I have received several E-mails over the last few weeks that suggest that the economics…

Return to a gold standard – don’t even think about it

I don’t have much time today. But over the weekend the talk has been of a return to the gold standard. Conservatives hark back to the gold standard as some sort of golden age when all was well with the world. They still think that prosperity is within the grasp of a society if it anchors its currency to the price of gold. It seems the US Republican party is toying with the idea again – presumably as a pitch to rope in the real conservatives (Ron Paul supporters). They couldn’t be serious though. It would be a disaster if the world attempted to go back to a system that failed when it operated and it would lead to the further immiserisation of the poor if implemented. The salient point is that it didn’t work when it was in operation. It didn’t produce lower price variability and lower inflation rates nor did it prevent bank crises and financial panics. It was abandoned because it was politically unsustainable such was the entrenched unemployment that accompanied it.

The Republicans seem enchanted with the idea of a gold standard and have recommended a Gold Commission be established to research the idea. The last time this idea raised its ugly head was in September 1981, when a group of 17 met as the newly established Gold Commission in Washington to determine whether the US should return to the gold standard in some form. Ron Paul was implicated in that too.

It was reported after their first 4-hour meeting that the Commission members could not “even agree on the facts.” My notes from research I have done in the past from that era (pre-electronic so no links) say that the majority of the members accepted that the “weight of evidence suggests none of the automatic systems, the rigid systems (such as a direct gold standard) has performed satisfactorily.”

Opposing that view on the Commission were the gold bug representatives that denied the historical record – as they continue to today. They claimed that US “price stability was better than in the past 10 years”.

The context of the Gold Commission, set up by Ronald Reagan was the persistently high inflation in the US at that time. Reagan, himself, supported a gold standard. The belief by those who support a return to a gold standard is that it keeps the money supply in check and therefore allows the central bank to better control inflation.

At the time, with large-scale gold production being geographically concentrated in the Soviet Union and South Africa, the opponents argued that a return to the gold standard would make the US hostage to these nations, in the same way oil-dependent states are held hostage by OPEC.

Conservatives hark back to the gold standard as some sort of golden age when all was well with the world. They still think that prosperity is within the grasp of a society if it anchors its currency to the price of gold. It seems the US Republican party is toying with the idea again – presumably as a pitch to rope in the real conservatives (Ron Paul supporters). They couldn’t be serious though. It would be a disaster if the world attempted to go back to a system that failed when it operated and immiserised the poor before it was abandoned.

There is no coherent economic argument that supports a return to any form of gold standard. I use “any form” because there are various ways in which gold standards might be defined. Please read my blog – Gold standard and fixed exchange rates – myths that still prevail – for more discussion on this point.

Under what was called a gold specie standard (sometimes called a 100 per cent reserve gold standard) the central bank was required to hold gold in proportion to the currency it issued (the proportion being the gold currency exchange rate), which meant it could always ensure full convertibility at the agreed exchange rate of currency into gold.

The monetary authority agreed to maintain the “mint price” of gold fixed by standing ready to buy or sell gold to meet any supply or demand imbalance. We should be clear that it was thought likely at the time that no major gold discoveries would be made in the future and so the price of gold was demand-determined (fixed supply).

It meant that if the central bank wanted to issue more currency then it had to get more gold to back it. That became the role of trade. Gold was considered to be the principle method of making international payments. Accordingly, as imbalances in trade (imports and exports) arose this necessitated that gold be transferred between nations (in boats) to fund these imbalances. Trade deficit countries had to ship gold to trade surplus countries.

For the surplus nations, the inflow of gold would allow their central banks to expand their money supplies (issue more notes) because they had more gold to back the currency. The rising money supply would push against the inflation barrier (given no increase in the real capacity of the economy) which would ultimately render exports less attractive to foreigners and the external surplus would decline.

For the deficit nations, the loss of gold reserves to the surplus nations forced their governments to withdraw paper currency which was deflationary and had the consequence of increasing unemployment, and driving down output growth and the general level of prices. The latter improved the competitiveness of their economy which also helped resolve the trade imbalance. But it remains that the deficit nations were forced to bear rising unemployment and vice versa as the trade imbalances resolved.

