It's Wednesday and I discuss a number of topics today. First, the 'million simulations' that…

A veritable pot pourri of lies, deception and self-serving bluster

Today, I present a series of vignettes that traverse a range of related topics. How Australia’s richest person thinks that billionaires work hard and create jobs and wealth and the poor … well drink and smoke a lot while socialising. Then we consider today’s investment data for Australia which is a precursor to the June-quarter national accounts release. We try to make sense of claims that Australia’s (alleged) socialist government has killed investment in mining. Then we consider how leading economic forecasters mislead the Australian public by claiming that the Australian government will not have enough money to provide dental care to the poor. Then we hop over to America and learn that government spending creates jobs and even the conservatives are saying it. All in a day’s blogging. A veritable pot pourri of lies, deception and self-serving bluster.

The poor should drink less, smoke and socialise less

Today’s first topic belongs in my series on vilification of the disadvantaged. The richest person in Australia – mining heiress – who has been fighting it out in the courts with her own children over their grandfather’s inheritance – echoed the Ann Raynd line that the “billionaires and millionaires” create all the jobs and help the poor but the latter are too lazy to do their bit.

That’s her below – looking sour.

The ABC News Report (August 30, 2012) – More work, less play: Rinehart sets out road to riches – says that the Gina Rinehart claims that “billionaires and millionaires are doing more than anyone to help the poor by investing their money and creating jobs”.

Even though the current mining boom has seen her wealth (derived from an inheritance from her father who was a mining magnate) increase by more than $A20 billion in a few year claims that “anti-business and socialist policies for hurting the poor”.

Apparently, socialism in Australia is “killing off investment in Australian projects”.

She wants the mininum wage cut and attacked the poor by saying that:

If you’re jealous of those with more money, don’t just sit there and complain; do something to make more money yourself – spend less time drinking, or smoking and socialising, and more time working. Become one of those people who work hard, invest and build, and at the same time create employment and opportunities for others.

This sounds like it is coming from someone who is “self-made”. The reality is different. She inherited her wealth and didn’t have to do any work to be at the top of the wealth distribution. And then came the socialist state we call China who launched its development phase at just about the right time for Gina – she has made a fortune from companies that dig our resources up, put it into trucks, take it to a ship and send it to China.

Of-course, the empirical evidence is the opposite. The lower income groups in Australia spend less of their budget on alcohol than the higher income earners.

In this 2010 study – Drinking patterns in Australia, 2001-2007 – from the Australian Institute of Health and Welfare (an Australian Government research body) we learn that (Table 2.6):

… people that are currently employed are most likely to be recent consumers of alcohol.

A lower proportion of the unemployed consume alcohol (within the previous 12 months of the survey) relative in work.

Digging deeper, we find that in terms of the Australia Bureau of Statistics (ABS) Index of Relative Socioeconomic Disadvantage (based on the SEIFA Indexes), which measure how well off a person is across a range of indicators, that the first quintile (“the most disadvantaged 20% of people in Australia”) have the lowest proportion of alcohol consumers and between 2001 and 2007, the proportion dropped.

Conversely, the highest quintile (the most advantaged Australians) are way out there in terms of proportions of that cohort that use alcohol. The AIHW Report concluded that:

… as the socioeconomic status goes up, the proportion of people consuming alcohol also increases.

Later, the Report analyses alcohol use and income and concluded that:

When personal income by alcohol drinking status was analysed, the data show that as personal income increases, so does the prevalence and frequency of drinking … For example, the prevalence of any alcohol consumption is 95% among the highest income group, compared with around 80% among the lowest income group, and there is a fairly constant gradient across these groups. This applies for both sexes.

The March 2012 edition of the ABS Australian Social Trends – carried a feature on “low economic resource households” – which is a cute way of say those who are poor.

The article presented data (for 2009-10) on expenditure on goods and services by the poor relative to the rest of the population.

