It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

External economy considerations – Part 1

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text by the end of this year. Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

Chapter 15 International Trade, Capital Flows and the Exchange Rate

[Note: This is the first rough layout and will evolve over the next few weeks]

15.1 Introduction

In Chapter 8, we introduced trade into the income-expenditure model. The representation was simplistic, in the sense, that we assumed that exports were determined by the income levels prevailing in the rest of the world (that is, they were exogenous to the domestic economy) and that imports were a simple proportion of the national income of the homeeconomy. This proportion was termed the marginal propensity to import.

In this Chapter we extend our understanding of the way in which the economy behaves once it becomes open to the World. We will continue to consider the price level to be fixed, which means we are assuming that firms respond to an increase in aggregate demand by increasing real output. Later in the Chapter we will consider price level movements in the open economy context.

We will the consider the concept of an exchange rate and examine how movements in exchange rates influence exports and imports and financial transactions between nations.

For an economy as a whole, imports are real goods and services coming into the nation from abroad and as such represent a real benefit to residents. Conversely, exports are real goods and services that are sold to foreigners.

Exports represent a real cost to residents because they represent real resources (labour, capital and other productive inputs) that the residents are unable to utilise themselves.

It is obvious that the only motivation for a nation to export, and incur the real costs involved in exporting goods and services abroad, is to gain foreign currencies, which, in turn, allow the nation to purchase other goods and services that it does not produce itself.

If imports exceed exports then a nation is able enjoy higher material living standard by consuming more goods and services than it produces for foreign consumption. We will consider how this conception of trade interacts with a flexible exchange rate.

You will already appreciate that the transactions between nations involve both real goods and services and financial flows. The financial transactions represents currency flows in and out of a nation and have significant implications for movements in the exchange rate and other macroeconomic aggregates, such as interest rates, the inflation rate and real GDP.

All transactions between a nation and the rest of the world are recorded in the Balance of Payments. We will initially examine the way the national statistician accounts for the external economy via the Balance of Payments, which is a framework that is closely related to the National Accounts.

15.2 The Balance of Payments

National Statistical agencies regularly publish statistics relating to a nation’s economic interaction with the rest of the world using what is known as the balance of payments and international investment position framework. While there are variations in terminology used by different nations the principles are universal. Most nations use the International Monetary Funds’s http://www.imf.org/external/pubs/ft/bop/2007/pdf/bpm6.pdf (BPM6), augmented by the System of National Accounts 2008 (2008 SNA), “as the standard framework for statistics on the transactions and positions between an economy and the rest of the world” (IMF, 2011: 1).

The IMF define the balance of payments as:

… a statistical statement that summarizes transactions between residents and nonresidents during a period. It consists of the goods and services account, the primary income account, the secondary income account, the capital account, and the financial account.

The differentiating feature of these difference accounts relates to “the nature of the economic resources provided and received” by the nation (IMF, 2011: 9).

The Current Account (IMF, 2011: 9):

… shows flows of goods, services, primary income, and secondary income between residents and nonresidents.

The goods and services or balance of trade records “transactions in items that are outcomes of production activities” (IMF, 2011: 149) and considers the exchanges between the local economy and the rest of the world.

[NOTE THIS SECTION IS TO BE WRITTEN AND IS DESCRIPTIVE – IT OUTLINES THE BALANCE OF PAYMENTS AND RELATED INTERNATIONAL ACCOUNTS]

15.3 Essential concepts

Before we consider a more complex income and expenditure model (to incorporate exchange rates) we need to understand the basic nomenclature.

The following essential concepts are used in open economy macroeconomics:

- Nominal exchange rates

- Foreign exchange markets

- Exchange rate determination mechanisms – fixed and flexible

- Real or effective exchange rates, unit labour costs and competitiveness

We will consider the history of exchange rate systems in a later section of this Chapter.

Nominal exchange rate (e)

The nominal exchange rate (e) is the number of units of one currency that can be purchased with one unit of another currency. There are two ways in which we can quote a bi-lateral exchange rate. Consider the relationship between the Australian dollar ($A) and the United States dollar ($US).