Under the gold standard, the government could not expand base money if the economy was in trade deficit. It was considered that the gold standard acted as a means to control the money supply and generate price levels in different trading countries which were consistent with trade balance. The domestic economy however was forced to make the adjustments to the trade imbalances.

Monetary policy became captive to the amount of gold that a country possessed (principally derived from trade). Variations in the gold production levels also influenced the price levels of countries.

In practical terms, the adjustments to trade that were necessary to resolve imbalances were slow. In the meantime, deficit nations had to endure domestic recessions and entrenched unemployment. So a gold standard introduces a recessionary bias to economies with the burden always falling on countries with weaker currencies (typically as a consequence of trade deficits). This inflexibility prevented governments from introducing policies that generated the best outcomes for their domestic economies (high employment).

Ultimately the monetary authorities were not able to resist the demands of the population for higher employment.

The onset of World War I interrupted the operation of the gold standard and currencies were valued by whatever the specific government wanted to set it at. The reason was that governments wanted the leeway to fund the war efforts and realised that they could not be hostage to the gold stocks their central banks held in reserve.

The ensuing 25 odd years saw significant instability with attempts to go back to the standard in some countries proving extremely damaging in terms of gold losses and rising unemployment.

The UK abandoned the gold standard in 1931 as it was facing massive losses of gold. It had tried to maintain the value of the Pound in terms the pre-WW1 parity with gold but the war severely weakened its economy and so the pound was massively over-valued in this period and trade competitiveness undermined as a consequence.

After World War 2, the IMF was created to supersede the gold standard and the so-called gold exchange standard emerged. Convertibility to gold was abandoned and replaced by convertibility into the US dollar, reflecting the dominance of the US in world trade (and the fact that they won the war!).

This new system was built on the agreement that the US government would convert a USD into gold at $USD35 per ounce of gold. This provided the nominal anchor for the exchange rate system.

The Bretton Woods System was introduced in 1946 and created the fixed exchange rates system. Governments could now sell gold to the United States treasury at the price of $USD35 per ounce. So now a country would build up USD reserves and if they were running a trade deficit they could swap their own currency for USD (drawing from their reserves) and then for their own currency and stimulate the economy (to increase imports and reduce the trade deficit).

The fixed exchange rate system however rendered fiscal policy relatively restricted because monetary policy had to target the exchange parity. If the exchange rate was under attack (perhaps because of a balance of payments deficit) which would manifest as an excess supply of the currency in the foreign exchange markets, then the central bank had to intervene and buy up the local currency with its reserves of foreign currency (principally $USDs).

This meant that the domestic economy would contract (as the money supply fell) and unemployment would rise. Further, the stock of $USD reserves held by any particular bank was finite and so countries with weak trading positions were always subject to a recessionary bias in order to defend the agreed exchange parities. The system was politically difficult to maintain because of the social instability arising from unemployment.

So if fiscal policy was used too aggressively to reduce unemployment, it would invoke a monetary contraction to defend the exchange rate as imports rose in response to the rising national income levels engendered by the fiscal expansion. Ultimately, the primacy of monetary policy ruled because countries were bound by the Bretton Woods agreement to maintain the exchange rate parities. They could revalue or devalue (once off realignments) but this was frowned upon and not common.

Whichever system we want to talk off – pure gold standard or USD-convertible system backed by gold – the constraints on government were obvious.

Those constraints would return immediately the world moved back onto a gold standard.

Further, a gold standard dramatically restricts the capacity of the government to manage a crisis such as the world has been enduring for the last 5 odd years. The gold standard was one of the reasons the Great Depression was worse than the Global Financial Crisis. The central banks then were unable to ensure financial stability by expanding their monetary bases.

The proponents argue that price stability would be the principle gain from a return to the gold standard. They argue that it stops central bank printing presses running because monetary growth would be tied to the growth in the gold stock.

Of-course, this view assumes that when the central bank expands the monetary base there is automatically inflation. You guessed it – the Quantity Theory of Money interacting with the equally defunct concept of the money multiplier leads to that conclusion.

It is a pity that it doesn’t remotely describe the reality. How is it that inflation has not been accelerating in the US over the last few years or in Japan for nearly two decades?

How come Japan has been fighting deflation as its monetary base expands?

