Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – September 22, 2012 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you understand the reasoning behind the answers. If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Here are the answers with discussion for yesterday’s quiz. The information provided should help you understand the reasoning behind the answers. If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

If the national accounts of a nation reveal that its external surplus is equivalent to 2 per cent of GDP and the private domestic sector is saving overall 3 per cent of GDP then we would also observe:

(a) A budget deficit equal to 1 per cent of GDP.

(b) A budget surplus equal to 1 per cent of GDP.

(c) A budget deficit equal to 5 per cent of GDP.

(d) A budget surplus equal to 5 per cent of GDP.

The answer is Option (a) – A budget deficit equal to 1 per cent of GDP.

This question requires an understanding of the sectoral balances that can be derived from the National Accounts. But it also requires some understanding of the behavioural relationships within and between these sectors which generate the outcomes that are captured in the National Accounts and summarised by the sectoral balances.

Refreshing the balances (again) – we know that from an accounting sense, if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the accounting rules.

The important point is to understand what behaviour and economic adjustments drive these outcomes.

So here is the accounting (again). The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

So what economic behaviour might lead to the outcome specified in the question?

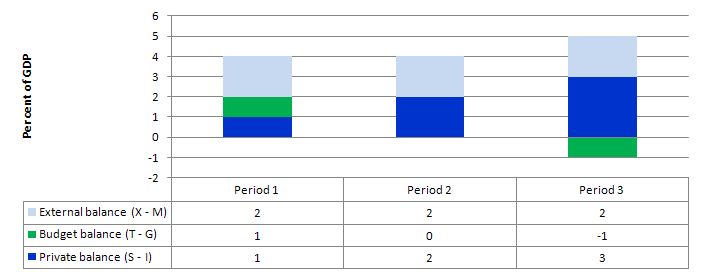

The following graph shows three situations where the external sector is in surplus of 2 per cent of GDP and the private domestic balance is in surplus of varying proportions of GDP (note I have written the budget balance as (T – G).

In Period 1, the private domestic balance is in surplus (1 per cent of GDP), which means it is saving overall (spending less than the total private income) and the budget is also in surplus (1 per cent of GDP). The net injection to demand from the external sector (equivalent to 2 per cent of GDP) is sufficient to “fund” the overall private sector saving drain from expenditure without compromising economic growth. The growth in income would also allow the budget to be in surplus (via tax revenue).

In Period 2, the rise in overall private domestic saving drains extra aggregate demand and necessitates a more expansionary position from the government (relative to Period 1), which in this case manifests as a balanced public budget,’

Period 3, relates to the data presented in the question – an external surplus of 2 per cent of GDP and private domestic saving equal to 3 per cent of GDP. Now the demand injection from the external sector is being more than offset by the demand drain from private domestic saving. The income adjustments that would occur in this economy would then push the budget into deficit of 1 per cent of GDP.

The movements in income associated with the spending and revenue patterns will ensure these balances arise.

The general rule is that the government budget deficit (surplus) will always equal the non-government surplus (deficit).

So if there is an external surplus that is less than the overall private domestic sector saving (a surplus) then there will always be a budget deficit. The higher the overall private saving is relative to the external surplus, the larger the deficit.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 2:

In a currency-issuing nation, real surpluses must be expropriated from productive workers to feed the unemployed.

The answer is True.

This question explores the true relevance of the dependency ratio, which will rise as demographic changes age our populations. It also aims to disabuse the reader of the notion that the income support benefits are paid for by taxes that those in employment (and other income generating activities) might pay.

Initially, we have to be very clear as to what “living off the hard work of those who pay taxes” means. In this sense, it is not a focus on the “income” that the non-workers receive but the command over real good and services that that income provides them with. We will come back to the “funds” issue soon.

So the focus has to be on the real side of the economy because that is, ultimately, the only way our material living standards can be expressed. Nominal aggregates mean very little by themselves.

Income support recipients (who do not work – for whatever reason) clearly command real resources that they have not themselves produced. These real goods and services are produced by those who do work (and the presumption is that most workers pay taxes of some sort or another).

The use of the emotive term “living off the hard work” was deliberate and designed, as a foil, to invoke the idea that governments have created welfare states which provide unsustainable benefits to the poor and marginalised at the expense of those who are materially successful – the classic conservative argument against government welfare provision.

But it doesn’t alter the fact that the statement is false because real goods and services have to be consumed by those who are on income support payments and the goods and services are produced by those who are not.

A slight complicating factor is that the income support recipients also pay taxes if there are indirect tax systems in place but that doesn’t alter the story about the provision of real goods and services.

Now the second part of the answer relates to the question of funding. In terms of where the funds come from to provide the income support for those who do not work the answer is simple: no-where.

While taxation raises revenue for national governments it doesn’t “fund” its spending. Currency-issuing governments can spend without revenue should they wish to.

