It's Wednesday, and as usual I scout around various issues that I have been thinking…

IMF to get Nobel Peace Prize in 2013

There was a report – Poverty in Australia – released over the weekend by the Australian Council of Social Service, which brought the reality of our lying federal government home- 1 in 6 Australian’s are living below the poverty line (which itself is a very low hurdle for an advanced nation to have to clear). I will dedicate a separate blog to that in the coming weeks. But the Federal government needs to face facts and stop adding to the despair of millions of Australia as part of its ideological and political obsession with budget surpluses. This brazen disregard for the most disadvantaged citizens probably qualifies the Government for a Nobel Peace prize, although I was thinking of nominating the IMF and the OECD to be joint recipients for 2013. They would join the current recipients, the EU and a host of other “deserving” winners over the last several years. I guess in awarding this year’s Peace Prize to the EU, the Nobel Prize Committee is trying to bring their main prizes into line with the rogue Economics Prize in terms of quality and deservedness of the winners.

When I first heard the news that the EU had one the 2012 Peace Prize, I wondered whether the tropical heat of my new location (Darwin) was getting to me already after just a week of being here. The weather is pretty torrid here for a “southerner”, a sort of affectionate (but, ultimately barbed) term that the locals use for blow-ins such as me from the South-Eastern states. So it is possible I was having a spasm or something when I read the news.

But it was confirmed to be my a spate of E-mails from disbelievers everywhere – most of whom live in more temperate climates and probably were not using any mind-altering substances, at least at the time they sent the E-mails.

As an aside – on the doping angle, I am doing an interview soon with a major cycling publication on the doping scandal in that sport. My involvement in that issue goes back to my days as a bike racer and the founder of the largest WWW cycling page – cyclingnews.com. More another day on that story, which has a long way to go yet, despite, the USADA’s recent success in breaking the big US conspiracy to cheat.

I thought this ABC News header caught what I was thinking about the announcement although the characterisation of the problem (“debt crisis”) is not how I would construct the travesty of giving the Prize to the EU.

Why not start with – “that plays down the fact that at least 50 per cent of youth and more than a quarter of all working age persons are being deliberately denied an opportunity to work” – or “that plays down the fact that there is a class war developing on the streets of Athens, Madrid and elsewhere in Europe as unemployment and increased poverty bites” or “that right-wing extremism is gathering ground as economies grind to a halt under the yoke of the ideological assault from the EC elites” or whatever else you think expresses this viewpoint.

In terms of the photo though – I did like the blue shades!

In his will, Alfred Nobel indicated that one-fifth of the annual interest on his invested “remaining realizable estate” shall be awarded annually:

… to the person who shall have done the most or the best work for fraternity between nations, for the abolition or reduction of standing armies and for the holding and promotion of peace congresses.

This New Statesman article (October 12, 2012) – Why the European Union does not deserve the Nobel Peace Prize – makes the obvious points.

The arguments presented in this Bloomberg Op Ed (October 12, 2012) – A Nobel Prize for Idiots, Signifying Only Bias – are contestable, but I agree with this observation:

Ask an Athenian shopkeeper, who during the past two years of civil unrest has had to board up his shop for weeks at a time, whether the EU has brought him peace. Ask the immigrants, who increasingly are threatened by Europe’s resurgent fascist parties, galvanized by the recessions that were caused in part by the EU’s effort to straitjacket every economy in Europe into a single currency, with a single interest rate and exchange rate. Ask the youth of Europe whether they’ve found peace, as the unemployment rates for their age groups rise above 50 percent in Spain, and only slightly less in Italy, Portugal and Greece.

Voters also rejected austerity in last week’s Lithuanian national election. The leading contender for government said that if his Labour Party took control it would ditch the SGP rules dictating a maximum 3 per cent budget deficit to GDP because (Source):

How otherwise can you generate [growth in] the economy if you only borrow to cover regular expenditure? You need to borrow for generating [growth].

Poverty rates in the EU are very high for an advanced block of countries and are getting worse. According to the – European Anti-Poverty Network (EAPN) – the poverty rate in the EU is currently around 16 per cent (1 in 6), similar to the shocking result just revealed for Australia.

Any way, we could go on about whether the recipient is deserving, which, in a way, would first of all have to be a discussion about whether the entire Nobel Prize apparatus has any credibility – given that even the close relatives of the original founder consider the Committee has been violating the original intentions of the will.

More important is the “Interim Report” released by the President of the European Council last Friday (October 12, 2012) – Towards a Genuine Economic and Monetary Union – which is meant to feed into this week’s summit of the EU elite.