How does a currency lose its domestic value if there are millions of people unemployed wanting to work and firms willing to employ them if some new orders appears in their books?

How would we get an inflation if firms have capacity to expand should new spending growth emerge?

Why hasn’t the substantial expansion in the US monetary base manifested as a proportional expansion in spending?

Please read my blogs – Money multiplier and other myths and Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion (even answers to those questions).

Even a cursory glance at the principle evidence shows the idea has no merit. The US maintained the gold standard from June 1919 to March 1933 (more or less) although it was on the standard in 1914-1917.

The history of the US participation in the gold standard is well described in this interesting US Federal Reserve Bulletin paper from June 1989 – The International Gold Standard and U.S. Monetary Policy from World War 1 to the New Deal

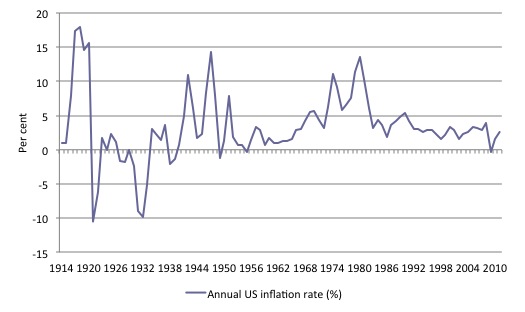

Here is a graph taken from US Bureau of Labor Statistics data for the Consumer Price Index from 1913 to 2011. It shows the annual inflation rate from 1914 to 2011.

Under the gold standard, domestic prices were prone to sharp fluctuations as the stock of gold changed and/or the nation’s external trade situation changed. An external deficit nation was subject to short and sudden plunges in prices. Deflation is generally considered to be highly undesirable.

The evidence is fairly clear (although complicated by other factors which I don’t mention here) – price stability has been higher in the period after gold standard arrangements were abandoned.

The average inflation rate in the period 1914 to 1971 was lower than in the period following 1971 but that is because of the violent swings into deflation. If we take the average of the positive inflation rates we get 4.6 per cent and 4.5 per cent, respectively for the pre-1971 and post-1971 periods. So inflation was not lower during the period when the gold standard or variations of the same operated.

Moreover, the variance in the inflation rate from 1914 to 1971 was 33.5 whereas from 1971 to 2011 is was 8.8. Price stability requires low inflation but also low variability. Variability introduces uncertainties which spill over into the real economy by distorting consumption and investment decisions.

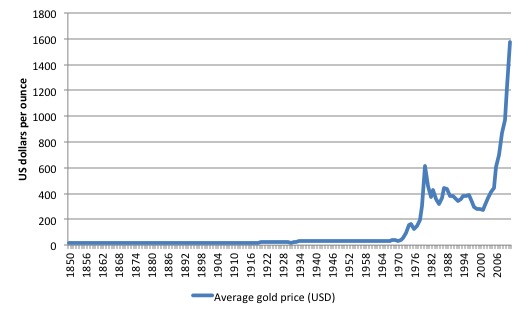

Here is the gold price from 1850 to 2012. A gold standard requires that the numeraire (gold) be relatively stable so as to discipline the value of the currency. Imagine what would happen to the price of gold if it once again had to back the US monetary base? Skyrocket is the direction.

Further, here is a List of Banking Crises just in case you are wont to believe the arguments that a return to a gold standard would eliminate financial instability.

What it would eliminate is the central bank’s capacity to deal with these crises.

Conclusion

The Republicans would be better advised to work out how they can support a major fiscal stimulus package to ensure the US economy does not slip back into recession rather than delving back into the looney conservative history for defunct ideas.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Dear Bill,

Why have only the second phrase in your title in the imperative form? Why not all of it?

“Go ahead, return to the Gold Standard! Don’t even think about it!”

Only a taste of real-life (and bitter) experience can debunk voodoo economics, the kind constantly peddled in the United States, most prominently these days by the GOP’s VP candidate.

Cheers.

Typo:

“For the surplus nations…The rising money supply would push against the inflation barrier (given no increase in the real capacity of the economy) which would ultimately render exports less attractive to foreigners and the external surplus would decline.”

