It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

Some notes on Aggregate Supply

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text by the end of this year. Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

Chapter 9 Introduction to Aggregate Supply

[NOTE: All graphs etc will be professionally drawn rather than plotted using a spreadsheet as below.]

Overview

In Chapter 8, we reinterpreted the theory of nominal effective demand developed in Chapter 7 in real terms. Our theory of expenditure and income determination linked aggregate spending to the generation of income. This focus on the demand drivers of aggregate income and output abstracted from any spending impacts on the price level and assumed that the multitude of firms in the economy were rather passive. They simply responded to growth in nominal spending by increasing real output up to the full capacity level in the economy.

In Chapter 7, however, we noted that the point of nominal effective demand is in fact found at the intersection of the aggregate demand (D) and aggregate supply price (Z) curves. We learned that the point of effective demand occurs where all individual firms are maximising expected profits.

In this Chapter we consider the Z function that Keynes proposed (using what is known as the Marshallian supply price), which abstracts from notions of industrial concentration (or degree of monopoly). The degree of monopoly influences the capacity of the firms to set rather than take prices.

Further, the Z function relates total revenue (income) in nominal terms to employment. As we learned in Chapter 8, this was a reasonable path for Keynes to take because the advances in national accounting were minimal at the time he was forming his ideas made it difficult to formulate a reliable measure of real output (income). Total employment was a more reliable measure of (real) quantity.

However, national income accounting is now very sophisticated and great advances were made in the 1950s and beyond which allow more reliable measures of real (constant price) output. In that context, economists starting to move away from the nominal DZ framework and instead sought to relate real output directly to a measure of the aggregate price level. In this context, an aggregate supply function describes the real output (goods and services) that the firms in aggregate will be prepared to supply at each price level.

The price-quantity (real) version (Chapter 8 ) of the nominal DZ framework (Chapter 7) was developed to help us focus on the demand-side of the economy. In doing so, we ignored the complexity of the supply-side. For example, we abstracted from what might happen after the economy reached its full capacity level.

So we are, as yet, not equipped with a framework that allows us to articulate how the economy responds to a rise in nominal aggregate demand (spending).

When nominal aggregate spending rises the economy can respond in the following ways:

1. Increase real output (this is what we assumed in Chapter 8).

2. Increase prices.

3. A combination of increasing real output and increasing prices.

In this Chapter we seek to develop an understanding of when each of these options might arise in a modern monetary economy and what might be considered to be the usual case. This is an important issue because it influences the way we construct macroeconomic policy in relation to maintaining the goals outlined in Chapter 1 – full employment, price stability and equity.

The first option – increase real output – is sometimes referred to as quantity adjustment while the second option – increase prices – is referred to, in the same nomenclature to be price adjustment. In this Chapter we aim to consider the conditions under which a macroeconomy might be considered to be a quantity adjusting economy as opposed to the conditions that would lead us to conclude the economy is a price adjusting one.

The theory we develop in this chapter will therefore complete the demand-side model that we developed in Chapter 8 to allow us to determine the real output level, the price level and total employment.

[MORE INTRODUCTORY MATERIAL HERE ON CONCENTRATION, INDUSTRY STRUCTURE ETC …. ]

Some introductory concepts

The concept of schedules and functions

In Chapter 4 Methods, Tools and Techniques we introduced the essential analytical and introductory techniques that students should learn in order to grasp macroeconomics.

As a reminder, economic models use schedules or curves to depict behaviour, which can either be ex ante (prior to action and reflects planned or desired action by households, firms, government etc); or ex post, which represents actual outcomes that are the result of action.

In the most simple macroeconomic model of expenditure, income and employment we encounter an aggregate demand schedule and an aggregate supply schedule. These schedules depict ex ante behaviour and tell us what the outcomes will be given other conditions in the economy. In this Chapter we will considering aggregate supply schedules.

The terms – schedule and function – are used interchangeably in the economics literature. We prefer to use function to depict a relationship between variables of interest – such as spending and income.