Abba Lerner’s 1951 book The Economics of Employment was really a rewritten version of the 1941 article The Economic Steering Wheel where he elaborated his version of Keynesian thinking. He conceptualised macroeconomic policy as being about “steering” the fluctuations in the economy. Fiscal policy was the steering wheel and should be applied for functional purposes. Laissez-faire (free market) was akin to letting the car zigzag all over the road and if you wanted the economy to develop in a stable way you had to control its movement.

This led to the concept of functional finance and the differentiation from what he called sound finance (that proposed by the free market lobby). Sound finance was all about fiscal rules – the type you read about every day in the mainstream financial press. Sound finance is about balancing the budget over the course of the business cycle and only increasing the money supply in line with the real rate of output growth; etc – noting the approach erroneously assumes the central bank can control the money supply.

Lerner thought that these rules were based more in conservative morality than being well founded ways to achieve the goals of economic behaviour – full employment and price stability.

He said that once you understood the monetary system you would always employ functional finance – that is, fiscal and monetary policy decisions should be functional – advance public purpose and eschew the moralising concepts that public deficits were profligate and dangerous.

Lerner thought that the government should always use its capacity to achieve full employment and price stability. In Modern Monetary Theory (MMT) we express this responsibility as “advancing public purpose”. In his 1943 book (page 354) we read:

The central idea is that government fiscal policy, its spending and taxing, its borrowing and repayment of loans, its issue of new money and its withdrawal of money, shall all be undertaken with an eye only to the results of these actions on the economy and not to any established traditional doctrine about what is sound and what is unsound. This principle of judging only by effects has been applied in many other fields of human activity, where it is known as the method of science opposed to scholasticism. The principle of judging fiscal measures by the way they work or function in the economy we may call Functional Finance …

Government should adjust its rates of expenditure and taxation such that total spending in the economy is neither more nor less than that which is sufficient to purchase the full employment level of output at current prices. If this means there is a deficit, greater borrowing, “printing money,” etc., then these things in themselves are neither good nor bad, they are simply the means to the desired ends of full employment and price stability …

Mainstream advocacy of fiscal rules that are divorced from a functional context clearly do not make much sense even though their use dominates public policy these days. It may be that a budget surplus is necessary at some point in time – for example, if net exports are very strong and fiscal policy has to contract spending to take the inflationary pressures out of the economy. This will be a rare situation but in those cases I would as a proponent of MMT advocate fiscal surpluses.

Lerner outlined three fundamental rules of functional finance in his 1941 (and later 1951) works.

- The government shall maintain a reasonable level of demand at all times. If there is too little spending and, thus, excessive unemployment, the government shall reduce taxes or increase its own spending. If there is too much spending, the government shall prevent inflation by reducing its own expenditures or by increasing taxes.

- By borrowing money when it wishes to raise the rate of interest, and by lending money or repaying debt when it wishes to lower the rate of interest, the government shall maintain that rate of interest that induces the optimum amount of investment.

- If either of the first two rules conflicts with the principles of ‘sound finance’, balancing the budget, or limiting the national debt, so much the worse for these principles. The government press shall print any money that may be needed to carry out rules 1 and 2.

So in an operational sense, taxation serves to reduce the spending capacity of the non-government sector to ensure that there is non-inflationary space for government to deliver public services. It doesn’t fund anything.

You might like to read these blogs for further information:

- I just found out – state kleptocracy is the problem

- Functional finance and modern monetary theory

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

Question 3:

The British government’s budget deficit has been rising despite the Government’s stated fiscal austerity stance. We can conclude from the evidence at hand that the austerity mantra of the British government doesn’t correctly describe its fiscal policy stance.

The answer is False.

The actual budget deficit outcome that is reported in the press and by Treasury departments is not a pure measure of the discretionary fiscal policy stance adopted by the government at any point in time. As a result, a straightforward interpretation of

Economists conceptualise the actual budget outcome as being the sum of two components: (a) a discretionary component – that is, the actual fiscal stance intended by the government; and (b) a cyclical component reflecting the sensitivity of certain fiscal items (tax revenue based on activity and welfare payments to name the most sensitive) to changes in the level of activity.

The former component is now called the “structural deficit” and the latter component is sometimes referred to as the automatic stabilisers.

The structural deficit thus conceptually reflects the chosen (discretionary) fiscal stance of the government independent of cyclical factors.

The cyclical factors refer to the automatic stabilisers which operate in a counter-cyclical fashion. When economic growth is strong, tax revenue improves given it is typically tied to income generation in some way. Further, most governments provide transfer payment relief to workers (unemployment benefits) and this decreases during growth.

In times of economic decline, the automatic stabilisers work in the opposite direction and push the budget balance towards deficit, into deficit, or into a larger deficit. These automatic movements in aggregate demand play an important counter-cyclical attenuating role. So when GDP is declining due to falling aggregate demand, the automatic stabilisers work to add demand (falling taxes and rising welfare payments). When GDP growth is rising, the automatic stabilisers start to pull demand back as the economy adjusts (rising taxes and falling welfare payments).