Bill;

You give Republicans in America way too much credit. I have to watch these bozos every day and I assure you that not one in a thousand is capable of following the argument you make – and that one wouldn’t read past the first paragraph anyway. These are creatures of pure politics and pure ideology. If the truth meant anything to them, the Darwinian process that governs public life in America would have culled them long ago.

So, in my opinion, the American politicians we should devote our critique to are the feckless, amoral, equally-sold-out Democrats. What are *they* doing to educate people about the real dynamics of the economy? And I’ll tell you what – absolutely nothing. And I’ll tell you why – it’s because they believe all the same garbage. Barack Obama is in complete agreement with Mitt Romney on the need to “pay for” Medicare and Social Security by having the government borrow the currency that it, itself, issues.

But of course, you know that and I know you know it. I keep a copy of your article from The Nation under my pillow. I’m just venting today because American T.V. is doing its annual “both sides are equally to blame” festival. A.K.A. the Republican and Democratic conventions. What joy.

The problem with a fixed money supply is that it provides a risk-free incentive to hoard. But progress requires risk-taking. Thus a fixed money supply is a recipe for economic stagnation.

A gold standard is also fascist and a waste of money. Why should a monetary sovereign have to buy someone’s expensive material before it can create money? Cui bono?

But heck, let the shiny metal worshippers play, I suggest, and learn thereby. Let gold and everything else be used for private debts but mandate that (inexpensive) fiat be the ONLY acceptable money for government debts.

“Beware the leader who bangs the drums of [gold-standards] in order to whip the citizenry into a patriotic fervor, for patriotism is indeed a double-edged sword. It both emboldens the blood, just as it narrows the mind. And when the drums of war have reached a fever pitch and the blood boils with hate and the mind has closed, the leader will have no need in seizing the rights of the citizenry. Rather, the citizenry, infused with fear and blinded by patriotism, will offer up all of their rights unto the leader and gladly so. How do I know? For this is what I have done. And I am Caesar.”

― Julius Caesar

http://www.goodreads.com/author/quotes/97728.Julius_Caesar

I don’t think many serious people are talking of a standard.

Well under the present euro structure of seperate political systems yet cross border claims in the same currency each countries national CB bidding up the price of Gold in euro terms is a option.

Indeed I think this is the primary reason for Golds rise since 1999…..get it – the year of non physical euro introduction.

I must admit there was a time I believed in this solution as I am not a fan of a national fiat currency operating as a Global reserve….see the $

However I am far more sceptical now.

Still Bill – both the Sov UK & US operate very large physical trade defecits – with countries such as Ireland doing their best to keep the standard of living in London up to acceptable standards of decency – now showing a marginal current account surplus with a catastrophically non optimum , non national currency.

Preforming its tradional role again of exporting surplus wealth to the Uk

Gold may have a role in rational trade policey that is the great weakness of free floating international currencies in my opinion although ireland will always be someones little Bitch.

She was always a whore anyway …poor dirty Hibernia.

If such as system operates again the UK will take more direct control of this bog I guess.

Google Google :Trading economics – Commercial service imports (US dollar) in Ireland –

Its a truely fantasical graph – the crumbs from these $$ distorted the entire rational and semi rational physical economy of Ireland post 1987.

PS

You should know

The Gold standard never recovered from the run on the BoE in 1914………both the clearing banks and people clutching Gold sovergins decided they did not believe the bull.

What happened after that I wonder……..

Well the UK tresuary quite rightly produced paper to give to people to reduce the leverage in the system but then found a mechanism to take it away again by killing people en masse.

Dear Vassilis Serafimakis (at 2012/08/27 at 23:56)

Thanks for picking up the typo. It is fixed now. I appreciate the scrutiny.

best wishes

bill

The 10 shilling note was legal tender in Ireland & Scotland I believe…..its issuance by HM treasury was with Interest however….obviously…..

I would recommend – Strachan, Hew. The First World War: Volume I: To Arms (2004): the major scholarly synthesis.

In particular the financing of the war chapter.

Its the roots of modern Keynesian theory really.

I seem to remember him saying you could cash a Sterling cheque in Berlin up to 1916 – ah CB internationalism – isn’t it great ?

