It's a big data week for me and today's post is more of a news…

US government is undermining its own people

I read an article in the UK Guardian over the weekend (July 14, 2012) – Scranton, Pennsylvania: where even the mayor is on minimum wage – which told a sorry tale of municipal bankruptcy in the US. There was an earlier story in the UK Daily Mail (June 26, 2012) – Camden, city of ruins: Depressing images of once-thriving metropolis reduced to decaying, crime-ridden rubble – that traversed similar terrain, except carried a number of graphic shorts of urban decay in the face of persistent recession. What these articles tell me is that the US Federal system has failed its people. The rigid balanced budget rules at the State level and the ideologically-driven unwillingness of the Federal government to use its currency powers to redress the damage caused by the application of those rules at the State level have combined to create wastelands across the urban landscape in the US. The damage that is being caused each day will haunt that nation for years to come. Meanwhile, the ideologues are trumpeting a new book about 4 per cent solutions that claim large-scale government cutbacks are needed to re-create the US as a great nation. From afar, one can only conclude that the US glory days (whatever they were) are passing – probably more quickly than they care to acknowledge.

The Guardian article predicted a:

… a wave of municipal bankruptcies is set to sweep the United States as towns, cities and counties plunge into a fiscal black hole, collapsing under the weight of huge debts and reduced revenues.

It is one of many reports that are emerging of once-thriving urban areas becoming unviable wastelands as employment dries up and state and local governments turn off the lights, sack the teachers and cops, and close down medical facilities.

This October 2011 Report – At the Edge: A Survey of New York State School Superintendents on Fiscal Matters – is truly staggering.

It tells us that in that state along, “schools absorbed one of the largest state aid cuts in history … [in 2011-12] … But 2011-12 is the third tough year for school budgets, not the first: 90% of districts are getting less help from the state than they were three years ago.”

Job cuts are escalating in New York State:

Districts reduced their workforce by an average of 4.9% this year; other, non-teaching student support positions took the steepest cuts – 8%. Position reductions were generally steepest among city and rural districts. These are reductions on top of those taken in prior years.

The story is repeating across the nation. The problem is not just an over-indebted private sector that has lost its thirst for credit and are not spending enough. It is not that the US manufacturing base is disappearing because US firms are increasingly exploiting cheap labour elsewhere.

The problem is that the US government is not reacting to these developments and seeing that they have a major role to play in providing a buffer to the non-government demise – to steer the economy through the private downturn and to minimise the overall job losses.

The problem is that the US government (at all levels) is deliberately undermining the growth of its own economy and destroying millions of jobs. In doing so it is worsening the problems associated with the ageing society.

It is cutting education services which are the one major source of future productivity growth for the nation. Skilled labour does not emerge from a schooling system being cut to threads by the mindless application of erroneous budget rules.

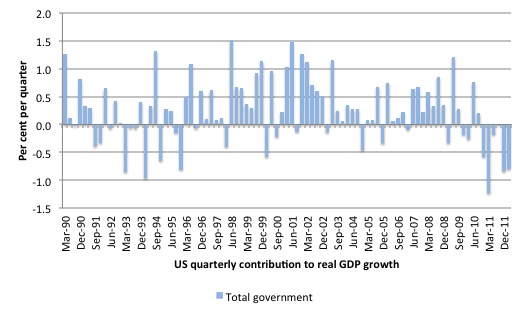

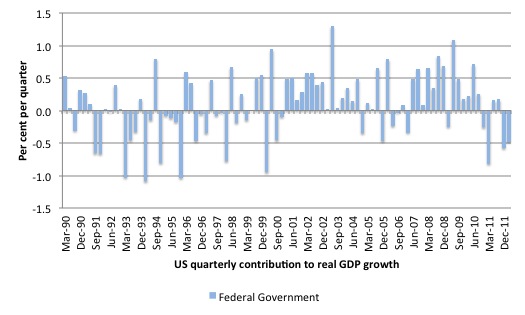

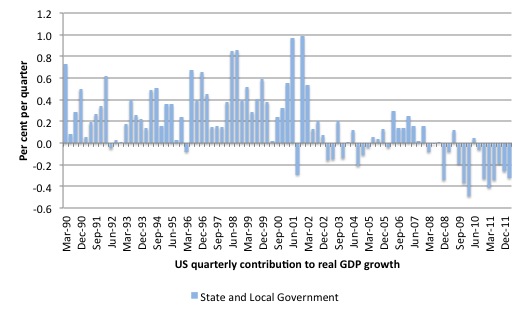

Contributions to real GDP growth by Sector

The following sequence of graphs are derived from the US Bureau of Economic Analysis and shows the contributions to quarterly real GDP growth in the US since the March-quarter 1990 to the March-quarter 2012 by government level (total, federal and state/local in order).