The employment-output function

To develop a theory of employment – that is, explain its level and movement over time – in relation to a monetary economy operating under capitalist conditions, we need to develop and understanding of how employment is related to output determination. We focus on that question in more detail in Chapters 10 and 11 but for now we need to consider this relationship because it impacts on cost movements in the economy. In this context we develop the concept of the Employment-Output function, which shows the how much labour is required to produce a given volume of real output.

Assume that the amount of labour that a firm hires is determined by the amount of output that they plan to produce. This decision is made in an environment of stable wage rates and capital-labour ratios. The capital-labour ratio depicts the combination of productive capital (machines, equipment, etc) and labour that defines the current productive technology.

For example, an excavation firm might provide a hand shovel to each worker engaged in digging foundations for a new building. This would be a low capital-labour ratio production technology. Sometimes this is referred to as a labour-intensive technique.

Alternatively, it could use mechanical digging equipment and employ less workers to produce the same output. In this instance, the production process would employ higher capital-labour ratio techniques – sometimes referred to as capital-intensive production.

We can write the employment-output function as:

(9.1) Y = αN

where N is the total number of workers employment, α is the rate of labour productivity, and Y is planned output (based on expected spending), which is equal to the actual income generated in the current period. Firms produce based on expected aggregate spending and once all the sectors have made their spending decisions (that is, once aggregate demand is actually realised), the firms discover whether their expectations were accurate or not. That is, they discover whether they have overproduced, under-produced or produced according to the spending actions realised.

What is labour productivity? Labour productivity is defined as output per unit of labour input. So we could solve Equation 9.1 for α to get Y/N, which is the algebraic equivalent of our definition.

The higher is labour productivity (α) the less employment is required to produce a unit of output for a given production technique (implicit in α).

Factors which influence the magnitude of α include: technology (whether it is best-practice, capital- or labour-intensive); worker skill and motivation; and management skill and business organisation. Often in the public discussions about slowing productivity growth there is an undue focus on the worker with claims such as poor motivation and skill gaps. Rarely is management skill the focus of enquiry despite evidence that poor management decision-making is a cause of slow productivity growth. For example, failure to invest in the latest technology.

As an example, the Australian airline Qantas dominated the international travel market for Australians travelling abroad. In the late 1970s the airline carried around 42 per cent of Australian travellers abroad. By 2012, this proportion had dropped to 18 per cent as competition from airlines such as Emirates and Singapore Airlines has cut into its market share. There are many reasons for this decline in market share but one of the major explanations is that Qantas management made poor decisions with respect to its fleet upgrades and refused to invest in the latest jets which are more fuel efficient and hence can operate at lower costs.

If α is stable in the short-run (within the current investment cycle) then once the firm decides on the level of output to produce, to satisfy expected demand, it simultaneously knows how many workers must be employed.

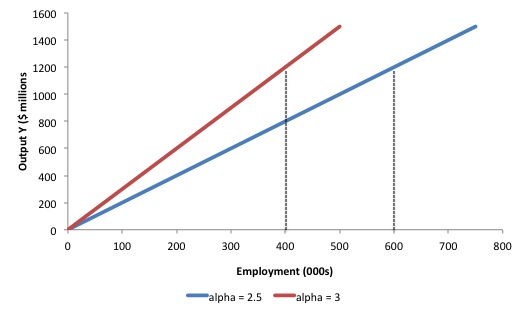

Figure 9.1 shows the two different employment-output functions, both are proportional (that is, straight lines) but positively sloped (according to the size of α).

If the firms expected demand for its output would be $1200 million in the current production period, then given the state of technology (represented by α) it would employ 600 workers if α = 2 (lower productivity) and 400 workers if α = 3 (high productivity).

Figure 9.1 The Employment-Output function

Money wages

In Chapter 10 we will consider wage determination in detail. For now we use some simple, but realistic assumptions to motivate the analysis in this Chapter.

A useful short-run assumption therefore is to assume that money wage rates are exogenous in the short-run. This is not the same as assuming that money wage rates never change. It merely says that, in terms of the parameters of our aggregate supply model (that is, the different influences we will consider that impact on aggregate supply), the money wage rate will be assumed to be invariant in the short-run.

Before we discuss the possible factors which make this a reasonable assumption to make we must first clarify some, often-confused concepts relating to wages.