- We might be interested in knowing the amount of Australian currency that is necessary to purchase one unit of the US currency ($US1). In this case, the $US is what we call the reference currency and the other currency is expressed in terms of how much of it is required to buy one unit of the reference currency. So $A0.80 = $US1 means that it takes $0.80 (or 80 cents) of Australian currency to buy one $US.

- Alternatively, e can be defined as the amount of US dollars that are needed to by one unit of Australian currency ($A1). In this case, the $A is the reference currency. So, in the example above, this is written as $US1.25= $A1. Thus if it takes $0.80 Australian to buy one $US, then $US1.25 is required to buy one $A.

It is clear that the quotation under the first alternative with the US dollar as the reference currency is the inverse of the second alternative. But to understand exchange rate quotations you must know which is the reference currency. In this Chapter we use the first convention so e is the amount of domestic currency which is required to buy one unit of the foreign currency.

|

e is the amount of $A which is required to buy one unit of the foreign currency |

Change in e – appreciation and depreciation

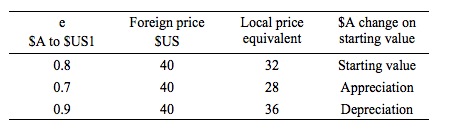

Imagine that an Australian resident wishes to buy a product from a USA supplier who quotes the current US price as $US40 and the $A-$US parity is current at $0.80. Then the equivalent Australian price is $A32 (multiply the foreign price by the nominal exchange rate. This situation is shown in the first row of Figure 15.1.

What happens if the nominal exchange rate falls to 0.70 (as shown in the second row of Figure 15.1)? This means that instead of 80 cents Australian being required to purchase one $US only 70 cents Australian is required.

So, a fall in e means that the $A has appreciated – it is worth more in terms of foreign reference currency. In the example shown in Figure 15.1, this would mean that the price of the product from the USA would now be equal to $A28 (0.7 times $US40).

Thus, even though the quoted US dollar price for the product remains unchanged, the local price equivalent is now lower when the nominal exchange rate appreciates.

The example shows that an appreciation of the $A leads to:

- Cheaper foreign goods in terms of $A and, other things being equal, this should lead to a rise in the quantity of imports demanded.

- Higher prices which foreigners will have to pay for our goods, and other things being equal, this should lead to a fall in the quantity of exports demanded.

Now, assume that the Australian-USA parity rises to 0.80 from 0.90. This means that we now need 90 cents Australian to purchase one $US. So, given our exchange rate definition, a rise in e means that the $A has depreciated.

In the example shown in Figure 15.1, this would mean that the price of the product from US would now be equal to $A36 (0.9 times $US40).

The example shows that an depreciation of the $A leads to:

- Foreign goods more expensive in terms of $A, and other things equal, this should lead to a fall in the quantity of imports demanded.

- The price foreigners have to pay for our goods lower, and other things equal, this should lead to a rise in the quantity of exports demanded.

Figure 15.1 Comparison of international prices

What determines the exchange rate?

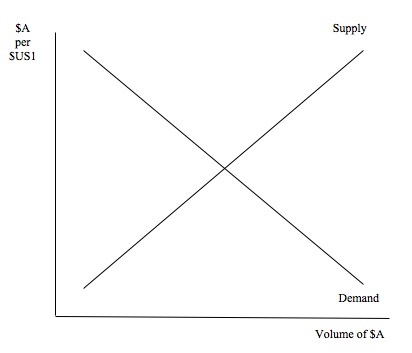

Exchange rates are determined by the supply of and the demand for currencies in the world foreign exchange markets, which could be the local bank foreign currency desk or elsewhere, like a train station kiosk in a city where travellers meet.

Sometimes we refer to foreign exchange in jargon as forex. The supply of and demand for currencies are in turn linked to trade and capital flows between countries.

In Figure 15.2 we consider the foreign exchange market for the $A and the $US. In reality, many currencies are traded in the foreign exchange market.

