It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

Mass unemployment is involuntary

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text by the end of this year. Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

This section continues the work on stylised facts that should be explained by any credible macroeconomic theory. In this part I deal with involuntary unemployment and its associated time series properties.

Unemployment

One of the stark facts about modern economies has been the way in which unemployment has evolved over the last three or more decades. While different nations have recorded varying experiences the common thread is that unemployment rates have risen overall and, in most cases, endured at higher levels for many years.

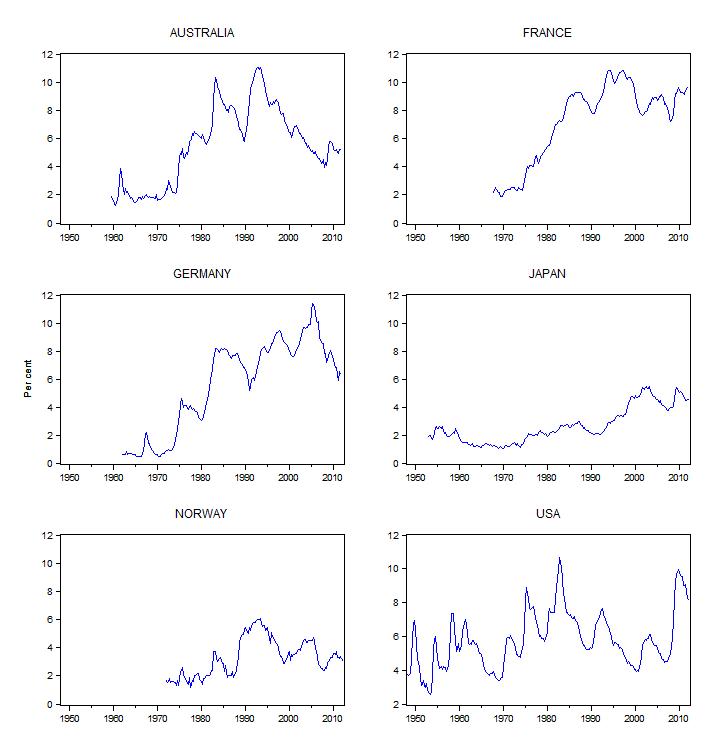

In Figure 1.x unemployment rates – the percentage of willing workers who are unable to find work – are shown for six nations. The time frame extends from 1948 for the US and less periods for the other nations – Australia (from the third-quarter 1959), Japan (from first-quarter 1953), Germany (first-quarter 1962), France fourth-quarter 1967) and Norway (from first quarter 1972). The samples used reflect the available comparable data. The sample of nations chosen include the two largest industrialised European nations (Germany and France), a Scandinavian exporting nation (Norway), a small open economy predominantly exporting primary commodities and with a relatively underdeveloped industrial base (Australia), and two large industrialised nations (Japan and the USA).

Figure 1.x Comparative unemployment rates (%)

Sources: OECD Main Economics Indicators, US Bureau of Labor Statistics, Statistics Japan, Statistics Norway. Data is seasonally adjusted.

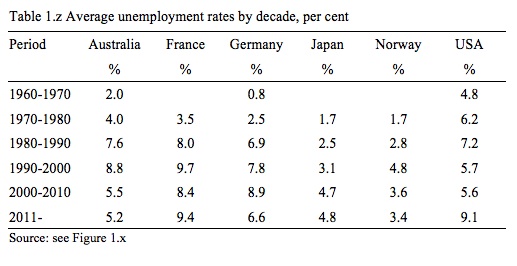

The accompanying data in Table 1.x provides further information upon which to assess the historical behaviour of unemployment.

The data shows that unemployment rose in all nations shown during the 1970s and persisted at these high levels well into the first decade of the new Century. For some nations (Japan and Norway) the level of the unemployment rate has been significantly below that of the other nations shown.