The Great war……to bail out the BoE

I think the ECB is functioning as the BoE did then …. with the CBs now sadly preforming the role of pseudo treausuries without the purity of these effective colonies producing Greenbacks outside the banking sector and therefore denying them recaptilisation opportunities.

Central banks are well…..banks Bill – they are not real treasuries , goverments should have no relationship with credit institutions via the CB conduit and credit banks should have no role in money creation period…..

This is another failure of the CB system is it not – up there with 1914.

Time for it to leave the building ?

Goverments should produce pure fiat internally and settle their foregin imbalances with Gold….

Its a purist position that will never happen I guess.

But its worth stating none the less.

However you need trusted bankers to settle the Gold transactions….now where will…..

Its a funny old world.

Wonderful discussion about utopias amongest very old teenagers……back in 1993

http://www.youtube.com/watch?v=tHP0IgD53A8

“he turns to a illegal underground movement who believes Pigs can fly”

Before you can attempt a modern utopian journey you must ditch this idea that money is interest bearing debt.

Goverment money must become Base money again.

The Keynesian debt dream is not only dead ,but a nightmare.

Part 3s interveiws get to the meat of our present crisis (recorded in 1993) – ….Sean Stewarts Passion play sounds interesting.

http://www.youtube.com/watch?v=ECMgNVk5z2I

“Its one version of the world as our standard of living decays”

“People are digging in”

“And I think passion play is a 20 or 30 years down the road DUG IN North America”

Goverments should produce pure fiat internally and settle their foregin imbalances with Gold…. Dork of Cork

Close but no cigar. Let international balances be settled with whatever people wish to settle them with. What is gold but someone’s favourite shiny metal? A traditional tool of banker oppression?

F.Beard

I agree Gold is problematic – the banks are all over it….but for a reason other then they probally have most of the stuff.

Imagine if another state asks the Irish State to settle in Cattle ?

The state would have to seize the cattle directly from the farmers via force and transfer these real goods to the foregin country , completly impractical – the farmers would give up farming.

However Gold would have to reach many $10,000s to replace the $ – you would be talking of very small quantities of the stuff that has very little physical use other then a recognized transaction mechanism.

Remember the remaining wealth of countries would not disappear – it would merely stop the completly unsustainable physical defecits and surpluses in this world.

Imagine if another state asks the Irish State to settle in Cattle ? Dork

Too bad. The Irish State should say “Here’s some Punt(?); take it or leave it.”

As for private international settlement, the private parties involved could negotiate that.

@F Beard

Well , we would not get any oil then……

Projecting your sovergin curreny beyond your own borders is very wrong – you as a citizen of one country should have no claims on other countries resourses.

PS however we could reduce our oil use substancially by simply producing Real Greenabacks (get it / Irish Greenbacks) by subsiding rail tickets at 1 Punt a piece.

You must learn to think in national economy terms……..in terms of real resourse use.

When SNCF produced one euro tickets in Nimes so thay people could get out of the city and get to the beech they weretotally swamped – but besides the police presence caused by class & social tension it did not cost France much real resourses.

If everybody went by car however………

PS

“you must think of real resourse use” WITHEN DEFINED POLITICAL BORDERS

Indeed what is politics without a defined chain of command where people have both power & responsibility ? – we have a amazing political vacuum in Ireland and elsewhere withen Europe because elected people have no power withen borders that can be defined – that is very very very dangerous territory.

Well , we would not get any oil then…… DoC

What? Ireland has NOTHING that foreigners want?

In that case, then you have to burn peat I guess.

@F Beard

Well we did use Peat for transport fuel during the last war.

I believe the Cork to Dublin Train took a week or something silly like that…..(just kidding, but not very much)

Bill,

Perhaps a couple points worth making here. Firstly, the Gold Commission was established under Jimmy Carter’s administration (though the report was tabled under Reagan). Secondly, Ron Paul is a proponent of free market money. He conjectures that the most likely form that this would take is gold or some other commodity. He arrives at this conclusion by looking at what has happened over the past few thousand years.

Ron Paul does NOT support a centrally controlled gold standard, which was the main thrust and description provided in your blog. While there are similarities in its effect (such as limiting government’s ability to influence the money supply), a free market gold standard and a centrally controlled gold standard (including the rather weak form that existed under Bretton Woods) operate very differently.

