I have received several E-mails over the last few weeks that suggest that the economics…

The myths that abound in Federal Budget Papers

Last night’s Federal Budget in Australia proved once again how dominant the macroeconomic myths are in policy development. You can read my pre-Budget comments – Budget 2012: a recipe for disaster – and apart from the 2011-12 deficit being larger than the Government planned as a result of the slowing economy undermining its estimated tax revenue (in other words, the Government was overly optimistic in its forecasts last year) I would not have written much different after seeing all the Budget documents. It remains the largest fiscal consolidation attempted in one fiscal year (equivalent to 3 per cent of GDP) at a time that GDP is growing around 2.5 per cent.and I cannot see private spending growth picking up to fill the gap. Outcome – a movement towards recession. Conclusion – poor fiscal management. But the Budget Papers that the Government releases are always interesting reading and one day I plan to trace the evolution of the shifts in macroeconomic ideology through the way the papers are presented (format, tables, and narratives). There you learn what the economists in Treasury think and the ideas espoused are generally applicable to the international debate given that the tentacles of the dominant paradigm of the day spread widely. In Budget Paper No 1, Statement 4 – Building Resilience Through National Saving we are provided with a demonstration lesson of how a fiat monetary system does not work and a classic depiction of the way the mainstream narrative deceives the citizens.

You can also read this Statement in PDF, which avoids scrolling through a number of html screens.

The myths in order of discussion in Statement 4:

1. “further improvements in government saving are desirable with the economy forecast to grow around trend”.

2. “Delivering surpluses, along with a further boost to superannuation, will foster fiscal sustainability in the context of an ageing population …”

3. Delivering surpluses will “ensure the Government is not contributing to price pressures in the economy, providing scope for monetary policy to respond to economic developments”.

4. “Higher national saving will also improve economic resilience by reducing Australia’s vulnerability to external shocks.”

Return to more typical behaviour

Statement 4 says that in recent years the:

… the significant increase in national savings likely reflects a combination of a return to more sustainable rates of consumption growth and cautious households consolidating their financial position – particularly by reducing the pace of their debt accumulation.

The reference to “more sustainable rates of consumption growth” is very relevant.

The Australian government ran budget surpluses in 10 out of 11 years from 1996-2007 and claimed they were the exemplar of prudent fiscal conduct. In fact, they were only possible because the private sector were engaged in a consumption frenzy driven by an explosion of credit. By the Treasury’s own words, this rate of consumption growth was unsustainable.

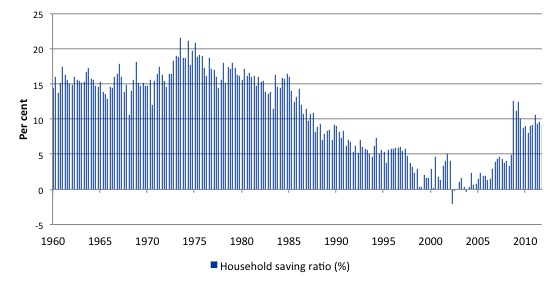

It was also a very atypical period – both the behaviour of households and the recording of budget surpluses. You get a better picture of how unusual the credit-binge period was by looking at the household saving ratio over a longer period.

The following graph starts September 1959 (when National Accounts data was first published) and shows the period up to the December quarter 2011. This graph helps readers understand the comments I make about “typical” and “atypical” behaviour among the macroeconomic aggregates.

I have often said that the period in the late 1990s up until the crisis when the government was running surpluses and the household sector was accumulating record levels of debt which allowed it to indulge in a consumption binge were atypical. The credit-binge underpinned relatively strong growth, which in turn allowed the government to run the surpluses (revenue growth was so strong) over this period.

The behaviour was very odd by historical standards. The problem now is that the neo-liberals have reconstructed history to suggest that budget surpluses are normal.

The following graph shows how atypical the period of the budget surpluses were (from 1996 to 2007). As households increasingly went into the red and were dis-saving the household saving ratio became negative. As a result of the risk now carried by the record levels of indebtedness and the uncertain nature of the economy at present (threat of unemployment is still high), households are resuming their historically typical behaviour and consumption is more subdued as a result.