As an aside, there are a lot of “interim” documents issued by the EU and the EC, which is, of-course, part of the problem. The decision-making machinery and processes are so elongated that it takes a long time to get anything done and when it is the compromises are so broad as to be (often) useless in relation to the problem being addressed.

This particular “Interim Report” was the result of an invitation from the June European Council “to develop, in close collaboration with the President of the Commission, the President of the Eurogroup and the President of the ECB, a specific and time-bound road map for the achievement of a genuine Economic and Monetary Union”.

It is intended to “highlight points of convergence and to outline areas that would require further work for the final report due in December”.

It is applicable to the Eurozone only.

So what does this 8-page interim report tell us about the advances in understandings of the Eurozone bureaucracy and leadership about the issues that are driving the economies of the member nations into oblivion? Answer: Not very much.

Essentially, the document recommends that an integrated financial framework being introduced to put banking regulation at the EU level rather than at the member state level. This is sensible, given that the member states do not have central banks, which can provide genuine lender of last resort guarantees to ensure depositors are protected.

Further, given the extensive cross-border capital flows, it makes no sense for a host of regulative frameworks to exist side-by-side.

But given the recent German resistance to the Spanish government’s “bailout” funding (to save the Spanish banks, which are collapsing) being treated outside of the official budget, we will see how effective such a supra-national framework actually is. Count me among the skeptics on this.

In addition to the proposal to create an integrated financial framework, the document proposes an “Integrated budgetary framework”. As I have noted previously, there are only two ways for the Eurozone to proceed:

1. The preferred way, given the cultural and economic differences across member states, is for the Eurozone to be broken up in an orderly way and currency sovereignty restored at the member state level.

These currencies would float against each other and the democratically-elected governments would be able to pursue an independent monetary and fiscal policy aimed at advancing national interest, which at present would require large budget deficits in many cases targetting direct job creation.

2. But in lieu of that piece of common-sense, the Eurozone would have to create a true federation, where the member states become states of the Eurozone along the lines that California or New South Wales are states of the US and Australia, respectively.

The federal government should then be elected democratically and control the currency-issuing authority (the ECB) so that fiscal policy could be directed at advancing the common purpose across the Federation and extensive fiscal transfers be made possible, should the circumstance arise. At present that would require large fiscal injections into Greece, Spain, Ireland, Portugal, Estonia, probably Italy, soon France and the Netherlands and so on.

What I would have been looking for at this top-level, mission-statement sort of level was a clear vision that the “Integrated budgetary framework” would allow for fiscally responsible policies to be introduced by the federal government of the Eurozone, such that full employment was a prime objective.

In this context, the Federal government of the Eurozone (FGE) would have to recognise that budget deficits are endogenous outcomes, largely outside the discretion of the currency-issuing government, and reflect the state of non-government spending (and saving).

Above all, there would have to be an understanding that mass unemployment always means that overal federal budget deficits are too small because it arises when public spending is too low relative to the tax collected across the “federal space”.

While regional disparities occur across that space, the notion of the regions becomes usurped by the greater understanding that the federal level is where the solutions lie – even if they manifest at the regional level – for example, via direct job creation programs funded at the federal level.

We would be looking for an understanding that the role of the federal government is to ensure there is adequate aggregate spending at each regional level relative to the real capacity of that level to produce. This might involve reducing public spending where full employment was already being realised and increasing it in areas where obvious output gaps exist.

This capacity to redistribute aggregate demand as well as increase or reduce it overall is one of the reasons why fiscal policy is the preferred policy tool to manage overall spending in the federal space. Monetary policy is an inferior tool in this regard.

Monetary policy – largely working via interest rate management – is what we call a “blunt tool” – because it is difficult to target regions, specific demographic cohorts via interest rate changes and its impacts are lagged (working indirectly via changes to behaviour) and uncertain (impacts are net effects of creditors and debtors, which are in themselves difficult to estimate).

There would be no question that citizens in one state (for example, Germany) were working to pay for the bailout of another state (say, Spain) in this sophisticated federal structure. Australians consider themselves to be part of a nation, even though there are obvious state and territory loyalties. The reference above to “southerners” being part of that parochialism.

But of one state of Australia is in trouble (for example, during the massive floods last year in Queensland or the bush fires in Victoria the year before), there is no debate about the fact that the Federal government has to spend to restore infrastructure and make sure citizens in the troubled areas are aided.