The data also shows quite clear cyclical patterns. Take Australia as an example where cyclical patterns are pronounced. Unemployment was below 2 per cent for most of the Post-World War 2 period and then rose sharply in the mid-1970s and continued rising as the economy went into a deep recession in the early 1980s.

Economic growth in the second-half of the 1980s brought the rate down from its 1982 peak but never to the level that had been enjoyed in the 1950s, 1960s and early 1970s.

The 1991 recession then saw the unemployment rate jump up again very quickly and reach a peak higher than the 1982 peak. Once again, the unemployment rate started to fall again as growth ensued after the recession was officially over but it took many years to get back to levels prior to the 1991 downturn.

The unemployment rates tend to behave in an asymmetric pattern – they rise very sharply and quickly when the economy goes into a downturn in activity but then only gradually fall over a long period once growth returns.

Any credible macroeconomic model needs to provide convincing explanations for these movements. How were unemployment kept at low levels during the 1950s and 1960s? Why did unemployment rates rise in the 1970s and persist at the higher levels for several decades? What determines the cyclical pattern of the unemployment rates – that is, the asymmetry?

There is some agreement among macroeconomists that the persistently high unemployment in the late 1970s and beyond was consistent with the economists concept of involuntary unemployment. Involuntary unemployment is a fundamental concept in macroeconomics and indicates that individuals are constrained by the systemic failure of the economy to provide enough jobs and have little power to alter that circumstance and thus gain work.

In Chapters 10 and 11 you will be introduced to various classification frameworks that have been used by economists to categorise the concept of unemployment. You will learn that a significant number of economists consider unemployment to be a voluntary state, chosen by individuals upon the basis of their preferences for “leisure” against work.

The concept of voluntarism comes from the Classical economists (pre 1930s) who denied that there could ever be an enduring state where the system failed to provide enough work relative to the preferences of those who desired to work. They claimed that output (which drives the demand for labour) could never persist at which would be insufficient to generate a job for all those who desired one.

The Great Depression in the 1930s changed the debate because the notion of voluntary unemployment failed to accord with the observed reality. Millions of workers clearly desired to work but were forced onto the unemployment queue because employers were not willing to provide them with jobs. It was clear that the firms had no desire to expand employment at that time because they could not foresee any potential sales for the extra output that might have been produced.

In the 1930s, the British economist John Maynard Keynes realised that the existing body of macroeconomic theory was inadequate for explaining the mass unemployment that persisted throughout the decade as production levels fell in the face of a major slump in overall spending. He thus defined involuntary unemployment in this way:

Men are involuntarily unemployed, if, in the event of a small rise in the price of wage-goods relative to the money-wage, both the aggregate supply of labour willing to work for the current money-wage and the aggregate demand for it at that wage would be greater than the existing volume of employment. (Page 15, General Theory)

At this stage of your studies, that definition will appear to be difficult to understand. It was deliberately designed to challenge the existing British Treasury viewpoint which claimed that the unemployment during the early part of the 1930s was due to the real wage (the purchasing power equivalent of the money wage) being too high relative to productivity.

So Keynes said that if the real wage falls and workers still supply more labour to the increased quantity of jobs offered by the firms then those workers were unemployed against their will – that is, involuntarily unemployed.

You will learn more about that argument as this course develops. But the essential point that Keynes was aiming to instill into the debate was that mass unemployment of the type he saw in the 1930s was a demand rather than supply phenomenon. That is, it is total spending in the economy that impels firms to employ workers and produce goods and services. A firm will not employ if they cannot sell the goods and services that would be produced.

Building on that concept, Keynes introduced the idea of the unemployment equilibrium – that is, a state where the monetary economy could continue to operate at high levels of unemployment and firms realising their expected sales volumes. He argued that if the economy reaches this type of impasse, the only way out is to reduce unemployment by an injection of government spending, which stimulates demand and provokes firms to increase output and offer more jobs.

We will consider these ideas in more detail starting in Chapter 7.