We learn that:

In 2009-10, the average weekly equivalised expenditure (adjusted to include imputed rent) on goods and services of people in low economic resource households ($500) was 57% of the average expenditure of other households ($872) … Housing, food and transport were the broad expenditure items that accounted for the largest proportion of expenditure on goods and services across both low economic resource households and other households. Among those in low economic resource households, these items accounted for 57% of total expenditure, while for those in other households they accounted for 45%.

In terms of weekly equivalised expenditure, the Low economic resource households spent $A10 a week on alcoholic beverages (1.9 per cent of their total spending) whereas the rest of the population spent $A21 a week on alcoholic beverages (2.4 per cent of their budget).

Spending on other items relating to “socialising” were also much lower in absolute and proportional terms for the poorest Australians.

Which leads to the conclusion that Madam doesn’t have a f**k*** clue.

And what about the socialist attack on investment in Australia?

The ABS released the latest data – Private New Capital Expenditure and Expected Expenditure – for June 2012 – which shows that the growth in private capital formation in Australia has never been as strong although it is being driven by the mining sector.

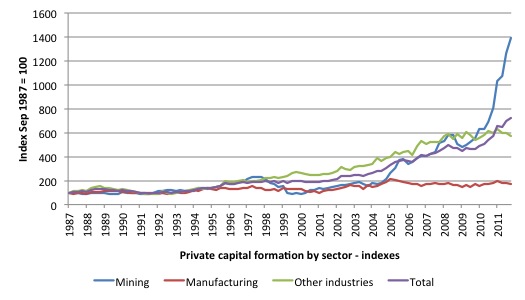

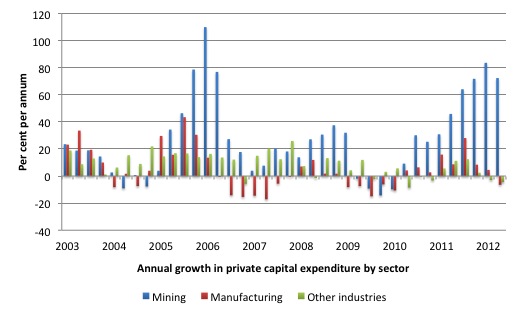

The following graphs provide two perspectives on the boom in mining investment at present. The first is indexed at 100 in the September 1987 quarter (when this series began) and shows the growth in expenditure on private capital formation by the sectors – mining, manufacturing, other selected and total.

The second graph shows the annual growth in spending by the sectors since the first-quarter 2003. Both graphs display a sense of the dramatic.

They confirm that while the mining sector is booming, the rest of Australia is going backwards.

As socialist China urbanises (building millions of houses) we dig more minerals up and get well-paid for it – at least some of us get well-paid. There is increasing inequality in Australia and many people in the Eastern States are not sharing in the bounty.

The ABS data shows that planned private capital spending for 2012-13 rose to $A181.5 billion – a record.

There are two sides to a boom – the price and quantity. In terms of the price side, commodity prices are now slowing.

It is interesting that Larry Elliot in the UK Guardian (August 29, 2012) chose to write about our mining boom in the article – China threatens to burst Australia’s iron ore bubble.

He didn’t write very much but the essence of the story was that we might be counting the days before the mining boom is over. He said:

In the past 15 years, China has built 90 million new homes – enough to house the populations of the UK, France and Germany combined. A quarter of global steel demand is for Chinese property and Chinese infrastructure.

Commodity-rich countries, like Australia, have never had it so good. China takes 25% of Australia’s exports and iron ore accounts for 60% of all the goods Australia sells to China.

All that is accurate.

He then said:

One reason Australia avoided recession during the global downturn of 2008-09 was that it had a well-run banking system. A much bigger reason was that the country had become a giant pit from which China could extract the minerals it needed for its industrial expansion.

In fact, the external sector continues to drain spending from national growth not contribute to it. Our current account is in deficit and despite occasional trade surpluses the net income transfers are strongly negative.

