Today (March 6, 2024), the Australian Bureau of Statistics released the latest - Australian National…

Australian growth rate halves as obsession with budget surplus continues

Today the ABS released the Australian National Accounts – for the December 2011 quarter which shows that the quarterly real GDP growth rate was 0.4 per cent, down from 0.8 per cent in the September quarter. For the year, the Australian economy grew by 2.3 per cent down which when compared to trend (around 3.25 per cent) reveals how sluggish our recovery after the crisis has been. The worrying sign is that private business investment contracted and offset the growth coming from household consumption, net exports and inventory building. Growth is also being held back by the Government’s obsessive pursuit of a budget surplus in the coming fiscal year. The fiscal drag is damaging output and employment prospects and dampening expectations in the private sector. The growth rate is not strong enough to make a dent in the unemployment and underemployment ranks. The case for continued government support for higher growth remains especially with inflation now falling.

There was an excellent article in the Melbourne Age yesterday (March 6, 2012) by Peter Martin – Economic chasm widens – which reported on Monday’s data release from the Australian Bureau of Statistics – Business Indicators, Australia (December 2011).

The ABS data shows that:

A SHARP geographic divide has opened up in business conditions … [with] … sales growth five times as fast in Australia’s north-west as in the south-east and wage growth twice as fast … sales growth over the year to December of 14.6 per cent in Queensland, the Northern Territory and Western Australia combined, compared with just 2.9 per cent in New South Wales, Victoria, South Australia, the ACT and Tasmania. Wage growth averages 10.9 per cent in the northern and western mining states, compared with just 5 per cent in the south-east.

This dual pattern of growth has been seen before in Australia and largely arises from our status as a primary commodity producer (and exporter) rather than an industrial nation.

Some sectors (such as manufacturing and tourism) and regions (such as Sydney and Melbourne) are struggling while other sectors (such as mining) and regions (such as Western Australia, Northern Queensland and the Northern Territory) are booming.

These trends – popularised by the term ‘two-speed economy’ – whereby serious sectoral and regional imbalances accompany overall economic growth, challenge the fundamental patterns of our economic and social settlements and threaten the financial viability of many Australian households.

While the term ‘two-speed economy’ has taken on a number of meanings in different countries the imbalance of most interest here is the precariousness of the East coast economy (particularly, NSW and Victoria) where the majority of Australians live and where most of the employment is generated, relative to the prosperousness of the mining regions of Western Australia, Queensland and the Northern Territory.

Several coincident factors are driving the ‘two-speed’ economy some of which have not received much public attention.

First, our terms of trade for non-rural, particularly base metal commodities are booming but delivering uneven benefits to Australian regions. Further, Australian manufacturing is declining with regionally concentrated costs. Consequently, unemployment is falling in some areas but rising elsewhere.

Second, the major city property booms in recent years have abated with households left holding record debt levels. In some areas, household finances are now highly vulnerable to minor interest rate variations and increasing unemployment.

Third, the Federal Government is now engaged in its obsessive pursuit of budget surpluses. The resulting squeeze on household disposable income combined with recent increases in interest rates, has elevated the danger that economic slowdown in some areas (like Sydney and Melbourne) will bankrupt many households.

The concept of a ‘two-speed’ economy is not new. In the 1970s, the term ‘Dutch Disease’ was coined. The hypothesis is that a resources boom caused the Australian dollar to appreciate which then: (a) damages the competitiveness of ‘import-competing’ sectors (dominated by manufacturing, service and agricultural firms) because import prices fall relative to local cost levels; and (b) promotes wage pressures which further damage sectors who are not enjoying buoyant demand conditions.

The ABS Business Indicators data is consistent with these trends although the wage pressures that are emerging in the booming areas are not spilling over to the majority of workers in the slow-growth states/regions.

The mining sector is booming because of the terms of trade are at record levels. A rising terms of trade means that prices we receive from foreigners for our products are moving favourably relative to prices we pay for products from abroad.

