It's Wednesday, and as usual I scout around various issues that I have been thinking…

Cancer is bad but budget deficits are generally good

The US Bureau of Economic Analysis released the first-quarter 2012 National Accounts data for the US last week (April 27, 2012) – see the News Release which showed that the US economy has slowed in the last three months, largely due to a decline in the government contribution. Annualised Real GDP growth was 2.2 per cent down from 3 per cent in the December 2011 quarter. The economy is now growing under trend and the signs are not good. If the politicians actually get around to imposing austerity then the US economy will join the UK in its race to the bottom with the other competitor being the Eurozone. The latest news from the Eurozone is that Spain will become the epicentre of the crisis in the coming weeks/months. Greece is yesterday’s news and the continuing deterioration of the Spanish economy – one considerably larger in importance than Greece – is focusing minds. The problem is that the reaction of the Euro elites is to inflict more austerity onto Spain which will – as night follows day – cause the situation to worsen. But still we read from leading US government officials that budget deficits are like cancer and will destroy countries “from within”. The only thing I can say about that astounding demonstration of ignorance is that I cannot think of a situation where cancer is good. But generally, budget deficits generate benefits to the nation that is enjoying them.

The BEA say that:

The increase in real GDP in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, private inventory investment, and residential fixed investment that were partly offset by negative contributions from federal government spending, nonresidential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased …

Real federal government consumption expenditures and gross investment decreased 5.6 percent in the first quarter, compared with a decrease of 6.9 percent in the fourth. National defense decreased 8.1 percent, compared with a decrease of 12.1 percent. Nondefense decreased 0.6 percent, in contrast to an increase of 4.5 percent. Real state and local government consumption expenditures and gross investment decreased 1.2 percent, compared with a decrease of 2.2 percent.

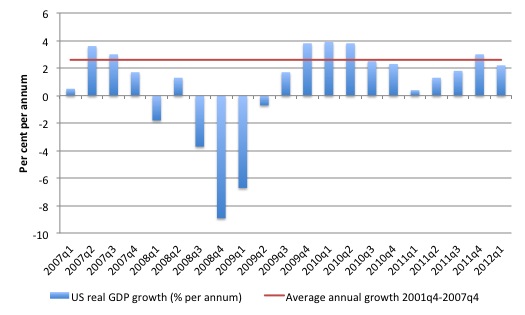

The following graph is taken from the BEA data and shows the annual real GDP growth per quarter from the first quarter 2007 to the March 2012 quarter (blue bars). The red line is the average real GDP growth rate (2.6 per cent) from 2001Q4 to 2007Q4 (roughly the period of expansion between the 2001 and 2008 recessions.

The fact is that American household consumption underpinned almost all the growth in real GDP which is both a sign of improving confidence but also a worry because the saving ratio is declining again.

The personal saving as a percentage of disposable personal income has been steadily falling since the third quarter 2010 (when it was 5. 6 per cent) and is now at 3.9 per cent. Real per capita disposable income also fell in the March 2012 quarter and if this continues over the course of the year, then consumer confidence will decline and the US economy will contract sharply.

With American households still heavily in debt and the housing market not showing any great signs of improving, the imperative for households to deleverage remains but the direction of policy is to undermine that imperative.

