I have received several E-mails over the last few weeks that suggest that the economics…

Historically high budget deficits will be required for the next decade

Japanese economist Richard Koo recently published his latest paper – The world in balance sheet recession: causes, cure, and politics – which reminds us that patience is the virtue that is required right now and that the major political responses to the crisis are exactly the opposite to what is required to safely steer the World economy back into health. The insights he provides, mostly consistent with Modern Monetary Theory (MMT), demonstrate how the current political cycle (and the imperatives that are being imposed) is so far out of kilter with what responsible macroeconomic management requires. The world economy will require continuous and historically large budget deficits in most advanced nations for many years to come. The demands for fiscal consolidation talk about this year and next year and surpluses in a few years. The reality is that deficits will be required to support growth while the private sector reconstructs its unsustainable balance sheet for more than a decade. We have to get use to that or suffer the consequences. To repeat: Historically high budget deficits will be required for the next decade – at least.

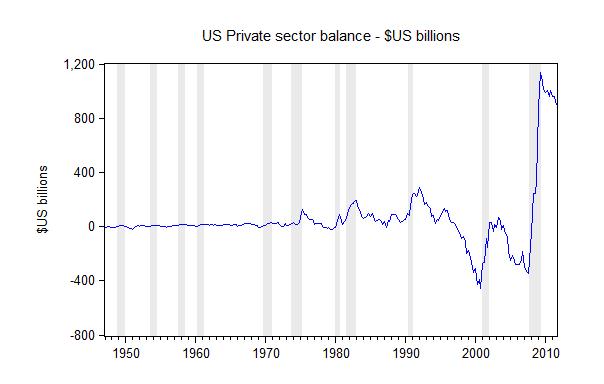

If you observed the following graph which spans from the first-quarter 1947 to the third-quarter 2011 you would probably conclude that something rather extraordinary happened over the last 20 years or so.

The data is from the FRED2 database provided by the St. Louis branch of the Federal Reserve Bank. It shows the difference between Gross Private Domestic Investment (GPDI) and Gross Private Saving (GPSAVE) from 1947:Q1 to 2011:Q3. The data was seasonally adjusted.

The shading is the NBER business cycle dates which the shaded area being the peak to trough of the official recessions since 1947.

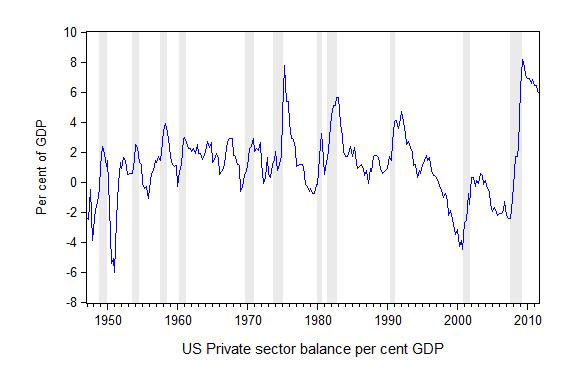

The graph is a little sensationalist (that is, misleading) because it is in nominal $US billions and doesn’t provide any scale upon which you can assess the fluctuations. It is usually better to scale National Account components by nominal GDP which is what the next graph presents.

But that still doesn’t change much. The private domestic sector were typically in surplus (with clear cyclical fluctuations evident) right up to the mid-1990s. At that stage, the neo-liberal deregulation agenda was ramping up and the financial markets grew on the back of the real income that was being redistributed away from wages towards profits.

As I explained in this blog – A radical redistribution of income undermined US entrepreneurship – the declining wage share over the last three decades or so is a common feature of most advanced economies.

Prior to the mid-1970s, the constancy of the wage share in national income, as a result of the close relationship between labour productivity and real wages growth, was one of six stylised facts of capitalist economic growth identified by Cambridge University (UK) economist Nicholas Kaldor in 1957.