We would never have the sort of debates that are common in Germany at present about lazy, fat Greeks and the rest of it. The fact those debates are frequent and occupy pages of the daily media is symptomatic of the problem this second option faces.

Will the Germans be willing to become part of a true fiscal federation where Germany becomes a “state” that is subjugated to the welfare needs of the union? Will health care, education, welfare entitlements, public housing be provided on equal terms across the federation?

I sense that that sort of cultural approach is totally absent in Europe at present. The Germans and Dutch hate the fact that they might have to pay out to assist the Greeks.

But never fear, none of this federal thinking is remotely in the minds of Mr Rompuy and his bureaucracy. They remain in denial and the Interim Report captures that in an exemplary fashion.

The “Integrated budgetary framework” proposal says:

Significant improvements to the rules-based framework for fiscal policies in the EMU have been enacted (‘Six-Pack’) or agreed (Treaty on Stability, Coordination and Governance) in the last couple of years, with greater focus on prevention of budgetary imbalances, more importance given to debt developments, better enforcement mechanisms and national ownership of EU rules. The other elements related to strengthening fiscal governance in the euro area (‘Two-Pack’), which are still in the legislative process, should be finalised urgently and be implemented thoroughly. This new governance framework will provide for ex ante coordination of annual budgets of euro area Member States and enhance the surveillance of those experiencing financial difficulties.

So – fiscal rules – tougher rules – tougher surveillance – tougher penalties for breaches of rules – tough, harsh – unworkable.

That is what this proposal is about.

I have considered the proposed “Six-Pack” solution in this blog – The left – entranced by the fiscal austerity mantra sold to them by the conservatives.

The “Six-Pack” refers to the new so-called “reinforced Stability and Growth Pact (SGP)”, which was agreed upon on December 13, 2011. In the Official Memorandum we read that the “Six-Pack” is “made of five regulations and one directive” and according to the EU elite spin:

… represents the most comprehensive reinforcement of economic governance in the EU and the euro area since the launch of the Economic Monetary Union almost 20 years ago … [and] … brings a concrete and decisive step towards ensuring fiscal discipline, helping to stabilise the EU economy and preventing a new crisis in the EU.

In fact, the Six-Pack annoucement further de-stabilised the EU economy when it was made public. The Six-Pack recognised that “23 out of the 27 Member States are in the so-called “excessive deficit procedure” (EDP), a mechanism established in the EU Treaties obliging countries to keep their budget deficits below 3% of GDP and government debt below (or sufficiently declining towards) 60% of GDP”.

These 23 have to undergo formal reviews and “must comply with the recommendations and deadlines decided by the EU Council to correct their excessive deficit”.

The components of the Six-Pack are that more rigourous imposition of financial sanctions will be followed if a nation fails to “comply with the specific recommendations” to get their deficits below 3 per cent of GDP. Further, if the “60% reference for the debt-to-GDP ratio is not respected” then the EDP will begin “even if its deficit is below 3%” and the nation will have to reduce “gap between its debt level and the 60% reference … by 1/20th annually (on average over 3 years).”

There will be “expenditure benchmarks” which will enforce “a cap on the annual growth of public expenditure according to a medium-term rate of growth”.

And a series of interventions under the so-called “Excessive Imbalances Procedure (EIP)” which aims to reduce macroeconomic imbalances (particularly unit costs etc) and will force nations to submit “a clear roadmap and deadlines for implementing corrective action”. The whole system will be subjected to a huge surveillance operation (EU monitoring) with “rigorous enforcement” (fines equal to 0.1 per cent of GDP) and central intervention in a nation’s budgetary process.

It all reeks of a nasty controlling, big brother sort of world where the worker in the village in Greece or the Netherlands will basically be casting a vote in futility if their respective governments stay in the Eurozone – because at any time an EU official will be able to intervene and coerce the elected government into following EU dictates rather than their elected mandate.

It seems from the recent political events in Europe that the people are getting wind of this abrogation of their democratic rights and are voting accordingly. But the choices now as so poor.

Fiscal discipline is not about meeting some arbitrary rules that were, as we have learned, just made up in an hour without any reference to any economic reality, to satisfy the political ambitions of Mr Mitterrand. Please read my blog – So who is going to answer for their culpability? – for more discussion on this point.

Fiscal discipline is ensuring there is enough aggregate demand, distributed across the federal space, that is consistent with full employment. Nothing more and nothing less. If the budget deficit that is required to satisfy this requirement is 10 per cent of GDP or 1 per cent then so be it.

