For years, those who want selective access to government spending benefits (like the military-industrial complex…

Nothing good in sight for the UK economy despite the Olympics

The British Office of National Statistics have published two new data releases in the last week which show that the British economy is plunging further into a deepening recession. On July 20, 2012, it published the Public Sector Finances, June 2012, which showed that the deficit is increasing. Then it published the – Gross Domestic Product, Preliminary Estimate, Q2 2012 – yesterday (July 25, 2012), which showed that the British economy had contracted n real terms by a staggering 0.7 per cent in the June quarter. The one hope on the near horizon for the British economy might be the Olympic Games, which are being use to gloss over the savage recession that the British government has deliberately created. However, a closer understanding of the way in which events such as the Olympic Games impact on the host economy suggests that the majority of benefits are already in the data and the dismal future facing Britain will not be attenuated by the running and jumping (and the rest of it).

The Public Finance data revealed no surprises.

The ONS say that:

Public sector net borrowing was … £0.5 billion higher net borrowing than in June 2011 … [the] … budget deficit was £13.0 billion in … [was] … £0.6 billion higher deficit than in June 2011 …

So despite attempting to cut net public spending the overall impact of that austerity push has been to expand it. A closer examination reveals that tax revenue is up in June although lower than earlier in the year.

The ONS says that a “large part of the rise in receipts between 2011/12 and 2010/11 was attributable to a rise in VAT receipts of £12.4 billion. This rise, in large part, reflects the change in the rate from 17.5 to 20 per cent”.

But spending grew faster and the ONS says that “The rise … is due to a rise in debt interest payments … a rise of net social benefits of … and a fall in other expenditure of £0.2 billion.”

In a slowing economy, governments find it hard to cut deficits because either tax revenue stalls in the face of the slowing economic activity and/or rising spending (either because welfare payments and/or debt servicing payments rise).

That data release shows that the British government is not yet achieving the reduction in net public spending that it desires and that failure is a good thing because it maintains a higher level of public spending support for the declining British economy.

But the release was a warm-up act for the National Accounts data release which was published yesterday by the ONS.

The headlines that greeted the latest National Accounts data were obvious – here is a sample:

1. George Osborne reeling as economy enters the disaster zone.

2. If the economy was a sick patient, George Osborne would be struck off.

3. And in the popularist press – http://blogs.telegraph.co.uk/news/jameskirkup/100172524/the-gdp-figures-are-a-brutal-size-12-boot-in-the-groin-for-george-osborne/.

4. And – the Chancellor cannot blame the weather.

The result is hard to massage in any consoling way or in any way that would convincingly absolve the national British government from being the primary culprits.

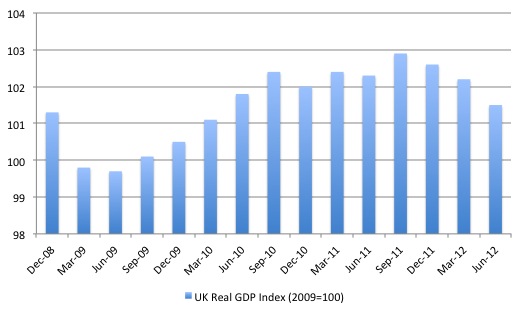

The following graph shows the real GDP index from the December quarter 2008 to the current quarter (June 2012). The current British government inherited an economy that was in the early phases of recovery after an extended period of recession. It was a fragile recovery as a result of the extensive private debt holdings constraining private spending and Britain’s trading performance being impaired by the death-wish policies employed in the Eurozone.

But it is clear that the recovery phase stumbled along for a while – under the support of the deficits that the previous government had allowed to occur. That recovery is now over and the economy is slipping badly.

There is no way to put a sugar coating on the data. All sectors (industries) contracted. The ONS said that:

1. Real GDP “decreased by 0.7 per cent in Q2 2012 compared with Q1 2012”.

2. “Output of the production industries decreased by 1.3 per cent in Q2 2012 compared with Q1 2012, following a decrease of 0.5 per cent between Q4 2011 and Q1 2012”.

3. “Construction sector output decreased by 5.2 per cent in Q2 2012 compared with Q1 2012, following a decrease of 4.9 per cent between Q4 2011 and Q1 2012”.

4. “Output of the service industries decreased by 0.1 per cent in Q2 2012 compared with Q1 2012, following an increase of 0.2 per cent between Q4 2011 and Q1 2012”.