Further, the mining sector went backwards during the early part of the crisis. The reason Australia avoided recession was largely due to the very well-timed and sizeable fiscal stimulus. Without that we would have been in recession in 2008-09.

The mining sector bounced back because of the fiscal stimulus in China. In both countries it was the fiscal stimulus that allowed growth to continue.

Larry Elliot notes that China is slowing fast with “two million unsold homes, with another 30 million under construction” and that the “glut of iron ore” is driving the price down.

He think that leaves Australia:

Horribly exposed, quite obviously. It has an over-valued currency, an over-valued property market, and its major customer is now desperately pulling every available policy lever in the hope of avoiding a hard landing.

All of which is true.

But for the time being it is the spending side – the private capital investment that is driving the growth. How long that lasts is uncertain. But what we know from today’s data release is that the projected (planned) investment has been revised down which means that actual spending will decline in the coming quarters.

While this mining boom is stronger than any before the pattern will play out the same.

Commodity prices rise and this spurs investment and due to delays in getting the capital infrastructure in place (it has to be designed, planned, sourced, constructed and installed) the “pipeline” of spending flow looks solid. A virtuous cycle drives prices and investment up. But remember that investment is the result of plans taken in the past on past data.

Once the commodity price cycle starts to come off (prices start dropping) then investment spending continues at a pace for a time but you see the finite nature of it in the slowing down of planned investment. Then it drops off a cliff.

That is the danger for Australia at present. The government is deliberately contracting growth as a result of its obsessive pursuit of a budget surplus in the coming fiscal year. Consumers are cautious and rebalancing their budgets away from mass consumption via credit.

And investment is looking to slow at some point in the not too distant future.

As in past mining booms when it turns it gets very ugly, very quickly.

They can’t spend … ah … (delay and mostly inaudible) … if they want to run surpluses

Private economic think tanks need to make a buck and to do that they need to be constantly in the public eye making important-sounding pronouncements – usually – on a regular cycle.

So it is no surprise to wake up to the news from the ABC that:

One of the country’s leading economic forecasters says both major political parties have spent too much and promised too much over the past decade.

This emerged after the Federal Government announced that it was finally going to do something about the appalling dental health of the most disadvantaged Australians. They announced a $A4 billion dental program which will provide free care to the poor and dramatically improve their lives.

Dental care was dropped from the national health scheme years ago as a “cost-cutting” measure – totally disregarding the adverse consequences this would have for low income and other disadvantaged citizens. Dental care in Australia is very expensive as a result of a nice little professional association (dare we call it a trade union) able to protect its members from competition.

It is cheaper to fly to Thailand or Manila for major dental care. Of-course, the poor cannot afford the air fares anyway. So they get holes in their teeth and then they wait for them to rot.

The dental scheme is a very significant and important policy reform in Australia and the Government is to be praised for introducing it. It just took a long time for them to see reason.

Anyway it has led to a shrill chorus from these “leading forecasters”, one of which was quoted by ANC News as saying:

I don’t think the budget’s in shape to deliver those sorts of things. Now, it doesn’t mean that those individual ideas, you know there are some good ideas in there … But, you look at what the Government is promising, or at least it would like to do, you look at an Opposition which is aiming to get rid of some taxes, both sides are still making promises, still assuming that China, which forgave the tax cuts and big spending increases over the last decade, will continue to do that.

If the budget were coming down tomorrow, it would be in deficit. A bunch of things have gone wrong in recent times. You know, share markets down, housing prices down … But, the bit of the world economy that is problematic for the budget is what’s happening in China and how that’s led to falls in iron ore and coal prices. Those things hurt the budget more than anything else.

What that means to me is that there’s savings to be made. Now, that’s not impossible, and the Government has already said it will look for savings in and around the new dental scheme, but it may be a reasonably big bill … Most of the things that have happened since the budget are hurting the bottom line.

Advance Saturday Quiz question – Pick the deep flaws in understanding in the previous quotation?