The data makes it clear that the declining wage share was not associated with a higher investment ratio. The question that arises, given these trends, is how did the consumption share rise so significantly at the same time as real wages growth was largely flat and the share of wages in national income was falling?

Over the last few decades, a new way was found to accomplish this which allowed real wages growth to be suppressed while an increasing share of national income was distributed to profits. The “realisation problem” was solved by the rise “financial engineering” which oversaw a significant escalation in debt being borne by the private sector, particularly consumers.

The rising debt underpinned the creation of a range of securitised (derivative) financial products that were deployed by the fast-growing financial sector to expand their profitability.

All components of private debt grew significantly in the decade leading up to the financial crisis which consumer debt leading the way.

The household sector, in particular, already squeezed for liquidity by the move to build increasing federal surpluses during the Clinton era, were enticed by lower interest rates and the vehement marketing strategies of the financial engineers to borrow increasing amounts.

However, whichever way you present the data, something rather extraordinary did happen in the US economy over the last 20 years and we are now in the second phase of these developments.

The US housing bubble that is associated with these developments was clearly the result of excessive deregulation and a lack of oversight by the prudential authorities and government agencies of the financial sector. Crony capitalism shifted from the big manufacturing bosses paying government to legislate in their favour to Wall Street “moving into Washington”.

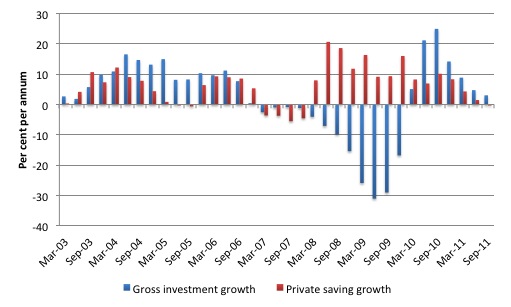

You can get a further appreciation of these extraordinary developments by decomposing the private domestic balance into its individual components – Gross Private Domestic Investment (blue bars below) and Gross Private Saving (red bars) expressed in annual growth rates.

The rapid and large rise in the private sector balance starting with the June-quarter 2008 was the result of a strong change in saving patterns by households and the nose-dive in private investment.

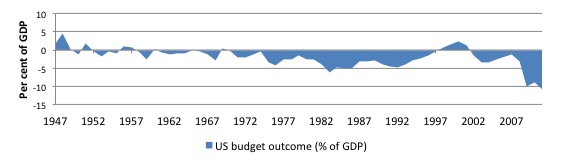

When you consider how extraordinary this private sector behaviour has been from a historical perspective it also helps you see the following graph in perspective.

It shows the US Federal government balance (deficit is negative) from 1947 to 2011 (data from the US Office of Budget and Management.

The Clinton surpluses in the late 1990s were abnormal and made possible by the burgeoning private sector deficits which maintained growth in tax revenue. Prior to that the more or less continuous (and relatively small as a per cent of GDP) budget deficits provided the aggregate demand stimulus to fill the gap left by the desire of the private domestic sector to save.

I consider that to be the normal situation for a capitalist economy which should give some pause for reflection when you consider the current mania directed towards running continuous budget surpluses or balanced budgets (a la the Euro fiscal union plan currently being considered by member states).

Once the housing bubble burst it was no surprise that the large (atypical) changes in private behaviour (the saving “overshoot”) would also manifest in some atypical government behaviour – the larger than usual deficit.

If you also know that the current account deficit is consistently draining growth (loss of spending in the domestic economy) and you understand how dramatic this recent shift in private sector behaviour has been then you would immediately ask – who is going buy the goods and services that provide the demand for labour services and produce incomes for Americans.

Then you do a simple calculation which only requires 3 fingers of one hand – the steps in the calculation go like this (yes, we have to spell it out):

1. How many sectors are there that can spend? Answer: three.

2. What are they? External sector, private domestic sector, and government sector.

3. Firms will layoff workers if they cannot sell the goods and services that they have produced (in expectation that they will be sold).