As the Treasury Statement 4 acknowledges, the household saving ratio is likely to remain around 10 per cent of disposable income into the future. What does this imply?

Unless the external sector is going to dramatically change direction and significantly increase its contribution to GDP from negative to a large positive amount and/or the private investment ratio rises significantly in the future (beyond its normal proportions) then there will be a need for continuous budget deficits in the coming years to support growth.

The juxtaposition is what I would call typical and runs against the austerity hype that is driving public policy at present. The Government and most of the mainstream commentators seem oblivious to this point.

Even in the Treasury’s own words the build-up of private domestic debt was unsustainable as the balance sheet risk increased.

The point is that the period before the neo-liberal era was characterised by several features:

1. Relatively continuous use of fiscal deficits.

2. Stable personal saving ratio of around 7-8 per cent of personal disposable income.

3. A consumption share of around 65 per cent of GDP.

4. Real wages growing in line with labour productivity – so that consumption could be driven by real wages growth rather than credit.

The neo-liberal period is in fact the outlier – an atypical period. Which makes the claims by those who hold out that governments should return to surplus as a demonstration of fiscal responsibility rather difficult to understand.

Please read my blog – The Great Moderation myth – for more discussion on this point.

In many cases, where actual budget surpluses were recorded, the economies went into recession soon after. The important point though is that the surpluses were made possible by the unsustainable growth in private credit which drove private spending and boosted tax revenue.

In the Eurozone, Spain and Ireland recorded budget surpluses in the lead up to the crisis and were held out as the exemplar of fiscal prudence and financial management. History has a way of showing nonsense for what it is. Their real estate booms drove the surpluses. The surpluses, in fact, squeezed the capacity of the private sectors to maintain reasonable saving ratios – which would have ensured better private risk management.

So it is highly likely that we are returning to a more normal environment now where the private sector are attempting to save more out of disposable income and reduce its reliance on credit.

Two implications arise if that if the private consumption is returning to more normal levels then two things follow:

1. The government will more likely have to run budget deficits of some magnitude indefinitely – as in the past.

2. Real wages growth will have to be more closely aligned with productivity growth to break the reliance on credit growth.

And when the nature of the balance sheet adjustments that are going on at present are included in the assessment these two points become amplified.

This also makes the quest for fiscal austerity to be mindless and very destructive. Where will growth ever come from if consumers are returning to higher saving ratios, firms are very cautious, all countries are eroding their neighbours export markets, and governments are adding to the malaise?

Please read my blog – Budget deficits are part of “new” normal private sector behaviour – for more discussion on this point.

[Reading Guide: Some E-mails I have received suggest that placing these “Please read my blog” links in the main body of the text diverts readers into more detailed discussion of a particular point and thus sidetracks them from the current blog. While I appreciate the point, the simple solution is to “right-click” the link and request the browser open the link in a new tab (or page) whereupon you can have the extra reading separated from the blog and go back and forth at your leisure.]

After extolling the virtues of private saving and the policy initiatives to support it, Statement No 4 says:

Consistent with this strategy, returning the Budget to surplus from 2012-13 will contribute to national saving and maintain confidence in the strength of Australia’s public finances. This will support Australia’s capacity to respond to unexpected adverse events.

At which point the narrative becomes unacceptable.

The Australian government issues its own currency – the AUD. There is no operational meaning to a currency-issuer “saving” in its own currency. Statement 4 notes that:

Households can maximise welfare by using part of their current income to fund increased future, rather than current, consumption; that is, by saving. This is achieved by investing in assets that raise future income and can be drawn on to finance consumption at a later date

Note the elements – saving means foregone current consumption to engender high future consumption for currency-issuing entities who are financially constrained (“drawn on to finance consumption at a later date”).

The currency-users (like households) always need to fund their spending and to create larger future consumption possibilities than their income would currently predict then they have to give up consumption now to build higher future revenue.