The budget of a currency-issuing nation can never be in good shape or bad shape. These are descriptive terms that have no real meaning. An economy can be in good shape or bad shape by which we mean that growth and employment and inflation are doing something but a budget is just a residual accounting statement of private spending and saving decisions combined with fiscal policy parameters set by government.

Is an increasing deficit bad and a decreasing deficit good? Meaningless. A deficit might rise because non-government saving is being supported by a fiscal stimulus which might lead to increases in employment, national income and real wages. That would be a good outcome.

A deficit might also rise because non-government spending collapses, the government doesn’t stimulate enough and tax revenue falls as national income and employment plummets. That would be a bad outcome.

So trying to bestow virtue on a particular budget balance or direction of movement of a budget balance is meaningless and always leads to erroneous reasoning and poor policy advice.

Which means that all the rest of the terminology – “problematic for the budget”; “hurt the budget”; “hurting the bottom line” – is all meaningless because it makes THE BUDGET BALANCE the object of focus and attention as if it is a goal in its own right.

A government cannot reasonably control what the budget outcome will be because it all depends on the strength of private spending, the contribution of the external sector – and those things are often beyond the influence of government policy. The government should pursue policies that advance national welfare which includes full employment, equity and specific things such as making sure kids don’t lose their teeth by their early teens as a result of their parents being too poor to afford dental care.

The only threat to the dental plan announced would be if there were not enough dentists and materials to bring to bear to service the extra teeth that will need attention. Judging by my knowledge of dental practices I have been serviced by – dentists in Australia enjoy a lot of free time doing enjoyable recreations. I think we will have enough real resources for the government to deploy in the program.

Which makes the point that a currency-issuing government can always bring into use idle resources that are available for sale in the currency it issues.

The dental scheme is a great advance. Now they might like to design and implement some direct job creation to reduce unemployment and underemployment which would allow more of the poor to pay for their own dental care and reduce the outlays of the dental scheme. Win-Win.

The other issue is the way that this “budget blowout” is being dealt with in recent days by the commentators. They give the impression that the government will “run out of money” and “be stretched” and all the other invocations that are used to deceive the listener into thinking that the government has a financial constraint.

Then … with some delay … they whisper – all this spending will be a problem …. (delay) … for achieving a surplus.

It sure might be but they never question the obsession with achieving budget surpuluses.

In the current climate, with investment starting to show signs of exhausting itself, the government will find it very hard to achieve a surplus which will be an excellent outcome for the economy but a disaster for them politically given they have been obsessed about it and held it out as the exemplar of fiscal responsibility.

The problem is not that they will fail but rather the misinformation they pumped out about the virtues of running surpluses when we have at least 12.5 per cent of our willing labour resources doing nothing – either not working as much as they desire or not working at all.

And from the above data … we know these workers are not drinking as much the bosses!

And finally … in this little pot pourri of blogging …

Cut the deficit but not my bit

I love it when conservatives get caught up in their own babble. Over the last several months, as the Republicans noisily maintain their threats to cut spending in the US, some of the big defense firms have been very edgy indeed.

Last month, there was a Bloomberg news report (July 18, 2012) – Lockheed Joined by Cheney in Push Against Defense Cuts – which detailed how one of the large companies was threatening to:

… fire 10,000 workers under across-the- board federal spending cuts …

The report noted that “(f)ormer Vice President Dick Cheney said at a private meeting with Senate Republicans yesterday that the projected cuts totaling $500 billion could be “devastating” to military modernization and planning.”

He was quoted as saying that “you need to keep money flowing in a predictable way so you can plan for the next war”. And, of-course, it is labour aka as employment that does the planning.

The defense industry has presented a study to the Republicans which says the proposed cuts will be an “unemployment Armageddon”.

Of-course the defense firms get themselves in a real tangle as their ideology (and their party affiliations) get in the way of their self interest.

