I have received several E-mails over the last few weeks that suggest that the economics…

Are our pollies lining their own nest?

Today, I was investigating pay structures and then became interested in the emerging public debate about Members of Parliament pay, after the Remuneration Tribunal has recommended that Electoral allowances go up 17 per cent per year to $32,000. Every time the pay of parliamentarians is increased there is a hue and cry from the media. In this case, even the Green’s Leader and an independent MP have also rejected their “own self interest” to oppose the pay rises. However, the Government will not stop the rises going through even though last year the PM froze the base rate pay to lead the wage restraint path in these difficult economic times. This raises two questions: (a) Are our pollies just lining their own nest? and (b) Should wages growth be restrained in times of recession? My spare moments today were filled with those issues.

In any one day as a researcher I have stacks of on-going projects to work on – more than I care to think about. But I also have a “curiousity factor” which I allocate time to – to see what is going on! The MP pay issue was in the latter category and I am glad I became curious about it.

So the facts as we know them. The Remuneration Tribunal today recommended a $4,700 increase in the electorate allowances payable to Members of Parliament. This will take the allowance up to $32000 per annum which if you click away on your calculator will reveal a 17 per cent increase. That as it stands sound big given last week inflation had dropped to around 2.5 per cent per annum (and 0.1 per cent in the March 2009 quarter). That sparked my curiousity.

The Government’s decision to allow the rises to continue is in part because they have been recommended by the Remuneration Tribunal, which is an independent statutory public body who function “to determine, report on or provide advice about remuneration, including allowances and entitlements that are within its jurisdiction for the following: (a) federal Parliamentarians, including Ministers and Parliamentary office holders; (b) judicial and non-judicial offices of federal courts and tribunals; (c) full-time and part-time holders of various public offices; and (d) Principal Executive Offices.”

So the Government and Opposition can appeal to the so-called “independent umpire” as they pocket the loot.

So how does all this work?

First, the determination of total parliamentary member’s pay takes a while to work out. For a start their pay scales are complex and if you consult Parliamentary Library Summary you will quickly form hypotheses about why there is so much back-stabbing going on in Canberra within parties. There are so many different classifications that define different allowances and extras. There seem to be so many incentives, if you were, say, a Second Deputy Speaker in the House of Representatives to undermine the Deputy Speaker in the House of Representatives, who at the same time was aiming knives at the Speaker in the House of Representatives. So while they have been imposing award simplification of the disadvantaged ends of the labour market it seems they haven’t taken the same razor to themselves.

Second, to explore the history of Parliamentary pay increases this document is a reasonable starting point. By way of simplification, since Federation in 1901, MPs receive a Basic Salary (or Annual Allowance) plus a string of other benefits which are aggregated as Entitlements (mainly an Electorate Allowance) and Other Benefits which includes travel, retirement and superannuation benefits. If you are a Ministers or Parliamentary office-holders you receive a Salary which has been also termed “Additional Salary, Salary of Office or Ministerial Salary.” The summary document linked to above provides all the details you would require to understand the wage structure.

So in the words of the Remuneration Tribunal, these components of MP pay are:

– All Senators and Members of the House of Representatives receive a base salary. The base salary is a matter for Government and is governed by the Remuneration and Allowances Act 1990.

– Additional salary is payable to those parliamentarians who are also Ministers or Parliamentary office holders. Since December 1999, additional salary has been expressed as a percentage of MPs’ base salary …

– The Tribunal makes recommendations to the Government on Ministers’ additional salary although the Government may accept or reject the Tribunal’s advice …

– The Tribunal may also determine additional salaries for Parliamentary Office Holders …

– Superannuation is not determined by the Tribunal but is governed by the Parliamentary Contributory Superannuation Act 1948 and the Parliamentary Superannuation Act 2004 …

The Tribunal also determines some transport and work facilities allowances for MPs, including a private plated vehicle.

How are these dollar amounts determined?

The Remuneration Tribunal, as an “independent statutory body” provides advice only on the annual allowances that MPs receive. The relevant rules state that:

The Tribunal has a formal role in advising the Minister… on an appropriate base salary for Senators and Members of the Federal Parliament. The Tribunal cannot issue a determination on this matter it can only provide advice, as it does on the additional salaries payable to Ministers. The Government can choose to accept or reject the Tribunal’s advice on these matters and must undertake the necessary action to bring the Tribunal’s recommendations into force.

So the Remuneration Tribunal is not empowered to set the Federal parliamentarians’ base pay. The basic salary is determined by Parliament under Section 48 of the Constitution and legislated under the Remuneration and Allowances Act 1990. Under that Act, before the Governor-General can accept the advice of Parliament, the Minister for Education, Employment and Workplace Relations “must consider advice from the Remuneration Tribunal about the proposed regulation. In modern times, the Federal Attorney-General then tables this advice for consideration.