We distinguish between the money wage rate and the real wage rate.

The money wage rate is determined in the labour market and is the amount, in nominal (current dollar) terms, that the workers receive per hour when they sell their labour power to the capitalist business firms or other employers (for example, government). The actual money wage at any point in time is the outcome of agreements reached between employers and workers, either one a decentralised negotiated basis or through sector- or economy-wide negotiations. In some nations, such as Australia, there has been a history of wage setting tribunals (courts) which place the determination of wages into the judicial jurisdiction, reflecting the adversarial nature of relations between workers and capital.

The wage outcome at any point in time is heavily dependent on the bargaining strengths of the parties involved. Wage changes occur at infrequent intervals and condition the behaviour of the parties concerned for the ensuing economic period (sometimes months, usually years). It is this infrequent nature of wage setting via institutional structures (such as, employer-union negotiations) and the implied contractual nature of the wage relationship existing between employers and workers over some future period, which is used to justify the assumption that wages are exogenous in the short-run for the purpose of developing an explanation of aggregate supply.

The real wage rate is the money wage rate deflated by some price index. We learned how deflators are constructed and are used to convert current price variables into constant price (real) variables in Chapter 4 Methods, Tools and Techniques.

The choice of deflator depends on the context. The real wage, may from the perspective of the worker be the money wage expressed in terms of real consumption good equivalents. So we would consider this rate to be the money wage rate divided by the measure of consumer prices (the CPI).

From the employer’s perspective, the real (product) wage is more accurately measured by the money wage paid to workers divided by the specific price the firms receives for its output which is a more narrow concept than the real wage considered from the perspective of the worker.

Importantly, contrary to what most mainstream textbooks will suggest, the real wage is not determined in the labour market and can only be influenced by the workers in as much as they can influence the money wage rate outcome.

The real wage is a ratio of two prices – the money wage (determined in the labour market) and the consumer price level (determined in the goods and services market). The two prices which form the real wage rate are determined by different forces in different markets in the economy.

As we will see, prices are assumed to be set by business firms in the goods and services (product) market according to desired mark-ups on cost. Prices are not fixed by workers.

Often economists and others suggest that workers should cut their real wages to improve the employment prospects of the unemployed. We will examine the logic of this proposition in detail in Chapters 10 and 11 and conclude that the policy suggestion is without merit. But as a precursor to that discussion, even if the proposition was based on a causal understanding of how mass unemployment occurs, there are several preliminary, but critical questions that such proposals fail to answer.

How can workers achieve a cut in their real wage when all they can do is influence the money wage outcome?

How might a money wage change influence price changes?

Might a money wage cut also provoke price cuts as costs of production fall, and thus leave the real wage unchanged?

These initial queries are quite apart from the dispute among economists as to whether a real wage cut would influence employment growth independent of changes in effective demand. That question is addressed in later chapters.

What is the basis of the money wage inflexibility assumption? There is strong evidence that workers resist cuts in money wages and firms, generally prefer not to offer such cuts. Only in extraordinary circumstances relating to the imminent collapse of the enterprise in they are employed and the existence of very high levels of unemployment have we observed workers agreeing to money wage reductions.

The downward rigidity of money wages is also the result of employer preferences. Even when the unemployment rate approaches double figures (a rate considered high by historical standards), the absolute number of workers not in employment relative to those who retain their jobs is small. As such, employers are reluctant to risk jeopardising convivial industrial relations with this large number of workers to improve the fortunes of a small proportion of the labour force.

We consider these issues in more detail in Chapter 11 Unemployment and Inflation and Chapter 17 Keynes and the Classics.

Keynes aggregate supply price (Z) function

Before we consider the way in which the economy prorate nominal aggregate demand between real output and prices we consider the aggregate supply price model that Keynes developed in his General Theory, which complements the effective demand analysis that was presented in Chapter 7 Introduction to Effective Demand – Nominal D-Z analysis.

