I have received several E-mails over the last few weeks that suggest that the economics…

Retail sales, budgets and other nonsense

Today’s ABS retail turnover data is very interesting considering the meltdown that is occuring elsewhere in the world. The summary result that retail turnover grew by 2.2 per cent in the month of March suggests that the Australian economy is still alive – at least in the consumer markets. This figure was a surprise to all those who were in denial of the usefulness of budget deficits – both the discretionary components (the “stimulus packages”) and the automatic stabiliser components.

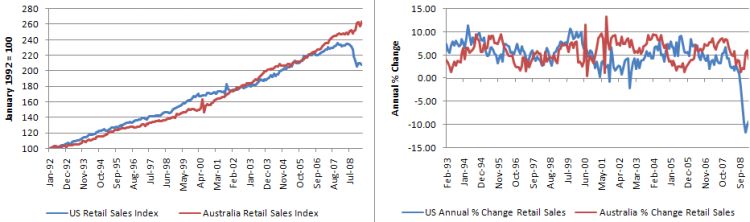

To see how far we have moved away from the trends in retail sales in the US consider the following graph I constructed. The left panel is retail turnover (sales) indexed at January 1992 = 100 (earliest US data available) and finishes in March 2009. The right panel depicts the annual changes from January 1993 to March 2009. The deterioration in the US is dramatic. However, the Australia consumer market has shown two recent small growth spurts which I focus on more in the second graph.

The second graph concentrates on the period since February 2008 which was the month that unemployment reached its lowest point in the last cycle and has been rising since. The yellow vertical lines are when the stimulus packages that were effective in December 2008 and April-May 2009 were announced – early October and February, respectively. You can clearly see the behavioural change in the sales turnover in the months that followed the announcements. If I modelled this formally (with econometrics) I would easily find a statistically significant impact of the announcements on the sales volume (a month or so after the announcements).

In the US, the stimulus so far provided by Government there has not been particularly targetted at households. Massive amounts have gone into banks and car companies and whatever but not much down into the streets – as yet. However, in Australia, the much maligned (by me as well) stimulus packages have put $As into the pockets of consumers.

It seems that households acted in March on the knowledge that they would be receiving the hand outs in the months to follow and brought forward their consumption desires. While interest rates have also fallen, I doubt that these have been as effective as the direct fiscal injection into the economy.

It also suggests that the commentators and politicians who have denied that the stimulus packages have been benign (at best) are probably going to have to revise their judgements or admit they just hate net government spending and would prefer mass unemployment instead.

The problem however is that these retail sales improvements are unlikely to be sufficient to prevent further rises in unemployment. The deficit is going to have be much bigger than currently planned to avoid that catastrophe.

But the T-word maintains momentum!

Meanwhile back at the Treasurer’s office, the Treasurer has overcome his anxieties with the D-word by taking the T-word remedy. He continues to defend the rising fiscal deficit and wants us to be safe and secure in the thought that is will only be “temporary”. He is even more edgy given his own Department is telling us that it will be at least 6 years before he can report the Government is back in surplus.

I clearly hope they never get back there. This period is realigning the relationship between the government and non-government sector to be more sustainable and to underping private saving.

While the deficit is being forecast to be around $60 billion in the next fiscal year I think that is probably (at least) $40-60 billion to small in relation to the spending gap that is implied in other data. It that is so, then unemployment will continue to rise despite the modest improvement in retail sales.

But in defensive mode, the Treasurer told ABC news today that:

We have a very clear determination to return our Budget back to surplus in a responsible way and to make sure that is is sustainable for the long term

The Government is continually using the defence that the budget will be in balance when average over the “economic cycle”. What this means is that is assuming that private saving will be zero on average over the business cycle. That will not happen.

Here is how it works in 10 simple statements

I tried encapsulating the way to think about a modern monetary economy in some simple statements. I came up with these 10 simple statements.

1. There are only two sectors in the economy – the Government and the Non-Government.

2. The Non-Government sector is made up of the foreign and domestic sectors.

3. The Government is the monopoly issuer of the currency and maintains demand for it by forcing the Non-Government sector to pay any taxes in that currency. The Government is not revenue-constrained but imposes taxes to force the Non-Government sector to offer their labour and services which the Government purchases in fulfillment of its socio-economic mandate.

4. Government spending adds currency (high powered money) to the Non-Government sector and taxation drains it.

5. If the Non-Government sector desires to save in the currency unit – then the source of those assets has to be Government spending. That is the only way that $A can enter the economy in net terms.

6. So the Government has to spend to: (a) provide the $s that are used to pay the tax obligations; and (b) finance any saving desires by the Non-Government sector. In normal times, the Government will have to be in continuous deficit – adding more financial assets (in the currency unit) than draining – if the Non-Government sector is to save. That is a matter of national accounting and is irrefutable.

7. If the Government runs a fiscal surplus (draining more currency units from the Non-Government sector than they are adding) then this forces the Non-Government sector to run down assets or to dissave in order to continue meeting their tax obligations in that currency unit. The only way the Non-Government sector can keep spending is to borrow and increasingly build up debt obligations. That is not a long-term sustainable path to economic prosperity. Eventually the leverage unwinds – either through cautious saving or through crisis (as now).