Prior to 1999, base level salaries were linked to the senior executive award rate in the Australian Public Service. In December 1999, the Government modified (by regulation) the relevant act (The Remuneration and Allowances Act 1990) to “link the parliamentary base salary to a reference salary”. Reference Salary A in the Remuneration Tribunal’s Principal Executive Office structure was chosen as it is adjusted annually (typically). The reason for this decision stems from that Government’s obsession with deregulation and their requirement that senior executives in the Australian Public Service go onto workplace agreements (now outlawed). This made it difficult for MPs to get any pay rises (due to secrecy and non-standard outcomes).

In the period up to 30 June 2008 the base parliamentary salary was equal to 100 per cent of Reference Salary A. However, by Remuneration and Allowances Amendment Regulations 2008 (No. 1) parliamentary base salary in 2008/09 and future years will be set at an amount equal to the Reference Salary A determined by the Tribunal, less the whole dollar increase to the reference salary determined by the Tribunal for the 2008/09 year.

Last year, the Remuneration Tribunal adjusted the Reference Salary A to $132,530 (relevant for 1/7/2008 to 30/6/2009) but the Government “froze” MP pay, as a gesture of belt-tightening at $127,060. The decision was a once-off and for the 2009-2010 determination period the base parliamentary salary will once again bet set equal to Reference Salary A less $5,470 (the difference between $127,060 and $132,530) per annum. So effectively the freeze realigned the relationship

between MP base pay and the reference salary.

In the case of Ministerial salaries, the Remuneration Tribunal reports to Government annually on any additional salary payable. But the final decision is made by the Executive Government and does not even require legislation to make it official.

For interest, I compiled this partial list of exceptions. On top of the Base Salary the following additions are awarded:

- Prime Minister – 160% extra;

- Deputy Prime Minister – 1050% extra;

- Treasurer – 87.5% extra;

- Leader of the Government in the Senate – 87.5% extra;

- Leader of the House – 75% extra;

- Other Minister in Cabinet who is also Manager of Government Business in Senate – 75% extra;

- Other Ministers in Cabinet – 72.5% extra;

- Other Minister who is also Manager of Government Business in Senate – 67.5% extra;

- Parliamentary secretary who is also Manager of Government Business in Senate – 35% extra;

- Parliamentary secretaries – 25% extra;

- Leader of the Opposition – 85% extra;

- President of the Senate – 75% extra;

- Speaker of the House of Representatives – 75% extra;

- Deputy Leader of the Opposition – 57.5% extra;

- Leader of the Opposition in the Senate – 57.5% extra;

- Leader of recognised party of more than 10 MPs, other than a party whose leader is the Prime Minister or the Leader of the Opposition – 45% extra;

- Leader of recognised party of at least 5, and no more than 10 MPs – 42.5% extra;

- etc;

But the reality is that the Government of the day, sets its own wages usually in cahoots with the Opposition. It is one issue they can be sure of achieving the so-called bi-partisan consensus.

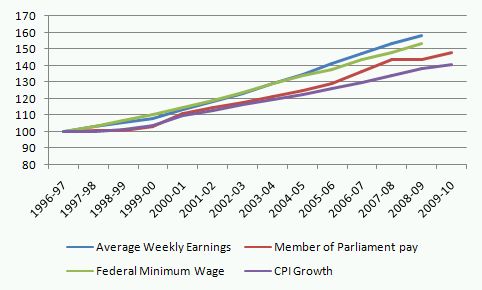

Anyway, the question to be answered is: Are our pollies lining their own nest? To explore this I examined the evolution of Parliamentarian pay compared to the recent history of Average weekly earnings (from the ABS) and the Federal Minimum Wage determined at present by the Fair Pay Commission. I compiled the FMW from documents reporting the various safety net decisions since 1996 either via the Australian Industrial Relations Commission or the FPC. All data was reconstructed into fiscal years to accord with the away the Remuneration Tribunal now presents its reports.

I made assumptions that the CPI would continue for the rest of the current financial year at 2.5 per cent per annum. I also indexed to 1996/97 = 100 the four time series: AWE; MP pay; FMW and CPI.

The inclusion of the change in CPI (in Index number terms) allowed me to determine whether the MPs have enjoyed substantial real wage increases relative to the other categories of wage earners represented by the average weekly earner and the minimum wage earner.

To make the analysis tractable (and quick) I ignored all the complexity of the scales because they are largely just proportional mark-ups of the base salary anyway. This would not make any difference to my index number comparison.

