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – November 19, 2011 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

The automatic stabilisers are supporting growth in Europe.

The answer is True.

The automatic stabilisers do operate in a counter-cyclical fashion and so when economic growth is slowing they provide stimulus that would otherwise not be there. The declining tax revenue and rising welfare payments force the budget into a more expansionary phase (even if discretionary government policy is unchanged).

The automatic stabilisers push the budget balance towards deficit, into deficit, or into a larger deficit when GDP growth declines and vice versa when GDP growth increases. These movements in aggregate demand play an important counter-cyclical attenuating role. So when GDP is declining due to falling aggregate demand, the automatic stabilisers work to add demand (falling taxes and rising welfare payments). When GDP growth is rising, the automatic stabilisers start to pull demand back as the economy adjusts (rising taxes and falling welfare payments).

We also measure the automatic stabiliser impact against some benchmark or “full capacity” or potential level of output, so that we can decompose the budget balance into that component which is due to specific discretionary fiscal policy choices made by the government and that which arises because the cycle takes the economy away from the potential level of output.

This decomposition provides (in modern terminology) the structural (discretionary) and cyclical budget balances. The budget components are adjusted to what they would be at the potential or full capacity level of output.

So if the economy is operating below capacity then tax revenue would be below its potential level and welfare spending would be above. In other words, the budget balance would be smaller at potential output relative to its current value if the economy was operating below full capacity. The adjustments would work in reverse should the economy be operating above full capacity.

If the budget is in deficit when computed at the “full employment” or potential output level, then we call this a structural deficit and it means that the overall impact of discretionary fiscal policy is expansionary irrespective of what the actual budget outcome is presently. If it is in surplus, then we have a structural surplus and it means that the overall impact of discretionary fiscal policy is contractionary irrespective of what the actual budget outcome is presently.

So you could have a downturn which drives the budget into a deficit but the underlying structural position could be contractionary (that is, a surplus). And vice versa.

The difference between the actual budget outcome and the structural component is then considered to be the cyclical budget outcome and it arises because the economy is deviating from its potential.

In some of the blogs listed below I go into the measurement issues involved in this decomposition in more detail. However for this question it these issues are less important to discuss.

The point is that structural budget balance has to be sufficient to ensure there is full employment. The only sensible reason for accepting the authority of a national government and ceding currency control to such an entity is that it can work for all of us to advance public purpose.

In this context, one of the most important elements of public purpose that the state has to maximise is employment. Once the private sector has made its spending (and saving decisions) based on its expectations of the future, the government has to render those private decisions consistent with the objective of full employment.

Given the non-government sector will typically desire to net save (accumulate financial assets in the currency of issue) over the course of a business cycle this means that there will be, on average, a spending gap over the course of the same cycle that can only be filled by the national government. There is no escaping that.

So then the national government has a choice – maintain full employment by ensuring there is no spending gap which means that the necessary deficit is defined by this political goal. It will be whatever is required to close the spending gap. However, it is also possible that the political goals may be to maintain some slack in the economy (persistent unemployment and underemployment) which means that the government deficit will be somewhat smaller and perhaps even, for a time, a budget surplus will be possible.

But the second option would introduce fiscal drag (deflationary forces) into the economy which will ultimately cause firms to reduce production and income and drive the budget outcome towards increasing deficits.

Ultimately, the spending gap is closed by the automatic stabilisers because falling national income ensures that that the leakages (saving, taxation and imports) equal the injections (investment, government spending and exports) so that the sectoral balances hold (being accounting constructs). But at that point, the economy will support lower employment levels and rising unemployment. The budget will also be in deficit – but in this situation, the deficits will be what I call “bad” deficits. Deficits driven by a declining economy and rising unemployment.

So fiscal sustainability requires that the government fills the spending gap with “good” deficits at levels of economic activity consistent with full employment – which I define as 2 per cent unemployment and zero underemployment.

Fiscal sustainability cannot be defined independently of full employment. Once the link between full employment and the conduct of fiscal policy is abandoned, we are effectively admitting that we do not want government to take responsibility of full employment (and the equity advantages that accompany that end).

So while the automatic stabilisers act to provide some floor in the collapse in aggregate demand they may still leave a structural deficit that is insufficient to finance the saving desire of the non-government sector at an output level consistent with full utilisation of resources.

The following blogs may be of further interest to you:

- A modern monetary theory lullaby

- Saturday Quiz – April 24, 2010 – answers and discussion

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

Question 2:

Continuous budget deficits are more likely to present an inflation risk than one-off deficits designed to meet a short-term private spending decline.