Your blog provides a whole host of reasons why a centrally controlled gold standard often provides sub-optimal outcomes. In a future blog, would you care to describe the operation of a free market money standard (such as through the use of gold, or silver, or copper, etc.) and how this might impact the economy?

P.S. I think we will eventually see more and more virtual currencies that are privately issued. I doubt these will be formally asset-backed. Eventually governments will effectively lose control over money issue. It will be interesting to see how taxes are levied and collected in these circumstances.

Cheers (and I enjoy your blog!)

Eventually governments will effectively lose control over money issue. Esp Ghia

Not over government money issue, not so long as they can effectively tax. As for private money, that should not be a government concern anyway.

F. Beard, regarding tax, I was was hinting loudly at that issue. And in terms of your last point, there are those who argue that there ought not be fiat currencies…I am interested to better understand the consequences of this (i.e., free market money) and, hence, asked if Bill might consider such a situation.

And in terms of your last point, there are those who argue that there ought not be fiat currencies… Esp Ghia

Inexpensive fiat is the ONLY ethical money form for government debts else a true free market in private money creation (for private debts only) is impossible. Why? Because any money or money form accepted for taxes will have an advantage over other monies or money forms. Thus government money must be distinct from private monies or private money forms to avoid favouritism.

Espia Ghia,

Free market currencies have a number of potential problems for the economy:

They are not cleared by the traditional banking system, and may not have a clear audit trail, so tax evasion may be rife (hence Ron Paul’s support). This tax evasion would compromise the role of tax to provide ‘non-inflationary space’ to support government spending when the economy is at full capacity.

Also, just as it is bad for the economy for government to have debts in foreign currencies, it is also bad if such debts are held by the private domestic sector too – and debts in such currencies would effectively be debts in a foreign currency.

Also, allowing free market currencies (or complementary currencies as they are also called) inhibit government fiscal policy, and its ability to target particular activities or sectors in the econoomy.

Kind Regards

so tax evasion may be rife CharlesJ

If taxes can be evaded with private currencies then they are not morally valid taxes to begin with?

Henry George’s land tax could not be evaded. Taxes based on physical quantities could not be evaded either.

In other words, we could have genuine private money alternatives and effective taxation to back the value of fiat.

F.Beard

In other words, we could have genuine private money alternatives and effective taxation to back the value of fiat.

Perhaps but that’s not why Ron Paul wants it.

Further, both currencies will be chasing the same resources. With global resources like oil that happens anyway, but with local resources like labour it would be difficult for government to reduce inflation in either currency as its ability has been compromised by the issuer of the other currency.

F.Beard

Taxes based on physical quantities could not be evaded either.

But that limits government’s fiscal policy to taxes that can only be reliably collected in its currency (a point I was making above). Better to ban complimentary currencies entirely to avoid unnecessary obstructions to fiscal policy.

but with local resources like labour it would be difficult for government to reduce inflation in either currency as its ability has been compromised by the issuer of the other currency. CharlesJ

It’s not the business of government to control price inflation in private currencies. In fact, price inflation in private currencies would make fiat more attractive relatively speaking and vice versa.

F.Beard

It’s not the business of government to control price inflation in private currencies.

Exactly – because the currencies are private, they will be managed in the interests of their issuers – much like having a privately owned Fed. The lack of regulation will cause these currencies to eventually either deflate (meaning they won’t get spent), or hyper-inflate due to the greeg of the issuer.

At this point we will come full circle to people calling on the government to regulate them, or government having to ban them because they cannot be regulated for the public good.

because the currencies are private, they will be managed in the interests of their issuers – CharlesJ

Private currencies would be completely unacceptable for the payment of government debts so the question is why would people accept them in the first place since fiat could also be (voluntarily) used for private debts?

My contention is that private money issuers would have to give genuine value in order for people to accept their money. Common stock as private money, for example, “shares” wealth and power with everyone who accepts it.

F.Beard

Do you advocate that a company might only employ people if they are apid in the company’s own currency, which can only be used to purchase goods and services that the company itself provides?

The company store? Hopefully not. But that would depend on the bargain power of the workers which should be drastically enhanced by:

1) A universal and equal bailout of the entire population till all credit debt is paid off.