4. A current account deficit means that some income produced in the local economy is lost to the foreign sector – that is, is not recycled back into domestic demand. This creates a drain on growth.

5. A massively rising private sector balance (S > I) means that the private sector (households and firms) are spending less than they are earning (much less in this case and the transition was very quick).

6. There is only one sector left to spend and keep the economy from recession.

This is the theme of Richard Koo’s work as well. He writes that:

The key difference between an ordinary recession and one that can produce a lost decade is that in the latter, a large portion of the private sector is actually minimizing debt instead of maximizing profits following the bursting of a nation-wide asset price bubble. When a debt-financed bubble bursts, asset prices collapse while liabilities remain, leaving millions of private sector balance sheets underwater. In order to regain their financial health and credit ratings, households and businesses are forced to repair their balance sheets by increasing savings or paying down debt. This act of deleveraging reduces aggregate demand and throws the economy into a very special type of recession.

That fact is basically forgotten by the vast majority of politicians, mainstream economists, financial commentators and most nearly everybody else.

It is an essential insight to understand what happened and why and what the “cure” has to be.

An ordinary recession – typically the result of growing pessimism among firms which then cut back investment – is usually short and sharp and recovery returns with a burst. That doesn’t mean they are not damaging events. The principal role of government, in this context, is to ensure that the variations in aggregate demand are much lower than the variability of private capital formation (investment).

However,when the collapse in private spending occurs because the “private balance sheet” is way out of whack then the situation is very different.

I last analysed this phenomenon in this blog – Balance sheet recessions and democracy.

Koo notes that the effectiveness of policy is also changed during a “balance sheet recession”.

The first casualty of this shift to debt minimization is monetary policy, the traditional remedy for recessions, because people with negative equity are not interested in increasing borrowing at any interest rate. Nor will there be many willing lenders for those with impaired balance sheets, especially when the lenders themselves have balance sheet problems. Moreover, the money supply, which consists mostly of bank deposits, contracts when the private sector collectively draws down bank deposits to repay debt. Although the central bank can inject liquidity into the banking system, it will be hard-pressed to reverse the shrinkage of bank deposits …

Which should be read and understood by all those who keep calling for more quantitative easing from the central banks. The credit cycle has ended as private households and firms return to more typical behaviours with a short-term emphasis on getting their balance sheets back into safe territory.

Banks are capable of lending at present but they are short of credit-worthy customers – which is no surprise.

The ECB lending in recent days has meant that the banks will have no trouble funding their loan books as they are – but will do nothing to stimulate private sector borrowing.

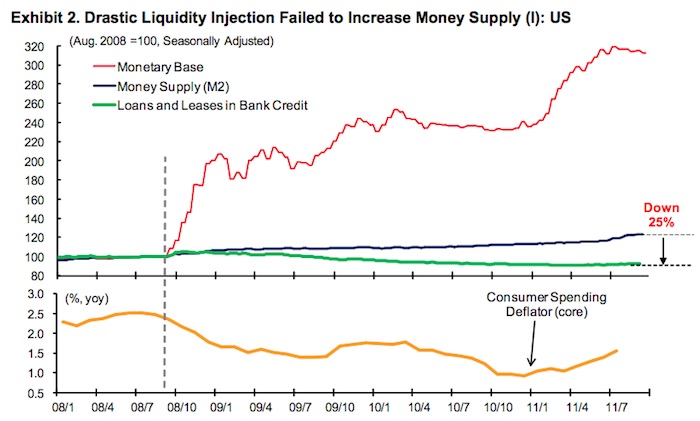

Richard Koo notes that “massive injections of liquidity by both the Federal Reserve in the US and the Bank of England in the UK not only failed to prevent contractions in credit available to the private sector, but also produced only minuscule increases in the money supply. This is exactly what happened to Japan after the bursting of its bubble in 1990”.