So production and construction have now contracted for two consecutive quarters and are thus unambiguously in recession. And now the service sector, which had resisted the broadening gloom until now, is also in decline.

What an appalling indictment of government policy.

Real GDP is now below the level that the current government inherited in the second-quarter 2010. Real GDP has declined for the last three quarters.

You can see the way a recession spreads by noting that production output has been contracting for three quarters, construction for two quarters, and now the service sector. The gloom is spreading throughout the service sector.

Not surprisingly, given the public finance data, the government and other services sector continues to make a modest contribution to growth (0.1 per cent in the second-quarter).

The private sector is clearly not responding in the way the British government thought they would. In early 2010, the narrative was Ricardian – in that the Government and its supporters were telling us that private sector spending was subdued because they feared the future tax increases that would accompany the budget deficits.

Accordingly, so the story went, if the Government announced its intention to cut the deficit then the private sector would respond by boosting spending. What seems to be happening is exactly the opposite – which is predicted by Modern Monetary Theory (MMT) – the private sector is tightening its spending in fear of the contractionary consequences of the coming fiscal austerity.

The head of the OECD, who has a very high paying, secure, tax-free position, was wheeled out in the British media yesterday urging the British government to “persevere” and to “stay the course”.

The Independent quoted the OECD boss in this article (July 26, 2012) – George Osborne must stay the course, says OECD – as saying:

I would say to the Chancellor ‘Stay the course’, I would say to the Chancellor that the cost of wavering or looking like you are wavering or looking like you are weakening your resolve today because of what is happening in the markets – because of Spain and Italy and Greece and everything else – is very high indeed … This is very important, this is why the UK adjustment programme cleared the markets, this is why you have very low borrowing costs, this is why I think you should persevere.

You are now sowing the seeds of what will be the elements for recovery. You have to have credible public finances before you start moving on growth.

So the neo-liberal party line par excellence – the same line that created the crisis.

The OECD boss might be reminded that the UK government issues its own currency, can set bond yields at whatever rate it likes and is observing strong demand for its debt because it is seen by the bond markets as risk free.

He might also be reminded that Spain and Italy do not enjoy any of those things and the bond markets know that they are at risk of losing any funds they invest in purchasing the debt of those governments.

The continual conflation of monetary systems where the government is sovereign and those where they are not is a sign the commentator is clueless about the fine points of economics. In that sense, they are welcome to their opinion but should be disregarded by those who desire to understand what is actually going on.

The UK Guardian article (July 25, 2012) –

If the economy was a sick patient, George Osborne would be struck off – makes this point:

Britain’s economic performance has been similar to that of the eurozone crisis countries Spain and Portugal, even though the Bank of England has the luxury of being able to set bank rates and the pound has the freedom to fall.

The OECD has become part of the problem and should be disbanded. That could easily happen if the major contributing governments (for example, the US and Japan) simply withdrew their financial support.

I note that the IMF and the OECD never volunteer to reduce their budgets to help the government that fund them achieve the austerity that they recommend so vehemently. Then Mr Gurria might have to tough it out on the unemployment queues that his continual policy suggestions have created, sustained and now increasing.

Gurria also claims that there can be growth as long as the British government keeps “within the envelope” (which is his fancy term for cutting public spending).

The response of the British government has been to double the projected austerity period from five years to a decade. The currency-issuing British government appears intent on chasing Greece and Spain and the rest of them down the drain for the extended future.

I have been wondering for a while now whether the Olympic Games might give the British economy some relief from the downward spiral that its government is intent on pursuing. It is hard to make assessments on the net benefits that come from hosting the Olympic Games

While most studies of past games show that real GDP is boosted and there are employment gains, the relevant questions for the British economy at present are how much and over what period.

There was an interesting study by one John Irons in 2000 – The Economic Impact of the Olympics. That link is an archive of the original article and does not include the graphs that were in the original offering, which is now gone from the public arena.

But what his analysis showed, based on a comparison of real GDP growth performance for Olympic hosts from 1952 to 2000 to their long-run average growth rates, was that:

… prior to the olympics and during the olympic year GDP growth is higher than average – maxing out at nearly 1.5% above average

GDP in the 3rd year before the Olympics … However … [the data] … also suggests that growth rates are lower in the years after

the Olympics, than in the years prior.