The answer is False.

This question tests whether you understand that budget deficits are just the outcome of two flows which have a finite lifespan. Flows typically feed into stocks (increase or decrease them) and in the case of deficits, under current institutional arrangements, they increase public debt holdings.

So the expenditure impacts of deficit exhaust each period and underpin production and income generation and saving. Aggregate saving is also a flow but can add to stocks of financial assets when stored.

Under current institutional arrangements (where governments unnecessarily issue debt to match its net spending $-for-$) the deficits will also lead to a rise in the stock of public debt outstanding. But of-course, the increase in debt is not a consequence of any “financing” imperative for the government. A sovereign government is never revenue constrained because it is the monopoly issuer of the currency.

The inflation risk is inherent in each period that the deficit runs. The continuous nature doesn’t change that. As long as the government is filling a spending gap then it can safely run non-inflationary deficits forever.

It may be argued that political forces (lobby group) capture rise after a long-period of government deficits and this makes it hard for governments to adjust net spending when there are fluctuations in private spending that warrant a cut back in public stimulus.

That might be true but one wouldn’t advocate entrenched unemployment to avoid the capture of government by lobby groups. The political problem of capture would be better dealt with via strict campaign funding rules and disclosures.

The following blogs may be of further interest to you:

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

- Fiscal sustainability 101 – Part 1

- Fiscal sustainability 101 – Part 2

- Fiscal sustainability 101 – Part 3

Question 3:

The current strategy for the Eurozone is for member states to undertake a painful internal devaluation to restore growth and the austerity programs are designed to deflate nominal wages and prices to facilitate that adjustment. The aim is for Greece, for example, to reduce its real unit labour costs faster than their trading partners can. For the logic to follow then if wages and prices fall at the same rate, labour productivity has to rise and employment has to fall.

The answer is False.

The correct answer is that if wages and prices fall at the same rate, then labour productivity has to rise but what happens to employment is irrelevant.

The EMU countries cannot improve their international competitiveness by exchange rate depreciation, which is the option always available to a fully sovereign nation issuing its own currency and floating it in foreign exchange markets.

Thus, to improve their international competitiveness, the EMU countries have to engage in “internal devaluation” which means they have to cut real unit labour costs – which are the real cost of producing goods and services. Governments setting out on this policy path have to engineer cuts in the wage and price levels (the latter following the former as unit costs fall).

But the question demonstrates that it takes more than just a nominal deflation. The strategy hinges on whether you can also engineer productivity growth (typically).

So given the assumption (wage and prices falling at the same rate), the correct answer is:

If wages and prices fall at the same rate, then labour productivity has to rise and what happens to employment is irrelevant.

Some explanatory notes to accompany the analysis that follows:

- Employment is measured in persons (averaged over the period).

- Labour productivity is the units of output per person employment per period.

- The wage and price level are in nominal units; the real wage is the wage level divided by the price level and tells us the real purchasing power of that nominal wage level.

- The wage bill is employment times the wage level and is the total labour costs in production for each period.

- Real GDP is thus employment times labour productivity and represents a flow of actual output per period; Nominal GDP is Real GDP at market value – that is, multiplied by the price level. So real GDP can grow while nominal GDP can fall if the price level is deflating and productivity growth and/or employment growth is positive.

- The wage share is the share of total wages in nominal GDP and is thus a guide to the distribution of national income between wages and profits.

- Unit labour costs are in nominal terms and are calculated as total labour costs divided by nominal GDP. So they tell you what each unit of output is costing in labour outlays; Real unit labour costs just divide this by the price level to give a real measure of what each unit of output is costing. RULC is also the ratio of the real wage to labour productivity and through algebra I would be able to show you (trust me) that it is equivalent to the Wage share measure (although I have expressed the latter in percentage terms and left the RULC measure in raw units).

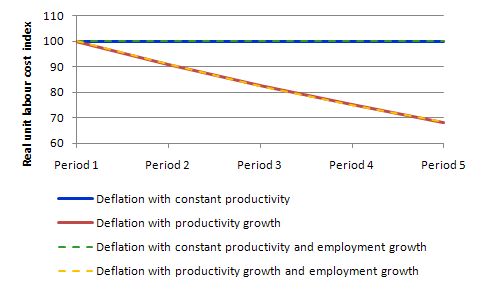

The following table models the constant and growing productivity cases but holds employment constant for five periods. We assume that the nominal wage and the price level deflate by 10 per cent per period over Period 2 to 5. In the productivity growth case, we assume it grows by 10 per cent per period over Period 2 to 5.