Figure 15.2 A simple bi-lateral foreign exchange market

Consider the supply of Australian dollars to the foreign exchange market. When Australian residents buy foreign goods (imports), buy foreign assets or lend abroad, they need to purchase the relevant foreign currencies in which the transaction is denominated. To buy the currency they desire, they supply $As in exchange.

Alternatively, on the demand side, when foreigners buy Australian goods and services (exports) and/or Australian financial assets they require $A. They purchase them in the forex market by supplying their own currency in exchange.

Like any market determined price, e is in equilibrium when supply equals demand.

If there is an excess demand for $A then there is pressure for the $A to appreciate in price relative to other currencies. As noted, an appreciation means that one unit of a foreign currency buys less $A, that is e declines.

If there is an excess supply of $A, the $A depreciates and one unit of foreign currency buys more $A, so e increases.

These changes in e resolve the supply and demand imbalance. In the case of a depreciation in the Australian dollar, the foreign price of Australian exports is now lower (less $US required to purchase a given $A priced good), and with export demand varying inversely with price (by assumption), the demand for exports and hence $A’s rises.

Assuming a fixed import price in the foreign currency, the $A price of imports has risen which reduces the quantity demanded.

While most currencies float freely against each other, at times the central bank will enter the foreign exchange markets as a buyer or seller of the local currency as a means of influencing the parity determined in that market. This is called Official intervention and we will examine it in more detail later in the chapter.

What happens to the total $A value of imports when the exchange rate depreciates depends upon what economists term the price elasticity of demand. An elasticity is the responsiveness in percentage terms of quantity to price changes.

When demand falls less in percentage terms than the price rises, we consider the commodity to be inelastic. Total revenue (or spending) will rise in this case.

When demand falls more in percentage terms than the price rises, we consider the commodity to be elastic. Total revenue (or spending) will fall in this case.

When price and quantity change by the same proportion the commodity has a unitary elasticity and total revenue (or spending) does not change.

Should the demand for imports be price inelastic (less than one), then the quantity demanded (volume) falls by a smaller percentage than the $A rise in price and total import spending in $A would increase.

However, if the price elasticity of demand for imports is greater than one, then the percentage decline in demand (volume) more than offsets the percentage gain in price and so total import spending in $A falls.

The circumstances under which the trade balance unambiguously improves following a depreciation is referred to as the Marshall-Lerner Condition. It states that net exports will improve following a depreciation as long as the sum of the export and import price elasticities exceeds unity. You do not have to learn the proof underpinning this condition.

In summary, if the Marshall-Lerner condition is satisfied:

- An excess supply of $A in the foreign exchange market leads to a depreciation in e and a rise in net exports. This will reduce the excess supply of $A in the foreign exchange market.

- An excess demand for $A in the foreign exchange market leads to an appreciation in e and a decline in net exports. This will reduce the excess demand for $A in the foreign exchange market.

Another component of the current account is net income, which results from the foreign ownership of domestic assets and vice versa. We consider this component of the current account in more detail later in the chapter.

This pattern of ownership of assets gives rise to a net flow of dividend and interest payments. If the net flow is positive then national income rises, other things being equal. If the net flow is negative then national income falls, other things being equal.

In Australia’s case, the net income flows on the current account are negative. In this case, a depreciation in the $A can lead to a deterioration in net income because the interest payments or dividends may be denominated in a foreign currency. The loss of income through this part of the current account may offset any gains that are made as a result of depreciation on the trade balance.

For simplicity, we shall ignore the possible impact on net income and assume that through the satisfaction of the Marshall-Lerner condition a depreciation of the domestic currency not only improves the trade balance but also the current account balance.

We can define three trade balance outcomes:

- The trade balance is in deficit if the local currency value of its exports is less than the local currency value of its import spending.

- The trade balance is in surplus if the local currency value of its exports is greater than the local currency value of its import spending.

- The trade balance is in balance if the local currency value of its exports is equal to the local currency value of its import spending.