Since late December 2010, the overall government sector in the US has been undermining real GDP growth as its dysfunctional Congress battles for ground on which party can do the most damage.

The federal level has been a negative contributor to quarterly real GDP growth for four out of the last six quarters. The situation is even worse at the State and Local government levels.

Since March 2008, state and local governments together have been negative contributors to real GDP growth in 14 of the 17 quarters, and every quarter since September 2010.

If you also consider the previous recession periods since 1990, both levels of government were running counter-cyclical strategies (contributing positively to growth) in contrast to the present recession.

This is especially so when you consider the State and Local governments.

So as the private sector struggles to build momentum, the support that is typically (and correctly) provided by the public sector in the early phases of recovery has been absent in this crisis.

State and Local government revenues cannot expand when their economies are stagnating or recessing. It is a myopic strategy to attempt to run budget balances by cutting spending in a downward chase of cyclically declining revenue. We have several years of data to confirm that proposition.

While many (most) states are tied by balanced budget legislation (which I urge them to repeal and allow themselves fiscal freedom) the solution to their declining tax bases was clear.

The Federal government which has not such legislative constraint should have engaged in significant transfers to the states to ensure that state and local employment and activity was maintained during the crisis.

While I am extremely critical of the Eurozone for designing a flawed monetary union from the outset that was always destined to fail once it was hit by a large negative aggregate demand shock, the US system is not doing that much better. However, the Europeans will have to alter their entire monetary system to overcome its intrinsic flaw if it wants to avoid a worsening situation.

In the case of the US, all that was needed was some responsible federal fiscal policy initiatives to buffer the declining state revenues and allow these non-currency issuing levels of government to maintain employment.

The fact that the US government has largely failed to do that is an indictment of their fiscal irresponsibility.

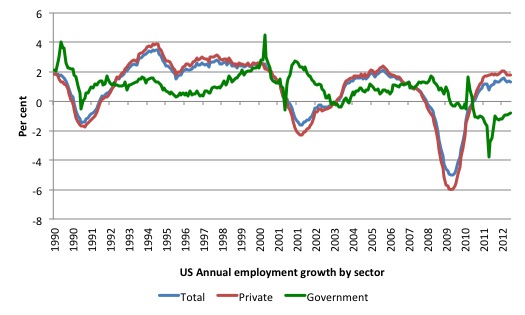

US Employment by Sector

The appalling performance in terms of contribution to real GDP growth by the government sector in the US during this crisis has not only allowed the downturn to be deeper and longer than otherwise would have been the case had the government acted responsibility but it has also manifest in a dramatic plunge in public employment.

Responsible fiscal policy should be counter-cyclical. Governments in a fiat-currency system should never cut employment when the private sector is engaging in employment contraction.

The following graph shows the annual growth of employment by sector (total, private and government). The data is from the US Bureau of Labor Statistics.

It is clear that the public sector overall acted in a counter-cyclical manner with respect to employment (the trough in total is less than the private trough) but has failed so support growth since that time.

Public employment in the US has been contracting overall since September 2010 – which is an astounding result given the extremely high unemployment in that nation.

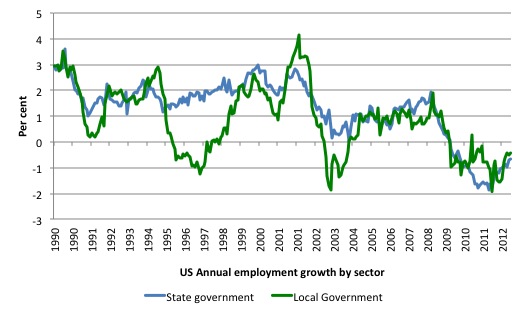

The next graph shows the annual growth in State and Local government employment since the March quarter 1990

To add to this analysis, I assembled some other information, to allow me to understand the scales involved a bit better.