8. Thinking you can run a balanced budget on average over the business cycle – meaning surpluses offset any deficits – assumes that the Non-Government sector will desire to save zero on average over the business cycle. That is not likely and has never been witnessed. Attempts to force this rule will only generate debt buildup in the Non-Government sector and eventual crises or more immediate contraction.

9. Deficits are good and should be sufficient to close the spending gap that is left by Non-Government saving. If the deficits are deficient (too small) then production and employment will fall and unemployment will rise. Concentrating on the size of the deficit is a total waste of time. All effort should be on estimating the size of the spending gap and filling it with net spending.

10. Statements about “debt blowouts”, “debt burdens”, “saddling our kids with debt” etc are emotionally-charged indicators of the ignorance of the person making the statements. The debt will always be paid back without compromising the capacity of the Government to spend elsewhere. Further, the debt is not required to “finance” the deficit given the Government is the monopoly issuer of the currency and therefore its spending is not revenue-constrained.

Which leads me to the next point!

Be fearful … this bloke may be Federal Treasurer one day

On the ABC Radio’s World Today program which runs from Midday, there was a segment called Budget to leave cocktail of deficit and debt: Opposition.

The transcript reads almost like a comedy script … and you would just die laughing if it wasn’t for the fact that the main comedian is the Federal Treasurer-in-Waiting. The link above will provide you with the full transcript but here is a sample. All of it is equally bad.

The segment was concentrating on the fact that reports are around – those pesky unsourced reports – that the Budget deficit will be around $70 billion in the coming fiscal year. Journalists are becoming obsessed with the numbers but generally fail to scale the nominal budget outcome against GDP. When you do that then you see it isn’t historically that different from previous recessions.

But then they started interviewing the Federal Opposition Treasury spokesperson who is being referred to increasingly in the media as a buffoon! Here is some of the transcript that followed:

JOE HOCKEY (Federal Opposition Treasury spokesperson): Why is it that every time the Labor Party gets elected into government, people lose their jobs, we end up with deficit and debt? Why is it? It’s because they don’t know how to handle money …

This debt and deficit means that we will all have to work harder, longer, for less pay. That we’ll have higher interest rates, we’ll have higher taxes and all as a result of the Budget to be brought down next week …

Unfortunately there was no followup from the journalist to this claptrap. Why do the journos let this stuff float out unchallenged on our national broadcaster? You can answer that question yourselves.

Regular readers of billy blog will realise this is about as bad as it gets. There is no relationship between the debt and deficit other than the voluntary one imposed by the Government that each $ net spent has to be matched fully by a dollar of debt issued to the private sector and the fact that the RBA wishes to run a spread between its short-term interest rate target and the support rate it pays on overnight reserves. There is certainly no financing relationship – that is, the debt doesn’t finance anything!

There is also no relationship as far as I know the research literature between deficits making us work more intensely for longer and take pay cuts. The only clear relationships that exist in the literature are that deficits stimulate employment, increase working hours for those without work, and raise productivity (because the economy is more productive) which helps provide for high real wages. So exactly the opposite to the scare claim.

Interest rates will only rise if the RBA decides as a statement of monetary policy that they have to rise.

Tax rates will only rise if in the future the Government of the day decides they want the private sector to have less disposable income. They do not finance Government spending and so there is no link between rising net spending and future tax rises. That is an outright lie.

He was then asked about the current forecasts coming from the Treasury. He replied:

JOE HOCKEY (Federal Opposition Treasury spokesperson): Well look, the Treasury figures are meaningless in a volatile economic environment … What you do know is that when you go on a path of unrestrained spending, when you say that you are delivering a “Robin Hood” Budget but in fact it is something that doesn’t in any way resemble Robin Hood because all the money is going to the sheriff, it is not going to the poor – the challenge is, how do you get out of this mess?

Now, we have got the Government spending more money. The number of people losing their jobs is dramatically increasing and they’re leaving those people with a massive amount of debt.

It is truly, truly a horrific cocktail for, not only future generations of Australians, but for today’s workers and their families.

Seems that Joe has got a bit lost here in Sherwood Forest. If it is to be a Robin Hood budget then presumably the Government is living deep in Sherwood and aiming to redistribute largesse away from the evil rich to the good poor. I have no real objections to that although I just keep remininding people (as I did during an ABC Radio interview today) that the main game is preventing the big equity losses – those that arise from the unemployment. The other equity issues, though important, such as making sure the distribution of income is appropriate for our social aspirations – are secondary at this stage to stopping unemployment from rising.

But if Rudd and Co and Robin and his merry men then who the hell is the Sherriff that Joe thinks is getting all the money? Which money exactly is being diverted from the poor to the unknown Sherriff? And then, who is Maid Marion?