It is quite clear that under the assumptions employed, RULC cannot fall without productivity growth. The only other way to accomplish this is to ensure that nominal wages fall faster than the price level falls. In the historical debate, this was a major contention between Keynes and Pigou (an economist in the neo-classical tradition who best represented the so-called “British Treasury View” in the 1930s. The Treasury View thought the cure to the Great Depression was to cut the real wage because according to their erroneous logic, unemployment could only occur if the real wage was too high.

Keynes argued that if you tried to cut nominal wages as a way of cutting the real wage (given there is no such thing as a real wage that policy can directly manipulate), firms will be forced by competition to cut prices to because unit labour costs would be lower. He hypothesised that there is no reason not to believe that the rate of deflation in nominal wage and price level would be similar and so the real wage would be constant over the period of the deflation. So that is the operating assumption here.

The following table models the constant and growing productivity cases as above but allows employment to grow by 10 per cent per period. All four scenarios in the Table are them modelled in the following graph with the Real Unit Labour Costs converted into index number form equal to 100 in Period 1. As you can see what happens to employment makes no difference at all.

I could have also modelled employment falling with the same results.

The following graph shows the four scenarios shown in the last two tables. I have dashed some scenarios to make the lines visible (given that Case A and Case C) are equivalent as are Case B and Case D. What you learn is that if wages and prices fall at the same rate and labour productivity does not rise there can be no reduction in unit or real unit labour costs.

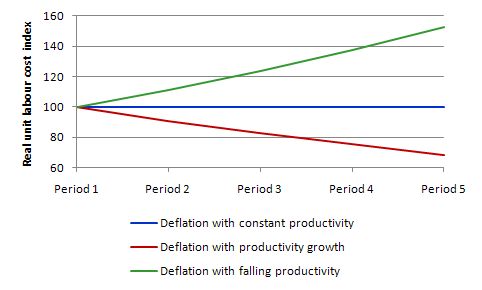

So the internal devaluation strategy relies heavily on productivity growth occurring. The literature on organisational psychology and industrial relations is replete of examples where worker morale is an important ingredient in accomplishing productivity growth. In a climate of austerity characteristic of an internal devaluation strategy it is highly likely that productivity will not grow and may even fall over time. Then the internal devaluation strategy is useless.

This graph compares the two scenarios in the first Table with the more realistic one that labour productivity actually falls as the government ravages the economy in pursuit of its internal devaluation. As you can see real unit labour costs rise as labour productivity falls and the economy’s competitiveness (given the exchange rate is fixed) falls.

Of-course, this “supply-side” scenario does not take into account the overwhelming reality that for an economy to realise this level of output over an extended period aggregate demand would have to be supportive. The internal devaluation strategy relies heavily on the external sector providing the demand impetus.

Given that Eurozone trade is heavily internal, it seems far fetched to assume that the trade impact arising from any successful internal devaluation will be sufficient to overcome the devastating domestic contraction in demand that will almost certainly occur. This is why commentators are calling for a domestic expansion in Germany to boost aggregate demand throughout the EMU, given the dominance of the German economy in the overall European trade.

That is clearly unlikely to happen given Germany has been engaged in a lengthy process of internal devaluation itself and the Government is resistant to any stimulus packages that might improve things within Germany and beyond via the trade impacts.

The following blogs may be of further interest to you:

- Euro zone’s self-imposed meltdown

- A Greek tragedy …

- España se está muriendo

- Exiting the Euro?

- Doomed from the start

- Europe – bailout or exit?

- Not the EMF … anything but the EMF!

- EMU posturing provides no durable solution

- Protect your workers for the sake of the nation

- The bullies and the bullied

- Modern monetary theory in an open economy

Question 4:

A nation can run a current account deficit accompanied by a government sector surplus (of equal proportion to GDP as the external deficit) while the private domestic sector is spending more than they are earning.

The answer is True.

This is a question about the sectoral balances – the government budget balance, the external balance and the private domestic balance – that have to always add to zero because they are derived as an accounting identity from the national accounts.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

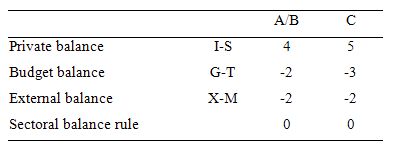

The following Table represents three options in percent of GDP terms. To aid interpretation remember that (I-S) > 0 means that the private domestic sector is spending more than they are earning; that (G-T) < 0 means that the government is running a surplus because T > G; and (X-M) < 0 means the external position is in deficit because imports are greater than exports.