It might be that a budget surplus is required. Then so be it. The actual budget outcome should never be the objective. The budget is a vehicle to a greater economic goal not an end in itself.

Once we get lost in rules that the currency-issuing entity can not really meet with any surety, much less whether these rules are relevant to the current situation that the policy makers confront, then fiscal responsibility is being abandoned in favour of a blind ideology.

That is where the European leadership is at present. Lost in its blind acceptance of an ideology that has already delivered manifest failure and can never be the basis of a policy-making framework that delivers sustained prosperity to its citizens.

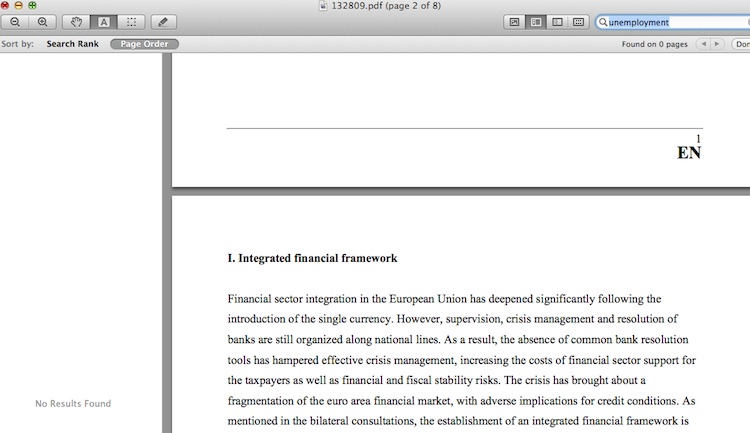

Just to see what was in the Report I did some text searches – for full employment, welfare, youth unemployment or even unemployment – the response to these searches “No Results Found”.

This screen capture is for the “unemployment” string search.

So you see that the Interim Proposal has its priorities firmly in the “right place” (not!)

The Interim Report makes some noises about the functions of the “new fiscal capacity”:

… could be to facilitate adjustments to country-specific shocks by providing for some degree of absorption at the central level … [but] … Elements of fiscal risk sharing can and should be structured in such a way that they do not lead to permanent transfers across countries or undermine the incentive to address structural weaknesses.

Note the hedged terminology – “could” rather than “has to for the system to be workable”.

And then we read that the “establishment of such a new fiscal capacity should not water down the compliance with fiscal rules and fiscal discipline in individual Member States” and that although there would have to be the “establishment of a Treasury function with clearly defined fiscal responsibilities” there would have to be a:

… balanced budget rule enshrined in both the Stability and Growth Pact and the Treaty on Stability, Coordination and Governance would need to apply to this fiscal capacity.

The best comedy writer could not script this sort of stuff. If it wasn’t so tragic in the impact it is having on people at the street level it would be high farce.

What economic model tells us that a balanced budget rule is appropriate? Given the EU broadly runs an external balance overall with the rest of the world, how would the private domestic sector ever save overall? And what would happen if it tried to save overall?

Well that is what is happening now and the results are obvious. There would be a major recession every time the government tried to run pro-cyclical policy to maintain the balanced budget rule.

Conclusion

Later in the Interim Report we read about the need for “flexibility in prices” (read: wage cutting in poor nations) and the need for “structural reforms” (read: welfare state retrenchment).

But on Page 7, it turns to “Democratic legitimacy and accountability” and says that “ways to ensure a debate in the European Parliament and in national parliaments on the recommendations adopted in the context of the European Semester should be explored”.

But it fails to acknowledge that the only way a federal fiscal capacity can have legitimacy is if it is fully elected by the citizens of Europe on the basis of equal representation – one person, one vote and equal electorates – and is not subject to the fiat of non-elected and unaccountable bureaucracies – such as the EU, the ECB, the IMF or any other similar body.

The Interim Proposal is a long way from that ideal. It is about as crazy – given the problems at hand – as the IMF getting the Nobel Peace Prize next year!

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Does anyone know of, or is willing to do, an analysis of UK’s IMF crisis of 1976 from an MMT perspective? I think this period of history is very interesting since the UK was forced to take a bailout from the IMF which set the stage for Thatcher’s neoliberal revolution. The UK was off the gold standard, but I believe had pegged its exchange rate. Inflation was high due to the OPEC price shocks and trade unions were strong.

I have got hold of a PhD thesis (Political Science) which looks at this period in depth. In the thesis it discusses a series of events related to currency devaluation which precipitated the IMF deal.