The debate between Keynes and the Classical economists in the 1930s has resonated throughout the decades since. In the 1980s and beyond as unemployment persisted at high levels in many nations it was clear that firms wanted to increase output at the current real wage levels but were constrained by the aggregate spending available.

We need to understand how economies became trapped in an unemployment equilibrium long after Keynes first identified the tendency within the capitalist monetary system.

The Great Depression in the 1930s taught us that, without government intervention, capitalist economies are prone to lengthy periods of unemployment. The emphasis of macroeconomic policy in the period immediately following the Second World War was to promote full employment. Inflation control was not considered a major issue even though it was one of the stated policy targets of most governments.

In this period, the memories of the Great Depression still exerted an influence on the constituencies that elected the politicians. The experience of the Second World War showed governments that full employment could be maintained with appropriate use of budget deficits (national governments spending more than they were receiving in tax revenue).

The employment growth following the Great Depression was in direct response to the spending needs that accompanied the onset of the War rather than the failed Classical remedies (the British Treasury view) that had been tried during the 1930s. The problem that had to be addressed by governments at War’s end was to find a way to translate the fully employed War economy with extensive civil controls and loss of liberty into a fully employed peacetime model.

Governments all around the world endorsed the emerging Keynesian orthodoxy of the time and committed to the notion that unemployment was a systemic failure in aggregate demand (spending) and moved the focus away from an emphasis on the ascriptive characteristics of the unemployed (for example, whether they were lazy and avoiding work) and the prevailing wage levels.

Many leading economists in the immediate Post World War 2 period pronounced that it was the responsibility of the national government to ensure there was enough spending in the economy such that all the workers seeking jobs would be satisfied.

Full employment was the articulated macroeconomic goal and was expressed as the number of jobs that satisfied the desire of workers to work. It was recognised that at any point in time, some workers would be unemployed because they would be moving between jobs. Economists term this sort of unemployment frictional and consider it provides benefits to the economy because it helps to ensure workers are moving into positions where they are best suited.

Frictional unemployment is typically below 2 per cent of the available labour force and so full employment was defined in terms of this very low unemployment rate. You will learn more about these concepts in Chapter 10 when we discuss labour market measurement.

The result of these new understandings from the Great Depression was that from around 1945 until 1975, national governments manipulated fiscal and monetary policy to maintain levels of overall spending sufficient to generate employment growth in line with labour force growth. This was consistent with the view that mass unemployment reflected deficient aggregate demand which could be resolved through positive net government spending (budget deficits). Governments used a range of fiscal and monetary measures to stabilise the economy in the face of fluctuations in private sector spending and were typically in deficit.

As a consequence, in the period between 1945 through to the mid 1970s, most advanced Western nations maintained very low levels of unemployment, typically below 2 per cent.

In Figure 1.x the last part of that period is shown for most nations.

In Chapter 11 we will learn that the stability of this Post-War framework with the Government maintaining continuous full employment via policy interventions broke down in the 1970s.

Following the first OPEC oil price hike in 1974, which led to accelerating inflation in most countries, there was a resurgence of pre-Keynesian thinking. Inflationary impulses associated with the Vietnam War had earlier provided some economists, who had contested the desirability of full employment, with opportunities to attack activist macroeconomic policy in the United States.

Governments around the world reacted with contractionary policies to quell inflation and unemployment rose giving birth to the era of stagflation (the joint incidence of high unemployment and inflation).

From that time until the present day, many governments have not run large enough budget deficits to ensure that overall spending in the economy was sufficient to generate full employment. The result has been the persistently high unemployment in the 1980s and 1990s and again in the current period.

We will discuss the reasons why governments abandoned their commitment to full employment and what options the government has within a modern monetary system for maintaining low rates of unemployment. We will provide a theoretical and policy framework that contests the current orthodoxy which has downgraded the importance of low unemployment.