A rising terms of trade rise usually promotes exchange rate appreciation. Since March 5, 2010 (to today) the Australian dollar appreciated by 16.5 per cent against the US dollar, 10.6 per cent against the Trade Weighted Index, 20.7 per cent against the YEN, 15.4 per cent against the Euro and 11 per cent against the UK pound.

This suggests a classic Dutch Disease situation where world demand growth in resources is placing upwards pressure on the currency, disadvantaging export industries which are not enjoying buoyant world prices (such as, manufacturing and tourism).

Peter Martin reports that the ABS data shows that:

The ABS says company profits barely grew in 2011, inching ahead just 2.1 per cent; the worst result in more than a decade, with the exception of the global financial crisis in 2009, in which profits slid 13.7 per cent. In the December quarter, company profits fell 6.5 per cent, led down by a halving in profits in financial, insurance and other services, a 9 per cent dive in mining profits and a 5 per cent fall in manufacturing profits. Profits in the administrative and support sector climbed 12 per cent and utilities profits climbed 5 per cent.

In addition, wages and salaries and employment barely grew at all.

This is the problem that the Australian government has to deal with. There was a very interesting exchange last week (February 24, 2012) when the Reserve Bank Governor appeared before the House of Representatives Standing Committee on Economics which was reviewing the Reserve Bank of Australia Annual Report 2011.

The full Transcript provides this statement from the Governor after the question from Chair:

CHAIR: You referred in your opening statement to the different elements of the economy and the different demands and condition of them, I guess. In the early days when I sat on this panel, not in this position, you seemed to not give a great deal of consideration to the different responses to interest rates in the different sectors of the economy and your language has changed quite a bit in the last few years. I heard what you said in your opening statement that you cannot really take them into account, but, given the concern across the country about the different impacts of the high dollar and the boom et cetera on different elements of the economy, how do you deal with that?

Mr Stevens: I say that we are conscious of these differences … and this is a message that does not really gladden too many people’s hearts: monetary policy is a national policy. We have one instrument-one currency. We are a currency area and we cannot make the differences go away because they are really driven by fundamental forces in the global economy.

What has happened is that there has been a major shift in relative prices, so the prices for natural resources and energy are way up; the prices for manufactured products and some services are down. There is nothing anyone in Australia has done to make that occur; it is a global phenomenon and there is actually nothing we can do to make it go away … In aggregate, for our country it is an enriching thing because we have such a large natural endowment of natural resources and energy, but also, because it is a relative price shift, that will occasion pressure to change the structure of the economy. There are no two ways about that. Monetary policy cannot make it go away. I do not actually think any policy can make it go away. If we are talking about policies to help the economy adjust, they would be in the realm of other policy areas. Monetary policy cannot do anything about that because we cannot change relative prices. That is the fundamental thing. It is a major, relative price shift that the global economy, because of what is happening with Asia and so on, has handed down, so to speak. Every country in the world has to adjust to that, including us. For us the adjustment is not necessarily easy but, overall, it is actually a positive opportunity because of our resources endowment. So, in that sense, you would have to think we are better placed than most others. But it is an adjustment; there is no way around that.

This is a very interesting observation. One of the characteristics of the neo-liberal era has been the promotion of monetary policy as the primary vehicle for counter-stabilisation policy and the requirement that fiscal policy plays a passive role overall. This change in thinking corresponded with the ascendancy of inflation control as the primary aggregate target for macroeconomic policy.

Unemployment ceased to be a policy target (that is, to maintain low rates of unemployment overall) and, instead, became a vehicle whereby monetary policy could discipline the inflation process.

As the RBA governor notes, monetary policy is indiscriminate across both households and regions, except to differentiate between creditors and debtors. Economists used to refer to monetary policy as a blunt instrument.

The policy lags (that is, the time it takes for policy changes to impact) are also long and uncertain. Monetary policy works in an indirect way and so it may take some time before the impacts are observable. Often, if monetary policy changes have been effective, the impacts overshoot the initial goals before the central bank has a chance to observe the impact.