Take Australia, as an example. A trade deficit for Australia means that increasing quantities of Australian dollars are being accumulated by non-Australian residents. In return, the non-Australian residents have supplied goods and services (imports) to Australian residents.

Clearly, the foreigners have allowed Australia to run a trade deficit because they preferred to accumulate financial assets denominated in Australian dollars. The alternative would have been to spend the Australian dollars they acquired through their exports to buy Australian goods and services (that is, to buy Australian imports).

Had the foreigners used their export income, which is denominated in $A to purchase other goods and services from Australia, then there would have been a trade balance.

A trade deficit thus means that the foreigners are increasing their nominal savings (which in this case manifests as Australian dollar denominated financial assets).

International competitiveness

[NOTE: I WILL CONTINUE THIS CHAPTER NEXT WEEK]

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

“It is obvious that the only motivation for a nation to export”

This is a way too strong statement and is wrong as numerous real world examples show. Exports can be a strategic tool for a country as a whole to realize certain objectives, political or economic, in the global world.

and here is today’s real world example of how exports can very rationally (for a nation) be more than just imports: link_http://www.nakedcapitalism.com/2012/11/has-chinese-currency-manipulation-succeeded-in-breaking-japanese-manufacturers.html

“Exchange rates are determined by the supply of and the demand for currencies in the world foreign exchange markets”

I do not know where to start here. It is such a simplistic and too mainstream view that it does not even deserve to be a simplistic model. There is an implicit assumption that exchange rates are driven by trade flows in almost real-time, i.e spot. That is where you need demand/supply to apparently get the exchange rate. Well, the thing is that this is hardly THE place where the exchange rate IS really determined. And determined should be used in a broad sense and not just exchange transactions.

But I stop commenting not to occupy the whole space.

Bill,

It might be worth spending a bit of time on worked examples of how the foreign exchange market comes to the clearing point – as in which transactions get eliminated and how they get eliminated.

One of the common complaints is that the statistics are always reported in the domestic currency – even though a great many of the transactions may not have taken place in that currency.

The transactions reported in AUS will be denominated in $A whereas precisely the same transactions reported in the US from the opposite perspective are reported in $US.

It may be worth demonstrating the equivalence or at least pointing out where the confusion comes from.

Bill, it would be better were you to replace most instances of the term “model” with the term “theory”, as this is what you are actually constructing. To talk about models in your context is not best practice however common it is in economics. For a discussion of models in science, see http://plato.stanford.edu/entries/models-science/ by Frigg and Hartmann.

“It is obvious that the only motivation for a nation to export, and incur the real costs involved in exporting goods and services abroad, is to gain foreign currencies, which, in turn, allow the nation to purchase other goods and services that it does not produce itself. ”

I would go much further in the critique of this statement than Sergei (this is the continuation of what I wrote in the comments on Warren’s blog). That statement is not only an oversimplification, it is plainly incorrect when applied to the current socioeconomic reality. To me this statement may describe (fallen) socialist states. It has very little to do with modern capitalism in its neoliberal form (West) or even with the post-communist “state capitalism” form (China, to some extent Russia).

The entities which take part in the economic life are individuals/families, firms (local or international corporations) and state governments. Not just “nations”. It just happens that most of the production occurs in privately-owned firms.

The main driving force behind export are individual firms maximising their profits and seeking new markets. This itself has nothing to do with the welfare of the “nation”. The whole process of production, exchange and consumption of goods and services increases the welfare of the people. State governments export very little (may export weapons for political gains). I do not deny that state-owned enterprises can efficiently deliver public goods such as educational services, health care, drive scientific research, etc.

However it is a historic fact that all attemps to nationalise the process of production of everything else on a mass scale eventually led to a dramatic loss of productivity (Soviet Union, all the Eastern Bloc, China, North Korea, Cuba, etc) and this doctrine was abandoned in the majority of the countries.

The Chinese ditched the faulty straitjacked of Marxist-Leninist-Maoist ideology and evolved their system into a modern state capitalism, not subverted like the neoliberal Western model to the interests of the capitalist/financial oligarchy. The Chinese oligarchy (roughly the same as the “communist” party) “owns” the state so that they don’t need to steal anything from themselves (this situation is often incorrectly described by Western commentators as “corruption”).