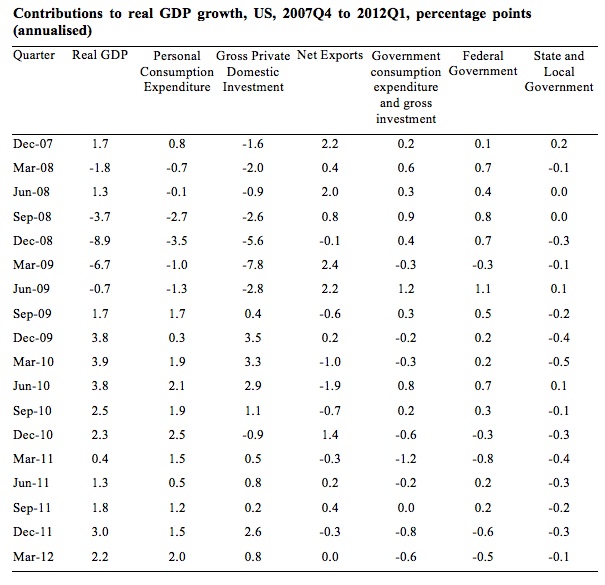

The following table shows the contributions (in percentage points) to real GDP growth from the various expenditure components from the peak of the last cycle (December quarter 2007) to the current quarter – March 2012. The data is available from Table 1.1.2 Contributions to Percent Change in Real Gross Domestic Product.

You can see that during the period of private contraction, the government contribution was almost always positive (there was one quarter, March 2009, when the government sector contributed to the negative GDP result).

The important observation is that the government sector mostly contributed to overall growth even after private spending growth was also making a positive contribution.

The overall contribution from government turned negative in the December 2009 and March 2010 quarters as a result of the austerity being imposed at the state and local government level. The Federal contribution remained firmly positive and allowed the US economy to move on even though private consumption growth was still weak.

The overall fiscal contraction (federal and state/local) is now clearly impacting negatively on real GDP growth since the December 2011 quarter and with private domestic investment also showing volatility any further austerity will damage growth significantly in the coming quarters.

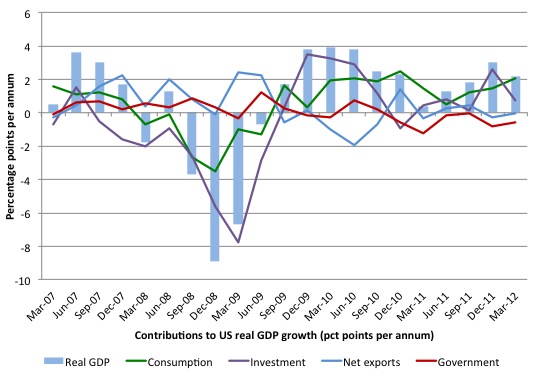

For those that prefer graphical depictions, the following shows the contributions to real GDP growth in the US from the March quarter 2007 to the March 2012 quarter.

It is interesting to note that once the contribution of the government sector started tapering and then went into negative territory the overall real GDP growth right in the US began to fall.

The US situation is clearly complicated by the fact that the state governments were contracting while the federal government was trying to stimulate the economy. It was only the strength of the federal stimulus that ensured that the overall contribution of government to real GDP growth was mostly positive at the crucial time when private sector spending was contracting.

But now fiscal austerity at the federal and state/local levels runs the risk of undermining the nascent recovery that has clearly been underway (in sharp contradistinction to what is going on on the other side of the Atlantic).

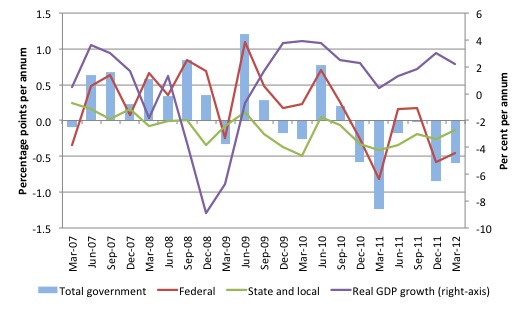

The following graph shows the contributions to real GDP growth in the US from the March quarter 2007 to the March 2012 quarter for the government sector and its components – federal and state and local.

While the signals for continued growth in real GDP are mixed at the moment in the US, the one striking feature is that they are standing in stark contradistinction to the Eurozone.

It is clear that the fiscal stimulus (trillions of USD) supported the confidence of the private sector. While I am not a supporter of the way the Obama Administration chose to spend the stimulus funds (excessively supporting the financial sector) the fact remained that they attempted to (and succeeded) in limiting the damage of the collapse in private spending.

It is only political ineptitude at present that is saving the US economy because if the Republicans could have their way, the austerity programs would be accelerating more than is obvious from the recent GDP data release.

Not so in Europe.