Further, while the press has been reporting a 17 per cent rise in allowances in fact there are several different “electorate allowances” depending on what sort of electorate the member represents. The allowance that the press has focused on applies to Senators all States and Territories and Members of the House who represent electorates of less than 2,000 km squared. You can see the other allowances HERE.

I also lumped together the base salary with the electorate allowance as parliamentarians can convert the allowance into private income if they want. The allowances are clearly intended to run the business of the electorate but it is clear that the money is used for private purposes in many cases although the politicians want us to believe otherwise. So even though I am assuming the PM’s freeze on the base salary will continue, the 17 per cent allowance increase represents a pay rise equal to 3 per cent for 2009-10 and hence a real wage increase in the coming year if inflation remains at around 2.5 per cent. However, given the state of the economy, it is likely, that inflation will fall further in the coming year, which means the politicians are awarding themselves a nice real wage rise.

But what about recent history? How are the MPs faring? It was relatively easy to assemble data from 1996/97 onwards. The following graph shows the index number movements in the four time series since then. It is clear that while all three pay series have enjoyed modest real wages growth (and I stress modest) since 1996/97, the pay of politicians has lagged behind Average Weekly Earnings and the Federal Minimum Wage. You can also see that in the latter years of the Howard Government, MP pay was growing much more quickly than the other pay series. The Rudd freeze is also very evident post 2007/08.

I note that while there have been modest real wage rises, the growth in real wages has lagged drastically behind measures of labour productivity over the same period. For a discussion of this see my blog – The origins of the economic crisis – where I document the drastic fall in the share of wages in national income (and the corresponding rise in the profit share) over the last 20 years.

Further, one might point to the other entitlements such as very generous superannuation, the “life time” gold travel pass etc that parliamentarians receive. Do they make up for their relatively poor performance in base salary? Maybe for some politicians who qualify, but that is another question and to complex to model in a short blog.

Today’s decision has raised calls for reforming the way politicians receive pay rises. The independent senator Nick Xenophon wants a total overhaul of the procedures for setting the pay for politicians and suggested that they become part of the new industrial relations structure which will determine all minimum wages. That is, from one tribunal to another. I can see some merit in that suggestion.

But I would extend that suggestion. My preference is that the Federal politicians have their pay set as a mark up on the minimum wage (determined by the Fair Work Australia tribunal) and then they get performance bonuses for how close the official unemployment plus underemployment get to full employment. In this case, the performance bonus would be pay cuts for every percentage point the broad measure of labour underutilisation went above 2 per cent. The Centre of Full Employment might receive a hefty consultant’s fee to determine the pay taper!

That way, we would guarantee full employment. I think we would see strong bi-partisan support for the overnight implementatin of a Job Guarantee.

In retrospect, given that the Governments of both persuasions have chosen over time to allow high rates of labour underutilisation to persist, I think the graph suggests they have been overly generously compensated.

A final question: Should wage restraint be widespread given the recession? Answer: no? Why? A later blog! Remember that wages are both a cost and an income. Widespread wage restraint reduces growth in both and probably would undermine the recovery process, especially as household saving is already rising quickly. But this topic needs more coverage than I have time for today.

Back to the underlying research tasks of the day!

Digression: IMF and World Bank reports on poverty

The IMF and the World Bank) now think that the GFC could turn into “a human and development calamity”. The IMF said:

The crisis has already driven more than 50 million people into extreme poverty, particularly women and children. We must alleviate its impact on developing countries and facilitate their contribution to global recovery.

The World Bank said:

The recent food crisis threw millions into extreme poverty, and the prospect of much slower growth in developing countries is now likely, in turn, to slow the pace of poverty reduction. Estimates of the additional number of people trapped in extreme poverty in 2009 as a result of the financial crisis range from 50 to 90 million … The number of chronically hungry people in the world, which rose in 2008 because of the food crisis, is set to exceed 1 billion in 2009, reversing gains in fighting malnutrition and making investment in agriculture all the more important.

I haven’t had time to fully read the reports yet. But a reasonable glance tells me that neither institution are advocating wide-scale public sector job creation programs. They are both emphasing making the private sector more efficient as a principle strategy. And given the history and performance of both institutions you can guess what that means. Based on this, I would immediately send redundancy letters to both head offices in Washington DC.

But I won’t put them in the post just yet! I will comment again when I have thought about the content of the respective reports in more depth.

Digression: Interview for Solidarity Magazine

I did an interview for the Solidarity Magazine recently about the Australian Government’s stimulus approach. It is pretty much my standard message. If you are interested you can read it HERE.

The current government much like the last is oblivious to how a modern money economy operates and until this changes I see little if any hope for many Australians.

Aside from that I support politicans getting an increase because with a bit of luck they may just choke on it.