The Wall Street Journal (July 18, 2012) carried this story – Defense Firms Open to Higher Taxes to Avert Cuts – which reported that:

Two top defense contractors told a House committee Wednesday that Congress should consider including increasing taxes as part of a package of changes to reduce the deficit, a sign that industry fear over the impact of spending cuts next year could challenge party orthodoxy.

One of the CEOs said needed to be a “flexible array of solutions” to allow the Congress to make “tough decisions”.

The executives from the big (we feed off the public purse) defense companies were happy to maintain the dialogue that the deficit had to be cut. They just didn’t want their portion of the deficit cut. Hands off!

There are two significant points here.

First, it is clear that these characters have a basic grasp of macroeconomics and now that what the European and the British elites are attempting to deny – that spending cuts at a time when the economy is declining – will damage private sector confidence and undermine economic growth and employment.

The fiscal contraction expansion myth – the Ricardian Equivalence myth – which underpins the stated claim that fiscal austerity will be good for growth because the private sector will be revitalised by the boost in confidence that comes from knowing that the budget deficit is being cut – denies basic human psychology.

The defense CEOs know that public spending cuts will impact directly on jobs and have spill-over effects on other activity in their region and then the entire economy. It is called the multiplier.

It is obvious that spending growth is needed to restore overall economic growth in the US (and elsewhere). So the debate is about where that spending growth will come from.

At last count there were two broad macroeconomic sectors – the government and the non-government. The non-government sector can be decomposed into the private domestic sector and the external sector. The private domestic sector can be further decomposed into households who consume and firms who invest (in productive capital).

Macroeconomics is easy – thats it! 2 broad spending sectors and then some more detail.

What do we know about these sectors in the US?

1. Households are not spending enough on consumption – and why should they given they have to reduce their unsustainable debt levels and are saving to generate buffers just in case they are next to join the unemployment queue.

2. Business firms are not spending enough on investment – and why should they given they have to reduce their unsustainable debt levels and that household spending is not pushing production levels beyond existing capacity (by a long margin).

3. The external sector is deteriorating – that is, spending is contracting because the Europeans and the Brits are killing growth in their economies.

Another advance warning Saturday Quiz question: How many more spending sectors are left in the US?

The most basic macroeconomic rule – spending equals income. When someone spends another gains income. When a sector increases spending, other sectors enjoy the rise in income.

So if all these non-government sector spenders are being cautious and the private domestic sector is attempting to save overall – and – the world economy is not going to drive US exports very hard – where is the deficit spending going to come from to drive growth?

There is only one source – government budget deficits.

A non-government surplus has to be matched by a public deficit – $-for-$. If income is declining as a result of private sector and external sector spending growth cuts then it has to be replaced by spending growth in the public sector.

Simple arithmetic – simple macroeconomics – a fundamental rule of a modern monetary system.

The second point is that the defense contractors are lying about the scale of the job losses (that is, about the size of the employment multiplier in defense).

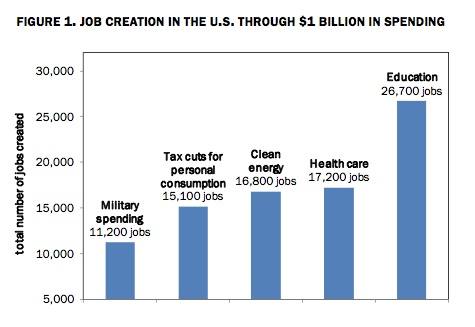

An interesting study – The U.S. Employment Effects of Military and Domestic Spending Priorities: 2011 Update – from the Political Economy Research Institute University of Massachusetts, Amherst was published in December 2011. It provides some very salient estimates of the:

… employment effects of military spending versus channeling equivalent amounts of funding into education, health care, clean energy, and personal consumption within the U.S. economy.

I haven’t time today to analyse the paper in full but it is worth reading.