The latest news from Spain is that Greece is “so yesterday” and bailout talks will start focusing on the Spanish situation.

The National Institute of Statistics (Intituto Nacional de Estadistica) published the latest – Economically Active Population Survey – (EAPS) data on April 27,. 2012 and unsurprisingly, unemployment continues to rise and employment falls.

The data shows the following:

1. Employment fell by 2.1 per cent (374.3 thousand) in the first quarter of 2012.

2. Unemployment rose by 365.9 thousand or 6.94 per cent.

3. Over the last 12 months, the Spanish labour market has shed 718.5 thousand jobs (4 per cent decline) and 729.4 thousand additional workers have become unemployed (a rise of 14.8 per cent).

4. The participation rate is down to 59.5 per cent which is very low by advanced nation standards.

5. The unemployment rate for the working age population (16 to 64 years) is 24.59 (up by 1.59 percentage points on the quarter and 3.17 percentage points on the year to March 2012.

6. For 16 to 19 year olds, there has been a 25. 6 per cent decline in their employment over the last year.

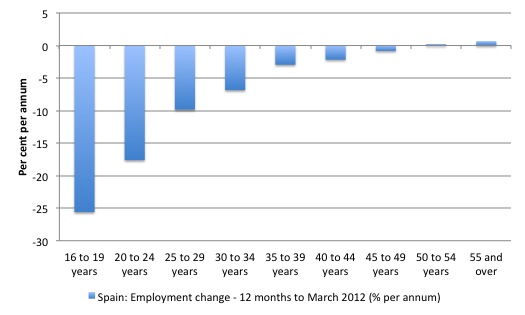

The following graph is taken from the official EAPS data and shows the employment growth by broad age group in the 12 months to March 2012 (percentage). While the overall impact is a disaster, the concentration towards the younger end of the age spectrum is very disturbing.

The future of Spain is being undermined systematically by its political leadership under coercion from the EU elites.

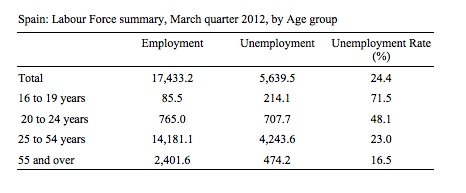

The following Table summarises the main labour force aggregates – Employment and Unemployment (both in thousands), and the Unemployment rate (%) – for the March quarter 2012 by age category.

While the weighted-average youth unemployment rate (16-24 year olds) is around 52 per cent (and stable in the current quarter), the data shows that the teenage unemployment rate is a staggering 71.5 per cent in the March quarter 2012. That is a recipe for long-term disaster in Spain.

The Eurozone crisis will intensify in the coming weeks and focus squarely on Spain – one of the larger economies in the EMU. The relative speed at which the Spanish economy is deteriorating and its size (relative to the zone as a whole) will cause much larger problems for the EU leadership than the relatively small Greece.

Stay tuned for that.

The gap between reality and the political narrative could not be wider than demonstrated in a Bloomberg Op Ed (April 30, 2012) – U.S. Perfecting Formula for Budget Failure, Says Bowles.

Apparently, Erskine Bowles is “a true Southern gentleman and co-chairman of President Barack Obama’s erstwhile budget-deficit commission” who went to “New York City from his home in North Carolina the other night to talk sense about the nation’s perilous fiscal condition”.

He is also a former a President of the University of North Carolina.

Mr Bowles was in New York as part of the – HBO History Makers Series – organised by the Council on Foreign Relations.

The CFR claims to be “an independent, nonpartisan membership organization, think tank, and publisher” (Source) but its membership is laden with business leaders and high-ranking government officials and it has supported highly contentious foreign policy decisions (for example America’s corrupt involvement in the Vietnam War). The CFR has been involved (directly or indirectly in other scandals).

I also have to say that I was disappointed the HBO would cover this sort of nonsense. They produce first-rate television series (The Wire, Treme etc) yet also it seems get sucked into producing trash.