Fiscal policy in the form of spending changes, in contradistinction, is a direct instrument (that is, changes spending levels in the economy immediately) and its effect is more easily measured. It can also be highly targeted to certain demographic cohorts and specific regions.

I thus reject the governor’s claim that no “policy can make … [the relative price effects] … go away”. Specific fiscal policy initiatives may not be able to change these externally-induced, relative price effects, but they can certainly target employment creation in areas disadvantaged by these global impacts.

A correctly calibrated and well-designed fiscal intervention can always promote domestic growth in disadvantaged areas.

But the Governor’s statement demonstrates how limited a reliance on monetary policy as the primary aggregate policy tool is.

And now … the National Accounts for December 2011

As I always note – the National Accounts data provide a rear-vision view of what was happening in October, November and December and is only a proximate guide to what is happening now. Since then the global economy has probably contracted – with the Euro crisis now back in the spotlight and the impacts of that crisis starting to show in Asia. China is now slowing and that will be the most likely conduit for the Euro crisis to impact negatively on our economy

The main features of today’s National Accounts release for the December 2011 quarter were (seasonally adjusted):

- Real GDP increased by 0.4 per cent (after rising by 0.8 per cent in the September quarter – revised downwards from 1 per cent).

- The main positive contributors to expenditure on GDP were Household final consumption expenditure (0.3 percentage points), Inventories (0.3 percentage points) and Net exports (0.3 percentage points).

- The main main negative factors impacting on spending was Private gross fixed capital formation (detracting 0.4 percentage points).

- Real gross domestic income, which adjusts real GDP for Terms of Trade effects, fell by 0.6 per cent (the Terms of Trade fell by 4.7 per cent while real GDP rose by 0.4 per cent), In the September quarter 2011, it rose by 1.6 per cent.

- Real net national income, which is a broader measure of change in national economic well-being decreased by 0.9 per cent.

The ABC News Report (March 7, 2012) – GDP figures show economic growth slows – quoted the Federal Treasurer as admitting that the poor growth result was:

… somewhat softer … [than anticipated] … With economies going backwards like Germany, Japan, the United Kingdom and Italy in the last quarter of last year, for us to have any growth at all in that period I reckon is a pretty good result. Once again we have seen the enduring resilience of our economy and … a reminder that our economy does walk pretty tall in the world.

Which is a pretty extraordinary statement for a Federal Treasurer of a nation which issues its own currency to make.

The Australian government can always motivate domestic growth and given that the external sector typically does not add to Australian growth in net terms this statement demonstrates the way in which the Australian government is seeking to reduce its responsibility for the slowdown.

In general, the bank economists expected growth to be twice as much as it was in the December quarter. The fact that they were 100 per cent wrong, on average, is no surprise. They are part of the narrative that seeks to downplay the damaging effects of fiscal contraction and to promote the once-in-a-hundred-years mining boom myth.

While the Terms of Trade fell sharply in the December quarter 2011, it is true that the external sector is strong and providing some small growth stimulus now. But there is still significant room for fiscal support of aggregate demand.

The ABC quote one bank economist as saying:

Normal economic growth is around 3.25 per cent, but we haven’t hit that level for almost four years … While economic growth is sub-standard, other indicators are still encouraging: consumer spending growth is close to normal; there are no wage or price pressures; and even productivity is looking perkier. The sluggish pace of the economy keeps the door open to another rate cut. Not only has data confirmed that the economy is just chugging along, timelier indicators suggest there has been little improvement in 2012.

I agree mostly with this assessment. But you note the bias towards monetary policy in this economist’s policy advice.

Given that the more timely indicators are showing that the trends in the December 2011 quarter are continuing into 2012, the case for fiscal expansion is acute.

The Sydney Morning Herald article (March 7, 2012) – GDP slowdown fans rate cut chance – also reinforced the misguided bias towards monetary policy as the preferred policy response to the slowing economy.

It noted that the RBA had been forecasting a 1 per cent growth rate in the December quarter.