Article from UK Guardian on IMF predictions on GDP from UK austerity measures:

http://www.guardian.co.uk/business/2012/oct/13/imf-george-osborne-austerity-76bn

Dear Bill

Establishment opinion in Europe is that the EU has brought peace, freedom and prosperity. Never mind that European countries that never joined the EU, such as Norway and Switzerland, are also free and prosperous. Never mind that countries that joined the EU much later, such as Austria, Finland and Sweden in the 1990’s, are also free and prosperous. Never mind that between 1946 and 1989 there was no real peace in Europe but a Cold War. The fact that this cold war never became hot is due to the decisions made in Moscow and Washinton, not due to the wisdom and moderation of the gentlemen in Brussels. Never mind that the credit for the disappearance of communism from Europe should go to Gorbatchev, not to the EU. Never mind that the democratization of Greece, Portugal and Spain has nothing to do with their membership in the EU but that their membership in the EU is the result, not the cause of their democratization. Never mind all that. The European establishment knows that the EU has brought many blessings and that Europe always needs more centralization, not less.

Similarly, the Europeand establishment knows that Europeans need the Euro and that the euro should never be abolished. After all, it is only racists, xenophobes and other scum who are skeptical about the EU and the euro. The Norwegian parliamentary committee that awarded the Nobel Peace Prize to the EU is thinking exactly like the European establishment, even though the Norwegians rejected EU membership in a referendum in the 1990’s.

Cheers. James

I think this goes much deeper , to Europe post 1648…..

Bill , I think you are great guy and all but we have had a Titanic free banking crisis with global central banks – these institutions were supposed to stop that sort of thing.

MMT does not really want to deal with this central fact in my opinion although even Randy Wray had some Hamiltonian doubts in a article from last year.

The case for a complete divorce of the treasuries from the banks is a open and shut case in my opinion ,never again let a banker into the halls of goverment.

Banks either of the central or commercial variety should be as far removed from fiat production as it is possible to be.

Speaking as a Irishman I have a great scepticism towards these false Cromwellian republics which create “wealth” by stripping other juristictions clean.

Ireland , Spain and the rest of the PIgs needs Fiat KIngs to teach these banking bastards a lesson they will never forget.

Remove forever the concept of debt on the national money supply….forever.

Write it on every stone and every village from the coast of Donegal to the shores of Valencia.

These men are a den of vipers and cannot be trusted for any task.

http://www.youtube.com/watch?v=3PvmUsVktFM

@Mary

The Imperium or reserve currency shifted from the UK post 1914 ~ and the process was finally complete after Suez or thereabouts.

To project state force effectively beyond its borders it seems one needs a global central bank.

I think Napoleon was the last major guy who raised a war chest half honestly by selling Louisiana to the Americans.

Did you catch my recent video of Roy Jenkins and the TSR 2 mystery , it actually explains some things , including how the IMF were throwing their weight around much earlier then in 1976 …..10~ years earlier in fact.

The UK before the IMF arrived…….

http://www.youtube.com/watch?v=D1DCyJxHfOo

“I think this period of history is very interesting since the UK was forced to take a bailout from the IMF”

It wasn’t forced. It chose to. The Downing street minutes are very clear on that point. You had a bunch of politicians that thought in a fixed exchange rate manner, were pretty weak as a government and didn’t want to let go of their ‘beer and sandwiches’ industrial policy.

For my money the IMF ‘bailout’ was a convenient excuse.

Thanks Neil – In his PhD thesis Kevin Hickson (now a Senior Lecturer at University of Warwick)

states that in Sept 1976

‘Until the summer, the main problem had been the declining value of the pound as the foreign exchange market sold sterling. In August, this stopped, but then recommenced in early September. An added problem was now the gilt-edged market: that is the market in the sale of public sector debt to the non-bank domestic sector. By the summer, the gilt-edged market was refusing to purchase public sector debt as it feared rising inflation and expected interest rates to rise in early- September. The gilt-edged market was therefore a part of the Government’s considerations at this time. ”

So like the Eurozone, the markets started bidding up the price of government bonds. In addition sterling was depreciating and the government was trying to keep sterling pegged to $1.77. (Like you say they were thinking in a fixed exchange manner).

I suppose I was thinking along the lines of an alternative history – what advice would MMT economists have given to the Labour party at that time (between 1974-1976) and what would have happened if Labour had taken their advice given that it would have been a slap in the face to the US.

Mary-Ellen.