A currency-issuing government has no such constraint. Despite all the institutional machinery that it has erected to make it look as though it is reliant on private bond markets for the funds it spends, the reality is that the Australian government can spend when it likes and if bond markets do not support a particular bond tender volume then the central bank will.

If things became really dire and the private bond markets boycotted a tender then it would not take long for the Government to change the rules to permit it to spend as it desired. That is the intrinsic capacity of a fiat currency issuing government.

In that context, current public spending imposes no constraints on future government spending, quite unlike the situation faced by currency-users. The government’s capacity to spend next period is not enhanced nor compromised by its past spending decisions. In which case, the concept of saving as we commonly think of it is inapplicable to a fiat currency-issuing government.

It is true that an aggressive budget deficit position may push nominal spending growth close to the real capacity of the economy to absorb it and thus push up against the inflation barrier. Further, if the high levels of activity stimulate further private sector confidence and perhaps an investment surge then fiscal policy will have to pull back.

So there is a context in which one budget position is linked to a past position. But the link is via the real economy and the positive impact that budget deficits have on aggregate demand. There is no sense that by spending today the government runs out of money to spend tomorrow.

While the mainstream claim that national saving is the sum of household saving and budget surpluses the truth is that budget surpluses undermine national saving because they introduce fiscal drag which reduces the pace of income growth. In some circumstances that is an appropriate fiscal strategy. For example, in the case of Norway with a very strong external surplus, the government has to run a surplus to keep nominal demand growth within the real capacity of the economy. They still allow the private domestic sector to achieve their desired private sector saving.

A budget surplus is more correctly thought of as a destruction of non-government purchasing power and wealth. It might be a desirable strategy in some cases but it should never be seen as part of national saving.

From Page 4-16 in Statement 4 we encounter a section entitled “Government Saving Promotes Macroeconomic Stability and Fiscal Sustainability”, which begins the discussion about the virtues of government surpluses. The first thing a person who understands Modern Monetary Theory (MMT) will say to themselves is “nonsense ahead”.

The subsequent sections provide a classic demonstration of the way that mainstream macroeconomics misleads the society and the erroneous ideas presented are in no small way responsible for the crisis and the painful recoveries and double-dips that are now being endured. The ideas presented are used to justify pro-cyclical fiscal austerity which is now making the initial crisis much worse than it should ever have been.

First, we read that:

Fiscal policy plays an important role in helping to stabilise the economy through the operation of the automatic stabilisers and during exceptional circumstances where monetary policy alone may not be able to respond with sufficient speed and force. The Government’s fiscal stimulus during the GFC is a prime example of this important role. The Government stepped in to support aggregate demand when the private sector retreated, with a credible strategy for returning the budget to surplus as the economy recovered to trend growth.

I agree with statement that when private sector spending retreats the government sector has to expand its deficit (via discretionary choices and the automatic stabilisers) to ensure the spending gap is closed.

The Government did increase the budget deficit in two major stimulus packages in late 2008 and early 2009 although the scale was not sufficient to prevent labour underutilisation from rising from around 8.5 per cent to 12.5 per cent (now).

First, there is no necessity for the budget to return “to surplus as the economy recovered to trend growth”. This is make-believe stuff. Depending on the behaviour of the external sector and the private domestic sector, the structural budget position at “trend growth” could be a surplus or deficit (of varying magnitudes) or even a balance.

So for a nation with a current account deficit of say 2 per cent of GDP, and the private domestic sector spending exactly what it earns (S = I) and therefore not building indebtedness overall, the appropriate government balance would be a deficit of 2 per cent even if trend growth was being achieved.

In other words, the a particular budget balance should not be the target of policy because it is determined by both government spending and tax plans and the strength of private spending. The latter determines how much tax revenue the government earns for a given tax structure. There is nothing sacrosanct about a budget surplus in isolation from what is happening in non-government sector.