The goods and services market of the economy is where output is produced and sold. Sometimes this is referred to as the product market. In Chapter 5 The National Accounting (NIPA) Framework, we studied the way the national statistician measures the aggregate activity that occurs in the goods and services market. We saw that total nominal (current price) output (or GDP) can be expressed simply as PY, where P is the aggregate price level and Y is total real output.

So the total market value of output produced in the economy in any period is expressed as the total real output produced valued by the aggregate price level.

This is our starting point. Later in the Chapter we will separate out the two components – price and quantity – to develop an understanding of the questions posed at the outset of this chapter – how does the economy respond to a rise in nominal aggregate demand in terms of output and prices.

But first we consider how Keynes considered the relationship between total revenue (income) – PY – and employment.

Chapter 3 of the General Theory is entitled “The Theory of Effective Demand” and the discussion that follows provided the basis for the basic macroeconomic of output and income determination that you will find in most textbooks.

Keynes said that when a business firm hires labour they will incur “two kinds of expense”. These labour costs are:

- The factor cost – the amounts the firm has to pay the workers; and

- The user cost – the amounts the firm has to pay other firms for capital inputs.

The amount that the firm receives by selling the resulting output over the sum of these costs is their income or profit. The factor cost is the income of the workers. So total income is the sum of profits and factor costs.

Keynes argued that the motivation of the business firm when employing workers is to maximise the profit it receives from the output they produce. In that context, we might consider aggregate or total income which is derived from each level of employment to be the “proceeds of that employment”.

From another perspective, Keynes said that:

… the aggregate supply price of the output of a given amount of employment is the expectation of proceeds which will just make it worth the while of the entrepreneurs to give that employment.

This idea provides the basis for his aggregate supply price function which indicates, for all the possible employment levels, how much revenue (income) the firms would require to render each employment level consistent with profit maximisation.

Clearly, we could vary the profit maximisation objective to incorporate different aims regarding margins. But that complexity is not germane at this point.

In constructing the aggregate supply price function, Keynes assumed that production techniques, resource availability and the money wage rate were given. Under these conditions, firms thus

… endeavour to fix the amount of employment at the level which they expect to maximise the excess of the proceeds over the factor cost.

Accordingly, Keynes defined his Aggregate Supply Function, Z to be the “aggregate supply price of the output from employing N men” and the schedule was written as Z = φ(N).

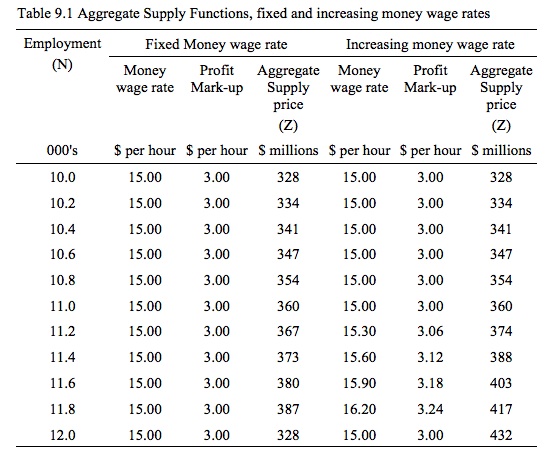

As a practical example consider the data in Table 9.1 which describes the derivation of an Aggregate Supply function under two assumptions about money wage rates.

Columns (2) to (4) assume a constant money wage rate of $15 per hour and that there are 52 working weeks in the year. Each working week is 35 hours so that a full-time worker is engaged for 1820 hours per year in employment. Firms, in turn, require a 20 per cent profit return on total costs (which in this example are total labour costs). So when money wages are fixed at $15 per hour, firms require a profit mark-up of $3 per hour.

By way of interpretation, for the economy to employ 11 million workers, the business firms in total would require $360 million in total revenue per year to cover their total labour costs ($15 per hour times 35 hours per week times 52 weeks in the year) plus their desired profit mark-up on per hourly wage.