Read the cabinet papers at The UK National Archive

In particular the outline by Denis Healey in the July 2 1976 paper

And look at paragraph 5 onwards you can clearly see the understanding mistakes that were made. They were obsessed with the growth of the money supply causing ‘inflation’ and ‘crowding out’ finance to the private sector – both of which are errors of understanding of how a money system works in a free floating environment.

What is interesting is the extent to which the ‘balance of payments’ was worried about. It was an enormous obsession at the time. I remember it being mentioned regularly on the news. And yet you rarely here about it now – or at least not stated in such catastrophic terms. The way imports are financed was poorly understood.

Notice how quickly the ‘print money’ option is summarily dismissed and the lack of understanding that as non-government savings diminished and industrial investment increased, the PSBR would naturally decline.

So the whole episode looks to me like a complete misunderstanding of the causal process as we now understand it.

Steve Keen’s universal bailout (he calls it “A Modern Debt Jubilee”) would give new fiat equally to the entire Eurozone population, including non-debtors. Why should the Germans and Dutch object to that?

The UK August monthly trade balance figures are quite extraordinary.

They show possibly a record negative monthly trade balance with Germany of £2,221 million.

Also

Q1 : – £4,672

Q2 : – £ 5,236

Could the UK be heading for a – £20 billion trade deficit with Germany this year ?

This most important of trade relationships is rarely covered.

The UK (London really) wants German goods and Germany needs london to prevent social chaos …. but this BMW surplus is a Dramatic malinvestment of capital.

To sustain this flow of real goods the UK is prepared to slash Irish & Spanish consumption & investment to the point where its getting negative yields on these units.

IT WANTS REAL GOODS MORE THEN INCOME and london always did the income thing.

The UK / French trade relationship seems a bit more balanced…..

There was a net surplus of +20 million in August………….

Go figure where the problem is.

And its not Germany – its the UK

Its credit banks produce credit to buy BMWs – this is a real waste of capital.

Its does not start with a Kiss – it starts with the bank credit note and not the production.

Need I say UK fixed capital formation was almost third world like in Y2011

Uk : 14.2 %

Only Greece & Ireland was lower in Europe.

Greece : 14%

Ireland :12.6 %

France was above the EU average at 20.1 %

Germany was lower then this as it must put much of its resourses into BMW production at 18.2 % which feeds the UKs of this world.

Need I say much of the UKs fixed capital stuff is housing grot rather then the rail and power stations of France.

The Euro crisis is a Anglo crisis of investment as the city created the Euro.

@Neil

You don’t get it.

20 billion is 3 Nuclear power stations a year ……..you spend it on cars and they are scraped after 9 years.

The UK imported £21,331 million worth of cars in Y2011 even though it makes enough of them.

This is a very dramatic bank consumer credit malinvestment crisis.

No lasting wealth comes from those consumption sinks.

“The UK imported £21,331 million worth of cars in Y2011 even though it makes enough of them.”

Which means it exported the rest of them. What’s wrong with that.

Trade makes the world go round. It’s not that big a deal.

Excess imports *cannot* happen unless they are funded by someone who wants to save.

@Bill Mitchell

Horizontal Fiscal Equalisation (HFE) is political impossible in the EU, already too many ‘hate’ is in EU to bail out Greece, Italy and Spain. Sovereign Nations which have HFE (Australia, US, Canada etc.) all have this psychological behavior of helping others of the same nationality when they are in trouble (although this is in a delcining trend in my opinion), and they do not have the thought (literally) that they are doing what the Germans hate doing everyday, which is that ‘they are working to bail out another state’.

This psychological barrier of HFE is the main barrier of a fiscal union in the EU which I don’t think it will ever be overcomed when there are newspaper articles denouncing populations of another ‘state’ everyday. However my perception from reading your posts is that you ignores political and psychological feasibility in policy prescriptions. This although enables policy advice which is workable economically (I acknowledge that in some situations there can be no workable policy if these two factors are not ignored), it might leave an impression to policy makers that your advice is political infeasible, resulting that they will not listen or even look at your policy advice.

The Nobel Peace Prize going to EU is just………… (words fail me). Considering how much the Greeks spend on military and the riots in the streets.

@Neil

In my best Cork accent – the capital is gone boy.

You try to understand why the inflation was so high in the 70s ?

Its easy.

They blew the capital the minute they turned the key in the 50s and 60s

You just don’t get what happened the minute the world turned from coal to oil.

For God sake man the world had two world wars over the stuff.

The foundation of the MMTs thought framework was built on that post 1914 moment in time.