The transcript is long and I haven’t time today to go through it line by line with you – but the repeating message is clear – the US is going to go broke and:

Deficits are truly like a cancer … and over time they are going to destroy our country from within.

He was of-course referring to public deficits. Remember that a government deficit equals ($-for-$) a non-government surplus and vice-versa.

I guess that means that the US has been suffering from cancer for 84 years out of the total since 1930 – because they typically have run continuous budget deficits. The lack of historical knowledge that refuts the claims made by the deficit terrorists is stunning really.

Mr Bowles was asked in relation to the current budget situation in the US – “why is it that the problem is so urgent and a solution so elusive?”. Note the bias in the question. He might have been asked to discuss the current budget situation in relation to the broader real economy etc – but, instead, from the outset, he was asked to explain the “problem”.

The budget deficit in the US is only a problem because it is too small as evidenced by the persistently high unemployment rate.

Anyway, after claiming “Pete Peterson” could give a better answer to the question (which points you in the direction of his bias), Mr Bowles claimed that:

I think today we face the most predictable economic crisis in history. Fortunately, I think it’s also the most avoidable.

I think it’s clear, if you do simple arithmetic, that the fiscal path that the nation is on is simply not sustainable. And if I had to give you an analogy … I would say that the deficits are truly like a cancer, and over time they are going to destroy our country from within.

So his view is clear enough.

Simple arithmetic in relation to budget accounting is always fraught because it proceeds as if there is inherent meaning in the numbers themselves. The reality is that the budget outcome gives us some information about the health of the economy but only if we are very careful in separating the discretionary component (the policy parameters chosen by government for tax rates and spending) from the cyclical component (the impact on the budget outcome of the state of the business cycle (in particular, the variations in tax revenue as the economy ebbs and flows).

Mr Bowles’ simple arithmetic turns out to be that “total revenue that came into the country last year” was totally “consumed by our mandatory spending and interest on the debt”.

To which we yawn and say so what?

For those not familiar with US terminology – mandatory spending “is principally for the entitlements — Medicare, Medicaid and Social Security”.

Given that, Mr Bowles then thinks it is shocking that:

… every single dollar we spent last year on these two wars, on national defense, on homeland security, on education, infrastructure, high-value-added research … was borrowed. And last year, half of it was borrowed from foreign countries.

First, it is shocking that the US is such a martial nation. It has caused incredible damage around the world in pursuit of its own warped notion of freedom and democracy. I would withdraw US troops from all foreign conflicts and downsize the military significantly. But that doesn’t mean I would not spend the military budget. I would just change the heading to Education, Research and the Environment and ensure all three portfolios were pursuing best practice.

Second, the simple solution to his “debt” paranoia would be for the US government to change its legislation/regulation environment and cease issuing any public debt. The US Federal Reserve could credit any bank account and clear any cheque that the US Treasury desired/issued and government spending would proceed as usual.

The US government issues its own currency and, in intrinsic terms, never needs to fund its own spending in US dollars. The issuing of public debt is an entirely voluntary act by the US government and provides the bond markets with “corporate welfare”. Just imagine what the uproar would be from the bond markets and investment banks if the US government announced it was cutting off this source of corporate welfare.

It happened in 2001 in Australia when the Australian government had virtually caused the official bond markets to dry up when it used the surpluses it was running to run down outstanding debt. The Sydney Futures Exchange led the charge and demanded that the Government continue issuing debt, which gave the game way – if debt-issuance was to fund net government spending (deficits) then why would they be issuing debt when they were running surpluses?

Answer: it was patently obvious that the outstanding debt was private wealth and its risk-free nature allowed the private investment institutions to price other risky assets and maintain a safe haven when uncertainty rose (by holding bonds).

Third, all these things apart, there is nothing sacrosanct about any sized budget deficit. The balance has to be judged in relation to the spending propensity of the non-government sector (external sector and the private domestic sector) in relation to the overall aggregate demand required to generate output necessary to fully employment productive capacity including labour.

The evidence is compelling – the US budget deficit is too small by some percent of current GDP (probably 3 or 4 percent).