This mixed-model system is very efficient in stimulating growth precisely because it harnesses the greed of the managerial class and so-called capitalists who compete (with the little help from the government) with everyone else in the world. Fat profits are then reinvested because Chinese firms expand their market and displace the competitors. Productive capacities grow and real capital is accumulated. This is what we may call a “welfare”. Workers are exploited in the Marxist sense but what they get is much more they would got in any utopian system base on direct implementation of the social justice (either communist or syndicalist). Why? Because of the microeconomic efficiency.

We won’t get even close to understanding these processes if we only think in terms of “exports are real losses and imports are real gains for a nation”.

Humans are not rational automata maximising their utility function in time as assumed in neoclassical economics. However humans also don’t behave as assumed by communist utopians. The majority are freeloaders. The minority are pathological exploiters and hoarders. Capitalism is based on harnessing these exploiters and hoarders (people obsessed with making profits – entrepreneurs) to drive the process of production and distribution of goods and services. In that sense “greed is good’ as long as profits are made in a capitalist (competitive) not in a feudal (monopolist) way (neoliberalism is to some extent a feudalism in disguise).

Michal Kalecki stated that in a closed simplified system aggregate profits of capitalists equal capitalist consumption plus investment. This statement is true but there is another condition which must be met – for every capitalist profits have to be made by selling the production of the firm. If the production remains unsold the profits equation doesn’t hold water. If a group of capitalists loses its share of the market, they won’t make any profits. This means that they will consume less and they won’t invest. This in turn will lead to decay of the real capital (falling productive capacities). If we move from the closed to the open economy model the benefits of export are clearly visible. Investment depends on the expected future profits.

We live in a globalised world and the apparent paradox of the glowing success of the Chinese (Asian in general but also German) export-led growth strategy must be explained correctly even by introducory-level textbooks.

“Take Australia, as an example. A trade deficit for Australia means that increasing quantities of Australian dollars are being accumulated by non-Australian residents. In return, the non-Australian residents have supplied goods and services (imports) to Australian residents. Clearly, the foreigners have allowed Australia to run a trade deficit because they preferred to accumulate financial assets denominated in Australian dollars. ”

Foreigners do not have to accumulate financial assets to fund the trade deficits. They can buy tangible assets,

for example, if australians own firm worth 100 billion A$, and foreigners accumulate 100 billion A$ and buy that firm, then all that takes place is the change in the form of wealth.

I belive these sales and purchases of assets are recorded in capital account so that the inflows in the capital account can fund the outflows (deficits) on current account.

Balance of payments balances. Accounting identities should be clearly stated.

Dear Sergio, Adam and PZ

I appreciate your comments and feedback and your concerns will not be ignored.

Remember:

1. This is an introductory macroeconomics textbook – and if you haven’t taught in an undergrad economics program before you might be surprised how elementary things have to be. This textbook is actually on the difficult side notwithstanding the paradigm shift as well.

2. I stated at the outset this was a rough draft and would be significantly altered.

3. In the exchange rate determination section, I noted financial (speculative) flows but didn’t have the notes with me that cover the fact that the vast majority of forex transactions are not related to trade. That will be added next week. But it still remains that the price of the currency against other currencies is determined by supply and demand on a minute by minute basis.

4. The motive to trade is of-course diverse and decentralised at the individual supplier level. But all those issues are about microeconomics and we abstract from them here. At the macroeconomic level, trade surpluses can only be realistically understood as the nation as a whole desiring to accumulate financial claims in currencies that the surpluses are being run against.

Thanks for the help.

best wishes

bill

Why is it assumed that the importing country always pays for it’s imports with it’s domestic currency?

Is this really the case? When Malawi buys goods from overseas, does this imply a desire of foreigners to hold Malawian kwacha? Wouldn’t the exporter exchange it for some other currency on the forex markets, with the net result that there may be no foreign accumulation of kwacha, but a devaluation instead? Or, the exporter would simply demand payment in their own currency in the first place?