The problem is then how to determine whether the chosen discretionary fiscal stance is adding to demand (expansionary) or reducing demand (contractionary). It is a problem because a government could be run a contractionary policy by choice but the automatic stabilisers are so strong that the budget goes into deficit which might lead people to think the “government” is expanding the economy.

So just because the budget goes into deficit doesn’t allow us to conclude that the Government has suddenly become of an expansionary mind. In other words, the presence of automatic stabilisers make it hard to discern whether the fiscal policy stance (chosen by the government) is contractionary or expansionary at any particular point in time.

To overcome this ambiguity, economists decided to measure the automatic stabiliser impact against some benchmark or “full capacity” or potential level of output, so that we can decompose the budget balance into that component which is due to specific discretionary fiscal policy choices made by the government and that which arises because the cycle takes the economy away from the potential level of output.

As a result, economists devised what used to be called the Full Employment or High Employment Budget. In more recent times, this concept is now called the Structural Balance.

The Full Employment Budget Balance was a hypothetical construction of the budget balance that would be realised if the economy was operating at potential or full employment. In other words, calibrating the budget position (and the underlying budget parameters) against some fixed point (full capacity) eliminated the cyclical component – the swings in activity around full employment.

This framework allowed economists to decompose the actual budget balance into (in modern terminology) the structural (discretionary) and cyclical budget balances with these unseen budget components being adjusted to what they would be at the potential or full capacity level of output.

The difference between the actual budget outcome and the structural component is then considered to be the cyclical budget outcome and it arises because the economy is deviating from its potential.

So if the economy is operating below capacity then tax revenue would be below its potential level and welfare spending would be above. In other words, the budget balance would be smaller at potential output relative to its current value if the economy was operating below full capacity. The adjustments would work in reverse should the economy be operating above full capacity.

If the budget is in deficit when computed at the “full employment” or potential output level, then we call this a structural deficit and it means that the overall impact of discretionary fiscal policy is expansionary irrespective of what the actual budget outcome is presently. If it is in surplus, then we have a structural surplus and it means that the overall impact of discretionary fiscal policy is contractionary irrespective of what the actual budget outcome is presently.

So you could have a downturn which drives the budget into a deficit but the underlying structural position could be contractionary (that is, a surplus). And vice versa.

The question then relates to how the “potential” or benchmark level of output is to be measured. The calculation of the structural deficit spawned a bit of an industry among the profession raising lots of complex issues relating to adjustments for inflation, terms of trade effects, changes in interest rates and more.

Much of the debate centred on how to compute the unobserved full employment point in the economy. There were a plethora of methods used in the period of true full employment in the 1960s.

As the neo-liberal resurgence gained traction in the 1970s and beyond and governments abandoned their commitment to full employment , the concept of the Non-Accelerating Inflation Rate of Unemployment (the NAIRU) entered the debate – see my blogs – The dreaded NAIRU is still about and Redefing full employment … again!.

The NAIRU became a central plank in the front-line attack on the use of discretionary fiscal policy by governments. It was argued, erroneously, that full employment did not mean the state where there were enough jobs to satisfy the preferences of the available workforce. Instead full employment occurred when the unemployment rate was at the level where inflation was stable.

The estimated NAIRU (it is not observed) became the standard measure of full capacity utilisation. If the economy is running an unemployment equal to the estimated NAIRU then mainstream economists concluded that the economy is at full capacity. Of-course, they kept changing their estimates of the NAIRU which were in turn accompanied by huge standard errors. These error bands in the estimates meant their calculated NAIRUs might vary between 3 and 13 per cent in some studies which made the concept useless for policy purposes.

Typically, the NAIRU estimates are much higher than any acceptable level of full employment and therefore full capacity. The change of the the name from Full Employment Budget Balance to Structural Balance was to avoid the connotations of the past where full capacity arose when there were enough jobs for all those who wanted to work at the current wage levels.

Now you will only read about structural balances which are benchmarked using the NAIRU or some derivation of it – which is, in turn, estimated using very spurious models. This allows them to compute the tax and spending that would occur at this so-called full employment point. But it severely underestimates the tax revenue and overestimates the spending because typically the estimated NAIRU always exceeds a reasonable (non-neo-liberal) definition of full employment.

So the estimates of structural deficits provided by all the international agencies and treasuries etc all conclude that the structural balance is more in deficit (less in surplus) than it actually is – that is, bias the representation of fiscal expansion upwards.

As a result, they systematically understate the degree of discretionary contraction coming from fiscal policy.

The only qualification is if the NAIRU measurement actually represented full employment. Then this source of bias would disappear.