We will explain how the current debates are really the same as those fought during the Great Depression and the dominant view among policy makers now is really just a reintroduction of the so-called Say’s Law, which claimed that free markets guarantee full employment and that Keynesian attempts to reduce unemployment will ultimately be self-defeating and inflationary. This was the view that Keynes discredited when he demonstrated beyond doubt that spending creates income and output which drives employment growth.

While the current era is dominated by governments who have prioritised low inflation over low unemployment we will show that the idea that at nation with full employment will suffer accelerating inflation is not supported by an understanding of how the economy works.

Mass unemployment still represents a macroeconomic failure that can be addressed by expansionary fiscal and/or monetary policy. We will consider the design of an effective policy intervention in Chapters 13 to 18.

[NOTE: TWO OTHER STYLISED FACTS WILL BE INTRODUCED INTO THIS CHAPTER: (a) the growing gap between real wages and productivity after a long stable period of proportional co-incidental growth; and (b) the dramatic rise in private sector indebtedness in the last 20 or so years]

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

I saw a documentary on British TV about 30 years ago on the great depression and it firmly registered in my mind the first part of the solution being a huge infusion of public spending on works programs. Since then, it was always obvious to me the Government could create full employment and embark on any works programs required to meet national goals. The only puzzle to me was why they didn’t.

Bill lays out the historical facts plainly for all to see. I’m waiting patiently for the rest of the population to cotton on. Still waiting…. Ho dee hum..

Some feedback. In the table, you list Germany. Was that West Germany prior to 1990? After re-unification massive East German unemployment would have dragged up the average. If I am right then you should probably point this out, or leave Germany out altogether. Second, while I enjoy reading the textbook preview, it doesn’t feel entirely dispassionate (though it probaby is). Maybe it’s just me. Is that deliberate, or am I reading too much between the lines?

Anyway, I can’t wait to see the finished copy. Good luck! Cheers.

Dear Bill

If an unemployed person were to offer himself to become your servant for 2 dollars a hour, he would probably find many takers. Normal people will nearly always be able to find a job if they are willing to work for a pittance and accept terrible working conditions. In that narrow sense, the neo-liberals may well be right. That’s why neo-liberals want to abolish the minimum wage and welfare in order to force people to take really awful jobs. However, when we say that people can’t find jobs, we should mean jobs that pay at least minimum wage and that aren’t truly appalling. It sometimes seems that the main interest of neo-liberals is to get people off the public payroll, not to provide them with a decent income and a tolerable job.

Regards. James

The numbers for Germany are indeed just for West Germany till 1990, and switch to the unified country thereafter.

In the DDR ruled a Job Guarantee-like full employment, which obviously crashed after the re-unification, when a large part of the economic base of the DDR was privatized and /or dismantled, with the result that a lot of people were fired or became unemployed, which in turn can be observed clearly in the spike in the early 90s period.

To be fair, one has to note that there were also very generous early retirement packages for quite a few categories of DDR workers, so the unemployment spike doesn’t really capture how much of the workforce in the DDR became inactive.

This combination of generous retirement packages and mass-firing people across relatively small regions combined to put a drag on the post-unification German workforce market, because on the one side you had ever increasing costs for social programs like unemployment or pensions, and on the other side structural concentrated unemployment which turned to some extent into a generation of long-term unemployed which had little chance of regaining high-earning jobs. Fortunately the common language eased this somewhat with mass migration of the workforce, but that caused even more structural problems for the depopulated regions.

Anyway, offtopic story, but such “details” have to be taken into consideration whenever you do long-term graphing and try to read cycles or tendencies from them – in a non-reunified Germany, or one where the DDR would have had the same economic power on re-unification day, I bet that the unemployment spike would have been far less pronounced in the period between 1990 and 2005.

James – They are wrong – wage cuts is *not* a safe recipe for clearing unemployment. Sure, in individual sectors perhaps. But not across the board.

Reason is that wage cuts means decreasing workers’ incomes. That will (likely) lead to decreased spending. That in turn means lower sales for businesses. Lower sales does not go hand in hand with employing people.