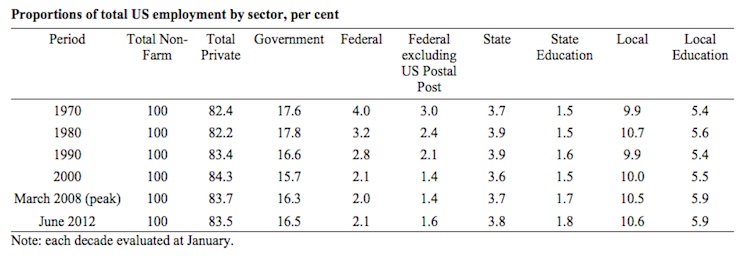

The following Table shows the proportions of total US employment by sector (evaluated for each decade at January). March 2008 was the most recent peak in total employment.

What I found interesting is that, despite claims that the public sector is becoming increasingly large, the evidence suggests that it is not even keeping its proportional employment stake. Most stark is the drop in US Federal government employment shares – from 4 per cent of total employment in January 1970 to 2.1 per cent now.

There has been some small increase in the proportions of employment in State and Local governments over the same period. But overall, the US is still dominated by private employment.

How has this translated into employment?

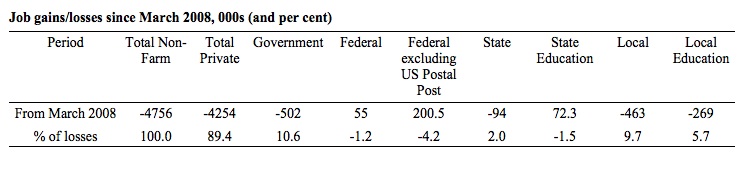

The following Table shows the gains/losses in employment by sector (thousands) and the share of the total employment loss since the crisis began in March 2008 in the US.

The dramatic loss of jobs in the private sector is clear. Well above their share in total employment. The loss of government jobs is lower than their share but still large.

Overall, the federal government has slightly expanded its employment adding 55 thousand jobs since the downturn started in March 2008. But you can also appreciate the losses in the US Postal service over the same period.

The real employment damage is being done in the State and Local government areas (particularly in provision of local education).

Taken together the state and local government 557 thousand jobs over the recession – a pro-cyclical response to the private sector spending collapse.

This New York Times article (Novermber 29, 2011) – As Public Sector Sheds Jobs, Blacks Are Hit Hardest – is one of many that details the human face of this government failure.

It is one of many that have emerged during the crisis to document the losses on the ground that are now pervasive in the US (and worldwide).

The article describes a bus driver who:

… is one of tens of thousands of once solidly middle-class African-American government workers – bus drivers in Chicago, police officers and firefighters in Cleveland, nurses and doctors in Florida – who have been laid off since the recession ended in June 2009. Such job losses have blunted gains made in employment and wealth during the previous decade and undermined the stability of neighborhoods where there are now fewer black professionals who own homes or who get up every morning to go to work.

The article notes that “the recession and continuing economic downturn have been devastating to the American middle class as a whole … [but has] … been singularly harmful to middle-class blacks in terms of layoffs and unemployment …”

Conclusion

The pro-cyclical government cutbacks have introduced a vicious circle of income loss, saving loss, wealth destruction, continuing real estate crisis, loss of state and local revenue, further cutbacks according to the application of their inappropriate fiscal rules (balanced budget amendments).

The pro-cyclical nature of state and local government employment is one of the principle reasons the US recession has endured and will ensure the long-term damage to that nation’s vitality and ability to provide high quality services to its people.

The reasoning in the public debate about the future consequences of government budget deficits is wrong-headed. The capacity of the US to provide for an ageing society amidst the long-term decline in its industry doesn’t depend on cutting in to public spending now – which is patently causing law and order to deteriorate, the standard of public education and health to slip.

Exactly the opposite response is required. Schools need to be revitalised. Communities need to be sure the streets are safe so that businesses will have an incentive to invest. People need to be mentally and physically well.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Bill, you missed out the bit about the public sector trade unions with their Mafia style pay claims; 90% pay as pension and the lifetime private medical insurance that is bankrupting Counties and Municipalities. Did you miss the one about the Orange County Firemen on $175,000 a year; or, the $100,000 a year public swimming pool attendants?

[Edited by BILL – I deleted the reference to a site that was making extreme claims not verifiable from the publicly-available data]

And you wonder why you are having problems selling MMT to people like me?

Just to fill in a few more factual details, in support of Bill’s blog, the following U.S. cities are visibly disintegrating – on an ongoing basis – in the face of the combination of municipal spending cutbacks, bankruptcies, growing unemployment, loss of local population, large-scale building vacancies, deteriorating infrastructure, and soaring record crime rates. In short, they are all being transformed into hell holes.