Further, if the real GDP growth rate was sustained at a higher rate, which would allow the economy to reduce the pool of unemployed, then the balance between tax revenue and “mandatory spending” would change dramatically (as tax revenue rose with activity).

The fixation on these numbers is “a formula for failure in anybody’s book” (Bowles words – meaning inverted).

He then demonstrated a total ignorance of economics when he said:

And if you just kind of think about the opportunity costs of just the interest on the debt today, and even at these current low rates, we’re spending more on interest alone — and we spend about $250 billion a year now, just to put it in perspective — than we spend at the Departments of Commerce, Education, Energy, Homeland Security, Interior, Justice and State, combined.

Opportunity costs relate to real resources not numbers in government accounts. The credits that go into private bank accounts under the memorandum entry “interest servicing” are not opportunity costs. They are numbers.

The opportunity costs arise if the recipients of the private income spend the receipts on real goods and services presumably via voluntary exchanges between consenting parties. By which you presume that the resources taken from one use to service another are being allocated to a higher use value – which is certainly what a proponent of market exchanges has to assume.

Further, when there is so much excess capacity available in the US at present it is likely that opportunity costs are low. Anything that brings a underutilized resource back into production is increasing efficiency at very low opportunity costs.

Mr Bowles then lamented that the fiscal austerity demands that the “deficit commission” took to the President was not embraced immediately. My view is that if the President had embraced their “consolidation” plan the US economy would be heading in the direction of Europe much more quickly than it already is.

The conversation then turned to projections of when the US government is going to having to face up to the fact that: The interviewer: “So when is that going to happen?” Mr Bowles:

Well, somebody asked me the other day, you know, how could interest rates be so low now if I was so concerned about this future problem with these economic events, and I said it’s because we’re the best-looking horse in the glue factory. (Laughter.) And I think today the world is focused on Europe, and probably rightly so. And I think we’re being given a pass today because people don’t believe that we’re going to let these events transpire without doing something significant about them. And I think if we don’t deal with them at the end of the year or don’t set up a process to get them done in 2013, that people believe, then I think we’ll rue the day.

We will revisit this projection – hazy as it is – at the end of this year and again next year. My prediction – the bond markets will not impose anything “severe” on the US government. Bond yields might rise if the private sector becomes more confident and diversifies its portfolio into more risky assets (thus reducing demand for government paper). But then the central bank could stop that happening any time it chooses by creating infinite demand in specific maturity segments at a given yield. If no private bond investor wanted to buy US government debt would the world collapse? It wouldn’t miss a beat. The government would be forced to alter some of the institutional machinery that currently requires it to match its deficit spending with bond issuance. Apart from that – the private sector would have less income than before and the deficit might have to rise to cover the decline in private spending. But we will hold Mr Bowles, the alleged expert on these matters to his prediction. When the time comes and his predictions fail then he will come up with some ad hoc reason – this didn’t happen, or they did this, or some such. This is what happens year-in-year-out when previous predictions from the deficit terrorists fall foul of the data. I have long time-series of such predictions by various “leading” economists going back 30 years (and also some from the Great Depression). They are always wrong and there is always an ad hoc response to the empirical anomaly. They are never wrong – its just ….! Mr Bowles claimed that the US government has been making:

… promises that we can’t keep. You know, if you think about the needs this country has and, you know, our ability to deal with them with our current state of finance, you know, we have an infrastructure that’s, you know, crumbling in many places, it’s badly in need of repair. We have a health care system that’s absolutely crazy.

