It is a public holiday in Australia today for some reason and I had to…

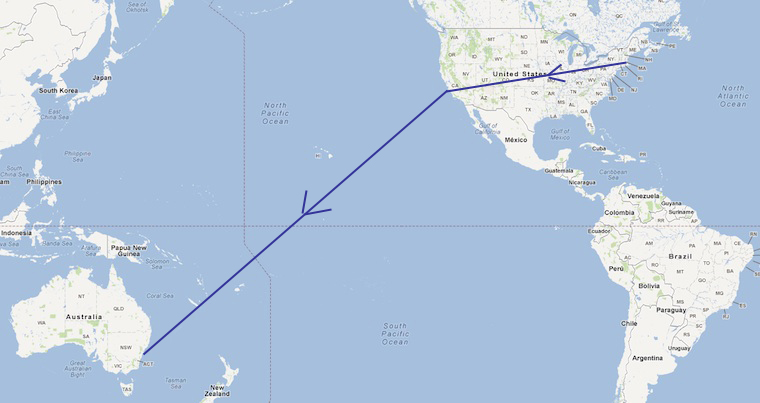

Where is Bill now?

In case you are wondering what is going on with my blog today you might care to read the following.

I have been working in the US the last week and in between snow and other distractions Randy Wray and I formulated a completion plan for our upcoming Macroeconomics textbook and agreed on a publisher. We still hope to have completed by the new Northern teaching year of 2012 although later in 2012 is probably more realistic.

Anyway, all parties end and now it is time to fly!

In the next 24 hours or so I will have limited capacity to respond to E-mails and moderate any comments. I moderate all comments which contain links so if it is sitting in the queue for some time you will understand why.

A new blog will appear on Tuesday.

Git ‘r done.

MMT appears to be busting loose and teachers gotta teach with the right textbook.

And I thought you were down in DC telling that WaPo writer off.

Bill, In writing your book I suggest you take account of a mistake that MMTers sometimes make in relation to this equation: (I-S)+(X-M)+(G-T)=0.

As Steve Waldeman rightly points out, MMTers often confuse stocks and flows here. Randall Wray makes this mistake here (see passage starting “this also means):

http://www.neweconomicperspectives.org/2011/10/mmp-blog-20-effects-of-sovereign.html

For Waldeman, see here: http://monetaryrealism.com/?p=192

Waldeman does not say the above equation is nonsense, but he does say that private sector savings can rise even if the external sector (X-M) and government sector (G-T) are in balance. This occurs where stock market prices rise.

I’ve seen MMTers answer the latter point by claiming that shares are assets for shareholders and liabilities for corporations, so the two cancel out. That strikes me as double counting: a share is a share in a large collection of assets and liabilities.

Will the chapters on bank nationalization and the mandatory ELR be towards the end?

Did you give a talk at Bard? How did that go?

Ralph, I believe that MMT treats companies and claims of companies (stocks) as real assets (although they have a financial form) hence there is no contradiction. One can think of real assets as claims on mother nature, physical goods like houses or infrastructure. They are not IOU of some actor among the troika: [govt-private sector-foreign sector], like financial assets. Of course the balance sheet of the private sector improves when we find more oil or gold, but this is not reflected in the financial eqn. you quote.

Private sector savings is the residual you get when subtracting consumption and taxation from GDP. In this sense, the stock market can do what it likes – it won’t change the equation, which is obviously an identity and so remains valid always by definition. Indeed, a rising stock market will tend to depress private sector savings, as household wealth (apparently) increases without the act of saving being necessary. A rising stock of financial wealth increases the propensity to consume and depresses savings. Falling savings relative to investment means the government budget deficit will fall, as the private sector surplus shrinks, assuming an unchanged external balance. Savings are a flow. Investment is a flow. Government spending, taxation, exports and imports are all flows.

Dear pebird (at 2012/02/21 at 2:10)

Yes I did. The title was “Why Italy should leave the Eurozone”. I think the audience enjoyed it although it might have been the free pizza that was provided by the organisers that kept them around!

It also kept us indoors which was just as well because there was a snow storm raging outside.

Best wishes

bill

Dear Spoony Bard (at 2012/02/21 at 0:08)

You asked:

Thank you for your interest (-:

Bank nationalisation is one policy option, which will be discussed in the chapter on Money and Banking where it belongs. If you recognise that banks are at present private-public partnerships then it is important to ask whether privatising the gains and socialising the losses, as we do today, is the best way to proceed.

The discussion of JG will appear in the Chapter on Inflation and Unemployment under a discussion of the Phillips Curve, as it should. At present we use unemployment to maintain price stability at great cost. If we are interested in efficiency, then employment buffers are clearly a better price anchor. The contribution of MMT is to show that within a conventional Phillips Curve framework, employment buffers can resolve the debate about trade-offs. That is a distinctive and significant advance on the mainstream PC literature.

I suspect you have been reading material that doesn’t understand that last point.

best wishes

bill

Dear Ralph Musgrave (at 2012/02/20 at 21:42)

There was no mistake in what Randy wrote. Steve (at 2012/02/21 at 17:53) has dealt with this well.

Saving is always a flow in macroeconomics. The stock that results from that flow is financial wealth.

Steve Waldeman is also incorrect for the same reason.

best wishes

bill

“If you recognise that banks are at present private-public partnerships then it is important to ask whether privatising the gains and socialising the losses, as we do today, is the best way to proceed”

Just want to make sure that you also discuss another way of breaking the partnership, i.e. making banks really private and instead fully nationalizing the payment system (which it anyways should be and is technically already). Try to remain apolitical in recommendations and avoid unnecessary screaming from conservatives. JG alone is more than enough for that.

“Try to remain apolitical in recommendations and avoid unnecessary screaming from conservatives. ”

Why this pretense that the system is apolitical. All systems are political. Trying to pretend otherwise is to play into the hands of those who gain from that pretense.

MMT is based on the state theory of money. Pandering to those who don’t believe in benevolent states, public purpose or full employment with price stability is utterly pointless.

Neil, text books should try to be as objective as possible. Alternatively they should present as many diverse points as possible. I am surprised that even such a simple and obvious point creates so much resistance. Maybe it is really time to slow down a little. You do not need to sacrifice anything for that.

What do you think?

“Neil, text books should try to be as objective as possible.”

Objective doesn’t mean devoid of direction or meaning.

I doubt there will be much of a ‘Robinson Crusoe’ island description in the book either, other than to point out its flaws.

And to Ralph I would add someone like Dan Kervick also adequately dealt with it in comments. I don’t know if it was Dan but it was someone like him.