So in terms of the question, a rising budget deficit can accompany a contractionary fiscal position if the cuts in the discretionary net spending leads to a decline in economic growth and the automatic stabilisers then drive the cyclical component higher and more than offset the discretionary component.

Without delving further into the actual factors that are delivering the budget outcome in Britain one cannot make the conclusion implied in the question.

The following blogs may be of further interest to you:

- A modern monetary theory lullaby

- Saturday Quiz – April 24, 2010 – answers and discussion

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

Question 4:

The impact on aggregate demand would be invariant between the government matching its deficit spending with private bond issues and the situation where the government instructed the central bank to buy its bonds to match the deficit.

The answer is True.

There are two dimensions to this question: (a) the impacts in the real economy; and (b) the monetary operations involved.

It is clear that at any point in time, there are finite real resources available for production. New resources can be discovered, produced and the old stock spread better via education and productivity growth. The aim of production is to use these real resources to produce goods and services that people want either via private or public provision.

So by definition any sectoral claim (via spending) on the real resources reduces the availability for other users. There is always an opportunity cost involved in real terms when one component of spending increases relative to another.

However, the notion of opportunity cost relies on the assumption that all available resources are fully utilised.

Unless you subscribe to the extreme end of mainstream economics which espouses concepts such as 100 per cent crowding out via financial markets and/or Ricardian equivalence consumption effects, you will conclude that rising net public spending as percentage of GDP will add to aggregate demand and as long as the economy can produce more real goods and services in response, this increase in public demand will be met with increased public access to real goods and services.

If the economy is already at full capacity, then a rising public share of GDP must squeeze real usage by the non-government sector which might also drive inflation as the economy tries to siphon of the incompatible nominal demands on final real output.

However, the question is focusing on the concept of financial crowding out which is a centrepiece of mainstream macroeconomics textbooks. This concept has nothing to do with “real crowding out” of the type noted in the opening paragraphs.

The financial crowding out assertion is a central plank in the mainstream economics attack on government fiscal intervention. At the heart of this conception is the theory of loanable funds, which is a aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking.

The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

At the heart of this erroneous hypothesis is a flawed viewed of financial markets. The so-called loanable funds market is constructed by the mainstream economists as serving to mediate saving and investment via interest rate variations.

This is pre-Keynesian thinking and was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

So saving (supply of funds) is conceived of as a positive function of the real interest rate because rising rates increase the opportunity cost of current consumption and thus encourage saving. Investment (demand for funds) declines with the interest rate because the costs of funds to invest in (houses, factories, equipment etc) rises.

Changes in the interest rate thus create continuous equilibrium such that aggregate demand always equals aggregate supply and the composition of final demand (between consumption and investment) changes as interest rates adjust.

According to this theory, if there is a rising budget deficit then there is increased demand is placed on the scarce savings (via the alleged need to borrow by the government) and this pushes interest rates to “clear” the loanable funds market. This chokes off investment spending.

So allegedly, when the government borrows to “finance” its budget deficit, it crowds out private borrowers who are trying to finance investment.

The mainstream economists conceive of this as the government reducing national saving (by running a budget deficit) and pushing up interest rates which damage private investment.

This trilogy of blogs will help you understand this if you are new to my blog – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

The basic flaws in the mainstream story are that governments just borrow back the net financial assets that they create when they spend. Its a wash! It is true that the private sector might wish to spread these financial assets across different portfolios. But then the implication is that the private spending component of total demand will rise and there will be a reduced need for net public spending.

Further, they assume that savings are finite and the government spending is financially constrained which means it has to seek “funding” in order to progress their fiscal plans. But government spending by stimulating income also stimulates saving.

Additionally, credit-worthy private borrowers can usually access credit from the banking system. Banks lend independent of their reserve position so government debt issuance does not impede this liquidity creation.

In terms of the monetary operations involved we note that national governments have cash operating accounts with their central bank. The specific arrangements vary by country but the principle remains the same. When the government spends it debits these accounts and credits various bank accounts within the commercial banking system. Deposits thus show up in a number of commercial banks as a reflection of the spending. It may issue a cheque and post it to someone in the private sector whereupon that person will deposit the cheque at their bank. It is the same effect as if it had have all been done electronically.

All federal spending happens like this. You will note that:

- Governments do not spend by “printing money”. They spend by creating deposits in the private banking system. Clearly, some currency is in circulation which is “printed” but that is a separate process from the daily spending and taxing flows.

- There has been no mention of where they get the credits and debits come from! The short answer is that the spending comes from no-where but we will have to wait for another blog soon to fully understand that. Suffice to say that the Federal government, as the monopoly issuer of its own currency is not revenue-constrained. This means it does not have to “finance” its spending unlike a household, which uses the fiat currency.

- Any coincident issuing of government debt (bonds) has nothing to do with “financing” the government spending.