The first two possibilities we might call A and B:

A: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending less than they are earn

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

So Option A says the private domestic sector is saving overall, whereas Option B say the private domestic sector is dis-saving (and going into increasing indebtedness). These options are captured in the first column of the Table. So the arithmetic example depicts an external sector deficit of 2 per cent of GDP and an offsetting budget surplus of 2 per cent of GDP.

You can see that the private sector balance is positive (that is, the sector is spending more than they are earning – Investment is greater than Saving – and has to be equal to 4 per cent of GDP.

Given that the only proposition that can be true is:

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

Column 2 in the Table captures Option C:

C: A nation can run a current account deficit with a government sector surplus that is larger, while the private domestic sector is spending less than they are earning.

So the current account deficit is equal to 2 per cent of GDP while the surplus is now larger at 3 per cent of GDP. You can see that the private domestic deficit rises to 5 per cent of GDP to satisfy the accounting rule that the balances sum to zero.

The final option available is:

D: None of the above are possible as they all defy the sectoral balances accounting identity.

It cannot be true because as the Table data shows the rule that the sectoral balances add to zero because they are an accounting identity is satisfied in both cases.

So what is the economic rationale for this result?

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down.

The external deficit also means that foreigners are increasing financial claims denominated in the local currency. Given that exports represent a real costs and imports a real benefit, the motivation for a nation running a net exports surplus (the exporting nation in this case) must be to accumulate financial claims (assets) denominated in the currency of the nation running the external deficit.

A fiscal surplus also means the government is spending less than it is “earning” and that puts a drag on aggregate demand and constrains the ability of the economy to grow.

In these circumstances, for income to be stable, the private domestic sector has to spend more than they earn.

You can see this by going back to the aggregate demand relations above. For those who like simple algebra we can manipulate the aggregate demand model to see this more clearly.

Y = GDP = C + I + G + (X – M)

which says that the total national income (Y or GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

So if the G is spending less than it is “earning” and the external sector is adding less income (X) than it is absorbing spending (M), then the other spending components must be greater than total income

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Premium Question 5:

To maintain financial stability, the monetary base has to be driven by changes in the money supply just as the money multiplier in mainstream macroeconomics textbooks explains.

The answer is False.

This is a trick question. The first part concerning the causality between the money base and the money supply is true but the second relating to the money multiplier is false because that theory predicts the opposite causality). So the overall proposition false.

Mainstream macroeconomics textbooks are completely wrong when they discuss the credit-creation capacity of commercial banks. The concept of the money multiplier is at the centre of this analysis and posits that the multiplier m transmits changes in the so-called monetary base (MB) (the sum of bank reserves and currency at issue) into changes in the money supply (M). The chapters on money usually present some arcane algebra which is deliberately designed to impart a sense of gravitas or authority to the students who then mindlessly ape what is in the textbook.

They rehearse several times in their undergraduate courses (introductory and intermediate macroeconomics; money and banking; monetary economics etc) the mantra that the money multiplier is usually expressed as the inverse of the required reserve ratio plus some other novelties relating to preferences for cash versus deposits by the public.

Accordingly, the students learn that if the central bank told private banks that they had to keep 10 per cent of total deposits as reserves then the required reserve ratio (RRR) would be 0.10 and m would equal 1/0.10 = 10. More complicated formulae are derived when you consider that people also will want to hold some of their deposits as cash. But these complications do not add anything to the story.

The formula for the determination of the money supply is: M = m x MB. So if a $1 is newly deposited in a bank, the money supply will rise (be multiplied) by $10 (if the RRR = 0.10). The way this multiplier is alleged to work is explained as follows (assuming the bank is required to hold 10 per cent of all deposits as reserves):

- A person deposits say $100 in a bank.

- To make money, the bank then loans the remaining $90 to a customer.

- They spend the money and the recipient of the funds deposits it with their bank.

- That bank then lends 0.9 times $90 = $81 (keeping 0.10 in reserve as required).

- And so on until the loans become so small that they dissolve to zero

None of this is remotely accurate in terms of depicting how the banks make loans. It is an important device for the mainstream because it implies that banks take deposits to get funds which they can then on-lend. But prudential regulations require they keep a little in reserve. So we get this credit creation process ballooning out due to the fractional reserve requirements.