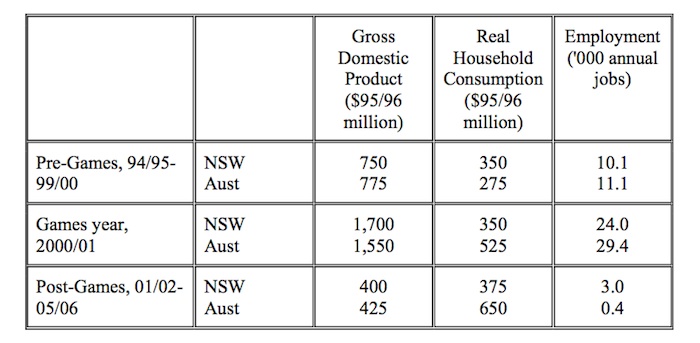

Prior to the 2000 Sydney Olympic Games, the NSW Treasury commissioned a report to study the economic benefits of the Games for Sydney and Australia.

The Report – The Economic Impact of the Sydney Olympic Games – was released in November 1997.

The Report provided this summary Table of the benefits spread over three periods: The Pre-Games period from 1994/95 to 1999/2000; the actual Games year 2000/01; and the 4 years following the Games – 2001/02 to 2005/06.

In relation to the summary table the Report concluded that:

… the effects of the Games are spread unevenly over the three phases with the bulk of the gains accruing in the first seven years of the twelve-year Olympic period. For instance, 61 per cent (or almost $3.8 billion) of the NSW increase in GSP, in net-present value terms, results from the pre-Games phase, while the Games year, which results in the largest single-year impact, contributes a further $1.2 billion (present value to 1995/96).

The last phase, despite significant Olympics-induced tourism and manufactured goods exports and an assumed slight Olympics-induced boost in labour productivity, contributes less than $1.3 billion to the total impact on the net present value of NSW GSP.

Those estimates are certainly consistent with many studies of previous Games.

The NSW Treasury study also summarised the results of many similar studies for previous Olympic Games (see Appendix A.4.2) and said:

1. Early estimates of international visitors are typically overestimated – that is, less turn up than is expected and factored into the forecasting models which estimate the likely net benefits of the event. Remember all the empty seats in Athens and the “rent-a-crowds” (aka PLA) in Beijing.

2. Further, the patterns of spending by Olympic visitors is significantly different to that associated with tourism in general. The lesson in that Olympic visitors tend to stay clear of the usual tourist haunts and this reduces the revenue that the Government gets from various taxes (alcohol, gambling etc).

3. Local residents also change their own spending patterns during the Olympic Games to avoid price gouging and congestion that accompanies such events. They go to restaurants else and frequent other public spaces where they might have spent.

The upshot is that the gains accruing to Britain as a result of hosting the Olympic Games this year are almost certainly mostly exhausted. There will be some positive contribution in the coming year but the major gains are already in the data.

If that is true, then it makes the performance of the British economy even more dire.

Conclusion

There is no sugar coating in the data.

Britain is now in a deepening recession and its government is to blame. Pity there is not an election imminent and pity the Opposition is so weak and misguided.

Pity also that the Liberal Democrats abandoned their values and become tied up in this sorry tale of power.

Alternative perspective on the Olympic Games

Since the 2000 Olympic Games I have been publishing (for fun) my Alternative Medal Tally.

There are many ways to express the Medal Tally and you can become as complicated as you wish, subject to the rather severe data limitations. While the exercise is fun I do consider the extra information provides a more meaningful perspective than the official rankings, which merely add up medals and give no particular significance to the size of the economy, the population size and the different types of medals.

I will repeat the exercise this year and you will be able to follow my weighted indexes at this page – Alternative Olympic Games Medal Tally.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

What odds we see a “dead cat bounce” from the Olympics and a triple-dip depression …?

It will also be interesting to see if the much-heralded increase in employment over recent months is reversed when all those temporary Olympics jobs end.

The UK ambassador to Belgium recently gave a lecture on “Who’s to gain from the Olympics?” that was given context by Jo Swinnen from the KUL who pointed out that empirical research shows that the economic benefit of large sports events is negligible (downloadable here: http://www.kuleuven.be/english/ambassador_lectures/lecture_uk.html)

What blew my mind listening to the ambassador, however, was that he showed a government-produced video (viewable at http://www.youtube.com/watch?v=SU-M8AoNzYU) in which one official clearly states that the infrastructure investments of the government, i.e. public spending, were very important economically (starting at 1:15, with the phrase “has helped the recovery” before at 1:11).