Moreover, wage cuts can lead to price cuts. The economy can enter a deflationary spiral.

So the macro-effects of pushing down wages across the board are quite uncertain – contrary to what neoclassical theory may suggest.

When you see it presented this way, we can understand why the monetary system is controlled as it is and why its operations must be obscured.

Intelligent people, willing to work – if they had access to universal means of exchange, why would they need employers in the first place?

Suggestion:

“We will explain how the current debates are really the same as those fought during the Great Depression…”

Should read: We will explain how the debates that arose in the wake of the 2008 financial crisis were really the same as those fought in the Great Depression…”

This will give the book more longevity.

“.. spending creates income and output which drives employment growth.”

But it also creates inflation. The question MMT has to answer is .. what is its interpretation of NAIRU- what is the safe level of non-inflationary unemployment (or JG employment, which is a related concept). Even if this has to be dynamically modelled over the business or financial cycle, there needs to be a statement of safe levels, rather than the vague refrain of .. we can do better.. no inflation till “full” employment … trust us.

Andrei, thanks for your detailed reply re Germany.

Dear Hugo

I agree with you totally. I wasn’t thinking about across-the-board wage cuts, only about creating a low-wage sector for the long-term unemployed.

Cheers. James

“However, when we say that people can’t find jobs, we should mean jobs that pay at least minimum wage and that aren’t truly appalling”

What we’re really saying are jobs that pay enough to obtain resources that allow an individual to live a reasonable, if basic, existence.

In other words we want to stop starving people to death, killing them early with poor housing and inadequate health care and smashing up their communities unnecessarily by forcing them to wander around the world looking for work.

We have the economic knowledge that says that is all unnecessary.

Love these characters willing to kill off the masses so that the richest 1% can improve their lot.

NAIRU indeed.

“However, when we say that people can’t find jobs, we should mean jobs that pay at least minimum wage and that aren’t truly appalling”

There is a subsistence cost of labour and a reproductive cost of labour. It is not viable for someone to labour for wages which do not pay for basic accomodation and sustenance. Also, it is not viable for a social class to work for less than the amount which pays for accomodation, sustenance and reproduction (including support and education). These facts must put a lower bound on the driving down of wages. Indeed, the socially and economically desirable lower bound is considerably higher than the bare reproductive cost of labour. Well paid labour means a healthy level of aggregate demand.

In Australia, the “Harvester Case” (Ex parte HV McKay -1907) established under Justice Henry Bournes Higgins found that a reasonable wage would would allow an average worker with a wife and three children needed to support his family. This led to the concept of the basic wage and later the minimum wage. In a modern, wealthy and enlightened society, the minimum wage ought to cover suitable housing, a healthy diet, proper education, and a general capacity to participate in the benefits of human progress and the social and cultural life of the nation.

In an macroeconomics textbook (McConnell & Brue) I’m reading it shows a graph on labor productivity in the US with a slope of 1.4% average growth from 1973-1995 and a different slope of 2.9% average from 1995-2005. This change is widely ascribed to computerization of manufacturing and back office work. However, productivity is Real GDP/hours of work. And Real GDP is made up of wages, rents, interest, profits and statistical adjustments. Two factors could account for the difference in rates of productivity. One is people are working longer hours. I know this to be true for myself and colleagues in salaried jobs (I’m now retired). Most salaried workers were progressively “required” to work longer and longer hours for no increase in pay from the 90s on. And their work week would be assumed to be 40 hours even when, in reality, it was 50 or 60 hours steadily and up to 80 hours on occasion. Secondly, with the financial sector taking on a greater portion of output in the US the wages and profits of the 1% would have steadily increased from the 90s on. If the wages and profits of the 1% could be removed from GDP then what would the productivity rate look like? Back to 1.4% or even lower?

Since you are going to include the gap between wages and productivity perhaps you could address these facts as part of that problem.

Regards,

John