Some of their results are summarised in the following graph (Figure 1 in the Report). It is accompanied by the following text:

Considering overall job creation, we see from Table 1 that military spending creates about 11,200 from $1 billion in spending. By a significant amount, this is the fewest number of jobs of any of the alternative uses of funds that we present. Thus, household consumption generates about 15,100 jobs, 35 percent more than military spending. Clean energy generates about 16,800 jobs (50 percent more than military), and health care generates about 17,200 jobs (54 percent more than the military). Spending on education is the largest source of job creation by a substantial amount, generating about 26,700 jobs overall through $1 billion in spending, which is 138 percent more than the number of jobs that are generated through $1 billion in military spending.

Conclusion

There was a theme in today’s blog even though it was a series of vignettes. But I have run out of time to repeat it.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Keep hitting ’em with the facts Bill.

You do a wonderful job, Bill. I am a high school teacher in Oz and I have put some of my brighter students onto the ‘insightful’ article by our dear friend Niall Ferguson recently in Newsweek for a critique. I am actually astounded how many people have accepted his balderdash (staff, parents, friends). It seems to have gone viral. Perhaps a Billy Blog should ensue to put this monster to sleep. I have been pleased to see that some of my students clearly know more about what is going than their seniors.

Great, Bill!

By the way, the photo apparently shows Madam Gina under the influence of booze.

That’s not a critic; it’s only human. The fact is just ironic, for it goes contrary to what she preaches for the poor; only a cigarette dangling from her lips is missing.

As discussed recently over here (in the comments), somebody that rich is just extracting economic rents.

just disgusting. I just wish people like her would have gone to their paradise and keep investing and creating jobs all by themselves and leave rest of us alone.

“Which leads to the conclusion that Madam doesn’t have a f**k*** clue.”

I just love your style 🙂 Brilliant!

Hi Bill

Did you read the transcript of the long interview of Jens Weidmann in der Spiegel yeasterday:

http://www.spiegel.de/international/europe/spiegel-interview-with-bundesbank-president-jens-weidmann-a-852285.html

Example; on the question why he’s against EDB purchasing southern european sovereign bonds to ease the situation:

##

SPIEGEL: Isn’t it necessary to occasionally break dogma to prevent something worse from happening?

Weidmann: It’s not about dogma. It’s about reinstituting confidence during a crisis of confidence, and it’s about key monetary policy lessons from the past.

SPIEGEL: Now you’re going to refer to the German hyperinflation of 1923 again.

Weidmann: No, lessons from European postwar history are reflected in the Maastricht Treaty. During the 1970s, the central banks of many Western industrialized nations were chained to economic and fiscal policies. The idea was that it’s better to have 5 percent inflation than 5 percent unemployment. This resulted in inflation and unemployment rising simultaneously. Based on such experiences, the Eurosystem (ed’s note: the ECB and the central banks of the euro-zone members) was aimed solely at the objective of achieving monetary stability, in accordance with the traditions of the Bundesbank.

SPIEGEL: Do you mean that if the rest of Europe were to follow the German example then everything would be fine?

Weidmann: Not at all, it has to do with successful monetary policy principles, and it just so happens that the Bundesbank in particular has apparently succeeded in building up an enormous amount of confidence. It has proved effective for a central bank to remain independent of financial policy and not finance government budgets. These principles are not an end in themselves — rather, they are designed to prevent the central bank from running the risk of neglecting its key mission: keeping prices stable. In the 1970s, a number of countries that are now members of the monetary union experienced double-digit inflation. Remember the story of the Banca d’Italia: how hard it had to fight to free itself of the clutches of the Finance Ministry, and how this was then rightly celebrated as a great success.

##

Is this version of history correct?

I’m not exactly rolling in money but I don’t feel in the least bit jealous of Gina Rinehart. From observation(at a distance,fortunately) I suspect that she has serious mental and physical health problems. The same goes for that other noisy elephantine specimen,Clive Palmer.

They are both riding high at the moment but when the boom inevitably goes phwat I expect that there will be some throttle down in their motor mouth tendencies.