This means that the UK government is obviously aware of the benefits of public spending. The hypocrisy is astounding.

“But spending grew faster and the ONS says that “The rise … is due to a rise in debt interest payments … a rise of net social benefits of … and a fall in other expenditure of £0.2 billion.”

With regard to the debt interest payment:

Also published this month were the accounts of the Bank of England Asset Purchase Facility Fund Ltd annual accounts, available at the bank of england website which show that this company, created specially for holding the Government Debt acquired though the Asset purchasing program, is holding £20.7 billion in cash in an account at the Bank of England.

This cash is the interest received on the Government debt acquired and held over the last 3 years.

As the UK Government does not produce consolidated accounts we now have the bizarre situation whereby The National Loan Funds’ Accounts show Government Debt liabilities of over a £1 Trillion and BOEAPFF Ltd showing assets of Government Debt worth £308 billion (Feb12 and rising) with the Debt Management Office holding another £52 billion, nevermind any Repos held by the Bank of England………… Sorry, getting carried away but the original point I was going to make is that the debt interest payments are included in the deficit figure which is clearly barmy.

Considering the UK is essentially (and voluntarily) following the same wrong-headed austerity as Italy, Spain et al *but* is not enjoying the weakening currency of those Eurozone countries it appears quite clear to me that, a short UK (FTSE) long Eurozone (IBEX/MIB/AEX) will prove a positive trade … Until Osbourne eventually (if ever) sees the light.

In the UK there is alot of confussion around the fact that unemployment has been falling, yet growth is too. My view is that if you take out the drop that was due to the extra bank holiday you would get a fall in GDP of about -0.3%.

Then we note that although unemployment has been falling, it is also true that wages have been rising slower than prices, which might account for the rest of the drop in growth.

Obviously, government spending has been too low to keep wage growth high enough.

“The result is hard to massage in any consoling way or in any way that would convincingly absolve the national British government from being the primary culprits.”

The biggest newspaper in Finland managed to do just that. They presented the austerity programme as one of many possible causes for the contracting economy. The media is totally clueless here and continually airs the views of so called “experts” who claim that austerity brings growth.

Well sombody or something is buying a shit load of buses in the UK……

Somebody better write a paper on the dramatic change in Transport patterns in the UK……….I feel it must have something to do with QE despite its reported non effects in come circles.

ACEA

In June, new bus and coach registrations increased by 16.5%, boosted by the good performance recorded in the UK (+97.9%), Germany (+39.0%) and France (+24.5%). The Spanish (-15.4%) and Italian (-21.5%) markets declined. From January to June, the segment of buses and coaches was the only one to expand (+5.2%), driven by the upturn in the UK (+67.2%) and Germany (+7.1%). Results in France (-11.8%), Italy (-30.0%) and Spain (-38.8%) were negative”

UK Bus regs Jan – June : 4,473 !!!!!!!!!

Germany Jan – June :2,409

France ,Italy , Spain combined :4,581

The IEA in their latest July report talks of a flattening of European efficiency gains because of suppressed investment in capital stock……

Also Jet fuel consumption in the UK is up…..increased tourists ?……increased need for tour buses I guess.

UK Tram passenger 2011 /12 statistics

http://www.dft.gov.uk/

2011/12 : 204 million passenger journeys (highest modern numbers ever)

2010 /11 :196.5 million.

Docklands increased from 78.3 to 86.1 million

Croydon increased from 27.9 to 28.6 million

But outside London with the exception of Manchester tram passenger numbers are declining or stable which perhaps reflects the farming of London’s more local hinterland of wealth as people begin to run out of money tokens.

Manchester 19.2 to 21.8 million

Tyne Metro decline – 39.9 to 37.9 million

Sheffield unchanged at 15 million

Nottingham decline – 9.7 million to 9 million.

I am not sure the UK GDP numbers are reflecting the true picture….. much of the decline was because of a drop in house construction which is a waste of resourses in my book.

There is indeed a chronic lack of fiscal production / investment in areas which could reduce oil imports but whats the point of gifting the commons to private companies which offshore the profits ?

Indeed in the modern market state this is where much of the fiscal funds will eventually flow to …….everything is kind of pointless really.

Its a rentiers paradise.