It quoted a bank economist as saying:

At this point, GDP is a flag that (interest) rates may need to fall further, but we need follow through in the unemployment rate to be an actionable item,

Which if you can work that out you are better than me. Is he saying that monetary policy rate cuts will not lead to a fall in the unemployment rate? If so, then I agree. As noted above, I consider monetary policy to be a relatively ineffective tool for improving job prospects.

More direct manipulation of aggregate demand is required (fiscal policy) and initiatives should be targetted at creating jobs.

The SMH article carried later statements from the Treasurer:

There’s no doubt that these numbers will have a detrimental impact on our budget bottom line … Having said that, there’s nothing in these numbers that deters the government from bringing down a surplus in 2012/13 … Although, obviously, this makes that task more difficult.

Which when combined with his previous comments (above) should disqualify him from holding the post of Australian Treasurer.

What the declining growth rate tells us is an overall spending is insufficient to maintain production levels. What that means is that firms are unwilling to produce more goods and services because they know that aggregate spending is in retreat.

The slowing economy, in turn, undermines the growth in tax revenue and hence makes it did difficult, if not impossible, for the government to achieve its budget surplus ambitions in the time-frame noted.

The signal that should send the government is that its budget surplus ambitions are contrary to what is required for overall economic health. The slowing tax revenue is not a sign that governments should cut spending harder. Rather, it is a sign that government should expand net spending (that is, increase the budget deficit).

If is the task of achieving a budget surplus is “difficult” then that tells us that such a task is inappropriate at that point in the business cycle.

The fact is that private spending is currently incapable of driving spending growth at such a rate that Australia can achieve full employment.

Another bank economist interviewed by the SMH made a point I have been making for the last 2 years:

The so-called trickle-down effect is nothing more than a few drips … The mining boom is alive and well, but it’s not leading to much in the way of a spillover effect on the rest of the economy … I think, to ensure trend growth, we really need to see lower interest rates.

At least some people are now acknowledging that the narrative being spread by the government and the mining sector that we are booming and that governments should move into surplus (with a combination of lower taxes and even greater cuts in spending) are false.

But the monetary policy bias remains.

The Australian economy is still not growing fast enough to absorb the huge pool of underutilised labour (currently around 12.5 per cent of the available labour force). The ABS trend growth estimate is at 2.8 per cent (annualised) (down from 3.2 per cent in the September 2011 quarter). The average annual growth rate in the five years leading up to the crisis (up to December 2007) was 3.6 per cent.

The idle labour (particularly the staggeringly high youth unemployment and underemployment) provides the scope for government to pursue further non-inflationary growth and that should be a priority. There is no case for a budget surplus at present or into 2012 while labour underutilisation remains that high.

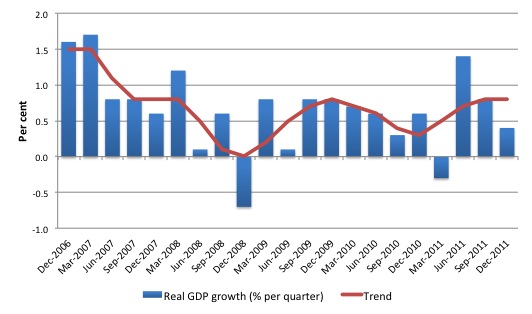

The following graph shows the quarterly percentage growth in real GDP from December 2006 to December 2011 (blue columns) and the ABS trend series (red line) superimposed. After the decline in trend growth was arrested by the fiscal stimulus in 2008-09 the decline in government support saw the dip in trend growth in 2010. Initially, growth in private investment helped drive the new rise in trend growth but in the December 2011 quarter that source of growth was negative.

The average real GDP quarterly growth over the last year is 0.6 per cent (trend 0.7 per cent). Today’s data indicate that over the last year the Australian economy grew by only 2.3 per cent. However, even if we discount the poor March quarter and assume that the ABS trend growth estimate continues the economy will still be well below the pre-crisis trend.

So there is not much hope of achieving significant reductions in labour underutilisation under the current policy settings.

What components of expenditure added to and subtracted from real GDP growth in the December 2011 quarter?