All the commercial banks maintain reserve accounts with the central bank within their system. These accounts permit reserves to be managed and allows the clearing system to operate smoothly. The rules that operate on these accounts in different countries vary (that is, some nations have minimum reserves others do not etc). For financial stability, these reserve accounts always have to have positive balances at the end of each day, although during the day a particular bank might be in surplus or deficit, depending on the pattern of the cash inflows and outflows. There is no reason to assume that these flows will exactly offset themselves for any particular bank at any particular time.

The central bank conducts “operations” to manage the liquidity in the banking system such that short-term interest rates match the official target – which defines the current monetary policy stance. The central bank may: (a) Intervene into the interbank (overnight) money market to manage the daily supply of and demand for reserve funds; (b) buy certain financial assets at discounted rates from commercial banks; and (c) impose penal lending rates on banks who require urgent funds, In practice, most of the liquidity management is achieved through (a). That being said, central bank operations function to offset operating factors in the system by altering the composition of reserves, cash, and securities, and do not alter net financial assets of the non-government sectors.

Fiscal policy impacts on bank reserves – government spending (G) adds to reserves and taxes (T) drains them. So on any particular day, if G > T (a budget deficit) then reserves are rising overall. Any particular bank might be short of reserves but overall the sum of the bank reserves are in excess. It is in the commercial banks interests to try to eliminate any unneeded reserves each night given they usually earn a non-competitive return. Surplus banks will try to loan their excess reserves on the Interbank market. Some deficit banks will clearly be interested in these loans to shore up their position and avoid going to the discount window that the central bank offeres and which is more expensive.

The upshot, however, is that the competition between the surplus banks to shed their excess reserves drives the short-term interest rate down. These transactions net to zero (a equal liability and asset are created each time) and so non-government banking system cannot by itself (conducting horizontal transactions between commercial banks – that is, borrowing and lending on the interbank market) eliminate a system-wide excess of reserves that the budget deficit created.

What is needed is a vertical transaction – that is, an interaction between the government and non-government sector. So bond sales can drain reserves by offering the banks an attractive interest-bearing security (government debt) which it can purchase to eliminate its excess reserves.

However, the vertical transaction just offers portfolio choice for the non-government sector rather than changing the holding of financial assets.

This is based on the erroneous belief that the banks need deposits and reserves before they can lend. Mainstream macroeconomics wrongly asserts that banks only lend if they have prior reserves. The illusion is that a bank is an institution that accepts deposits to build up reserves and then on-lends them at a margin to make money. The conceptualisation suggests that if it doesn’t have adequate reserves then it cannot lend. So the presupposition is that by adding to bank reserves, quantitative easing will help lending.

But this is a completely incorrect depiction of how banks operate. Bank lending is not “reserve constrained”. Banks lend to any credit worthy customer they can find and then worry about their reserve positions afterwards. If they are short of reserves (their reserve accounts have to be in positive balance each day and in some countries central banks require certain ratios to be maintained) then they borrow from each other in the interbank market or, ultimately, they will borrow from the central bank through the so-called discount window. They are reluctant to use the latter facility because it carries a penalty (higher interest cost).

The point is that building bank reserves will not increase the bank’s capacity to lend. Loans create deposits which generate reserves.

The following blogs may be of further interest to you:

- When a huge pack of lies is barely enough

- Saturday Quiz – April 17, 2010 – answers and discussion

- Quantitative easing 101

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Money multiplier and other myths

- Will we really pay higher interest rates?

- A modern monetary theory lullaby

Question 5 – Premium question

In Year 1, the economy plunges into recession with nominal GDP growth falling to minus -1 per cent. The inflation rate is subdued at 2 per cent per annum. The outstanding public debt is equal to the value of the nominal GDP and the nominal interest rate is equal to 2 per cent (and this is the rate the government pays on all outstanding debt). The government’s budget balance net of interest payments goes into deficit equivalent to 1 per cent of GDP and the debt ratio rises by 4 per cent. In Year 2, the government stimulates the economy and pushes the primary budget deficit out to 4 per cent of GDP in recognition of the severity of the recession. In doing so it stimulates aggregate demand and the economy records a 4 per cent nominal GDP growth rate. The central bank holds the nominal interest rate constant but inflation falls to 1 per cent given the slack nature of the economy the previous year. Under these circumstances, the public debt ratio falls even though the budget deficit has risen because of the real growth in the economy.

The answer is False.

This question requires you to understand the key parameters and relationships that determine the dynamics of the public debt ratio. An understanding of these relationships allows you to debunk statements that are made by those who think fiscal austerity will allow a government to reduce its public debt ratio.

While Modern Monetary Theory (MMT) places no particular importance in the public debt to GDP ratio for a sovereign government, given that insolvency is not an issue, the mainstream debate is dominated by the concept.

The unnecessary practice of fiat currency-issuing governments of issuing public debt $-for-$ to match public net spending (deficits) ensures that the debt levels will rise when there are deficits.