Still the old rail line between Cambridge and Oxford could need more then a lick of paint………

Nearly every fiscal penny spent on fixed capital formation should go into reversing the Beeching petro Vandalism

en.wikipedia.org/wiki/Varsity_Line

Dork of Cork,

Look at the variability of the data, it is huge: my guess is municipalities buy buses in batches, a couple of times a year here and there, and you get the pattern of huge swings +/-30% compared to previous year.

@Ron T

The record bus numbers purchased have been every month this year…….like clockwork outpacing all other European countries – even much larger Germany.

Also the rail passenger numbers are not only beyond post war highs which peaked during the Suez fuel crisis but are now well past all time highs.

The tram passenger numbers are also at record post war highs.

Indeed there is huge fiscal bottlenecks now appearing in the rail system as the Brits don’t spend anything like the same amount of money the French spend through RFF , SNCF , more Direct fiscal measures, private complanies such as SYSTRA , local authorties and now sadly the corrupt PPP system.

Almost The entire British rail system is now chocking because of a historic lack of fiscal investment.

Official Utube video of the latest GNP Q2 figures

http://www.youtube.com/watch?v=xNY1U8gSH_8

Just over half the GDP contraction was due to construction …also the absurdly small production sector relative to the absurdly large 77% service sector is illustrated.

The UK farms global money flows and thats about it really.

Also this disposable house hold income video is interesting.

http://www.youtube.com/watch?v=x6LWqQ_MUcM

It illustrates the huge North south gap and indeed the London Vatican Vs the rest of the country.

The Lowest geographic income area is interesting…..Nottingham…. it fits into the poor Tram data from above…..they plan to build two more tram lines for that city but if people don\’t have the tokens to travel then why invest ?

It would become malinvested spare capacity.

We are clearly seeing the manifesation of Malthusian dynamics withen the UK these past 30+ years … although the roots of this malaise go back to the Labour goverment of the 60s.

So electricity demand (a proxy for real consumption rather then monetary pound figures) is at 1998 figures…..

Yet the population of England grew 3.6 million since 2001

population of Wales grew .153 million

population of N.I. grew .125 million

So we have a clear policey of deindustrialisation yet at the same time the goverments encourage immigration on a massive scale…..

Something is just not right.

The real standard of living is collapsing to Victorian levels by some measures as the carrying capacity of these islands overshoots.

look to figure 2 in this British census PDF Document.

The decline in GDP withen the Baltics may not be so bad per head given the young people are moving west on a vast scale.

The decline of Latvia’s population is Black Death like since 2001

http://www.ons.gov.uk/ons/dcp171778_270487.pdf

Southern Ireland is the most extreme of these large social experiments with GNP per head declining by 37,000~ to 27,000 + withen 5 years !!

Did you look at those recent Irish national accounts…..the revised GNP per head is very strange given the rise of population and decline of GNP.

Have you any idea of the methodology of those numbers ?

I am sure it is not a straight division of people /GNP

Something is just not right.

If you simply divide the census 2011 figures into GNP (current) for 2011 you get

27,725 Euros per head for Year 2011

Yet the latest National accounts for GNP per head (current) display 28,325 for Y2011.

What Data are the using ? , what are they adjusting for etc etc

More evidence that the UK & Germany are the only countries in Europe with a half optimum monetary envoirment.

With the UK replacing much of its transport capital stock while countries such as Italy & Spain depreciate their existing transport fleet dramatically……

ACEA

New Heavy Commercial Vehicles over 16t (excluding Buses & Coaches) – “heavy trucks”

In the first half-year, the EU* registered 112,762 new trucks, or 6.1% less than in the first six months of 2011. The UK was the only important market to post growth (+12.7%). Germany (-3.0%) and France (-4.6%) contracted, while Spain (-21.4%) and Italy (-28.9%) faced a more severe downturn.

New Commercial Vehicles over 3.5t (excluding Buses & Coaches) – “trucks”

Six months into the year, the EU* totaled 150,568 new trucks, or 5.5% less than in the same period a year earlier. While the UK posted a strong 21.5% growth, the French (-3.2%), German (4.7%), Spanish (22.4%) and Italian (-30.9%) markets all shrunk.

Only in Vans (-3.5 tons) has the Brits seen a decline so far this year like all major European countries.