Second, trend growth might not be the optimal benchmark if the economy has been operating at levels of activity for many years, which are patently well below full employment. Over the last three decades, government policy has deliberately maintained a state of the entrenched labour underutilisation.

So using the trend rate of growth associated with this historical period as the policy goal is to adopt a somewhat diminished aspiration and deliberately waste the potential of a certain proportion of the willing and available labour force.

Third, while the Treasurer maintains the mantra that the economy has recovered to trend growth and the Treasury clearly chooses to support that lie in the official Budget papers, the fact is that the Australian economy is nowhere near trend growth.

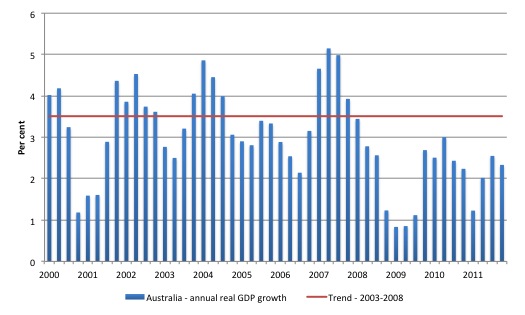

The following graph is taken from ABS National Accounts data (latest available December quarter 2011) and shows the annual rate of real GDP growth since the March quarter 2000 to the December quarter 2011 (blue bars). The red line is the average growth rate (3.5 per cent) for the 20-quarters before the recent crisis impacted (September 2003 to September 2007). This is normally considered to be trend growth.

The Australian economy started slowing in the March 2008 quarter and has not gone close to achieving the growth rate that was enjoyed in the 5 year period before the crisis. The pace of growth was gathering on the back of the fiscal stimulus in the December 2009 to June 2010 quarters but then fell away as the fiscal stimulus was withdrawn.

Private domestic spending growth remains subdued and the pursuit of the fiscal surplus is now introducing serious drag on the growth rate.

The economy is nowhere near is past trend. The Treasury has a current trend estimate of 3.25 per cent which is about the average growth of the period from March quarter 2000. Even with this more subdued growth trend forecast (a period which included two major downturns as you can see from the graph), the Australian economy is nowhere near trend performance and is now moving away from that benchmark.

Statement No 4 then claims that:

Another crucial objective of fiscal policy is fiscal sustainability. Maintaining fiscal sustainability is particularly important at this time of ongoing global economic uncertainty and when fiscal deficits and high national debt have been a proximate cause of distress in many countries around the world.

Please read the suite of blogs – Fiscal sustainability 101 – Part 1 – Fiscal sustainability 101 – Part 2 – Fiscal sustainability 101 – Part 3 – for a MMT perspective on fiscal sustainabilty.

Note that the reason that the “many countries” where “fiscal deficits and high national debt have been a proximate cause of distress” do not issue their own currency and are at the prey of the private bond markets in the absence of a sensible intervention from the ECB.

There is no fiscal distress in Japan (highest public debt ratios and on-going relatively large deficits), in the US and elsewhere where the bond markets know that the government faces no solvency risk and where the central bank can always deal them out of the equation with appropriate bond purchasing policies. In those nations, the bonds markets are the recipients of corporate welfare and know it!

Statement No 4 claims that budget surpluses build resilience. We read that:

The Government gives effect to promoting fiscal sustainability through its objective of achieving budget surpluses on average over the medium-term.

Which means the Treasury defines fiscal sustainability as a situation where on average over the medium-term, the private sector balance will be of the same sign but greater than the external balance as a percentage of GDP.What does that mean?

Recall the sectoral balances framework which allows us organise our understanding of the macroeconomic relationship between the government and non-government sector (the latter being decomposable into the external and private domestic sectors).

As they are derived from the national accounts (that is, they are an accounting identity), the sectoral balances tell us that the government budget balance, the external balance and the private domestic balance have to always add to zero.

The summary equation is this (expressed as a per cent of GDP). Please read my blog – Saturday quiz – May 5, 2012 – answers and discussion – (Answer to Question 3) – for a more detailed derivation.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

Take the case of a balanced budget (averaged over a given cycle – “medium term”). Then:

(I – S) + 0 + (X – M) = 0.