The money multiplier myth also leads students to think that as the central bank can control the monetary base then it can control the money supply. Further, given that inflation is allegedly the result of the money supply growing too fast then the blame is sheeted home to the “government”. This leads to claims that if the government runs a budget deficit then it has to issue bonds to avoid causing hyperinflation. Nothing could be further from the truth.

That is nothing like the way the banking system operates in the real world. The idea that the monetary base (the sum of bank reserves and currency) leads to a change in the money supply via some multiple is not a valid representation of the way the monetary system operates.

First, the central bank does not have the capacity to control the money supply in a modern monetary system. In the world we live in, bank loans create deposits and are made without reference to the reserve positions of the banks. The bank then ensures its reserve positions are legally compliant as a separate process knowing that it can always get the reserves from the central bank. The only way that the central bank can influence credit creation in this setting is via the price of the reserves it provides on demand to the commercial banks.

Second, this suggests that the decisions by banks to lend may be influenced by the price of reserves rather than whether they have sufficient reserves. They can always get the reserves that are required at any point in time at a price, which may be prohibitive.

Third, the money multiplier story has the central bank manipulating the money supply via open market operations. So they would argue that the central bank might buy bonds to the public to increase the money base and then allow the fractional reserve system to expand the money supply. But a moment’s thought will lead you to conclude this would be futile unless (as in Question 3 a support rate on excess reserves equal to the current policy rate was being paid).

Why? The open market purchase would increase bank reserves and the commercial banks, in lieu of any market return on the overnight funds, would try to place them in the interbank market. Of-course, any transactions at this level (they are horizontal) net to zero so all that happens is that the excess reserve position of the system is shuffled between banks. But in the process the interbank return would start to fall and if the process was left to resolve, the overnight rate would fall to zero and the central bank would lose control of its monetary policy position (unless it was targetting a zero interest rate).

In lieu of a support rate equal to the target rate, the central bank would have to sell bonds to drain the excess reserves. The same futility would occur if the central bank attempted to reduce the money supply by instigating an open market sale of bonds.

In all cases, the central bank cannot influence the money supply in this way.

Fourth, given that the central bank adds reserves on demand to maintain financial stability and this process is driven by changes in the money supply as banks make loans which create deposits.

So the operational reality is that the dynamics of the monetary base (MB) are driven by the changes in the money supply which is exactly the reverse of the causality presented by the monetary multiplier.

So in fact we might write MB = M/m.

You might like to read these blogs for further information:

- Teaching macroeconomics students the facts

- Lost in a macroeconomics textbook again

- Lending is capital- not reserve-constrained

- Oh no … Bernanke is loose and those greenbacks are everywhere

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- 100-percent reserve banking and state banks

- Money multiplier and other myths

Sorry, Bill, your answer to question 2 is wrong for two reasons:

Firstly, look at the wording:

Consider real resource use. Too much of it is a inflation risk. But if there is short term private spending decline then real resource use declines so it won’t be a constraint. And if one-off deficits are designed to meet rather than merely mitigate the decline, that strongly suggests that there weren’t capacity problems to begin with. Whereas we have no clue as to the reason for continuous budget deficits – they could be to compensate for insufficient private spending, but they could just as easily be due to economic mismanagement.

So the one off deficits have a lower probability of resulting in inflation. Therefore the statement is true.

Secondly, budget deficits can reduce the value of the currency, resulting in higher commodity prices. If this occurs as a one off, it could easily be absorbed by businesses cutting their profit margins, but if it’s continuous they have no choice but to pass on the rising costs, resulting in inflation. This also supports the statement being true.

Got all correct except for #1 (which I understand now – I simply didn’t know the term!) and #3, which is complex.

I get the reasoning behind #3, but if unemployment is considered “irrelevant” for austerity then there is a serious problem with the EU austerity program – but after a second’s thought this is what I have been disturbed about all along. I agree this is true. Also troublesome is the definition of the aim of austerity – although I guess the answer squeaks through, once again, as this is a secondary effect of austerity, not the primary effect (austerity, at least recently, has always been marketed as “getting one’s house in fiscal order” and “cutting spending to sustainable levels”). Tricky question!

I was under the impression that the bank loan multiplier went out with the gold standard in 1971. However, your reference to Tobin under further information indicates that it was gone as early as 1963. That would indicate that the multiplier was never operationally correct. Was it ever operationally correct under a strict gold standard?? Perhaps the Brenton Woods system in effect in 1963 was not a strict gold standard. I need a little help here!