Six months into the year, results were negative across major markets, leading to an overall 12.2% downturn. Germany saw its demand go down 0.8%, France 7.6%, the UK 10.1%, Spain 25.5% and Italy 37.8%. In total, the EU recorded 726,284 new vehicles.

The key to understanding the European malaise is its car and truck Industry which is much bigger then the US Industry.

There is simply too much capital sunk into this dead Industry with spare capacity all over the shop.

The Brits are finally realising this with some belated capital going into their rail Industry but they have the oldest rail fleet in western Europe.

“More than 900 jobs will be created and thousands more secured after Transport Secretary Justine Greening approved a £4.5bn contract to supply Britain with the next generation of intercity trains.

In a major boost to the UK’s manufacturing industry, 596 railway carriages will be built at a brand new train factory in the north east of England.

Agility Trains, a consortium made up of Hitachi and John Laing, has been awarded the contract to build and maintain the trains under the Intercity Express Programme (IEP), the project to replace Britain’s Intercity 125 trains with new higher capacity modern trains………..”

Replacing these locos then……

http://www.youtube.com/watch?v=D4CybduRq2k

http://www.dft.gov.uk/

There is also talk of producing the crossrail trains in this future factory.

Also A new concrete sleeper factory is planned which will supply the bulk of demand.

George Osborne will seek to reinvigorate the government’s growth agenda next week, before MPs depart for … Osborne backs £10bn rail plan …

http://www.bbc.co.uk/news/uk-politics-18839483

Dork – This investment could also be tied into increasing St Pancreas international operations as that is the terminus for this line with many substancial towns & stations on this route.

This is a typical Midland mainline station serving a 20,000~ size town.

en.wikipedia.org/wiki/Market_Harborough_railway_station

Indeed Eurostar is reporting signs of weakness as the Hinterlands of London & Paris become all extracted out.

http://www.rail.co/2012/07/12/eurostar-sees-fall-in-business-passengers/

British investment in rail is not of a French scale but something seems to be happening (they will get more bangs for their Buck from the above operations rather then the construction of new high speed lines)……………………..

Also from http://www.rail.co/

“The Government has backed an investment of up to £500 million to build a new rail link between Heathrow and the South West.

There was also talk of electrifying the valley railways servicing South Wales but I fear it is just talk.

http://www.bbc.co.uk/news/uk-wales-18852955

“Theres no magic money” – Secretary of State for Wales

This is one of the Valley rail lines from the Industrial past

This line reopened merely 4 years ago and is now a great success

en.wikipedia.org/wiki/Ebbw_Valley_Railway

It seems to have reached capacity despite not terminating in Ebbw Vale town.

en.wikipedia.org/wiki/Ebbw_Vale_Parkway_railway_station

So either extending stations to accommodate bigger trains or making faster electric trains seems the best option so as to increase capacity on these single rail lines.

But some of this is state propoganda – it will be two years at least before they get around to these busy little lines.

Terminus stations for the other (4) Valley lines to be electrified.

en.wikipedia.org/wiki/Treherbert_railway_station

en.wikipedia.org/wiki/Aberdare_railway_station

en.wikipedia.org/wiki/Merthyr_Tydfil_railway_station

en.wikipedia.org/wiki/Rhymney_railway_station

Passenger number increase (look to the right) speaks for itself.

PS….and who says really short passenger lines don’t work ?

en.wikipedia.org/wiki/Butetown_Branch_Line ( One Mile)

Cardiff bay train station passenger numbers

en.wikipedia.org/wiki/Cardiff_Bay_railway_station (terminus)

2002/3 : 177,911

2010 /11 : 753,148

The extreme neo -liberal nature of the UK is illustrated in this HM Treasury infrastructure document PDF from late last year.

cdn.hm-treasury.gov.uk/national_infrastructure_plan291111.pdf

Instead of simply spending money into existence 2 thirds of the infrastructure is financed via private credit

See section 5 – Finance and Funding.

Figure 2.A also gives a good run down of the projects planned although there has been some recent (2012) add on to this.

The still heavy emphasis on road over rail is illogical given the catostrophic decline rates in the North Sea …..although the recent stuff has had more rail emphasis.

See Chart 5 A

100 % of energy projects is now privately funded !!

This explains the catostrophic decline of British Nuclear power and their hopeless efforts to get private funding for a single plant as these stations have a possible 60+ year operational lifetime – as corporations these days have a very short term perspective it makes you wonder what gives ?

These private utilties simply make money by running down assets … not making them.