But the serious issue is the claim that the Government is leaving those people (presumably the poor from the context) with “a massive amount of debt”. This is false. It is the Government that holds the debt and it can always service that debt by crediting bank accounts without compromising its future capacity to spend and without needing any revenue to do it.

The poor never know anything about the debt issuance and servicing transactions that the Treasury are making all the time!

The only horrific cocktail that will arise if the Government doesn’t increase the deficit substantially will be the mass unemployment that is forced onto the current generation which would, in turn, provide for intergenerational disadvantage for their children.

That is the main game.

Digression: Informed commentary from the Third Estate

Michael Stutchbury is the Economics Editor for The Australian, which is the only true national daily and is published by News Limited. It is increasingly taking a negative position about the evolving budget parameters in Australia and making various claims that are not at all representative of the way that the modern monetary system operates.

Michael, in particular, has become a strident critic of the Government and is transfixed on the “deficit blowout” and the “debt blowout” and keeps making statements about the taxpayers having to pay it all back and all of that.

In this multimedia age, he has also taken to gracing the WWW with his expert video commentaries where he pontificates about economics and economic policy. The videos appear to be viewed by many. The original video in full is HERE.

But I took the liberty of editing a portion of it to correct some elementary mistakes of fact that the expert has made. It makes you wonder!

This sounds quite unusual to me Bill.

http://www.theaustralian.news.com.au/story/0,25197,25440881-2702,00.html

The article credits a vast surge in exports to China for the trade surplus. 1000+ men have just lost their jobs in my town because exports of alumina to China and Japan are down in both price and quantity and the same is true for coal and iron ore. I would have thought a rise in retail sales would have pushed us back toward a trade deficit and that the chief reasons for us recently starting to run a rare trade surplus were that sales of imported goods were down while the price of gold (which we have plenty of) was up.

What gives?

Dear Bill,

From what I can make of it The Australian appears to follow the Austrian School of economics in particular Mises, Rothbard, and a new kid on the block by the name of Roger Garrison (a former Engineer).

Their major downfalls are their “regression theory of money” which unfortunately does not recongnise Government / Central banks being the monoplist suppliers of fiat money which coincidently is also the only means for the non-government sector to meet their tax obligations to the government.

What this effectively means is that Austrian economics provides and explanation of a barter economy but by adhering strictly to says law cannot explain a capitalist economy with growth.

Moreover they stress how their version is a non-equilibrium version of Say’s Law and they also claim that we should all go back to a gold standard.

I could also go on about how the Austrians cannot differentiate between inside and outside money or the money stock and money supply, or exogenous and endogenous money supplies, or exogenous and endogenous interest rates.l….. but I’m sure most will get the point.

Overall, the Austrian School is the Neophillia less the mathematics and the diagrams (although Rothbard even introduced a bit of that).

Cheers, Alan

Alan

Pretty much spot on. I like to say that the Austrian approach to monetary economics is to analyze the economy as if a gold standard were in place, and then to propose as a solution to all problems a return to the gold standard.

Dear Lefty

I had a look at the data today and the report is faithful to that information. Exports to China have been very strong but they have fallen off badly in relation to Japan. The falling prices will be factored into new contracts and that will really damage our export performance in the coming quarters

Total volume ($A) of imports was down but some of that was that no large items like aeroplanes were in the data this time around.

Overall, our trade position will deteriorate in the period ahead though as commodity prices fall and contracts are renegotiated.

best wishes

bill

Took our stimulus shopping yesterday, looking for a piece of furniture. Of the three funiture retailers in our shopping complex, two of them (one specialising in big items and one a high end store) now have “closed” hung in the window, nothing left inside but a bare concrete floor.

Not unexpected.

Dear Lefty

Interestingly, a major job creation project in Sydney has just been announced by a furniture store. But bad luck for Gladstone – it is really being hit at present. We are not long off putting out an update on how our EVI work is mapping against the actual changes in the regional labour markets – Gladstone appears not to be evolving as predicted – badly. This work will be out in June sometime – I am giving a talk on it at a regional science workshop in Amsterdam around mid-June.

best wishes

bill

That is interesting. I suppose that in a place the size of Sydney that may be viable given the so-called “cash splashes” but with such a large portion of local employment tied to the still job shedding resource sector, Gladstone is not faring so well.

As a school leaver walking into the last recession, I seem to recall that the government of the day did little to alleviate the situation (beholden to neo-liberalism? A belief that if government does not “interfere”, the market would soon enough correct the situation? I believe that unemployment then went on to exceed 10.5%). While some of the current spending could be better targeted (the job gaurantee for starters) I feel that the fact that our government, as well as others, have acted more quickly this time will probably work in our favour.

Dear Lefty

That particular furniture chain won’t set up without a population base of approximately 2 million within a certain trade area. Gladstone has around 32,000 (no?).

During the 1991 recession the federal government did do some things but it was too little too late. The point you make about the current government’s injections are valid. We can argue about the size of the stimulus (too small) and the composition (not targetted at job creation) but not the speed of reaction.

best wishes

bill

Yeah, about 32-35 000. Subject to fluctuations of the resource boom/bust cycle.