It's Wednesday and I discuss a number of topics today. First, the 'million simulations' that…

US inflation expected to average 1.3827935 per cent for the next ten years

Yesterday (March 18, 2012), the Cleveland branch of the US Federal Reserve Bank released their latest estimates of US inflationary expectations. This data estimates what the “public currently expects the inflation rate to be” over various time horizons up to 30 years. The data shows that the US public “currently expects the inflation rate to be less than 2 percent on average over the next decade”. The ten-year expectation is in fact 1.38 per cent per annum. In the light of the massive expansion of the US Federal Reserve’s balance sheet and all the mainstream macroeconomic theory is predicting that such an expansion would be highly inflationary, how can the public expect inflation to be so low over the next decade? Answer: the mainstream macroeconomic theory is deeply flawed and should be disregarded. Modern Monetary Theory (MMT) correctly depicts the relationship between the monetary base and the broader measures of money and explains why movements in the former are no inflationary.

On October 22, 2011, the New York Times published an Op Ed by Harvard’s Greg Mankiw – Four Nations, Four Lessons – which purports to examine the historical experience of four nations – France, Greece, Japan and Zimbabwe – and why the US would not want to be like them.

I immediately thought – well unless the US is preparing to scrap up to 60 percent of its productive capacity and then push nominal aggregate demand growth harder we can ignore the Zimbabwe case study.

Hyperinflationists still wheel out the African nation as a case study but never display any understanding of what happened there and why it is rather unique and hardly a platform upon which to oppose fiscal or monetary expansion.

Please read my blog – Zimbabwe for hyperventilators 101 – for more discussion on this point.

The only thing the US can learn from France and Greece at the moment is why they should always hold on to their currency sovereignty. The current malaise in the EMU nations is purely a function of the fact that they use a foreign currency (Euro) and the central bank is not willing to act in the best interests of the citizens who form the monetary system.

So not too much to learn from there. The case studies are vacuous attempts to hit the usual mainstream runs (bond markets closing US down like they have Greece; downgrades from ratings agencies; workers refusing to work because tax rates are too high which will hit the US unless deficits are reined in).

But Greg Mankiw also adds weight to that now-failed Presidential challenger (Perry) arguments that “reckless money creation is … a concern” (citing Perry’s claim that “it would be ‘almost treasonous’ if Ben S. Bernanke, chairman of the Federal Reserve, were to print too much money before the election”.

Why even give this view oxygen?

In Mankiw’s textbook (I am quoting from the first edition of the Principles of Economics) we encounter a chapter on “Inflation: its causes and costs”.

There we are presented with the framework whereby the supply of money is invariant to its value (the latter which is inverse to the price level) because “the quantity of money supplied is fixed by the Fed”.

The demand for money is downward sloping with respect to the price level in his framework “because people want to hold a larger quantity of money when each dollar buys less”.

Mankiw then says:

Let’s now consider the effects of change in monetary policy. To do so, imagine that the economy is in equilibrium and then, suddenly, the Fed doubles the supply of money by printing some dollar bills and dropping them around the country from helicopters. (Or, less dramatically and more realistically, that the Fed could inject money into the economy by buying some government bonds from the public in open-market operations.) What happens after such a monetary injection?

Just in this paragraph alone there is an alarmist rhetoric introduced to students when it comes to considering government policy.

Why would we imagine that a central bank in an economy that is in equilibrium would double the money supply, even if it could?

When in history under stable conditions as a central bank acted in that way? The answer is never.

So after raising the “Weimar-style” bias in the students, we are then asked to consider a less dramatic and more realistic scenario of the type that applies in the real world. The analysis that follows claims that the money supply curve shifts outwards (that is, it increases).

The increasing money supply is leads to money demand rising and (emphasis in original):

… an increase in the money supply makes dollars more plentiful, the result is an increase in the price level makes each dollar less valuable. This explanation of how the price level is determined and why it might change over time is called the quantity theory of money.

If we accumulated all the inflation predictions in the last several years from the mainstream of my profession plus the fringe dwellers such as the Austrian school economists we would document a majority of the articles that had been written in the popular press on economic policy. Typically, somewhere in the article there will be a reference to the growing or mounting inflation risk.