Rising deficits usually mean declining economic activity (especially if there is no evidence of accelerating inflation) which suggests that the debt/GDP ratio may be rising because the denominator is also likely to be falling or rising below trend.

Further, historical experience tells us that when economic growth resumes after a major recession, during which the public debt ratio can rise sharply, the latter always declines again.

It is this endogenous nature of the ratio that suggests it is far more important to focus on the underlying economic problems which the public debt ratio just mirrors.

Mainstream economics starts with the flawed analogy between the household and the sovereign government such that any excess in government spending over taxation receipts has to be “financed” in two ways: (a) by borrowing from the public; and/or (b) by “printing money”.

Neither characterisation is remotely representative of what happens in the real world in terms of the operations that define transactions between the government and non-government sector.

Further, the basic analogy is flawed at its most elemental level. The household must work out the financing before it can spend. The household cannot spend first. The government can spend first and ultimately does not have to worry about financing such expenditure.

However, the mainstream framework for analysing these so-called “financing” choices is called the government budget constraint (GBC). The GBC says that the budget deficit in year t is equal to the change in government debt over year t plus the change in high powered money over year t. So in mathematical terms it is written as:

which you can read in English as saying that Budget deficit = Government spending + Government interest payments – Tax receipts must equal (be “financed” by) a change in Bonds (B) and/or a change in high powered money (H). The triangle sign (delta) is just shorthand for the change in a variable.

However, this is merely an accounting statement. In a stock-flow consistent macroeconomics, this statement will always hold. That is, it has to be true if all the transactions between the government and non-government sector have been corrected added and subtracted.

So in terms of MMT, the previous equation is just an ex post accounting identity that has to be true by definition and has not real economic importance.

But for the mainstream economist, the equation represents an ex ante (before the fact) financial constraint that the government is bound by. The difference between these two conceptions is very significant and the second (mainstream) interpretation cannot be correct if governments issue fiat currency (unless they place voluntary constraints on themselves to act as if it is).

Further, in mainstream economics, money creation is erroneously depicted as the government asking the central bank to buy treasury bonds which the central bank in return then prints money. The government then spends this money.

This is called debt monetisation and you can find out why this is typically not a viable option for a central bank by reading the Deficits 101 suite – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

The mainstream view claims that if governments increase the money growth rate (they erroneously call this “printing money”) the extra spending will cause accelerating inflation because there will be “too much money chasing too few goods”! Of-course, we know that proposition to be generally preposterous because economies that are constrained by deficient demand (defined as demand below the full employment level) respond to nominal demand increases by expanding real output rather than prices. There is an extensive literature pointing to this result.

So when governments are expanding deficits to offset a collapse in private spending, there is plenty of spare capacity available to ensure output rather than inflation increases.

But not to be daunted by the “facts”, the mainstream claim that because inflation is inevitable if “printing money” occurs, it is unwise to use this option to “finance” net public spending.

Hence they say as a better (but still poor) solution, governments should use debt issuance to “finance” their deficits. Thy also claim this is a poor option because in the short-term it is alleged to increase interest rates and in the longer-term is results in higher future tax rates because the debt has to be “paid back”.

Neither proposition bears scrutiny – you can read these blogs – Will we really pay higher taxes? and Will we really pay higher interest rates? – for further discussion on these points.

The mainstream textbooks are full of elaborate models of debt pay-back, debt stabilisation etc which all claim (falsely) to “prove” that the legacy of past deficits is higher debt and to stabilise the debt, the government must eliminate the deficit which means it must then run a primary surplus equal to interest payments on the existing debt.

A primary budget balance is the difference between government spending (excluding interest rate servicing) and taxation revenue.

The standard mainstream framework, which even the so-called progressives (deficit-doves) use, focuses on the ratio of debt to GDP rather than the level of debt per se. The following equation captures the approach:

So the change in the debt ratio is the sum of two terms on the right-hand side: (a) the difference between the real interest rate (r) and the real GDP growth rate (g) times the initial debt ratio; and (b) the ratio of the primary deficit (G-T) to GDP.

The real interest rate is the difference between the nominal interest rate and the inflation rate. Real GDP is the nominal GDP deflated by the inflation rate. So the real GDP growth rate is equal to the Nominal GDP growth minus the inflation rate.

This standard mainstream framework is used to highlight the dangers of running deficits. But even progressives (not me) use it in a perverse way to justify deficits in a downturn balanced by surpluses in the upturn.

MMT does not tell us that a currency-issuing government running a deficit can never reduce the debt ratio. The standard formula above can easily demonstrate that a nation running a primary deficit can reduce its public debt ratio over time.

Furthermore, depending on contributions from the external sector, a nation running a deficit will more likely create the conditions for a reduction in the public debt ratio than a nation that introduces an austerity plan aimed at running primary surpluses.

But if growth is not sufficient then the public debt ratio can rise.