In other words, if X < M (a current account deficit) - say 2 per cent of GDP, then we must have a private domestic deficit (I > S) of 2 per cent of GDP (averaged over the given cycle).

A budget surplus would force the private domestic deficit to be greater than this for a given external deficit. The upshot is that the Government’s own definition of fiscal sustainability for a nation with an external deficit is based on private domestic sector behaviour which leads to increasing private indebtedness over each business cycle which by their own logic is unsustainable.

There is thus a serious disconnect in their conceptual narrative. Using an integrated framework like the sectoral balances allows us to put the individual elements together to check for macroeconomic consistency.

Australia typically runs a current account deficit. So unless that situation is going to change rather dramatically (which it will not), the government’s surplus pursuit is unsustainable in the medium-term.

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down.

The external deficit also means that foreigners are increasing financial claims denominated in the local currency. Given that exports represent a real costs and imports a real benefit, the motivation for a nation running a net exports surplus (the exporting nation in this case) must be to accumulate financial claims (assets) denominated in the currency of the nation running the external deficit.

A fiscal surplus also means the government is spending less than it is “earning” and that puts a drag on aggregate demand and constrains the ability of the economy to grow.

In these circumstances, for income to be stable, the private domestic sector has to spend more than it earns.

You can see this by going back to the basic aggregate demand relations. For those who like simple algebra we can manipulate the aggregate demand model to see this more clearly.

Y = GDP = C + I + G + (X – M)

which says that the total national income (Y or GDP) is the sum of total final consumption spending (C), total private investment (I), total government

spending (G) and net exports (X – M).

So if the G is spending less than it is “earning” and the external sector is adding less income (X) than it is absorbing spending (M), then the other spending components must be greater than total income. That is not a sustainable growth strategy.

Statement No 4 then discussed private expectations and confidence. We read:

… the overall budget position can affect expectations and confidence. Public finances that are viewed as unsustainable generate uncertainty, as governments are expected to act to secure finances by reducing expenditure or increasing taxes, or face the risk of default. A credible strategy to maintain fiscal sustainability, therefore, provides a positive foundation for long-term decision-making by households and businesses.

There are overtones of Ricardian Equivalence in this statement. But overall the assertion is that people judge their own spending propensities and investment opportunities with respect to the state of the fiscal balance. There is scant evidence to support such an assertion.

Households are confident when employment and real wages are growing and this state is secure. Firms will invest when the expected future demand is greater than the current productive capacity and that expect to be able to realise that future expected spending in the form of sales. They will not invest while household consumption growth is subdued and the current capacity can service future demand growth.

Fiscal austerity at a time when private spending is not strong enough to drive growth further undermines growth and future private spending growth.

Many European governments have recently pursued fiscal austerity with the intended purpose of reducing deficits, only to see private spending collapse, and in turn, their tax revenue decline and their budget deficits rise. The legacy is continued recession and rising unemployment.

Statement No 4 then rehearses the ageing society myth:

Fiscal sustainability is also important because of the longer-term challenges arising from population ageing and climate change. These challenges result substantially from decisions made by preceding generations from which they benefitted: in the former case, establishing spending programs with unsustainable future fiscal costs; in the latter case, burning of fossil fuels with unsustainable future environmental costs.

The entire premise that a currency-issuing government can run out of money is flawed. The flawed chain of logic begins with the erroneous claim that if accumulated surpluses are allegedly “stored away” then this will help government deal with increased public expenditure demands that may accompany an ageing population with growing income support needs.

There will never be a squeeze on “taxpayers’ funds” because the taxpayers do not fund “anything”. The concept of the taxpayer funding government spending is misleading. Taxes are paid by debiting accounts of the member commercial banks accounts whereas spending occurs by crediting the same. The notion that “debited funds” have some further use is not applicable.

When taxes are levied the revenue does not go anywhere. The flow of funds is accounted for, but accounting for a surplus that is merely a discretionary net contraction of private liquidity by government does not change the capacity of government to inject future liquidity at any time it chooses.