Earlier this year I wrote a sequence of blogs – Bank of England money supply data paints a grim picture – Latest ECB data shows how bad things have become in Eurolandand Monetary movements in the US – and the deficit – which discussed the movements in broad money in the UK, the Eurozone and the US, respectively.

Mainstream macroeconomists think that the “money supply” is a child of the monetary base. Underpinning this notion is the concept of the money multiplier.

A central tenet of mainstream macroeconomics that follows from the concept of the money multiplier is that the central bank is to control the money supply.

I covered the base money-money supply relationship in these blogs among several – Money multiplier – missing feared dead and Money multiplier and other myths. You can consult those blogs for further information.

The claim that the central bank controls the money supply (broad money) is embedded in students’ minds from the first-year of undergraduate study in economics.

For example, in an earlier chapter of Greg Mankiw’s Principles of Economics (Chapter 27 First Edition) he says that the central bank has “two related jobs”. The first is to “regulate the banks and ensure the health of the financial system” and the second “and more important job”:

… is to control the quantity of money that is made available to the economy, called the money supply. Decisions by policymakers concerning the money supply constitute monetary policy (emphasis in original).

How does the mainstream economists claim the central bank accomplishes this task? Mankiw is representative of the plethora of textbooks that say that the:

Fed’s primary tool is open-market operations – the purchase and sale of U.S government bonds … If the FOMC decides to increase the money supply, the Fed creates dollars and uses them buy government bonds from the public in the nation’s bond markets. After the purchase, these dollars are in the hands of the public. Thus an open market purchase of bonds by the Fed increases the money supply. Conversely, if the FOMC decides to decrease the money supply, the Fed sells government bonds from its portfolio to the public in the nation’s bond markets. After the sale, the dollars it receives for the bonds are out of the hands of the public. Thus an open market sale of bonds by the Fed decreases the money supply.

This description of the way the central bank interacts with the banking system and the wider economy does not relate to the real world. The reality is that monetary policy is focused on determining the value of a short-term interest rate. Central banks cannot control the money supply. To some extent these ideas were a residual of the commodity money systems where the central bank could clearly control the stock of gold, for example. But in a credit money system, this ability to control the stock of “money” is undermined by the demand for credit.

MMT assumes that the central bank has very little capacity to control the monetary aggregates.

The theory of endogenous money is central to the horizontal analysis in MMT. When we talk about endogenous money we are referring to the outcomes that are arrived at after market participants respond to their own market prospects and central bank policy settings and make decisions about the liquid assets they will hold (deposits) and new liquid assets they will seek (loans).

For a discussion of the difference between vertical and horizontal transactions in a modern monetary economy please see Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 and Deficit spending 101 – Part 3.

The essential idea is that the “money supply” in an “entrepreneurial economy” is demand-determined – as the demand for credit expands so does the money supply.

As credit is repaid the money supply shrinks. These flows are going on all the time and the stock measure we choose to call the money supply, say M3 (Currency plus bank current deposits of the private non-bank sector plus all other bank deposits from the private non-bank sector) is just an arbitrary reflection of the credit circuit.

So the supply of money is determined endogenously by the level of GDP, which means it is a dynamic (rather than a static) concept. This means that the latest developments in M3 in the Eurozone are telling us something very clear about what is going on it that economy.

Central banks clearly do not determine the volume of deposits held each day. These arise from decisions by commercial banks to make loans. The central bank can determine the price of “money” by setting the interest rate on bank reserves.

Further expanding the monetary base (bank reserves) as we have argued in recent blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – does not lead to an expansion of credit.

So why do the mainstream place so much attention on broad measures of money such as M2 in the US?

The answer is that they believe that inflation is the result of the money supply growing too fast.

In 2006, Bernanke gave a speech (November 10, 2006) in Germany – Monetary Aggregates and Monetary Policy at the Federal Reserve: A Historical Perspective – where he discussed some of the evolution of monetary thinking among central bankers. At one point he posed the question:

Why have monetary aggregates not been more influential in U.S. monetary policymaking, despite the strong theoretical presumption that money growth should be linked to growth in nominal aggregates and to inflation? In practice, the difficulty has been that, in the United States, deregulation, financial innovation, and other factors have led to recurrent instability in the relationships between various monetary aggregates and other nominal variables.