Esteemed Bill-

Re your 3rd item. I infer (courtesy of the invaluable MMT blogosphere you inhabit) that national budget balancing:

> Is not a requirement of macroeconomics;

> Is not a desirable aim towards a robust future economy;

> Saves nothing.

It is a purely political statement that the current macroeconomy is the best there can possibly be, so we’re ensuring its indefinite persistence.

Should this pass muster, I have a general question: Who stands to benefit from a permanent recession? It’s all too easy to assign pejorative motives to others, so please only people or groups that gain substantively regardless of their attitude.

It beats me.

Who stands to benefit from a permanent recession? Peter Shaw

The debt holders of monetary sovereigns. A permanent recession does not increase default risk (there is none) but does increase real yields on existing debt.

Ironically, the debt of monetary sovereigns is “corporate welfare” according to Bill so we have rich welfare recipients opposing welfare for the poor!

What a nasty, selfish, hypocritical and mean spirited piece of work Gina is. Even Clive Palmer has given her a serve over these comments http://www.heraldsun.com.au/news/national/palmer-offers-rinehart-a-reality-check/story-fndo48ca-1226461622456

“Billionaire Clive Palmer has invited Australia’s richest person Gina Rinehart to spend three weeks on the “roasters” in his nickel refinery before she tells workers to “stop whingeing, socialise less, and work harder for lower wages”. “

Finally, the truth comes out.

Excellent article Bill.

Podargus, I think she may have fat cow disease … er, mad cow … er …

I think what she really needs is a tax cut, isn’t that ight?

Dear APJ and others

I think it is better focusing on Gina’s ideas rather than her ascriptive characteristics.

best wishes

bill

“Austerian! Heal thyself!”

The comments by Clive Palmer linked to above gives you some basis for hoping that it is possible for people of all social classes not to see each other as different (and lesser) species. I thought exactly the same about this recent article: http://www.theamericanconservative.com/paul-ryan-the-boy-in-the-bubble/

Particularly telling for me was the line saying that Ryan thought that people fell into one of two groups: entrepreneurial job creators or parasites.

The sort of discourse that the likes of Ryan and Rinehart want to participate in will become a greater feature of the the poor economic situation the longer it goes on.

The subject of “hard work” is a particular part of this discourse, and it has blown up in recent weeks in the UK: http://www.bbc.co.uk/news/uk-politics-19300051

But the subject is a soft underbelly for the political right and economically wrong. I was particularly struck by the comments in this post on the Naked Keynesian blog:

http://nakedkeynesianism.blogspot.co.uk/2012/08/full-employment-why-it-is-important.html Most particularly in the last paragraph:

“I am a big believer in the ethics of hard work, and that is why I think rents and wealth should be heavily taxed, so that everybody needs to work to earn a living.”

The rent seekers in financial services have hollowed out the UK economy just as those in mining are hollowing out Australia to meet China demand for raw material.

“Particularly telling for me was the line saying that Ryan thought that people fell into one of two groups: entrepreneurial job creators or parasites”. Sean Fernyough

MMT might say that the governments are the job creators in recessionary times and the parasites are the rich and corporations. Putting the shoe on the other foot sometimes leads to insights.

“Particularly telling for me was the line saying that Ryan thought that people fell into one of two groups: entrepreneurial job creators or parasites”. Sean Fernyough

Let’s not forget that credit creation is the lending of everyone’s stolen purchasing power to the so-called “creditworthy.” To the extent entrepreneurs have used bank credit then what they have built they have built with stolen goods.

Tonight the ABC program 7:30 reported on the increasing number of mesothelaeoma cases being caused by home renovators disturbing asbestos particles. The manufacturer James Hardie was mentioned for moving its corporate head office offshore to avoid paying compensation to the victims. There was no mention made of the former mine owners, Hancock, of which Gina Rinehart is current owner and managing director. Nor was it mentioned that the dangers of asbestos have been known since the early 1920s