The idea that unless policies are adjusted now (that is, governments start running surpluses and cutting welfare entitlements), the current generation of taxpayers will impose a higher tax burden on the next generation is deeply flawed.

The government budget constraint is not a “bridge” that spans the generations in some restrictive manner. Each generation is free to select the tax burden it endures. Taxing and spending transfer real resources from the private to the public domain. Each generation is free to select how much they want to transfer via political decisions mediated through political processes.

Each generation is free to choose how much income support they offer their disadvantaged citizens.

This insight puts the idea of sustainability of government finances into a different light. The emphasis on forward planning that has been at the heart of the ageing population debate is sound. We do need to meet the real challenges that will be posed by these demographic shifts.

But if governments continue to try to run budget surpluses to reduce public debt then that strategy will ensure that further deterioration in non-government savings will occur until aggregate demand decreases sufficiently to slow the economy down and raise the output gap.

The real issue about future entitlements is ignored by the conservatives who construct the problem in terms of the financial capacity of the government.

Not once is this question asked: Will there be enough real goods and services available for sale to absorb the spending demands of the populations in the future. se projected expenditures?

If the answer is yes then there is no policy problem – the national government will be able to afford the projected demands on its spending and the income support provided (in $A) will be commensurate with growing real living standards.

In other words, under this scenario, the distribution of real goods and services between welfare provision and the rest will be determined politically,

The rising dependency ratios do matter but it is future productivity and inequality that matter. The conservatives think the dependency ratio is important because it will push governments into insolvency. The logic used is typically based on false notions of the government budget constraint.

A rising dependency ratio suggests that there will be a reduced tax base and hence an increasing fiscal crisis given that public spending is alleged to rise as the ratio rises as well.

If the ratio of economically inactive rises compared to economically active, then the economically active will have to pay much higher taxes to support the increased spending. So an increasing dependency ratio is meant to blow the deficit out and lead to escalating debt.

These myths have also encouraged the rise of the financial planning industry and private superannuation funds which blew up during the recent crisis losing millions for older workers and retirees.

The conservative policy recommendations are that people have to work longer despite this being very biased against the lower-skilled workers who physically are unable to work hard into later life. Additionally, welfare entitlements have to be withdrawn.

We can reject this logic out of hand (except in the EMU) for the reasons noted above.

By imposing fiscal austerity onto economies, the neo-liberals push the dependency ratio up well beyond what the underlying population demographics might produce because they create entrenched unemployment and underemployment. In other words, the neo-liberals actually undermine the future by damaging the present.

The conservative remedies miss the point overall. It is not a financial crisis that beckons but a real one. Are we really saying that there will not be enough real resources available to provide aged-care at an increasing level? That is never the statement made. The worry is always that public outlays will rise because more real resources will be required “in the public sector” than previously.

But as long as these real resources are available there will be no problem. In this context, the type of policy strategy that is being driven by these myths will probably undermine the future productivity and provision of real goods and services in the future.

With less producers and more consumers the problem becomes a productivity one. Productivity growth comes from a number of interconnected factors.

First-class public education and health systems to support human capital development; strong funding for research and development; and high levels of activity (utilising all potential labour).

The neo-liberal solution for the future – fiscal austerity – which attempts to tackle the problems of the future by cutting spending now – will actually undermine the achievement of a high productivity future.

Maximising employment and output in each period is a necessary condition for long-term growth. The mainstream fiscal austerity approach is full of contradictions.

On the one hand, the the emphasis in mainstream is that to lift labour force participation we have to better utilise older workers (which is sound logic) but then they exhort governments to impose damaging fiscal austerity which reduces job opportunities for older workers and forces them onto the unemployment scrap heap.

Worse still is their treatment of the future workforce. With teenage unemployment rates up around 50 per cent in some nations and approaching that in other nations – the consequence of a deliberate act by governments to impose fiscal austerity – the policy choices are dramatically undermining the capacity of the economies to achieve high productivity in the future when it will be needed.