There has been a long history of economists being “surprised” when their estimates of M1 or M2 don’t pan out in the real world. The development of broad monetary aggregates like M2 and beyond were an ad hoc response to repeated failures to accurately forecast the movements in M1.

But as Bernanke noted “over the years the stability of the economic relationships based on the M2 monetary aggregate has also come into question”.

The upshot is that these aggregates have very little relevance for policy making and only serve to excite Austrian-school devotees and remnant-Monetarists who don’t know any better.

The idea that the monetary base (the sum of bank reserves and currency) leads to a change in the money supply via some multiple is not a valid representation of the way the monetary system operates.

The US Federal Reserve defines M1 as currency, traveller’s cheques, demand deposits and other checkable deposits. M2 is M1 plus retail MMMFs, savings and small time deposits. MMMFs are money market mutual funds.

M2 is the US Federal Reserves broad monetary aggregate. You can get the data for Aggregate Reserves of Depository Institutions and the Monetary Base and Money Stock Measures from the excellent statistics made available by the US Federal Reserve.

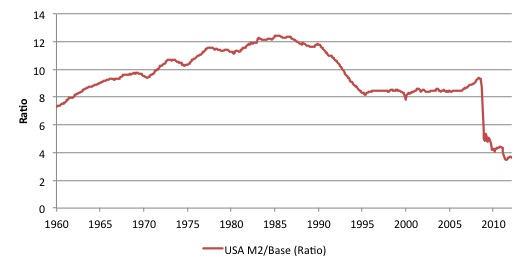

The following graph shows the evolution of the ratio of the US Federal Reserve’s M2 measure of broad money to the monetary base from 1960 and updated from earlier graphs I have presented to February 2012 (the latest data). As you can see it is all over the place and renders concepts like the “money multiplier” (which logically is this ratio) useless.

In the world we live in, bank loans create deposits and are made without reference to the reserve positions of the banks. The bank then ensures its reserve positions are legally compliant as a separate process knowing that it can always get the reserves from the central bank.

The central bank has to guarantee reserves to the commercial banks on demand in order to guarantee financial stability. The viability of the payments system is an essential aspect of the maintenance of financial stability.

So the monetary base (currency plus reserves) always adjusts to the broad monetary aggregate not the other way around. Further, the base can move independently of the broader aggregate depending on what the central bank is doing with its balance sheet.

In other words, the central bank can expand the base at the same time as the broad aggregate is falling. That is the situation that most of the world was in a few years ago as central banks engaged in various balance sheet operations such as quantitative easing and other strategies via their standing facilities.

While this was going on, demand for credit from the private sector has been drying up and so the growth in broad monetary aggregates have been in decline.

Banks are not institutions that wait for deposits so as to build up reserves which would then allow them to on-lend at a margin in order to profit.

The conceptualisation suggests that if it doesn’t have adequate reserves then it cannot lend. So the presupposition is that by adding to bank reserves, quantitative easing will help lending.

To repeat, bank lending is not “reserve constrained”. Banks lend to any credit worthy customer they can find and then worry about their reserve positions afterwards. If they are short of reserves (their reserve accounts have to be in positive balance each day and in some countries central banks require certain ratios to be maintained) then they borrow from each other in the interbank market or, ultimately, they will borrow from the central bank.

What about inflation expectations?

In 2007, the current Federal Reserve Chairman Ben Bernanke made the following remarks at a NBER Monetary Economics Workshop (Reference: Bernanke, B.S. (2007) ‘Inflation expectations and inflation forecasting’, Comments at the NBER Monetary Economics Workshop):

Undoubtedly, the state of inflation expectations greatly influences actual inflation and thus the central bank’s ability to achieve price stability. But what do we mean, precisely, by “the state of inflation expectations”? How should we measure inflation expectations, how should we use the information for forecasting and controlling inflation? I certainly do not have complete answers to those questions, but I believe that they are of practical importance … we must understand better the historical variation in inflation expectations, the effect of this variation on actual inflation and economic activity, and the relationship between policy actions and the formation of inflation expectations.