2) Abolition of government backed credit creation, the means by which the so-called “creditworthy” steal the workers’ purchasing power.

3) A BIG so that no one need work just to avoid starving or being homeless.

And if those are not enough then:

4) The nationalization of all large corporations and the equal distribution of their common stock to the entire population.

It seems like I have opened a can of worms.

btw, just to clarify my question: what are the economic impacts of not having govt-issued / fiat currency, and instead havng one or (likely) more free market monies (that may or may not be asset backed)? That is, money that people voluntarily accept to transact, etc. Also, could governments even collect taxes in that situation? Could governments collect taxes without coercion? In the latter question, I am wondering whether there are circumstances where people would pay taxes without the threat of violence hanging over them.

what are the economic impacts of not having govt-issued / fiat currency, and instead havng one or (likely) more free market monies … ? Esp Ghia

As long as government exists, it is impossible to have true free market monies unless government only recognizes its own fiat as money. Otherwise, government is playing favourites and so no true free market in private money creation would exist.

“Could governments collect taxes without coercion?”

Government is merely everybody else other than you.

“no true free market”

There is no such thing as a true free market. People who believe in such things are no better that people who believe in fairies and supernatural redemption.

Markets are always regulated. It’s just a matter of what regulations are required to provide, at least, everybody with something.

Neil Wilson, I am struggling to interpret your response.

When you say that “there is no such thing as a true free market”, do you mean this is because governments intervene in all markets; or, are you saying that markets are subject to non-governmental distortions that result in potentially undesirable outcomes? (I agree that there is currently no example on this planet of ‘free market capitalism’.)

“…and that markets are always regulated” – does this include ‘self-regulated’, or are you referring to legislated rules?

Kind regards.

Esp Ghia: The point is that you’re thinking about things backwards, conceptually & historically. Markets are historically & logically subsequent to money, and money is historically & logically subsequent to the state.

The error is in imagining a mythical pre-existing private sector economy that government intervention is superimposed on.

this is because governments intervene in all markets No, governments underly, define all markets. Rules of ownership & their enforcement among many other things.

There is no such thing as a difference between “free-market” money & “fiat money”. Fiat money is “free-market money”, and there really isn’t any other kind of money. The state’s “fiat money”, its tax credits, its debts, predominate because of the dominant real-world power of the state, not because it calls itself “the government” or “the state”. Whether there are other sorts of money floating around is not very important (except sometimes for financial stability, and for the extent that they manage to acquire state backing) as long as the state is as big & powerful as any modern state. They need not be regulated or banned if the government regulates banking and finance as well as everybody did during the middle of the last century.

Thinking about “free markets” & “free market money” independently verges on thinking about games of Monopoly that have neither a Bank nor rules. Meaningless, because you have defined all meaning away.

Most likely both.

When you concede that “there is currently no example on this planet of ‘free market capitalism'” you imply that there could theoretically be one. Although I severely doubt that that is possible, ie: property rights it is also highly undesirable.

Esp Ghia: “Ron Paul is a proponent of free market money. He conjectures that the most likely form that this would take is gold or some other commodity. He arrives at this conclusion by looking at what has happened over the past few thousand years.”

I would think that the most pertinent data would be from the U. S. in the 19th century after Andrew Jackson took down the Bank of the U. S. That was a time of depressions and regular banking panics. I believe that most banks backed their notes with specie, but things were a mess. One bank in Rhode Island (as I recall from a talk on CSPAN) issued $600,000 in notes with 7 bits ($0.875) in their vault. At the time the Federal Reserve system was enacted, there were, IIRC, some 50,000 different currencies in the U. S.

It appears the people did not like free market money very much, and voted it down. Since we have not much experience with it, I am inclined to trust their judgement. 🙂

“Ron Paul is a proponent of free market money. He conjectures that the most likely form that this would take is gold or some other commodity. He arrives at this conclusion by looking at what has happened over the past few thousand years.”

RP’s mistake is to attempt to define what private money is. Instead we should only define what government money is – inexpensive fiat that is only legal tender* for government debts.

* After a universal bailout of the population from all credit debt with full legal tender fiat.

Aren’t store gift cards, paypal credit, and loyalty programs (airline miles) all forms of private money?