Chicago, Illinois

Detroit, Michigan

Cleveland, Ohio

Baltimore, Massachusetts

St Louis, Missouri

New Orleans, Louisiana

West Philadelphia, Pennsylvania

Gary, Indiana

Flint, Michigan

Stockton, California

Oakland, California

Camden, New Jersey

And look at our choices for President, Dumb and Dumber. Which is which?

Dear Acorn (at 2012/07/16 at 19:18)

I didn’t miss anything. My blog was about employment losses in a federal system which behaves poorly.

You should also check broader (and credible) data sources before believing the information from the site you linked to. Standard recruitment data tells me that firefighter salaries are quite low in fact. A senior firefighter manager in Orange Country gets around $US60-62k per year, a lead firefighter (a specific classification) gets around $US53 thousand in Orange County, a regular firefighters gets in the low $US40k range and a Wildland Firefighter in Orange County gets down around $US24k per year.

And I should add – I do not believe in selling education.

best wishes

bill

Great post, Bill!

As always.

I think if someone deserves the Nobel Prize in economics it is you.

However, I have a doubt: Can the federal, state and local governments in the US legally lay off public employees at will or cut down their salaries?

In Brazil the law forbids it, which in my opinion is good. And absolutely necessary.

I agree with Bill. The US is in serious decline. The refusal to allocate adequate funds for public administration and services and the refusal to deficit spend in a recession are both pushing the US down. It is doing serious and unecessary damage to itself. I see no sign that the US political system can respond correctly to this crisis. The US is not a democracy, it is a Republic (of the Rich) geared for plutocratic, oligarchic rule and interests only. As such, it has no way, no will and no intention to respond to a crisis of the poor and middle classes.

Collapse or revolution (peaceful or bloody) are the ONLY possibilities. Ultimately, collapse is the most likely. Peaceful change will not be permitted and forceful opposition will be smashed ruthlessly. The natural limits to growth tip the balance towards complete collapse. As the US crumbles, the EU stumbles and thr BRICs realise they cannot grow much more in a resource limited world, global affairs will become highly unstable.

If New Zealand were more geologically stable, I would go there to live. Failing that, a move to Tasmania might be the best bet. Any quiet place as far from the northern hemisphere and other continents as possible.

Ikonoclast,

Why do you have to go to NZ? You just need to away from population centers with enough land for food sufficiency. If you are not the fighting type I’d stay away from choice agricultural land. I reckon going bush in Queensland might be your better option.

The United States, like Europe, is crippled by fears of inflation. Until the one percent in both regions are taught that low unemployment will not produce high inflation, the governments they own will not take action to reduce unemployment.

Bill, scheduled salaries are the last place you should look. Have a read of what the Orange County Grand Jury said. http://taxdollars.ocregister.com/files/2012/06/ocfa_salaries.pdf . To be middle class in the US, you have to be in a public sector job at “union” rates. The OC Register also commented http://taxdollars.ocregister.com/2012/06/28/steep-firefighter-pay-violates-law-of-supply-and-demand-grand-jury-says/158004/ .

Bill – You know you’ve hit the big time when the right wing starts sending over its paid provocateurs. (Obviously, they’re not yet sending over any that are well paid.) It speaks volumes to your theme here that some are reduced to such lowly acts in their desparate searches for income.

An interesting speculation on what is going wrong in the US: “Conservative Southern Values Revived: How a Brutal Strain of American Aristocrats Have Come to Rule America“.

Dear Acorn (at 2012/07/17 at 2:20)

The Grand Jury document you provided is very useful. But it doesn’t say anything about firefighters receiving $175,000 a year either individually or as the pay norm. It says that pay rose above the CPI.

The pay increases documented were probably still below the escalation in “Wall Street” salaries, commissions and bonuses (that is, salaries in the financial sector). And as we know – when the bankers got themselves into trouble who kept their companies solvent – the US Federal government via bailouts.

There are rent-seekers everywhere – unionised and non-unionised. It doesn’t negate one insight that Modern Monetary Theory (MMT) provides.

best wishes

bill

Frederico Carvalho: Yes, govt employees can be laid off in the US. What is happening now is the govt is choosing not to do so, yet are unable to make payrolls (at least at state and local levels). We do have a law that compells employers to make payroll for work performed.

The ideology of the market and free enterprise,when taken to extremes,is just as damaging as the ideology of communism. The US is not the only nation with a dysfunctional political and economic system. Australia is not far behind. The US is somewhat different in that the capitalist ideology has permeated down to lower income levels.This is unusual and has been commented on by many American writers including the redoubtable Joe Bageant – “Deer Hunting With Jesus” and “Rainbow Pie”.

re Ikonaclast et al – you surely are not such cowards as to desert your country in its hour of need.

citi: “deficit spending does not matter for growth”

Does the fiscal cliff matter for interest rates?