Its like trying to understand Rome without speaking about Slaves and Oxen.

Absurd.

Mary Ellen Large: I agree, it is a very interesting and important period. Geoffrey Gardiner’s Towards True Monetarism (I only have the first, cheap edition) describes contemporaneous thinking and advice he gave around then, from a pretty conservative, but knows-what-he’s-talking-about, creditary perspective, quite close to MMT. So he advised people, wrote letters to the Times, to let the pound float, forget about keeping the exchange rate high, lower interest rates ( the book is dedicated to the victims of high interest rates!) . So the reason they weren’t following floaty, zirpy MMT, true Keynesian advice wasn’t because they hadn’t heard it, that nobody knew better. He said such high interest rates would not cure inflation, (policies based on half-baked Milton Friedmanian monetarism) but cause nothing but stagflation, and that is what the UK got.

@Neil

Just to add.

Imagine a simple but extreme slave state / trade model.

England is the primary consumer of goods for its Villas such as marble products , fine wines , refined metal work etc etc.

The Rhine / Rhur region is the producer of these goods.

But the crops (bread) which supply the energy for its slaves is reducing by 2% a year.

To continue to do what it does the Rhine Rhur Jurisdiction decides to increase efficiency rather then productivity. ( productivity = investing more in agriculture which is really energy in a slave state)

However it gets the same or more goods for less by reducing the calories of its workforce……this appears to work until you finally hit a entropy wall.

The modern German production machine which orbits the Rhine / Rhur is the most efficient in the world , however it has become efficient by destroying its long term productivity.

http://www.youtube.com/watch?v=aRghETHFvYs

(its energy density declines year after year because for example it has given up the Nuclear energy thingy which is very capital intensive , it therefore prefers to run down its capital and express a short term profit.)

Eventually deficit England will not receive the goods.

These weird trade systems have very little redundency……they were built that way to increase their short term labour arbitrage profits as global finance houses control the money supply of these former nations.

However a vast amount of capital (oil and stuff) is lost in this from a global perspective pointless trade.

The UK is perhaps the most extreme deficit large country whose credit based demand can shift capital allocation worldwide.

PS

The UKs primary trade “partner” is Germany but it has a larger trade deficit with China which is a extreme colony.

The UKs trade deficit with China was -£22,203 in Y2011 although it has come down a bit since Y2010 and is showing continual signs of weakness.

China will come out worst from this crash but there is really nothing there withen the UK….its a empty box.

It all starts with the credit note and not the production process.

Need I say this is game theory played at the highest level possible.

“But the crops (bread) which supply the energy for its slaves is reducing by 2% a year.”

The assumption there is that there is a one to one match between the real system and the monetary one.

MMT shows you that there isn’t that correlation. Money drives the real system more like an induction circuit than a direct circuit. The movement in the real circuit is different from the movement in the monetary one.

It is important to realise that MMT is a *monetary* theory. It is designed to explain how money works and how it can be used and generally take the money issue off the table.

At which point the powers that be can get real and concentrate on the actual issues that need to be addressed.

@Neil

On cue from ACEA

“In September, the EU* recorded a total of 1,099,264 new cars, or 10.8% less than in the same month a year ago. Looking at the major markets, the British was the only one to expand, while Germany (-10.9%), France (-17.9%), Italy (-25.7%) and Spain (-36.8%) all faced a double-digit downturn.

From January to September, the EU* market shrank by 7.6%, compared to the first nine months of 2011. Results were diverse across markets, as the UK posted growth (+4.3%), while Germany saw its demand fall by 1.8% and Spain (-11.0%), France (-13.8%) and Italy (-20.5%) contracted more severely. ”

The British are the last men standing with a credit note…………they are simply wasting Europe to a point they are getting negative income from the rest of the world (which is almost unheard of in the UK as they have always earned a income from the planet)

The Brits want real goods from the Rhine /Rhur region over and above income.

This is very very big news people

Again the UK engages in almost no rational energy /transport investment.

Its fixed capital investment is almost third world.

But its sov nature withen the Euro soup enables it to buy real goods from non sov states who must export to earn a income.

The Euro region is a colony of the UK.

Case closed.

@ Neil

Thanks for the reply to my posts. Will check out those links. What you are say tallies with Hickson’s PhD thesis. I guess it was around this time that politicians started to get infected with neoliberalism and monetarism on both sides of the house.

@SomeGuy – thanks for more background.