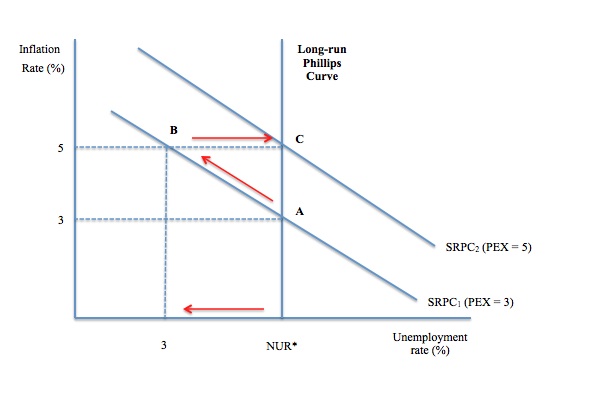

The original conception of the Phillips curve can be understood by the following diagram, which plots the inflation rate on the vertical axis and the unemployment rate on the horizontal axis. To those that understand the history of the Phillips curve you will note that this diagram reflects the work after Lipsey and others had converted the vertical axis from wage inflation to price inflation.

That nuance should not detain us here however.

Imagine, the economy is currently experiencing an inflation rate of 3 per cent with the unemployment rate is at the NUR* level.

The government currently might adopt the view that the unemployment rate is too high at NUR*. The original Phillips curve approach suggested that there was a trade-off between inflation and unemployment such that expansionary fiscal and/or monetary policy could drive the unemployment rate down to, say, 3 per cent which would push the inflation rate up to 5 per cent.

The inflation was considered to be the product of increasing wage demands as the labour market became tighter. There was considerable literature based upon the causes of inflation and its transmission mechanisms during this period of intellectual development.

In other words the economy, moves from Point A to Point B along what was considered to be a stable Phillips curve (SRPC1).

This was the dominant approach for many years leading up to the end of the 1960s. In the late 1960s, Milton Friedman and Edmund Phelps, in two separate articles, challenged this view of the Phillips curve.

They said that workers’ labour supply preferences would not be invariant to the inflation that was produced. They argued that the assumed stability of the Phillips curve relied on an assumption of “money illusion”, whereby workers were assumed to be better off if the money wages rose.

However, based upon the mainstream microeconomics, Friedman and Phelps argued that the only way the firms would employ more workers (implicit in the movement from Point A to Point B) would be if the real wage had fallen. In other words, the inflation rate must have been rising at a faster rate than the growth in money wages.

So the workers were tricked into supplying more labour by the fact that they misunderstood what happened to their real wages and had confused and money wage increase with a real wage increase of the same proportion.

They argued that workers really cared about real wages and once they discovered the truth they would withdraw their labour and adjust their expectations of inflation upwards to be consistent with the actual rate of inflation.

These labour market movements would continue until expected inflation was equal to actual inflation.

In terms of the diagram, the SRPC1 line is thus drawn for a given level of inflationary expectation, in this case equal to 3 per cent. Once workers adjust their expectations upwards to 5 per cent the economy shifts from Point B to Point C. In other words, the Phillips curve shifts upwards to SRPC2.

According to this theory, NUR* is the natural rate of unemployment and there is no “trade-off” between inflation and unemployment once expectations have adjusted. So the Phillips curve in their model was really a vertical line in the long-run.

The short run Phillips curve was considered to be unstable once inflationary expectations were introduced into the model. The literature then evolved into a series of theoretical approaches to model inflationary expectations and empirical attempts to estimate them. Critically, the speed of adjustment in expectations to current inflation, was considered to depend on how the workers formed their expectations. The modern variant – Rational Expectations – assumed instantaneous adjustment.

Please read my blog – The myth of rational expectations – for more discussion on this point.

By the late 1970s and early 1980s, this effort was into full swing and it was around that time (early 1980s) that I began my PhD studies specialising in the Phillips curve.

I won’t discuss that research here (space). My early work was based on developing alternative models to the natural rate approach. Here are some earlier blogs – Redefining full employment … again! and OECD – GIGO Part 2 and NAIRU mantra prevents good macroeconomic policy – provide some more discussion on the Phillips curve.