He provided the following graph (his Exhibit 2) which shows how stark the change in behaviour has been and invalidates all the predictions that the mainstream economists have made about the likely trajectory (for example, exploding interest rates, accelerating inflation) of the economy.

As Koo notes (and it is a point I have made for the last 10 years) – the experience of Japan has already given us a preview to what we could have expected in 2008 as the governments starting responding to the crisis.

Given how wrong the mainstream predictions have been – why are the financial commentators etc still giving oxygen to the mainstream economists? Surely, there has to come a time when the credibility of most of my profession is destroyed and governments etc start listening to people like Koo and, may I add, the MMT gang.

In the absence of government intervention the prospects are very bleak during a “balance sheet recession”. Koo provides the following example:

Consider a world where a household has an income of $1,000 and a savings rate of 10 percent. This household would then spend $900 and save $100. In the usual or textbook world, the saved $100 will be taken up by the financial sector and lent to a borrower who can best use the money. When that borrower spends the $100, aggregate expenditure totals $1,000 ($900 plus $100) against original income of $1,000, and the economy moves on. When demand for the $100 in savings is insufficient, interest rates are lowered, which usually prompts a borrower to take up the remaining sum. When demand is excessive, interest rates are raised, prompting some borrowers to drop out.

In the world where the private sector is minimizing debt, however, there are no borrowers for the saved $100 even with interest rates at zero, leaving only $900 in expenditures. That $900 represents someone’s income, and if that person also saves 10 percent, only $810 will be spent. Since repairing balance sheets after a major bubble bursts typically takes many years-15 years in the case of Japan-the saved $90 will go un- borrowed again, and the economy will shrink to $810, and then $730, and so on.

It is not rocket-science. A basic macroeconomic rule is that spending creates income and output which then stimulates employment. Leakages from the spending stream (for example, via saving) have to be offset or this recursion into recession is inevitable.

Again the experience of Japan is enlightening. Richard Koo tells us that “Japan faced a balance sheet recession following the bursting of its bubble in 1990 as commercial real estate prices fell 87 percent nationwide. The resulting loss of national wealth in shares and real estate alone was equivalent to three years of 1989 GDP.”

The response was that Japanese firms stopped borrowing and instead embarked on a massive debt repayment strategy which served to reinforce the already strong household saving rate.

Given that, how did Japan avoid a depression given the collapse in private spending?

The answer is very clear – according to Richard Koo:

Japan managed to avoid a depression, however, because the government borrowed and spent the aforementioned $100 every year, thereby keeping the economy’s expenditures at $1,000 ($900 in household spending plus $100 in government spending). In spite of a massive loss of wealth and private sector deleveraging reaching over 10 percent of GDP per year, Japan managed to keep its GDP above the bubble peak throughout the post-1990 era … and the unemployment rate never climbed above 5.5 percent.

He refers to the returns from this government intervention as a “tremendous bargain” because “(a)lthough this fiscal action increased government debt by 460 trillion yen or 92 percent of GDP during the 1990-2005 period … to buy 2,000 trillion yen of GDP” (as a result of spending multipliers intrinsic to government spending.

Please read my blog – Spending multipliers – for more discussion on this point.

I could quibble with him about the reasoning he gives to explain why “the government’s fiscal actions did not lead to crowding out, inflation, or skyrocketing interest rates” (principally he claims it is because “the private sector was deleveraging”) but that is not the purpose today.

There was no crowding out because the central bank controls the interest rate and can control longer-term interest rates if it desires. Further, bank loans create deposits within an environment where saving are not fixed. The fact that the government action didn’t generate inflation is also because there was so much spare capacity in the system when private spending collapsed.

Should there have been less capacity spare and should the firms not been deleveraging then the scale of the fiscal intervention would have been smaller with the same positive impact on overall GDP growth.

The scale of the required fiscal intervention is mediated by the extent of the private sector withdrawal (for a given external deficit).