Here is why that is the case.

While a growing economy can absorb more debt and keep the debt ratio constant or falling an increasing real interest rate also means that interest payments on the outstanding stock of debt rise.

From the formula above, if the primary budget balance is zero, public debt increases at a rate r but the public debt ratio increases at r – g.

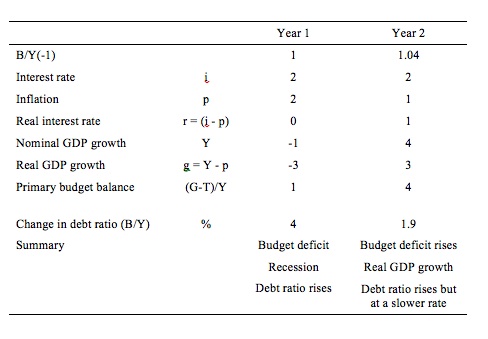

The following Table simulates the two years in question. To make matters simple, assume a public debt ratio at the start of the Year 1 of 100 per cent (so B/Y(-1) = 1) which is equivalent to the statement that “outstanding public debt is equal to the value of the nominal GDP”.

In Year 1, the nominal interest rate is 2 per cent and the inflation rate is 2 per cent then the current real interest rate (r) is 0 per cent.

If the nominal GDP grows at -1 per cent and there is an inflation rate of 2 per cent then real GDP is growing (g) at minus 3 per cent.

Under these conditions, the primary budget surplus would have to be equal to 3 per cent of GDP to stabilise the debt ratio (check it for yourself).

In Year 1, the primary budget deficit is actually 1 per cent of GDP so we know by computation that the public debt ratio rises by 4 per cent.

The calculation (using the formula in the Table) is:

Change in B/Y = (0 – (-3))*1 + 1 = 4 per cent.

The situation gets more complex in Year 2 because the inflation rate falls to 1 per cent while the central bank holds the nominal interest rate constant at 2 per cent. So the real interest rate rises to 1 per cent.

The data in Year 2 is given in the last column in the Table below. Note the public debt ratio at the beginning of the period has risen to 1.04 because of the rise from last year.

You are told that the budget deficit rises to 4 per cent of GDP and nominal GDP growth shoots up to 4 per cent which means real GDP growth (given the inflation rate) is equal to 3 per cent.

The corresponding calculation for the change in the public debt ratio is:

Change in B/Y = (1 – 3)*1.04 + 5 = 1.9 per cent.

That is, the public debt ratio rises but at a slower rate than in the last year. The real growth in the economy has been beneficial and if maintained would start to eat into the primary budget balance (via the rising tax revenues that would occur).

In a few years, the growth would not only reduce the primary budget deficit but the public debt ratio would start to decline as well.

So when the budget deficit is a large percentage of GDP then it might take some years to start reducing the public debt ratio as GDP growth ensures.

The best way to reduce the public debt ratio is to stop issuing debt. A sovereign government doesn’t have to issue debt if the central bank is happy to keep its target interest rate at zero or pay interest on excess reserves.

The discussion also demonstrates why a falling inflation rate makes it harder for the government to reduce the public debt ratio – which, of-course, is one of the more subtle mainstream ways to force the government to run surpluses.

Q1, “(I – S) + (G – T) + (X – M) = 0”

Doesn’t that assume all new medium of exchange is borrowed into existence?

Q2, “Government should adjust its rates of e xpenditure and taxation such that total spending in the economy is neither more nor less than that which is sufficient to purchase the full employment level of output at current prices.”

Isn’t full employment affected by the retirement market?

“Doesn’t that assume all new medium of exchange is borrowed into existence?”

It always is. It’s either borrowed into existence by private sector banks expanding their balance sheet, or it is borrowed into existence by the central bank expanding its balance sheet.

Something has to expand its balance sheet.

The government sector includes the central bank in MMT.

The sectoral balances are accounting identities. They are true whatever viewpoint you want to take.

Off Topic

Dear blog writer and blog readers.

I read this site from time to time and I do not understand so much of the jargon and theories.

But I do understand the aim behind the debate on the blog. Where I live, Sweden, the youth unemployment have been persistent for years.

But there is almost no debate around the issue. It is almost like there is no unemployment-problem.

Everything (social issues) has been cooked down to a dubious morality and ethics-discussion, and I feel more and more that I have been born and raised in a society that has lost the intellectual capacity to really solve its problems. It is like living in a religious sect, and reason and common sense have been stolen by the leaders.

There must be an end to this. I do not see the light in the tunnel.

Is there light out there?

I will lose my job in about two weeks, and I see absolutely nothing out there waiting for me.

Neil Wilson, government does not borrow, it issues its own liabilities.