Sorry for the dumb question, I’m probably missing something obvious.

“When Malawi buys goods from overseas, does this imply a desire of foreigners to hold Malawian kwacha? ”

Aggregation can cause lots of funny effects. Getting to grips with the dynamic effects of aggregation is where all the fun is in economics.

For example At an individual level income tends to determine spending, but at the aggregate level it is spending that tends to determine income.

So at the individual level almost nobody wants to hold the Malawian kwacha. So to buy something from abroad, not only do you need the services of a bank but you also need the services of a money changer.

But on the flip side there are Malawian exporters. They also need the services of a bank and a money changer, because although they buy and sell in foreign currency, they still have to pay their taxes and at least the taxes of their domestic staff in Kwacha.

Note that exporters like to sell things. Therefore they do whatever they can to enable a sale – including introducing an appropriate money changer.

All this gives the opportunity to the money changer to buffer and maturity match. They have people with foreign currency balances who need Kwacha and people with Kwacha that need foreign currency. That gives you the basic setup where exporters and importers match.

Then you move to the next level where the money changer feels confident in his business model and looks to borrow US dollars which he can swap for Kwacha to allow the importers to do their stuff. There you are borrowing a stock against the turnover of US dollars through the money changer.

And then the big change happens.

Exporters realise there is a market in Malawi and great demand for their products, but there is a shortage of exports to match against. The terms of trade are very much against the Malawians. So the exporters complain to their foreign government which, since they are steeped in neoliberal dogma, is obsessed with export led growth.

So the foreign government has a word with their own central bank, who relieves that pressure by essentially purchasing an amount of Malawian Kwacha from the money changer with fresh money (which of course is the other side of the money exchanger ‘borrowing’ the foreign currency). That Kwacha will essentially never see the light of day again. The terms of trade move towards the Malawians and the foreign exporters are happy. Malawians are buying their stuff again.

(The other approach is more direct. The central bank stands ready to swap foreign currency for local currency. Exporters with that sort of central bank behind them can accept any currency in payment for their goods).

The downside of that approach is that the domestic circulation is slowly drained of Kwacha as the ‘foreign savings’ builds up in the foreign central bank.

And that’s the modern dynamic. Foreign central banks enabling local money changers to change money so they can buy foreign goods – and therefore enabling the foreign ‘export led growth’. You can add layers and lots of indirection in there, but essentially that is the dynamic – even if it is not deliberate.

Of course when you then add in people panicking about foreign savings and how we must ‘cut the deficit’ you just reduce the amount of domestic currency circulation even more – which makes even more space for foreign exporters to pursue their ‘export led growth’.

Bill: it still remains that the price of the currency against other currencies is determined by supply and demand on a minute by minute basis

It is still way too simplistic and too textbook. And exchange rate determination does not really have to do a lot with speculative flows.

There is big problem with any modern thinking about financial markets in the sense that they are driven by demand/supply forces. In reasonably liquid markets, of which AUD definitely is, the price is often NOT a supply-demand phenomenon despite the volume of transactions on the spot. Think of it as central bank setting its target rate. Is there supply demand? Well, there definitely is. Does it define the rate? Well, kind of. Are you sure-sure? 🙂 Well, maybe if we condition it on this and that… So when the central bank announces the rate it just moves. Without anybody incl. central bank doing anything else. So there is no supply-demand mechanism which moves the interest rate. But the *market* rate still moves!

Lets take government bonds. Do they move, esp long end, based on the supply-demand forces? Not really. People normally hold long-dated government bonds NOT for trading purposes. They do not really care about prices. And supply and demand is pretty much fixed and does not change on the spot. Why do they move? Because expectations change. And they change in relation with all other financial assets in the world. So that a move in Spanish government bonds can move US government bonds without *ANY* changes in the *SPOT* demand-supply.

It is normally bid/ask quotes which determine the price. And bid/ask quotes can move without any transactions in the market. So what is a demand/supply if there are no transactions happening but the price still moves? What is price in such case in the sense of the standard literature?