Great post. Unfortunately, many wealthy and upper middle-class Americans can avoid many of the problems caused by economic and social collapse by retreating into gated communities. Didn’t John Kenneth Galbraith predict that something like this would happen in the United States? The country would become a land with

islands of great wealth surrounded by oceans of misery.

Always best to got to the source for data, New York State Office of the State Comptroller.

Snapshot of the New York State Common Retirement Fund

http://www.osc.state.ny.us/pension/snapshot.htm

Average Pensions:

Average pension for all ERS retirees in FY 2011: $19,151 = non-fire & police

Average pension for all PFRS retirees in FY 2011: $40,932 = Fire & police

California

http://www.calpers.ca.gov/index.jsp?bc=/about/facts/home.xml

http://www.calpers.ca.gov/eip-docs/about/facts/retiremem.pdf

Which is not to say there are not outliers who abuse the system.

Thanks for your help, Zedaneski.

But you wrote: “We do have a law that compels employers to make payroll for work performed.” I didn’t quite understand the meaning of the sentence. What does it signify? If a work is performed to the benefit of someone, at his request, it must –of course– be duly paid. Every country in the world has a like law. But what has it to do with public jobs in the US? Could you please clarify?

You say the federal, state and local governments in the US have the power to arbitrarily sack public servants, but at least the federal government has chosen not to (why?).

If that is indeed so, then it is awful for the public purpose, because public employees become prone to be coerced, blackmailed by (at least one hopes) transitory politicians and political nominees for high public office, with their occasional particular agenda.

In Brazil, all non-elected available public offices are constitutionally obliged to be filled only through public contests of specific and generic knowledge. If the candidates pass the exams and enter public service, then they have secure jobs for life, except if they indulge in gross misconduct, according to an in-house commission of inquiry. So, they constitute the permanent meritocratic burocracy, ie, the permanent government. The elected and their nominees, by definition, the transient government. So, public officials in Brazil are constitutionally protected against potential political abuse from transient politicians. And that is undeniably positive for the public good.

Nowhere in Acorn’s posts or links are the actual current firefighter wages listed. The wages Bill reported seemed modest for the work involved. Also, it is not mentioned what pay base the firefighters came off in the 1990s. If it was a low base then percentage rises above the CPI would only move the pay from low towards modest or reasonable. The fact that actual wages were not mentioned and wage comparisons with other forms of work were not made seems to indicate that the Grand Jury was cherry picking its “Facts”.

It is worth noting that in California: “These county-level grand juries primarily focus on oversight of government institutions at the county level or lower. Almost any entity that receives public money can be examined by the grand jury, including county government, cities, and special districts. Each panel selects the topics that it wishes to examine each year.”

It would be intriguing to know the politics and politicking surrounding the California GJ system. It almost certainly operates at the behest of rich landed and monied interests and against the interests of working people. One suspects that GJ membership is rigged and tampered with in various subtle manners and directed to many of its findings. This would be par for the course in the totally corrupt US system of governance.

In regards to what Orange County law enforcement has garnered in regards to income, there are some individuals who have made substantial incomes — in the upper ranges listed, but they have also worked substantial amounts of overtime, and I believe the questions are not if they should have been compensated the way they were — they worked those hours — but rather whether it was healthy and within the best interests of public safety to have worked the number of hours, and specifically back to back hours they worked. The incomes these people have attained do affected their retirement packages, but then again these are decisions the county has chosen to take — decisions I might add that are taken by a county run by Republicans. That county has a long history of supporting law and order and having a high regard, at least rhetorically for is law enforcement officers, and has structured pensions that on the face are generous for the public sector, but then has not necessarily provided the funding for them — this despite it being one of the wealthiest counties in the US. The county has never wanted to tax itself conmensurate with the services it has wanted to provide.

This goes for California as a whole. I’m live in the state and know Orange County well, as well as much of the rest of the state, and as a whole the state has never seen a tax cut it didn’t like and a service it didn’t want. The state regularly votes for services without any sort of funding, and regularly turns down additional sources of funding or changing the tax structure. While I don’t disagree with Bill’s analysis that the federal government should and could well, and should provide additional funding to cover short falls during a recession, the state’s themselves, balanced budget or not, can’t fund themselves by printing money — they are dependant on what revenue they raise by taxes. This may or may not be a good thing, but they do have to borrow on the open market — unlike the federal government.