Anything that has a positive impact on the dependency ratio is desirable and the best thing for that is ensuring that there is a job available for all those who desire to work.

Further encouraging increased casualisation and allowing underemployment to rise is not a sensible strategy for the future. The incentive to invest in one’s human capital is reduced if people expect to have part-time work opportunities increasingly made available to them.

For sovereign currency-issuing nations these issues are about political choices rather than government finances. The ability of government to provide necessary goods and services to the non-government sector, in particular, those goods that the private sector may under-provide is independent of government finance.

Any attempt to link the two via fiscal policy “discipline:, will not increase per capita GDP growth in the longer term. The reality is that fiscal drag that accompanies such “discipline” reduces growth in aggregate demand and private disposable incomes, which can be measured by the foregone output that results.

For EMU nations and other nations that surrender their currency-issuing sovereignty, the problem lies in that surrender. The solution lies in restoring currency sovereignty.

Clearly budget surpluses help control inflation because they act as a deflationary force relying on sustained excess capacity and unemployment to keep prices under control. This type of fiscal “discipline” is also claimed to increase national savings but this equals reduced non-government savings, which arguably is the relevant measure to focus upon.

There are those that will argue that if welfare entitlements continue to rise in nominal terms then even if the government is not financially constrained, the impact will be that nominal spending will outstrip the real capacity of the economy to absorb it and inflation will result. In other words, governments will have to cut public and/or private nominal spending to arrest the inflation.

Statement No 4 concludes that:

Under the Government’s macroeconomic policy framework, the primary objective of fiscal policy is to maintain the budget in a sustainable position from a medium-term perspective. Monetary policy has primary responsibility for managing the level of demand to keep the economy on a stable growth path consistent with low inflation over the medium-term.

In other words, the Government has embraced the neo-liberal line that fiscal policy should be passive (and support) monetary policy as the principle counter-stabilising policy tool.

This is despite all the evidence of the last several years that monetary policy is not a very effective counter-stabilising tool. Monetary policy impacts are uncertain because they affect spending decisions indirectly (via the cost of loans) and the distributional intricacies are largely unpredictable (creditors gain from higher rates, debtors lose and vice versa). Further, monetary policy is largely a broad brush tool which cannot be targetted at specific income cohorts or across space.

Fiscal policy is direct and can be very finely targetted to ensure that aggregate demand can be managed in a flexible manner consistent with full employment and equity.

The period of inflation-targetting (reliance on monetary policy) has largely coincided with persistently high unemployment and growing underemployment across all economies. The inflation-first strategy uses unemployment as a policy tool rather than sees it as a policy target. The result is a bias towards high labour underutilisation rates and an abandonment of full employment.

I will write more about this in another blog.

Finally, Statement No 4 claims that:

Against a backdrop of continuing global uncertainty, it is also prudent to strengthen the government’s balance sheet while economic conditions remain favourable to support Australia’s capacity to respond to future adverse shocks.

As noted above – a surplus in year 1 provides no extra capacity to spend in year 2.

I have run out of time!

Conclusion

The Budget Papers are interesting reading and compulsory reading for all those who are interested in macroeconomics and the state of the art. They provide a clear insight into the dominant ideology of the day and do away with the more sensationalist spin that the financial journalists fill their stories with.

The problem is that at present – the neo-liberal ideology is firmly imprinted on the official documents. And you will see all the myths of that paradigm spelled out in some detail in the Budget Papers.

It is just a pity that this represents the real world account of what our government is actually doing. If only it was a fairy tale.

That is enough for today!

“They will not invest while household consumption growth is subdued and the current capacity can service future demand growth.”

I have noticed that a few neo-liberal true believers have now started pushing capital replacement spending as the new saviour of the nation.

In other words the recession has gone on so long that plant and machinery has worn out and has to be replaced to maintain currency capacity. And it is this spending that will catapult the economy back to growth.

Desperate stuff.