My 2008 book with Joan Muysken – Full Employment abandoned – is a definitive reference to my work on this topic.

You should also appreciate that my work on employment buffer stocks fits into this literature and is an integral part of the development of Modern Monetary Theory (MMT).

The other implication of the so-called “Expectations-augmented Phillips curve” was that inflation could be driven by excess demand for labour (that is, departures in the unemployment rate from its “natural rate”) and shifts in inflationary expectations.

So inflationary expectations became a separate driving force in the inflationary process according to this theory. Central banks started to become obsessed with the management of inflationary expectations as a key vehicle to achieving their inflation targeting goals.

The role of inflationary expectations also explained why the Monetarists advocated harsh monetary contraction during times of high inflation. They reasoned that this would drive the economy into high unemployment (that is, above the natural rate) and overtime workers would reduce their expectations of inflation and the economy would move through a sequence of Phillips curves towards a lower rate of inflation.

This process of central bank-induced disinflation would stop when the economy reached the natural rate of unemployment and inflationary expectations stabilised around the new lower inflation rate.

I have noted the following point previously. It was in this context, Chicago monetarist Milton Friedman was asked during the high unemployment in the 1970s how long it would take for unemployment to fall back to its so-called (mythical) natural rate if central banks embraced his dis-inflation recommendations. He said about 15 years. So 10 or more percent unemployment was expected for 15 years … as the way in which the mainstream models of self-correction work.

Central banks have been very interested in measuring inflation expectations since this literature evolved.

In the US, the Federal Reserve Bank of Cleveland provides the most current series on inflationary expectations.

Yesterday (March 16, 2012), the Cleveland Federal Reserve Bank issued their updated – Cleveland Fed Estimates of Inflation Expectations – which tell an interesting story.

In October 2009, the Bank released a discussion paper outlining – A New Approach to Gauging Inflation Expectations. It is a non-technical version of this 2007 paper – Inflation Expectations, Real Rates, and Risk Premia: Evidence from Inflation Swaps – which I suspect many of my readers would struggle with.

You can get the latest data HERE.

The data spans the period from January 1, 1982 to March 1, 2012. The following graph shows the evolution of inflationary expectations over this period for the 10-year ahead horizon (blue line) and the 20-year ahead forecasts (red line).

The Cleveland Federal Reserve say that its:

… latest estimate of 10-year expected inflation is 1.38 percent. In other words, the public currently expects the inflation rate to be less than 2 percent on average over the next decade.

So the data is not suggesting that the the US inflation rate is about to explode over the next decade despite the massive increase in the Federal Reserve’s Balance Sheet as a result of its mis-guided attempts to revitalise the US economy via quantitative easing.

The point is that if we polled students in undergraduate macroeconomics classes who had been studying monetary theory they would be unable to explain this data.

The firm prediction from mainstream models is that inflationary expectations should be moving up and that expected inflation over the next decade should be rising.

Inflation remains firmly anchored at low levels (and is expected to remain that way for the next 10 to 20 years at least.

Conclusion

As this crisis unfolds and time passes, we are getting excellent data which can inform our views about the validity of different competing macroeconomic approaches.

Today’s blog provides a snippet of information (contextualised by a theoretical discussion) that is inconsistent with the mainstream approach to monetary economics.

It makes a mockery of the Austrian school and the more mainstream macro economists who three years ago were urging us to be fearful of what they considered to be the massive inflationary (if not hyperinflationary) consequences of the expansion of central bank balance sheets in response to the crisis.

So far the substantive predictions by the mainstream macroeconomists, across the range of macroeconomic aggregates, have failed to materialise.

The inflationary expectations series provided by the Cleveland Federal Reserve Bank is just another piece of data that brings the mainstream approach unstuck.

That is enough for today!

Dear Bill

I think that asset inflation is as much inflation as inflation in consumer prices. The asset inflations in the real estate sector in Ireland and the US before 2008 seem to have been caused by excessive credit. If banks aren’t reserve-constrained, what is to stop them from providing excessive credit and thereby cause inflation?

One part of the world where inflation has been quite frequent is Latin America. Yet Latin America is not a region noted for full employment of resources. What is the explanation for these frequent inflations in LA within MMT?