Finally, Bank of Japan has unlimited supply of yen and yet it persistently fails to move the exchange rate. Can it sound that something is wrong with supply/demand forces? Because it would be a strange statement that someone else has unlimited+1 demand for yen.

Yes, you write an intro book. But do not fall into the mainstream trap of simplifying to a such extent that it becomes outright wrong. Does it really matter how exchange rates are really set? Noone knows it. There is no model in this world which can explain exchange rates movements. Why to pretend that you have one?

It will be harder to explain the strange Irish model – we are now the model pupil…………….

, Pharma , Google ,aircraft renting GPA like stuff etc etc.

These use Ireland as a base of operations with limited impact on the domestic economy outside of some local areas which depend on these operations almost totally.

Dublin depends on the IFSC , Cork city on Pharma etc etc.

After 1986 ~ the trade balance in Ireland became very strange.

http://www.tradingeconomics.com/ireland/balance-of-trade

These corporations who reside outside the confines of nation states other then when given letters of the mark to pillage various countries with the consent of former Imperial powers.

My gut tells me massive trade imbalances began after the city of london and the uk went into current account deficit in 1984. (although our trade balance remains negative with the UK)

Germany appears to be waging a proxy limited war against London (Dublins IFSC is a branch of the cities operations) using the bogs of Ireland as a battleground while preserving their symbiotic trade relationship.

Given this tale of 2 economies and the fact the Irish are unwilling to confront any cuckoos in the nest would it not be more honest if we had a dual currency system or would this merely expose the fraud in the system ?

Companies such as CIE public transport is in terrible trouble with them withholding their financial reports – meanwhile across the border NIR is recording record passenger and revenue numbers.

See April to June NIR figures

http://www.drdni.gov.uk/ni_road_and_rail_transport_statistics.htm

10 % increase in passengers

10 % increase in revenue

8 % increase in rail passenger miles.

Both IR & NIR have a similar organisation – how can this be ?

We are in a oil crisis yes ? or is it ?

Is it a capital misallocation crisis

@Neil

Thanks for your detailed reply. I definitely need to do some more reading in this area. If I understand you correctly, an apparent desire (at the macro level) of foreigners to hold kwacha – allowing Malawi to run trade deficits, is partially explained by the activities of foreign central banks in enabling international commerce? In other words, foreign accumulation of kwacha is a byproduct of activities with other goals, which is then interpreted post hoc as a desire to hold kwacha?

“In other words, foreign accumulation of kwacha is a byproduct of activities with other goals, which is then interpreted post hoc as a desire to hold kwacha?”

It’s a by-product in aggregate as all aggregation is. The causality is viciously complex with things pulling in all directions.

But ISTM that foreign central bank activity attempting to ease the path of its traders will cause a build up of foreign savings. After all a central bank doesn’t really need to spend foreign currency – it can create all the currency it needs at will. So there is no incentive to recycle. ISTM that the foreign saving is there as much saving is – as an ‘FU Fund’ (ie insurance). In that respect it is no different from gold.

@Sergei:

Expectation can only drive prices through trade. If agents on the market think that the price of goverment bonds will decrease because the central bank increased its operational rate, this expectation will be fulfilled if these agents sell their bonds. And so we are back to supply and demand forces.

This is of course true on the fx market. If speculators or hedgers think that the price of a currency will (shall) go up, it goes up only if they buy it. It’s important what is behind their thinking – a credible central bank, their own model, technical analysis or the course of stars – but eventually supply and demand drive prices.

Besides the microeconomic supply/demand approach it is important to speak about arbitrage pricing – three of the next factors determine the fourth: the spot and the termin (forward) price of the currency the home and the foreign interest rate. But if the arbitrage-pricing equation is not fulfilled it’s again supply and demand that can restore the equilibrium.

Larry: Agreed about using the words “model” & “theory”. Although it’s some kind of achievement – and not one of best practice – for that linked article to not mention or refer to Alfred Tarski anwyhere!