The problem in California is that since proposition 13 in the late ’70’s changed the property tax structure, but not change in services as the state payed out of the surplus it had at the time, there has been a growing disconnect between how the state raises revenue and how it provides services. The end result is a mentality where people believe they can have more and more services while paying less and less for them.

@Tyler Healey The 1% knows that low unemployment doesn’t cause inflation. That’s just the excuse they tell the media for their policies. They have much better reasons to keep unemployment high. High unemployment makes it harder for workers to find replacement jobs if they get fired, so workers are willing to work harder for less because they fear being unemployed. Greenspan even had a name for it: the “traumatized worker.”

Salaries $147.6 m; + Employer Pension Contribution $56.9 m; + Private Medical Insurance; worker compensation and Medicaid Heath Insurance $23.6 m. Total salaries and employee benefits = $228.2 m. Number of employees 1176 – $194,000 dollars each. http://www.ocfa.org/_uploads/pdf/sr_bf120111-packet.pdf . Average gross pay $145,000. Overtime pay of some individuals $30,000; i.e. $175,000 per annum.

Bill focuses on a number of mechanical problems and issues, but there is a more fundamental reason for this decline. America’s ruling class (I know it is heresy to even use the term) has failed it. Too many of our leaders are either incredibly selfish or incompetent or both. There have always been ‘leaders’ who fit that description, but the percentage is high now. You can look at the financial sector as a prime example … Bankers were once respected for their probity and conservative nature. Now, we have a large fraction of them that can only be described as sociopaths.

Why does a country like Mexico stay down decade after decade? Because too many of its leaders care only for themselves and basically don’t give a sh*t about their country. The US has been heading in that direction for at least 30 years.

Social mobility is rapidly declining in the US. I would not count on revolution. Technology has raised general standards of living so high, that although the great majority of people could and should, be living much better, they are not miserable enough to go into the streets and fight.

The US was in a somewhat similar condition in the 1920’s. In that case the depression and WWII, caused a huge change in society (for the better). We started drifting back to 1920’s style inequality about 30 years ago. I had some hope that the latest upheaval would see a shift back to a bit more fairness, but that is clearly not going to happen. It’s not evident what difference he might have made, but early comparisons of President Obama to President Roosevelt were obviously erroneous.

So we now have a choice between a Presidential Candidate who will give Wall Street 95% of what it wants, versus and actual creature of Wall Street who will give them 100%.

Science and Technology continue to advance, so we can hope that even with ridiculous levels of inequality people will live decently. What is sad, is the brilliant child born into our new ‘lower classes’ who won’t live up to his/her potential. That is not to say that such a person can’t rise above their background (we are not a rigid class society yet), but the chances are less than they should be.

Acorn, on a quick perusal I could not see where you got the average pay rates information from. Can you nominate a page or schedule? Plus I have some general points;

1. It is not valid to include Private Medical Insurance; worker compensation and Medicaid Heath Insurance ($23.6 m) in wage or salary packets for a dangerous occupation and under the American system where there is no public medicine to speak of.

2. It would not be valid to include benefits if these largely comprised assistance with personal costs associated with being a firefighter.

3. A quick perusal of the financial data seems to show that the OC Fire Dept is partially publicly funded and partially privatised and privately funded by business contracts. The overall business model shows they are not going broke and indeed their total financial position is improving. Perhaps those pay rates are what they have to pay to get enough good, qualified staff. It’s what people call the free market and its what people with money are all in favour of until they have to pay workers enough money to actually attract good workers.

4. The wage/salary figures you quote do not gel with what Bill Mitchell posted. Someone is clearly wrong. The only clear pay scale per position that I saw was CEO pay scales for Californian counties and these ranged from about $150,000 to $250,000 per CEO. The OC CEO was at the top of that range as one would expect. I would think that is a reasonable pay packet for a Fire Dept CEO.

5. I would like to see actual official wage scales for the firefighters (including average OT earnings). Your claims do not gel at this stage. Australian firefighters get about $35,000 to $80,000 depending on grade and experience. Seeing that the average self-employed bricklayer or tradesperson (carpenter, electrician etc.) in Australia can earn about double those rates, I would say we should be paying our Firefighters double i.e. $70,000 to $160,000. US and Australian currencies and pay rates are roughly equatable at the moment. Thus $145,000 for a firefighter might well be reasonable in a society that really valued people who did the tough jobs as opposed to those who just sit in offices, drink coffee and tap on computers.