Regards. James

“what is to stop them from providing excessive credit and thereby cause inflation?”

Maybe the fact that unemployment is high and most people have either have seen their incomes drop, are in a savings mode, or trying to pay down debt. All adding up to not wanting anymore credit.

So the money supply is determined by the interest rate, and the interest rate by the amount of bank reserves (rather, by the percentage change of those reserves), and the bank reserves are controlled by central bank … so how is that not the central bank determining the money supply? Yeah it doesn’t actually go, we need $5T this year, we’d better print it up, but it has every intention of changing the money supply when it changes interest rates, because it’s targeting inflation, so why not call a spade a spade?

Also to say that US inflation is 1.38% is absurd. Quite apart from the fact that the CPI aggregate is a joke, the metrics that used to be used put US inflation at something like 11% and even that hasn’t worried the persistently high unemployment level. So here is an economic home truth: printing reserves does not reboot the economy. Fed interference in the interest rate is what caused the problem so how is more Fed interference going to fix it?

You mention the quantity theory of money indirectly, and since you make no attempt to rebut it I assume you think it is correct. How then do you reconcile the view that the money supply must grow if there is demand for credit? On the one hand, the real quantity of money is irrelevant, and on the other it is not? My view is that the real size of the money supply has no effect on the economy as long as it can be divided into sufficiently small units. What matters more than the size per se is the manner in which the real size changes. If the money supply grows because the unit’s real cost of production has fallen slightly below the market rate for such a unit, all is well; but if the supply can be modified at will because the units have little or no real cost of production then whoever is the first spender or lender enjoys the benefits of free money, and that is immoral.

@James – Banks are not reserve constrained but they are capital constrined. Regulations regarding how much and of what quality was reduced during the credit expansion period (pre 2007), we are now facing increasing regulations (Basel III and country specific) requiring strong(er) capital constraints. These have the effect of being pro-cyclical, just at the time when we would want banks to extend credit not only are they reluctant (uncertainty) but the capital restraints (Price & quality) deter them even further.

Reinhard: If the Fed lowers interest rates it is trying to increase economic activity, and that would probably increase the money supply, but they aren’t targeting the money supply directly.

1.38% are inflation expectations. Do you live in the US? If so, I don’t know how you reach the conclusion that inflation is 11%. Consumer items are VERY cheap in the US and seem to be getting cheaper most of the time. Oil (gas) prices is about the only area that has seen any recent increases.

I think Bill’s whole article is meant to rebut the quantity theory of money.

@James – Regarding “quite frequent” bouts of inflation in Latin America, the cause is generally large borrowing in foreign currencies. When there is then a large outflow of “hot” money, the value of the local currency plunges, and the foreign debt becomes unserviceable. For a while, the local government devalues its currency in an effort to continue servicing this debt, but this usually ends in that currency hyperinflating itself out of existence.

@Reinhard – The Quantity Theory does not take into account changes in the rate of saving, increases in productivity, and claims that unemployment doesn’t exist. The first two make the Quantity Theory wrong; the final one makes it absurd. I have no doubt that Bill is aware of these “flaws”.

Great post Bill. While the Austrians provide the best explanation for what caused the Great Depression and how governments have a tendency to bugger things up, there is ample to evidence they are wrong about hyperinflation and the money multiplier. Monetarism was a disaster.

Reinhard, further exploration of the literature, Bill’s in particular, will lead you to rebuttals of the QTM from first principles. In fact, the blogs Bill links to above deal completely with this as well as the so-called “multiplier”. Have a look. You will get more than you asked for there.

Broad money aggregates will indeed grow with demand for credit. This makes perfect sense. Bank reserves don’t lead the broad aggregates because they are base money that is not lent except in the Fed Funds or short term government securitities markets. They are bank transactional and payments-related reserves. They don’t correlate at all with broad money, which grows as demand for credit rises, which occurs as banks are more inclined to take credit risk which, in turn is a result of firms and banks identifying profitable business opportunities. That doesn’t happen in a moribund economy with few prospects (ask much of the EZ). So when you more reserves don’t reboot the economy, you’re actually right!

Finally, the 1.38pc is the “market-based”expectation of the inflation rate for the next 10yrs. Pretty low in anyone’s language, and awfully inconvenient to those predisposed the the QTM and classical-type economic theory.