Noting that the “private sectors in the U.S., the U.K., Spain, and Ireland (but not Greece) are undergoing massive deleveraging in spite of record low interest rates”, Richard Koo says that “it is no wonder that, after nearly three years of record low interest rates and massive liquidity injections, industrial economies are still doing so poorly”.

But with such a shift in US private sector behaviour (evident in the US graphs above), it is now evident that the:

… increase in private sector savings exceeds the increase in government borrowings … which suggests that the government is not doing enough to offset private sector deleveraging.

He also considers the “UK government is not doing enough to stabilize the economy by offsetting private sector deleveraging”.

In the context of both countries pushing fiscal austerity, Richard Koo concludes that while:

… shunning fiscal profligacy is the right approach when the private sector is healthy and is maximizing profits, nothing is worse than fiscal consolidation when a sick private sector is minimizing debt. Removing government support in the midst of private sector deleveraging is equivalent to removing the aforementioned $100 from the economy’s income stream, and that will trigger a deflationary spiral as the economy shrinks from $1,000 to $900 to $810.

Instead of relentlessly publishing graphs about the budget deficits and quoting public debt ratios, the media should concentrate on providing information about how much the private sector is now saving. This would provide a measure of:

The amount of money … [governments] … must borrow and spend to avert a deflationary spiral is exactly equal to the un-borrowed and un-invested savings in the private sector (the $100 mentioned above) that is sitting somewhere in the financial system.

Richard Koo is emphatic that their is no danger that the “bond market vigilantes” will undermine this strategy. Governments after all is the last borrower standing”

How long will the adjustment process take before the private sector can resume “normal” overall saving levels?

This is the point that should really give policy makers cause for reflection. The process of balance sheet adjustment in the private sector is very slow – perhaps up to 15 years will be required to work this out.

Thinking that the crisis is over once economic growth resumes is poor reasoning. Growth helps the private sector restructure its balance sheet but must be continually supported by budget deficits.

Richard Koo notes that the experience of Japan in the 1990s provides a very compelling demonstration of the need for governments to be the stimulus game for the long-haul.

He notes that:

… governments are likely to … be forced back into fiscal consolidation once the stimulus breathes life back into the economy. This pattern of on-again, off-again fiscal stimulus is the reason why it took Japan 15 years to climb out of its own balance sheet recession … this policy zigzag, especially the austerity initiatives in 1997 and 2001, prolonged the recession by at least five years if not longer and added at least $1 trillion to the public debt unnecessarily. This policy zigzag also caused the disastrous collapse of the US economy in 1937.

The are very strong historical precedents to warn us about the current drive for austerity from the conservative deficit terrorists.

Richard Koo says that:

As a result of this backlash from fiscal hawks, the fiscal stimuli implemented by these countries in response to the Lehman-induced financial crisis are being allowed to expire. Private sector deleveraging, on the other hand, continues unabated at alarmingly high levels in all of these countries. Consequently, all of these economies are decelerating if not contracting altogether.

The policy debate is being conducted as if the slightest sign of growth is the time for a major fiscal contraction. What our governments should be doing is educating the public about what is going on and how long it will take to remedy.

In the meantime, we will have to get used to on-going budget deficits – one way or another.

I note that the Council on Foreign Relations recently published (December 27, 2011) some research that demonstrates that the payroll tax cuts in the US in the year to September 2011 helped private consumption drive real GDP growth.

More on that analysis another day.

Conclusion

Keep thinking about which sectors are available to boost spending at present and the state of those sectors – that is, the capacity that each sector has to respond to the crisis. There is a desperate need for renewed (and significant) fiscal stimulus in most advanced economies at present. Other 2012 will be a repeat of 1937 and 1997.

The history evidence is very strong.

Richard Koo also considers the Eurozone but in the interests of time I leave that for another day.

That is enough for today!

This whole 20 year episode also illustrates one of the main weaknesses of fractional reserve: i.e. the freedom that private banks have to lend money into existence. Relax the rules governing fractional reserve, and banks will create money on the basis of ever more questionable collateral – NINJA mortgages etc.