Now UK government’s deficit is up 22% year-on-year. Orborne’s plan is backfiring. Slower economy AND higher deficits.

http://www.bbc.co.uk/news/business-19672660

Johnny B Bad: as I understand it, the answer to your question is largely political: there is nothing to impede the Swedish government from using its spending power to create the employment that your desire, as, correct me if I am wrong, there is no official “peg” of the Krone to the Euro. You seem very bright, so don’t fall into despair over your prospects, but as to the larger unemployment problem that you identify, when you are re-employed, there will be someone else who will still need a job. Some good stuff on the Swedish political system is written by Magnus Ryner, of Kings’ College: maybe start with the forthcoming : “Swedish Trade Union Consent to Finance-Led Capitalism: A Question of Time,” Public Administration 91 (2012, forthcoming). (I am am not competent to comment on stuff actually written in Swedish!) Best of luck.

“Neil Wilson, government does not borrow, it issues its own liabilities.”

It depends on your viewpoint.

The government sector as a whole expands its balance sheet on the consolidated balance sheet, which is where it appears to issue its own liabilities.

However underneath that there is usually the Treasury and the Central Bank and on those balance sheets it appears that the Treasury borrows from the Central Bank via an intra-government loan system.

Both are accurate descriptions.

It’s very important not to get fixated on a single viewpoint or stuck at a particular level of abstraction. There are numerous views that are internally consistent with each other.

Johnny B Bad,

To be blunt, the greatest threat to your country now is that it will join the EMU and subject itself to the same fate as the others. In answer to your questions yes, full employment in a productive economy like

Sweden’s is very achievable. The greatest weapon to bring this about is to learn the concepts taught by Bill Mitchell, Warren Mosler and others so that you can spread the word to others. Ask as many questions as you have, there really are no stupid questions when it comes to learning about MMT.

Sweden is part of this EU fiscal pact that imposes austerity everywhere. They did not see any reason to make it eurozone-only. 🙁

Johnny B Bad, hopefully you have come across Lars P Syll’s blog http://larspsyll.wordpress.com/ . He is based in Malmo. I believe there is light :). Good luck with your near future struggles – may the luck that guided you here help you find a way :).

Neil Wilson’s post: “”Doesn’t that assume all new medium of exchange is borrowed into existence?”

It always is. It’s either borrowed into existence by private sector banks expanding their balance sheet, or it is borrowed into existence by the central bank expanding its balance sheet.”

And is that where the probelm is, the idea that all new medium of exchange has to be borrowed into existence the way the system is set up now?

And, “The sectoral balances are accounting identities. They are true whatever viewpoint you want to take.”

My viewpoint is that there is something missing there. I believe it is:

current account deficit = gov’t deficit plus private deficit PLUS A ZERO

“And is that where the probelm is, the idea that all new medium of exchange has to be borrowed into existence the way the system is set up now?”

I would suggest that is more to do with the way you are viewing the word ‘borrowing’ than any accounting or economic impact that may have.

If you prefer you can view it as the idea that they are ‘saved’ into existence. It’s the same thing viewed from the other side of the balance sheet.

Dear JBB Johnny B Bad Sun 23Sept at 18:57

Homo sapiens have been on the road for 200,000 years now, and still haven’t risen above the simple attractive energy of greed, or the illusion of ego – so I wouldn’t set the angst bar too high. Solving problems is one thing; coming to grips with the problem generator is another.

Do you know Johnny B Good could ‘play a guitar, like ringin’ a bell’. Everybody has a gift for something. What is yours? Have you developed it fully?

There are times in everyone’s’ lives when ‘there is nothing out there waiting for them’. So turn around: what is there inside of you waiting for you?? Intellectual capacity is one thing – it’s highly overrated in my opinion; and often faulty. The ability to feel what it means to exist, to be alive, to be human; to be fulfilled and to be you, is quite another. There is the most noble challenge …!

So long as you are breathing you are successful; there is no greater success than that. Most people don’t understand this. When you were a kid you were fully employed, having fun!! Today, you still want to enjoy yourself. No need to worry about what will happen to you; it is already happening. Catch23 – If your happiness is dependent upon something on the outside being a certain way, then it is conditional and subject to every way the wind blows. Ignorant people turn this beautiful planet into a factory, or a war-zone, a toxic dump or an asylum: but that is not why we are here.

Take your one chance at life. I can guarantee you will not feel empty-handed if you look inside and find yourself, get in touch with yourself, no matter what is going on on the outside. Start from there, every day. If you are looking for light, have you looked within??? Most people’s self is absolutely flooded with light, but they forget to look. Listen to your heart; it’s much wiser than your mind!

Hope I have managed to cheer you on just a little!! When the heart is full, the landscape is seen exactly as it is. Then we can improve it free of agendas.

Here is my latest little fridge note:

Be strong! Walk your life …

Be even stronger! Enjoy your life …

Cheers …

jrbarch

Neil, there may be something on the other side of the balance sheet. It doesn’t seem like ‘saved’ is correct.

I think it does have an economic impact.