It puzzles me how people remember garbage such as the money multiplier from their 1st year of study until the day they die.

And yet forget that spending = income pretty, much the instant their final 1st year macro exam is over.

Thanks all for your responses. I’ll be reading some more stuff more carefully. I study the Austrian and MMT viewpoints since I find them both valuable for understanding – Austrians are horrified by credit money so they don’t know it in the fine detail. For those interested the 11% inflation figure comes from http://www.shadowstats.com/alternate_data/inflation-charts

Ulrich Bindseil, former head of the ECB liquidity management, has published interesting working paper debunking what he calls “reserve positions doctrine” i.e. money multiplier model. There is some ponderings about history of this doctrine and theory/practise differentials.

http://www.ecb.int/pub/pdf/scpwps/ecbwp372.pdf

Reinhard, the one thing I really like like about “Austrians” (bloodlines notwithstanding) is that they have a keen sense for unsustainable credit booms. However, I’m not sure this is particularly Austrian, and there is considerable difference in what Austrians regard as the “money supply”. There still seems to be monumental confusion between base money and broad money supply aggregates. If the government could control the money supply to achieve economic objectives, then they would. Under interest rate targeting, they can’t. Base money is endogenous – it will swing to meet the central bank’s target base rate. And the extension from base money to broad aggregates is not feature of the current monetary system. The BIS, the Fed, and even the ECB agree on this.

PZ

Thanks for the reference 🙂

A major problem with at least some views of the Austrian theory of credit and the business cycle is they think that low interest leads to malinvestment, which requires purging through liquidation. Any attempt to avoid the pain will simply result in complications instead of cure. They presume that markets are self-correcting and that after being purged of malinvestment will spontaneously bounce back stronger for the “cure. They have no debt-deflation theory of depression and their theory does not acknowledge the financial cycle as Minsky described it. It’s a recipe for ruin through a deflationary spiral.

“In the light of the massive expansion of the US Federal Reserve’s balance sheet and all the mainstream macroeconomic theory is predicting that such an expansion would be highly inflationary …”

I’d call neo-Keynesians such as Mankiw (Bush 2’s CEA, FFS!), Krugman, Blanchflower, Bernanke himself, etc pretty mainstream, and they all firmly assert that in a liquidity trap this is just not so, and that the US has been in a liquidity trap (Europe … that’s more complicated and opinions differ).

You are being unfair to the mainstream – its only RBC turkeys like Cochrane and Fama who have dogmatically insisted that, as all markets clear instantaneously due to perfect rational expectations, more money always and everywhere means instant inflation rather than more growth. And they are definitely a minority.

Dear Derrida Derider (at 2012/03/26 at 21:40)

You wrote:

I specifically used the phrase “mainstream macroeconomic theory is predicting that such an expansion would be highly inflationary”. I was referring to the body of theory that is taught to students all around the world. The textbooks that constitute the bulk of a typical student’s “education” in macroeconomics certainly predicts inflation and all the rest of the things that haven’t happened.

Specific economists like the US Federal Reserve chairman have nuanced views of what is happening but every day their academic colleagues are teaching this stuff.

best wishes

bill

SteveK9 says “Consumer items are VERY cheap in the US and seem to be getting cheaper most of the time.”

Steve, tell me what state you’re in and I’ll move there. Meanwhile, here in PA, prices are continually rising for everything I need to survive, from food to electricity.

Starting with the financial collapse, I saw cat food double and dog food go up 50%. Sugar is up about 35%. Tuna, toilet paper, cereal, candy–they shrunk the packaging from 30-50% but the price stayed the same. Last week, half and half jumped from $1.68 to $1.98. Processed food is full of GMOs and non-nutrients, meat and chicken are full of antibiotics, and I no longer eat any sea food because of pollution and farm-raised bacteria. If something is really edible, I probably can’t afford it.

If you’re talking electronics, appliances, and low-end clothing, a cheap can opener made in China that only lasts three months is worthless. In fact, most of the stuff made in China has high odds that it won’t work or that the buttons will fall off at the first wearing. I now buy everything second hand and I joined a local organic farm co-op.