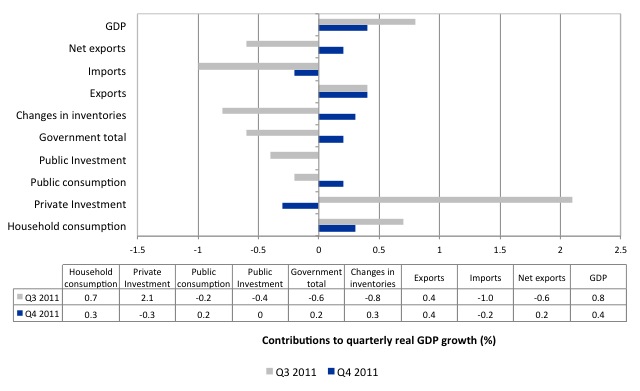

The following bar graph shows the contributions to real GDP growth (in percentage points) for the main expenditure categories. It compares the third quarter contributions (grey bars) with the December quarter (blue bars).

The growth components were household consumption (although more than half as low as in September 2011 quarter), Public consumption (0.2 percentage points), growth in inventories (0.3 percentage points) and net exports (0.2 percentage points). Imports contracted reflecting the slowing economy.

Whether the behaviour of private investment is a blip (the sudden swing from strength to weakness) remains to be seen.

Household saving ratio

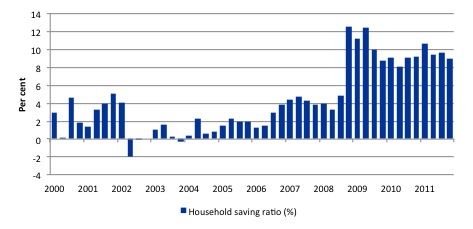

The following graph shows the household saving ratio (% of disposable income) from 2000 to the current period. The household sector is now behaving very differently since the GFC rendered its balance sheet very precarious. Prior to the crisis, households maintained very robust spending (including housing) by accumulating record levels of debt. As the crisis hit, it was only because the central bank reduced interest rates quickly, that there were not mass bankruptcies.

The household saving ratio was at 9 per cent of disposable household income in the December 2011 quarter (down from 9.6 per cent in the September quarter). It has averaged around 10 per cent since the crisis.

For the economy to continue to grow strongly while households are maintaining rising levels of saving (from disposable income), public spending, private investment and/or net exports has to increase.

Clearly the contribution from net exports is modest and private investment spending has contracted. Which means that if the household deleveraging effort is to continue with undermining growth, then the contribution of goverment has to increase.

Given that the household sector is now carrying record levels of debt as a result of the credit binge leading up to the crisis, we are unlikely to see a return to the low saving ratios that were evident in the period 2000 to 2005.

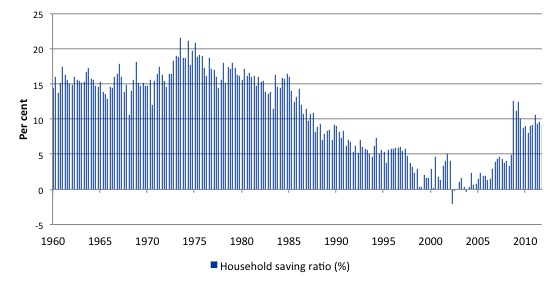

You get a better picture of how unusual the credit-binge period was by looking at the household saving ratio over a longer period. The following graph starts at the time National Accounts data began (December 1959). This graph helps readers understand the comments I make about “typical” and “atypical” behaviour among the macroeconomic aggregates.

I have often said that the period in the late 1990s up until the crisis when the government was running surpluses and the household sector was accumulating record levels of debt which allowed it to indulge in a consumption binge were atypical. The credit-binge underpinned relatively strong growth, which in turn allowed the government to run the surpluses (revenue growth was so strong) over this period.

But the behaviour was very odd by historical standards. The problem now is that the conservatives (who are really neo-liberals rather than traditional Tories) have reconstructed history as if the budget surpluses are normal.