Then everyone realises the collateral is rubbish, and the whole edifice collapses. It’s happened repeatedly throughout history, but we never learn.

Banks create credit; not money. Money is secure, as in non-convertible. Credit is not secure, as it is convertible. There is no more important distinction in macroeconomics than this.

When Bill titles this as “Historically high budget deficits will be required for the next decade,” what he is really saying is that before we get back to the business of creating credit, we’re going to have to do a whole lot more of the busines of creating money.

Benedict, Most dictionaries of economics define money as anything that is widely accepted in payment for goods and services. Private bank created “credit” is widely accepted in payment for goods and services, ergo this credit is money. And it is included in the M2,3,4, etc measures of the money supply in most countries.

However, there are all shades of grey between money and non-money. Hence the different “M” classifications. Plus the “shades of grey” feature means you have a point. That is, monetary base is more “secure” and is “non-convertible” (to use your phraseology), so monetary base has more of the characteristics of money than private bank created credit.

Therein lies the problem: the value of private bank created credit / money is dependent on whim. About three years ago Brits decided that Northern Rock money was not worth the paper it was printed on. We all know the result.

@ Ralph

Not quite regarding the Northern Rock. The Brits, correctly guessed the bank was going bust, and decided not to trust the government promises that their savings were secure.

What happen to the Northern Rock was that the basis of its operations was borrowing in international money markets, to loan this as mortages in the UK, to then sell the mortages in international markets. When the markets interest in the mortages dried up, they were unable to repay their loans, which in turn lead to them asking the BoE to provide funds.

We now also know that the sale to Virgin (who would have guessed eh???) will incur in a loss of between £400m to £650m to the taxpayers. Nationalization also brought the loss of 3000 people, just over 50% of the workforce. Northern Rock also owes the taxpayer £21bn. The Chancellor also added this pearl of wisdom about the sale:

“It represents value for money, will increase choice on the High Street for customers, and safeguards jobs in the North East.”

He could be joking (specially after being responsible for sending way over 50% of the workforce) , but he was not.

Bill:

Joe Stiglitz has a new article out at Vanity Fair, “The Book of Jobs” (here and here), that is almost painful to read, and is quite obviously about your favorite subject: jobs. In the first half, he seems to be kicking out the possibility of a job guarantee as an effective response to the crash, while later on he seems to almost be saying something like it is needed. Is this some sort of lump of labor argument? Is it just me who is confused? Can you make anything out of it?

@Ralph – I plead guilty to being very much the nit-picker on the use of the word “money”. It’s a habit I have derived from spending most of my time around people who talk about neoliberal multipliers and that (yech!) stuff. In fact, I won’t even use the “M” classes when I attempt to enlighten them, as those classes, as you note, are “infected” by that softer kind of money. The point I try to get across to them is that it is exactly this “lesser” kind of money that causes a crisis like this one (hence why I don’t call it money to them; it confuses the issue), and it is only by increasing the “real” stuff (I guess Bill & Co call it “high-powered”) that we come out of the other side of these things.

Bill,

Am I wrong to think of the accounting identities as being flows of income from the sales of goods and services?

How do you incorporate that banks can create new purchasing power by advancing loans?

Ralph said “Then everyone realises the collateral is rubbish, and the whole edifice collapses. It’s happened repeatedly throughout history.” Precisely the problem, as to more evidence that the private sector, on its own, can’t push itself out of this excessively long period of doldrums; the ship we’re on has been wandering around in circles since 2008 and will continue to until fiscal policy is used to inject collateral (money) into the mill stream. Further to the point, the giant squid banking system is just sucking blood from the wreckage of the mortgage carcasses -(vast generalization, I know) and not doing much lending in comparison to their size. Mainly they won’t and can’t lend because the trust in each other and in consumers is just not there. That leaves only one player with the capability to move us up and out-the Federal Government.