The only promises that matter are those relating to real resource availability into the future. A promise of a certain amount of nominal pension support, for example, carries with it an implicit notion of a real standard of living. The US government can always honour the nominal promise (that is, pay the cheque) but it may not be able to honour the implied real promise. In that context, it should do everything it can to enhance future productivity and ensure that all Americans are well educated and have employment opportunities. It is in this context, that the US government is failing – and that is mostly because it listens to characters like Mr Bowles who are always pressuring it to cut back on public provision. I agree that the US health system is crazy and doesn’t work – it does “spend twice as much as any other developed country in the world on health care” (in percent of GDP and per capita terms) and still Americans are fat and unhealthy but the problem is not that the US government cannot pay the cheques or will be unable to in the future. The problem is the entrenched power of the private health insurance companies and the lack of a viable public health system. Major reform is needed but not along the lines that Mr Bowles would advocate. Mr Bowles then claimed that the US “education system” was “is in no way globally competitive” and compared it to China and Singapore where the children were much more advanced in algebra and English. His concern is real but cutting budgets won’t fix that. China and Singapore have very strong public education systems unlike the US. More public spending on education is needed in the US. He was then asked to focus on bond market. He was asked whether the greatest danger facing the US was “a sudden change in the bond market sentiment … as investors become worried about the country’s ability to repay its debts” or “the continuing absence of the market reaction” – which I thought was a strange question. Mr Bowles responded that the “market are definitely giving us a pass today” but that: Apparently, interest rates will “begin to climb” and “then I think you’ll see the availability of credit” will dry up. The US Federal Reserve will not increase interest rates significantly over the next two years and the availability of credit will be whatever is demanded. The lack of growth in the credit aggregate is being driven by a cautiousness in the private sector as a result of the private debt overhang (courtesy of the credit binge and the collapse of the housing market). The interview turned to Europe (as one suspected it would). The exchange went like this:

Interviewer: And speaking of Europe, the U.K. has aggressively targeted deficit reduction, you know, and its economy is now contracting and it’s under-performing its record from the Great Depression. What do you see as the lesson from the U.K.’s experience with these austerity policies? BOWLES: Well, it’s kind of interesting. You know, in the U.K., they adopted a program that was similar to some of the things that we recommended on our commission, but had at least one big difference.

After documenting the close similarity in the two austerity plans he claimed that the big difference was the UK wanted to do generate “balance within five years” but that the deficit commission wanted a longer consolidation. He agreed that the UK had undermined the prosperity of the economy. But the interesting thing about the UK is that the really harsh austerity has yet to occur. The collapse of aggregate demand and the double-dip recession is largely being driven by a loss of private sector confidence which is sourced in the “anticipation” of what will happen when the government really starts to cut. So it is the announcement of the austerity process that has initially undermined real GDP growth in the UK. A similar impact would occur in the US if the deficit commission’s recommendations were adopted within the next months – the fragile private spending would also start to decline. It got worse after that. He continued to reiterate that the US could not “afford” its health system but failed to make any reference to real resources, the same with education and the rest of the spending portfolios. One statement refutes all his claims: the US government can afford to purchase anything that is available for sale in US dollars any time it chooses. The problem is that there might not be enough real resources (goods and services) available to satisfy the aspirations of the citizens. That is, the problem is real not financial. The corollary of the problem is that by constructing it, falsely, as a financial problem and then insisting that the government reduce its support for growth, the US government runs the danger of undermining the potential of the US economy to grow the real supply of goods and services into the future. The policy debate should be centred on first-class education and equity in educational participation, full employment and high productivity growth. The deficit terrorists rarely focus on these issues but get lost in financial matters that are largely irrelevant. Mr Bowles was then invited to answer questions from the floor. In response to one question about quantitative easing, he claimed that the US was heading towards “the Weimar Republic” outcomes because the government:

… we’ve got trillion-dollar deficits as far as the eye can see. They manufactured money to bring down unemployment. That’s what I think the QE programs are. And they de-valued their currency. We’ve done that.