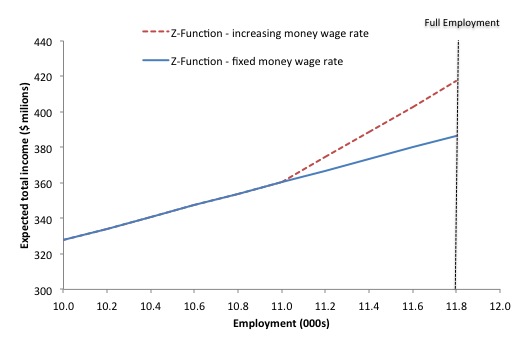

Figure 9.2 captures this data in graphical form with the solid line depicting the fixed money wage rate assumption. Under this assumption, the slope of the Z-function is upward sloping because when money wage rates are fixed the total costs of employment rise as more workers are hired. Firms will thus require more sales revenue (proceeds or total income) at each level of employment to ensure they can cover their costs of production and generate the desired profit income.

The schedule might also slope upwards (even more steeply than the fixed money wage rate schedule depicted in Figure 9.2) if firms have to pay higher wages as employment rises and unemployment falls. The data depicted in Columns (5) to (8) of Table 9.1 reflects this possibility with full employment assumed to be 11.8 million. We assume that after employment reaches 11 million, firms pay higher hourly money wage rates as shown in Table 9.1, which has the effect of increasing total labour costs

In this case, the Z-function would become steeper – see the dotted line in Figure 9.2.

The faster the money wage rate rises as the economy approaches full employment the steeper would the Z-function become and the less responsive total employment would become to a given change in expected total income. Once the economy reaches full employment the Z-function would become vertical because no further employment could be offered.

Figure 9.2 Aggregate Supply Function (Z) under different money wage rate assumptions

Some economists argue that costs rise even more quickly than the possibility of rising wages as employment increases. This relates to the issue of whether there are increasing or decreasing returns.

In the General Theory, Keynes adopted the Classical view that firms faced increasing costs (decreasing returns) driven by the assumption of diminishing marginal returns. That is, productivity declined as employment rose given the fixed supply of capital. We will return to this issue in Chapters 10 and 11 when we study the labour market in more detail.

As we saw in Figure 9.1, we adopt the operational assumption in this Chapter that returns are constant.

The point is that if productivity declines as employment rises then the Z-schedule will become steeper as activity increases independent of what happens to money wage rates.

MORE HERE

Later in this Chapter we will reconstruct the aggregate supply side of the economy in real terms and relate price and output.

Conclusion

The next part of this Chapter considers the impact of industrial structure and concentration on price setting; various price setting models and an explanation of mark-up pricing which is a Post Keynesian staple; the implications for price setting for the derivation of a price-quantity (real) aggregate supply function; the correspondence between the nominal DZ version of aggregate supply and the real aggregate supply function; and a discussion of the way the mark-up, real wages and inflation are mediated by (class) conflict expressed as an on-going nominal struggle over the available real output.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. I hope everyone gets a 5/5 outcome.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

A comment or two:

(1) “As an example, the Australian airline Qantas dominated the international travel market for Australians travelling abroad. In the late 1970s the airline carried around 42 per cent of Australian travellers abroad. By 2012, this proportion had dropped to 18 per cent as competition from airlines such as Emirates and Singapore Airlines has cut into its market share. There are many reasons for this decline in market share but one of the major explanations is that Qantas management made poor decisions with respect to its fleet upgrades and refused to invest in the latest jets which are more fuel efficient and hence can operate at lower costs.” — You should consider putting examples such as this in boxes and then reference them in the main body of the text. It would be great if you could put in lots of examples as this would give the book a lot of colour.

(2) For example, you could also pull out stuff like this: “In some nations, such as Australia, there has been a history of wage setting tribunals (courts) which place the determination of wages into the judicial jurisdiction, reflecting the adversarial nature of relations between workers and capital.”

(3)

It’s all a matter of personal preference of course but I hate books with boxes in them (as per the above suggestion). However, used judiciously and sparingly boxes could be OK in a textbook. I would prefer the boxes to be limited to formulas and summations of key points and not used for examples. Tables and graphs are “natural boxes” in any case, of course.

Greetings, Bill.

Is the book on MMT you are preparing jointly with L. Randall Wray the one Wray announced in his own website (‘Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems’, by L. Randall Wray , Palgrave Macmillan, ets. date August 2012) or something else?