The following graph shows how atypical the period of the budget surpluses were (from 1996 to 2007). As households increasingly went into the red and were dis-saving the household saving ratio became negative. As a result of the risk now carried by the record levels of indebtedness and the uncertain nature of the economy at present (threat of unemployment is still high), households are resuming their historically typical behaviour and consumption is more subdued as a result.

A household saving ratio of 10 per cent is thus likely to continue indefinitely. There will be a need for continuous budget deficits in the coming years to support growth and private saving.

The juxtaposition is what I would call typical and runs against the austerity hype that is driving public policy at present.

Conclusion

The trend in the Australian economy is becoming more defined after being upset by the natural disasters earlier in 2011 which made it difficult to interpret exactly where things were.

The results today show that in the December quarter 2011 the economy is slowing and while Australia is still outperforming many advanced economies, our growth rate is insufficient to make any dent in the massive pool of underutilised labour.

The worrying sign is that private gross capital formation went backwards. It is clear that the so-called “trickle down” effect of the mining boom (strong volumes and terms of trade) is not occurring.

The data also shows that the Government contribution remains positive although all the expansion from the infrastructure investment has gone. I consider the government will not be able to achieve its desired budget surplus in the coming fiscal year because growth in tax revenue will be undermined by the sluggish growth.

The problem is that in trying to achieve this surplus the government will further undermine growth. Now is definitely not the time to be pursuing contractionary fiscal policy.

Tomorrow is the labour force data which is a more timely indicator of how the economy is travelling.

And on Friday, I might write about whether Keynes would support the fiscal austerity programs now in place in various nations. The conservatives are trying to play wedge-politics by claiming just that.

Personal note

I wasn’t going to write a blog today. Instead, I was going to have a holiday. But then the National Accounts came out which thwarted that plan.

But anyway, some lovely presents turned up this morning and my work colleagues arranged a nice lunch to follow. I also received a number of best wishes by E-mail, Skype and telephone from friends … and twitter.

It must be my birthday.

Thanks to all for being so kind and thoughtful.

That is enough for today!

While I support the tenets of MMT I think that the emphasis of most economists on growth per se is misplaced.Infinite growth is not possible in the finite system of planet Earth.What must and will happen is a stable no growth economic system.This does not mean a no progress,no change system.Progressive economists such as from the MMT discipline would do well to take heed.

As for the 2 speed economy has anybody stopped to think that the resources sector which is booming is sending most of its profits overseas due to foreign ownership.In other words we are digging up our mineral wealth at a furious pace to benefit,not Australians,but an international rentier class.Will our children or their children thank us for this? I think not.

And I am not taking into account the environmental damage caused by such abominations as coal and CSG mining. A sick govenment,a sick society, and a predominantly sick population doesn’t bode well for the future of Australia.

Roll on a global economic meltdown.It is our only hope.

Bill –

If the Aussie dollar’s rise were merely a result of better terms of trade than you’d have a point. But at the moment it’s largely driven by the carry trade, and that’s mainly a result of interest rates being higher here than in the rest of the world.

Stimulating the economy by cutting interest rates would help businesses not only by making investment cheaper, but also by reducing the value of the dollar, making businesses more competitive against their foreign rivals. It probably won’t cure Dutch Disease, but it will at least delay it.

So why do you persist in claiming that a fiscal stimulus would be a better solution?

Happy birthday. By the way today is my birthday also. That is no joke.

Hi Bill

Many Happy Returns to you, all the very Best Wishes

From

Lyn and all at TPS

Mine too (seasonally adjusted!). Happy Birthday Bill

Happy Birthday, Professor!

If MMT were to speak on birthdays, I suspect it would say that it’s not about how old you are, but rather about how young you act. Let your inner child out today, Bill. 🙂

“A rising terms of trade rise usually promotes exchange rate appreciation.” You then discuss the movement of the dollar vs some currencies and so on.

While it is true that the rising terms of trade and rising currency are positively correlated over the last couple of years I note that in the period from post dot com crash, say 2002 through to just prior to the GFC the terms of trade and currency were negatively correlated.

Happy Birthday Bill

Happy Birthday Professor !

Happy Birthday