It strikes me that the Australian govt know exactly what they are doing – tightening fiscal policy to force a loosening of monetary policy to reduce interest rates. They hope the resulting fall in mortgage payments will win over the important floating voters. This is the Osbourne’s strategy in the UK any interview ends with “… this government is delivering record low interest rates…” Rubbish, I know, but if you say it often enough….

They have been caught out by the continuing world downturn resulting in falling rather than anaemic GDP growth. Their aim is to privatise the public sector as much as possible, not to shrink govt spending (which is increasing).

@Neil ~

Capital replacement spending? In other words, they want to make sure that the machinery they aren’t using is up to date?

Aren’t these the same people who complain about digging holes just so hole fillers have something to do?

Benedict / Neil – I believe the so-called ‘libertarians’ call it the ‘broken window fallacy’. I’m glad they’ve conjured up a new term though!

This budget,delivered by the sock puppet,Swan, is directly targeted at buying votes in the forthcoming federal election. That election could be sooner than we think.

The whole situation is sad. This present government has lost the confidence of most of the electorate and for good reason.So their attempted vote buying exercise will fail.The replacement Tory government will just continue the same idiocy as detailed by Bill above unless I am very much mistaken.

Not a good outlook for Australia.

Another fabulous blog Bill, thanks.

Shows how truly bogus the mainstream thinking is. But, you know, I have noticed the beginnings of some MMT concepts creeping in where they weren’t before. Just here & there, but noticeable. It’s in the use of phrases, such as ‘currency issuer’, that I never saw even a few months ago. I always try to use the phrasing that you employ here & other MMT advocates use. I think MMT blogs & comments are becoming more widely read than we might think, & repetition of phrasing is a powerful tool.

According to polls, support in Ireland for a ‘no’ vote in the Fiscal Treaty referendum (given the Orwellian title ‘Stability’ treaty by gov.) has been gaining ground steadily despite a barage of scaremongering by all three main parties advocating ‘yes’. Ireland’s usual apathy is shifting. Election results in Greece & France have helped, as well as the news of worsening conditions across the whole Eurozone.

I think Tony has it right. Swan is hoping to be bailed out by the RBA. Come next year, he’s going to be saying “we ran a surplus, gave money to families and delivered low interest rates” and blaming the higher unemployment on tough economic conditions globally. If China can oblige with a hardish landing, his story might well play.

Hi Mike,

I’ve noticed that too: MMT concepts and language creeping into the comments sections of mainstream newspaper articles and the like.

Many comments I’ve seen could’ve been cut-and-pastes from Bill’s blog.

Krugman, and in Australia, Quiggin have been forced to acknowledge (albeit grudgingly) the gathering interest in MMT.

Bill’s venture into the blogosphere is certainly paying off.

Tony and Dr Zen,

One of the problems with your arguments is that lower interest rates will be accompanied by deteriorating employment. That’s one of the reasons households have gone back to saving.

And the few mortgagors who benefit will be outnumbered by cranky self-funded retirees.

Swan claiming that his surplus creates “headroom” so the RBA can lower rates mystifies me. I can’t see the mechanism, except in the most negative light: “I’ll screw the economy and force the RBA to drop rates”

I think the simple reason is that he’s been got at by the ideologues in Treasury.

This was a very interesting article for someone like me, who is quite interested in these issues but lacks significant technical training in economics.

However, whilst I agree with the suggestion that now is not the time for a surplus fixation, given that growth is likely to remain below trend this year, I cannot see how this can be extrapolated out as a general rule going forward. Obviously, if we take the view that savings are reverting back to a historical mean and credit growth will thus be very limited in the medium to long term, then it will certainly be easier and, potentially, cheaper for the government to run deficits. (There will be lots more domestic savers to buy the goverment’s bonds, for example,.) However, why does that automatically mean governments *should* run deficits?

At the risk of paraphrasing Wayne Swan, surely a better policy is to seek run a balanced budget across the economic cycle, with deficits in downturns followed by surpluses in upturns, sort of like a bank overdraft?