Inflation is falling in the US. QE programs did not “manufacture money to bring down unemployment”. They were largely designed to reduce long-term interest rates (which they did) in the hope that private investors would increase borrowing and create new productive capacity – as a spur to growth. They didn’t work because they wrongly assumed the private sector was not borrowing because there was a lack of credit available. Exactly the opposite has been the case. The banks are not lending because people do not want to borrow. They don’t want to borrow because they can service existing demand with existing capacity. Households have been reluctant to spend because they fear unemployment and have excessive debts. And for those who do not know – Mr Bowles is a Democrat! Conclusion Cancer is a serious problem and becoming more so as people live longer. The cause in many cases is unknown and the treatment remains somewhat speculative. Once revealed it is also largely, but not completely, beyond the control of the person afflicted. Government budgets are also largely beyond the control of the government because non-government sector spending and saving decisions drive the cyclical component. The discretionary component is completely within the control of the government but then political considerations may compromise the government’s capacity to make adjustments. But these considerations are not financial. The cancer analogy fails because budget deficits only become a problem is they accelerate the growth of nominal aggregate demand beyond the capacity of the productive sector to absorb it by way of real responses – that is, producing new goods and services. After that point, budget deficits run the risk of generating inflation and become problematic. Once that becomes the situation, the government has to act to reduce net government spending and/or reduce non-government spending. A variety of tax increases and/or spending cuts (targetted in various ways) will be required. Public Event – Can the Eurozone survive its Crisis? If you are in Melbourne tomorrow evening I am speaking at an event – Can the Eurozone survive its Crisis? – which is hosted by the Monash University European Union Centre. The event will be held at the Monash Conference Centre, Level 7, 30 Collins Street, Melbourne (that is, in the CBD) from 18:00 to 19:30. I will giving a 40 minute presentation outlining why the Eurozone is doomed. A discussant will speak for 10 minutes and then it will be Q&A from the floor. As an interesting aside, the Ambassador and Head of Delegation of the European Union to Australia and New Zealand heard that the seminar would be largely anti-Eurozone and requested he be invited to participate. He is chairing the event now and we will wait to hear what his intervention will bring. It should be a good night and I hope to see a few of you Melbournians there. I will record my presentation and make it available at some later date (soon). That is enough for today!

The expression “budget deficit” logically implies that government spending is a negative quantity, say Gdemoniac, that algebraically adds to taxes (these being a positive quantity).

Gdemoniac = -|G|, where |G| is the absolute value of government spending.

BD = T + Gdemoniac = T + (-|G|) = T – |G|

Actually, from the point of view of citizens, government spending is always a positive quantity (as it increments their bank accounts) and taxes are always a negative quantity (as they decrement their bank accounts).

In the citizens view, net government spending, NGS equals the algebraic addition of G and T

NGS = G + T = G + (-|T|) = G – |T|

The expression “net government spending” implies (correctly) that G is positive and T is negative.

Actually, from the point of view of citizens, the expression “budget deficit” should only be applied to negative net government spending because in such situation citizens pay more in taxes than they receive in government spending.

Confusion of arithmetic signs is a source of waste and disasters.

Can anyone from Spain tell me why there aren’t (or more) mass demonstrations? Are welfare payments keeping people from becoming that desperate?

Great discussion. Someone should tell Erskine Bowles he knows little of economics. I doubt that would do much good, since he quite obviously thinks he understands all these matters. Just ask him.

“Can anyone from Spain tell me why there aren’t (or more) mass demonstrations?”

You are assuming that the figures reported are accurate. Reports I see suggest a growing black market and whole families living off Granny’s pension.

Newsflash for Mr. Bowles.

The market has been punishing the unemployed and low income earners for over thirty years,

It will take many years of government deficits to right those neo-liberal wrongs.

Bill:

Always enjoy your analysis – even though I consider myself “conservative”. But more recently, your work and that of Warren Mosler have convinced me that much of what I thought I knew may have been due to misunderstanding. When I try to explain MMT to people, I often mention that the 1980’s in the US were successful economically because of the large deficits that resulted from tax cuts and spending increases, and further that this is the only way we’ll get out of our current problem.

Someone challenged me and referred to the “depression” of 1920, and that Harding and Mellon’s policies got us out of that by cutting spending and cutting taxes. I’m not as well versed in history as some, but my response is usually that the end of WWI was what led to the depression in 1920 and the “spending cuts” were mostly due to lower military spending, while the Mellon tax cuts helped propel the economy forward. How much of this do I have correct ?