Mary-Ellen

How about “Goodbye, Great Britain” by Kathleen Burk and Alec Cairncross? I think it’s a good read. I would call the economic analysis Post Keynesian.

My conclusions from reading the book are..

The IMF bailout worked as a bad political solution to attacks from powerful representatives for financial capital. The economic problems fixed themselves before the IMF bailout but not the political problems. Problems with inflation were caused by private credit expansion in the early 70s but the government of the time did not understand the nature of the problems. The book raises questions about the extent to which financial capital is able to shape politics and the toxic influence on democracy. I think these questions are still pertinent.

These are my conclusions which may be political, however the analysis is not political and the book is not a polemic.

“The 1976 events began when the Treasury mandarins advised Prime Minister James Callaghan and Chancellor of the Exchequer Dennis Healey that the Public Sector Borrowing Requirements for 1977-78 and 1978-79 would be exceptionally high, £22bn in total. On this basis the Labour government decided to request a loan from the International Monetary Fund (IMF), and did so on 29 September 1976. . . .

IMF head Witteveen came to London and told Callaghan on 1 December 1976 that his government would have to make cuts to get a loan. After a bit of bluster Callaghan agreed. To implement the IMF deal three weeks of cabinet meetings followed – all conducted in a gravely serious atmosphere – before the cuts were agreed and announced on 21 December 1976.

Three months later the Treasury announced that fresh calculations now showed the PSBR for 1977-1978 would be 50% of the amount they had told Callaghan and Healey six months earlier. The cuts were not needed and nor was the IMF loan.”

http://www.lobster-magazine.co.uk/free/lobster64/lob64-running-britain.pdf

The conclusion of that lobster piece is one of the most succint and accurate summaries of establishment positions and intentions I have seen. A nation ready for the 19th century.

A common critique of UK economic and political life since

1945 has been that one of the problems has been the failure

to take long term decisions or have a long term strategy. In

2012 and the country in which we now live a riposte to this

argument might be that the UK establishment has indeed

been pursuing, very successfully, a long term strategy of its

own since at least the mid 1970s (and possibly since the mid

1950s), that this strategy has been carefully disguised, is now

more overt, and is returning them to the type of society they

last enjoyed fully in the 1930s.

Hacky The Hufrex

You may be interested in this analyis of the UK economy?

http://www.press3.co.uk/publications/to_full_employment/chapters/

Here’s a great quote from ‘Theodore Dalrymple’ that recently appeared in the Oz:

“The award of the Nobel Peace Prize to the EU, however, shows that the spirit of satire is not quite dead: for surely the present state of the continent can hardly have escaped the notice of the committee that awarded the prize. It is a bit like awarding the prize in economics to Bernie Madoff or that in medicine to Harold Shipman, the British doctor who found a way of killing 200 of his patients without detection.”

Or try this for size:

“Let us overlook the fact the hard-bitten expense-claimers of Brussels are not the kind of people to be deeply touched by anything except a reduction in their privileges, that the EU came into existence only in 1993, that it did not require much in the way of peacemaking to prevent Belgium from attacking Slovakia or Luxembourg from attacking Sweden, that what is meant by peace is the prevention of war between France and Germany, and that the EU is the consequence of an imposed peace between those two countries and not the cause of it. Let us, rather, think about the part played by the EU in the financial and political crisis that it is now trying, not very effectively, to solve.”

And the guy (a conservative) understands economics to some extent:

“The monetary union, which was an act of the most obvious political hubris, and for which there was never any economic argument or need, led very quickly to a gross misallocation of funds, leading to incontinent private borrowing in Spain and Ireland, and equally incontinent public borrowing in Greece. … If Spain, Ireland and Greece had kept their peseta, punt and drachma, none of this would have happened and there would have been no crisis. Thus the EU is not the solution to Europe’s problems, economic and social, but the cause of them.”

He leaves us with this gem:

“If there were a Nobel prize for the creation of conditions for conflict and war, then it could be awarded to the EU without irony or satire.”

Cheers!

Postkey

Thanks for the link. As an equivocal examination of traditional theories, it’s quite good. I don’t really agree with the conclusions. The main reason I take this view is that the focus is too narrow to draw any policy prescription. I found the book more convincing on the period of the 50s and 60s than later periods. I’d certainly recommend it to people to help them understand the economy in the 50s and 60s. The book doesn’t incorporate change and disruption in production schemas and in some places shows a lack of understanding of technological change. This weakens the conclusions because it’s right at the centre of the scope of the book.

I haven’t read the lobster link yet. I will need to do some work for a while before any more serious reading.